by John | Mar 26, 2017 | Currencies, Saving Money, Wealth Protection

There is a lot I like about cryptocurrencies. Many cryptocurrencies seek to make money decentralised and wrest control from the central banks that have a history of devaluation and abuse.

But there are several things I dislike about cryptocurrencies. I see several problems with them as a long-term store of value.

“What is a Cryptocurrency Anyway?”

Bitcoin is the largest cryptocurrency but there are hundreds of others as well. If you’re not familiar with Bitcoin I provide some background here: “What is Bitcoin?”

What I Dislike About Cryptocurrencies

Cryptocurrencies are better than government controlled fiat. But I don’t accept that being better than the disaster that is government fiat currency is good enough and I’m not going to pretend like cryptocurrencies solve all the problems of government controlled fiat money.

I’ve presented what I think are superior alternatives such as Goldmoney.

I touched on what I don’t like about cryptocurrencies in my gold versus bitcoin article but I wanted to dedicate an article solely to the elucidation of what I don’t like about cryptocurrencies.

My dislikes fall into three main categories.

1) They are centrally controlled

2) There are no natural limits on the quantity of cryptocurrencies

3) Cryptocurrencies have very low (or no) non-monetary use

Cryptocurrencies are Centrally Controlled

I am skeptical of the claim that cryptocurrencies like bitcoin are decentralised

The holdings of the cryptocurrencies are concentrated in the hands of the early adopters.

It is estimated that the mysterious creator(s) of Bitcoin, Satoshi Nakamoto, holds between 4-6% of all Bitcoin.

Source: http://www.businessinsider.com/satoshi-nakamoto-owns-one-million-bitcoin-700-price-2016-6

Vitalik Buterin owns a large number of Ether. Evan Duffield owns a large quantity of DASH.

Ripple intends to hold onto 50% of all Ripple cryptocurrency. There are similar situations for altcoins as well.

I think it is fine and good that early adopters and founders reap more reward for investing in a technology–my point is that cryptocurrencies are not actually as decentralised as cryptocurrency advocates would like you to believe.

This control isn’t limited to who holds the cryptocurrencies.

The control also extends to how the cryptocurrency technologies will function moving forward.

The Bitcoin Foundation, Bitcoin core developers and the largest miners control Bitcoin. The Ethereum Foundation and Vitalik Buterin control Ethereum.

People try to make arguments that cryptocurrencies aren’t centrally controlled and I’m not swayed by any of them.

At the end of the day cryptocurrencies are controlled by a small group of computer programmers.

What happens when cryptocurrencies actually behave in a decentralised manner? You get forks, like Ethereum Classic. Which brings me to my next point.

There are no natural limits on the quantity of cryptocurrencies

Like water in the desert, things that are both limited in supply and desirable tend to be valuable

I don’t have the knowledge or time to delve into the code of the Bitcoin algorithm but I accept on faith that because of how the bitcoin algorithm is written only 21 million Bitcoins will ever exist.

So in that way the quantity of Bitcoins are limited.

However, there is no limit to the number of “altcoins” or other cryptocurrencies that can be and are created.

There is Dash, Ethereum, Litecoin, Ripple, Monero and dozens of other altcoins you’ve never heard of. There are currently nearly 100 altcoins with a market cap over $20 million.

I’m all for competition and choice but when I’m investing in something as a long term store of value I want it to be limited in supply.

Furthermore, if the cryptocurrencies actually behave in a decentralised manner, you sometimes get hard forks.

Hard Forks

There is a cap on the maximum number of Ethereum that will ever be in circulation–but after a hack related to the “DAO” Ethereum forked and a new cryptocurrency was created called Ethereum Classic. This fork effectively doubled the number of Ethereum in existence.

Hard forks effectively result in double the number of units of that particular cryptocurrency

As a brief background, someone the “DAO” which was one of programs on the Ethereum network and stole a lot of Ether.

This caused an outcry, some people wanted to reverse that transaction so the thief wouldn’t get away with it. Some people didn’t want to reverse the transaction because it would mean Ethereum transactions weren’t irrevocable.

Ultimately a hard fork ensued and people who didn’t want to reverse the transaction got Ethereum Classic and those that followed the Ethereum Foundation and Vitalik Buterin remained on what is called Ethereum.

There is also talk of a fork in Bitcoin which would have a similar result: two different flavors of Bitcoin when before these was only one. In effect a doubling of the number of Bitcoins.

Cryptocurrencies have Very Low (or no) Non-Monetary use

I’m not going to flat out say that cryptocurrencies like Bitcoin have zero non-monetary use.

Although if you wanted to round down zero would be accurate.

Some people probably purchased Bitcoin as a political statement or way of saying that they didn’t want to be a part of a government controlled currency system. That is a non-monetary use.

But I think that use value is fairly low. Physical US dollars have non-monetary uses, like kindling or tacky wallpaper, but again that use value is very low and there are much better alternatives that accomplish the same thing.

Some people don’t think it matters that cryptocurrencies have little to no non-monetary use. For a time it probably doesn’t matter. People can subjectively value whatever they want. Otherwise you can’t explain why some works of modern “art” are sold for such high prices. But the question is will that subjective valuation be likely to hold?

Fiat currencies have little to no non-monetary use and how have they fared?

The value of Fiat currencies throughout history have eventually gone to zero. The fiat currencies that exist today did not exist 300 years ago.

The British pound Sterling, founded in 1694, is the oldest fiat currency in existence at 317 years. Most fiat currencies don’t last long.

Source: http://georgewashington2.blogspot.com/2011/08/average-life-expectancy-for-fiat.html

Gold has been valued for the past 3,000 years. What is the difference between gold and government issued fiat currencies? Gold has non-monetary use and non-monetary properties that have, for the past 3,000 years and up to this day, caused people to value it.

But I had better stop myself there rather than jump back into a gold versus bitcoin debate.

I don’t see how cryptocurrencies, that have very little non-monetary use, will fare better than government issued fiat over the long term.

Summing it Up

Some of the other shortcoming of cryptocurrencies are related to security and ease of use but I think those issues are sufficiently manageable.

I just don’t think the coins themselves are a good long-term store of value.

I choose to own both gold and cryptocurrency–I just choose to own more gold.

Just because there are things I don’t like about cryptocurrencies doesn’t mean I won’t use them and profit by them.

I own several flavors of cryptocurrency because I believe that they will be worth more in the future than what I paid for them. I also like to take advantage of the price differences on different exchanges.

I will be writing a future article entitled “Why I Like Cryptocurrencies” where I go into more detail about what I do like about cryptocurrencies.

What do you think of cryptocurrencies? Do you currently own any?

(29 July 2017: In a previous version of this article I claimed that cryptocurrencies are not scarce. I’ve updated the article with more precise language. At the time I first published this article there were over 100 cryptocurrencies with a market capitalization over $1 million, I’ve updated this number to nearly 100 cryptocurrencies with a market capitalization over $20 million.)

by John | Mar 19, 2017 | Geopolitical Risk Protection, Preservation of Purchasing Power, Wealth Protection

I wanted to flesh out the idea that my Caribbean Cruise was a microcosm of the global economy.

