by John | Mar 26, 2018 | Geopolitical Risk Protection, The Stock Market

The Markets as of Friday

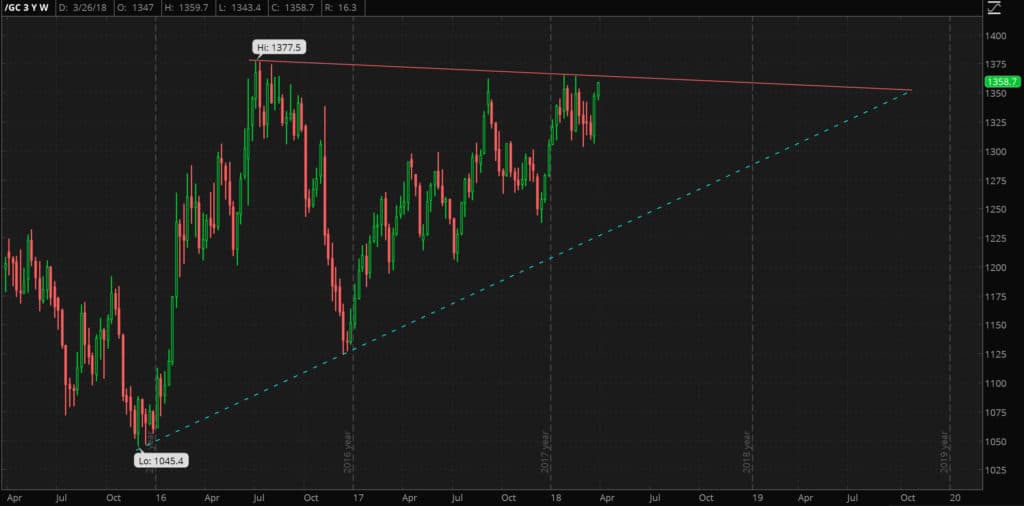

The S&P 500 was down nearly 10% from it’s January high after another significant selloff on Friday. Eight out of the last ten trading days had been negative. At Friday’s close S&P 500 was down almost 4% in 2018. The NASDAQ was flat in 2018, down 10% from the highs. The Dow Jones was down 5% on the year and 11.6% from the highs.

S&P 500 down nearly 10% from the high at the close on Friday

Gold has looked relatively stronger. The yellow metal was up a modest 2.14% on the year.

With gold holding it’s value and US equity markets in correction territory I was asking myself over the weekend, “is this the start of something bigger?”

Since the lows in 2009 the S&P 500 has made some large drops. From high to low the S&P 500 dropped 17% in 2010. It went down 22% between April and September in 2011. From July of 2015 to February 2016 the S&P dropped 15%. There have also been 10% drops like in the spring of 2012 and fall of 2014.

A 10% correction in and of itself is not a big deal.

But I think when combined with trade war brewing with China, rising interest rates (at least nominally), a $1.3 trillion spending bill and simply being 9 years into a bull market–this could make for the start of a larger selloff into a new bear market.

From a technical perspective this correction has been more violent than previous ones. In the first 18 days of trading in 2018 all but 14 were positive and the S&P 500 rose 7% from 2,682 up to 2,872 only to reverse and over 10 days (only 2 of which were positive) drop down 11.8% to 2,532.

I think it is fair to say that is one of if not the most violent rise and reversal since the 2009 lows.

The 2008-2009 crisis saw a 57% stock market crash. A similar drop from the new high would result wipe out 7 years of gains.

I don’t think the US Federal Reserve will let the markets drop 57%. I think they will cry uncle if there is a 40-50% drop, they will freeze all rate hikes and may even start lower rates again.

Gold and emerging markets should do very well in this environment.

Monday Market Rally

The S&P 500 opened up at 2601 this morning and went up to 2661 and closed near the highs at 2658.

Gold did not sell off however, it actually rose to near the highs of the year.

We’ll see if gold can breech the resistance that has thwarted a larger rally for the yellow metal this year.

As previously mentioned the S&P 500 has dropped like this before. It hasn’t been this rapid before. But given additional negative factors, perhaps most significantly rising interest rates. I believe this could be the start of a larger correction.

I certainly don’t know for sure, if I had a crystal ball I’d be much richer than I am now. But it is important to be diversified in non-correlated alternative investments.

by John | Feb 26, 2018 | Asset Allocation, Capital Appreciation, Economic Outlook, Geopolitical Risk Protection, Liquidity, Preservation of Purchasing Power, The Economy, The Stock Market, Wealth Protection

Over the past few weeks I’ve been writing about the faulty wiring in the United States economy that will eventually result in an Economic Conflagration.

