by John | Feb 12, 2017 | Capital Appreciation, Value Investing, Wealth Protection

Imagine if you will your fairy godmother appears and you’re given the opportunity to backdate one trade to five years ago.

You’re given 1,000 dollars and you’re presented with three investment choices.

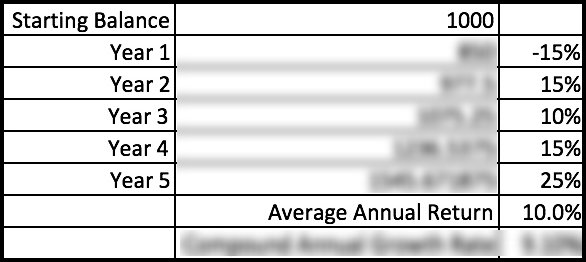

For each option she tells you the annual gain or loss as well the average return:

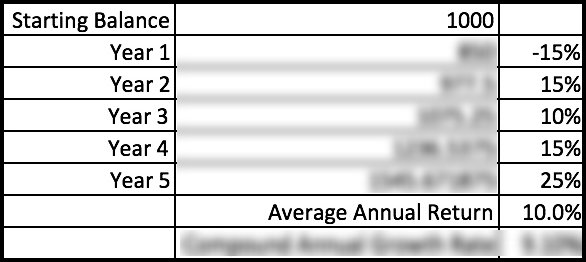

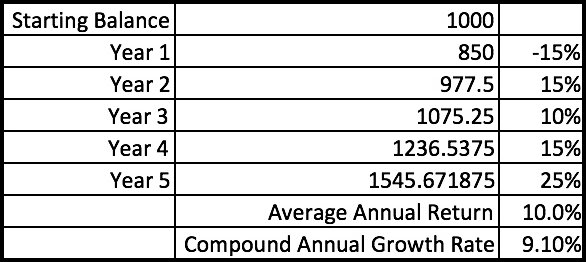

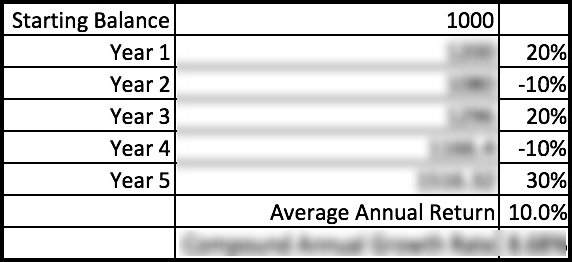

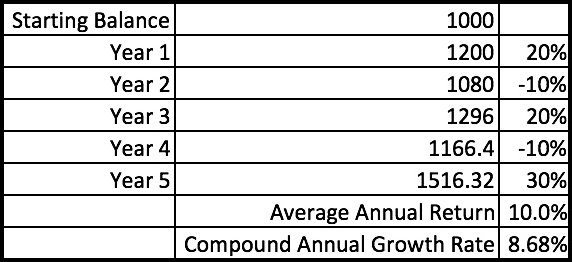

Investment One

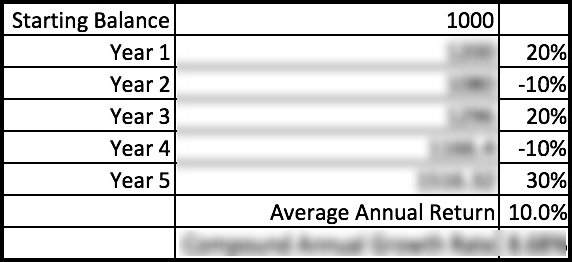

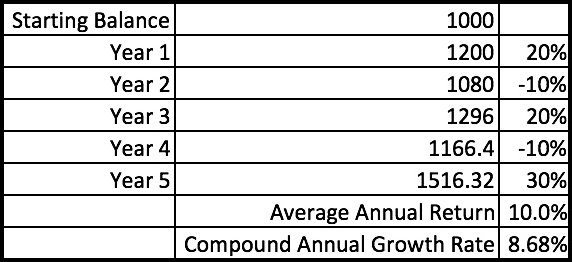

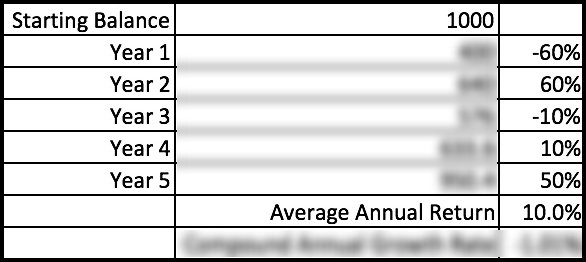

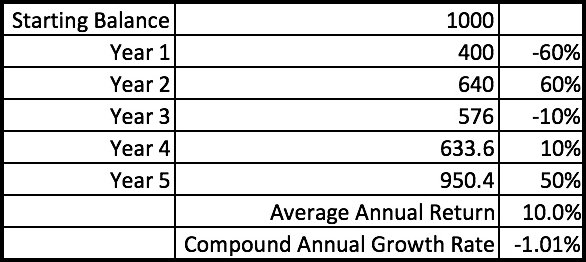

Investment Two

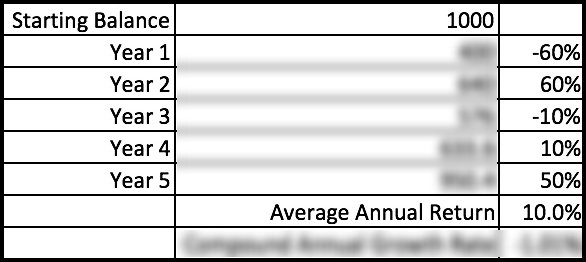

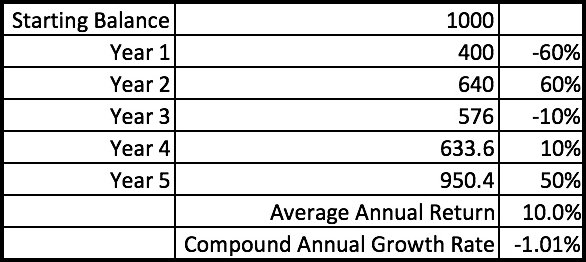

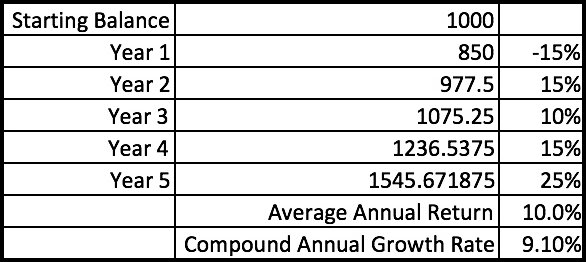

Investment Three

Now your fairy godmother told you the average annual return for each is 10%. So, one might be tempted to assume each investment will perform the same!

But you don’t get average returns so this number is not particularly useful.

Total Return

You want to choose the one that has the highest total return. Total return is just a fancy way of saying how much an investment went up (or down) from it’s starting value.

So you’d take the starting amount, $1,000, and add the gain or loss from the first year, second year, etc, and see how much the $1,000 is now worth after five years. The percentage increase from the original value to the ending value is the total return.

Total return would be 54.57% for investment one, 51.63% for investment two and lastly investment three has a total return of -4.96%, even though the average return for each was the the same: 10%.

Compound Annual Growth Rate

Investors typically want to know how an investment tends to perform each year. A useful way of seeing how an investment does each year in a way that smooths out up years and down year that is more useful than average returns is the Compound Annual Growth Rate (CAGR).

CAGR is calculated as follows:

Source: http://www.investopedia.com/terms/c/cagr.asp

I’ve calculated the CAGR for you below.

Investment One

Investment Two

Investment Three

So if the fairy godmother had provided the CAGR; it would have a been a useful number to determine which investment had the highest total return.

Why Do fairy godmother’s overcomplicate things?

Why wouldn’t your fairy godmother just give you an even $1,500 and call it a day?

Why wouldn’t your fairy godmother just give you an even $1,500 and call it a day?

I don’t know.

Cinderella‘s fairy godmother gave her until midnight to get back home. Why didn’t she give her a year to get back or just make the pumpkin turn into a carriage permanently?

Why weren’t the slippers made out of something more comfortable and durable than glass?

