Below is a summary of the option trades I closed in the month of August.

If you’re not familiar with stock options you might first read my introductory article Get Started Trading Options.

My first trade was on the 16th. In total I made $120.87 with a $10,000 account. That is 1.2% over about 2 weeks. However, my option buying power never dropped below around $3,000. So I was using about $7,000 with the rest in cash.

Some of that margin usage includes other options trades not listed here because they are made based on the trades made by Kirk DuPlesis over at OptionAlpha.com and I am not going to post those out of respect for his paid service. I’m also NOT including any profits or losses from the OptionAlpha trades I make.

Again, the trades listed below are MY trades closed out in the month of August.

Urban Outfitters (URBN) Earnings Iron Condor

Notes: Urban Outfitters beat their estimated earnings and the stock gapped up beyond the range I expected it to. I made one good adjustment to limit my losses, but then made a bad adjustment when I sold a 37 strike call for just .16 which added a little more to the loss when the stock moved past 37.

Margin Requirement/Cost: Not recorded

Margin Requirement/Cost: Not recorded

Income: -$56.51 (-$26 less commissions and fees)

Nordstrom (NDSN) Earnings Strangle

Note: The stock stayed in my range the morning after earnings were announced, my profits were initially higher, but I waited and didn’t get out until later in the day, the stock creeped up towards my break even point, and that cut into my gains. Good rule of thumb, close profitable earnings trades out when the markets opens.

Margin Requirement/Cost: Not recorded

Margin Requirement/Cost: Not recorded

Income: $8.92 ($15 less commissions and fees)

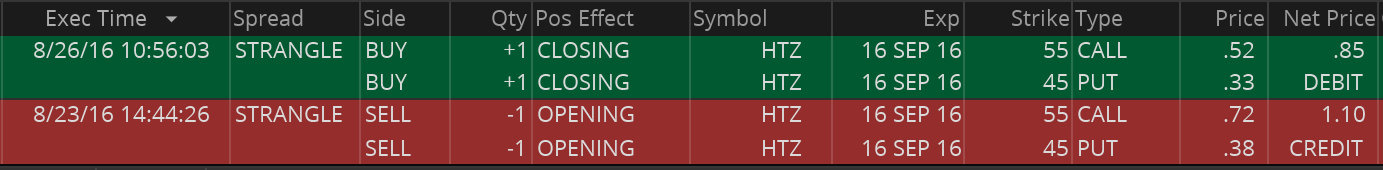

Hertz Global Holdings (HTZ) Strangle

Notes: HTZ stock was trading with high volatility. I’m not sure why but I sold some options. Volatility and time to expiration decreased and I made a little money.

Margin Requirement/Cost: ~$750

Margin Requirement/Cost: ~$750

Income: $18.92 ($25 less commissions and fees)

Big Lots (BIG) Earnings Strangle

Note: My position size was too big on this trade. One strangle would have been more appropriate given my account size. I was fortunate that BIG only beat earnings slightly, and the stock didn’t move too much before I was able to exit for a decent profit.

If I had waited until later in the day to open this position (which I could have known) I would have gotten a better price. If I had waited a little later the next day to close this position (but not too late), I would have made a better profit (not sure I could have known). Plus I was trying to implement the lesson learned in not closing out NSDN asap.

Margin Requirement/Cost: ~$2500

Margin Requirement/Cost: ~$2500

Income: $274.42 ($293 less commissions and fees)

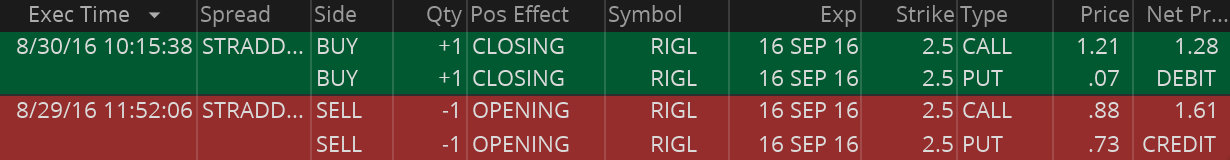

Rigel Pharmaceuticals (RIGL) Straddle

Note: There was a lot of volatility for pharma stocks. Probably related to the epi-pen outrage.

