Roth IRA vs 401k

Roth IRA vs 401k: who will win? Both plans enable a person to save and invest for retirement in a tax advantaged way. What does tax advantaged mean? That you pay less taxes!

(more…)

Roth IRA vs 401k: who will win? Both plans enable a person to save and invest for retirement in a tax advantaged way. What does tax advantaged mean? That you pay less taxes!

(more…)

According to the United States Bureau of Labor statistics the rate of consumer price increases, as measured by the Consumer Price Index (CPI) is 2.4%. That is the combination of a variety of factors such as food, fuel, clothing et al. One of the factors is “Shelter” and the rate of price increases for shelter according to the BLS comes in at 3.3% for the 12 month period ending in march 2018.

It sounds comical for me to write it out but I am passionate about inflation. Inflation is a terrible injustice to the people, destructive to the economy and a leading contributor to many economic crises such as the “dot-com” bubble in 2000 and the 2008 financial crisis.

When I talk about inflation I typically mean an increase in the money supply which in many cases leads to price inflation which is an increase in prices as a result of an increase in the money supply.

I have long believed that the BLS CPI is flawed and that the actual rate of price increases is much higher, between 5-10%. And in fact if the BLS measured price inflation in the same way they did in 1990, the CPI would be 6%.

Source: http://www.shadowstats.com/alternate_data/inflation-charts

I recently renewed my apartment lease. My apartment hasn’t changed at all. And after the previous 10 month lease has ended my renewal lease rate is 2.6% higher for a new 12 months lease.

That doesn’t seem like much, and in the grand scheme of things it isn’t, but rent is the largest expense I have so it is an unpleasant increase.

I have to admit I’m not as passionate about the rent being too high as compared to say Mr. James McMillan III, who ran for Governor of New York numerous times, with high rent being a core pillar of his political platform.

Parental warning: Video below contains the “D” word

According to the BLS healthcare costs rose 2% for the 12 month period ending March 2018.

Source: Bureau of Labor Statistics

It’s time for my annual enrollment in health insurance. I’ve written about health insurance costs and how the affordable care act made healthcare less affordable for me.

I am fortunate (and grateful) to have health insurance coverage through my employer and I would prefer to be in a scenario where health insurance wasn’t tied to employment. I would prefer a true free market system in health care and health insurance. But recently I have been trying, to quote the serenity prayer, to take “as Jesus did, This sinful world as it is, Not as I would have it.”

My health insurance monthly premium actual fell by 0.66%. However, the devil is in the details.

My previous plan had a $3,000 deductible, 10% coinsurance once the deductible was met and a max out of pocket (or “MOOP”) of $5,000. So if I had the worst year ever I wouldn’t pay more than about $5,000. Since I’m single, relatively young and relatively healthy I think this is a pretty good deal since my monthly premiums are very low.

However, this plan was “discontinued” and the new “comparable” plan now has a $3,500 deductible, 20% coinsurance once the deductible is met a $5,950 MOOP.

So this means that while my premiums fell by just 0.66%, my deductible went up by 14.29%, my maximum out of pocket went up 15.97%, and the amount my insurer pays once I reach my higher deductible falls from 90% down to 80%.

I hope I don’t have to use my medical plan at all, and if I don’t I will have saved token amount of money (which I will take!), but if I do have the worst year ever (medically) then I’ll be paying nearly $1,000 more.

I’m just one person so it isn’t fair to generalize my experience to the United States as a whole, with this caveat in mind I suspect that the individual mandate being removed has something to do with it.

If people don’t have to buy health insurance anymore then that means there are fewer younger, healthy people buying insurance and on a percentage basis, more sick people with insurance. I’m sure there are a variety of factors as well but this could be part of it.

Of course I think that removing the individual mandate was a good thing–I don’t see how a “free society” can require individuals to buy something.

However, in order for Obamacare to work your really need that mandate. Obamacare made it so that people with pre-existing conditions could still get “health insurance”.