The faulty wiring that will ultimately lead to this economic firestorm includes the fact that the real economy is weak, the economy is crushed by profligate debt and that stocks are overpriced and due for a significant crash.

One of the reasons why candidates such as Bernie Sanders and Donald Trump were popular in the last United States presidential primary and general election is because people know that the real economy is weak. They know how much debt they have and they want someone to make radical changes and do something about it.

Unfortunately government has never been particularly good at creating wealth or prosperity.

Some people might choose to rely on politicians to fix things. This website is not for those people. HowIGrowMyWealth.com is for people who want to take some common sense steps to grow and protect their wealth.

Given the faulty wiring the economy it is more important than ever to grow and protect one’s wealth. It might take a while but this faulty wiring will eventually result in a fire that will burn uncontrollably.

I realize this isn’t necessarily very cheery stuff but fear not! There is plenty of room for optimism.

I’m not a doomsday “prepper” or perma-bear and I’m sure that entrepreneurs, if free to do so, will rebuild the economy and usher in greater prosperity that will not be funneled to the politically connected.

I’m also cognizant that the stock market has gone up nearly 300% since the great recession, there hasn’t been hyperinflation in consumer prices and on the surface the crisis seems to have passed long ago. I don’t have a crystal ball and being right early sometimes looks like being wrong.

Despite the relative calm there is faulty wiring in the economy and sooner or later it will spark and ignite blaze that will, to quote Peter Schiff, “will make the financial crisis of 2008 look like a Sunday school picnic.”

The politicians, if they even realize that there are systemic problems in the economy, simply aren’t willing to endure the short term pain and inconvenience of ripping out the faulty wiring in order to fix the underlying problems. So they will continue to kick the can until the economic house burns down.

The bright side is that this will present an opportunity to rebuild the economy based on a strong foundation as opposed to what we have now, a phony economy based on debt, cheap money and consumption.

There will be winner and losers. I’m very optimistic about the future and I want to be counted amongst the winners.

So where am I putting my money?

My asset allocation falls into three main areas. Value stocks, gold and cash.

Value Stocks

Most people love buying things on sale and getting a great deal, expect when it comes to investing. When it comes to investing people want to buy expensive things and hope they go higher. Value investing takes that same common sense, buying things when they’re on sale and applies it to stocks and other asset classes.

The stock market as a whole is overvalued by a variety of metrics. But there are still good deals out there especially in non-US markets. I don’t doubt that value stocks will also go down in the event of a stock market crash but I think they will go down less and they will recover with more strength.

I could write entire articles on value stocks and I have. I’ve written about the value investing metrics I use when evaluating a stock and I also have my own value stock picks based on these metrics.

I share my value stock picks publicly. But I only share if I would buy them today or if I would hold or add to my positions with members of my free email newsletter. I will also let me email subscribers know when I buy or sell a stock first, before I publish that information to this website.

Gold

I don’t think you will get rich buying gold but it could prevent you from getting poor. Under relatively normal circumstances the demand for gold is fairly steady and the supply is fairly steady so for the most part the price of gold will rise with the level of inflation.

Gold is a way to save purchasing power. It’s a way to opt out of the financial system and wait for sanity to return.

If the dollar tanks loses it’s reserve currency status gold will still be valued.

I also think there has been significant effort to suppress the price of gold and depending on how much downward price manipulation there really has been, the price of gold could go up significantly from where it is right now.

If fiat currencies collapse that could very well induce a flight to the safe haven asset of gold that this influx of demand would be very bullish for gold.

Because of the absurd expansion in central bank balance sheets and artificially low interest rates I like gold presents a fantastic value at current prices.

What I write about gold applies to silver–another asset I think will do very well in a downturn. Silver has the added benefit of being an industrial metal that is more widely consumed.

Cash

Long term, like every other fiat currency, I think the dollar will go to zero. So why would I want to hold dollars?

First, I own a month or two of expenses in physical cash in a secure location in case there are capital controls. If there is a panic and people start withdrawing money from the banks the banks might in turn say, you can only withdraw $500 a week or something like that. Withdrawal limits could also be imposed if the US implements negative interest rates and people (very rationally) decide it is better to hold dollars in physical cash so they don’t have to pay interest to their bank for the privilege of loaning their money to the bank.

I reside in the United States and everything is priced in dollars so I need dollars to buy things. If I lived in the eurozone I would hold pounds or euros, if I lived in China I would hold Yuan. If I lived in the socialist paradise of Venezuela I would probably hold dollars (and try to get out).

Secondly, apart from physical cash I also hold dollars in a money market fund as a war chest. If stocks tank I expect there will be bargains to be had. I want to be buying stocks (if they are high quality free cashflow producing companies) when everyone is panicking and selling.