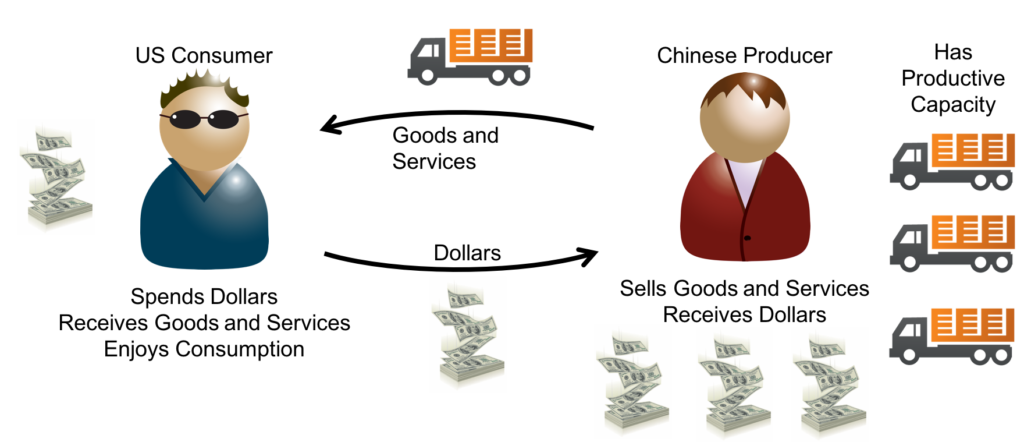

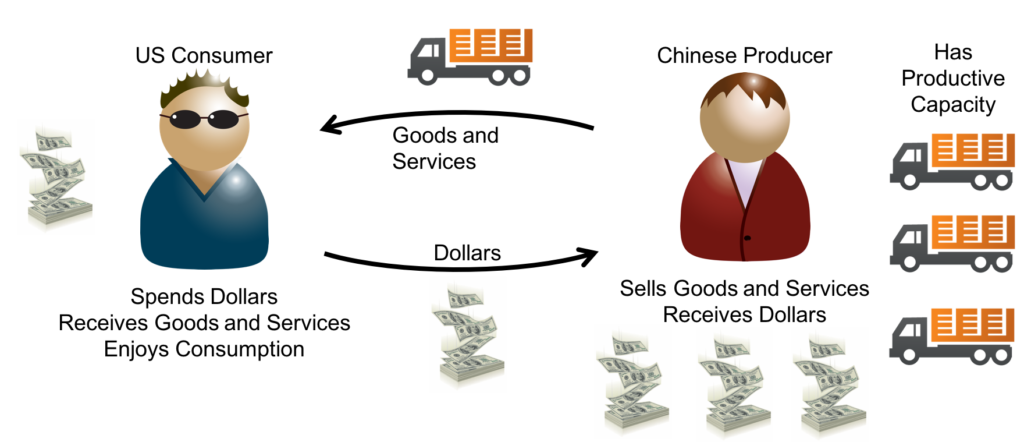

Basically Americans spend US dollars to consume goods and services while the rest of the world works to provide those goods and services in exchange for dollars.

One problem with this arrangement, at least for the people of the world who aren’t US citizens, is that the US dollar is no longer backed by a solvent and productive economy.

Another problem is that a lot of the loans American use to acquire dollars are provided by the very countries who also provide the goods and services.

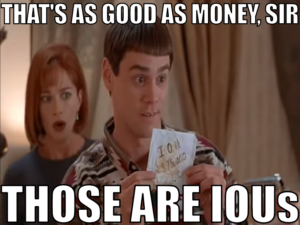

In other words what are these countries getting in exchange for providing goods and services? IOUs.

These IOUs are promises to pay from a group of people and a country that has more debt that any country or people in the history of finance.

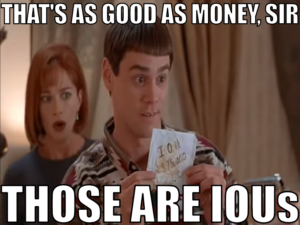

In the movie Dumb and Dumber, main characters Harry and Lloyd spend hundreds of thousands of other people’s money. But hey, they kept IOUs so they could pay them back! (both were unemployed)

So what will happen?

The US dollar will continue to lose a significant portion of it’s remaining value and American’s standard of living will continue to fall while the standard of living for the rest of the world will eventually rise once they stop selling their goods and services in exchange for overvalued US dollars.

This has been happening for a while, but people still have faith in the dollar and the other fiat currencies around the world are being devalued by their respective government even faster than the dollar.

So dollars are the cleanest dirty shirt.

But will this continue forever? Will Americans be able to continue to borrow at low rates and live beyond their means while the rest of the world foots the bill?

I doubt it.

The World Reserve Currency

The US dollar is the world reserve currency which means that many things that are traded on the global market are priced and bought and sold with US dollars.

It also means I was able to buy a Hawaiian shirt in Honduras, go snorkeling in Belize and buy drinks in Mexico at a low cost using US dollars.

Using China as an Example

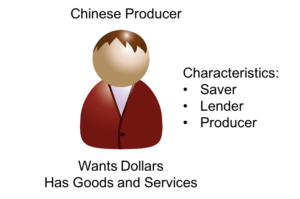

Why do countries put up with this lopsided arrangement?

It has everything to do with history and perception. I touch on this some in another article downfall of the US dollar. But the short version is that the US was the most powerful and dominant country after World War II and the currency reflected this strength.

The result was that critical goods like oil were priced in dollars.

Countries like China therefore need dollars in order to buy oil.

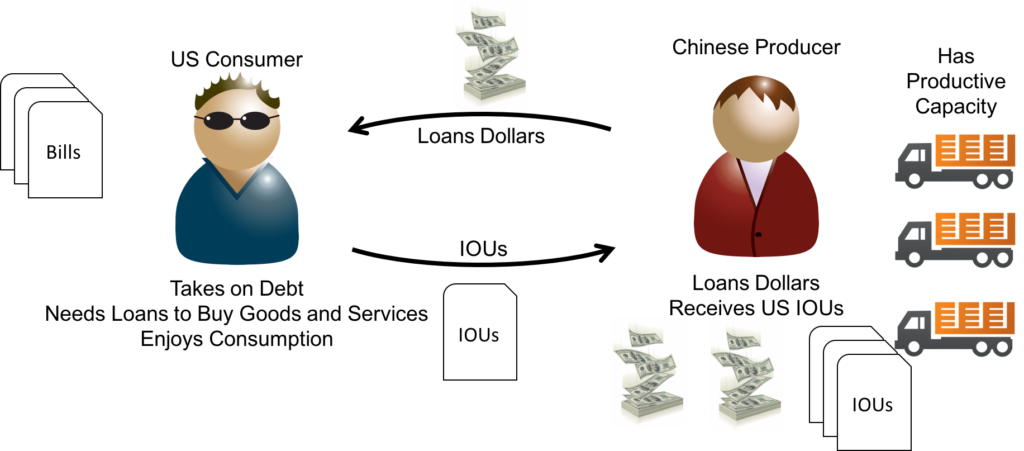

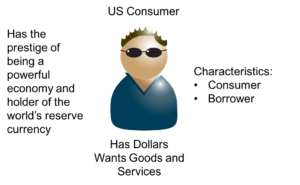

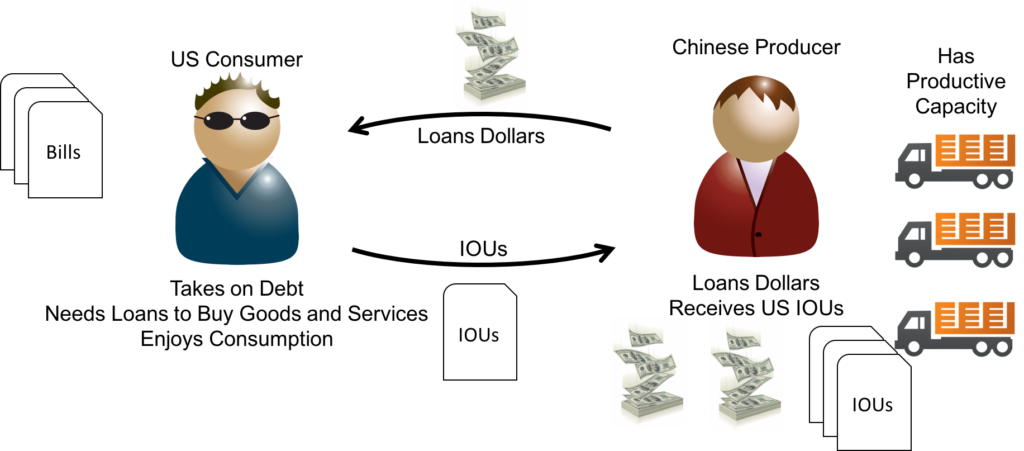

Meanwhile the American consumer wants goods and services.

