by John | Oct 16, 2016 | Active Monthly Income, Geopolitical Risk Protection, Monthly Income, Passive Income, Saving Money

In my culture there is an old adage: “Don’t put all your eggs in one basket.” It’s a quaint agrarian saying that captures a great deal of wisdom.

This principle applies most directly to savings and asset allocation. Savings are key but today I’m writing about income.

When it comes to income the expression is don’t have all your eggs come from one chicken.

When it comes to income the expression is don’t have all your eggs come from one chicken.

In truth many people have almost no income diversity.

To stretch the analogy way to far: most workers have access to one chicken and in exchange for their work they get a small portion of the eggs the chicken lays. If the chicken stops laying eggs or the person who owns the chicken doesn’t want want or need a worker anymore, then the workers go hungry until they can find access to another chicken.

They have their job (and little to no savings or maybe a little to a lot of debt) and that’s it.

If they lose their job and can’t find another one they are in a very bad place. Without a job many people can’t service the debts they have, they can’t pay for their basic needs, it’s a hot mess. An emergency fund and savings are helpful but I was unemployed for 100 days and it was stressful even though I do have savings!

Unless you’re self employed you don’t own your job and can be let go even if you work hard and do a great job!

Losing a job happens all the time. A company gets bought and people get laid off. “My boss is a jerk and I can no longer stand to work for her.” The industry you’re in collapses. Dollars don’t buy as much and a raise doesn’t cover the difference.

Even if you are gainfully self-employed the market you’re in could contract and squeeze your earnings.

Multiple Income Streams

Multiple income streams, income diversification, it means not keeping all of your income “eggs” coming from just one chicken.

Multiple income streams provides strength and security. If one has multiple streams of income and lives below their means it isn’t a big deal if one of the income streams stops.

Multiple income streams provides strength and security. If one has multiple streams of income and lives below their means it isn’t a big deal if one of the income streams stops.

If all of your income comes from your job, and you lose your job for any reason, you have to rely on any savings you have until you find another job.

But if you have income from 4 sources and one of them stops yielding; you’re still getting a large percentage of your income.

Going out and getting four full time jobs is probably not possible. I know I’m only one person and can’t be two places at once and there are only so many hours in the week.

Right now my day job is the main engine that drives my economic wagon. But I’m saving money so that won’t always be the case.

I continue to develop additional income streams including ones that make money even while I sleep. Some of the areas I’m capitalizing on are: dividend paying value stocks, bitcoin arbitrage, and trading options. While option trading is somewhat active during regular business hours (unless you place good till cancelled limit orders in the morning or evening), the others can be done with little time outside normal working hours.

I do still want to get into real estate (rental property) that has been on hold until I’m more established in my new career.

It’s popular to talk about diversity and diversification, but when it comes to income the norm seems to be getting one job and working there for a long time. That isn’t always possible, practical or prudent in “today’s economy.” Branching out into multiple sources of income provides most financial resilience and security.

by John | Sep 25, 2016 | Capital Appreciation, Passive Income, Preservation of Purchasing Power, Value Investing

Value investing is a way to bring intelligence back into stock selection.

Everyone loves a great deal when they’re shopping but for some reason that love does not transfer when shopping for stocks. Many retail investors tend to buy expensive stocks as they are getting more expensive.

They pile into trendy growth stocks like Twitter and Netflix.

It doesn’t make sense.

Making money in stocks can be done in just two ways:

1) buying low and selling high

2) dividends

Because many investors like to buy expensive stocks with no dividend the prevailing strategy has become “buy high, sell higher”.

This could work some of the time but if you buy stocks at all time highs (like many are now) who are you eventually going to sell them to? You’d have to find someone else who wants to buy them at an even higher price or sell them at a loss.

Buying overpriced stocks also leaves a person much more vulnerable during a stock market correction as was experienced by countless stock owners in 2000 and 2008.

An Intelligent Approach: Value Investing

Value investing takes that same desire to find a bargain while shopping and applies it to stock selection.

Value investing is purchasing the shares of quality companies trading at a discount.