Cleary there is NOT a precedent for the pragmatic or straightforward. So don’t ask me to explain how fairy godmothers operate. But lest I upset the fairy godmother community I think the principle of don’t look a gift horse in the mouth also applies. After all, she’s hooking you up with the ability to backdate a trade.

You don’t get the Average Annual Return

At best the average return % isn’t useful. At worst the average return is rather deceptive–but that is the number that most mutual funds list.

While not without it’s limits, the compound annual growth rate is much more useful than average returns and it is something to keep in mind when evaluating an investment.

Average returns tell you very little while the compound annual growth rate shows you which investment would have had the highest total return.

by John | Jan 29, 2017 | Capital Appreciation, Stocks I Like, Value Investing, Wealth Protection

I don’t know how to time the market.

I wish I did.

If I could do marketing timing I would have bought US stocks in in the early 90s (I was pretty young but still!). Sold in early 2000, bought in October 2002, sold in October 2007, bought in March 2009.

That would be fantastic.

S&P 500 Market Timing Guide (Only Available in Hindsight)

Unfortunately I’m only good at timing the market in hindsight.

This of course isn’t useful, since my broker doesn’t let me backdate trades.

John: “[Phone rings] Hello, TD Ameritrade?”

TD Ameritrade: “Yes, this is TD Ameritrade.”

John: “I would like to buy 100 shares of the Vanguard S&P 500 Fund at the 1992 price.”

TD Ameritrade: “….[click]”

In all seriousness though, the above chart does say something about the long-term benefits of buy and hold (but you have to buy and hold for very long periods of time and suffer through large drawdowns).

But I’ve always wanted to do better than a long term buy and hold strategy. I think the best way to do that is through value investing.

US Stocks and Bonds are Overvalued

Today I was reading a MarketWatch.com article by Thomas H. Kee Jr. in which he states, “Ultimately, liquidity matters more than valuation to professional investors, and it is far more important to the market than any of the noise we are hearing.”

I think he is right insofar as what professional investors care about. The performance of US stocks since 2009 bears this out.

This is also supports my belief that US stocks and US bonds are in a bubble, the rise in price of these asset classes is based on liquidity (central bank money printing) and NOT valuations.

But if markets have anything to do with the real economy security valuations will eventually return to a market-based and realistic level of valuation regardless of central bank injections of liquidity.

Let me summarize what I’ve said so far.

1) Stocks and bonds are in a bubble due to central bank manipulation called “liquidity”

2) I don’t know how to time the market

In other words I know that stocks are overvalued but I don’t know when they will revert to a valuation based on company performance and realistic valuation.

So I don’t want to buy stocks that I know are overvalued when I don’t know when they will crash.

