Ethereum Cloud Mining on Hashflare.io is a losing investment. It is more profitable to simply buy Ether on an exchange.

I want to share my negative experience with Ethereum Cloud Mining on Hashflare.io so that you can learn from my mistakes when making your own investment decisions.

It’s very important to me that I am 100% honest.

I don’t want to just talk about my investment successes but also those times when I fall short of my goals.

I don’t like to dwell on times I lost money but if I’m not Learning from Mistakes then I’m not getting anything in exchange for the money I parted with.

I made the decision to invest in Ethereum Cloud Mining as a way to generate passive monthly income…and it didn’t work out at all!

If you’re already familiar with Ethereum, Ether and Mining you can skip down below.

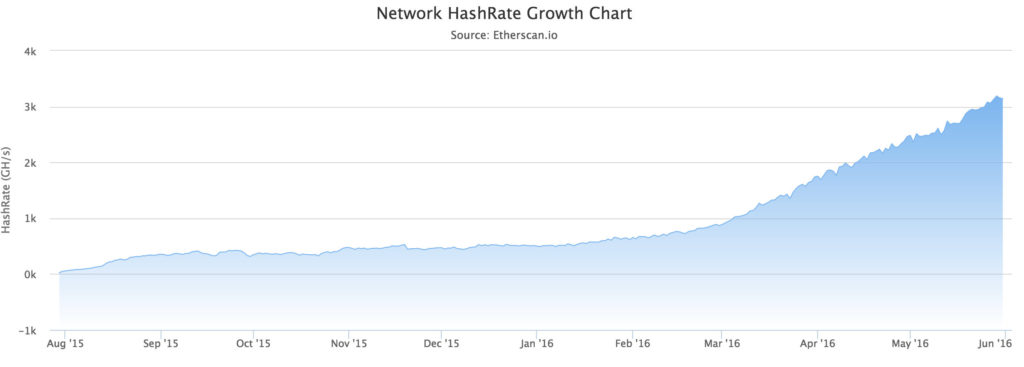

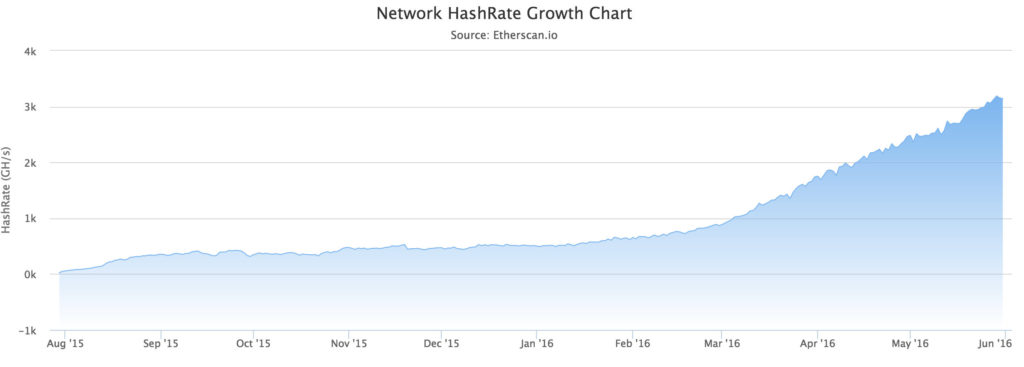

In other words the Network HashRate has gone up 255% since I started mining.

Relative to the new, higher Network HashRate my fixed hashing power is proportionally less and so I’m unable to mine as much Ether each day.

Meanwhile, the price of ETH has gone from $9 to $13, a more modest 44%. So the price increase in ETH is not keeping pace with the Network HashRate increase as I anticipated it would.

