by John | Oct 16, 2016 | Active Monthly Income, Geopolitical Risk Protection, Monthly Income, Passive Income, Saving Money

In my culture there is an old adage: “Don’t put all your eggs in one basket.” It’s a quaint agrarian saying that captures a great deal of wisdom.

This principle applies most directly to savings and asset allocation. Savings are key but today I’m writing about income.

When it comes to income the expression is don’t have all your eggs come from one chicken.

When it comes to income the expression is don’t have all your eggs come from one chicken.

In truth many people have almost no income diversity.

To stretch the analogy way to far: most workers have access to one chicken and in exchange for their work they get a small portion of the eggs the chicken lays. If the chicken stops laying eggs or the person who owns the chicken doesn’t want want or need a worker anymore, then the workers go hungry until they can find access to another chicken.

They have their job (and little to no savings or maybe a little to a lot of debt) and that’s it.

If they lose their job and can’t find another one they are in a very bad place. Without a job many people can’t service the debts they have, they can’t pay for their basic needs, it’s a hot mess. An emergency fund and savings are helpful but I was unemployed for 100 days and it was stressful even though I do have savings!

Unless you’re self employed you don’t own your job and can be let go even if you work hard and do a great job!

Losing a job happens all the time. A company gets bought and people get laid off. “My boss is a jerk and I can no longer stand to work for her.” The industry you’re in collapses. Dollars don’t buy as much and a raise doesn’t cover the difference.

Even if you are gainfully self-employed the market you’re in could contract and squeeze your earnings.

Multiple Income Streams

Multiple income streams, income diversification, it means not keeping all of your income “eggs” coming from just one chicken.

Multiple income streams provides strength and security. If one has multiple streams of income and lives below their means it isn’t a big deal if one of the income streams stops.

Multiple income streams provides strength and security. If one has multiple streams of income and lives below their means it isn’t a big deal if one of the income streams stops.

If all of your income comes from your job, and you lose your job for any reason, you have to rely on any savings you have until you find another job.

But if you have income from 4 sources and one of them stops yielding; you’re still getting a large percentage of your income.

Going out and getting four full time jobs is probably not possible. I know I’m only one person and can’t be two places at once and there are only so many hours in the week.

Right now my day job is the main engine that drives my economic wagon. But I’m saving money so that won’t always be the case.

I continue to develop additional income streams including ones that make money even while I sleep. Some of the areas I’m capitalizing on are: dividend paying value stocks, bitcoin arbitrage, and trading options. While option trading is somewhat active during regular business hours (unless you place good till cancelled limit orders in the morning or evening), the others can be done with little time outside normal working hours.

I do still want to get into real estate (rental property) that has been on hold until I’m more established in my new career.

It’s popular to talk about diversity and diversification, but when it comes to income the norm seems to be getting one job and working there for a long time. That isn’t always possible, practical or prudent in “today’s economy.” Branching out into multiple sources of income provides most financial resilience and security.

by John | Sep 1, 2016 | Active Monthly Income, Monthly Income, Options

Below is a summary of the option trades I closed in the month of August.

If you’re not familiar with stock options you might first read my introductory article Get Started Trading Options.

My first trade was on the 16th. In total I made $120.87 with a $10,000 account. That is 1.2% over about 2 weeks. However, my option buying power never dropped below around $3,000. So I was using about $7,000 with the rest in cash.

Some of that margin usage includes other options trades not listed here because they are made based on the trades made by Kirk DuPlesis over at OptionAlpha.com and I am not going to post those out of respect for his paid service. I’m also NOT including any profits or losses from the OptionAlpha trades I make.

Again, the trades listed below are MY trades closed out in the month of August.

Urban Outfitters (URBN) Earnings Iron Condor

Notes: Urban Outfitters beat their estimated earnings and the stock gapped up beyond the range I expected it to. I made one good adjustment to limit my losses, but then made a bad adjustment when I sold a 37 strike call for just .16 which added a little more to the loss when the stock moved past 37.

