by John | Sep 25, 2016 | Capital Appreciation, Passive Income, Preservation of Purchasing Power, Value Investing

Value investing is a way to bring intelligence back into stock selection.

Everyone loves a great deal when they’re shopping but for some reason that love does not transfer when shopping for stocks. Many retail investors tend to buy expensive stocks as they are getting more expensive.

They pile into trendy growth stocks like Twitter and Netflix.

It doesn’t make sense.

Making money in stocks can be done in just two ways:

1) buying low and selling high

2) dividends

Because many investors like to buy expensive stocks with no dividend the prevailing strategy has become “buy high, sell higher”.

This could work some of the time but if you buy stocks at all time highs (like many are now) who are you eventually going to sell them to? You’d have to find someone else who wants to buy them at an even higher price or sell them at a loss.

Buying overpriced stocks also leaves a person much more vulnerable during a stock market correction as was experienced by countless stock owners in 2000 and 2008.

An Intelligent Approach: Value Investing

Value investing takes that same desire to find a bargain while shopping and applies it to stock selection.

Value investing is purchasing the shares of quality companies trading at a discount.

In other words, you’re buying stock in a company that is undervalued. This creates a margin of safety and built-in downside protection. It’s a way of increasing the odds that you are buying a stock low so you can sell it higher later (or so you can hold it and collect the dividends).

Is Value Investing just buying Cheap Stocks?

Cheap lawn chairs tend to collapse when you’re sitting in them

Value investing isn’t buying cheap stocks. Value investing is buying high quality companies at a price below their book value.

You can find a deal on a high quality lawn chair and pay less than you would for a lower quality, more expensive lawn chair. The key to spotting a bargain is to know what to look for. Fortunately, there are a number of indicators (or metrics) one can look at to determine if a stock is both low cost and high quality.

What indicates a stock is a Great Value?

[Note from John, 5 Feb 2017: While the principles of value investing are timeless I have since started looking at Better Metrics for Value Investing.]

The metrics I look at are as follows:

- Price to book of less than 1 (can go up to a PB of 1.5)

- Price to earnings less than 15

- Positive Cashflow

- Positive Earnings per share

- Return on equity greater than 8% on average per year

- Dividend Yield

I’ll break down each one below.

Price to Book

The Price to Book ratio is calculated by taking the companies’ market capitalization and dividing it by the companies’ total assets minus total liabilities. A low price to book could indicate that a stock is undervalued.

If the P/B is below 1 that means if the company’s assets were liquidated and the stockholders were paid out in cash they would get more than what they paid for the stock.

Price to Earnings

The historical average for the stock price to earnings ratio is 15. The current PE ratio for the S&P 500 is around 25. By purchasing stocks with a PE less than 15, you’re ensuring the company’s price to earnings is below the historical average. It’s another indicator of value.

Source: http://www.multpl.com/

Positive Cashflow and Earnings per Share

A low price to book by itself could indicate that a stock is undervalued or that the company is on shaky ground. Positive cashflow and positive earnings per share means that the company is making money. The higher the EPS the better all else given.

Return on Equity

A return on equity of 8% or more over a period of years indicates the company consistently produces value to shareholders. It’s another way to ensure the company is healthy and is not undervalued due to a fundamental issue with the performance of the business.

Dividend Yield

This is the second way to make money on a stock. If a company provides a yield that means the investor is being compensated for holding the stock while waiting for the undervalued equity to revert to a more fair valuation.

Does Value Investing Work?

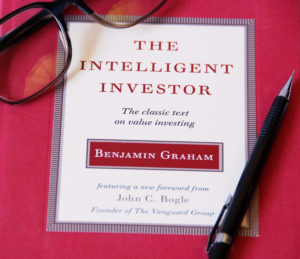

Value investing was pioneered by Benjamin Graham. You may never have heard of Benjamin Graham but it’s likely you’ve heard of Graham’s most successful student, Warren Buffett.

The investing principles Buffett used to grow his wealth were developed and taught by Benjamin Graham, the father of value investing.

Value investing is the way Warren Buffett became one of the richest men alive.