Buy Stocks at a Discount

I don’t know how to time markets and I believe US markets overvalued so I take the approach of value investing.

By investing in stocks that are trading for less than their book value I have a built in margin of safety.

That way I have good reason to believe I’m not buying a security that will drop radically in price since a value stock is by definition already undervalued.

I think it’s a great way to grow wealth in good times and bad.

Later this week I’ll be unveiling some additional refinements to my value investing metrics.

[mc4wp_form id=”4538″]

by John | Jan 22, 2017 | Geopolitical Risk Protection, Value Investing, Wealth Protection

For better or worse the President of the United States gets credit (or blamed) for how the economy has performed during his tenure.

How much control does the President have over the economy? In my opinion more than he should have but less than people give him credit for.

Donald Trump was sworn in a couple days ago and there is alternating fear and hope from either side of the aisle about what he will or won’t do.

But as I’ve written before, when it comes to some of the largest systemic issues facing the United States: it doesn’t matter who won.

How has the US Economy Fared under the last three Presidents?

Pals

As part of trying to anticipate how the markets will fare under Trump I was inspired to take a brief look back at how “the economy” performed during the past three presidents’ terms.

Past performance does not guarantee future results but the past is all we have.

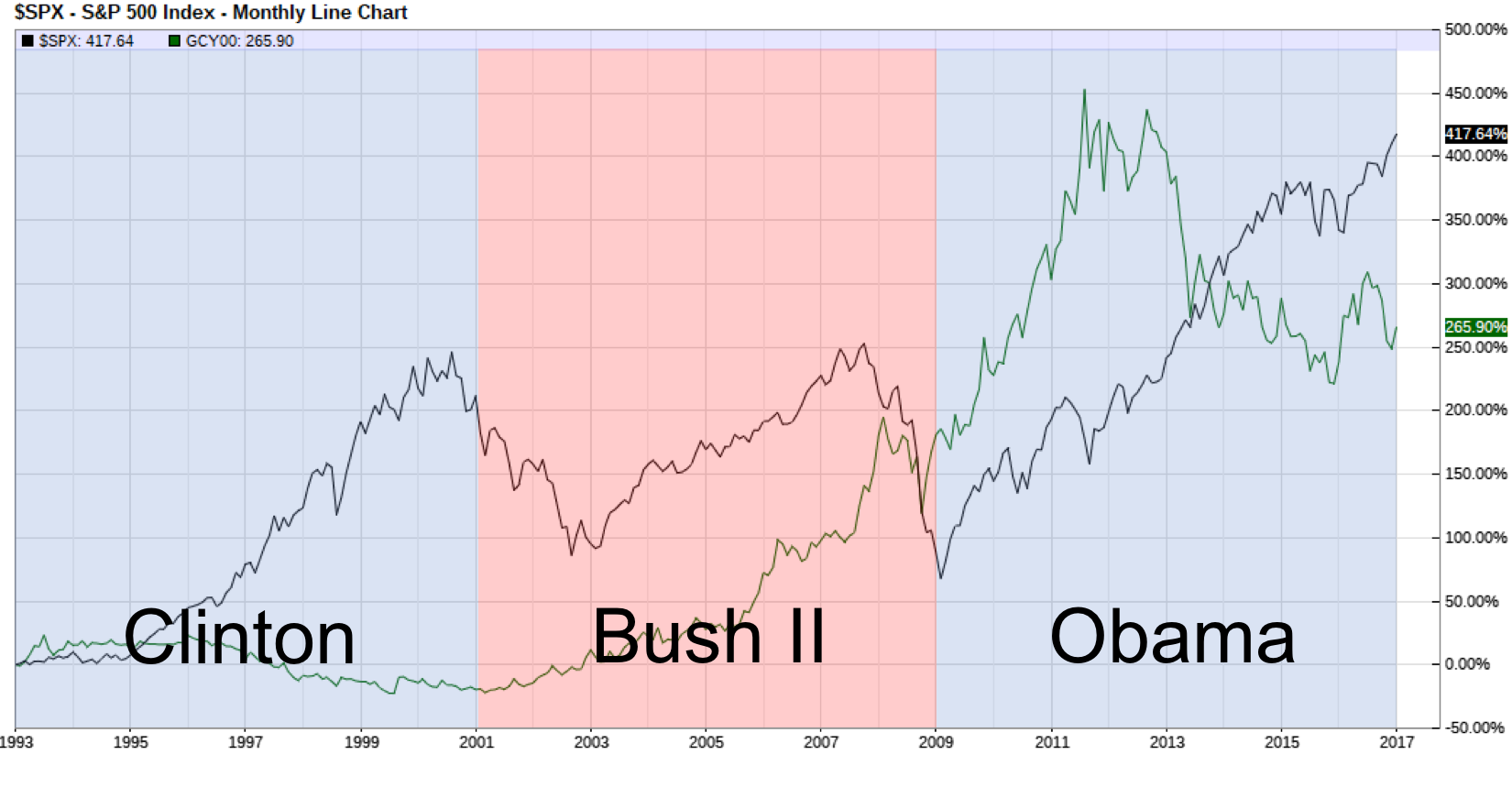

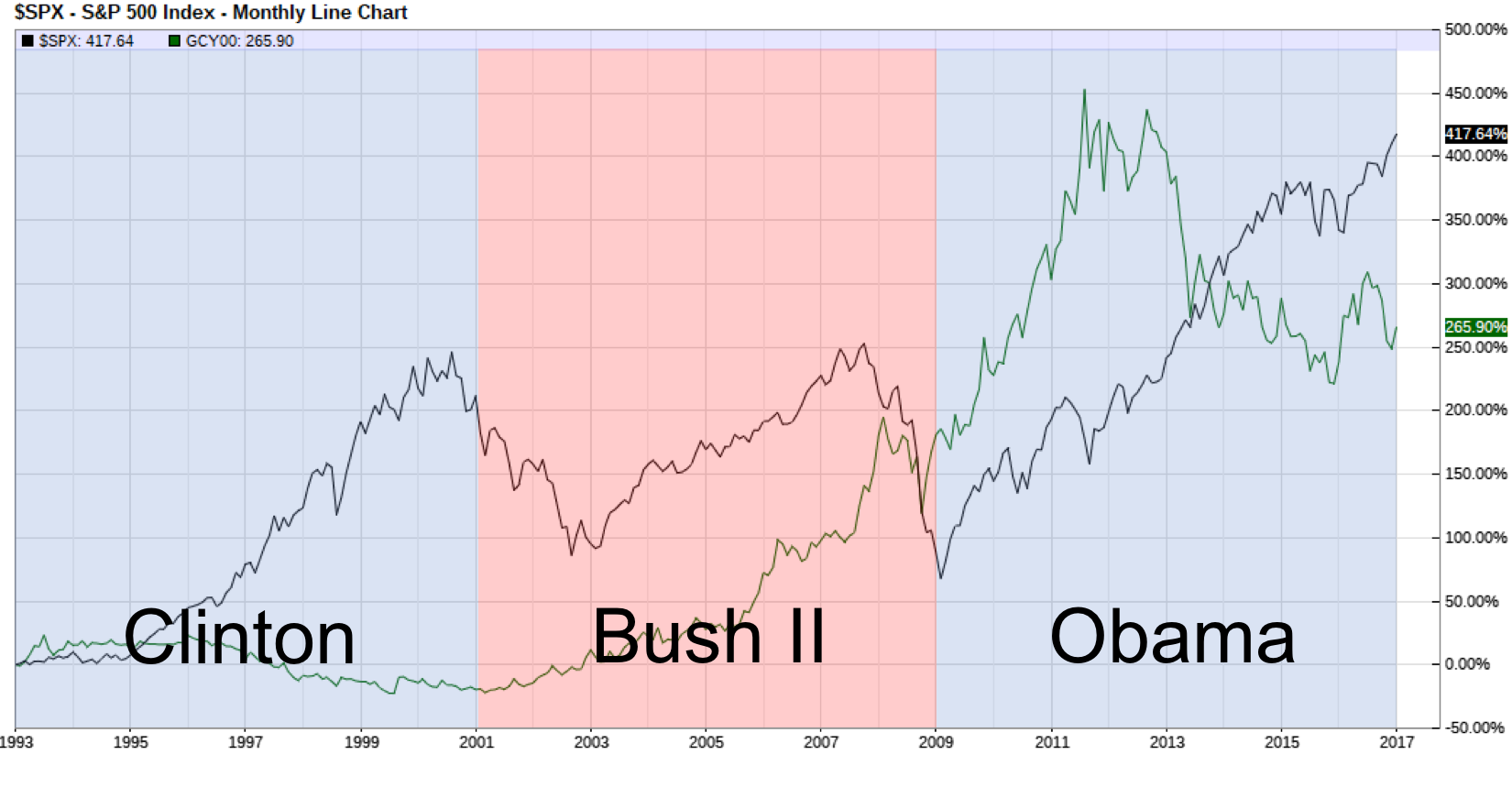

For my high-level assessment I looked at US national debt, the price of gold and the S&P 500.

These three areas are just scratching the surface of the United States economy.