So in order to get dollars China produces goods and services that are then sold to Americans for dollars.

Back when the majority of Americans had a lot of savings and the dollar had more value this worked fine.

But the US began producing less while simultaneously consuming more resulting in trade deficits.

In 2015 the US imported $497.8 billion in goods and services from China and exported $161.6 billion to China. Thus the U.S. goods and services trade deficit with China was $336.2 billion.

Source: https://ustr.gov/countries-regions/china-mongolia-taiwan/peoples-republic-china#

You can’t consume more than you produce (which is what a trade deficit is) without losing money and as time passed the US consumer found his savings depleted.

About half of Americans have zero net worth.

Source: https://www.marketplace.org/2014/04/21/wealth-poverty/about-half-america-has-zero-net-wealth

But China has an large portion of it’s economy built around American consumption and the world associated dollars with strength and prosperity.

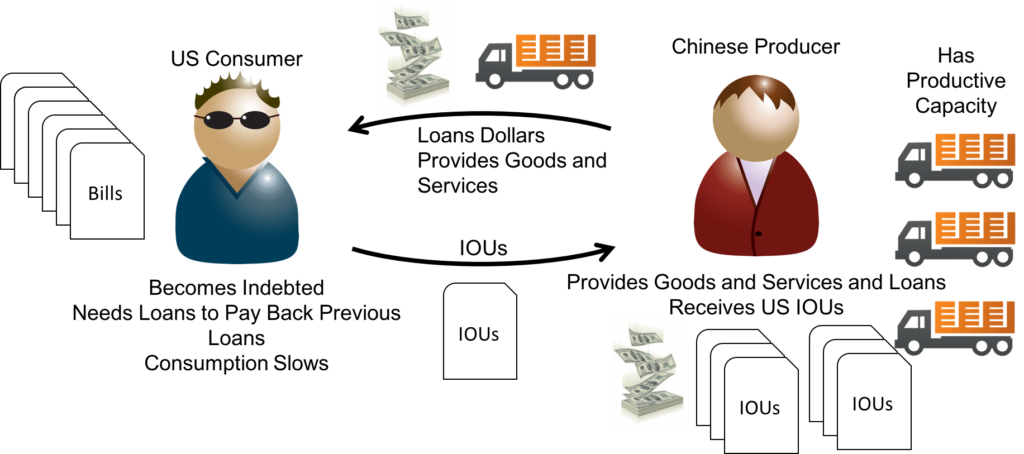

So China loans money to the American consumer to pay for the American to buy the things China produces.

This works for the time being because the US is the most powerful economy in the world and the dollar is the world reserve currency.

So of course the American will pay back the Chinese producer! Or so the thought goes.

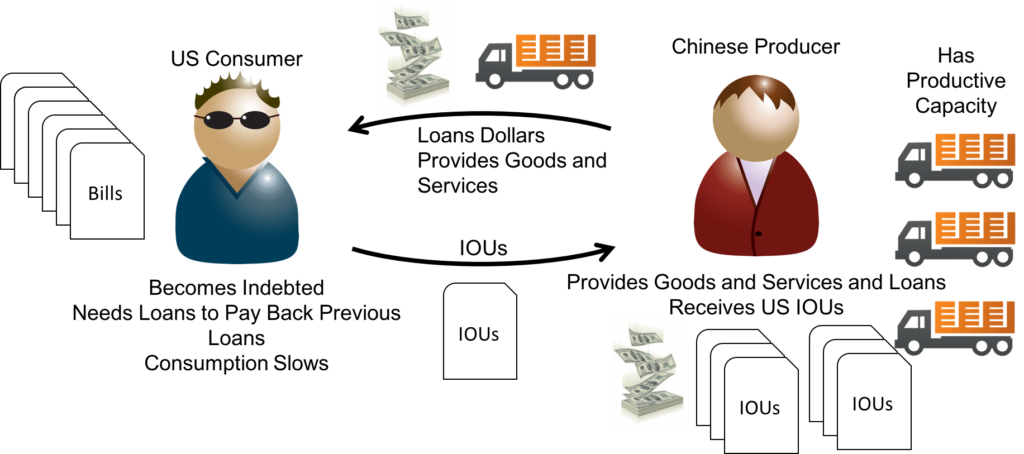

It’s the ultimate vendor financing: China provides the goods and services as well as the loans to pay for the goods and services.

Meanwhile the US government has also taken on monstrous amounts of debt and has devalued the dollar.

So the IOUs the Chinese producer already has are worth less and less each year.

How long before the Chinese producer begins to seriously doubt if the US consumer will ever pay back the IOUs?

Once this doubt takes how long before the Chinese producer stops providing the loans to buy the goods and services?

When this happens prices will have to rise and it will be harder for Americans to buy goods and services.

This process is explained in more detail in an excellent book that I recommend. The book is written by Peter Schiff and is called “How an Economy Grows and Why It Crashes “.

“.

Two beers, four mixed drinks and chips and salsa for under 20 USD. Compliments of El Cial La Ceiba in Cozumel, Mexico. It wasn’t just the two of us imbibing though!

This is basically what I was witnessing on my Caribbean Cruise.

I was able to spend my higher valued US dollars for goods and services provided by peoples outside the US who wanted dollars.

It is a great benefit that Americans have had for some time but will it continue forever?

I don’t think it will.

I think there are lots of opportunities to position oneself to avoid getting destroyed as the dollar continues to lose value.

Thats why I created this website.

by John | Mar 12, 2017 | Currencies, Geopolitical Risk Protection, The Inflation Bandit, Travel, Wealth Protection

I recently got back from a Caribbean cruise I took with my family. It was a wonderful time of relaxation, adventure and reconnecting.

But since I’m often thinking about economics and finance it was also a proxy for the global economy.

The first stop of the cruise was Roatan, an Island in Honduras. We drove from the port (pictured below) to the other side of the Island to go snorkeling.

Roatán Island, Honduras

Driving around the Island I saw mostly what I would have described as lower income areas if I’d been back in the United States.

I’ve certainly seen worse neighborhoods in the US.

I still got LTE mobile phone coverage with data (made a few stock trades), we drove by pharmacies, gas stations, supermarkets, a bank with rifle toting guards outside and a modern looking power plant.

One of the houses we drove by had some chickens in the front yard which at first seemed quite rustic until I remember I’ve seen that same thing an hour south of Columbus, Ohio.

The people I encountered were very friendly. I didn’t know what to expect but it was fascinating to spend time in another country.

Spending US Dollars outside the United States

My sister and I at Roatan. The Hawaiian shirt shows my commitment to leisure.

I bought a Hawaiian shirt for 22 US dollars (USD) as well as a small hand carved mahogany box that cost 45 USD.

The next day the ship stopped off the coast Belize and we took a tender into the City of Belize.

From there we went on a semi-guided snorkeling tour in which we got to swim with stingrays and nurse sharks.

It was incredible.

Afterwards we stopped at an Island called Caye Caulker for lunch. I could get a burger and fries for about 10 USD (Hey! Lobster wasn’t in season!).

