by John | Feb 11, 2018 | Economic Outlook, Geopolitical Risk Protection, The Stock Market, Wealth Protection

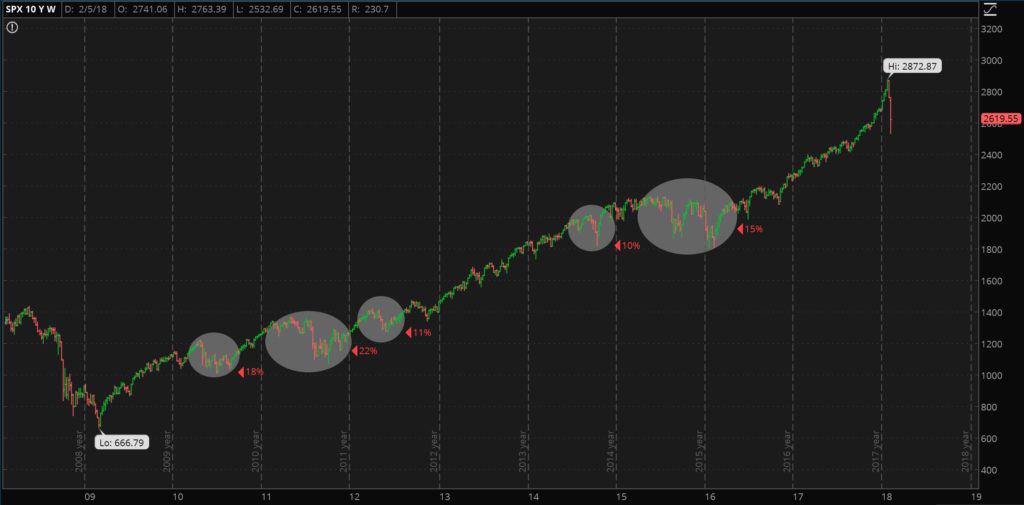

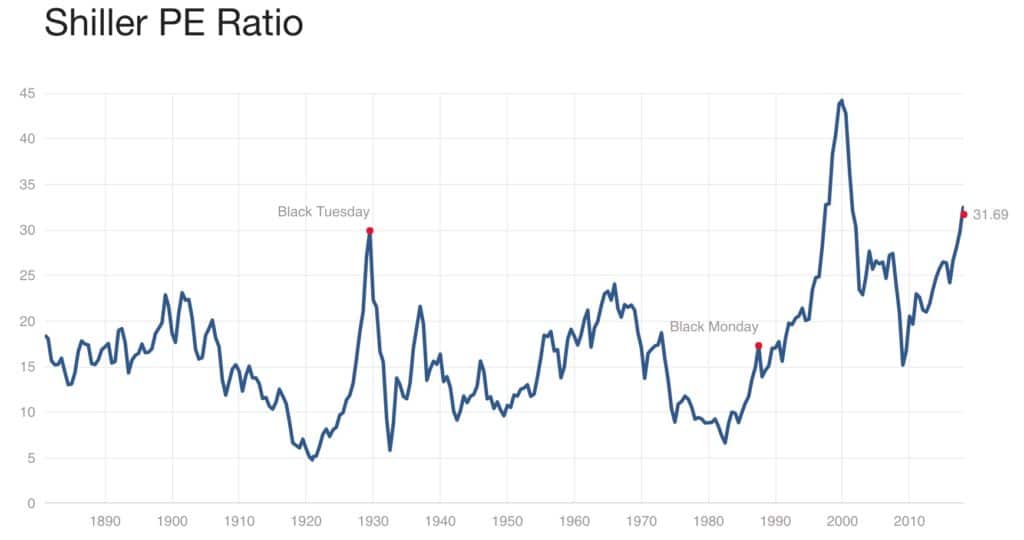

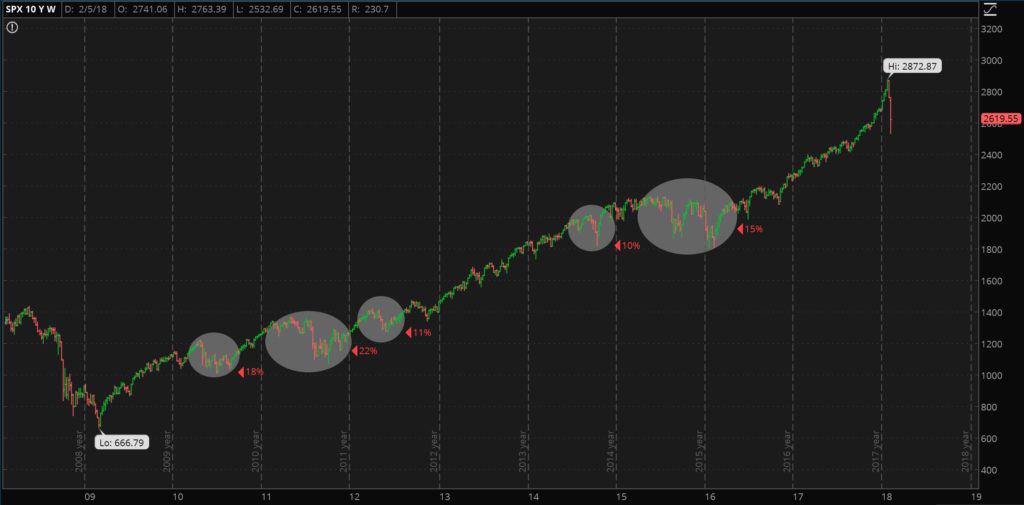

Despite the pullback over the past few trading days, the S&P 500 is still far beyond the highs during the dot-com bubble and subsequent bust as well as the housing bubble and subsequent great recession.

If the fundamentals supported the S&P 500 at these elevated prices it would be great but the fundamentals do not…these elevated stock prices are one of the faulty wirings running through the global economy.