Margin Requirement/Cost: Not recorded

Margin Requirement/Cost: Not recorded

Income: -$56.51 (-$26 less commissions and fees)

Nordstrom (NDSN) Earnings Strangle

Note: The stock stayed in my range the morning after earnings were announced, my profits were initially higher, but I waited and didn’t get out until later in the day, the stock creeped up towards my break even point, and that cut into my gains. Good rule of thumb, close profitable earnings trades out when the markets opens.

Margin Requirement/Cost: Not recorded

Margin Requirement/Cost: Not recorded

Income: $8.92 ($15 less commissions and fees)

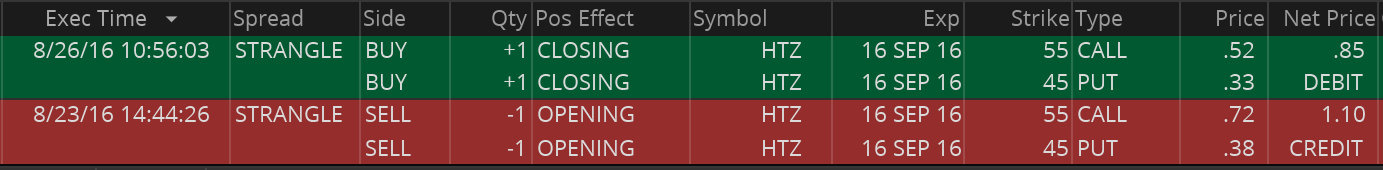

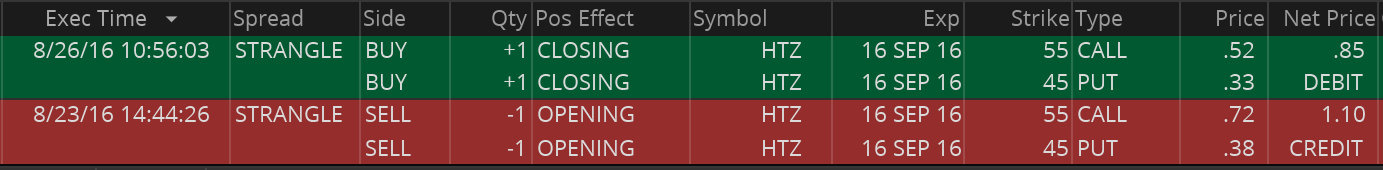

Hertz Global Holdings (HTZ) Strangle

Notes: HTZ stock was trading with high volatility. I’m not sure why but I sold some options. Volatility and time to expiration decreased and I made a little money.

Margin Requirement/Cost: ~$750

Margin Requirement/Cost: ~$750

Income: $18.92 ($25 less commissions and fees)

Big Lots (BIG) Earnings Strangle

Note: My position size was too big on this trade. One strangle would have been more appropriate given my account size. I was fortunate that BIG only beat earnings slightly, and the stock didn’t move too much before I was able to exit for a decent profit.

If I had waited until later in the day to open this position (which I could have known) I would have gotten a better price. If I had waited a little later the next day to close this position (but not too late), I would have made a better profit (not sure I could have known). Plus I was trying to implement the lesson learned in not closing out NSDN asap.

Margin Requirement/Cost: ~$2500

Margin Requirement/Cost: ~$2500

Income: $274.42 ($293 less commissions and fees)