I list “health insurance” in quotes because at this point health insurance in the US is no longer insurance. Insurance is a way of protecting against a potential risk. For example you can’t buy fire insurance when your house is on fire because once it is on fire it is no longer a risk it is a certainty.

But Obamacare made it so that people can essentially buy health insurance after they get sick (they might have to wait until annual enrollment but still).

I want everyone to have access to medical care. Co-opting and ruining the health insurance industry is not a good approach to working towards a world where everyone has access to medical care.

With the individual mandate revoked but the inability for insurance providers to take into account pre-existing conditions means that prices will have to rise. A lot. This is the tradeoff, if you want to force insurance companies to “insure” sick people then the government would need to force people healthy people to buy insurance.

Of course I don’t believe in initiating force to get anyone to do anything. I am saying that in order for this coercive system to work in which insurance companies are forced to “insure” people with pre-existing conditions that you have to coerce healthy people to buy insurance.

In the short term nothing. I hope to remain relatively healthy and hope I don’t have to foot a $5,000 medical bill any time soon. However, in the medium to long term I have a plan that will help me pay for medical care and fight against health insurance price increases. I’ll write more about this strategy in an upcoming article.

A 2.6% rise in the price of gold doesn’t seem like a lot given the tremendous volatility of cryptocurrencies like Bitcoin which can go up or down 30% in a day. Twenty eighteen has started off strong for the yellow metal. While gold has lost some if it’s shine in the eyes of many since the drop from it’s highs in 2011 it remains the standard in wealth preservation as far as I’m concerned. I am as bullish on gold today as I ever have been. Perhaps not in the medium term, but in the short and long term I think gold will be rising in USD price.

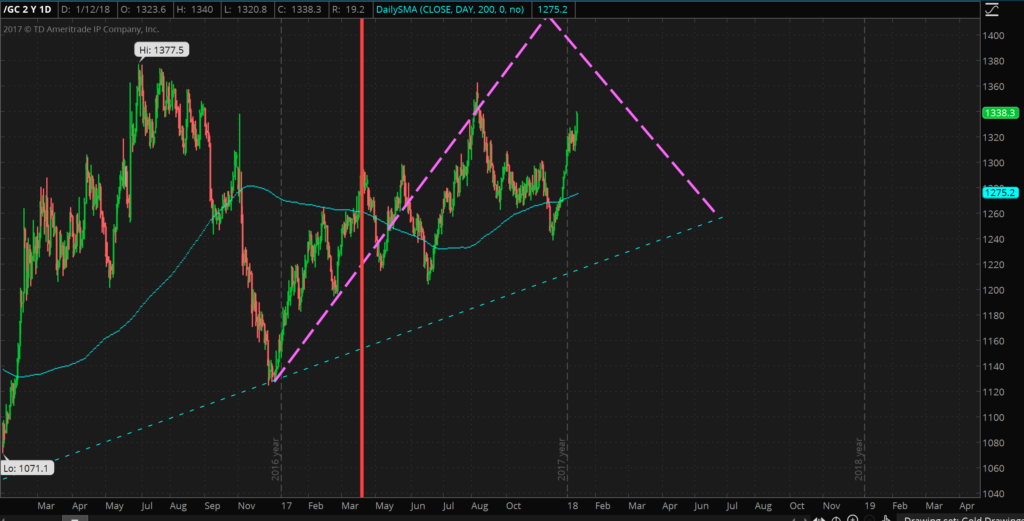

I posited back in April 2017 that 2016 was the start of a new bull market in gold and that trend has continued.

The dashed purple line indicates my prediction/guess as to the price movement of gold. This prediction was made back in the middle of April, 2017 (indicated by the vertical red line).

While this prediction looked fairly close up through August 2017, gold has since diverged quite a bit. Because gold hasn’t been able to take out the previous high of $1377.5 made back in July 2016, this bull market is looking fairly weak from a technical perspective, especially compared to the 2008-2011 bull market. This is why I think gold looks weak in the medium term (say 6 months to a year). In the short term gold is looking good, as previously mentioned gold is up over 2.5% this year.

