by John | May 1, 2018 | Insurance, Preservation of Purchasing Power, Saving Money

According to the United States Bureau of Labor statistics the rate of consumer price increases, as measured by the Consumer Price Index (CPI) is 2.4%. That is the combination of a variety of factors such as food, fuel, clothing et al. One of the factors is “Shelter” and the rate of price increases for shelter according to the BLS comes in at 3.3% for the 12 month period ending in march 2018.

It sounds comical for me to write it out but I am passionate about inflation. Inflation is a terrible injustice to the people, destructive to the economy and a leading contributor to many economic crises such as the “dot-com” bubble in 2000 and the 2008 financial crisis.

When I talk about inflation I typically mean an increase in the money supply which in many cases leads to price inflation which is an increase in prices as a result of an increase in the money supply.

I have long believed that the BLS CPI is flawed and that the actual rate of price increases is much higher, between 5-10%. And in fact if the BLS measured price inflation in the same way they did in 1990, the CPI would be 6%.

Source: http://www.shadowstats.com/alternate_data/inflation-charts

The Rent is Too Darn High

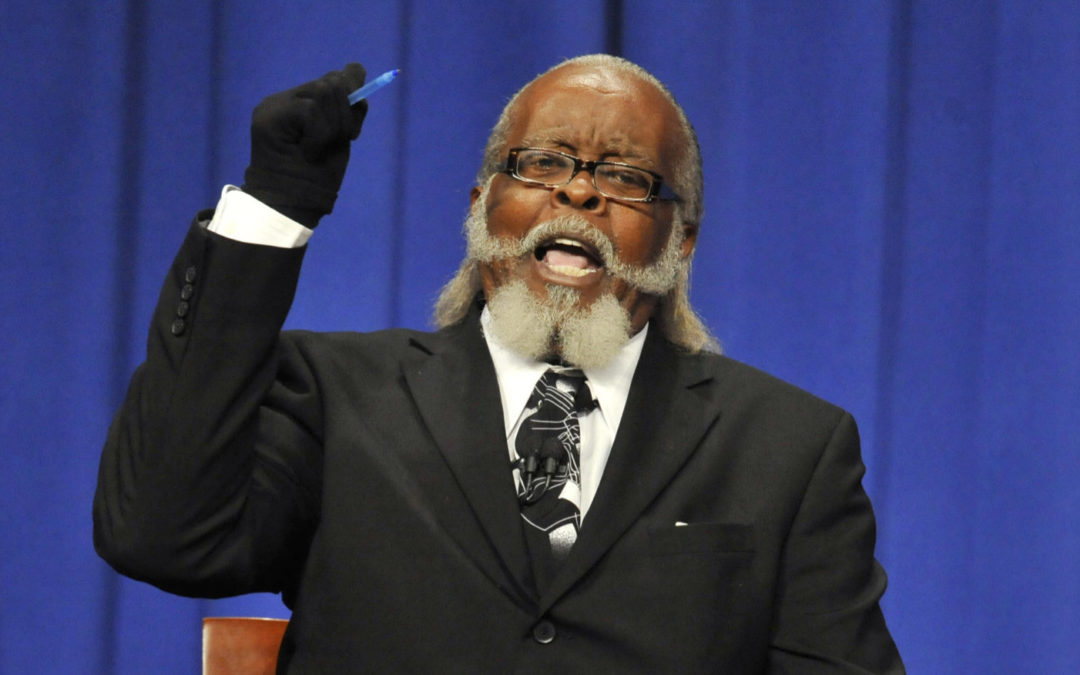

I recently renewed my apartment lease. My apartment hasn’t changed at all. And after the previous 10 month lease has ended my renewal lease rate is 2.6% higher for a new 12 months lease.

That doesn’t seem like much, and in the grand scheme of things it isn’t, but rent is the largest expense I have so it is an unpleasant increase.

I have to admit I’m not as passionate about the rent being too high as compared to say Mr. James McMillan III, who ran for Governor of New York numerous times, with high rent being a core pillar of his political platform.