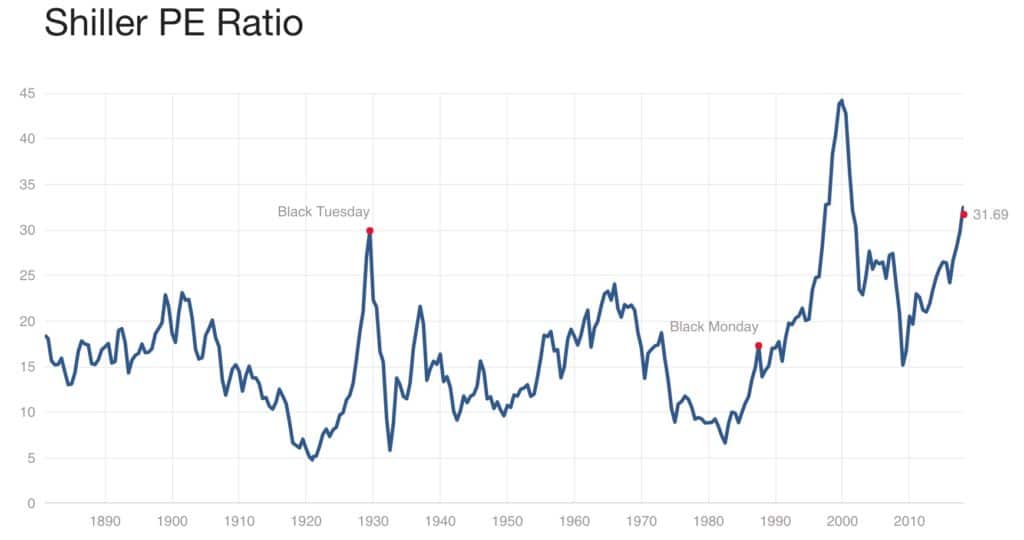

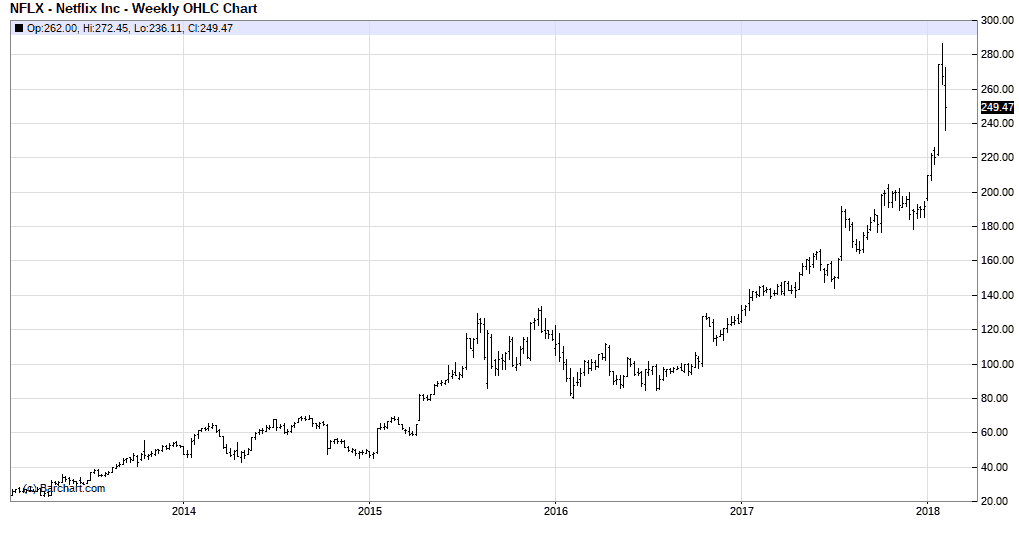

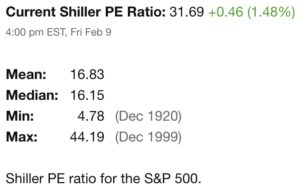

Up until the last few trading days, using the Shiller PE ratio*, there has only been one time in the history of the S&P 500 when the Price to Earnings level was higher, and that is the peak of the dot-com bubble.

*Price earnings ratio is based on average inflation-adjusted earnings from the previous 10 years, known as the Cyclically Adjusted PE Ratio (CAPE Ratio), Shiller PE Ratio, or PE 10

*Price earnings ratio is based on average inflation-adjusted earnings from the previous 10 years, known as the Cyclically Adjusted PE Ratio (CAPE Ratio), Shiller PE Ratio, or PE 10

Source: http://www.multpl.com/shiller-pe/

While imperfect (I tried in vain to find a Price to Free Cashflow chart for the S&P 500), the price to earnings ratio is essentially how much a stock (or in this case the S&P 500 index) costs relative to it’s earnings. A lower PE is better because it means you are paying less for a stream of income.

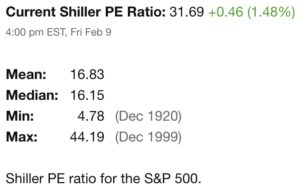

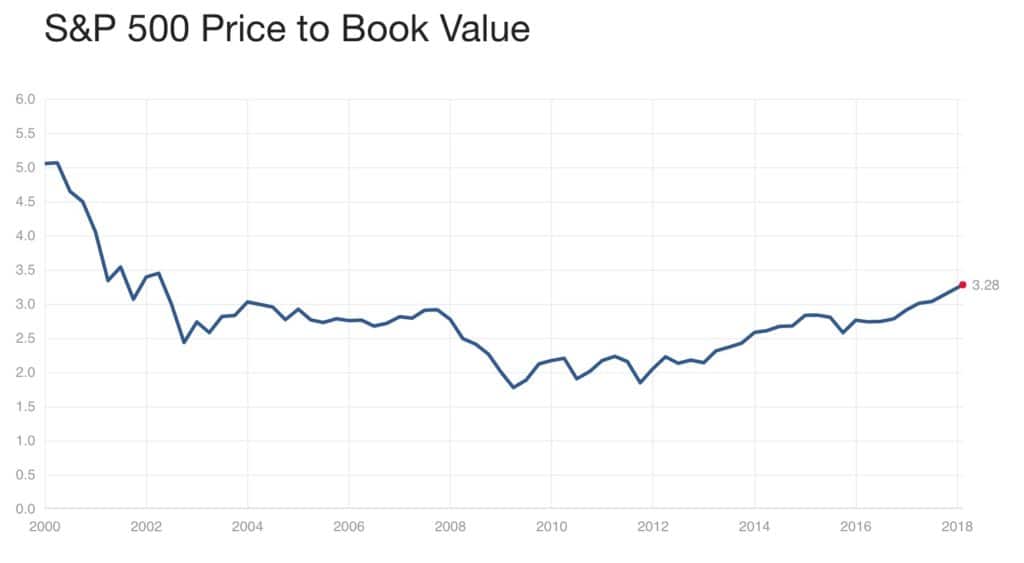

Price to book is another metric we can look at and the price to book ratio of the S&P 500 is at a level not seen since the 2008 financial crisis.

Source: http://www.multpl.com/s-p-500-price-to-book

Netflix: A Specific Example

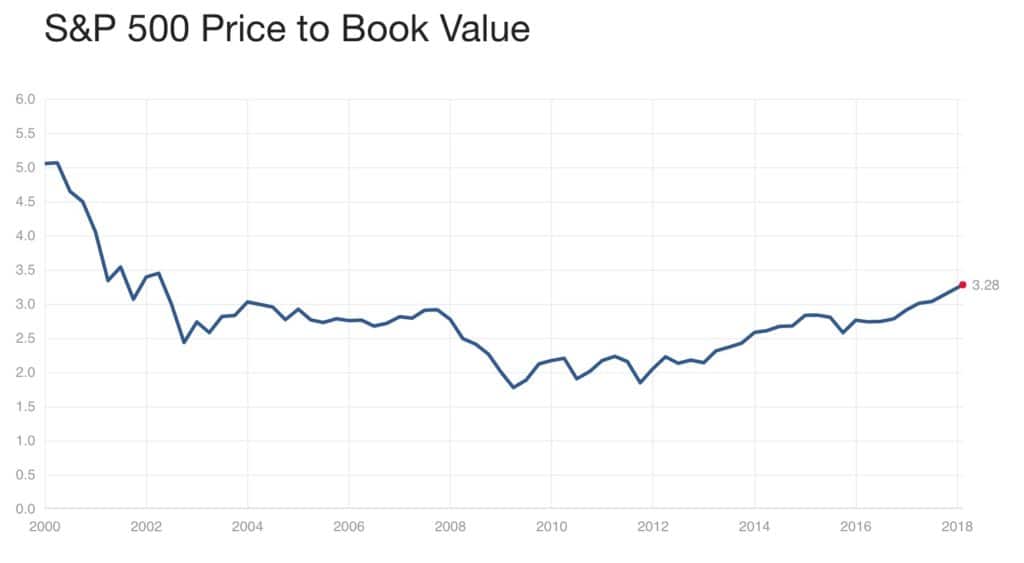

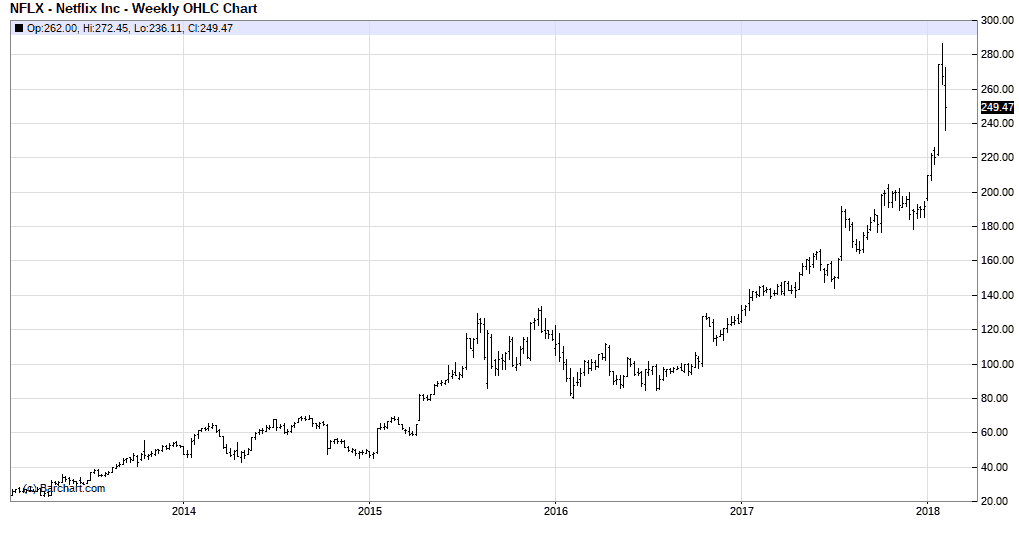

I want to pick on Netflix as an example of an overvalued stock.

One of the most important metrics for evaluating a company is free cash flow. Earnings can be a little suspect because of accounting gimmicky but it is tough to hide free cash flow numbers. It’s one of my value investing metrics.

Netflix (NFLX) has not had positive free cash flow since twenty-thirteen. In 2016 the free cash flow was in excess of negative $1.5 billion and the trailing twelve month free cash flow amounts to over negative $2 billion.

