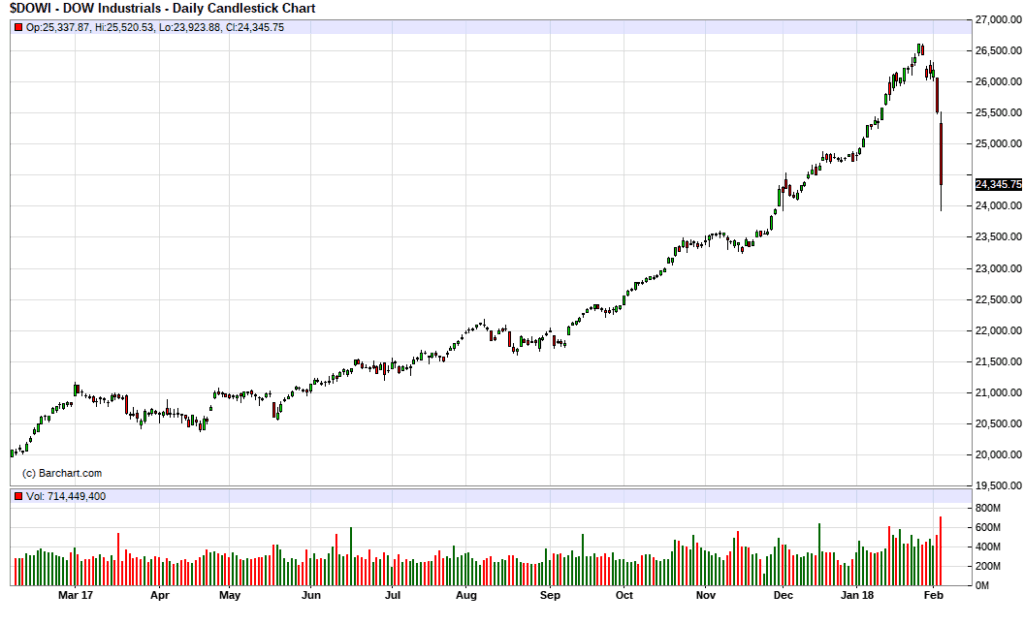

Today the Dow Jones Industrial Average dropped 4.6% and went negative for the year.

Investor’s Business Daily summarizes the pullback very well:

“The Dow Jones industrial average fell by 1,175 points on the stock market today, plunging nearly 1,600 points at session lows. Those were the worst one-day and intraday point losses ever for the blue-chip index, something trumpeted across most financial media.” -Investor’s Business Daily

Source: https://www.investors.com/news/dow-suffers-worst-point-drop-ever-but-percentage-loss-not-historic/

However, as Investor’s went on to point out, in percentage terms this is hardly historic.

The real question in my mind is, “does this mark the beginning of a larger selloff?” The Dow was also down on Groundhog Day, that is Friday the 2nd. So this marks two days of declines, with today’s selloff being even larger.

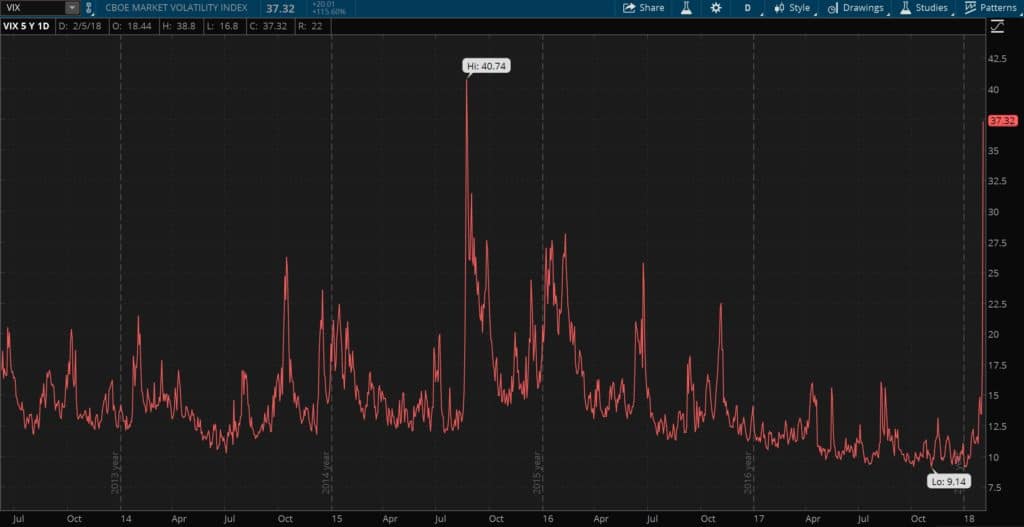

Volatility is Back

Volatility in the market has spiked tremendously as measured by the Chicago Board Options Exchange Volatility Index (VIX). You have to go back to 2015 to see volatility this high.

For all I know the market will stabilize tomorrow or the next day, but it is interesting to me that volatility, which as you can see had been declining for the past two years, is now back in the market.

Gold Stable

Gold was flat/slightly up today.

Cryptocurrencies Continue to Tank

Cryptocurrencies continue to tank. Bitcoin is trading around $7,000 (down from the December 2017 highs of $20,000). Ethereum is down to $700 (from the the January highs of nearly $1,400). Other cryptocurrencies have sold off similarly in the past few months but actually rallied modestly as the Dow and other stock indices sold off today.