Now I fully expect the United States Federal Reserve to do what it has done in all other crises it has created–it will lower interest rates and buy assets to prop up the markets.

With interest rates already low once they cut rates to zero they will only be able to do things like Quantitative Easing and Negative rates. This is very bearish for the dollar and very bullish for gold.

But in the highly unlikely chance the US Federal Reserve does the right thing and lets the stock market collapse and lets the US government default on it’s debts this could be very bullish for the dollar. So holding some dollars is a hedge against deflation as well as a war chest to draw upon to buy undervalued stocks post crash.

What are some other possibilities?

While the bulk of my holdings are in cash, value stocks and precious metals I also dabble in some other alternative investments.

Cryptocurrencies

I’ve been a skeptic of cryptocurrencies for many years. I’ve also owned them for many years.

If there is a dollar crisis or collapse in the faith of central bankers then more people could turn to cryptocurrencies and could see it rise. Demand for cryptocurrencies could also rise for other reasons pushing the price upwards.

While I think blockchain technology is here to stay the value of any one specific cryptocurrency or token could very easily tank to nothing. Cryptocurrencies are very risky and 90% swings (both directions) happen.

You need to have an iron stomach but having between 1-5% of your liquid net work in cryptocurrencies isn’t the most outlandish idea in the world.

I would only speculate on cryptocurrencies with what you can afford to lose and I don’t considering buying cryptocurrencies investing in a technical sense since I am simply betting on the price going up.

I’ve shared with my readers my Group of Six cryptocurrencies that I’ve chosen to own and speculate on.

Options

Net I’ve actually lost money trading options. I traded options while unemployed and failed to remain dispassionate and objective. I was so focused on making money that I opened positions when the conditions were not ideal and took risks I should not have been taking.

I do believe if you are disciplined and follow the appropriate rules, you can do well trading options.