In other words, you’re buying stock in a company that is undervalued. This creates a margin of safety and built-in downside protection. It’s a way of increasing the odds that you are buying a stock low so you can sell it higher later (or so you can hold it and collect the dividends).

Is Value Investing just buying Cheap Stocks?

Cheap lawn chairs tend to collapse when you’re sitting in them

Value investing isn’t buying cheap stocks. Value investing is buying high quality companies at a price below their book value.

You can find a deal on a high quality lawn chair and pay less than you would for a lower quality, more expensive lawn chair. The key to spotting a bargain is to know what to look for. Fortunately, there are a number of indicators (or metrics) one can look at to determine if a stock is both low cost and high quality.

What indicates a stock is a Great Value?

[Note from John, 5 Feb 2017: While the principles of value investing are timeless I have since started looking at Better Metrics for Value Investing.]

The metrics I look at are as follows:

- Price to book of less than 1 (can go up to a PB of 1.5)

- Price to earnings less than 15

- Positive Cashflow

- Positive Earnings per share

- Return on equity greater than 8% on average per year

- Dividend Yield

I’ll break down each one below.

Price to Book

The Price to Book ratio is calculated by taking the companies’ market capitalization and dividing it by the companies’ total assets minus total liabilities. A low price to book could indicate that a stock is undervalued.

If the P/B is below 1 that means if the company’s assets were liquidated and the stockholders were paid out in cash they would get more than what they paid for the stock.

Price to Earnings

The historical average for the stock price to earnings ratio is 15. The current PE ratio for the S&P 500 is around 25. By purchasing stocks with a PE less than 15, you’re ensuring the company’s price to earnings is below the historical average. It’s another indicator of value.

Source: http://www.multpl.com/

Positive Cashflow and Earnings per Share

A low price to book by itself could indicate that a stock is undervalued or that the company is on shaky ground. Positive cashflow and positive earnings per share means that the company is making money. The higher the EPS the better all else given.

Return on Equity

A return on equity of 8% or more over a period of years indicates the company consistently produces value to shareholders. It’s another way to ensure the company is healthy and is not undervalued due to a fundamental issue with the performance of the business.

Dividend Yield

This is the second way to make money on a stock. If a company provides a yield that means the investor is being compensated for holding the stock while waiting for the undervalued equity to revert to a more fair valuation.

Does Value Investing Work?

Value investing was pioneered by Benjamin Graham. You may never have heard of Benjamin Graham but it’s likely you’ve heard of Graham’s most successful student, Warren Buffett.

The investing principles Buffett used to grow his wealth were developed and taught by Benjamin Graham, the father of value investing.

Value investing is the way Warren Buffett became one of the richest men alive.

Getting Started in Value Investing

You can look for stocks that meet the criteria I’ve discussed above and purchase them individually.

Another option is to buy a value index fund. A a passive index fund takes little research and is theoretically lower risk.

An example of such a fund is the Vanguard Value Index Fund (VIVAX). The problem I have with funds like this is that the stocks in the fund aren’t the best values. For example, the largest holding in VIVAX is Microsoft (MSFT).

MSFT has a price to book of 6.2 and a price to earnings of 27.4. The other major holdings of VIVAX like Exxon Mobil and GE follow a similar story.

Microsoft and Exxon are quality companies but at these prices they don’t represent the extremely high value stocks I’m interested in.

Value investing like all investing is not without risk. But I believe taking the time to research undervalued stocks that present exceptional value is worth it.

Intelligent Research on Value Stocks

For a passive and defensive investor, value investing through index funds is fine. However, I believe an enterprising investor willing to dive deeper can make even better returns. But not everyone has the time or resources to research stocks that meet the criteria of a quality value stock.

I maintain a list of the stocks I like, access it fr-ee here.

Find An Edge

An Edge: a quality or factor that gives superiority over close rivals or competitors.

It’s hard to make money on stocks like Apple or Microsoft that have dozens of analysts following them, where virtually everything is known about the stocks, and which are traded at high frequency by Wall Street computer algorithms.

If you don’t know what your edge is you don’t have one.

I also think that there are exceptional values outside of the standard US stock exchanges.