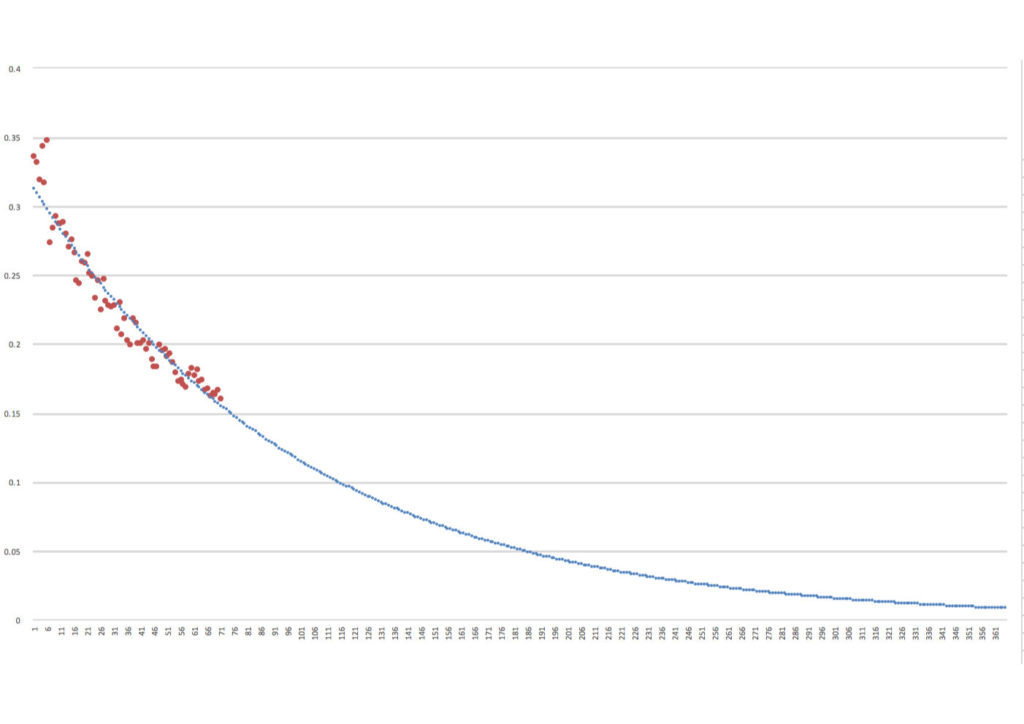

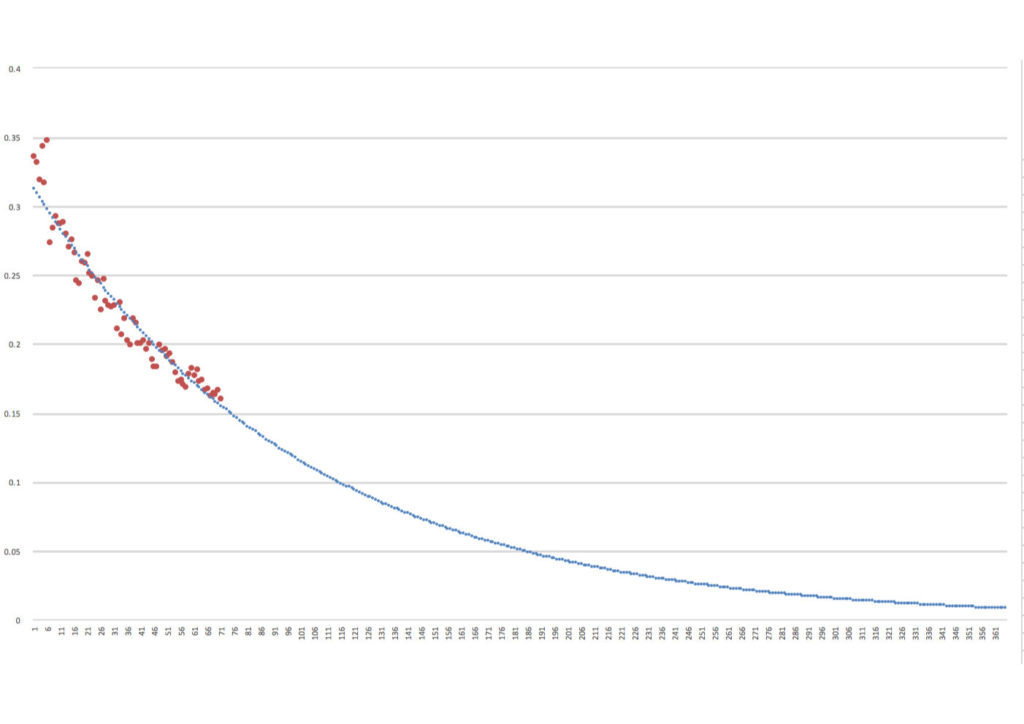

This is resulting in my profits being eroded away. On my first day of mining I mined about .33 ETH. Now I mine about .16 ETH. The amount I mine will continue to decline as long as the Network HashRate increases.

Even though ETH has gone UP in value 44%, the amount of ETH I’m getting each day has gone DOWN by 50%.

In order to simply break even ETH would need to trade up to around 18.7 USD.

I would also be better off if I had just bought ETH.