Source: http://financials.morningstar.com/cash-flow/cf.html?t=NFLX®ion=usa&culture=en-US

So they are bleeding money and yet as you can see from the chart above, apart from this last week Netflix stock continues to climb.

What is Causing the Stock Market to Rise?

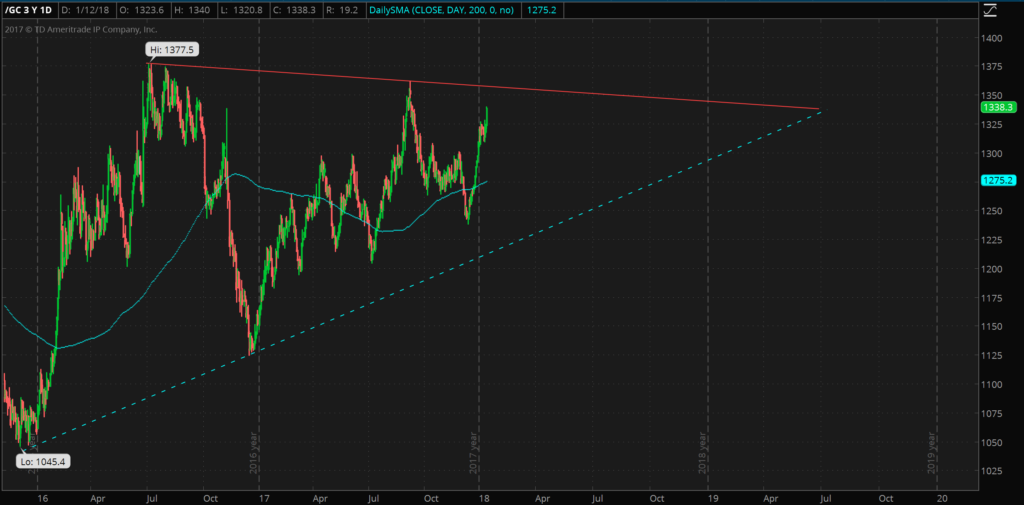

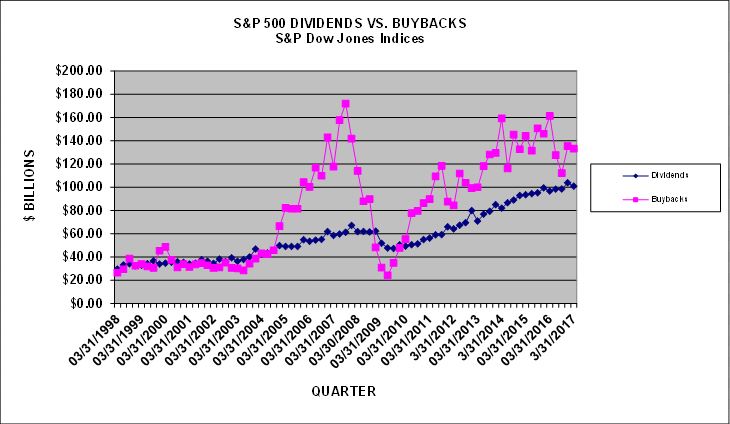

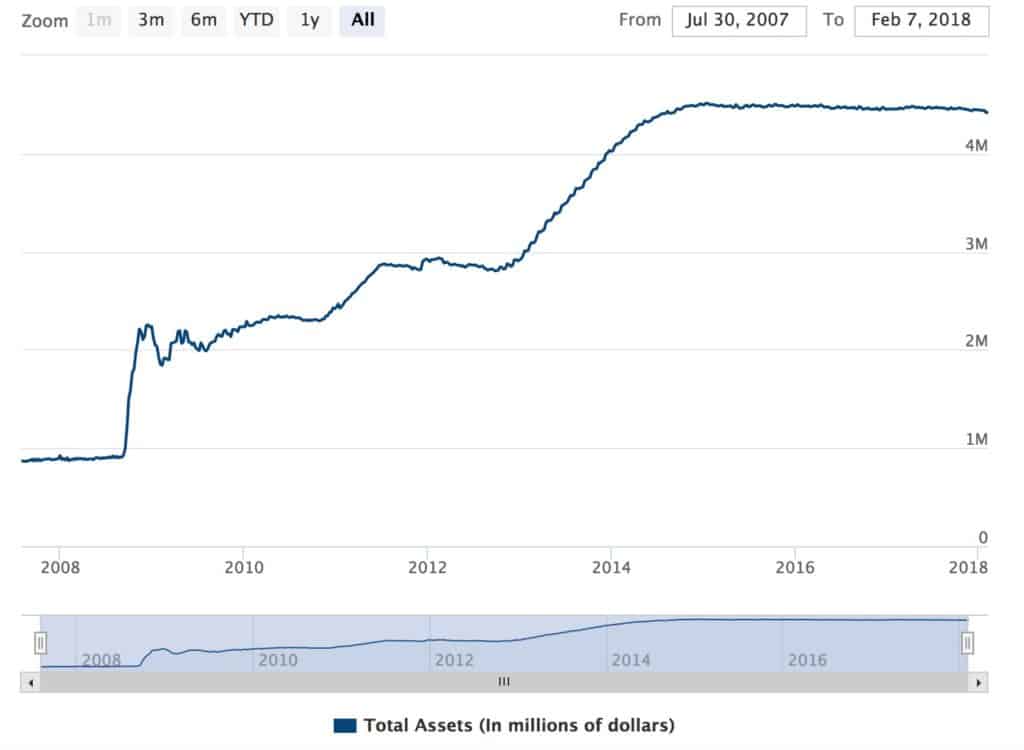

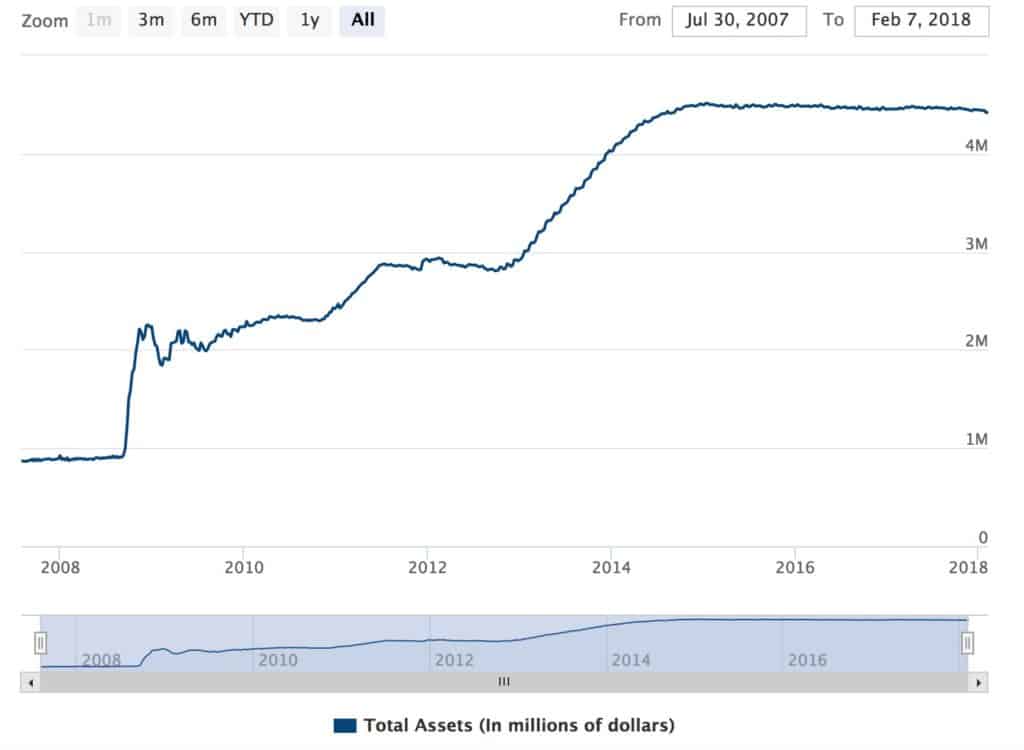

The United States Federal Reserve has bought bonds to lower interest rates and has also bought other toxic assets (like mortgage backed securities “backed” by mortgages that had defaulted).

In the wake of the 2008 financial crisis the Federal Reserve balance sheet has swollen to over $4 trillion. The chart below shows the Fed’s balance sheet in millions of millions (aka trillion).

Source: https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm

This has driven down bond yields and driven up bond prices.