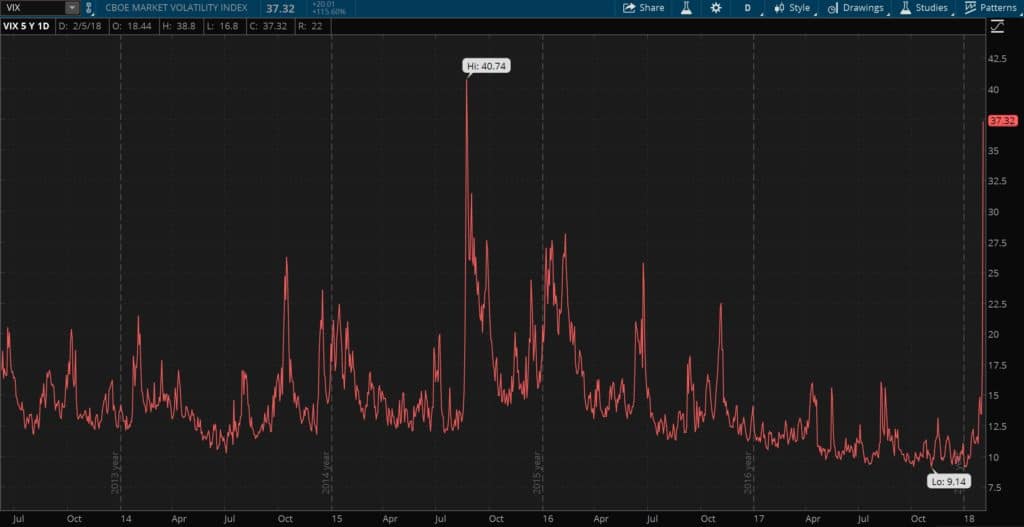

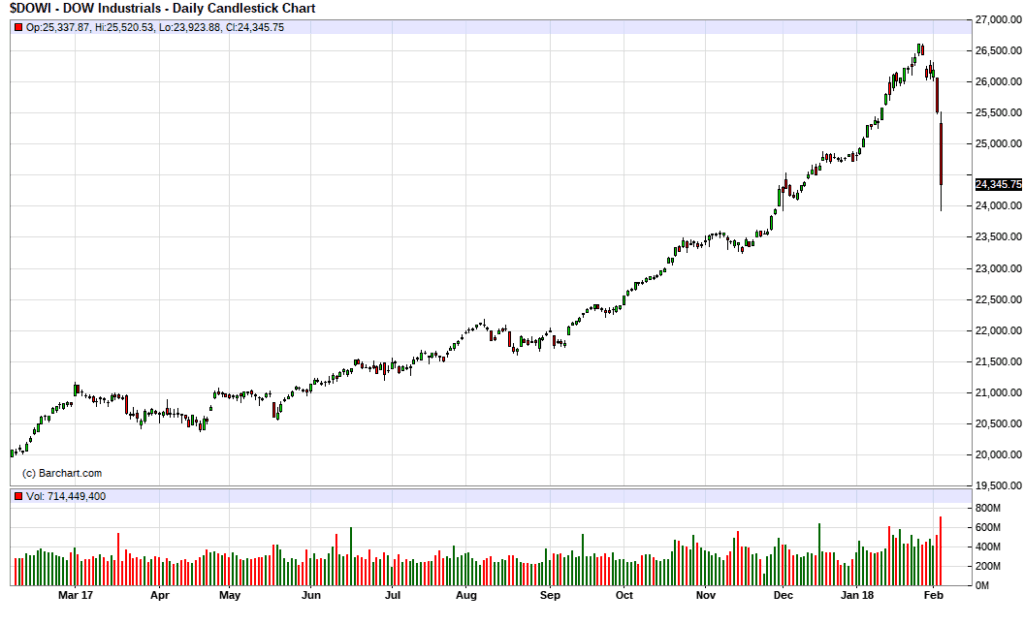

During a stock market crash volatility spikes and selling options could be a good strategy. When the VIX (a volatility index) spiked up in early February I sold a few options and those positions are doing well as volatility has dropped and the market has recovered. Markets don’t move straight up or down for very long so even if the February selloff portends drops to come, the market doesn’t drop as fast as people think in the midst of the drop.

Real Estate

Unlike all the other assets mentioned above I do not and never have owned any real estate.

Lots of people have made lots of money in real estate. I am working to learn more about this asset class and hope to own my own rental property at some point.

What I like about real estate is that it is easy to use leverage and the tax benefits are ridiculous. You can effectively pay no tax on investment property income and borrow a lot of the money you need to get started.

You of course need to know what you’re doing.

My goals for owning real estate involve owning a multi-family apartment building. The key for me is a cashflow positive property. I don’t have any interest in trying to buy and flip, although some people are very successful doing this. There are lots of ways to make money in real estate and I recommend biggerpockets.com to learn about them.

I think cashflow positive real estate will do okay in the event of a crash. If you’re in an area that has stable employment prospects those workers will always need a place to live and have the money to pay for it. Of course real estate won’t “always go up” and there are a lot of risks and headaches associated with managing property (if you don’t outsource property management).

This is part 5 of 5 of what I’ve decided to term The Economic Conflagration series where I discuss the faulty wiring pervasive the global economy:

Part 1: A Deadly Electrical Fire you Need to Know About

Part 2: The Real Economy is Weak

Part 3: Crushing Debt in the United States Limits Economic Growth

Part 4: Stocks are Overpriced and Due for a Significant Crash

Part 5: Where to Put Money when the Stock Market is Overheated

by John | Feb 5, 2018 | Economic Outlook, The Stock Market

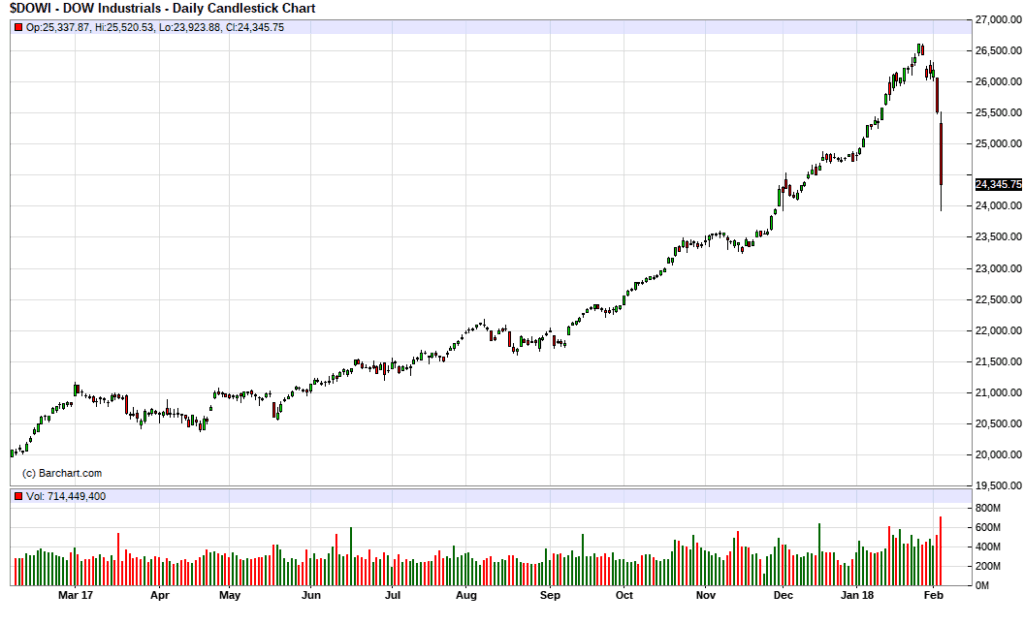

Today the Dow Jones Industrial Average dropped 4.6% and went negative for the year.