It was on the Island of Caye Caulker that I first saw a Belize dollar. We paid for lunch in cash and the waitress gave us change in a mix of Belize dollars and USD. All the other transactions both on Roatan in Honduras and Belize up to that point were solely in USD.

This restaurant on Caye Caulker, Belize accepted dollars

It was the same in Cozumel, Mexico. The vendors priced items in dollars. One hotel we stopped at had drinks priced in pesos, but they accepted dollars without question.

US Dollars as the World Reserve Currency

Even on the relatively remote Isle of Caye Caulker the vendors on the street took US dollars as if I was in the US. And goods were priced in USD.

Welcome to the Caribbean love. – Captain Jack Sparrow

It struck me as odd that I was transacting in dollars in other countries. If someone came to the US and wanted to pay me in Belize dollars I probably wouldn’t accept them.

Part of the reason why the people of Honduras, Belize and Cozumel accepted dollars is likely because dollars still are the reserve currency of the world.

I doubt they think about world reserve currencies (I wouldn’t if I didn’t really enjoy this stuff) but the people I encountered who accepted dollars know that dollars are valued and can be used to buy useful things.

A Microcosm of the Global Economy

On the ship itself the vast majority of crew members are not from the United States. Amongst the crew there are around fifty home countries, such as Mauritius, Hungary, Ukraine, India, Romania, France, United Kingdom, Canada, Nicaragua, Philippines and dozens more.

I did find a couple US crew members as well as one from Canada, and the UK. But the majority of the home countries in my informal assessment of the crew were Philippines, India and Mauritius.

The passengers, while not wearing name tags with their nationality listed on it, seem to be mostly from the United States.

I think this trip represents a microcosm of the global economy.

The US dollar is strong, it’s accepted by other countries, and people from the US participate in a lot of consumption and spending of US dollars. People from other countries work to provide goods and services for the Americans and accept these dollars.

My brother and I outside of El Cid La Ceiba in Cozumel, Mexico.

This is a great deal for the Americans.

But the fundamentals of the US dollar are not strong.

Even when it isn’t bullying foreign banks the US government has made no serious effort to balance the budget, reign in entitlement spending or reduce the debt. A few quarter point hikes notwithstanding the Federal Reserve has not seriously attempted to reduce it’s balance sheet or normalize interest rates.

These factors are not positive for the US dollar as evidenced by it losing over 90% of it’s value.

It made a lot of sense why everyone wanted dollars 50-60 years ago. It makes less and less sense as time goes on.

As Simon Black likes to say this isn’t a consequence free environment. More to follow on this topic in the next article.

by John | Feb 26, 2017 | Capital Appreciation, Geopolitical Risk Protection, Preservation of Purchasing Power, Wealth Protection

What is a 60/40 asset allocation? I’ll take a quote from an article on my favorite online finance wiki, investopedia:

For many years, a large percentage of financial planners and stockbrokers crafted portfolios for their clients that were composed of 60% equities and 40% bonds or other fixed-income offerings. And these portfolios did rather well throughout the 80s and 90s. But a series of bear markets that started in 2000 coupled with historically low interest rates have eroded the popularity of this approach to investing. – “Why a 60/40 Portfolio is No Longer Good Enough“

With that in mind, I’ve found a delightful free tool called Portfolio Visualizer that I’ve been using to backtest various asset allocation strategies.