Margin Requirement/Cost: ~$400

Margin Requirement/Cost: ~$400

Income: $26.92 ($33 less commissions and fees)

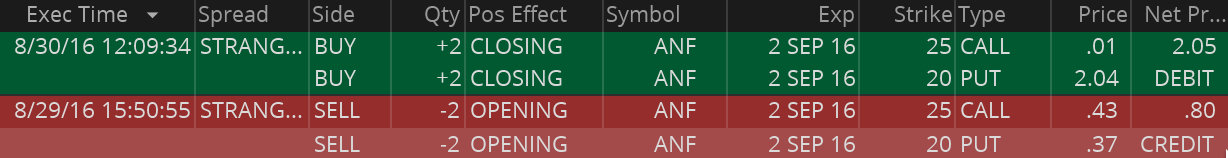

Abercrombie & Fitch (ANF) Earnings Strangle

Note: Missed earnings by a lot, moved beyond my range and I lost.

Margin Requirement/Cost: $670

Margin Requirement/Cost: $670

Income: -$262.20 (-$250 less commissions and fees)

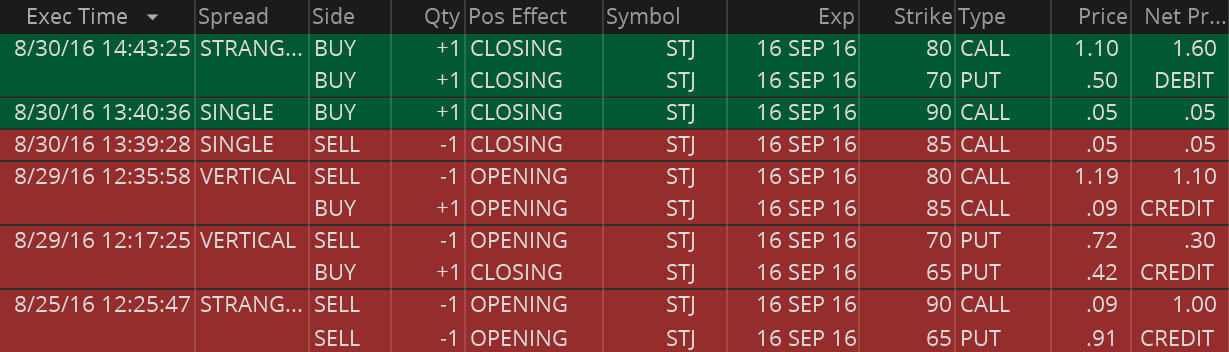

St. Jude Hack (STJ) Strangle

Note: St. Jude’s stock price plunged when a large short seller made some unfriendly comments about the security of some of the devices they sell. I opened up a strangle position that would be profitable provided the stock stayed above $60 per share and below $90 per share. The stock opened August 25th around $82, dropped down as low as $74.15, in a rather volatile move.

All else equal options get more expensive when the underlying stock volatility increases, so by selling options during what I thought was an overly volatile move, I’m captured more option premium.

On the 26th St. Jude actually halted trading and made some announcements indicating the claims against them were unfounded. Volatility dropped and the stock regained some value and I was able to close the option position for a profit. I would have liked it if volatility had dropped more, but it was approaching my break even on the upside so I closed it out.

Margin Requirement/Cost: ~$850 jumped to $1,400 after an adjustment, too high for my account size!

Margin Requirement/Cost: ~$850 jumped to $1,400 after an adjustment, too high for my account size!

Income: $66.30 ($80.00 less commissions and fees)

Designer Shoe Warehouse (DSW) Earnings Strangle

Note: Was waiting for a drop in implied volatility. I think the AAPL 14.5 billion tax hostage situation scared all a lot of stocks down, so even though DSW beat earnings it was down. It rebounded, implied volatility dropped, and I got out for a nice profit.

Margin Requirement/Cost: $610

Margin Requirement/Cost: $610

Income: $43.80 ($56 less commissions and fees)

Margin requirements are rounded to a whole number and are based on the margin requirement when the position was first opened. I’m not very good at noting the exact margin requirement for my position. I just try to keep it around $500. If I made adjustments or margin requirements changed, the number could go up or down.