Back when I was an impressionable college student I was shown an asset allocation rubric. The rubric was a list of asset classes with a recommended percent of funds to be invested in each asset type. The result would be a diversified portfolio.

It was my first exposure to asset allocation and it made a lot of sense.

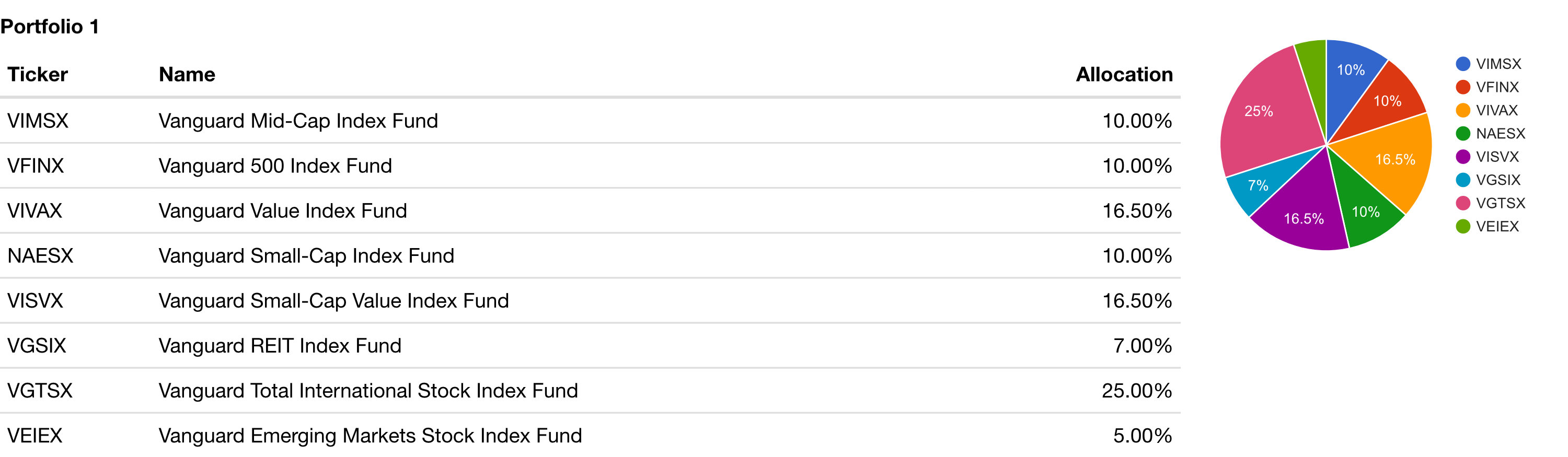

The allocation I was presented was very similar what I have listed below and I’ll call it “Portfolio 1”.