This makes it cheaper to borrow money to buy stocks. It also forces income focused investors to forsake bonds (which have little to negative real yield) and instead pour money into dividend paying stocks.

Companies can also issue bonds at lower rates, and use the proceeds to buy back their own stock.

Source: https://www.wsj.com/articles/companies-stock-buybacks-help-buoy-the-market-1410823441

Source: https://www.reuters.com/investigates/special-report/usa-buybacks-cannibalized/

Source: https://www.wsj.com/articles/buybacks-pump-up-stock-rally-1468363826

The Stock Market is Overvalued

Stocks are overvalued and as bubbly as can be due to reckless US Federal Reserve monetary policy. Last Thursday the 8th the stock market closed in correction territory. It rallied back Friday.

I don’t know if this is the start of a larger selloff into a full on bear market or if this will be contained to a correction.

Since the lows of the 2008-2009 financial crisis there have been several corrections and even a 22% drop in 2011. Those were in an ultra accommodative monetary environment and not in a tightening cycle.

This probably *should* be the start of a bear market but the bulls and the Fed might be able to bid the market back up as they have several times before.

I don’t recommend trying to short the market or (if you own stocks) sell. If you know how to time the market I want to get advice from you because I don’t know how to time the markets.

I do know that stocks are overvalued and due for a correction. If the Fed does step in to prop up the markets it will be more negative news for the dollar. The Fed also doesn’t have much room to cut rates and would either have to sit by and do nothing (unlikely) or restart quantitative easing and negative rates.

This should be positive for foreign value stocks and precious metals. From the lows in 2009 the S&P 500 is up 293%. Even if you bought the S&P 500 at the peak of the 2008-2009 bubble you’d be up 80%. The dollar hasn’t tanked so dollar denominated stocks have been a winner. However, if prices and fundamentals mean something, eventually stocks will correct or the dollar will implode. When that happens it will be critical to your financial survival to have alternative investments in place.

This is part 4 of 5 of what I’ve decided to term The Economic Conflagration series where I discuss the faulty wiring pervasive the global economy:

Part 1: A Deadly Electrical Fire you Need to Know About

Part 2: The Real Economy is Weak

Part 3: Crushing Debt in the United States Limits Economic Growth

Part 4: Stocks are Overpriced and Due for a Significant Crash

Part 5: What you can do about it

Part 5 will be release in the coming weeks. Subscribe below to ensure you don’t miss it.

by John | Jan 28, 2018 | Economic Outlook, Geopolitical Risk Protection, The Economy

I previously wrote about how this time is not different how there are systemic problems with the US economy and the economy at large. I wrote how there is the economic equivalent of faulty wiring in a building. You don’t know exactly when the building is going to burn down but it is only a matter of time.

One of the three main reasons why an economic conflagration is on the horizon and why it makes sense to start preparing now through alternative investments is the real economy is weak.

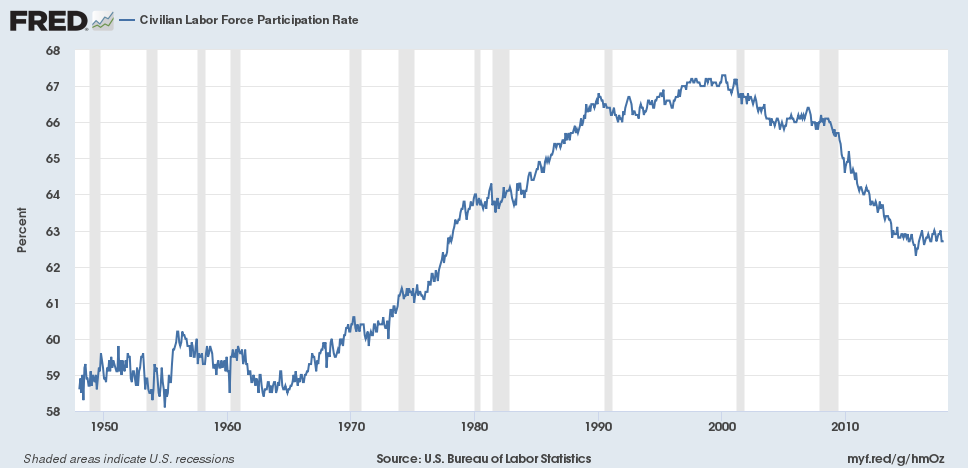

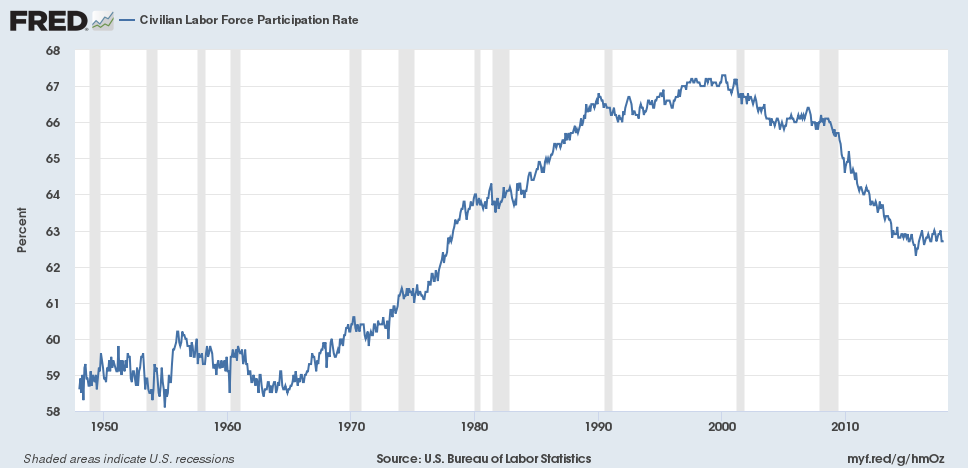

There are a variety of metrics that show the real economy is weak. I’d like to look at two: labor force participation and stagnant wages.

Labor Force Participation is Down

I don’t like looking at the unemployment rate for two reasons. 1) If people give up looking for work then that lowers the unemployment rate 2) The unemployment rate doesn’t look at the quality of jobs. If a person loses one high paying full time job but then they get 1 or even 2 part time jobs that pay less and have fewer benefits, that in and of itself, does not impact the unemployment rate, even though the person might be working lower paying jobs outside of their previous field.

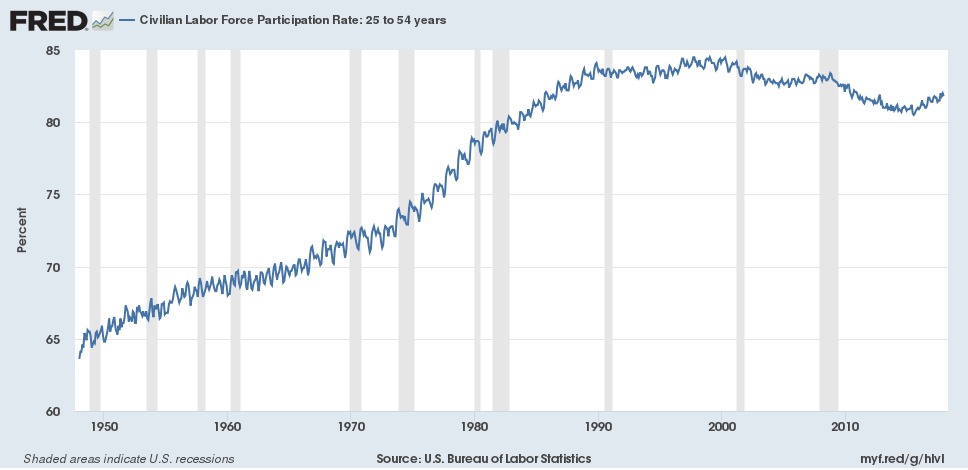

The labor force participation rate is by no means perfect either, but it is in my view a more useful metric in today’s economy.

Source: https://fred.stlouisfed.org/series/CIVPART

Source: https://fred.stlouisfed.org/series/CIVPART

The civilian labor force participation rate is at a level not seen since the 1970s.