I’m particularly fond of the Australian Securities Exchange because it is outside the Wall Street bubble but still a stable jurisdiction. My free report lists two brokers that will allow you to trade stocks in the land down under.

Wisdom from Benjamin Graham

I close this article with a quote from the Father of Value Investing:

“…the real money in investment will have to be made–as most of it has been in the past–not out of buying and selling but of owning and holding securities, receiving interest and dividends and increases in value.” – Benjamin Graham from The Intelligent Investor

by John | Sep 11, 2016 | Capital Appreciation, Getting Started, Passive Income, Preservation of Purchasing Power, Tax Strategies

The Building Blocks of Personal Finance

If you haven’t already read parts I and II start there!

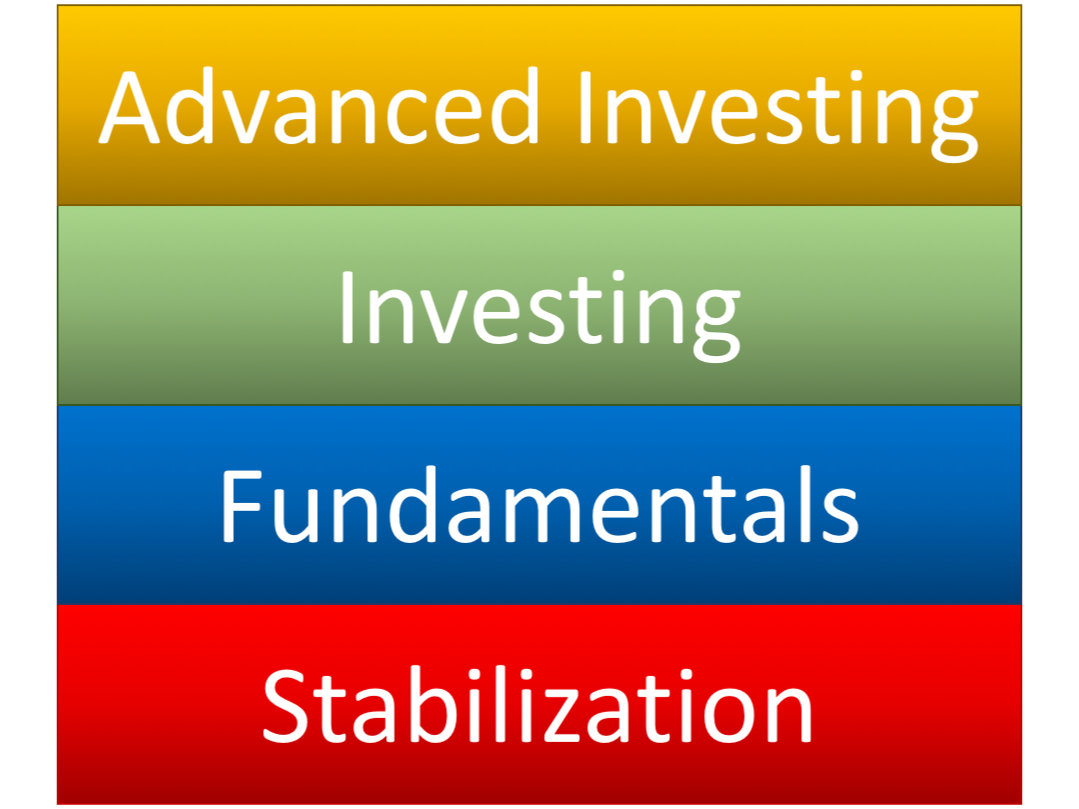

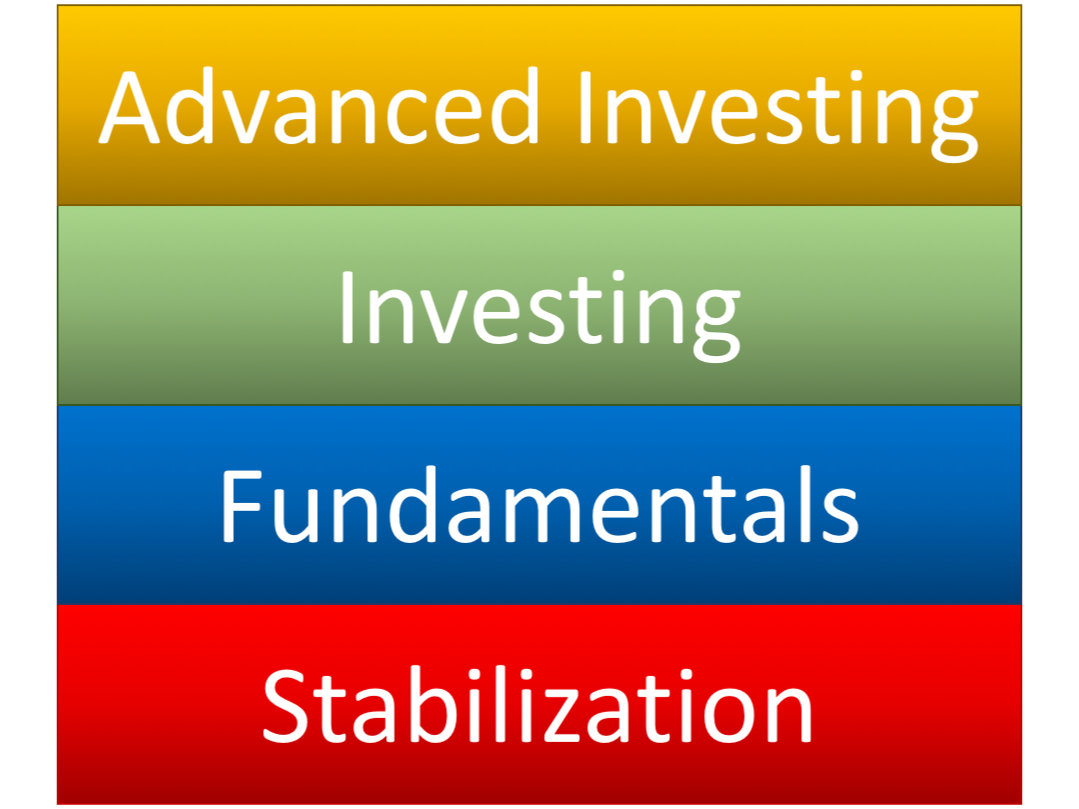

I visualize personal finance as building blocks stacked on top of each other (shown to the right).

You must master the lower levels before you can get to the upper levels.

Level 3: Basic Investing

I consider basic investing saving for retirement in a 401k and Individual Retirement Account (IRA) via mutual funds and bonds, and general savings in mutual funds.

Both the 401k and IRA are ways to invest for retirement and get some tax benefits. 401ks are through an employer, and IRAs can be setup through a company like Vanguard, Fidelity, TD Ameritrade, or any number of other firms that act as the “custodian”. I talk about them in a little more detail in my article Five Tax Strategies to Keep More Income under strategies one and two.

Employer Matching 401k

Some employers will match your 401k contributions. As an example lets say your employer matches your contributions up to 5% of your salary. If you make $50,000, and you save $2,500 in your 401k, your employer will add an additional $2,500 to your 401k. I put money in my 401k up to but not beyond the point where I’ve maxed out the match.

Some employers will match your 401k contributions. As an example lets say your employer matches your contributions up to 5% of your salary. If you make $50,000, and you save $2,500 in your 401k, your employer will add an additional $2,500 to your 401k. I put money in my 401k up to but not beyond the point where I’ve maxed out the match.

I prefer Roth 401ks to 401ks because I believe tax rates are going up in the future. Roth 401ks are more rare but I have had employers who offer them.

The vast majority of the investment options offered by the employers I’ve been at are VERY limited. The easiest option is to go with a target retirement fund. Target retirement funds are basically funds on autopilot, they automatically adjust their asset mixes to become more conservative as investors approach the target retirement date.

If there are more options I avoid bonds and favor international funds but investments depend on your risk tolerance and goals.

Individual Retirement Accounts

IRA’s come in the Roth and Traditional flavor. It all depends if you’d rather pay taxes now, or in retirement. I prefer to pay the taxes up front.