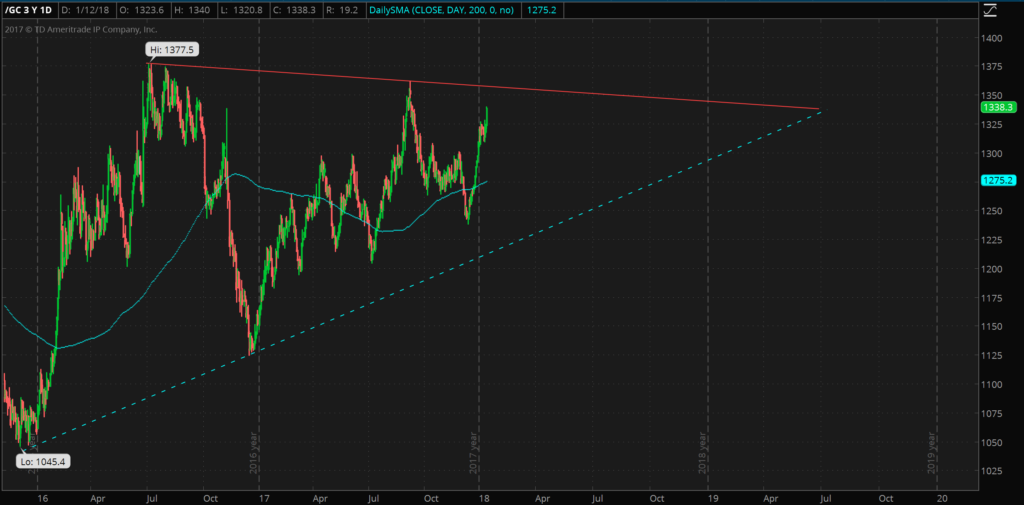

But even if the technicals of gold look weak the fundamentals of gold are still extremely strong. I think there is little chance that we will see gold available at a price of 1045 USD ever again and I think gold will eventually make new highs in excess of $2,000. I do think gold is in a bull market, albeit a weak one. A US War with North Korea, a Trump impeachment, another large scale terrorist attack, or any number of other catalysts could easily send gold upwards.

While we might have to wait until 2019, it will be interesting to see if gold breaks through the resistance (solid red line) and if so if it makes a new high above 1377.5, or if it goes back to test the longer term support levels drawn in a dashed blue line. Of course it could even do both if we see a lot of volatility.

I feel confident that gold will be above $1300. Regardless I think holding between 10%-25% of one’s assets in physical precious metals is a wise move. Go closer to 10% if you have faith in the US.gov and legacy financial system and closer towards 25% if you are a little more bearish on the US governments ability to handle the national debt, pension, social security and medicare funding crises. Of course all of these precious metal allocation percentages are just opinions and don’t take into account your age, goals and risk tolerance. If I had a lot of money in cashflow positive real estate or a successful and recession resistant business then I probably wouldn’t put as much into gold.

But if my income came from stocks and my job I would want to have 10-25% of my assets in precious metals and I would want to have some money in foreign stocks. I don’t think betting on the dollar is wise, it hasn’t been since 1913 and I think the dollar will only continue to weaken and at an accelerated pace.

While there is no substitute for physical precious metals like gold and silver held in a secure location one controls I think Goldmoney is a fast, easy and secure way to own physical precious metals. When you sign up for a Goldmoney holding account be sure to use my referral code: howigrowmywealth. A Goldmoney holding account allows you to store physical gold throughout the world in secure jurisdictions like Singapore and Switzerland. I personally own over $1,000 worth of gold through Goldmoney.

“With Widespread Power Failures, Puerto Rico is Cash Only” reads the title of a recent New York Times article in the wake of Hurricane Maria. This tragedy in the “Rich Port” is a sad reminder of the importance of keeping some emergency funds in physical cash.

The horrible devastation in this Caribbean territory of the Unites States is another reminder why keeping a few months worth of expenses in cash is a great idea.