Other metrics one could look at are GDP (which I don’t think is useful), unemployment rate (deceptive), the Consumer Price Index (CPI, which has been resigned so that it doesn’t measure consumer prices), labor force participation, dollar strength relative to other currencies, home ownership, household debt, etc.

However as an investor I’m mainly interested in getting any clues as to how stocks and precious metals are going to perform.

Keep in mind these trends have more to do with Federal Reserve actions, regulations, laws, and government spending and less to do with who is taking up space in the oval office.

Slick Willy

Former President Bill Clinton and Former First Lady of the United States Hillary Clinton

Under President William J. Clinton, the US national debt went from $4.2 trillion to $5.73 trillion, the price of gold fell 30% and the S&P 500 went up 182%. The housing bubble also started to form under Clinton.

Bonus: During the Clinton reign the NASDAQ tech bubble popped and the index went from it’s high of 4,696 down to 2,500.

To be fair, if you bought the NASDAQ in 1993 you would been up almost 300% by the end of Clinton’s term. But that doesn’t help anyone who bought in during the peak.

W

Former President George W. Bush attempting to wear a poncho.

Under US President George W. Bush the housing bubble continued to form and peaked. This bubble popped resulting in the 2008 financial crisis, the national debt nearly doubled and went from $5.73 trillion to $10.63 trillion, gold went up 222% and the S&P 500 dropped 41%.

In an attempt to paper over the 2008 financial crisis a stock and bond bubble also started to form in Bush’s last year.

Bonus: Under the Bush regime, during the 2008 financial crisis the S&P 500 went from it’s peak of 1550 down to 805.

