The S&P 500 is currently in the longest period EVER without a 3% correction. The unemployment rate in the US is just 4%.

Source: http://money.cnn.com/2017/11/26/investing/stocks-week-ahead-sp-500/index.html

The S&P 500 is at all time highs–far surpassing the dot-com bubble and the housing bubble.

Is this the new normal? Is Federal Reserve Chair Janet Yellen right that we won’t see another crisis in her lifetime? Is there even a need for alternative investments when the stock market continues to soar?

Yes, now more than ever.

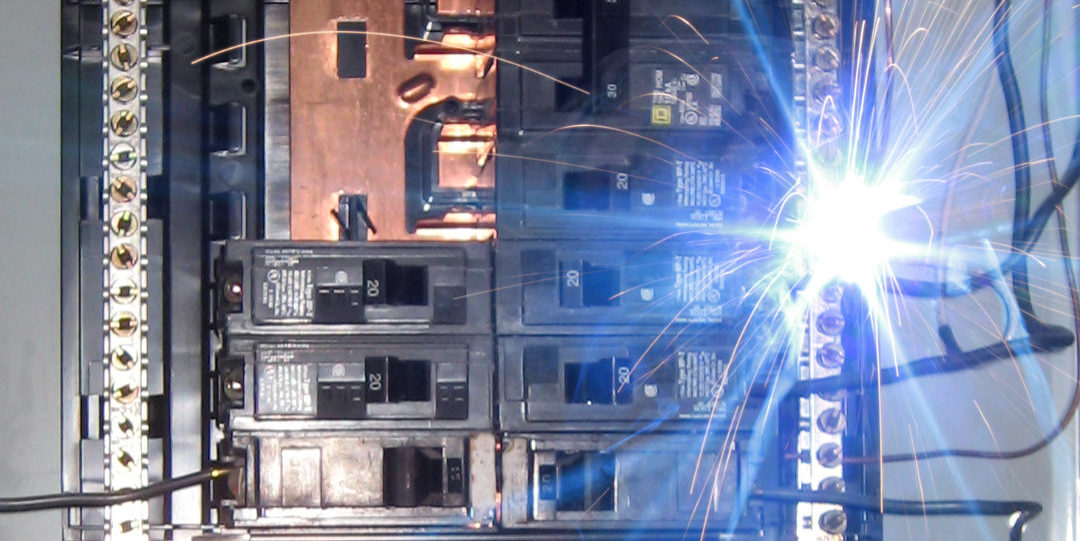

Faulty Wiring in the Economic House

Let’s say you live in an apartment building you’ve discovered has faulty wiring. You know there is a very good chance it will catch fire and burn to the ground.

Let’s say you live in an apartment building you’ve discovered has faulty wiring. You know there is a very good chance it will catch fire and burn to the ground.

Would you continue to go about your business and just hope the apartment building doesn’t burn down?

Or would you do something about it?

Unfortunately most people, if they even know about the risks, ignore them or simply choose not to do anything about them. When the fire starts they will get cooked.

But you don’t have to be one of those people

You can choose to do something about it

We can’t know exactly when but there are plenty of good reasons to believe the US economy is going to undergo an economic firestorm in the future.

Throughout US economy there is the financial equivalent to faulty wiring that will eventually cause an economic conflagration.

You can certainly point to more but here are three of the faulty wirings in the economy:

- The real economy is weak

- Debt at the Federal, State, and Personal levels are un-repayable

- Reckless Central Bank Actions have created a massive bubble in stock and bond markets

Despite all the doom and gloom there are plenty of things you can do to ensure you’re financially safe.

Do Something About It

The wiring in the building needs to be torn out, but landlords aren’t willing to go through the pain, cost and inconvenience of rewiring. All the while the problems get worse.

They’d much rather put on a new coat of paint and pretend like everything is fine.

But you can choose to position yourself so that when the building does burn down, you and your possessions won’t be incinerated.

Similarly, the powers that be in government are too entrenched and committed to maintaining the status quo as long as possible. They have continually demonstrated they are not going to take proactive steps to solve any of these economic problems (and after all they in large part the cause of the problems).

The government will only act when it has no other choice. In other words the government will only act once the crisis has hit and it is too late.

In the coming days I’ll be discussing these three categories of faulty economic wiring: a weak real economy, unrepayable debt and the stock and bond bubble.

Not only that I’ll be sharing actionable strategies through alternative investments to grow and protect your wealth.

It’s not about doom and gloom or prepping for the magnetic poles of the earth to reverse and cause gravity to invert.

It’s just about taking some practical steps in light of the very real and system risks present in the financial system.