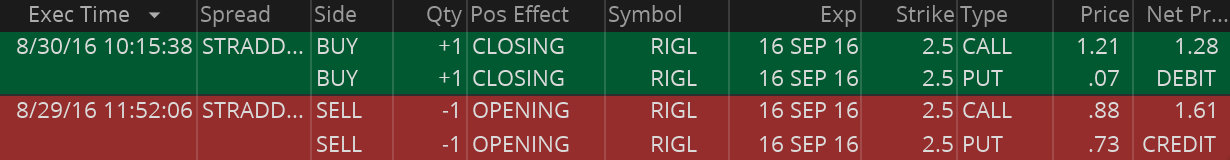

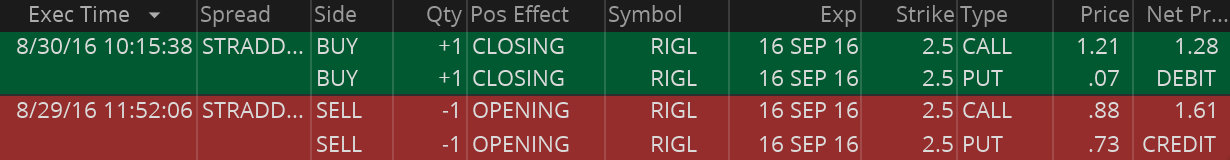

Rigel Pharmaceuticals (RIGL) Straddle

Note: There was a lot of volatility for pharma stocks. Probably related to the epi-pen outrage.

Margin Requirement/Cost: ~$400

Margin Requirement/Cost: ~$400

Income: $26.92 ($33 less commissions and fees)

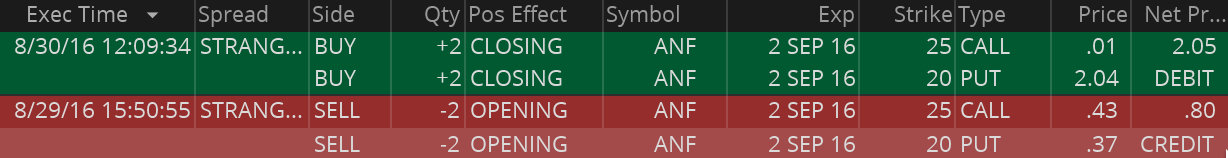

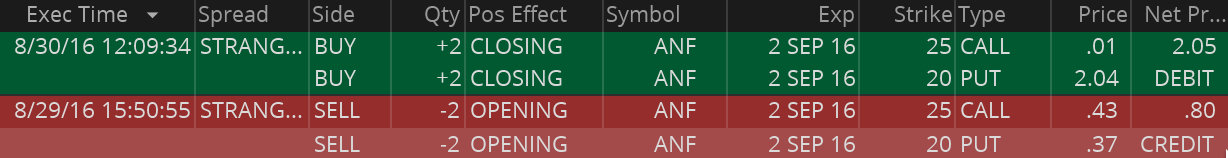

Abercrombie & Fitch (ANF) Earnings Strangle

Note: Missed earnings by a lot, moved beyond my range and I lost.

Margin Requirement/Cost: $670

Margin Requirement/Cost: $670

Income: -$262.20 (-$250 less commissions and fees)