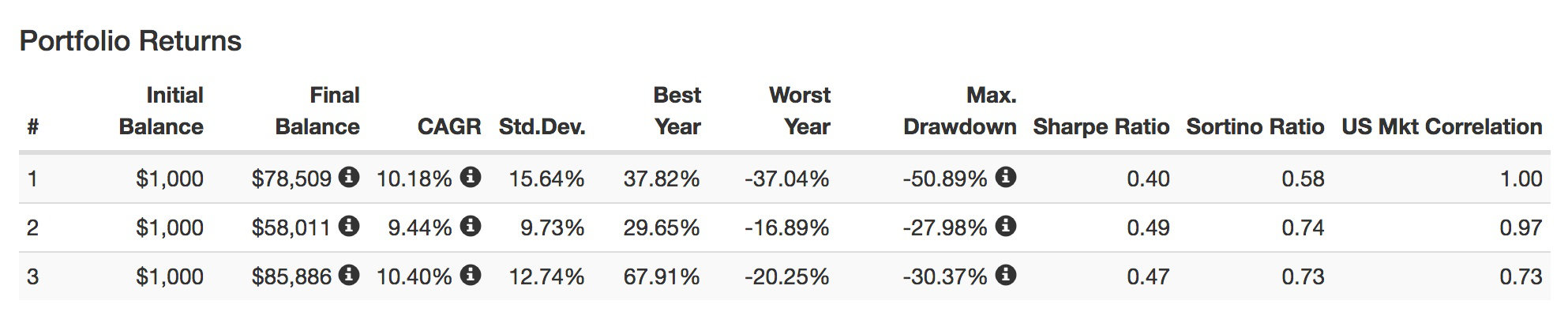

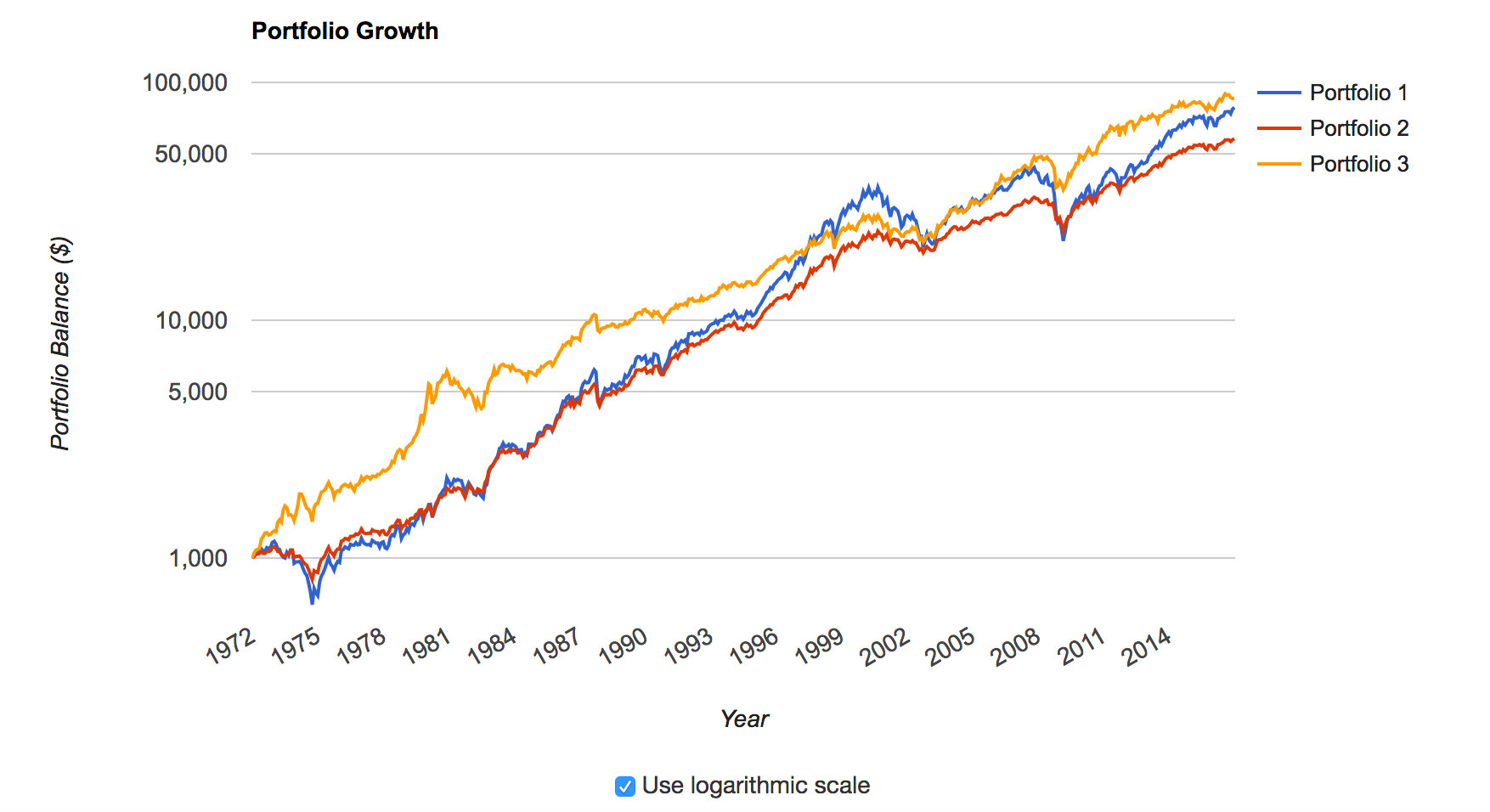

Today I’d like to share a few basic ones to provide some food for thought. Each of these portfolios is modeled for annual rebalancing, meaning assets would be bought and/or sold each year to retain the original allocation percentages.