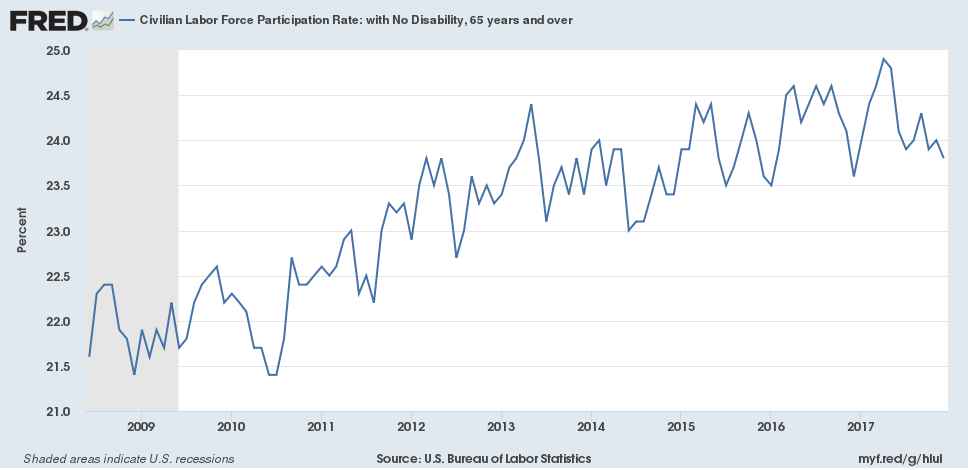

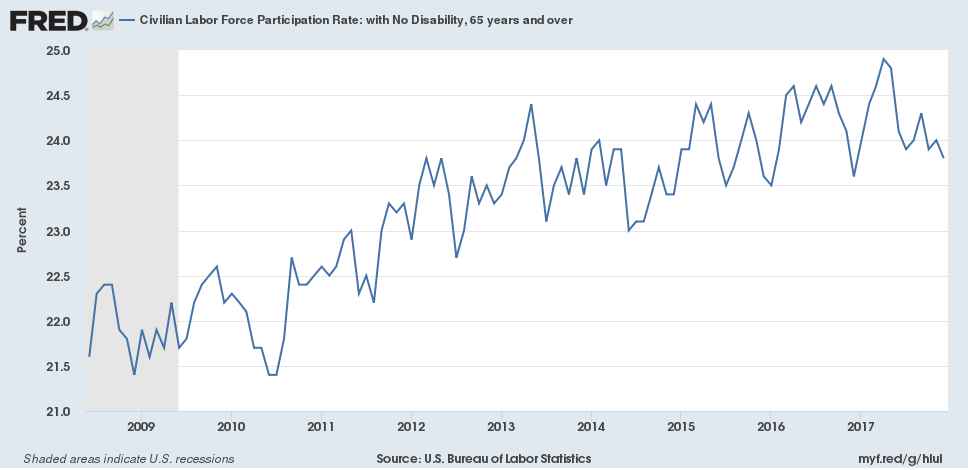

And no, it’s not because the baby boomers are retiring. The labor force participation rate amongst those 64 and older has been steadily climbing even as the the labor force participation rate at large has been declining.

Source: https://fred.stlouisfed.org/series/LNU01375379

Source: https://fred.stlouisfed.org/series/LNU01375379

Source: https://fred.stlouisfed.org/series/LNU01300060

Source: https://fred.stlouisfed.org/series/LNU01300060

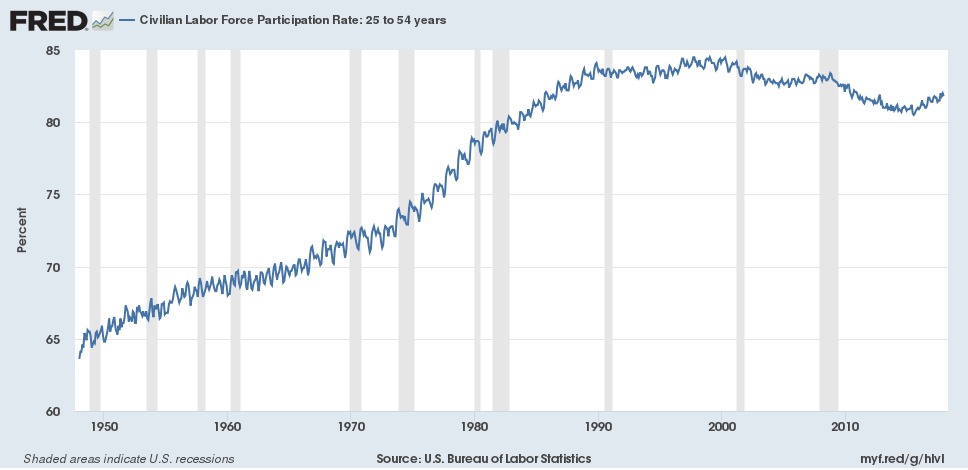

The civilian labor force participation rate amongst those in their prime working years, 24-54, has not regained the levels seen before the great recession nor the dot com bubble, despite rising steadily for decades, it’s been trending down since the peak in the late 90s.

Stagnant Wages

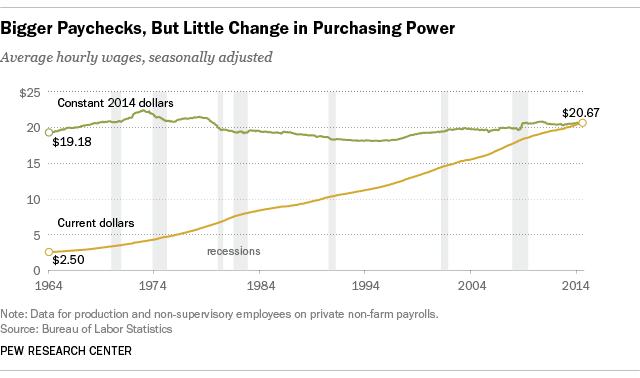

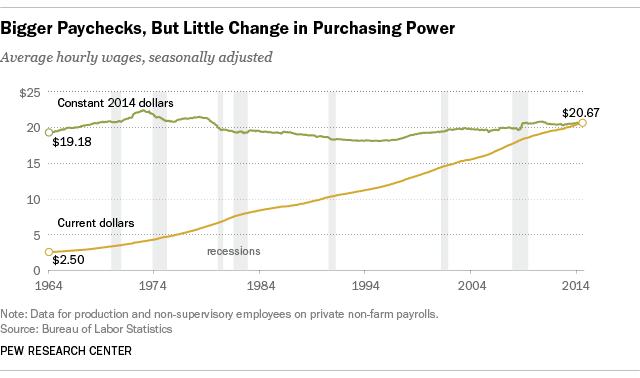

Not only are a smaller percentage of people are in the workforce but those that are working face stagnant wages. According to a PEW Research study, when adjusted for inflation wages have barely budged since the 60s.

Source: http://www.pewresearch.org/fact-tank/2014/10/09/for-most-workers-real-wages-have-barely-budged-for-decades/

However, I’m sure that the inflation adjustments used understate the rate of price inflation. If that is the case then real wages have actually fallen.

Fewer People are Working and They are Getting Paid Less

In summary the real economy is weak. A smaller percentage of people are working and they are getting paid less. The labor force participation rate is on par with levels from the 70s and at best people are not making any additional money and quite possibly making less money on average than in decades past, depending on how much trust you have in the official price inflation numbers.

On top of these factors debt has increased dramatically at the Federal, State, and personal levels. More on that next week.

This is not a consequence free environment. The real economic weakness in the US economy is one of the reasons I think that the US economy (and probably global economy) is due for a large correction. It might not happen this year or even next year, but such a correction is long overdue and it makes sense to take some basic precautions through alternative investments.

More on that in the coming weeks.

by John | Jan 22, 2018 | Geopolitical Risk Protection, Preservation of Purchasing Power, Wealth Protection

The S&P 500 is currently in the longest period EVER without a 3% correction. The unemployment rate in the US is just 4%.

Source: http://money.cnn.com/2017/11/26/investing/stocks-week-ahead-sp-500/index.html

The S&P 500 is at all time highs–far surpassing the dot-com bubble and the housing bubble.

Is this the new normal? Is Federal Reserve Chair Janet Yellen right that we won’t see another crisis in her lifetime? Is there even a need for alternative investments when the stock market continues to soar?

Yes, now more than ever.