Asset Allocation Portfolio 1

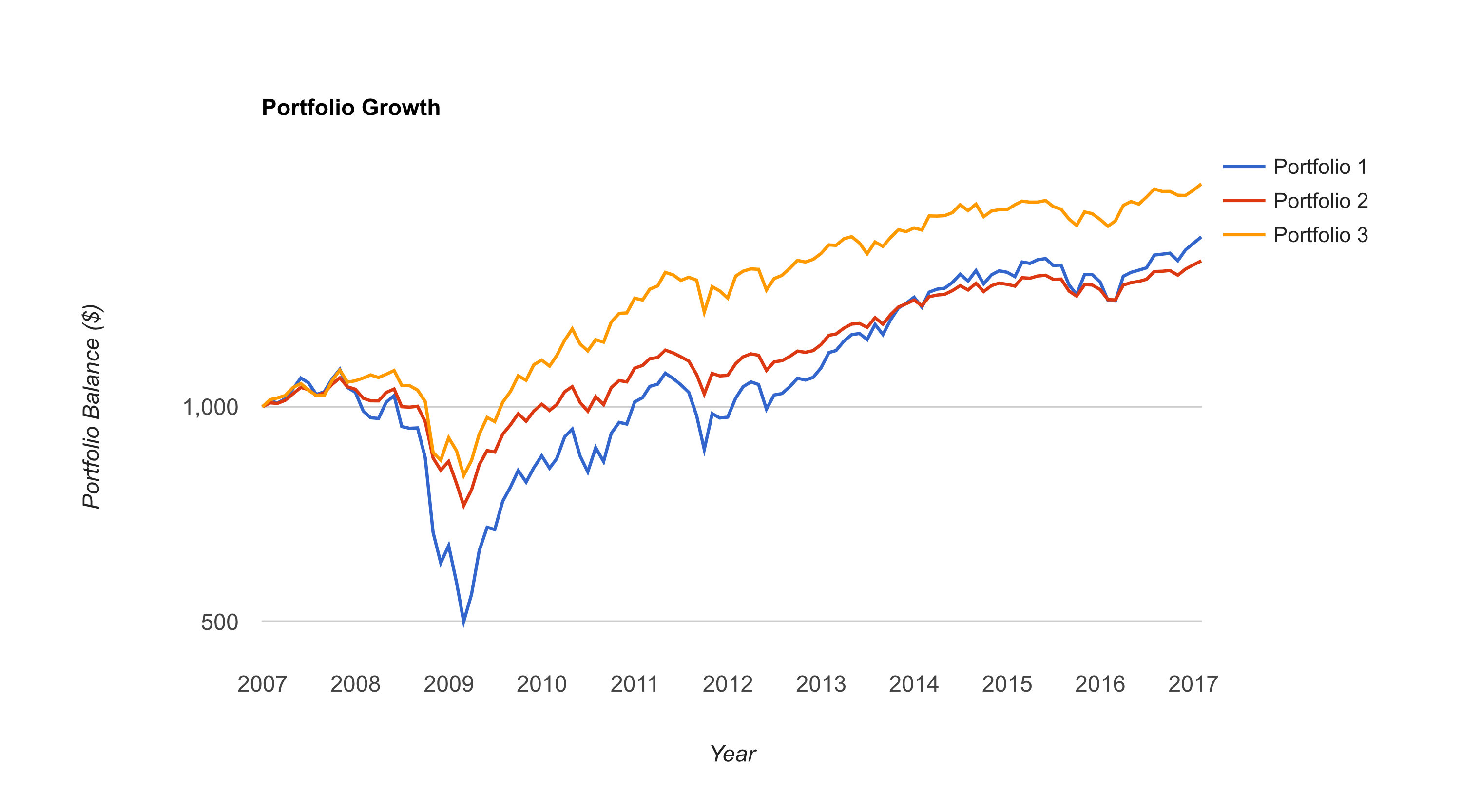

The problem with this portfolio is that is dropped over 55% in the 2008 financial crisis.

Without any bonds (or gold) this portfolio was subject to a massive drawdown.

Since January of 2007 to January of 2017 this portfolio has a compound annual growth rate (CAGR) of just 5.58%.

Plus the correlation with US stocks is .98.

In fact an investor would have been better off just buying the Vanguard Total Stock Market Index (VTSMX) and calling it a day. The “Just Buy VTSMX” strategy would have had a 7.25% CAGR with a lower maximum drawdown of around 50%.

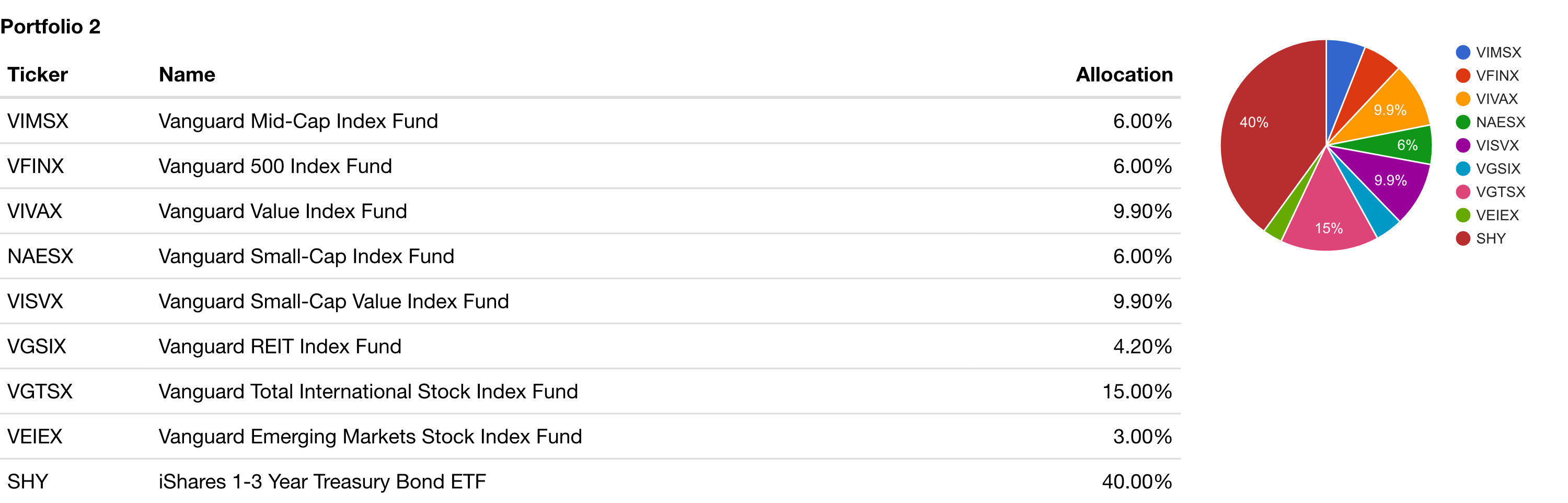

Asset Allocation: Portfolio 2 (Add Bonds)

To be fair, the allocation actually calls for a 40% allocation to short term bonds. Adding 40% bonds would have limited the maximum drawdown to a much more manageable 33.72% with a CAGR of 4.77%.

