Powerful Wealth Lessons Concealed by Schools

“We teach about how to drive in school, but not how to manage finances.” – Andy Williams

I didn’t learn much about personal finance or how to build wealth in school.

Even though I find art history, World War II, and the Pythagorean theorem interesting and important areas of study–I can think of few topics with more day to day relevance than personal finance.

But if it weren’t for two finance electives I took in college I wouldn’t have learned anything about personal finance in school.

There are powerful wealth lessons that schools could teach but for some reason do not.

Five Powerful Wealth Lessons School Didn’t Teach

1) I must Produce more than I consume to Build Wealth

I can’t say it better than Simon Black:

The Universal Law of Prosperity is very clear– in order to build wealth you have to produce more than you consume. – Simon Black

Source: https://www.sovereignman.com/trends/this-entire-system-is-rigged-against-your-prosperity-18760/

This basic concept isn’t taught in school and as a result we get polls like: “Two-thirds of Americans would have difficulty coming up with the money to cover a $1,000 emergency.”

The United States can also boast the following numbers:

Source: https://www.nerdwallet.com/blog/credit-card-data/average-credit-card-debt-household/

If you consume more than you produce, the only option is to go into debt, which is a sure way to become poor.

In school I never learned the powerful wealth lesson: I must Produce more than I consume to Build Wealth.

2) Money Loses Value Because of Central Banks

Marriner S. Eccles Federal Reserve Board Building by “ctj71081” https://creativecommons.org/licenses/by-sa/2.0/

I think most people KNOW that money loses value (or at least that things are getting more expensive each year), but for anyone who disagrees here are some facts:

- In 1950 a new house cost $8,450 in 2016 the average is over $300,000 (3,450% increase)

- In 1950 a gallon of gas was 18 cents in 2016 it is $2.40 (1,233% increase)

- In 1950 the average cost of new car was $1,510.00 in 2016 it is $33,560 (2,122% increase)

- In 1950 the average income per year was $3,210 in 2016 it is $55,000 (1,613% increase)

Source: http://fuelinsights.gasbuddy.com/content/docs/2016forecast.pdf

Source: www.thepeoplehistory.com/1950s.html

Source: www.deptofnumbers.com/income/us

Source: www.usatoday.com/story/money/cars/2015/05/04/new-car…price-3…/26690191/

Those are stats specific to the United States but I know you’d find similar statistics throughout the world.

Dollars (and other fiat currencies) are losing value. Incomes are not keeping up with the rising costs of homes and automobiles, the two major types of purchases many people will make.

Saving money in dollars is a sure way to get wiped out.

Money doesn’t lose value because of some mysterious force or greedy businesses, it loses value because of central banks. This is something I’m passionate about because it is simply robbery. Not only is price inflation robbery, but it most directly harms the poor. I’ve written about the Downfall of the US Dollar and What Causes Inflation.

In school I never learned the powerful wealth lesson: Money Loses Value Because of Central Banks.

3) I’m on my Own for Retirement

In over 18 years of education in US government schools I can’t recall ever learning about the failure of US government programs.

There are countless examples.

One is state public pensions. They are woefully underfunded. Alaska, California, and Illinois are some of the worst offenders when it comes to underfunded pensions.

However, all fifty of these United States plus the District of Columbia suffer from underfunded public pensions.

Two more in-progress failures are Social Security and Medicare. (To be fair, I did learn about the insolvency of these programs in FIN 232, my senior year of college.)

The Medicare Trustees’ report indicates the Medicare program is underfunded and revenue is less than expenditures.

The Social Security Trustees’ report indicates that Social Security is underfunded as well.

Source: https://www.ssa.gov/oact/tr/

This isn’t some tin-foil hat conspiracy. Below is a direct quote (from 2015) from the Social Security and Medicare Boards of Trustees:

Social Security’s Disability Insurance (DI) Trust Fund now faces an urgent threat of reserve depletion, requiring prompt corrective action by lawmakers if sudden reductions or interruptions in benefit payments are to be avoided. Beyond DI, Social Security as a whole as well as Medicare cannot sustain projected long-run program costs under currently scheduled financing.

Source: https://www.ssa.gov/oact/TRSUM/2015/index.html

I never learned about the importance of saving for retirement in school. I never learned about investing, IRAs, 401ks, pensions, or Health Savings Accounts. (Again, I did learn about these in FIN 232, my senior year of college.)

If you’re under 40 and you live in the US and you think you can count on Social Security and Medicare (or a public pension) I think you’ll be in for a rude surprise.

Social Security and Medicare are broken. Plain and simple. “But politician X will save these programs!” you might be tempted to think.

Here is another quote from the above report:

“Social Security and Medicare together accounted for 42 percent of Federal program expenditures in fiscal year 2014.”

This is the same Federal Government that is $20 trillion in debt. If the US Federal Government bails out Social Security and Medicare, who is going to bail out the Federal Government?

People need to make their own preparations!

In school I never learned the powerful wealth lesson: I’m on my Own for my Retirement.

4) College Isn’t Right for Everyone

Will this guy have to go $200,000 in debt to get a degree in British Literature?