Getting Started in Value Investing

You can look for stocks that meet the criteria I’ve discussed above and purchase them individually.

Another option is to buy a value index fund. A a passive index fund takes little research and is theoretically lower risk.

An example of such a fund is the Vanguard Value Index Fund (VIVAX). The problem I have with funds like this is that the stocks in the fund aren’t the best values. For example, the largest holding in VIVAX is Microsoft (MSFT).

MSFT has a price to book of 6.2 and a price to earnings of 27.4. The other major holdings of VIVAX like Exxon Mobil and GE follow a similar story.

Microsoft and Exxon are quality companies but at these prices they don’t represent the extremely high value stocks I’m interested in.

Value investing like all investing is not without risk. But I believe taking the time to research undervalued stocks that present exceptional value is worth it.

Intelligent Research on Value Stocks

For a passive and defensive investor, value investing through index funds is fine. However, I believe an enterprising investor willing to dive deeper can make even better returns. But not everyone has the time or resources to research stocks that meet the criteria of a quality value stock.

I maintain a list of the stocks I like, access it fr-ee here.

Find An Edge

An Edge: a quality or factor that gives superiority over close rivals or competitors.

It’s hard to make money on stocks like Apple or Microsoft that have dozens of analysts following them, where virtually everything is known about the stocks, and which are traded at high frequency by Wall Street computer algorithms.

If you don’t know what your edge is you don’t have one.

I also think that there are exceptional values outside of the standard US stock exchanges.

I’m particularly fond of the Australian Securities Exchange because it is outside the Wall Street bubble but still a stable jurisdiction. My free report lists two brokers that will allow you to trade stocks in the land down under.

Wisdom from Benjamin Graham

I close this article with a quote from the Father of Value Investing:

“…the real money in investment will have to be made–as most of it has been in the past–not out of buying and selling but of owning and holding securities, receiving interest and dividends and increases in value.” – Benjamin Graham from The Intelligent Investor

by John | Sep 20, 2016 | Learning from Mistakes, Saving Money

I have several credit cards. All of which I pay off each month.

I have one that I use for most of my expenses: groceries, petrol, utilities, etc. I have it set to be paid automatically each month.

I have a few others that I rarely use unless I’m making a purchase at a specific store. With those cards, I try to pay them off as soon as I make the purchase.

Well this month I made a mistake. I forgot to pay one of my rarely used cards off. I was alerted to my omission the other night via text that I was hit with a $25 late fee.

Ugh. I hate that.

I immediately paid off all my balance. Then I called up the bank and asked if there was anything they could do about the late fee. They said my account was in good standing and they would waive the fee.

Now I don’t think my bank had to do this. After all, they might say “I’m sorry, your payment was late and we can’t help you,” in which case I will have lost $25.

But you don’t know unless you ask.

The Phone I used didn’t look like this.

I caught it within a couple days, called up the bank and got the fees reversed.

I then went in and setup my auto-pay. In this second case I don’t feel as responsible, since I had auto-pay setup, but it is another example that you just have to ask.

Plus if your bank says no, that might be a good reason to take your business elsewhere.

by John | Sep 18, 2016 | Capital Appreciation, Investor Mindset, Investor Psychology, Tax Strategies, Value Investing

Warren Buffett is considered to be one of the most successful investors. He’s one of the wealthiest people in the world and he’s also fond of publicity and public appearances.

If you have some humility and don’t get caught up in jealousy you can learn a lot from wealthy and successful people like Warren Buffett.

My own Father is fond of saying that poor people should take rich people out to lunch. The idea being that the wisdom that can be gained from the wealthy is worth more than paying for lunch.

So what lessons can we learn from Warren Buffett?

Do As Warren Buffett Does, Not As He Says

There is an old expression “Do as I say, not as I do.” With Warren Buffett it is “Do as I do, not as I say.”

There is an old expression “Do as I say, not as I do.” With Warren Buffett it is “Do as I do, not as I say.”

Warren Buffett talks A LOT and shares a lot of opinions. But you shouldn’t follow what he says as advice because he might actually be doing the opposite of what he is saying.

In order to learn lessons from Buffett one must first filter out a lot of what he says.