I would open up a Roth IRA and try to max it out ($5,500 in 2016). Another neat trick is that you can contribute to a traditional IRA and then convert contributes to a Roth (you do of course have to pay the taxes though), so if you want to save more than $5,500 in after tax income, that is an option.

One of the things I like about IRAs is that the investment options are much, much more flexible. I think part of the reason employer sponsored 401ks have such limited investment options is because employers are afraid of being sued if an employee makes poor decisions and loses a lot of money, so employers only offer with the most conservative investment options.

If you want to save money and not think about, you’re asking for trouble, but one option is to open up an account at a low cost company like Vanguard (my favorite) or Fidelity. Setup auto-deposit and buy a balanced fund like the Vanguard STAR fund (VGSTX).

You can also buy additional index funds, like the S&P 500 index fund, Nasdaq, large and small cap US funds, etc. These index mutual funds are setup to track the gains and losses of the index they are based on. Again, I think it is good to have money in the emerging markets as well.

Vanguard has investment professionals that will help you decide how to allocate money to different mutuals funds. (Disclosure: I have been a vanguard client for years, but gain no benefit from listing them as an option).

By setting up auto-deposit and auto-invest into Vanguard (or your IRA custodian of choice) from your paycheck you’re dollar cost averaging into the fund and not trying to time the market.

Over time this is a good, conservative strategy, and one discussed by Benjamin Graham in his seminal work “The Intelligent Investor”. Ben Graham was a mentor to Warren Buffet, who you may have heard of, and has done decently well as an investor.

Conventional wisdom is often something like a 40% bonds and 60% stocks (mutual funds) as a conservative approach. Unless you’re retired and relying on your savings for monthly income, I would not buy bonds, but a portfolio that does not include bonds is considered more risky.

You can follow these same investing principles to buy non-retirement mutual funds.

Now I do think that US stocks and bonds are in a bubble. But if the Federal Reserve responds to the bubble bursting as I think they will, stocks and bonds will still go up. I just think there are other asset classes that will go up faster.

Consider Physical Gold

Consider Physical Gold

While this could be considered more advanced, I think it is very important to have somewhere around 10% of one’s assets in physical gold and silver bullion. While I don’t give investment recommendations I think that even some of the more conservative and traditional investment advisors would admit this is not a bad idea. I gain no benefit from mentioning them, but I buy bullion from Scotsman Auction house in Saint Louis. They have been in business a long time and have great pricing. I don’t buy numismatics or “rare” coins as an investment. I’m partial to Silver American Eagles and Gold Canadian Maples, but that is just personal preference.

There are lots of gold bullion companies but I would not want to pay more than around 2% over spot price for gold. I avoid numismatics unless they can be acquired at bullion prices.

Level 4: Advanced Investing

Advanced Investing techniques are what I’m most passionate about. Examples of what I consider advanced investments are: Investing in individual company stocks, gold mining stocks, peer to peer lending, real estate investments, private equity, foreign stocks, offshore brokerage accounts, options, cryptocurrencies, physical precious metals like gold and silver, and physical gold stored remotely through a Goldmoney personal account.

Advanced Investing techniques are what I’m most passionate about. Examples of what I consider advanced investments are: Investing in individual company stocks, gold mining stocks, peer to peer lending, real estate investments, private equity, foreign stocks, offshore brokerage accounts, options, cryptocurrencies, physical precious metals like gold and silver, and physical gold stored remotely through a Goldmoney personal account.

These techniques are generally considered more risky, although I think that buying US stocks at all time highs and negative yielding bonds is much more risky, even though conventional foolishness wisdom says these are the safe bets.

Get Started!

To get started figure out where you stand in the four phases. Master that phase and work towards the next.

It’s an iterative process once you’re out of stabilization and focusing on the fundamentals and investing. I’m often re-evaluating my fundamentals such as my budget and my goals. I work on my basic investing like maxing out my 401k company match and Roth IRA.