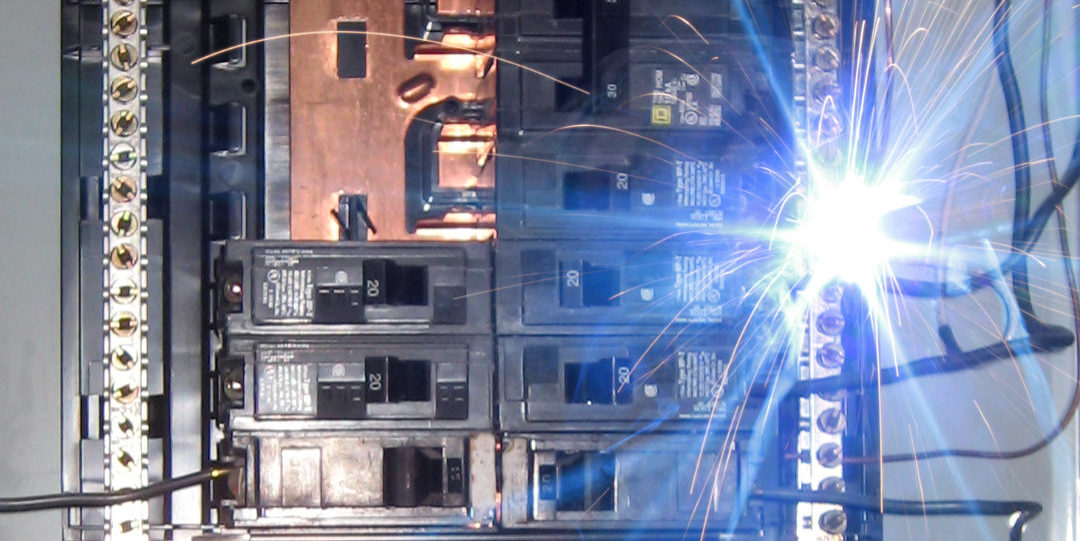

Faulty Wiring in the Economic House

Let’s say you live in an apartment building you’ve discovered has faulty wiring. You know there is a very good chance it will catch fire and burn to the ground.

Let’s say you live in an apartment building you’ve discovered has faulty wiring. You know there is a very good chance it will catch fire and burn to the ground.

Would you continue to go about your business and just hope the apartment building doesn’t burn down?

Or would you do something about it?

Unfortunately most people, if they even know about the risks, ignore them or simply choose not to do anything about them. When the fire starts they will get cooked.

But you don’t have to be one of those people

You can choose to do something about it

We can’t know exactly when but there are plenty of good reasons to believe the US economy is going to undergo an economic firestorm in the future.

Throughout US economy there is the financial equivalent to faulty wiring that will eventually cause an economic conflagration.

You can certainly point to more but here are three of the faulty wirings in the economy:

- The real economy is weak

- Debt at the Federal, State, and Personal levels are un-repayable

- Reckless Central Bank Actions have created a massive bubble in stock and bond markets

Despite all the doom and gloom there are plenty of things you can do to ensure you’re financially safe.

Do Something About It

The wiring in the building needs to be torn out, but landlords aren’t willing to go through the pain, cost and inconvenience of rewiring. All the while the problems get worse.

They’d much rather put on a new coat of paint and pretend like everything is fine.

But you can choose to position yourself so that when the building does burn down, you and your possessions won’t be incinerated.

Similarly, the powers that be in government are too entrenched and committed to maintaining the status quo as long as possible. They have continually demonstrated they are not going to take proactive steps to solve any of these economic problems (and after all they in large part the cause of the problems).

The government will only act when it has no other choice. In other words the government will only act once the crisis has hit and it is too late.

In the coming days I’ll be discussing these three categories of faulty economic wiring: a weak real economy, unrepayable debt and the stock and bond bubble.

Not only that I’ll be sharing actionable strategies through alternative investments to grow and protect your wealth.

It’s not about doom and gloom or prepping for the magnetic poles of the earth to reverse and cause gravity to invert.

It’s just about taking some practical steps in light of the very real and system risks present in the financial system.

by John | Jan 14, 2018 | Asset Allocation, Geopolitical Risk Protection, Preservation of Purchasing Power, Saving Money, Wealth Protection

A 2.6% rise in the price of gold doesn’t seem like a lot given the tremendous volatility of cryptocurrencies like Bitcoin which can go up or down 30% in a day. Twenty eighteen has started off strong for the yellow metal. While gold has lost some if it’s shine in the eyes of many since the drop from it’s highs in 2011 it remains the standard in wealth preservation as far as I’m concerned. I am as bullish on gold today as I ever have been. Perhaps not in the medium term, but in the short and long term I think gold will be rising in USD price.

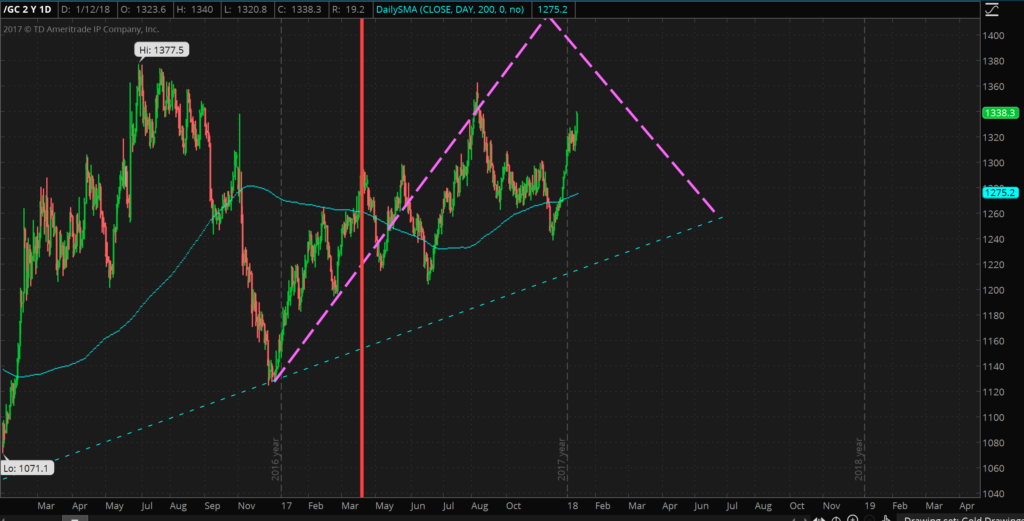

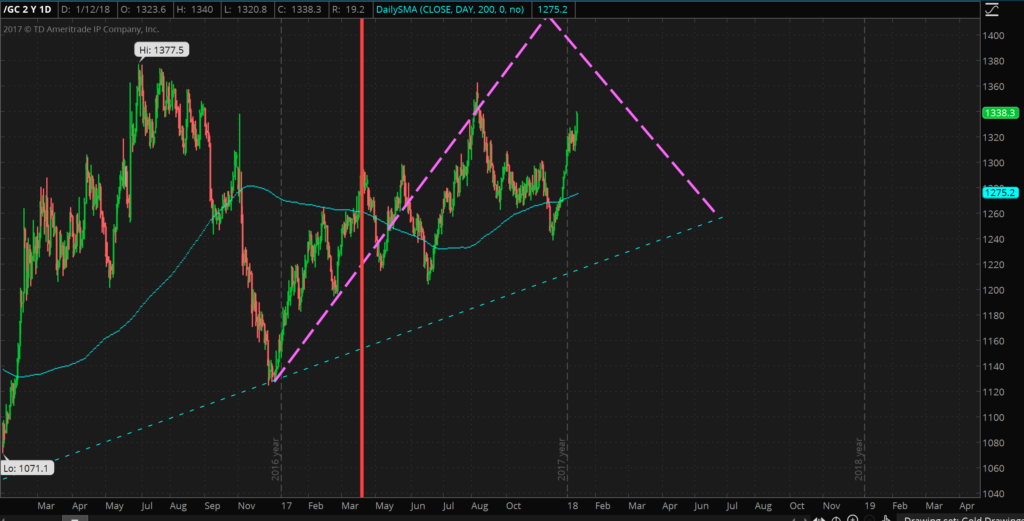

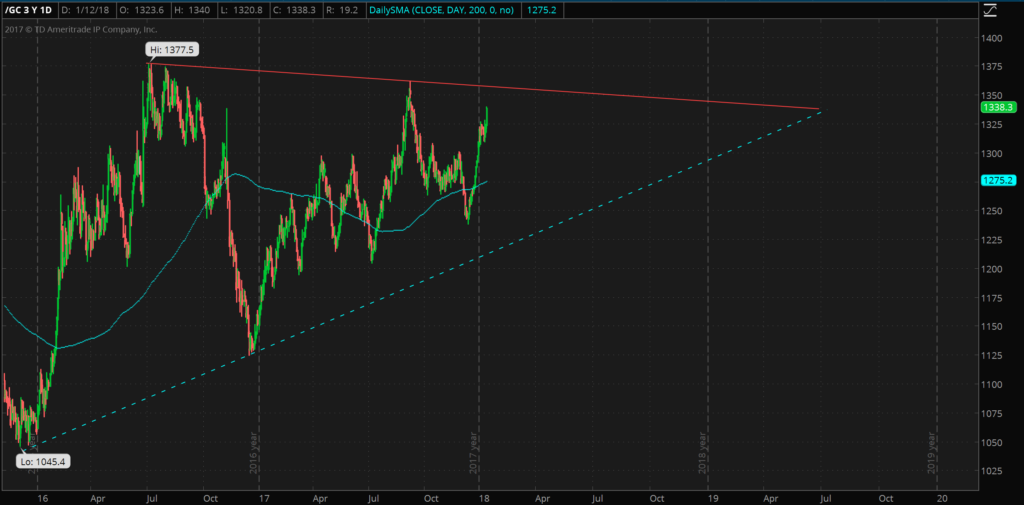

I posited back in April 2017 that 2016 was the start of a new bull market in gold and that trend has continued.