Parental warning: Video below contains the “D” word

Healthcare Price Increase

According to the BLS healthcare costs rose 2% for the 12 month period ending March 2018.

Source: Bureau of Labor Statistics

It’s time for my annual enrollment in health insurance. I’ve written about health insurance costs and how the affordable care act made healthcare less affordable for me.

I am fortunate (and grateful) to have health insurance coverage through my employer and I would prefer to be in a scenario where health insurance wasn’t tied to employment. I would prefer a true free market system in health care and health insurance. But recently I have been trying, to quote the serenity prayer, to take “as Jesus did, This sinful world as it is, Not as I would have it.”

My health insurance monthly premium actual fell by 0.66%. However, the devil is in the details.

Prior Plan

My previous plan had a $3,000 deductible, 10% coinsurance once the deductible was met and a max out of pocket (or “MOOP”) of $5,000. So if I had the worst year ever I wouldn’t pay more than about $5,000. Since I’m single, relatively young and relatively healthy I think this is a pretty good deal since my monthly premiums are very low.

New Plan

However, this plan was “discontinued” and the new “comparable” plan now has a $3,500 deductible, 20% coinsurance once the deductible is met a $5,950 MOOP.

So this means that while my premiums fell by just 0.66%, my deductible went up by 14.29%, my maximum out of pocket went up 15.97%, and the amount my insurer pays once I reach my higher deductible falls from 90% down to 80%.

I hope I don’t have to use my medical plan at all, and if I don’t I will have saved token amount of money (which I will take!), but if I do have the worst year ever (medically) then I’ll be paying nearly $1,000 more.

Why the Increase?

I’m just one person so it isn’t fair to generalize my experience to the United States as a whole, with this caveat in mind I suspect that the individual mandate being removed has something to do with it.

If people don’t have to buy health insurance anymore then that means there are fewer younger, healthy people buying insurance and on a percentage basis, more sick people with insurance. I’m sure there are a variety of factors as well but this could be part of it.

Of course I think that removing the individual mandate was a good thing–I don’t see how a “free society” can require individuals to buy something.

However, in order for Obamacare to work your really need that mandate. Obamacare made it so that people with pre-existing conditions could still get “health insurance”.

I list “health insurance” in quotes because at this point health insurance in the US is no longer insurance. Insurance is a way of protecting against a potential risk. For example you can’t buy fire insurance when your house is on fire because once it is on fire it is no longer a risk it is a certainty.

But Obamacare made it so that people can essentially buy health insurance after they get sick (they might have to wait until annual enrollment but still).

I want everyone to have access to medical care. Co-opting and ruining the health insurance industry is not a good approach to working towards a world where everyone has access to medical care.

With the individual mandate revoked but the inability for insurance providers to take into account pre-existing conditions means that prices will have to rise. A lot. This is the tradeoff, if you want to force insurance companies to “insure” sick people then the government would need to force people healthy people to buy insurance.

Of course I don’t believe in initiating force to get anyone to do anything. I am saying that in order for this coercive system to work in which insurance companies are forced to “insure” people with pre-existing conditions that you have to coerce healthy people to buy insurance.

What I’m Doing About It

In the short term nothing. I hope to remain relatively healthy and hope I don’t have to foot a $5,000 medical bill any time soon. However, in the medium to long term I have a plan that will help me pay for medical care and fight against health insurance price increases. I’ll write more about this strategy in an upcoming article.

by John | Jan 9, 2017 | Insurance, Tax Strategies, Wealth Protection

With the dawn of the Affordable Care Act (ACA, more often called ObamaCare) individuals are now taxed for NOT buying something.

I encountered this for the first time the 2016 calendar year during my 100 days of unemployment. For for the first six months of 2016 I had what the Affordable Care Act calls “minimum essential coverage” (MEC) through my employer.

Starting in July I no longer had employer provided health insurance.

I hardly considered continuing my employer coverage via COBRA because it’s so expensive.