Correlation of this portfolio is still .98.

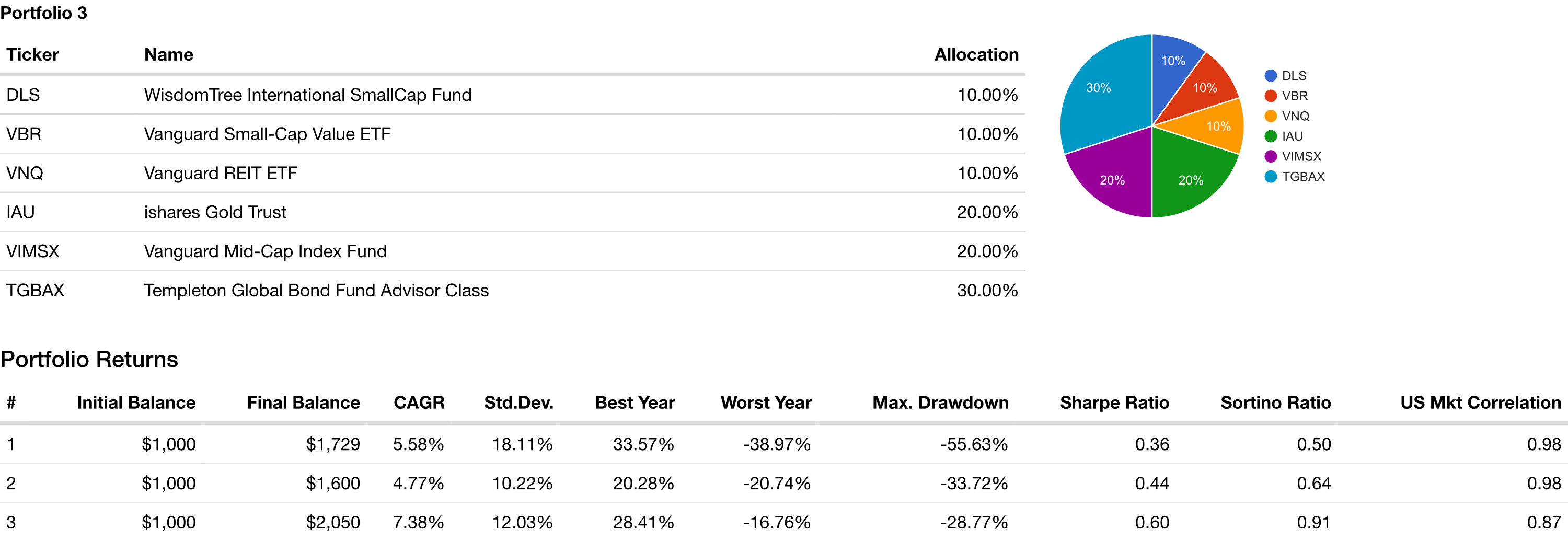

HIGMW Asset Allocation

But enduring a 33% drawdown for a a 4.77% return doesn’t seem stellar to me. So I’m been experimenting with different asset allocations using portfoliovisualizer.com.

The HIGMW Asset Allocation I’ve developed would have a maximum drawdown of 28.77% with a CAGR of 7.38%. Correlation with US stocks drops below the 90s down to .87, still high, but at least lower.

Now the actual investments in my allocation are listed below. I had to swap out some funds in order to get a sense of how this allocation would have performed in 2008.

However, many of the funds I like did not exist in 2008.

Yes, this allocation is 30% bonds. And yes, I think US stocks and bonds are in a bubble. And yes indeed I Don’t Own US Treasuries. But 20% of my allocation to bonds are outside the US and the other 10% are in a fund managed by Bill Gross mainly consisting of corporate bonds and only 6% in government bonds.

So my 30% allocation to these bond funds in no way contradicts my views on US debt.

I also allocated 20% to gold and 10% to real estate. I think if inflation does pick up (even more) these hard assets will add some resilience to the portfolio.

Small cap value stocks have outperformed over the last 45 year so I’m overweight small cap value. 10% is allocated to international small cap value stocks and 10% to small cap value stocks in the US. The 20% allocation to the First Trust Dorsey Wright Dynamic Focus 5 ETF is an interesting ETF in that it is somewhat trend following. Combine these three funds and 40% of this allocation is to stocks.

Gold doesn’t pay a dividend or yield. But until the central banks around the world stop acting like crazy people gold will remain a large part of my portfolio.

I don’t think I can be convinced that governments can continue to borrow, print and spend money without consequences.