Which phase are you in and what are your savings and investment goals?

by John | Jul 10, 2016 | Passive Income

Update: 2 August 2016 10:53 Eastern

Bitfinex reported it has been hacked. The website is not allowing logins.

bitfinex.statuspage.io

Coindesk is reporting that 119,756 BTC have been stolen.

http://www.coindesk.com/bitfinex-shuts-down-customer-bitcoin-stolen/

The hacking of Bitfinex brings up an additional risk that needs to be considered when investing in any type of Bitcoin enterprise. Even if the person or entity running the bitcoin exchange or bitcoin service is honest and trustworthy there is aways the risk of hacks.

Margin funding is a very exciting investment opportunity. It is offered by Hong Kong based crypto-currency exchange Bitfinex. Bitfinex allows investors to fund margin traders and earn passive income in return.

Why am I planning on growing my wealth through loans to margin traders? Because it is low risk, provides a great return, and is passive.

Brief Background on the Concept of Margin

Trading on margin means borrowing money to buy or sell a security. This increases risk and reward. For example, a trader borrows $100 and buys a share of a company for $100. The price of the share goes up to $110. The trader sells the share and makes $10 minus trade fees and the interest paid to borrow the $100.

Margin funding is simply lending the funds traders are borrowing. In exchange for loaning traders capital the lender is paid a percentage return.

Margin Funding has Limited Risk

Lending funds to margin traders is much less risky than actually trading on margin. There are three mechanisms that protect lenders: an initial equity requirement, equity maintenance requirement and finally traders can’t withdraw the borrowed funds.

1) Initial Equity Requirement

Bitfinex has a minimum initial equity requirement for margin trading. The trader must first have equity in their account equal to 30% the size of the trade they are making if the collateral is USD. The requirement is 33% if the collateral is BTC.

For example, if the account value is equal to 1,000 USD a trader could open a position equal to 3333.33 USD. [1000 * (1/.3)=3333.33]

Assuming a BTC price of 250 USD, a trader would be able to open a long or short margin position of 13.333 BTC. [3333 / 250 = 13.333 BTC]

2) Margin Maintenance Requirements

Once the trade has been made and the position is open Bitfinex enforces a margin maintenance requirement.

Lets say the price of bitcoins goes DOWN. Bitfinex doesn’t just let the trader ride the price of Bitcoin down to $0. If they did the trader would owe $2333.33 [$3333.33-$1,000].

Bitfinex has a margin maintenance requirement equal to 15%. So, for a 3333.33 position, the account value must be greater than $500. [3333.33*.15=500]

Continuing the previous example say the price Bitcoin were to reach $212.50. The trader would be sitting on a paper loss of $500. [$212.5*13.33-$3333.33]

The trader’s total account value would be down from the initial value of $1000 to $500. So the trader has reached the minimum margin requirement of 15%. The trader would then receive a “margin call” (actually an email and alert on the website) from Bitfinex and their position would be force liquidated.

This prevents a trader for losing more money than they have, so they aren’t in a situation where they owe money.

3) Traders can’t withdraw the funds borrowed

Bitfinex does NOT allow the borrowed funds to be withdrawn by the trader.

For example a trader can’t borrow $500 and then just withdraw the money and disappear.

The funding lent to a trader serves only to open margin positions. The actual funding always stays in either the funding provider’s account or on the exchange as part of a position.

Margin Funding Provides a Great Return

Most bank accounts pay less 1% if they pay anything at all. It’s paltry and it doesn’t even keep up with the rate of inflation.

Most bank accounts pay less 1% if they pay anything at all. It’s paltry and it doesn’t even keep up with the rate of inflation.

As you would expect market rate for margin funding on Bitfinex fluctuates. I’ve made between .05% and .07% per day lending. Although .05% (.0005) daily interest might not sound like a lot, compounded on a regular basis it is very good. If one were to invest $100 it would be worth about $120 at the end of the year or a 20% annual return. [11 December 2016 Update: Bitfinex charges a 15% fee on interest earned via margin funding, that is not included in this calculation.]

If you know a bank that will pay 20% let me know.

Margin Funding Provides Passive Income

You can setup Margin Funding on Bitfinex and walk away. I check up on it every now and again but it is passive income. Passive income is one of my five investment goal categories.