Even though I’m relatively young and healthy, accidents do happen. The number one cause of bankruptcy in the US is medical bills and I don’t want to be part of that statistic.

I could have signed up for a 2016 ACA plan within 60 days of losing my employer provided coverage but I didn’t think that was a good option.

The Affordable Care Act Made Healthcare Less Affordable For Me

The least expensive plan for me on healthcare.gov was $203.55 per month and had a $6,650 deductible, $40-$80 co-pays and/or 40/60 co-insurance and $6,850 maximum out of pocket.

This ACA health plan would have cost $2,442.60 per year or $1,221.30 for six months.

But even when you pay the premiums one still has to meet the $6,650 deductible.

For those not familiar with insurance jargon, a deductible is an amount that must be paid out of pocket by the insured (in this case me) before the insurance plan will cover anything.

So, in the course of a year you’d have to spend over $9,000 before this plan would kick in and start covering medical bills.

No thank you I’ll find a better plan.

What I Decided to Do for the Second Half of 2016

I purchased a non-MEC health insurance plan for $52 per month. It had a $5,000 deductible 30/70 co-insurance and a maximum out of pocket of $16,666.

I also got an accidental medical expense plan for $57.36 per month with a $250 deductible. I would be paid out up to $10,000 in the event of a disability or cancer/stroke.

So for a little over half the cost I was able to buy what I think is better coverage from both a cost and benefit perspective. My total cost was $656.16 for six months of coverage.

Minimum Essential Coverage

The only problem with the plan I purchased is that it does not fit into the government’s definition of “minimum essential coverage” (MEC).

Not having MEC results in one having to pay the Orwellian “Shared Responsibility Payment” which is $695 in 2016 or 2.5% of Adjusted Gross Income, whichever is higher, prorated for any months in which there was no coverage.

Since I had MEC for 6 months through work, but non-MEC for the 6 month I was unemployed, I would be “responsible” for paying half of the “Shared Responsibility Payment”. This “tax penalty” in 2016 is $695 or $347.5 or 2.5% of my AGI, whichever is higher.

So my total cost for health insurance in the last six months of the year was $1,003.66. Which is still $200 less expensive than if I had gone with the least expensive healthcare.gov plan.

Would I Have Done Anything Differently?

In hindsight I think I would have done the following.

After losing my employer coverage I would have gone without insurance for about 50 days or so (if I had gotten catastrophically ill in that time I would have bought an ACA plan since I would still be within that 60 day window). Then after 50 days of going without insurance I’d sign up for the least expensive ACA plan.

The ACA plan would have cost me $203.55 per month for four months or about $815.

You can go up to 3 months without MEC provided you have MEC for the rest of the time. So I wouldn’t have had to pay the newspeak “Shared Responsibility Payment.”

Lessons

My mistake was not factoring in the “tax penalty”. The health insurance I did buy was less expensive than buying the cheapest ACA plan for four months, but NOT once I factor in having to pay the penalty.

In 2016 I was right in the heart of the people who DON’T benefit from the ACA.

Young healthy single people who don’t need most of the extras health insurance HAS TO HAVE to be considered MEC and thus avoid the “tax penalty”.

At my stage in life I don’t need or want maternity and newborn care or pediatric services. I don’t need or want coverage for rehabilitative services and devices or nursing home care. All things that increase the cost of an insurance plan that MUST be included in an ACA approved plan.

I also was making enough money that I didn’t qualify for any tax subsidy.

Other people my age might opt to go without any health insurance and just pay the fine/tax. That would have been the least expensive option for me in 2016 but not one I was willing to take.

I didn’t want to go without insurance.

I know some people benefit from the Affordable Care Act. However, I was not one of them. The ACA made healthcare more expensive for me and limited my choices.

by John | Dec 4, 2016 | Capital Appreciation, Insurance, Personal Journey, Saving Money, Value Investing, Wealth Protection

“We teach about how to drive in school, but not how to manage finances.” – Andy Williams

I didn’t learn much about personal finance or how to build wealth in school.