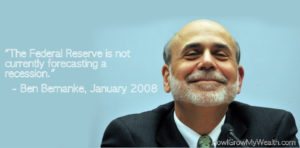

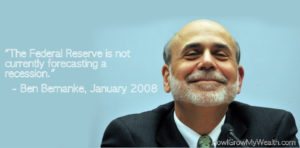

One of the worst things Bush did from an economic perspective was to appoint Federal Reserve Chair Ben Bernanke in 2006.

Based on all his public comments Bernanke was completely blindsided by the 2008 financial crash and is perhaps most responsible for the current stock and bond bubbles.

Obama

Former United States President and Golfer in Chief, Barack Obama

Under US President Barack H. Obama, the stock and bond bubbles grew to a capacious size, national debt went from $10.63 trillion to nearly $20 trillion, the price of gold went up 30% and the S&P 500 went up 175%.

Bonus: Under Obama’s rule, the labor force participation rate dropped down to a level not seen since the late 1970s. And no, it’s not because of baby boomers retiring.

Double Bonus: During Obama’s entire tenure as President the Fed Funds rate was never over .75%. Except for Obama’s last year in office the Fed Funds rate was below .25% for his entire presidency.

There has never been a period in US history that interest rates were that low for that long.

This means Obama presided over the US economy while the largest economic bubble to date was blown.

Interestingly, Obama retained the Bush appointed Fed Chair Ben Bernanke for the majority of his presidency. It was over five years into Obama’s presidency that Bernanke was replaced by current Fed Chair Janet Yellen.

Blow a Bubble, Let it Pop, Repeat

Bernanke could not correctly forecast the present

As you can see from the chart below, the S&P 500 grows in a bubble, then the bubble pops.

Obama truly lucked out.

During Obama’s tenure there was no significant correction, there was also no significant attempt to normalize interest rates and the bubble has grown even larger than past bubbles.

This means that when the stock and bond bubbles do pop the fallout will be much worse.

Most people don’t understand how the Federal Reserve fuels asset bubbles.

Unfortunately for Trump, the bubble will probably pop during his first (and thus only) term and he (and free-markets) will be blamed for it.

Free markets and deregulation are not the cause of these bubbles: it’s government spending, moral hazard created by the government, harmful government incentives and the Federal Reserve.

Green Shows the % increase in the price gold, Black shows the % increase in the S&P 500

What Can the Past Tell Us about the Future

History might not repeat itself but it does rhyme.

In many ways the Trump presidency, from an economic and market perspective, is starting off similarly to George W. Bush’s presidency.

Both Bush II and Trump inherited a bubble economy that formed under his predecessors. Bush continued to grow the housing, stock and bond bubbles and made them worse. Trump will probably do the same to the existing stock and bond bubbles.

Buddies

But the stock and bond bubbles will burst eventually.

It’s nigh-impossible to predict exactly when, but at some point valuations of US debt and US stocks will revert to their historical averages and more realistic valuations.

I thought theses bubbles would pop while Obama was in office but I was wrong. I think the bubbles will pop during Trump’s first term and I don’t anticipate being wrong again.

When the bubble does pop, the government will react the way it always does. Lower interest rates, print money, lower taxes (maybe), and spend, spend, spend.

This doesn’t work but it’s the only playbook the government knows.

I believe real assets and foreign stocks will perform well in this environment.

Trump’s Plans

Trump has talked about lowering taxes and reducing regulations.

Trump has talked about lowering taxes and reducing regulations.

These actions would benefit the US economy.

But Trump would also need to significantly reduce government spending. The US government is already insolvent and reducing taxes without also reducing government spending would only increase US national debt.

However, because most government spending is on the military, social security and medicare there is practically no chance Trump will actually reduce government spending.

Thus the US national debt will continue to grow and I believe will double to $40 trillion.

I hope I’m wrong.

Trump has also talked about tariffs, infrastructure spending, and how the dollar is too strong (implying he will try to weaken it).

These things are all bad for the US economy.

Over the next four years I believe the stock and bond bubbles will collapse. I also think the dollar will lose a great deal of value and the price of gold will outperform and reclaim the 2011 high of $1,920.

What John is Doing

So what is one to do in the age of Trump?

I know what I’ll be doing to grow and protect my wealth.

It’s the same things I’ve been doing:

Investing in Foreign Value Stocks

Purchasing Gold

Investing in alternatives like peer to peer loans

Holding some Cash

I’ve got those setup to both grow and protect my wealth. I also work in my day-career in financial services earning US dollars to spend on the necessities of life and to convert any excess funds to the assets I’ve mentioned above.

I’m excited about the Trump presidency.

Not because I expect him to do the right thing or because I think he can or will fix the foundational systemic issues with the US economy; but because this is a time of great opportunity for individuals who take the appropriate steps to protect themselves.

by John | Jan 9, 2017 | Insurance, Tax Strategies, Wealth Protection

With the dawn of the Affordable Care Act (ACA, more often called ObamaCare) individuals are now taxed for NOT buying something.

I encountered this for the first time the 2016 calendar year during my 100 days of unemployment. For for the first six months of 2016 I had what the Affordable Care Act calls “minimum essential coverage” (MEC) through my employer.

Starting in July I no longer had employer provided health insurance.

I hardly considered continuing my employer coverage via COBRA because it’s so expensive.

Even though I’m relatively young and healthy, accidents do happen. The number one cause of bankruptcy in the US is medical bills and I don’t want to be part of that statistic.

I could have signed up for a 2016 ACA plan within 60 days of losing my employer provided coverage but I didn’t think that was a good option.