Bitcoin Price Fluctuations

There are several options when funding margin traders on Bitfinex. You can fund them in USD, BTC, LTC (Litecoin) or ETH (Ether). Funding in USD eliminates bitcoin price fluctuation risk (and the potential for reward if the price of Bitcoin appreciates).

Lending in USD makes the most sense to me right now for three reasons.

1) The large run up in Bitcoin price in 2016

If Bitcoin were to sell off I might be tempted to start loaning in BTC. Right now BTC seems a little rich and could be due for a correction.

2) I have exposure to Bitcoin elsewhere

I already have exposure to Bitcoin and I don’t want to increase my exposure to BTC price fluctuations more than I already am.

3) USD margin funding pays a much higher return

Do you want a higher return on the funds you lend out and lower risk of Bitcoin price fluctuations, or do you want a lower return on the funds lent in exchange for the possibility of Bitcoin appreciating (while accepting the risk Bitcoin could drop)? I favor the higher return.

I’ve already made my first loans, or as Bitfinex calls it Margin Funding. The user interface of Bitfinex is a little confusing, and it seems like you have to move money around three different wallets several times to go from BTC to USD then provide margin funding. I highly recommend reading the step-by-step Bitfinex lending guide over at bitcoinpassiveincome.com. [11 Dec 2016 Update: Lending guide seems to have been removed.]

Do your own research and make your own decision if Margin Funding on Bitfinex is right for you. I’ve determined it is a solid investment that is suitable for me.

If you do decide to sign up for Bitfinex you can support this site by signing up through my affiliate link: https://www.bitfinex.com/?refcode=IuO4E6gXkj.

by John | Jun 16, 2016 | Capital Appreciation, Passive Income, Preservation of Purchasing Power, Real Estate

Buying Rental Property and Real Estate has helped create many a millionaire. Robert Kiyosaki, Barbara Corcoran, and even Donald Trump amassed fortunes via Real Estate.

Buying rental property is an investment that hits on three out of five of my Investment Goal Categories: Capital Appreciation, Preservation of Purchasing Power and Passive Monthly Income.

At it’s most basic level, investing in rental property consists of buying a property and then renting it out to gain monthly income.

I don’t directly own any rental property at this time but it is an area I’m investigating and learning more about.

Buying Rental Property has Five Great Benefits

1) Passive Monthly Income (Cashflow)

2) Equity Build-Up

3) Leverage Utilization

4) Very Favorable Tax Benefits (in the US)

5) Appreciation

Let’s explore the five benefits of buying rental property.

Passive Monthly Income

In many areas it’s feasible to purchase a rental property that generates positive cashflow each month. Even after making a monthly mortgage payment, taxes, fees and maintenance expenses, a good rental property can be have net positive cashflow from the rent payments of the tenants.

In many areas it’s feasible to purchase a rental property that generates positive cashflow each month. Even after making a monthly mortgage payment, taxes, fees and maintenance expenses, a good rental property can be have net positive cashflow from the rent payments of the tenants.

This meets one of my investment goal categories of passive monthly income.

Equity Build-up

Many banks will loan qualified persons enough money to purchase a rental property but typically require a 20-30% down payment. By renting the property you can use the rental income to pay the mortgage and continue to build equity in the property until you own it outright.

With equity in a property you have the option to choose between selling the property, taking a loan out on the property and re-mortgage it, or simply hold onto the property and continue to enjoy the monthly income.

Leverage Utilization

By taking out a loan to buy a positive cashflow rental property you are leveraging the capital you have to make more money. For example by using $16,000 for a down payment you could purchase an $80,000 property and rent it for $600 per month. Lets say after making the mortgage payments, paying property taxes, and other expenses, you are bringing in $150 per month in cashflow. At the end of the year that $150 monthly income would be $1,800 from a $16,000 investment, or over an 11% return. And that doesn’t even include the increase in equity.

Because of the use of leverage, price inflation actually reduces the cost of the remaining loan balance over time. This combined with the universal human need (and hence demand) for shelter even when the economy is not performing well makes buying rental property a great investment for preserving purchasing power.