If I bought $561 of ETH for $9 (where it was trading when I started mining). I would have 62 ETH, and with ETH trading at $13, would be worth $806 for a $245 profit.

In other words the Network HashRate has gone up 255% since I started mining.

Relative to the new, higher Network HashRate my fixed hashing power is proportionally less and so I’m unable to mine as much Ether each day.

Meanwhile, the price of ETH has gone from $9 to $13, a more modest 44%. So the price increase in ETH is not keeping pace with the Network HashRate increase as I anticipated it would.

This is resulting in my profits being eroded away. On my first day of mining I mined about .33 ETH. Now I mine about .16 ETH. The amount I mine will continue to decline as long as the Network HashRate increases.

Even though ETH has gone UP in value 44%, the amount of ETH I’m getting each day has gone DOWN by 50%.

In order to simply break even ETH would need to trade up to around 18.7 USD.

I would also be better off if I had just bought ETH.

If I bought $561 of ETH for $9 (where it was trading when I started mining). I would have 62 ETH, and with ETH trading at $13, would be worth $806 for a $245 profit.

What is the Ethereum Project?

Ethereum is a technology platform akin to Bitcoin. The project website defines Ethereum as follows:Ethereum is a decentralized platform that runs smart contracts: applications that run exactly as programmed without any possibility of downtime, censorship, fraud or third party interference. These apps run on a custom built blockchain, an enormously powerful shared global infrastructure that can move value around and represent the ownership of property. This enables developers to create markets, store registries of debts or promises, move funds in accordance with instructions given long in the past (like a will or a futures contract) and many other things that have not been invented yet, all without a middle man or counterparty risk.Source: Ethereum.org

What is Ether?

Ether is a necessary element — a fuel — for operating the distributed application platform Ethereum. It is a form of payment made by the clients of the platform to the machines executing the requested operations. To put it another way, ether is the incentive ensuring that developers write quality applications (wasteful code costs more), and that the network remains healthy (people are compensated for their contributed resources).Source: ethereum.org/ether

What is Ethereum Cloud Mining?

Mining Ether (Marketed as “Ethereum Mining”) is essentially renting processing power (hashing power) that is setup and maintained by a third party. This rented hashing power is then used to generate new Ether. It allows someone like me who doesn’t have all the expertise in setting up or maintaining a mining rig to participate in mining.What I Purchased from HashFlare.io

At the time I made my purchase, Ether was trading for around 9 USD, the Network HashRate was 945 GH/s, and the block time was around 17 seconds. Using this handy Ethereum mining calculator I determined I would be making 108.91 USD per month provided Ether slowly grew in value and the hashing power of the network grew at roughly the same pace. The 108.91 USD per month would be 1,306 USD at the end of the year. My cost was $561 so I had hoped to roughly double the invested capital in one year. I also knew that this was a very risky investment and there was a good chance I could lose all my money. Despite this I took the plunge and purchased 15 MH/s of processing power from Hashflare.io, good for one year, for 561 USD on 3 March of 2016. On day 1 I was bringing in around .33 Ether per day, which would be around 120 ETH after a year.The Investment Went Bad, Quickly

Since buying 15 MH/s of Ethereum Hashing power the overall Network HashRate of Ethereum has gone up. A LOT. As of writing the Ethereum Network HashRate is up to 3,356.29 GH/s from the 945 GH/s on 3 March 2017.

Ethereum Network HashRate Growth Since 30 July 2015

Ethereum Profitability Depends on Network HashRate

A Better Model

A better model for predicting mining profitability is to take into account the exponential growth of the Network HashRate. Using the model I’ve developed, I predict that the total amount I will mine in one year will be just 30 ETH. Much less than the 120 ETH predicted by the static calculators that did not take into account the ever increasing Network HashRate.

The Red Dots show the ETH I mined each day, the blue line are projections of how much I will mine each day

Now that Ether is $450 per coin, your theory is completely destroyed. And that is a good thing, right? 🙂

Not at all! Respectfully, if you think that then you did not understand the point of the article. I would have been able to buy more ETH if I had bought it directly, instead of mining.

The gain was entirely due to the increase in the price of ETH–the mining itself was not profitable.

I have the same Problem after half year im not in Profit.This is my first and last Cloud mining experience.

I’m sorry to hear that Mario. It is frustrating because some of these cloud mining companies (Hashflare.io for instance) try to make it seem like this is a great way to make money but it isn’t (at least not for their clients). I post these articles to help prevent people from making this mistake in the future.