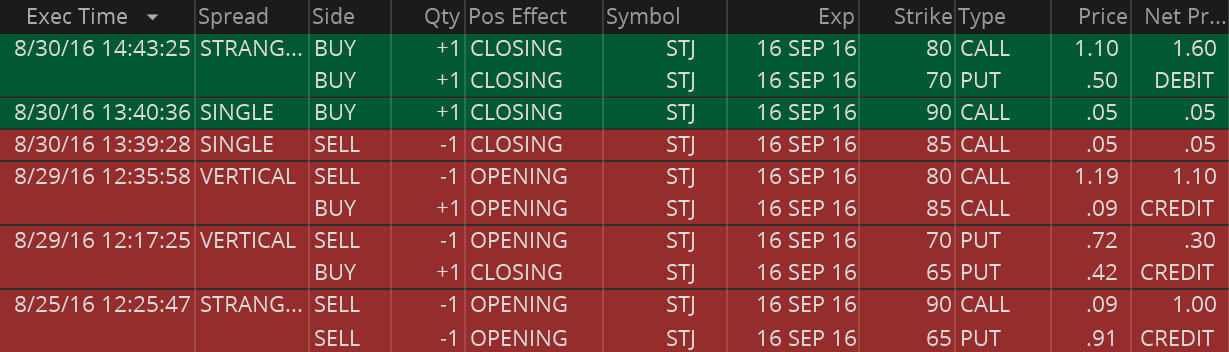

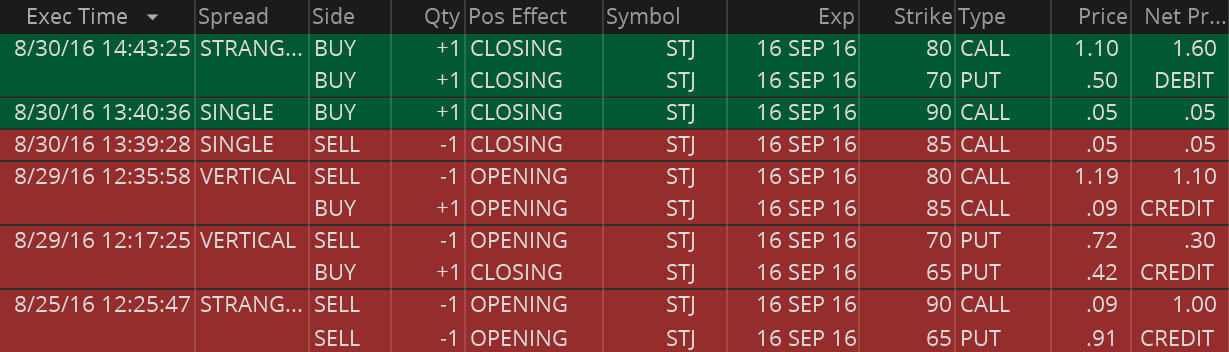

St. Jude Hack (STJ) Strangle

Note: St. Jude’s stock price plunged when a large short seller made some unfriendly comments about the security of some of the devices they sell. I opened up a strangle position that would be profitable provided the stock stayed above $60 per share and below $90 per share. The stock opened August 25th around $82, dropped down as low as $74.15, in a rather volatile move.

All else equal options get more expensive when the underlying stock volatility increases, so by selling options during what I thought was an overly volatile move, I’m captured more option premium.

On the 26th St. Jude actually halted trading and made some announcements indicating the claims against them were unfounded. Volatility dropped and the stock regained some value and I was able to close the option position for a profit. I would have liked it if volatility had dropped more, but it was approaching my break even on the upside so I closed it out.

Margin Requirement/Cost: ~$850 jumped to $1,400 after an adjustment, too high for my account size!

Margin Requirement/Cost: ~$850 jumped to $1,400 after an adjustment, too high for my account size!

Income: $66.30 ($80.00 less commissions and fees)

Designer Shoe Warehouse (DSW) Earnings Strangle

Note: Was waiting for a drop in implied volatility. I think the AAPL 14.5 billion tax hostage situation scared all a lot of stocks down, so even though DSW beat earnings it was down. It rebounded, implied volatility dropped, and I got out for a nice profit.

Margin Requirement/Cost: $610

Margin Requirement/Cost: $610

Income: $43.80 ($56 less commissions and fees)

Margin requirements are rounded to a whole number and are based on the margin requirement when the position was first opened. I’m not very good at noting the exact margin requirement for my position. I just try to keep it around $500. If I made adjustments or margin requirements changed, the number could go up or down.

by John | Aug 31, 2016 | Active Monthly Income, Options, Wealth Protection

Do you want to get started trading options?

What are options and how are they useful?

An option is a contract that gives the buyer the right, but not the obligation, to buy or sell an underlying asset at a specific price on or before a certain date. An option, just like a stock or bond, is a security. It is also a binding contract with strictly defined terms and properties.

Source: http://www.investopedia.com/university/options/option.asp

If that seems like a foreign language don’t worry. I’m going to break down what that means and provide an example to illustrate one way options are very useful.

If you buy a put option you have the right (but not the obligation) to sell a stock at a given price within a given timeframe. The put option seller has the obligation to buy the underlying stock from you at the given strike price, provided it is exercise before the expiration date. The seller gets a premium for providing this “insurance”.

Additionally you can buy what’s known as a call option where you have the right (but not the obligation) to buy the underlying stock at given price within a given timeframe. For the privilege of this “option” you pay a premium. On the other side of this option contract is an option seller who has the obligation to sell you the underlying stock at the strike price at any time before the contract expires if you choose to exercise the option.