Investor’s Business Daily summarizes the pullback very well:

“The Dow Jones industrial average fell by 1,175 points on the stock market today, plunging nearly 1,600 points at session lows. Those were the worst one-day and intraday point losses ever for the blue-chip index, something trumpeted across most financial media.” -Investor’s Business Daily

Source: https://www.investors.com/news/dow-suffers-worst-point-drop-ever-but-percentage-loss-not-historic/

However, as Investor’s went on to point out, in percentage terms this is hardly historic.

The real question in my mind is, “does this mark the beginning of a larger selloff?” The Dow was also down on Groundhog Day, that is Friday the 2nd. So this marks two days of declines, with today’s selloff being even larger.

Volatility is Back

Volatility in the market has spiked tremendously as measured by the Chicago Board Options Exchange Volatility Index (VIX). You have to go back to 2015 to see volatility this high.

For all I know the market will stabilize tomorrow or the next day, but it is interesting to me that volatility, which as you can see had been declining for the past two years, is now back in the market.

Gold Stable

Gold was flat/slightly up today.

Cryptocurrencies Continue to Tank

Cryptocurrencies continue to tank. Bitcoin is trading around $7,000 (down from the December 2017 highs of $20,000). Ethereum is down to $700 (from the the January highs of nearly $1,400). Other cryptocurrencies have sold off similarly in the past few months but actually rallied modestly as the Dow and other stock indices sold off today.

by John | Jan 14, 2018 | Asset Allocation, Geopolitical Risk Protection, Preservation of Purchasing Power, Saving Money, Wealth Protection

A 2.6% rise in the price of gold doesn’t seem like a lot given the tremendous volatility of cryptocurrencies like Bitcoin which can go up or down 30% in a day. Twenty eighteen has started off strong for the yellow metal. While gold has lost some if it’s shine in the eyes of many since the drop from it’s highs in 2011 it remains the standard in wealth preservation as far as I’m concerned. I am as bullish on gold today as I ever have been. Perhaps not in the medium term, but in the short and long term I think gold will be rising in USD price.