There is a quote from Daniel Loeb that summarizes Buffett’s contradictions quite succinctly.

“He criticises hedge funds yet he really had the first hedge fund,” Loeb said. “He criticises activists. He was the first activist. He criticises financial service companies, yet he likes to invest in them. He thinks that we should all pay more taxes but he loves avoiding them himself.”

Source: http://www.smh.com.au/business/warren-buffett-is-full-of-contradictions-hedge-funds-say-20150507-ggwv2o.html

Without further ado here are three lessons we can learn from Warren Buffett.

Lesson 1: Reduce Your Taxes

While publicly discussing how he wants to pay more taxes Warren Buffett has taken extraordinary steps to reduce his taxes.

Source: http://www.nytimes.com/2011/08/15/opinion/stop-coddling-the-super-rich.html

From how he structures his businesses to how he is paid to how he has bequeathed his inheritance Warren Buffett does all he can to reduce his taxes. He gets paid through dividends and long term capital gains rather than ordinary income. He’s also left 99% of his fortune to a private charity to avoid paying inheritance taxes.

Lesson number one from Warren Buffett is Reduce Your Taxes.

There are a variety of ways you can legally reduce your taxes: IRAs, 401ks, FSA, HSAs, charitable contributions, capital gains. I discuss some of them in Five Tax Strategies to Keep More Income.

Real estate is also an excellent way to increase your wealth in a tax advantaged way. BiggerPockets.com is an excellent Real Estate resource.

Lesson 2: Invest in High Quality Companies that are Undervalued

Warren Buffett loves great value. Much of his investing philosophy can be traced back to Benjamin Graham, the father of value investing.

According to Investopedia Buffett looks at six criteria for stock investments:

1. Has the company consistently performed well?

2. Has the company avoided excess debt?

3. Are profit margins high? Are they increasing?

4. How long has the company been public?

5. Do the company’s products rely on a commodity?

6. Is the stock selling at a 25% discount to its real value?

Source: http://www.investopedia.com/articles/01/071801.asp

Warren Bueffett is a value investor and I think value investing is an excellent way for the enterprising investor to achieve outsized returns. I’ll be writing more about value investing in future posts.

If you’re interested in reading one of Graham’s seminal works “The Intelligent Investor” use this link to buy it on Amazon and help support this site: The Intelligent Investor by Benjamin Graham. Buffet calls it “the best investing book ever written.”

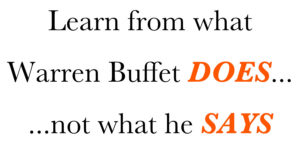

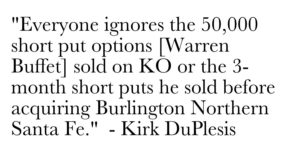

Lesson 3: Use Derivatives Wisely

Warren Buffett has written “derivatives are financial weapons of mass destruction.”

Source: http://www.fintools.com/docs/Warren%20Buffet%20on%20Derivatives.pdf

But Buffett has billions in derivatives as pointed out by Kirk DuPlesis of OptionAlpha.com.

Source: https://optionalpha.com/warren-buffett-options-trading-strategy-19655.html

In the article above Kirk talks about two ways Buffett uses derivatives:

1) Uses naked, short puts to lower the cost basis for purchasing stock or target companies that he wants to acquire.

2) Sells short index put options when volatility is at it’s highest, knowing that volatility is the one factor that is overpriced all the time.

I’ve written about trading options and think that done correctly it can be an excellent way to bring in monthly income. I’m interested in utilizing strategy one above more often as I open new stock positions.

Lessons from Warren Buffett

Those are three lessons I’ve learned from looking at what Buffett does, not what he says. Buffett probably gives some advice that is worth following directly but you have listen through a filter and weigh heavily what he actually does over his words.

by John | Sep 16, 2016 | Geopolitical Risk Protection, Liquidity

I’ve written about negative rates (potentially) coming to the US and the importance of holding cash. I personally hold about 1 month’s worth of expenses in physical cash stored in a secure location outside of the banking system.