The Affordable Care Act Made Healthcare Less Affordable For Me

The least expensive plan for me on healthcare.gov was $203.55 per month and had a $6,650 deductible, $40-$80 co-pays and/or 40/60 co-insurance and $6,850 maximum out of pocket.

This ACA health plan would have cost $2,442.60 per year or $1,221.30 for six months.

But even when you pay the premiums one still has to meet the $6,650 deductible.

For those not familiar with insurance jargon, a deductible is an amount that must be paid out of pocket by the insured (in this case me) before the insurance plan will cover anything.

So, in the course of a year you’d have to spend over $9,000 before this plan would kick in and start covering medical bills.

No thank you I’ll find a better plan.

What I Decided to Do for the Second Half of 2016

I purchased a non-MEC health insurance plan for $52 per month. It had a $5,000 deductible 30/70 co-insurance and a maximum out of pocket of $16,666.

I also got an accidental medical expense plan for $57.36 per month with a $250 deductible. I would be paid out up to $10,000 in the event of a disability or cancer/stroke.

So for a little over half the cost I was able to buy what I think is better coverage from both a cost and benefit perspective. My total cost was $656.16 for six months of coverage.

Minimum Essential Coverage

The only problem with the plan I purchased is that it does not fit into the government’s definition of “minimum essential coverage” (MEC).

Not having MEC results in one having to pay the Orwellian “Shared Responsibility Payment” which is $695 in 2016 or 2.5% of Adjusted Gross Income, whichever is higher, prorated for any months in which there was no coverage.

Since I had MEC for 6 months through work, but non-MEC for the 6 month I was unemployed, I would be “responsible” for paying half of the “Shared Responsibility Payment”. This “tax penalty” in 2016 is $695 or $347.5 or 2.5% of my AGI, whichever is higher.

So my total cost for health insurance in the last six months of the year was $1,003.66. Which is still $200 less expensive than if I had gone with the least expensive healthcare.gov plan.

Would I Have Done Anything Differently?

In hindsight I think I would have done the following.

After losing my employer coverage I would have gone without insurance for about 50 days or so (if I had gotten catastrophically ill in that time I would have bought an ACA plan since I would still be within that 60 day window). Then after 50 days of going without insurance I’d sign up for the least expensive ACA plan.

The ACA plan would have cost me $203.55 per month for four months or about $815.

You can go up to 3 months without MEC provided you have MEC for the rest of the time. So I wouldn’t have had to pay the newspeak “Shared Responsibility Payment.”

Lessons

My mistake was not factoring in the “tax penalty”. The health insurance I did buy was less expensive than buying the cheapest ACA plan for four months, but NOT once I factor in having to pay the penalty.

In 2016 I was right in the heart of the people who DON’T benefit from the ACA.

Young healthy single people who don’t need most of the extras health insurance HAS TO HAVE to be considered MEC and thus avoid the “tax penalty”.

At my stage in life I don’t need or want maternity and newborn care or pediatric services. I don’t need or want coverage for rehabilitative services and devices or nursing home care. All things that increase the cost of an insurance plan that MUST be included in an ACA approved plan.

I also was making enough money that I didn’t qualify for any tax subsidy.

Other people my age might opt to go without any health insurance and just pay the fine/tax. That would have been the least expensive option for me in 2016 but not one I was willing to take.

I didn’t want to go without insurance.

I know some people benefit from the Affordable Care Act. However, I was not one of them. The ACA made healthcare more expensive for me and limited my choices.

by John | Dec 18, 2016 | Options, Passive Income, Value Investing, Wealth Protection

I’ve decided to pivot towards a more passive option approach with covered calls.

The reason is twofold. First, I haven’t done well with options (except for August) because of mistakes I’ve made.

Back in November, after the surprise election of Donald Trump and the ensuing stock market melt-up, my option positions blew up and I lost around $1,500. My account size at the time had been around $10,000 so that is a big, big percentage loss over a short period of time.

The second reason is I don’t have free time during trading hours.

Reason One: I Made Mistakes

It should not have mattered much when the markets moved a lot. I pay to follow Kirk DuPlesis’s trades over at OptionAlpha.com. Kirk was only down around 2%. I was down around 15% even though I was in very similar positions.

Why the difference?

The main mistake I made is that I only had about $100 in free margin, which is a big no-no. I should have had $5,000 in margin available. Because I only had $100 when the markets went crazy I didn’t have any dry powder to make adjustments add additional positions to balance out the portfolio or hold positions to expiration.

Kirk was using around 50% of his available margin, so he is able to hold positions to expiration, make adjustments, sell additional premium, and keep his portfolio diversified.

It’s frustrating because while I know the rules I wasn’t following them.

Follow the Rules to Be Successful

To be successful trading options long-term there are several inviolable rules: small position sizes (1-5% of the portfolio per trade), only use half of your available capital, and place a lot of trades so the probabilities work out.

There are other factors too, like using the correct strategy, making high probability trades and being on the right side of volatility, among others.

But I don’t follow the rules! I’m afraid of missing out on a trade, or I allow myself to make an exception “just this once”, or I get greedy. And it burns me every time!

So I’m putting myself in time-out.

I’m going to stop trading options for a while. I haven’t had the discipline to follow the rules that must be followed in order for the math work out in my favor and be successful.

Reason Two: I Have Less Time

Not only that but I don’t have the free time I did when I was seeking out a new, full-time career.

Even though it might be possible to trade options and work a full time job it’s hard. One is confined to placing limit GTC orders before or after work or trading over lunch. However, a lot of the market movement tends to happen in the 30 minutes after the market opens and 30 minutes before the markets close.