The dashed purple line indicates my prediction/guess as to the price movement of gold. This prediction was made back in the middle of April, 2017 (indicated by the vertical red line).

While this prediction looked fairly close up through August 2017, gold has since diverged quite a bit. Because gold hasn’t been able to take out the previous high of $1377.5 made back in July 2016, this bull market is looking fairly weak from a technical perspective, especially compared to the 2008-2011 bull market. This is why I think gold looks weak in the medium term (say 6 months to a year). In the short term gold is looking good, as previously mentioned gold is up over 2.5% this year.

But even if the technicals of gold look weak the fundamentals of gold are still extremely strong. I think there is little chance that we will see gold available at a price of 1045 USD ever again and I think gold will eventually make new highs in excess of $2,000. I do think gold is in a bull market, albeit a weak one. A US War with North Korea, a Trump impeachment, another large scale terrorist attack, or any number of other catalysts could easily send gold upwards.

While we might have to wait until 2019, it will be interesting to see if gold breaks through the resistance (solid red line) and if so if it makes a new high above 1377.5, or if it goes back to test the longer term support levels drawn in a dashed blue line. Of course it could even do both if we see a lot of volatility.

I feel confident that gold will be above $1300. Regardless I think holding between 10%-25% of one’s assets in physical precious metals is a wise move. Go closer to 10% if you have faith in the US.gov and legacy financial system and closer towards 25% if you are a little more bearish on the US governments ability to handle the national debt, pension, social security and medicare funding crises. Of course all of these precious metal allocation percentages are just opinions and don’t take into account your age, goals and risk tolerance. If I had a lot of money in cashflow positive real estate or a successful and recession resistant business then I probably wouldn’t put as much into gold.

But if my income came from stocks and my job I would want to have 10-25% of my assets in precious metals and I would want to have some money in foreign stocks. I don’t think betting on the dollar is wise, it hasn’t been since 1913 and I think the dollar will only continue to weaken and at an accelerated pace.

While there is no substitute for physical precious metals like gold and silver held in a secure location one controls I think Goldmoney is a fast, easy and secure way to own physical precious metals. When you sign up for a Goldmoney holding account be sure to use my referral code: howigrowmywealth. A Goldmoney holding account allows you to store physical gold throughout the world in secure jurisdictions like Singapore and Switzerland. I personally own over $1,000 worth of gold through Goldmoney.

by John | Dec 29, 2017 | Cryptocurrency, Geopolitical Risk Protection

Cryptocurrencies are all the rage and gold remains time tested. Over the last few years cryptocurrencies like Bitcoin have been extremely volatile (mainly to the upside) while gold has been fairly stable and moved mostly sideways. Growing and protecting my wealth through alternative investments has been my focus for the last four years so I watch both the precious metals and cryptocurrency markets with great interest.

Bitcoin has risen exponentially in 2017. Clearly buying Bitcoin at $900 and riding it up to $20,000 was a fantastic trade in which the initial capital would have appreciated over 2,000% in less than a year.

How anyone besides a time traveller would have known to do that other than faith or luck is beyond me. I still think there are problems with cryptocurrencies. Even though there are several aspects of cryptocurrencies that I do like and a number of tokens and coins I choose to own.

Gold on the other hand has been slow and boring. As I wrote about in April this year, 2016 looks like it was the start of a new bull market in gold. Prior to 2016 gold had steadily declined since it’s $1,900 highs in 2010.

Since 2016 gold has steadily risen in price

A Place for Gold

I believe that now as much as any time in history gold (and silver) remains an important part of a diversified portfolio.

Dorian Nakamoto was accused by Newsweek of being Bitcoin founder Satoshi Nakamoto

I don’t know how high Bitcoin will go. However, in 50 years I believe that Bitcoin will be worth less than a few dollars and gold will have at a minimum retained it’s value in terms of purchasing power if not appreciated beyond that.

I think it’s entirely possible that some other cryptocurrency will be commonly used as a medium of exchange fifty years from now but it won’t be Bitcoin.

I could be wrong about that so I do own some Bitcoin but I’m not willing to take out a mortgage in order to buy Bitcoin on margin, as some people are doing.

Litecoin founder Charlie Lee announced 20 December 2017 he sold all his Litecoin

Source: https://www.engadget.com/2017/12/12/bitcoin-mania-mortage-house-investors/

If you want to speculate and trade I think Bitcoin and other cryptos are great for that.

I buy Bitcoin on Coinbase and move it to other exchanges to diversify into my “Group of Six” and it has worked out well so far.

If you have some money you can afford to lose then trade and speculate away.

However, I think that gold remains the gold standard in wealth preservation.

23 year old Ethereum Founder Vitalik Buterin

I don’t think there is any substitute for buying physical gold and silver from a reputable dealer.

Physical bullion you have in your possession is the ultimate way of removing yourself from an out of control wall-street/banking system. I don’t want to go down the path of radical Cartesian skepticism but with precious metals you aren’t betting on the Janet Yellens and Jamie Dimons of the world having everything under control and are looking out for the little guy.

With gold you don’t have to worry about Satoshi Nakamoto, Charlie Lee or Vitalik Buterin making a bad decision and tanking cryptocurrencies.

Geopolitical Risks Remain

The risks haven’t gone anywhere. The stock market continues to climb but this is one of the longest periods in the history of the stock market without a correction. Meanwhile the fundamentals are not strong.

Debt at the governmental, municipal and personal level continue to grow with no end in sight.

Central banks throughout the world have printed trillions in fiat currency. One of the most important alternative investments to hedge against these risks are precious metals. Blockchain technology, while revolutionary and disruptive to the status quo do not replace gold and silver as the ultimate insurance policy against central bank insanity.

by John | Sep 30, 2017 | Economic Outlook, Geopolitical Risk Protection, Investor Mindset

A few weeks ago on the 20th of September the United States Federal Reserve announced it would begin unwinding it’s $4.5 trillion balance sheet starting in October. The Federal Reserve undertook unprecedented action in the wake of the 2008-2009 financial crisis when it expanded it’s balance sheet from $900 billion to as high as $4.5 trillion in order to buy worthless mortgage backed securities and other assets that no one else would–as well as government bonds.

As the Fed unwinds it’s balance sheet by selling assets and not rolling over existing assets, the money supply in circulation will shrink.

If the money supply shrinks will the value of the S&P 500 as well?

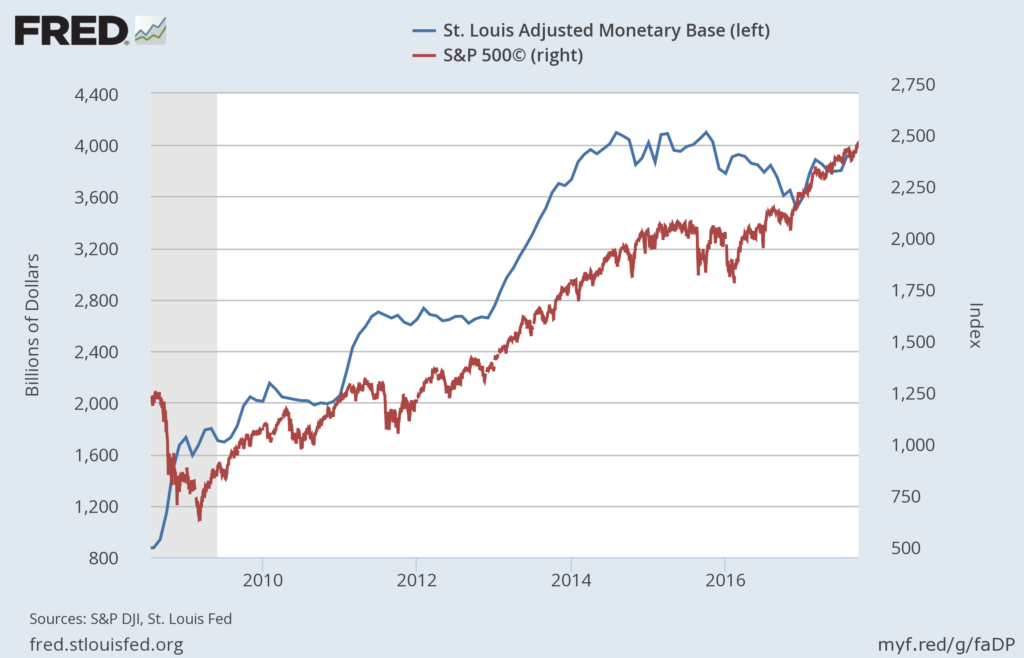

So why does this matter? Well, as pointed out at the beginning of the year over at Benzinga.com, the S&P 500 is 97% correlated with the Adjusted Monetary Base. As the Adjusted Monetary Base goes up, so does the S&P 500, as the Adjusted Monetary Base goes down, the S&P 500 goes down.