Why would I do this when I know that Inflation Destroys Dollars and that in the long term the value of fiat currencies goes to zero? When I’ve written articles like the above and Downfall of the US Dollar you know I’m not a fan of paper currencies.

Two main reasons why I want some cash:

Two main reasons why I want some cash:

1) If the US adopts negative rates that means that banks will take interest out of your account. Instead of gaining a fraction of a percent of interest on your bank deposit like you get today (if you get anything) you’ll lose a fraction of a percent of your money on a regular basis.

2) Banks might impose capital controls, you’ll only be able withdraw a certain amount of money (if anything) from your bank account in the form of cash. That’s because the natural response when a bank imposed negative rates is to withdraw cash to avoid having your money taken.

Keep in mind that cash is just one tool in the toolbox. There are other important tools as well.

Tools like precious metals, cryptocurrencies (even though I’m a bit skeptical of this tech as investment pun intended), value stocks, real estate, options, the list goes on.

So would I want to be 100% in cash? No way. Bad idea. I’ve never said that or done that.

I reside in the US so I think in terms of dollars, but there are a variety of countries where I think holding physical cash would be a good idea. Negative rates have already come to Japan and parts of Europe.

I reside in the US so I think in terms of dollars, but there are a variety of countries where I think holding physical cash would be a good idea. Negative rates have already come to Japan and parts of Europe.

Keeping a months worth of income in physical cash is something I’ve determined is a great way for me to protect my wealth, but it’s not all I’m doing.

In fact my physical cash holding is a small percentage of what I do. I withdrew some cash in $20’s (larger bills like the $50 and $100 are not right for me since some places won’t take them) over a period of time and I don’t think about it anymore (except to write some articles).

Holding cash is a defensive strategy that I do just to be able to buy gas and groceries in the event of negative interest rates, capital controls or natural disasters.

by John | Sep 11, 2016 | Capital Appreciation, Getting Started, Passive Income, Preservation of Purchasing Power, Tax Strategies

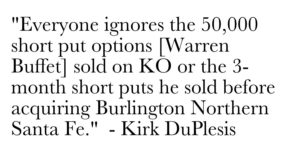

The Building Blocks of Personal Finance

If you haven’t already read parts I and II start there!