When I was doing a lot of trading (July-September) I didn’t have a day job. I had this website, option trading, and selling coins. I set my own schedule.

Now I’m on the road or in appointments 8-9 hours a day during trading hours and I rarely have time to place 3-4 trades 30 minutes before the markets close. I don’t have time to make the appropriate adjustments to existing positions and I don’t have time to look for new trade opportunities.

I need a more passive approach.

Covered Calls

So I’m winding down my existing option positions. I’m also increasing holdings in some of my Value Stock Picks and selling some covered calls on them.

Covered calls they work like this: first buy shares of a stock, say 100 shares of Acme Amalgamated for $40/share. Then sell an out of the money (out of the money for a call option contract would be a contract with a strike price above where the underlying stock is currently trading) call contract for a theoretical $100 premium. 10% out of the money would be a $44 strike price.

A call contract legally obligates the call option seller to sell 100 shares of the underlying stock to the option contract buyer at an agreed upon price (the strike price) at any time before the contract expires.

For a more in-depth introduction to covered calls I suggest checking out Investopedia.

With the covered call approach, I sell an out of the money call with a strike price about 10% above where the stock is currently trading, with a contract expiring 30-60 days out, and I buy 100 shares of the underlying stock. This provides some downside protection, regular income (from the option premium) and the only downside versus owning the stock outright is gains are capped at 10% until the contract expires.

With covered calls three things can happen.

1) The stock goes down

In the above example, the stock price could drop as low as $39 at the time of expiration and the position would still break even. Because even though $100 would be lost on the price of the stock (if one were to sell) the call option would expire without being exercised and the $100 premium is still retained.

If the stock fell below $39 a loss would occur, but it would be $100 less than it would otherwise be.

2) The stock goes up or down a small amount, or stays the same price

A $100 profit would be realized plus or minus the gain or loss of the stock. If the stock price was below $44 at expiration the sold call would expire worthless and not be exercised.

3) The stock goes up beyond the strike price

In this case the position would return about 10%. It would be $400 gain plus the $100 option premium. One could either close out the call contract for a wash/loss or just let the position get assigned and the 100 shares of ACME bought for $40 per share would get sold for $44 per share.

So by selling covered calls, you give up some upside potential in exchange for some downside protection and recurring income.

But if I could make 10% every 60 days I’d be thrilled. Lets say the stock is on a tear, and it goes up 15% in the first 30 days and I get assigned, I’d still make 10%. I could then buy the stock back and sell another covered call 10% out of the money, at the end of 30 days the stock goes up another 15%, I would have still make an additional 10%, etc.

I think it is a good strategy if you can execute it correctly. Plus it doesn’t take a lot of time.

Some important elements:

1) Picking a good stock

I want to sell covered calls on stocks (or ETFs) that I want to hold for the long term. I’ve previously talked about what metrics I use for selecting stocks.

Another strategy, for example, is to buy an S&P 500 ETF like SPY and sell covered calls on it.

2) Discipline

You need to limit risk and diversify in non-correlated assets. It’s a temptation to buy into the latest hot stock and sell calls on it, or try to use too much leverage on a position. Another temptation could be buying too much stock in a given company or industry.

I would like to go back to trading options in a more active way someday. And I’m not saying I won’t make the occasional earnings trade but if I get back into actively trading options it will require puritanical adherence to the rules.

by John | Dec 4, 2016 | Capital Appreciation, Insurance, Personal Journey, Saving Money, Value Investing, Wealth Protection

“We teach about how to drive in school, but not how to manage finances.” – Andy Williams

I didn’t learn much about personal finance or how to build wealth in school.

Even though I find art history, World War II, and the Pythagorean theorem interesting and important areas of study–I can think of few topics with more day to day relevance than personal finance.

But if it weren’t for two finance electives I took in college I wouldn’t have learned anything about personal finance in school.

There are powerful wealth lessons that schools could teach but for some reason do not.

Five Powerful Wealth Lessons School Didn’t Teach

1) I must Produce more than I consume to Build Wealth

I can’t say it better than Simon Black:

The Universal Law of Prosperity is very clear– in order to build wealth you have to produce more than you consume. – Simon Black

Source: https://www.sovereignman.com/trends/this-entire-system-is-rigged-against-your-prosperity-18760/

This basic concept isn’t taught in school and as a result we get polls like: “Two-thirds of Americans would have difficulty coming up with the money to cover a $1,000 emergency.”

Source: http://apnorc.org/news-media/Pages/News+Media/Poll-Two-thirds-of-US-would-struggle-to-cover-$1,000-crisis.aspx

The United States can also boast the following numbers:

Source: https://www.nerdwallet.com/blog/credit-card-data/average-credit-card-debt-household/

If you consume more than you produce, the only option is to go into debt, which is a sure way to become poor.

In school I never learned the powerful wealth lesson: I must Produce more than I consume to Build Wealth.

2) Money Loses Value Because of Central Banks

I think most people KNOW that money loses value (or at least that things are getting more expensive each year), but for anyone who disagrees here are some facts:

- In 1950 a new house cost $8,450 in 2016 the average is over $300,000 (3,450% increase)

- In 1950 a gallon of gas was 18 cents in 2016 it is $2.40 (1,233% increase)

- In 1950 the average cost of new car was $1,510.00 in 2016 it is $33,560 (2,122% increase)

- In 1950 the average income per year was $3,210 in 2016 it is $55,000 (1,613% increase)

Source: http://fuelinsights.gasbuddy.com/content/docs/2016forecast.pdf

Source: www.thepeoplehistory.com/1950s.html

Source: www.deptofnumbers.com/income/us

Source: www.usatoday.com/story/money/cars/2015/05/04/new-car…price-3…/26690191/

Those are stats specific to the United States but I know you’d find similar statistics throughout the world.