It’s also a reminder to the anti-cash types that even in parts of the United States, power restoration can take weeks or months and a society without some cash is economically more vulnerable. This isn’t some abstract problem. It has a face, the face of people waiting in line, not being sure if they’ll be able to buy food or gas because they can’t access their bank account or use their debit card.

If there is a power outage I’m not going to want to spend my gold (the average cashier at the quick mart would probably stare at me dumbly even if I tried), I’m not going to be able to use a credit card, Goldmoney or bitcoin—I need cash.

If you think you’re going to be able to wait for a disaster and then go to an ATM at the same time as everyone else then at best you’re going to be faced with a long line. At worst the ATM won’t work or will be out of cash. Banks will have long lines and they could start imposing withdrawal limits to ration the cash they have available.

This isn’t my theory or some doomsday scenario, this is what happened (and is still happening as I write this) in Puerto Rico.

If people held a few months of expenses in cash then they would be in a better position to buy food, fuel, and start repairing their homes and businesses.

I’m as bearish on US dollars and fiat money as anyone. So of course holding cash has downsides: Here are the main ones:

1) It loses value

The dollar has lost most of it’s value since 1913. So the wealth you have in cash will be inflated away as central banks inflate the money supply.

2) Theft

Carrying around a lot of cash is generally considered risky and not without reason. Looting and a general increase in crime is an unfortunate reality in the wake of disasters. There is also the problem of civil asset forfeiture. In the United States, the “freest country in the world,” if members of the law enforcement community suspect you of a crime, they have the means to simply take your money and/or other property and it will be up to you to sue the government and prove you’re not guilty and get your property back.

Civil asset forfeiture in the US is a black and white violation of the 4th amendment, but it happens all across the US and in 2014 more property was taken from US citizens by members of the law enforcement community than was taken by burglars. But I digress.

Think of cash as a form of insurance against: 1) Loss of electrical power 2) Capital controls 3) Negative interest rates

And like all insurance it comes at a cost. The cost of holding cash is inflation and the opportunity to put the cash to work in other investments.

I already own various hedges against inflation, such as gold, silver, stocks, and even cryptocurrency, albeit I remain very cautious of this last one. So the fact that a few months worth of expenses in cash losing value is of little concern.

The risk of theft can be mitigated as well:

1) Keep most of your cash in a safe or hidden place

2) Keep it in various locations around your home and perhaps at other locations as well

3) Don’t carry all of your cash at any one time

4) Dress nicely and be respectful to members of the law enforcement community

If two months worth of expenses is $2,000 I’m not saying carry around two grand. Maybe you keep $900 in a safe, $500 hidden someplace else in your home, and $500 with a trusted family member or close friend and a $100 in your purse or wallet. When you go to the store or gas station only take the cash with you that you need. That way if someone uses force to take your money, they won’t get all of it.

1) I can be my own ATM. I’m not reliant on a bank or ATM allowing me to withdraw my money. I hold my money. This is vital when everyone is trying to withdraw cash at the same time.

2) If there is a power outage or communication disruption I can still buy food and fuel. Whether it is an EMP, ice storm, hurricane, brownout or cyber-attack, I can still buy the basics of life until things settle down. While fiat money is weak over the long term, in a disaster cash is still king.

Holding a few months of expenses in cash is a great idea. It can also double as an emergency fund in case you have an emergency repair to your car or home, medical expenses, etc.

Smaller denomination bills make more sense. Acquire $10s and $20s not $50s and $100s. Stores are generally more suspicious of larger denomination bills.

Not only that but it allows you to provide for yourself and help others. If I don’t have to go to the ATM or bank to withdraw cash that means there is one less person in line and anyone who would have been behind me in line can get cash faster. If 20-30% of people or more are prepared for a disaster it means there are much fewer people that need to be helped and there will be more resources to help a smaller number of people who need help. Maybe you’ll be able to share some of your cash with a neighbor and help them out.

Cash isn’t an investment and yes it loses value thanks to central banks, but holding a month or two’s worth of expenses in cash is a smart idea as part of a larger wealth and financial protection strategy. My thoughts and prayers are certainly with the people of Puerto Rico and it is a sad reminder of the importance of cash.