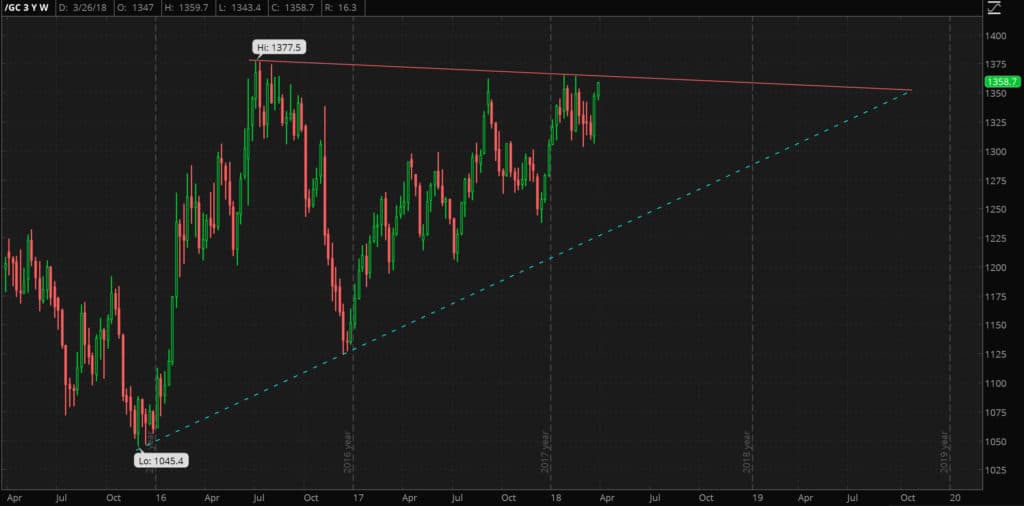

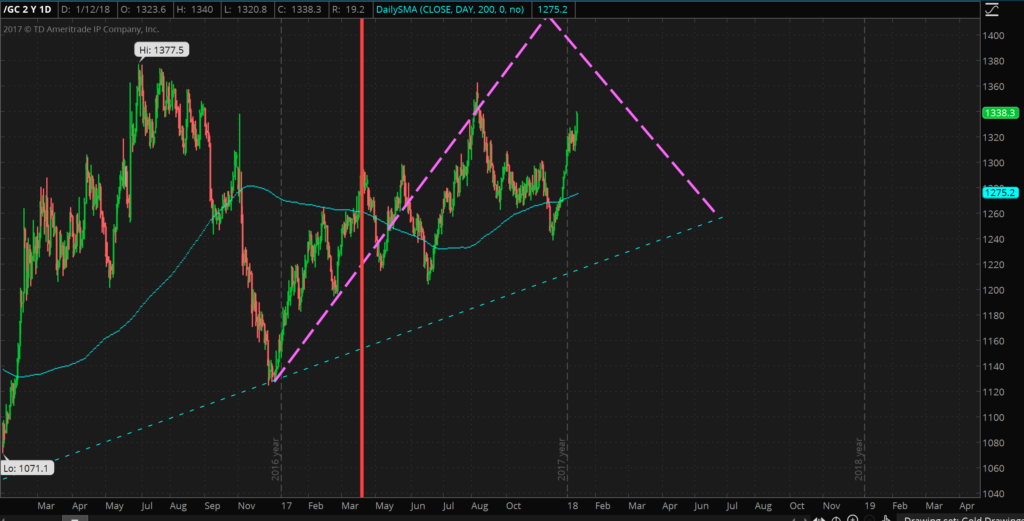

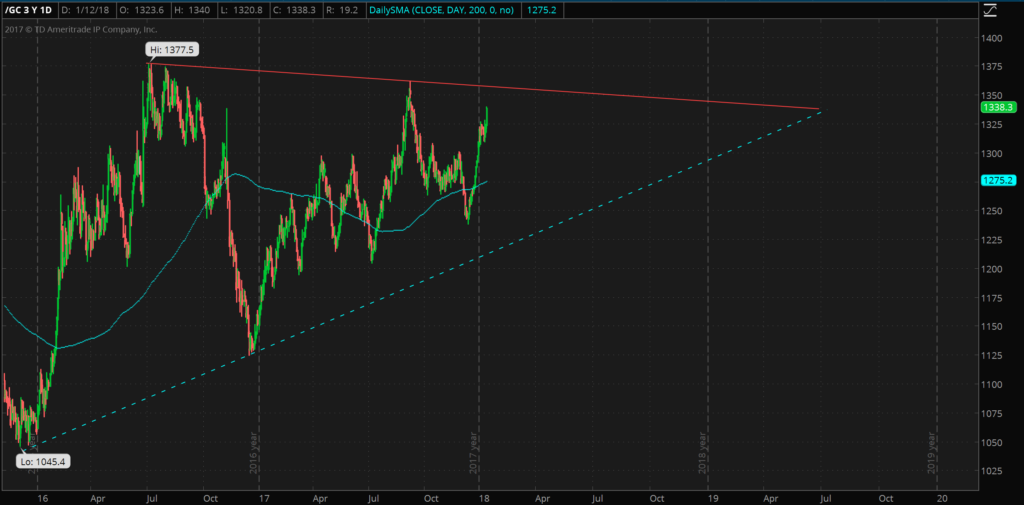

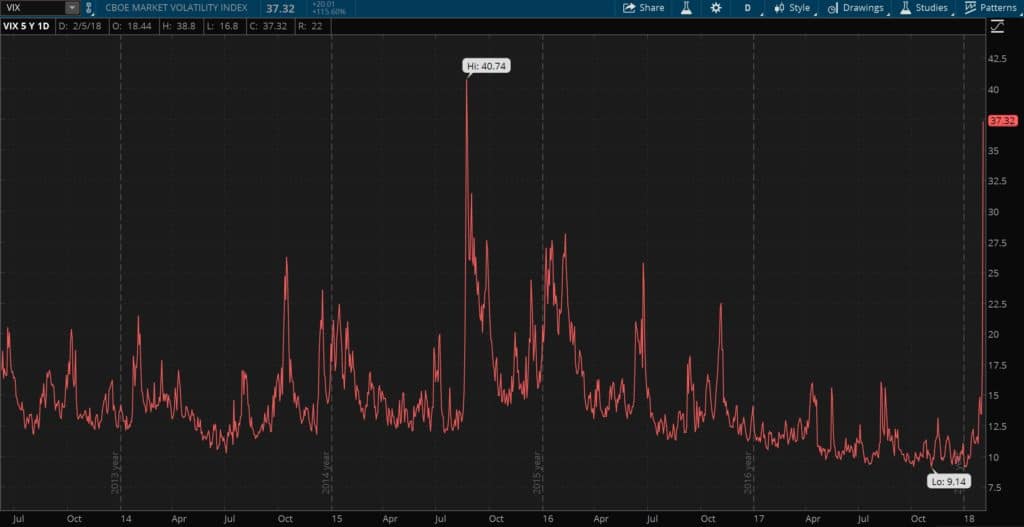

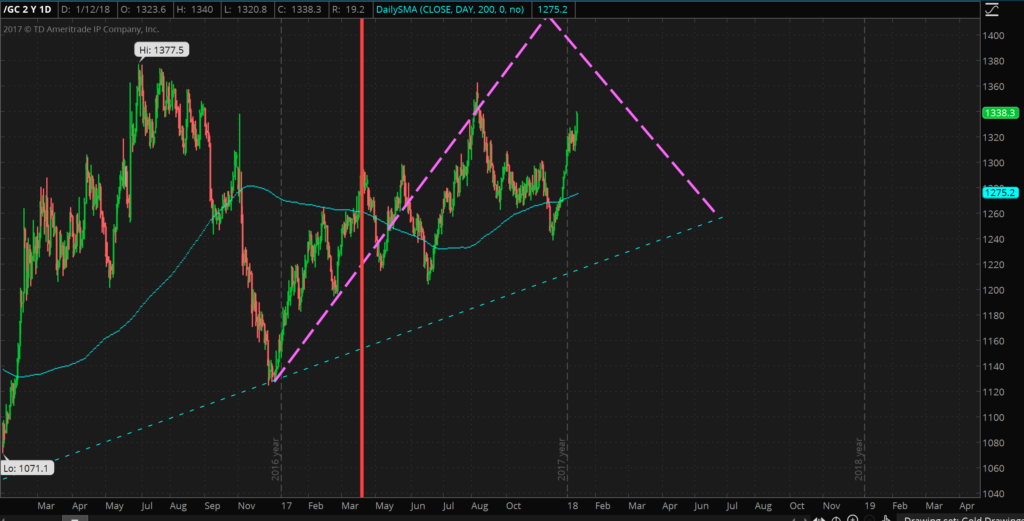

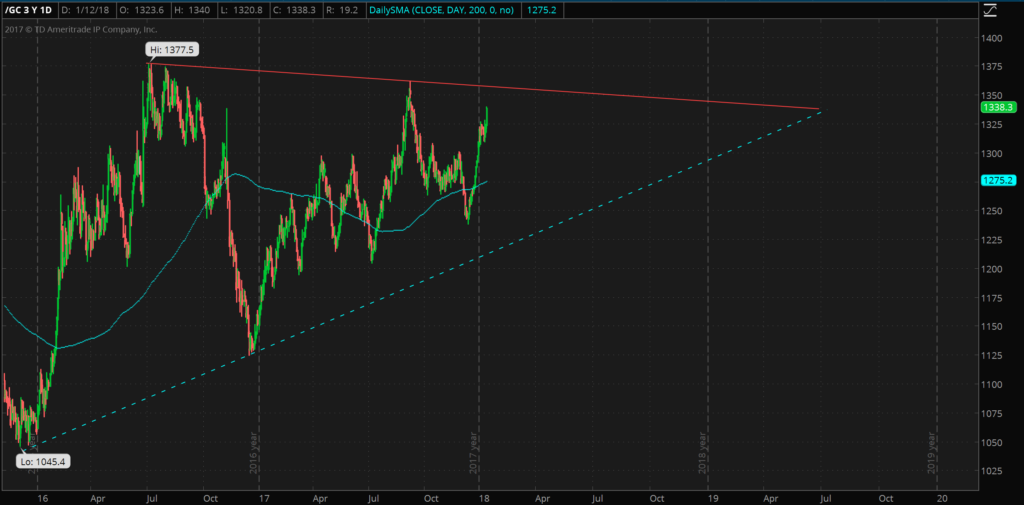

I posited back in April 2017 that 2016 was the start of a new bull market in gold and that trend has continued.

The dashed purple line indicates my prediction/guess as to the price movement of gold. This prediction was made back in the middle of April, 2017 (indicated by the vertical red line).

While this prediction looked fairly close up through August 2017, gold has since diverged quite a bit. Because gold hasn’t been able to take out the previous high of $1377.5 made back in July 2016, this bull market is looking fairly weak from a technical perspective, especially compared to the 2008-2011 bull market. This is why I think gold looks weak in the medium term (say 6 months to a year). In the short term gold is looking good, as previously mentioned gold is up over 2.5% this year.

But even if the technicals of gold look weak the fundamentals of gold are still extremely strong. I think there is little chance that we will see gold available at a price of 1045 USD ever again and I think gold will eventually make new highs in excess of $2,000. I do think gold is in a bull market, albeit a weak one. A US War with North Korea, a Trump impeachment, another large scale terrorist attack, or any number of other catalysts could easily send gold upwards.