Dollars (and other fiat currencies) are losing value. Incomes are not keeping up with the rising costs of homes and automobiles, the two major types of purchases many people will make.

Saving money in dollars is a sure way to get wiped out.

Money doesn’t lose value because of some mysterious force or greedy businesses, it loses value because of central banks. This is something I’m passionate about because it is simply robbery. Not only is price inflation robbery, but it most directly harms the poor. I’ve written about the Downfall of the US Dollar and What Causes Inflation.

In school I never learned the powerful wealth lesson: Money Loses Value Because of Central Banks.

3) I’m on my Own for Retirement

In over 18 years of education in US government schools I can’t recall ever learning about the failure of US government programs.

There are countless examples.

One is state public pensions. They are woefully underfunded. Alaska, California, and Illinois are some of the worst offenders when it comes to underfunded pensions.

However, all fifty of these United States plus the District of Columbia suffer from underfunded public pensions.

Source: http://www.zerohedge.com/news/2016-12-02/stanford-study-reveals-california-pensions-underfunded-1-trillion-or-93k-household

Two more in-progress failures are Social Security and Medicare. (To be fair, I did learn about the insolvency of these programs in FIN 232, my senior year of college.)

The Medicare Trustees’ report indicates the Medicare program is underfunded and revenue is less than expenditures.

Source: https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/ReportsTrustFunds/index.html?redirect=/reportstrustfunds/

The Social Security Trustees’ report indicates that Social Security is underfunded as well.

Source: https://www.ssa.gov/oact/tr/

This isn’t some tin-foil hat conspiracy. Below is a direct quote (from 2015) from the Social Security and Medicare Boards of Trustees:

Social Security’s Disability Insurance (DI) Trust Fund now faces an urgent threat of reserve depletion, requiring prompt corrective action by lawmakers if sudden reductions or interruptions in benefit payments are to be avoided. Beyond DI, Social Security as a whole as well as Medicare cannot sustain projected long-run program costs under currently scheduled financing.

Source: https://www.ssa.gov/oact/TRSUM/2015/index.html

I never learned about the importance of saving for retirement in school. I never learned about investing, IRAs, 401ks, pensions, or Health Savings Accounts. (Again, I did learn about these in FIN 232, my senior year of college.)

If you’re under 40 and you live in the US and you think you can count on Social Security and Medicare (or a public pension) I think you’ll be in for a rude surprise.

Social Security and Medicare are broken. Plain and simple. “But politician X will save these programs!” you might be tempted to think.

Here is another quote from the above report:

“Social Security and Medicare together accounted for 42 percent of Federal program expenditures in fiscal year 2014.”

This is the same Federal Government that is $20 trillion in debt. If the US Federal Government bails out Social Security and Medicare, who is going to bail out the Federal Government?

People need to make their own preparations!

In school I never learned the powerful wealth lesson: I’m on my Own for my Retirement.

4) College Isn’t Right for Everyone

Will this guy have to go $200,000 in debt to get a degree in British Literature?

How many times have you heard something to the effect of: “Study hard, go to college, get a good job and then retire at age 65.”?

That approach CAN work, but high school seniors need to be asking themselves, “does it make sense to go $150,000+ in debt for an art history degree?”

I took an art history class in college and I really enjoyed it. But if I knew how much I was paying for that class I would probably have done a lot better going to a museum or buying a few books.

If, for example, you can get a chemical engineering degree for $100,000 and are then able to make $70,000 per year right out of college then it starts to make more sense. But people need to start making those cost benefit and ROI calculations.

Young people need to stop assuming that college is a good idea. It depends on the cost of the education and how much that degree will allow you to earn once you graduate.

In school I never learned the powerful wealth lesson: College Isn’t Right for Everyone.

5) There is a Difference between Good Debt and Bad Debt

There is good debt and there is bad debt.

There is good debt and there is bad debt.

Taking out a $35,000 loan to buy a brand new car is very expensive. Maybe you’re making enough money that you can afford to treat yourself to a new car every 2-3 years and maybe leasing an automobile makes sense in that case.

But a good used car that is 5-6 years old makes a lot more financial sense particularly if you aren’t making a lot of money.

On the other hand, taking out a $200,000 loan to buy an income producing rental property could make a lot of sense.

Taking out a loan to buy new shoes or a car or other consumable items is bad debt.

Taking out a loan to buy an income producing asset is good debt.

In school I never learned the powerful wealth lesson: There is a Difference between Good Debt and Bad Debt.

I Learned a lot about Personal Finance outside of School

I learned a lot about personal finance from my parents, by reading, talking to experts, attending seminars and trial and error. In some ways it’s a good thing I didn’t learn about personal finance in school because I probably wouldn’t have learned as much and most likely would have been taught things that aren’t true that I would have had to unlearn.

The important takeaway is that financial education is critically important and that it’s up to YOU to make sure you learn what you need to know.

Why wouldn’t your fairy godmother just give you an even $1,500 and call it a day?

Why wouldn’t your fairy godmother just give you an even $1,500 and call it a day?

Trump has talked about lowering taxes and reducing regulations.

Trump has talked about lowering taxes and reducing regulations.

There is good debt and there is bad debt.

There is good debt and there is bad debt.