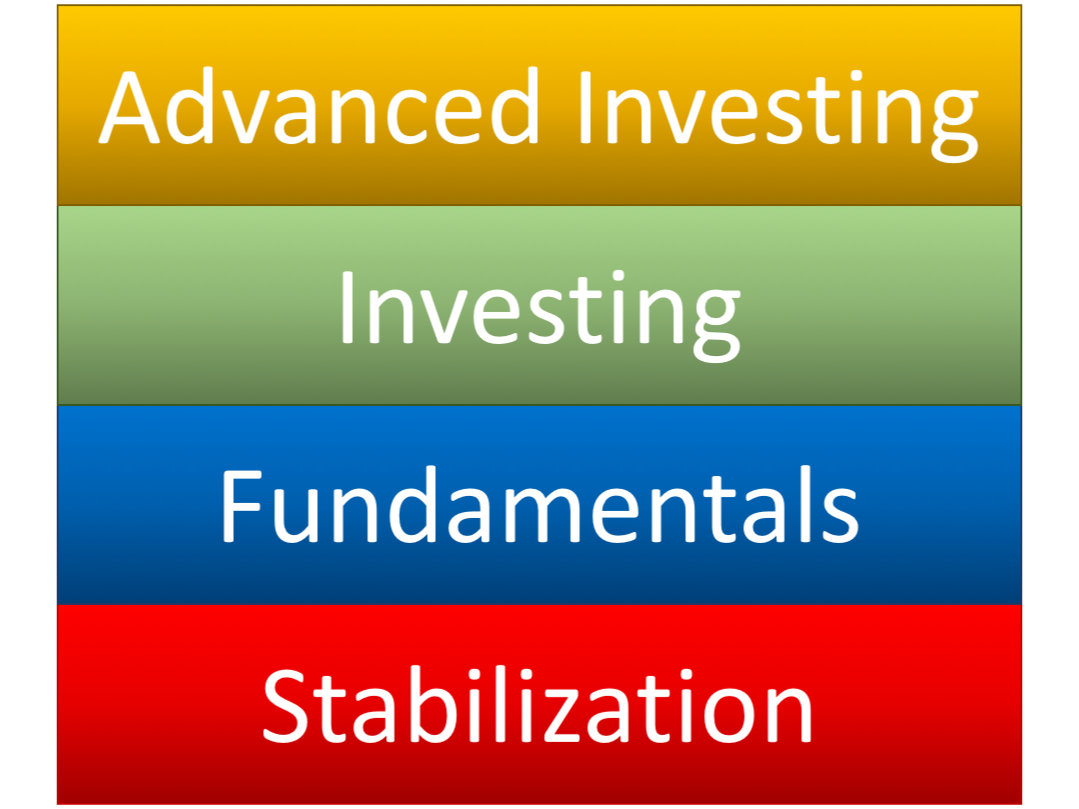

I visualize personal finance as building blocks stacked on top of each other (shown to the right).

You must master the lower levels before you can get to the upper levels.

Level 3: Basic Investing

I consider basic investing saving for retirement in a 401k and Individual Retirement Account (IRA) via mutual funds and bonds, and general savings in mutual funds.

Both the 401k and IRA are ways to invest for retirement and get some tax benefits. 401ks are through an employer, and IRAs can be setup through a company like Vanguard, Fidelity, TD Ameritrade, or any number of other firms that act as the “custodian”. I talk about them in a little more detail in my article Five Tax Strategies to Keep More Income under strategies one and two.

Employer Matching 401k

Some employers will match your 401k contributions. As an example lets say your employer matches your contributions up to 5% of your salary. If you make $50,000, and you save $2,500 in your 401k, your employer will add an additional $2,500 to your 401k. I put money in my 401k up to but not beyond the point where I’ve maxed out the match.

Some employers will match your 401k contributions. As an example lets say your employer matches your contributions up to 5% of your salary. If you make $50,000, and you save $2,500 in your 401k, your employer will add an additional $2,500 to your 401k. I put money in my 401k up to but not beyond the point where I’ve maxed out the match.

I prefer Roth 401ks to 401ks because I believe tax rates are going up in the future. Roth 401ks are more rare but I have had employers who offer them.

The vast majority of the investment options offered by the employers I’ve been at are VERY limited. The easiest option is to go with a target retirement fund. Target retirement funds are basically funds on autopilot, they automatically adjust their asset mixes to become more conservative as investors approach the target retirement date.

If there are more options I avoid bonds and favor international funds but investments depend on your risk tolerance and goals.

Individual Retirement Accounts

IRA’s come in the Roth and Traditional flavor. It all depends if you’d rather pay taxes now, or in retirement. I prefer to pay the taxes up front.

I would open up a Roth IRA and try to max it out ($5,500 in 2016). Another neat trick is that you can contribute to a traditional IRA and then convert contributes to a Roth (you do of course have to pay the taxes though), so if you want to save more than $5,500 in after tax income, that is an option.

One of the things I like about IRAs is that the investment options are much, much more flexible. I think part of the reason employer sponsored 401ks have such limited investment options is because employers are afraid of being sued if an employee makes poor decisions and loses a lot of money, so employers only offer with the most conservative investment options.

If you want to save money and not think about, you’re asking for trouble, but one option is to open up an account at a low cost company like Vanguard (my favorite) or Fidelity. Setup auto-deposit and buy a balanced fund like the Vanguard STAR fund (VGSTX).

You can also buy additional index funds, like the S&P 500 index fund, Nasdaq, large and small cap US funds, etc. These index mutual funds are setup to track the gains and losses of the index they are based on. Again, I think it is good to have money in the emerging markets as well.

Vanguard has investment professionals that will help you decide how to allocate money to different mutuals funds. (Disclosure: I have been a vanguard client for years, but gain no benefit from listing them as an option).

By setting up auto-deposit and auto-invest into Vanguard (or your IRA custodian of choice) from your paycheck you’re dollar cost averaging into the fund and not trying to time the market.