The Adjusted Monetary Base is the sum of currency (including coin) in circulation outside Federal Reserve Banks and the U.S. Treasury, plus deposits held by depository institutions at Federal Reserve Banks.

Source: https://fred.stlouisfed.org/series/BASE

So the by reducing it’s balance sheet, the Fed will lower the Adjusted Monetary Base and thus the S&P 500 would experience downward pressure.

But that isn’t the only headwind.

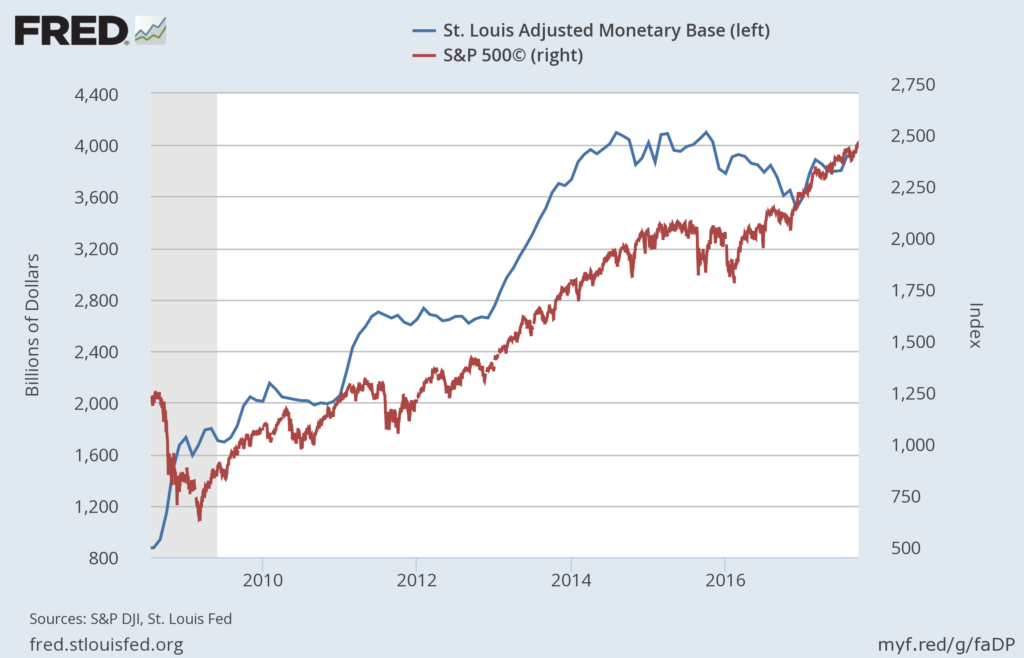

Reduction in Share Buybacks

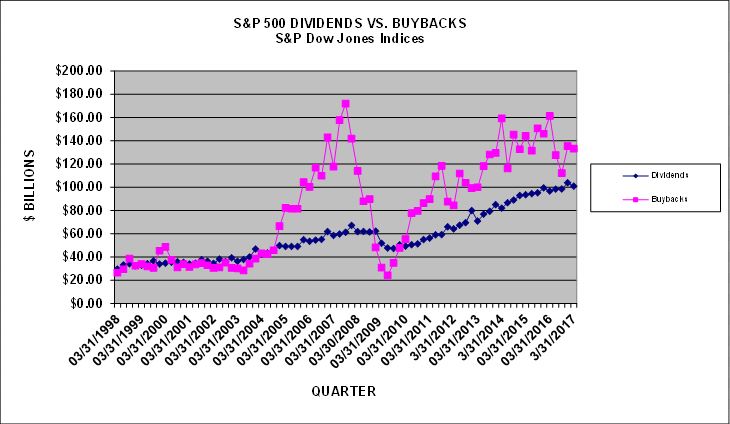

The Federal Reserve lowered interest rates to near zero for almost seven years. Low interest rates means it’s less expensive to borrow money. A lot of companies have taken advantage of these low interest rates to issue bonds (a way of borrowing money) at low interest rates and then used the proceeds not to invest in people, factories, or equipment, research and development or other business growing endeavors, but instead to use the borrowed money to buy back their own shares.

Source: http://www.marketwatch.com/story/sp-500-companies-slash-share-buybacks-despite-record-cash-levels-2017-06-21

Bond issues increases the debt companies have on their balance sheets, but also boosts their share prices, even when the companies aren’t performing any better. An example Simon Black of Sovereign Man uses is Exxon Mobil. Exxon is #4 on the Fortune 500.

In 2006, the last full year before the Federal Reserve started any monetary shenanigans, Exxon reported $365 billion in revenue, profit (net income) of nearly $40 billion and free cash flow (i.e. the money that’s available to pay out to shareholders) of $33.8 billion.

At the time, the company had $6.6 billion in debt.

Ten years later, Exxon’s full-year 2016 revenue was $226 billion, net income was $7.8 billion, free cash flow was $5.9 billion and the company had an unbelievable debt level of $28.9 billion.

In other words, compared to its performance in 2006, Exxon’s 2016 revenue dropped nearly 40%, due to the decline in oil prices.

Plus its profits and free cash flow collapsed by more than 80%. And debt skyrocketed by over 4x.

Source: sovereignman.com

Exxon Mobil is just one example. There are a variety of other blue chip stocks with shares prices that are higher despite lower profits and higher debt.

Share buybacks have declined in 2017. While the trend looks to continue upwards, rising interest rates will make it more expensive for companies to issue bonds and use the proceeds to buy back stock.

Source: http://www.marketwatch.com/story/sp-500-companies-slash-share-buybacks-despite-record-cash-levels-2017-06-21

Headwinds

Despite the article image and title I certainly don’t know that October will see the stock market dip into the red. It would make sense if it did, but the S&P 500 continues to make new highs in spite of the Federal Reserve tightening, lackluster GDP growth and saber rattling from both North Korea and the United States.

But it is another headwind.

At some point there will be a stock market correction. That is simply how markets work since the advent of central banking and hence the business cycle. It has take much longer than I expected for there to be a correction. I didn’t believe that President Barrack Obama would leave office without seeing a stock market crash, but he did.

But markets have been on a steady climb since early 2009 and the bull market is looking long in the tooth. The S&P 500 could continue to rise for the foreseeable future, but with this new headwind of balance sheet reduction in addition to interest rate hikes, it might be time to take some dollars off the table and pivot some assets into alternative opportunities.

*Price earnings ratio is based on average inflation-adjusted earnings from the previous 10 years, known as the Cyclically Adjusted PE Ratio (CAPE Ratio), Shiller PE Ratio, or PE 10

*Price earnings ratio is based on average inflation-adjusted earnings from the previous 10 years, known as the Cyclically Adjusted PE Ratio (CAPE Ratio), Shiller PE Ratio, or PE 10

Source: https://fred.stlouisfed.org/series/CIVPART

Source: https://fred.stlouisfed.org/series/CIVPART Source: https://fred.stlouisfed.org/series/LNU01375379

Source: https://fred.stlouisfed.org/series/LNU01375379 Source: https://fred.stlouisfed.org/series/LNU01300060

Source: https://fred.stlouisfed.org/series/LNU01300060

Let’s say you live in an apartment building you’ve discovered has faulty wiring. You know there is a very good chance it will catch fire and burn to the ground.

Let’s say you live in an apartment building you’ve discovered has faulty wiring. You know there is a very good chance it will catch fire and burn to the ground.