Aren’t Options Risky?

I’ve been trading options for around a year now. They can enable an inexperienced trader to lose money fast. However with the right education trading options is a great way to generate active monthly income.

I’d like to use an analogy to explain the risks of trading options.

Say you know how to drive an automatic transmission car in the US. But now you’re in a hilly and busy part of Britain and you’ve got a stick shift car. You’ve never driven a manual transmission car before, you’re not familiar with the area you’re driving and you don’t know the rules of road.

It’s going to be bad. Very bad.

But if you practice driving “stick”, learn the rules of road in Britain (like driving on the left side of the road, etc), don’t take too many risks and learn the area you’ll be driving in, a manual transmission automobile is an excellent and safe way to get around Britain. There are still risks but if you’re careful they will be small and rare.

If trading stocks is like driving an automatic car in one’s home country. Trading options is like driving a manual car in a foreign land.

Trading Options Can be Profitable

Unfortunately I’ve learned this the hard way. I thought, “I’m a smart guy and I’ve been trading stocks for a long time, I’ll jump into options!” As a result I lost a lot of money.

I have been interested in options for a long time and was devoted to finding a way to make money with them.

I believe that I’ve found a trade methodology that is profitable in the long run. In fact in August, making my own option trades, I’ve brought in $120 using an account that is roughly $8,000 in size. That’s a 1.5% gain in just a couple weeks.

I link to a free option education resource that I highly recommend later in this article. I’ll also be sharing the trades I made in August in a different post.

Tell me more about Stock Options!

I’d like to contrast options to stocks, since more people are familiar with stocks.

When buying stocks you want to buy low and sell high. You might also be interested in the dividend the company pays to shareholders. With stocks the name of the game is if the stock goes up or down.

Options are a different animal. Yes, direction matters, but option pricing is also a function of the time to expiration (the given timeframe you have to exercise the option) and implied volatility.

As it pertains to stock options volatility is how much the underlying stock price moves up or down within a given timeframe. For example, a stock that goes down in price 50% and then up in price 100% over a period of two days is more volatile than a stock that goes down 10% and then up in price 20% over a period of two days all else given.

Understanding volatility and how it impacts option pricing is arguably the most important difference between trading stocks and trading options.

Purpose of Options

But why even buy options?

You can use options to speculate (using leverage) on the direction of a stock up or down. You can use options to open or close a long stock position. You can also sell options to gain a premium depending on if you think a stock will go up, down, or sideways. I think of selling options as selling insurance.

Another reason for buying options is to hedge a position. Let’s dive into the example to explain how you can use options to hedge a position.

Let’s say you own a stock you think will go down $16 in value, but you don’t want to sell it (and pay commissions and potentially have a taxable event). You could buy a put option. A put option to protect a stock position is like buying insurance against losses.

An Example

For example lets say you own 100 shares of Apple stock (AAPL). AAPL is currently trading at around $106. Lets also say you think that the September 7 Apple event is going to disappoint and that the stock is going to go down to $90 per share. (This is just an example and should not be construed as my opinion on Apple, next iPhone, or stock movement.)

Lets also say you bought AAPL when it was trading at $50 and you don’t want to sell your stock at this time and have to pay taxes on $50 per share in gains.

Current theoretical AAPL position

Current AAPL value: $106 per share x 100 shares=$10,600

Cost: $50 per share purchase price x 100 shares=$5,000

Unrealized Gain/Loss: $5,600

If AAPL were to drop to $90

New AAPL value: $90 per share x 100 shares =$9,000

New Unrealized Gain/Loss: $4,000

So if you’re right and AAPL does drop to $90 per share you’re going to give up $1,600 in unrealized gains. (Unrealized just means you haven’t sold the stock and realized the profits yet.)

In order to hedge (or insure) your AAPL position you could go out and purchase a put option that expires on 16 September with a strike price of $106. One such option costs as of writing $1.77 and lets you sell up to 100 shares at a price of $106 for a total cost of $177 ($1.77 x 100).

