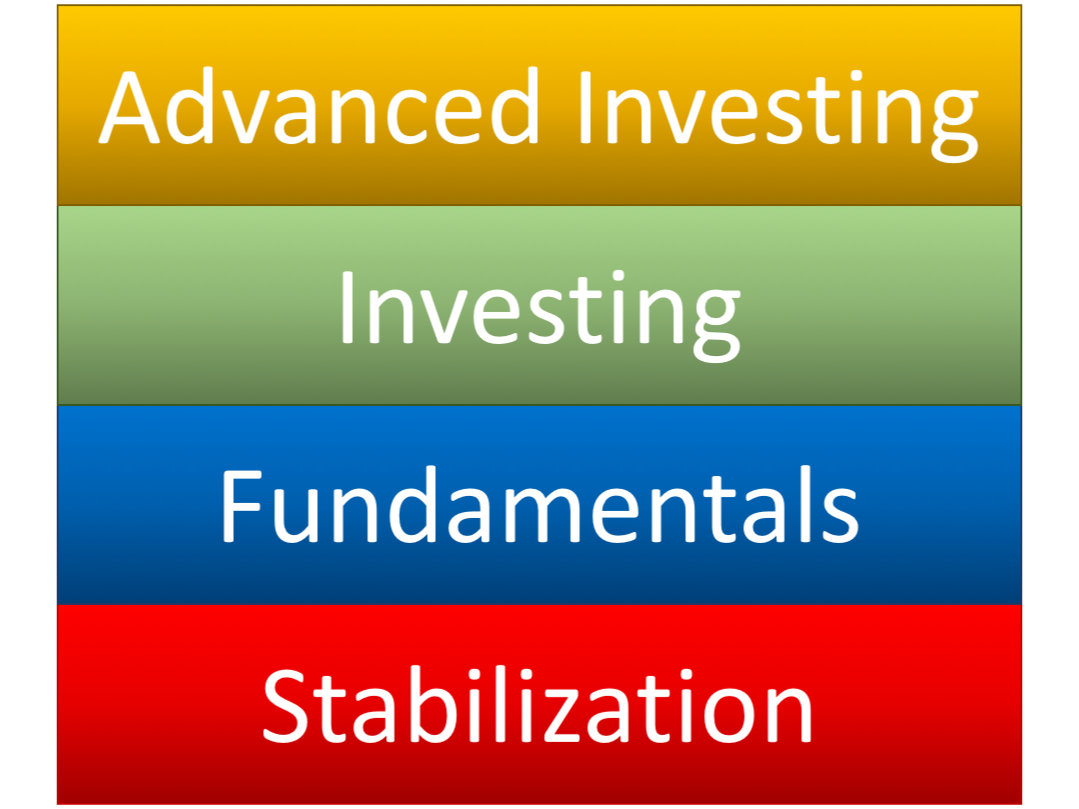

This article is part two of my three part series of getting started in personal finance. Part I is Stabilization. If you haven’t already read part one start there!

Part II: Fundamentals

The Building Blocks of Personal Finance

Level I is stabilization. Once you’ve stabilized your finances (you’ve stopped the bleeding, you’re no longer increasing your debts) it’s time to go onto the fundamentals.

Level 2: Fundamentals

You’d think that the Fundamentals would come first but I list it second intentionally. When you take on bad debt you’re starting your wealth growing journey BEHIND. You’re not even beginning at the starting line!

Piggy Bank

Setup a budget.

Having a written budget on paper, an excel spreadsheet, or your tool of choice enables you to produce and save more than you consume.

For excellent resources on budgeting, I refer you to McClain Griffin of ijustwanttobewealthy.com. He has an excellent process for setting a budget, broken down into three parts (1), (2), and (3). He also has a great Ultimate Budgeting Check List to help in this process.

Your budget should include a plan for paying off any outstanding debts you have.

You’ll want to start with the loans with the highest interest rate. You might also look into a debt consolidation loan.

In a simplified example let’s say you owe $1,000 and are being charged 20% interest per year ($200). If you can take out an additional loan for $1,000 that only costs 8% interest and use that money to pay off the loan that costs 20%, you’ve just saved yourself 12% in interest. 8% of 1000 is $80 so you’ve just lowered your costs by $120. This example doesn’t factor in payments or compounding interest but the principle is the same.

Part of getting started in Personal Finance is Saving up money for an emergency fund

Save for a rainy day.

Part of your budget should also include saving for an emergency fund. I like to keep a months income in cash in a safe.

You’ll know you’re well established in the fundamentals of finance when you stick to your budget and you have more money in your bank account at the end of each month than when you started.

Once you’ve setup an emergency fund, what is there to do with the rest of the money?

Oh what a nice problem to have. In Part III I discuss the third and fourth levels of personal finance, investing and advanced investing.

Hey thanks for the mention, I can’t believe I’m just getting around to reading this! These levels of personal finance are awesome man, keep up the good work!

Thanks McClain! I appreciate the great budgeting content you created and for letting me link to it!

High five for saying you should start with the loans with the highest interest rate. That is the only way to go about it that makes any sense and yet most personal finance sites I’ve seen are recommending the snowball method.

However, regarding the emergency fund, I found a number of savings accounts to keep your it that yield at least 5% APY (https://www.walletsage.com/single-post/The-Best-Places-to-Stash-Your-Emergency-Fund). Many of them have low limits and additional requirements, but they’re manageable. That would at least provide a hedge against inflation.

The snowball method makes some sense from a psychological point of view but not a math point of view. Those account are great finds! I didn’t know such accounts existed anymore. Thanks for the link.

Thanks, I’m glad you found the info useful.

I understand why the snowball method is motivating, but I see it as stemming from not understanding things clearly. Here are a couple analogies I came up with (copied and pasted from my blog) to illustrate how irrational that kind of thinking is.

1. Let’s say you have two leaks in the ceiling and it’s been raining like crazy lately. One has a steady drip, with one pan under it. Another leak is through a larger hole in the ceiling, and there’s a waterfall coming down, with multiple pans under it. Instead of trying to patch up the bigger hole, you decide to tend to the one with the drip, simply because it will mean one less pan.

2. Imagine there are two people shooting a you. One has a machine gun, and the other has a BB gun. You decide to focus on your energy on stopping the one with the BB gun, because it will mean one less stream of bullets is coming at you.