The vast majority of money I’ve made has been working for someone else. Why were they willing to pay me? Because I created value for them. The work I did for my employer allowed the employer to make more money than would have otherwise been possible–even after paying for my labor.

That is really the key to wealth: creating value for others.

The vast majority of wealthy people have helped lots and lots of people. Sure there are exceptions, but most people who have wealth have created value in proportion to the money they’ve made.

So if you want to grow wealth, ask “How can I help people?” If you provide a product or service that helps people and it is available to them at an attractive price people will gladly pay you money for it.

I appreciate that can be hard to do.

But there are people and organizations (businesses) that have already figured out a product or service that people want and are willing to pay money for and they often hire others to help them run their business. That is of course the way that most people make money–by working for someone else. That is how I’ve made the majority of my money, by working as an employee.

But the value creation mindset is still there. I think that mindset helps me to be a valued employee. It prompts me to ask: What knowledge, skills and abilities to I need in order to help this company? How can I help make this business more successful? How can I help this business be more efficient and more profitable?

By creating value at a company and helping make the business more profitable I know that I’ll be rewarded as well. Does it always work that way? No. But it has worked that way for me more often than not.

I enjoy investing. Investing is a way to passively grow one’s wealth over the long term. But I need to make money to have money to invest.

The way to make money in business is by helping people. It’s by creating value. Wether you’re starting or running your own business or working for someone else creating value is the key to growing wealth.

There is a lot I like about cryptocurrencies. Many cryptocurrencies seek to make money decentralised and wrest control from the central banks that have a history of devaluation and abuse.

But there are several things I dislike about cryptocurrencies. I see several problems with them as a long-term store of value.

Bitcoin is the largest cryptocurrency but there are hundreds of others as well. If you’re not familiar with Bitcoin I provide some background here: “What is Bitcoin?”

Cryptocurrencies are better than government controlled fiat. But I don’t accept that being better than the disaster that is government fiat currency is good enough and I’m not going to pretend like cryptocurrencies solve all the problems of government controlled fiat money.

I’ve presented what I think are superior alternatives such as Goldmoney.

I touched on what I don’t like about cryptocurrencies in my gold versus bitcoin article but I wanted to dedicate an article solely to the elucidation of what I don’t like about cryptocurrencies.

My dislikes fall into three main categories.

1) They are centrally controlled

2) There are no natural limits on the quantity of cryptocurrencies

3) Cryptocurrencies have very low (or no) non-monetary use

I am skeptical of the claim that cryptocurrencies like bitcoin are decentralised

The holdings of the cryptocurrencies are concentrated in the hands of the early adopters.

It is estimated that the mysterious creator(s) of Bitcoin, Satoshi Nakamoto, holds between 4-6% of all Bitcoin.

Source: http://www.businessinsider.com/satoshi-nakamoto-owns-one-million-bitcoin-700-price-2016-6

Vitalik Buterin owns a large number of Ether. Evan Duffield owns a large quantity of DASH.

Ripple intends to hold onto 50% of all Ripple cryptocurrency. There are similar situations for altcoins as well.

I think it is fine and good that early adopters and founders reap more reward for investing in a technology–my point is that cryptocurrencies are not actually as decentralised as cryptocurrency advocates would like you to believe.

This control isn’t limited to who holds the cryptocurrencies.

The control also extends to how the cryptocurrency technologies will function moving forward.

The Bitcoin Foundation, Bitcoin core developers and the largest miners control Bitcoin. The Ethereum Foundation and Vitalik Buterin control Ethereum.

People try to make arguments that cryptocurrencies aren’t centrally controlled and I’m not swayed by any of them.

At the end of the day cryptocurrencies are controlled by a small group of computer programmers.

What happens when cryptocurrencies actually behave in a decentralised manner? You get forks, like Ethereum Classic. Which brings me to my next point.

Like water in the desert, things that are both limited in supply and desirable tend to be valuable

I don’t have the knowledge or time to delve into the code of the Bitcoin algorithm but I accept on faith that because of how the bitcoin algorithm is written only 21 million Bitcoins will ever exist.