How many times have you heard something to the effect of: “Study hard, go to college, get a good job and then retire at age 65.”?

That approach CAN work, but high school seniors need to be asking themselves, “does it make sense to go $150,000+ in debt for an art history degree?”

I took an art history class in college and I really enjoyed it. But if I knew how much I was paying for that class I would probably have done a lot better going to a museum or buying a few books.

If, for example, you can get a chemical engineering degree for $100,000 and are then able to make $70,000 per year right out of college then it starts to make more sense. But people need to start making those cost benefit and ROI calculations.

Young people need to stop assuming that college is a good idea. It depends on the cost of the education and how much that degree will allow you to earn once you graduate.

In school I never learned the powerful wealth lesson: College Isn’t Right for Everyone.

5) There is a Difference between Good Debt and Bad Debt

There is good debt and there is bad debt.

There is good debt and there is bad debt.

Taking out a $35,000 loan to buy a brand new car is very expensive. Maybe you’re making enough money that you can afford to treat yourself to a new car every 2-3 years and maybe leasing an automobile makes sense in that case.

But a good used car that is 5-6 years old makes a lot more financial sense particularly if you aren’t making a lot of money.

On the other hand, taking out a $200,000 loan to buy an income producing rental property could make a lot of sense.

Taking out a loan to buy new shoes or a car or other consumable items is bad debt.

Taking out a loan to buy an income producing asset is good debt.

In school I never learned the powerful wealth lesson: There is a Difference between Good Debt and Bad Debt.

I Learned a lot about Personal Finance outside of School

I learned a lot about personal finance from my parents, by reading, talking to experts, attending seminars and trial and error. In some ways it’s a good thing I didn’t learn about personal finance in school because I probably wouldn’t have learned as much and most likely would have been taught things that aren’t true that I would have had to unlearn.

The important takeaway is that financial education is critically important and that it’s up to YOU to make sure you learn what you need to know.

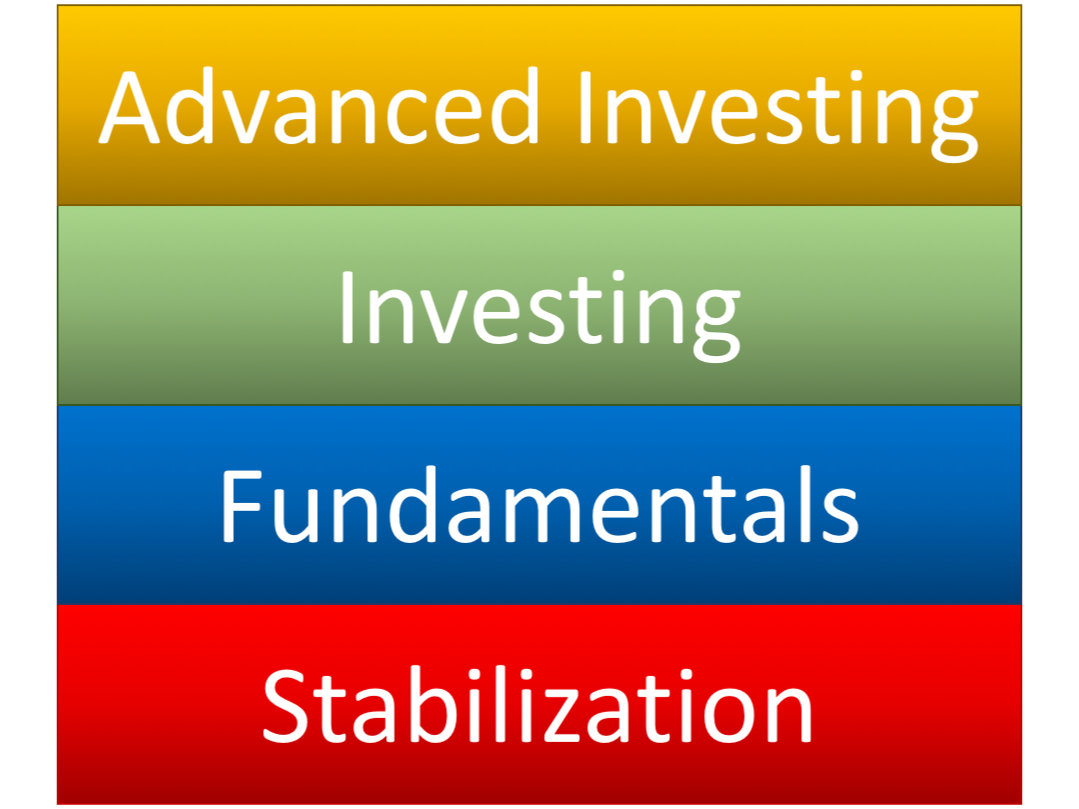

If an out of shape person is hemorrhaging blood due to an injury it would be absurd to focus on ways to improve their cardiovascular fitness until they are stable and healed from their injury.

If an out of shape person is hemorrhaging blood due to an injury it would be absurd to focus on ways to improve their cardiovascular fitness until they are stable and healed from their injury.