Even though I find art history, World War II, and the Pythagorean theorem interesting and important areas of study–I can think of few topics with more day to day relevance than personal finance.

But if it weren’t for two finance electives I took in college I wouldn’t have learned anything about personal finance in school.

There are powerful wealth lessons that schools could teach but for some reason do not.

Five Powerful Wealth Lessons School Didn’t Teach

1) I must Produce more than I consume to Build Wealth

I can’t say it better than Simon Black:

The Universal Law of Prosperity is very clear– in order to build wealth you have to produce more than you consume. – Simon Black

Source: https://www.sovereignman.com/trends/this-entire-system-is-rigged-against-your-prosperity-18760/

This basic concept isn’t taught in school and as a result we get polls like: “Two-thirds of Americans would have difficulty coming up with the money to cover a $1,000 emergency.”

Source: http://apnorc.org/news-media/Pages/News+Media/Poll-Two-thirds-of-US-would-struggle-to-cover-$1,000-crisis.aspx

The United States can also boast the following numbers:

Source: https://www.nerdwallet.com/blog/credit-card-data/average-credit-card-debt-household/

If you consume more than you produce, the only option is to go into debt, which is a sure way to become poor.

In school I never learned the powerful wealth lesson: I must Produce more than I consume to Build Wealth.

2) Money Loses Value Because of Central Banks

I think most people KNOW that money loses value (or at least that things are getting more expensive each year), but for anyone who disagrees here are some facts:

- In 1950 a new house cost $8,450 in 2016 the average is over $300,000 (3,450% increase)

- In 1950 a gallon of gas was 18 cents in 2016 it is $2.40 (1,233% increase)

- In 1950 the average cost of new car was $1,510.00 in 2016 it is $33,560 (2,122% increase)

- In 1950 the average income per year was $3,210 in 2016 it is $55,000 (1,613% increase)

Source: http://fuelinsights.gasbuddy.com/content/docs/2016forecast.pdf

Source: www.thepeoplehistory.com/1950s.html

Source: www.deptofnumbers.com/income/us

Source: www.usatoday.com/story/money/cars/2015/05/04/new-car…price-3…/26690191/

Those are stats specific to the United States but I know you’d find similar statistics throughout the world.

Dollars (and other fiat currencies) are losing value. Incomes are not keeping up with the rising costs of homes and automobiles, the two major types of purchases many people will make.

Saving money in dollars is a sure way to get wiped out.

Money doesn’t lose value because of some mysterious force or greedy businesses, it loses value because of central banks. This is something I’m passionate about because it is simply robbery. Not only is price inflation robbery, but it most directly harms the poor. I’ve written about the Downfall of the US Dollar and What Causes Inflation.

In school I never learned the powerful wealth lesson: Money Loses Value Because of Central Banks.

3) I’m on my Own for Retirement

In over 18 years of education in US government schools I can’t recall ever learning about the failure of US government programs.

There are countless examples.

One is state public pensions. They are woefully underfunded. Alaska, California, and Illinois are some of the worst offenders when it comes to underfunded pensions.

However, all fifty of these United States plus the District of Columbia suffer from underfunded public pensions.

Source: http://www.zerohedge.com/news/2016-12-02/stanford-study-reveals-california-pensions-underfunded-1-trillion-or-93k-household

Two more in-progress failures are Social Security and Medicare. (To be fair, I did learn about the insolvency of these programs in FIN 232, my senior year of college.)

The Medicare Trustees’ report indicates the Medicare program is underfunded and revenue is less than expenditures.

Source: https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/ReportsTrustFunds/index.html?redirect=/reportstrustfunds/

The Social Security Trustees’ report indicates that Social Security is underfunded as well.

Source: https://www.ssa.gov/oact/tr/

This isn’t some tin-foil hat conspiracy. Below is a direct quote (from 2015) from the Social Security and Medicare Boards of Trustees:

Social Security’s Disability Insurance (DI) Trust Fund now faces an urgent threat of reserve depletion, requiring prompt corrective action by lawmakers if sudden reductions or interruptions in benefit payments are to be avoided. Beyond DI, Social Security as a whole as well as Medicare cannot sustain projected long-run program costs under currently scheduled financing.

