Imagine if you will your fairy godmother appears and you’re given the opportunity to backdate one trade to five years ago.

You’re given 1,000 dollars and you’re presented with three investment choices.

For each option she tells you the annual gain or loss as well the average return:

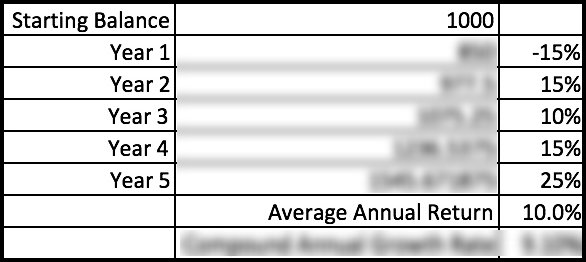

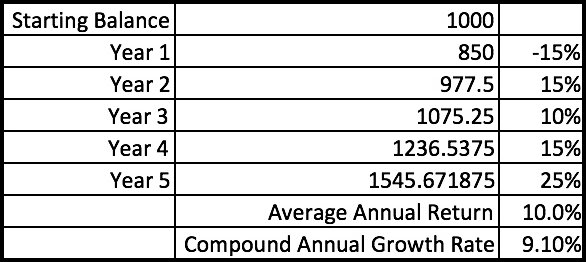

Investment One

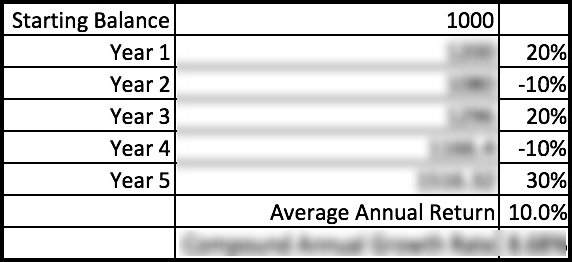

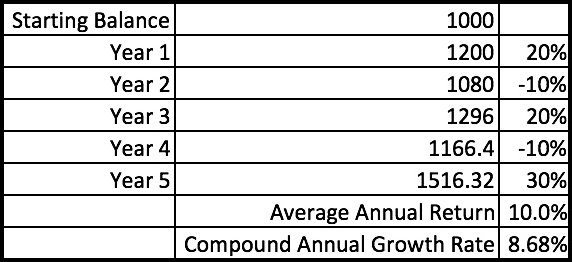

Investment Two

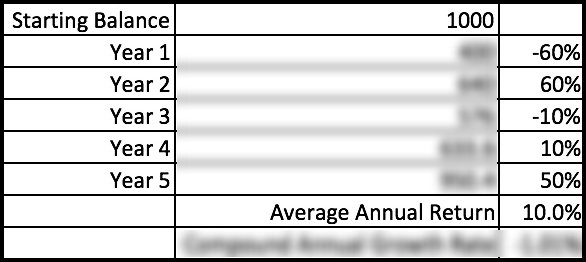

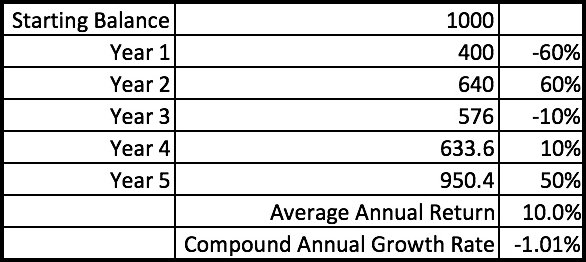

Investment Three

Now your fairy godmother told you the average annual return for each is 10%. So, one might be tempted to assume each investment will perform the same!

But you don’t get average returns so this number is not particularly useful.

Total Return

You want to choose the one that has the highest total return. Total return is just a fancy way of saying how much an investment went up (or down) from it’s starting value.

So you’d take the starting amount, $1,000, and add the gain or loss from the first year, second year, etc, and see how much the $1,000 is now worth after five years. The percentage increase from the original value to the ending value is the total return.

Total return would be 54.57% for investment one, 51.63% for investment two and lastly investment three has a total return of -4.96%, even though the average return for each was the the same: 10%.

Compound Annual Growth Rate

Investors typically want to know how an investment tends to perform each year. A useful way of seeing how an investment does each year in a way that smooths out up years and down year that is more useful than average returns is the Compound Annual Growth Rate (CAGR).

CAGR is calculated as follows:

Source: http://www.investopedia.com/terms/c/cagr.asp

I’ve calculated the CAGR for you below.

Investment One

Investment Two

Investment Three

So if the fairy godmother had provided the CAGR; it would have a been a useful number to determine which investment had the highest total return.

Why Do fairy godmother’s overcomplicate things?

Why wouldn’t your fairy godmother just give you an even $1,500 and call it a day?

Why wouldn’t your fairy godmother just give you an even $1,500 and call it a day?

I don’t know.

Cinderella‘s fairy godmother gave her until midnight to get back home. Why didn’t she give her a year to get back or just make the pumpkin turn into a carriage permanently?

Why weren’t the slippers made out of something more comfortable and durable than glass?

Cleary there is NOT a precedent for the pragmatic or straightforward. So don’t ask me to explain how fairy godmothers operate. But lest I upset the fairy godmother community I think the principle of don’t look a gift horse in the mouth also applies. After all, she’s hooking you up with the ability to backdate a trade.

You don’t get the Average Annual Return

At best the average return % isn’t useful. At worst the average return is rather deceptive–but that is the number that most mutual funds list.

While not without it’s limits, the compound annual growth rate is much more useful than average returns and it is something to keep in mind when evaluating an investment.

Average returns tell you very little while the compound annual growth rate shows you which investment would have had the highest total return.