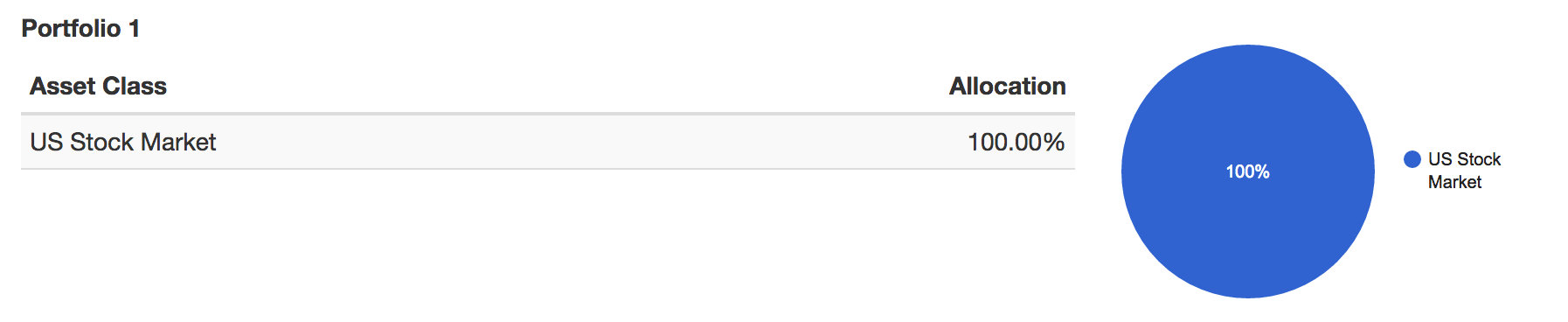

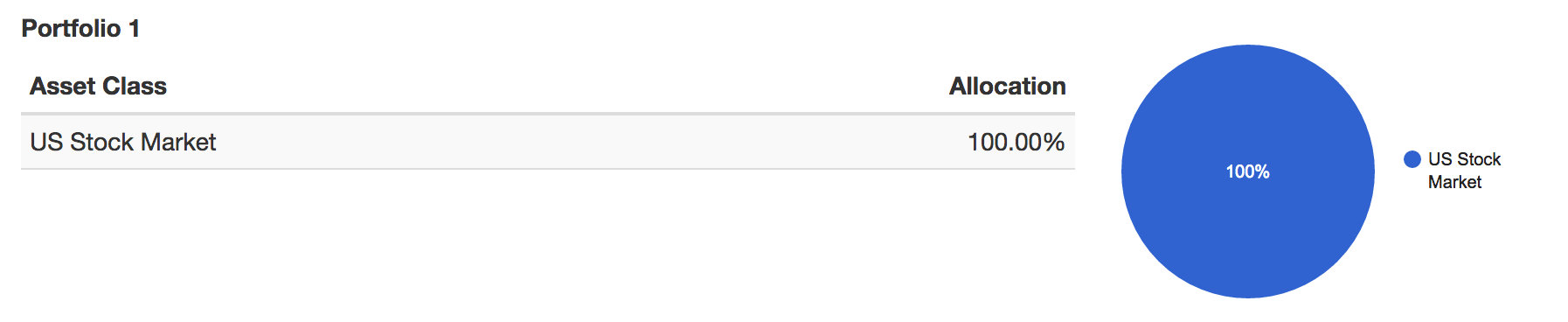

Portfolio 1: 100% Allocation to US Stocks

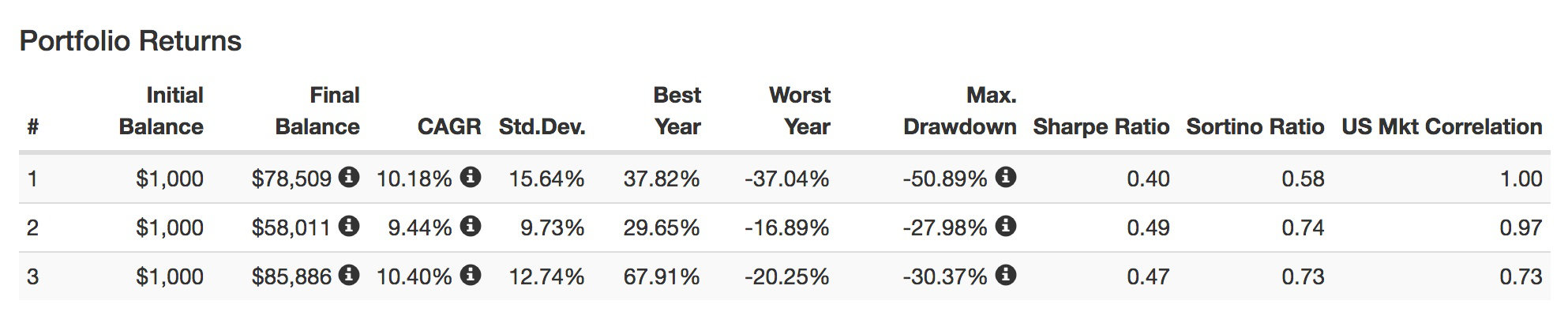

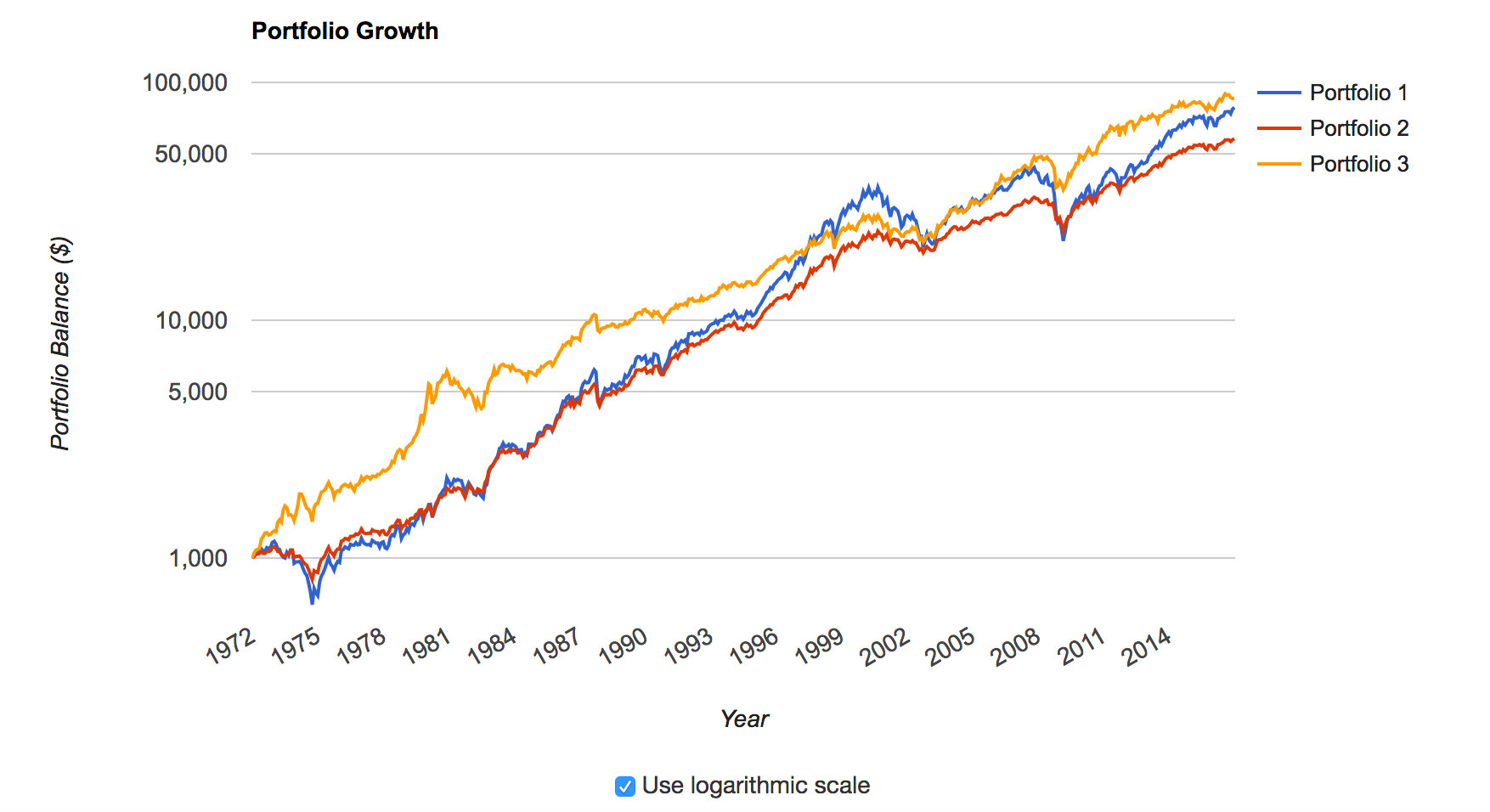

Using this tool, you can see that if in 1972 you invested $1,000 in US stocks, it would grow to be worth $78,509 at the end of 2016, representing a compound annual growth rate (CAGR) of 10.18%. You would have had to endure a drawdown of 50.89%, from November of 2007 through February of 2009. During this crisis the portfolio would have gone from $43,886 down to $21,551.

Using this tool, you can see that if in 1972 you invested $1,000 in US stocks, it would grow to be worth $78,509 at the end of 2016, representing a compound annual growth rate (CAGR) of 10.18%. You would have had to endure a drawdown of 50.89%, from November of 2007 through February of 2009. During this crisis the portfolio would have gone from $43,886 down to $21,551.

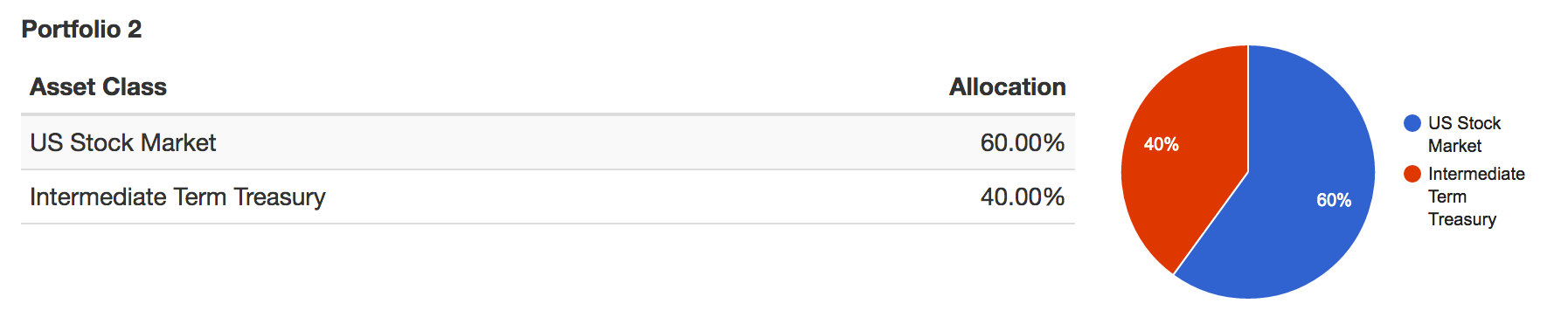

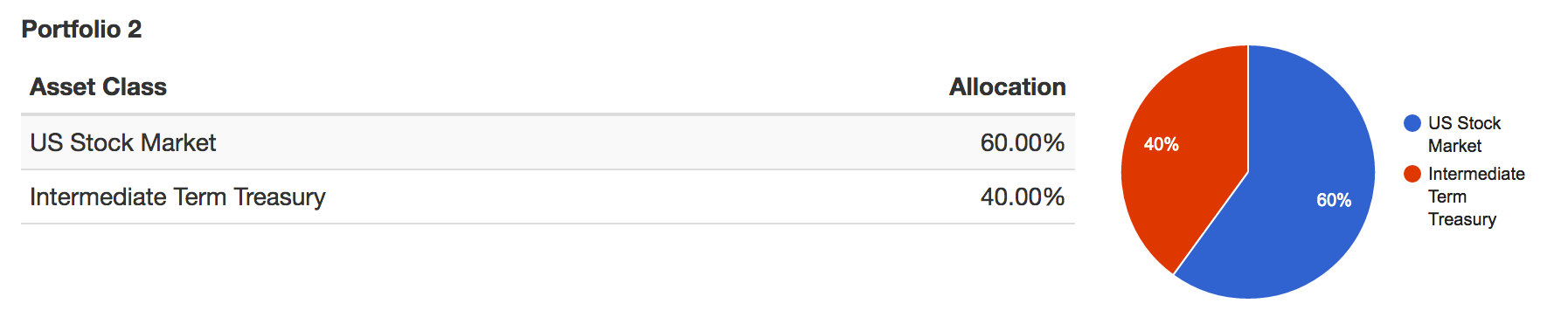

Portfolio 2: 60/40 Asset Allocation of US Stocks and Bonds

Most people don’t have the iron stomach needed to hold onto their stocks while their portfolio drops by 50%.

Most people don’t have the iron stomach needed to hold onto their stocks while their portfolio drops by 50%.

Enter the 60/40 asset allocation.

A traditional allocation in the investment community is (or has been) 60% stocks 40% bonds (in this case I used Intermediate Term Treasuries). The thought being that if stocks are going up, bonds are going down, but also that if stocks are going down, bonds will go up. If you did this 60/40 allocation starting in 1972, again with $1,000, the 2016 value would be $58,011, the CAGR would be 9.44% and the 2008 drawdown would have been around 28%.

So you give up $20,500 in exchange for some peace of mind.