Source: https://www.ssa.gov/oact/TRSUM/2015/index.html

I never learned about the importance of saving for retirement in school. I never learned about investing, IRAs, 401ks, pensions, or Health Savings Accounts. (Again, I did learn about these in FIN 232, my senior year of college.)

If you’re under 40 and you live in the US and you think you can count on Social Security and Medicare (or a public pension) I think you’ll be in for a rude surprise.

Social Security and Medicare are broken. Plain and simple. “But politician X will save these programs!” you might be tempted to think.

Here is another quote from the above report:

“Social Security and Medicare together accounted for 42 percent of Federal program expenditures in fiscal year 2014.”

This is the same Federal Government that is $20 trillion in debt. If the US Federal Government bails out Social Security and Medicare, who is going to bail out the Federal Government?

People need to make their own preparations!

In school I never learned the powerful wealth lesson: I’m on my Own for my Retirement.

4) College Isn’t Right for Everyone

Will this guy have to go $200,000 in debt to get a degree in British Literature?

How many times have you heard something to the effect of: “Study hard, go to college, get a good job and then retire at age 65.”?

That approach CAN work, but high school seniors need to be asking themselves, “does it make sense to go $150,000+ in debt for an art history degree?”

I took an art history class in college and I really enjoyed it. But if I knew how much I was paying for that class I would probably have done a lot better going to a museum or buying a few books.

If, for example, you can get a chemical engineering degree for $100,000 and are then able to make $70,000 per year right out of college then it starts to make more sense. But people need to start making those cost benefit and ROI calculations.

Young people need to stop assuming that college is a good idea. It depends on the cost of the education and how much that degree will allow you to earn once you graduate.

In school I never learned the powerful wealth lesson: College Isn’t Right for Everyone.

5) There is a Difference between Good Debt and Bad Debt

There is good debt and there is bad debt.

There is good debt and there is bad debt.

Taking out a $35,000 loan to buy a brand new car is very expensive. Maybe you’re making enough money that you can afford to treat yourself to a new car every 2-3 years and maybe leasing an automobile makes sense in that case.

But a good used car that is 5-6 years old makes a lot more financial sense particularly if you aren’t making a lot of money.

On the other hand, taking out a $200,000 loan to buy an income producing rental property could make a lot of sense.

Taking out a loan to buy new shoes or a car or other consumable items is bad debt.

Taking out a loan to buy an income producing asset is good debt.

In school I never learned the powerful wealth lesson: There is a Difference between Good Debt and Bad Debt.

I Learned a lot about Personal Finance outside of School

I learned a lot about personal finance from my parents, by reading, talking to experts, attending seminars and trial and error. In some ways it’s a good thing I didn’t learn about personal finance in school because I probably wouldn’t have learned as much and most likely would have been taught things that aren’t true that I would have had to unlearn.

The important takeaway is that financial education is critically important and that it’s up to YOU to make sure you learn what you need to know.

by John | Oct 30, 2016 | Insurance, Wealth Protection

I’ve started a new career in the financial services industry helping people protect their finances in the event of death, illness or disability.

I enjoy it and it goes right along with my mission on this website where I share how I grow and protect my wealth.

During the initial training at my new job I’ve learned a lot but one of the more surprising facts I’ve come across is the number one cause of bankruptcy in the United States.

The number one cause of personal bankruptcy in the United States is not student loans or credits cards. It isn’t gambling or home mortgages. The #1 cause of personal bankruptcy in the US is medical bills.

Source: http://www.cnbc.com/id/100840148

As a relatively young, relatively healthy person, I’m interested in making money, saving and investing it and building wealth.

But it is important to keep in mind the importance of protecting and preserving the wealth one does have. After all, what I spend 40 years building my wealth but then I get cancer and have to spend it all on medical bills?

If you own a home you probably have homeowners insurance to protect you from fires, floods and other damage. If you drive a car you have insurance for that. So why wouldn’t you insure your life and heath?