So again lets say you bought the $106 strike price put option for $177 and AAPL does drop down to $90 on 8 September.

You’re gain/loss on the stock would be the same, $4,000. But you’d have the option to exercise your put option and sell AAPL at a price of $106. If you did that you’d keep your AAPL gains, less $177 paid for the put option.

So your gains would be $5,432 once you exercise the option and take into account that you paid $177 for the option.

Now the downside is that if AAPL doesn’t drop down $1.77 you are better off NOT exercising the option and you’d have paid $177 for nothing except peace of mind.

So buying a put option to protect a stock position can be thought of like homeowners insurance. You hope you don’t have to use it, but if your house catches fire and burns down you’re glad you have it.

Now I mentioned before one of the reasons for buying the option to lock in gains was so you wouldn’t have to sell the stock. Exercising the option is one choice but that still creates a taxable event.

If AAPL were to drop down to $90 the intrinsic value of the option would be at least $16 per share. Because the option contracts come in lots of 100 that option would now be worth somewhere around $1,600. In reality the option would likely be worth even more depending on the implied volatility, time decay and a lot of other complex factors beyond the scope of this article.

The point is you could sell the put option for a $1,600 profit, without ever exercising it, and never touch your stock position.

An Excellent Free Resource to help Get Started Trading Options

To learn more about options I highly recommend OptionAlpha.com. OptionAlpha.com is run buy a guy named Kirk DuPlesis. I’ve never met him in person but we’ve exchanged emails and he is a great guy.

Disclaimer: I am not compensated for recommending option education at OptionAlpha.com.

Kirk has created dozens of training videos that are available for FREE.

Not only are the videos 100%, no-catch, FREE, but watching these videos are one the best ways to learn about options and how to trade options.

The OptionAlpha website and podcast have been very valuable resources for me and I’ve paid for some of Kirk’s more advanced information, like his trade alerts and stock watchlist.

I think Kirk is giving away tons of high quality information for free because once you see how much value you get from his free materials, you’ll be very likely to buy some of his other paid services.

Again, I don’t gain anything from Kirk or OptionAlpha.com by recommending you visit his site. It is a valuable resource that I’ve taken advantage of that I want to share with my readers. I wish I had known of OptionAlpha.com to help me get started trading options. It would have saved me a lot of money and allowed me to avoid a lot of mistakes.

Options can be very risky if done incorrectly. Trading and selling options is not right for everyone. If you decide to learn more about options, get educated at places like OptionAlpha.com, paper trade for a long time, and keep your position size small.

I’ll be posting another article later in the week with the option trades I made in the later half of August to make $120 with an $8,000 account. I’m still an option trading neophyte and I don’t recommend anyone trade options without first considering your risk tolerance and investment objectives. Get educated and make your own decision.

I just want to share one of the things I’m doing to grow my wealth.

When it comes to income the expression is don’t have all your eggs come from one chicken.

When it comes to income the expression is don’t have all your eggs come from one chicken. Multiple income streams provides strength and security. If one has multiple streams of income and lives below their means it isn’t a big deal if one of the income streams stops.

Multiple income streams provides strength and security. If one has multiple streams of income and lives below their means it isn’t a big deal if one of the income streams stops.

Margin Requirement/Cost: Not recorded

Margin Requirement/Cost: Not recorded Margin Requirement/Cost: Not recorded

Margin Requirement/Cost: Not recorded Margin Requirement/Cost: ~$750

Margin Requirement/Cost: ~$750 Margin Requirement/Cost: ~$2500

Margin Requirement/Cost: ~$2500 Margin Requirement/Cost: ~$400

Margin Requirement/Cost: ~$400 Margin Requirement/Cost: $670

Margin Requirement/Cost: $670 Margin Requirement/Cost: ~$850 jumped to $1,400 after an adjustment, too high for my account size!

Margin Requirement/Cost: ~$850 jumped to $1,400 after an adjustment, too high for my account size! Margin Requirement/Cost: $610

Margin Requirement/Cost: $610