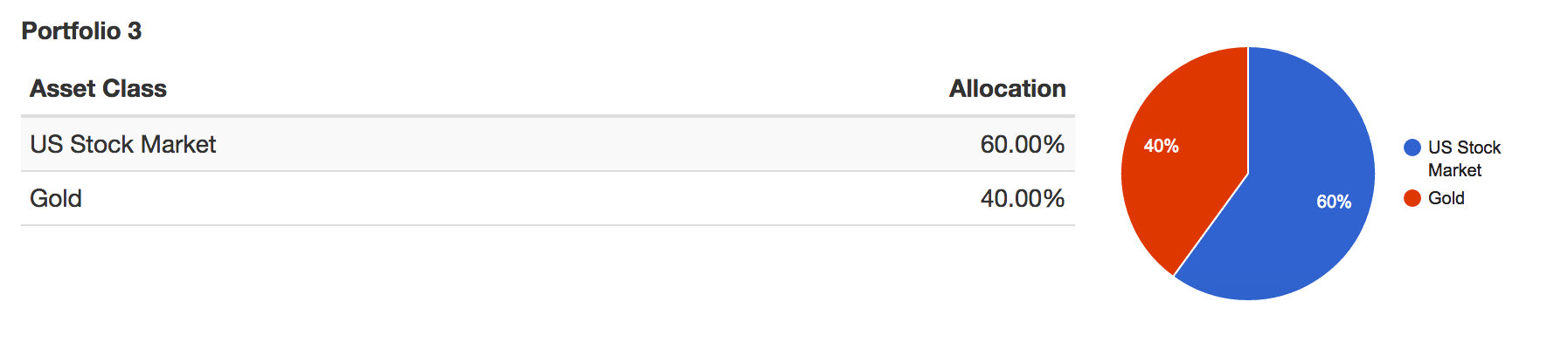

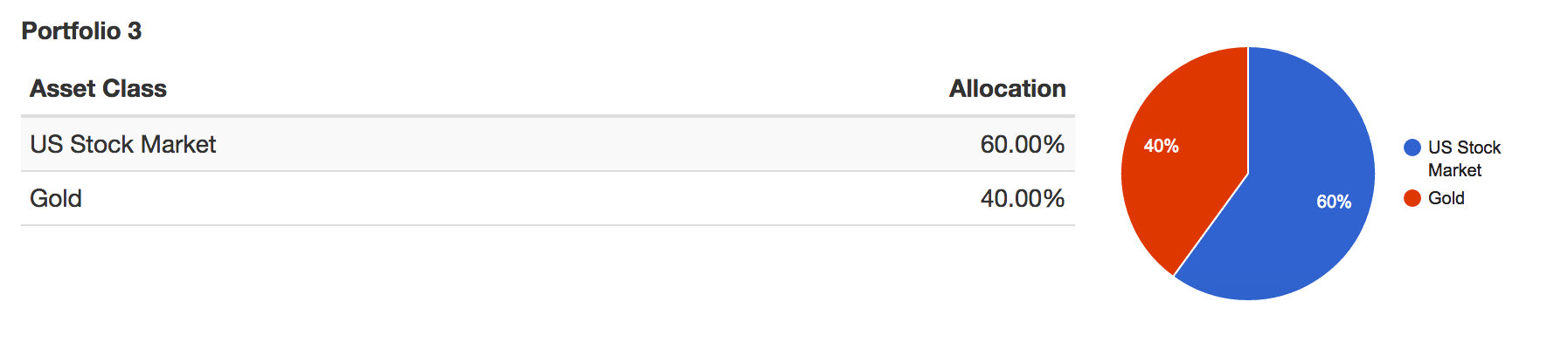

Portfolio 3: 60/40 Asset Allocation of US Stocks and Gold

I think that US debt has nowhere to go but down. And I’ve never been particularly fond of loaning the government money, through treasuries or otherwise, so I thought: what if one replaced the 40% allocation to bonds with my favorite yellow metal?

I think that US debt has nowhere to go but down. And I’ve never been particularly fond of loaning the government money, through treasuries or otherwise, so I thought: what if one replaced the 40% allocation to bonds with my favorite yellow metal?

With this allocation the $1,000 invested in 1972 would grow to $85,886 by 2016, the CAGR would be 10.40% and the maximum drawdown would have been 30% back in 1980-1982.

So over the 1972-2016 timeframe, a 60/40 asset allocation of US stocks and gold would have performed better than either 100% US stocks or a 60/40 US stock and bond portfolio.

You can always cherrypick allocations in hindsight that will outperform. But I think it is an interesting datapoint in the case for gold.

by John | Feb 20, 2017 | Tax Strategies, Wealth Protection

I’ve written about how I hate tax refunds.

I want to share three ways I avoid getting one.

I’m not a tax advisor, CPA, or attorney. I’m just sharing what I’ve done in the past as an individual subject to United States taxes.

This isn’t tax advice.

In my experience there are two steps to avoiding a tax refund.

Step one is to have an accurate prediction of how much tax I will owe (or get refunded) at the end of the year and (this is the key) knowing this information before the calendar year ends when I can still do something about it.

The second step is to take action to influence how much tax will be owed at the end of the year. All while being careful not to owe too much.

It’s important to know the maximum one is allowed to owe in federal taxes and the state level as it could change.

In past years it was $1,000 at the federal level. If one were to owe more than $1,000 in taxes there would be penalties.

Step One: Know How Much Tax you will Owe (or be Refunded) in Advance

Most people don’t look at their taxes until the next year.

For example, right now, most people probably haven’t even looked at their 2016 taxes yet. When they do and they realize they will be getting a $2,000 tax refund, well there is nothing they can do now, except file their taxes as soon as possible to get the refund check.

But if one were to assess his or her tax situation in June of 2016, there would still be half a year to make changes.

So how do I predict how much tax will be owed at the end of the year?

There are several ways.

Use Last Year as a Proxy

At a very basic level, one could use the past year as a proxy.

Ask yourself, did I get an income tax refund last year? If so, ask, am I going to be making the same amount next year? Will I have the same or similar capital gain/loss. Will I be making similar charitable contributions?

If one’s tax situation last year is likely to be very close to what it will be this year then it makes sense there will be a similar tax refund.

This isn’t a very sophisticated approach but it is a start.

In order to make an accurate prediction of how much income tax will be owed more a more detailed and comprehensive approach is needed.

Use Income Tax Calculators

Last year I put together a complicated spreadsheet that basically enabled me to calculate my income taxes during the year.

But rather than reinvent the wheel manually like I did–it would have been better to use the prebuilt tools and resources available to calculate taxes due.

One could experiment with the TurboTax W4 Calculator. Armed only with a copy of the most recent pay stub, as well as some other information, like charitable contributions, capital gains/losses, one can tweek allowances to avoid getting a refund.

Turbotax also has something called Taxcaster.

I wish I had known about these last year.

They key is having tools available to predict how much tax one will owe (or have overpaid) during the current tax year, while a person can still make changes.

Another strategy I’ve used is to start my taxes in December. By December 2016 I had filled out most of my tax information in Turbotax.

Sure, I didn’t have 1099s, W2s or many other tax documents, but I can look at pay stubs to figure out how much my W2 will be, I can look at my brokerage statements to see gains and losses.

This allows me to make decisions when I can still influence my 2016 taxes.

Step 2: Take Steps to Avoid a Tax Refund

Once I have a good prediction of how much of a tax refund I’ll get based on income, charitable giving, capital gains, and other tax situations it’s time to do something about it.

Strategy One: Increase Allowances on the W-4 Worksheet

Increasing allowances on a W-4 reduces the amount of tax withheld from each paycheck.

The tools referenced above enable one to tweek withholding allowances to make sure some money will be owed at the end of the year.