Medical bills are the #1 cause of personal bankruptcy so can you afford not to think about it?

What Is Insurance?

You can’t talk about insurance without talking about risk. A risk is the possibility of gaining or losing something of value. Insurance deals with pure risk. Pure risk is the possibility of a loss with no possibility of gain. For example, there is a risk of death, the risk of getting sick, the risk of your house burning down. Insurance provides financial compensation if one were to realize the risk the insurance policy covers.

True insurance is risk transfer. You trade a risk with a high cost (in the case of homeowners insurance let’s say your house burning down), in exchange for a lower cost loss (insurance premiums) and a high payout if you need it.

So if your $250k house burns to the the ground your insurance company will help you buy a new one. You hope nothing happens to your home but if it does you’re covered. You sleep better with the peace of mind knowing that if your house does catch fire you will be able to rebuild or buy a new place to stay.

So you’ve transferred the risk to your insurer.

Four Possible Outcomes

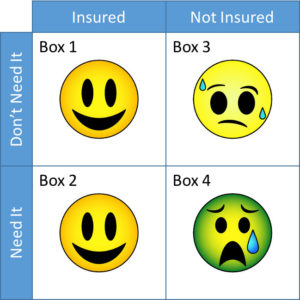

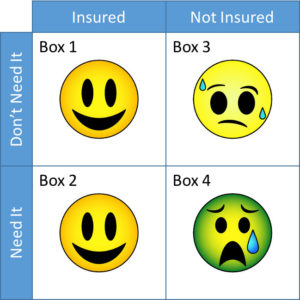

When discussing risks some people just don’t want to accept the possibility of a bad thing happening. They don’t want to think about getting sick, or their house burning down. So they deny the possibility of the risk or hope it doesn’t happen. “I’m not going to get sick!” they might say, or “That will never happen!” This is certainly one option. But is it a good option?

When it comes to insuring against a risk there are really only four outcomes. The first two are: either the bad thing doesn’t happen and you don’t need the insurance or the bad thing happens and you do need insurance.

Since you have a choice wether or not to purchase insurance you are either 1) insured or 2) you’re not insured.

An Example

There is a risk of getting cancer. I don’t know for sure that I will or I won’t get cancer but my family history is against me. I have a choice of wether or not to buy a critical illness plan that will pay in cash in the unfortunate event I get do get cancer.

So, I could choose to buy insurance, and it may turn out I don’t need it. I would be in Box 1. Personally I would be very glad and grateful if I never got cancer.

Would you?

Sure, I will have spent money on insurance premiums but I slept better knowing that if I did get cancer I would get a lump sum payment to help offset medical bills.

Which Box Represents the Situation You’d Rather Be In?

Well let’s say I do buy insurance and sadly I follow in the footsteps of my grandparents and parents and I do get cancer. I’ll get a lump sum payout that will help offset medicals bills or once I survive cancer (as I plan to do) I could use the money the plan pays me to go on a cruise to celebrate being alive. I’d be in Box 2.

Another option would be to not buy insurance and hope that I don’t need it. After all, maybe I won’t!

That would be nice, I’d save the money that I would have spent on the insurance premiums but I’d probably spend some time worrying about what I would do if I did get cancer. This is Box 3.

The final option would be that I choose not to purchase insurance and I do end up needing it. Medical expenses are costly! I could wind up being like one of the 2 million Americans who in 2013 went bankrupt because they couldn’t pay their medical bills. I don’t want that to happen to me. This is Box 4 and I don’t wind to end up there.

I’m certainly not saying to rush out and buy insurance today. You need to figure out what you’re at risk for, see if you’re financially vulnerable, and then find out if there are plans that meet both your needs and your budget.

But insurance is an important part of my own financial plan and it’s something I think more people should take time to think about.

Disclaimer: John is licensed with the State of Ohio for Life, Accident and Health Insurance, License # 1126312, NPN # 18149670

There is good debt and there is bad debt.

There is good debt and there is bad debt.