Over time this is a good, conservative strategy, and one discussed by Benjamin Graham in his seminal work “The Intelligent Investor”. Ben Graham was a mentor to Warren Buffet, who you may have heard of, and has done decently well as an investor.

Conventional wisdom is often something like a 40% bonds and 60% stocks (mutual funds) as a conservative approach. Unless you’re retired and relying on your savings for monthly income, I would not buy bonds, but a portfolio that does not include bonds is considered more risky.

You can follow these same investing principles to buy non-retirement mutual funds.

Now I do think that US stocks and bonds are in a bubble. But if the Federal Reserve responds to the bubble bursting as I think they will, stocks and bonds will still go up. I just think there are other asset classes that will go up faster.

Consider Physical Gold

Consider Physical Gold

While this could be considered more advanced, I think it is very important to have somewhere around 10% of one’s assets in physical gold and silver bullion. While I don’t give investment recommendations I think that even some of the more conservative and traditional investment advisors would admit this is not a bad idea. I gain no benefit from mentioning them, but I buy bullion from Scotsman Auction house in Saint Louis. They have been in business a long time and have great pricing. I don’t buy numismatics or “rare” coins as an investment. I’m partial to Silver American Eagles and Gold Canadian Maples, but that is just personal preference.

There are lots of gold bullion companies but I would not want to pay more than around 2% over spot price for gold. I avoid numismatics unless they can be acquired at bullion prices.

Level 4: Advanced Investing

Advanced Investing techniques are what I’m most passionate about. Examples of what I consider advanced investments are: Investing in individual company stocks, gold mining stocks, peer to peer lending, real estate investments, private equity, foreign stocks, offshore brokerage accounts, options, cryptocurrencies, physical precious metals like gold and silver, and physical gold stored remotely through a Goldmoney personal account.

Advanced Investing techniques are what I’m most passionate about. Examples of what I consider advanced investments are: Investing in individual company stocks, gold mining stocks, peer to peer lending, real estate investments, private equity, foreign stocks, offshore brokerage accounts, options, cryptocurrencies, physical precious metals like gold and silver, and physical gold stored remotely through a Goldmoney personal account.

These techniques are generally considered more risky, although I think that buying US stocks at all time highs and negative yielding bonds is much more risky, even though conventional foolishness wisdom says these are the safe bets.

Get Started!

To get started figure out where you stand in the four phases. Master that phase and work towards the next.

It’s an iterative process once you’re out of stabilization and focusing on the fundamentals and investing. I’m often re-evaluating my fundamentals such as my budget and my goals. I work on my basic investing like maxing out my 401k company match and Roth IRA.

Which phase are you in and what are your savings and investment goals?

There is an old expression “Do as I say, not as I do.” With Warren Buffett it is “Do as I do, not as I say.”

There is an old expression “Do as I say, not as I do.” With Warren Buffett it is “Do as I do, not as I say.”

Two main reasons why I want some cash:

Two main reasons why I want some cash: I reside in the US so I think in terms of dollars, but there are a variety of countries where I think holding physical cash would be a good idea. Negative rates have already come to Japan and parts of Europe.

I reside in the US so I think in terms of dollars, but there are a variety of countries where I think holding physical cash would be a good idea. Negative rates have already come to Japan and parts of Europe.

Some employers will match your 401k contributions. As an example lets say your employer matches your contributions up to 5% of your salary. If you make $50,000, and you save $2,500 in your 401k, your employer will add an additional $2,500 to your 401k. I put money in my 401k up to but not beyond the point where I’ve maxed out the match.

Some employers will match your 401k contributions. As an example lets say your employer matches your contributions up to 5% of your salary. If you make $50,000, and you save $2,500 in your 401k, your employer will add an additional $2,500 to your 401k. I put money in my 401k up to but not beyond the point where I’ve maxed out the match.  Consider Physical Gold

Consider Physical Gold Advanced Investing techniques are what I’m most passionate about. Examples of what I consider advanced investments are: Investing in individual company stocks, gold mining stocks, peer to peer lending,

Advanced Investing techniques are what I’m most passionate about. Examples of what I consider advanced investments are: Investing in individual company stocks, gold mining stocks, peer to peer lending,