So in that way the quantity of Bitcoins are limited.

However, there is no limit to the number of “altcoins” or other cryptocurrencies that can be and are created.

There is Dash, Ethereum, Litecoin, Ripple, Monero and dozens of other altcoins you’ve never heard of. There are currently nearly 100 altcoins with a market cap over $20 million.

I’m all for competition and choice but when I’m investing in something as a long term store of value I want it to be limited in supply.

Furthermore, if the cryptocurrencies actually behave in a decentralised manner, you sometimes get hard forks.

There is a cap on the maximum number of Ethereum that will ever be in circulation–but after a hack related to the “DAO” Ethereum forked and a new cryptocurrency was created called Ethereum Classic. This fork effectively doubled the number of Ethereum in existence.

Hard forks effectively result in double the number of units of that particular cryptocurrency

As a brief background, someone the “DAO” which was one of programs on the Ethereum network and stole a lot of Ether.

This caused an outcry, some people wanted to reverse that transaction so the thief wouldn’t get away with it. Some people didn’t want to reverse the transaction because it would mean Ethereum transactions weren’t irrevocable.

Ultimately a hard fork ensued and people who didn’t want to reverse the transaction got Ethereum Classic and those that followed the Ethereum Foundation and Vitalik Buterin remained on what is called Ethereum.

There is also talk of a fork in Bitcoin which would have a similar result: two different flavors of Bitcoin when before these was only one. In effect a doubling of the number of Bitcoins.

I’m not going to flat out say that cryptocurrencies like Bitcoin have zero non-monetary use.

Although if you wanted to round down zero would be accurate.

Some people probably purchased Bitcoin as a political statement or way of saying that they didn’t want to be a part of a government controlled currency system. That is a non-monetary use.

But I think that use value is fairly low. Physical US dollars have non-monetary uses, like kindling or tacky wallpaper, but again that use value is very low and there are much better alternatives that accomplish the same thing.

Some people don’t think it matters that cryptocurrencies have little to no non-monetary use. For a time it probably doesn’t matter. People can subjectively value whatever they want. Otherwise you can’t explain why some works of modern “art” are sold for such high prices. But the question is will that subjective valuation be likely to hold?

Fiat currencies have little to no non-monetary use and how have they fared?

The value of Fiat currencies throughout history have eventually gone to zero. The fiat currencies that exist today did not exist 300 years ago.

The British pound Sterling, founded in 1694, is the oldest fiat currency in existence at 317 years. Most fiat currencies don’t last long.

Source: http://georgewashington2.blogspot.com/2011/08/average-life-expectancy-for-fiat.html

Gold has been valued for the past 3,000 years. What is the difference between gold and government issued fiat currencies? Gold has non-monetary use and non-monetary properties that have, for the past 3,000 years and up to this day, caused people to value it.

But I had better stop myself there rather than jump back into a gold versus bitcoin debate.

I don’t see how cryptocurrencies, that have very little non-monetary use, will fare better than government issued fiat over the long term.

Some of the other shortcoming of cryptocurrencies are related to security and ease of use but I think those issues are sufficiently manageable.

I just don’t think the coins themselves are a good long-term store of value.

I choose to own both gold and cryptocurrency–I just choose to own more gold.

Just because there are things I don’t like about cryptocurrencies doesn’t mean I won’t use them and profit by them.

I own several flavors of cryptocurrency because I believe that they will be worth more in the future than what I paid for them. I also like to take advantage of the price differences on different exchanges.

I will be writing a future article entitled “Why I Like Cryptocurrencies” where I go into more detail about what I do like about cryptocurrencies.

What do you think of cryptocurrencies? Do you currently own any?

(29 July 2017: In a previous version of this article I claimed that cryptocurrencies are not scarce. I’ve updated the article with more precise language. At the time I first published this article there were over 100 cryptocurrencies with a market capitalization over $1 million, I’ve updated this number to nearly 100 cryptocurrencies with a market capitalization over $20 million.)