While we might have to wait until 2019, it will be interesting to see if gold breaks through the resistance (solid red line) and if so if it makes a new high above 1377.5, or if it goes back to test the longer term support levels drawn in a dashed blue line. Of course it could even do both if we see a lot of volatility.

I feel confident that gold will be above $1300. Regardless I think holding between 10%-25% of one’s assets in physical precious metals is a wise move. Go closer to 10% if you have faith in the US.gov and legacy financial system and closer towards 25% if you are a little more bearish on the US governments ability to handle the national debt, pension, social security and medicare funding crises. Of course all of these precious metal allocation percentages are just opinions and don’t take into account your age, goals and risk tolerance. If I had a lot of money in cashflow positive real estate or a successful and recession resistant business then I probably wouldn’t put as much into gold.

But if my income came from stocks and my job I would want to have 10-25% of my assets in precious metals and I would want to have some money in foreign stocks. I don’t think betting on the dollar is wise, it hasn’t been since 1913 and I think the dollar will only continue to weaken and at an accelerated pace.

While there is no substitute for physical precious metals like gold and silver held in a secure location one controls I think Goldmoney is a fast, easy and secure way to own physical precious metals. When you sign up for a Goldmoney holding account be sure to use my referral code: howigrowmywealth. A Goldmoney holding account allows you to store physical gold throughout the world in secure jurisdictions like Singapore and Switzerland. I personally own over $1,000 worth of gold through Goldmoney.

by John | Dec 29, 2017 | Cryptocurrency, Geopolitical Risk Protection

Cryptocurrencies are all the rage and gold remains time tested. Over the last few years cryptocurrencies like Bitcoin have been extremely volatile (mainly to the upside) while gold has been fairly stable and moved mostly sideways. Growing and protecting my wealth through alternative investments has been my focus for the last four years so I watch both the precious metals and cryptocurrency markets with great interest.

Bitcoin has risen exponentially in 2017. Clearly buying Bitcoin at $900 and riding it up to $20,000 was a fantastic trade in which the initial capital would have appreciated over 2,000% in less than a year.

How anyone besides a time traveller would have known to do that other than faith or luck is beyond me. I still think there are problems with cryptocurrencies. Even though there are several aspects of cryptocurrencies that I do like and a number of tokens and coins I choose to own.

Gold on the other hand has been slow and boring. As I wrote about in April this year, 2016 looks like it was the start of a new bull market in gold. Prior to 2016 gold had steadily declined since it’s $1,900 highs in 2010.

Since 2016 gold has steadily risen in price

A Place for Gold

I believe that now as much as any time in history gold (and silver) remains an important part of a diversified portfolio.

Dorian Nakamoto was accused by Newsweek of being Bitcoin founder Satoshi Nakamoto

I don’t know how high Bitcoin will go. However, in 50 years I believe that Bitcoin will be worth less than a few dollars and gold will have at a minimum retained it’s value in terms of purchasing power if not appreciated beyond that.

I think it’s entirely possible that some other cryptocurrency will be commonly used as a medium of exchange fifty years from now but it won’t be Bitcoin.

I could be wrong about that so I do own some Bitcoin but I’m not willing to take out a mortgage in order to buy Bitcoin on margin, as some people are doing.

Litecoin founder Charlie Lee announced 20 December 2017 he sold all his Litecoin

Source: https://www.engadget.com/2017/12/12/bitcoin-mania-mortage-house-investors/

If you want to speculate and trade I think Bitcoin and other cryptos are great for that.

I buy Bitcoin on Coinbase and move it to other exchanges to diversify into my “Group of Six” and it has worked out well so far.

If you have some money you can afford to lose then trade and speculate away.

However, I think that gold remains the gold standard in wealth preservation.

23 year old Ethereum Founder Vitalik Buterin

I don’t think there is any substitute for buying physical gold and silver from a reputable dealer.

Physical bullion you have in your possession is the ultimate way of removing yourself from an out of control wall-street/banking system. I don’t want to go down the path of radical Cartesian skepticism but with precious metals you aren’t betting on the Janet Yellens and Jamie Dimons of the world having everything under control and are looking out for the little guy.

With gold you don’t have to worry about Satoshi Nakamoto, Charlie Lee or Vitalik Buterin making a bad decision and tanking cryptocurrencies.

Geopolitical Risks Remain

The risks haven’t gone anywhere. The stock market continues to climb but this is one of the longest periods in the history of the stock market without a correction. Meanwhile the fundamentals are not strong.

Debt at the governmental, municipal and personal level continue to grow with no end in sight.

Central banks throughout the world have printed trillions in fiat currency. One of the most important alternative investments to hedge against these risks are precious metals. Blockchain technology, while revolutionary and disruptive to the status quo do not replace gold and silver as the ultimate insurance policy against central bank insanity.