If the max I’m allowed to owe at the end of the year was $1,000, I would try to owe around $500 or so.

This provides some wiggle-room, because despite best efforts, the tax situation could change and I’m only able to estimate what I think my taxes will be Maybe I’ll decide to give a big $1,000 check to the charity in December, or maybe I’ll suffer a large realized stock loss I wasn’t anticipating.

These are things that a taxpayer might not realize are going to happen until later in the year.

Strategy Two: Convert IRA Money to a Roth IRA

I think taxes will be higher in the future than they are now.

So when it comes to retirement accounts I prefer paying taxes upfront (when I think they’ll be lower) and then having that money grow tax free over the course of 40-50 years, and then be able to withdraw it tax free.

Thus I prefer a Roth IRA over a traditional IRA (and Roth 401ks over 401ks).

But employer’s tend to do company matching to a 401k which is pre-tax money. I’ve been in several jobs that had a 401k and upon leaving those employers I’ve rolled my 401k money into an IRA.

So if I know I’ve overpaid my taxes I will convert some of my IRA money to a Roth in late December.

This increases taxable income, but one can opt NOT to have taxes withheld during the conversion.

This tax is still owed of course, but the payment can be delayed until later in April.

So if I know I’ll be getting a refund I can use that as an opportunity to convert some of my IRA money to a Roth.

I did this last year. I was working a W2 job for a half a year, and then when my contract was up I had no job. So I’d been overpaying withholding taxes.

So I decided to convert a large portion of IRA funds to a Roth IRA to avoid getting a refund. If I had known I was only going to be working for half a year I would have increased my withholding allowances.

Strategy Three: Realize Some Capital Gains

You want to be smart about this.

I wouldn’t sell a winning investment just to avoid a tax refund, but if you’ve been thinking about getting out of a winning position anyway, doing so will increase your taxable income.

In the US short term gains are currently taxed as ordinary income.

Strategy Four: Give Money to Charity

This strategy doesn’t help avoid a tax refund, but it is invaluable if you have underpaid your taxes too much, because it is a way to avoid penalties (see page 51).

If I realize that I owe more than the penalty-free amount on my taxes, I’ll give some money to charity or make some additional donations or put some money in a Health Savings Account.

These contributions reduce taxable income and can be useful when avoiding penalties that can be assessed if too much tax is owed at the end of the year.

Similar to strategy one, you can also reduce your withholding allowances to have more tax withheld each paycheck, if you realize that you’ll wind up owing too much at the end of the year.

I Hate Tax Refunds

I hate tax refunds because they are an interest free loan to the government and I have better use for my hard earned money than the IRS does.

It’s vitally important to legally pay all taxes due and remain in compliance with all applicable tax laws. It’s just not worth trying to cheat the IRS.

But there are legal ways to reduce your taxable income and avoid getting a tax refund.

Avoiding a tax refund has nothing to do with cheating the IRS or evading taxes.

It’s simply a way to make sure you aren’t paying more than you’re legally required.

It’s also a way to make sure that you don’t pay the taxes you owe earlier than you’re legally required to do so.

The above strategies are merely things I’ve done in the past to manage my tax burden and isn’t advice.

But these ideas could spark some conversation when you speak to your licensed tax advisor and as you make your own tax decisions based on your own unique situation.

by John | Feb 19, 2017 | Tax Strategies, Wealth Protection

I hate tax refunds. Some people think, “I can’t wait for my tax refund so I can do X.” If you really don’t want to wait for your tax refund, take steps so you don’t get one.

See, a tax refund is just that, a refund. It’s not a bonus, new money, or an extra paycheck. An income tax refund is money you could have had earlier in the year, that you overpaid to the government, which is now being returned to you, without any interest.

The United States Tax System

First, a bit of a background on the tax system in the United States.

HowIGrowMyWealth.com has a global audience. I focus on the US with respect to taxes because I am subject to income taxes in the United States and have no experience with taxes outside the US.

While I’m not tax attorney, accountant, CPA or guru, I have been in charge of my own income tax returns since college and I have over 10 years experience doing my own taxes.

There are a myriad of tax situations. I’m just writing about my own experience through 2016 as a W2 income earner.

Income taxes in the United States are imposed at various levels. There are Federal Taxes, State Income Taxes (in most states but not all), and in some cases income taxes on an even more local level.

The US has a pay-as-you-go tax system. That means one is taxed throughout the year at a rate that assumes you’ll make the same amount each pay period.

So if one were to make $4,000 in January, the United States Internal Revenue Service (IRS) assumes you’ll make $48,000 ($4,000 x 12) and taxes will be withheld by one’s employer from each paycheck as if you were going to make $48,000.

But the US tax code is hopelessly complex (you can ask 3 different accountants a tax question and get three different answers all of which could be correct) and tax withholding doesn’t take into account changes in income, deductions, credits, allowances, or capital gains/losses.

As a result one could end up owing more or less in tax at the end of the year, once the myriad of factors that factor into an income tax return are known.

Why I Hate Tax Refunds

Imagine you go to a store and buy a shirt and you pay $100 for it. But the shirt really only cost $50. An honest storekeeper would give you $50 change at the point of sale.

But this store owner holds onto your $100 for over a year and then finally tells you that you overpaid and gives you $50 back.

If you didn’t realize you overpaid you might be glad, “Hey, I’ve got an extra fifty smackers!” But what if you needed that $50 a year ago to pay rent, or buy food, or to buy a pair of pants to go with your shirt, or better yet, save that money and earn interest on it. You’ve lost out on all kinds of opportunities for those funds.

Try to Be Rational

Now I get it, just like if you were to find a $20 bill in your couch that you thought you had lost, there is a certain emotional thrill of getting money back.

I also get that as humans, myself included, we’re very emotional creatures.

Sure, humans have the capacity for reason, but unfortunately and all to often emotion rules the day.

I quote my favorite playwright, Oscar Wilde:

Lord Caversham: No woman, plain or pretty, has any common sense at all, sir. Common sense is the privilege of our sex.

Lord Goring: Quite so. And we men are so self-sacrificing that we never use it, do we, father?

- An Ideal Husband, Oscar Wilde

In the witty quote above, I think Oscar Wilde is basically saying that too few of us (men and women) use common sense or reason as often as would be ideal.

Rationally it doesn’t make sense to get a tax refund. A tax refund is money that has been overpaid that is being returned much later with no interest.

I strive to be a rational person. Not in the sense of being a robot, but rather having rational thoughts in the driver seat and emotions serving more of a supporting role, rather than using reason to justify my emotions.

It’s much more reasonable to avoid a tax return and be happy that one has the money throughout the year, rather than get the money in April.

My next article will provide ways in which I’ve avoided getting a tax refund in the past, so that I had more money throughout the year and I didn’t give the government an interest free loan.

Using this tool, you can see that if in 1972 you invested $1,000 in US stocks, it would grow to be worth $78,509 at the end of 2016, representing a compound annual growth rate (CAGR) of 10.18%. You would have had to endure a drawdown of 50.89%, from November of 2007 through February of 2009. During this crisis the portfolio would have gone from $43,886 down to $21,551.

Using this tool, you can see that if in 1972 you invested $1,000 in US stocks, it would grow to be worth $78,509 at the end of 2016, representing a compound annual growth rate (CAGR) of 10.18%. You would have had to endure a drawdown of 50.89%, from November of 2007 through February of 2009. During this crisis the portfolio would have gone from $43,886 down to $21,551. Most people don’t have the iron stomach needed to hold onto their stocks while their portfolio drops by 50%.

Most people don’t have the iron stomach needed to hold onto their stocks while their portfolio drops by 50%. I think that

I think that