Tax Benefits

I’m not a CPA or tax advisor, but I understand that when it comes to investment properties, mortgage interest, depreciation of the property, and other expenses that go into maintaining the property are tax deductible. Often times the 11% profit can be made tax free because of all the deductions the tax code (at least in the US) provides to real estate investors.

Appreciation

Partly due to price inflation, partly due to an increasing population and demand for housing, real estate prices tend to rise. So it is possible to grow wealth because the value of the property has gone up. While this is more on the speculative side of the housing and real estate market, appreciation can be a very nice bonus.

This meets one of my investment goals of capital appreciation as well as preservation of purchasing power.

What has stopped me from Buying Rental Property in the past?

- Capital I need money for a down payment. Most of my savings go into stocks and I want to buy a rental property with new money. So I’m going to start earmarking money for buying rental property. While it might be possible to buy a property with zero down I think this is reckless and irresponsible. It’s a good way to find yourself underwater on your mortgage. By making a 20% down payment you can weather a 20% drop in the value of the property and still be even in terms of equity. Plus if the property is cashflow positive, even if you are not making money via appreciation, you can still make money via cashflow and equity building.

- Knowing how to make an offer I would like to better learn how to coordinate having a loan pre-approved with making the offer. With real estate you have to be able to move quickly. In some markets if you go eat lunch to think it over the property will be sold by the time you get back.

- Maintenance Costs and Expenses If you know purchase price of a property and how much you can rent it for (by looking at similar properties being advertised in the same area) and what your costs are going to be you can determine if a property will be profitable (or not). However, I find the most difficult part to research is estimating maintenance costs. The hot water heater breaks, furnace needs repair, a crazy tenant tears up the place, etc. As someone who has been a renter all his life I don’t have a good sense of how much I need to budget for maintenance costs for a rental property. These costs are a huge factor in the profit and loss calculations.

There are five great reasons why real estate investing is a superb way to build and grow wealth. I’ll be sharing my progress in the coming months as I continue to learn more about real estate investing.

by John | Jun 2, 2016 | Learning from Mistakes, Passive Income

Ethereum Cloud Mining on Hashflare.io is a losing investment. It is more profitable to simply buy Ether on an exchange.

(more…)

When it comes to income the expression is don’t have all your eggs come from one chicken.

When it comes to income the expression is don’t have all your eggs come from one chicken. Multiple income streams provides strength and security. If one has multiple streams of income and lives below their means it isn’t a big deal if one of the income streams stops.

Multiple income streams provides strength and security. If one has multiple streams of income and lives below their means it isn’t a big deal if one of the income streams stops.

Some employers will match your 401k contributions. As an example lets say your employer matches your contributions up to 5% of your salary. If you make $50,000, and you save $2,500 in your 401k, your employer will add an additional $2,500 to your 401k. I put money in my 401k up to but not beyond the point where I’ve maxed out the match.

Some employers will match your 401k contributions. As an example lets say your employer matches your contributions up to 5% of your salary. If you make $50,000, and you save $2,500 in your 401k, your employer will add an additional $2,500 to your 401k. I put money in my 401k up to but not beyond the point where I’ve maxed out the match.  Consider Physical Gold

Consider Physical Gold Advanced Investing techniques are what I’m most passionate about. Examples of what I consider advanced investments are: Investing in individual company stocks, gold mining stocks, peer to peer lending,

Advanced Investing techniques are what I’m most passionate about. Examples of what I consider advanced investments are: Investing in individual company stocks, gold mining stocks, peer to peer lending,

Most bank accounts pay less 1% if they pay anything at all. It’s paltry and it doesn’t even keep up with the rate of inflation.

Most bank accounts pay less 1% if they pay anything at all. It’s paltry and it doesn’t even keep up with the rate of inflation.

In many areas it’s feasible to purchase a rental property that generates positive cashflow each month. Even after making a monthly mortgage payment, taxes, fees and maintenance expenses, a good rental property can be have net positive cashflow from the rent payments of the tenants.

In many areas it’s feasible to purchase a rental property that generates positive cashflow each month. Even after making a monthly mortgage payment, taxes, fees and maintenance expenses, a good rental property can be have net positive cashflow from the rent payments of the tenants.