by John | Feb 4, 2018 | The Economy, Wealth Protection

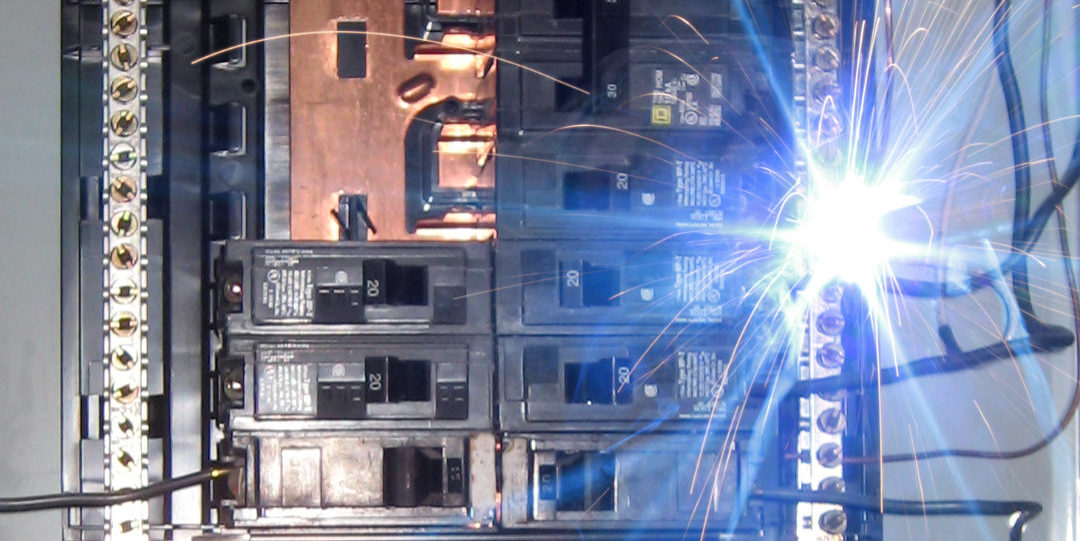

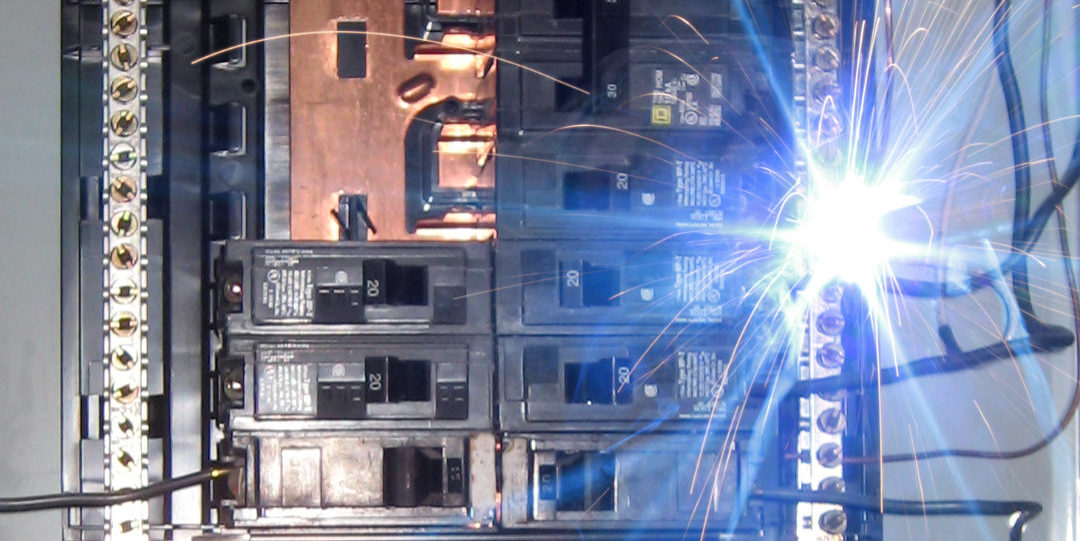

There is faulty wiring running throughout the US economy and economy at large. Previously I wrote about how the real economy is weak, pointing to stagnant wages and a low labor force participation rate.

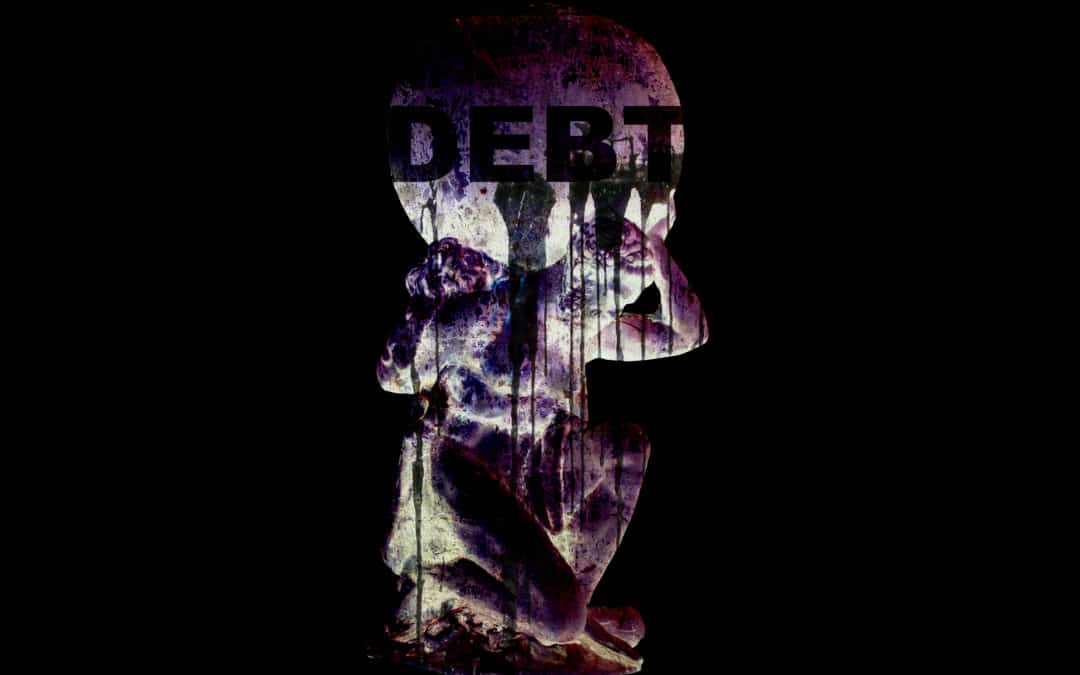

Today I’m going to talk about how debt at the federal, state and personal levels are unrepayable.

Debt at the Federal Level is Unrepayable

As of 1 February 2018 total public debt outstanding is $20,494,566,890,206.07.

Source: https://www.treasurydirect.gov/NP/debt/current

Not only is this debt impossible to repay but it continues to grow with little chance that this spending will subside until it has to.

According the United States Congressional Budget office the US Federal Government brought in $3.3 trillion in taxes in 2016. The US Federal Government spent $3.9 trillion.

But the vast majority of expenses was in areas that simply will not be cut.

The United States spent $910 billion on Social Security, $588 billion on Medicare, $368 billion on Medicaid, and another $563 billion on other mandatory spending which includes items such as Federal employee retirement programs, SNAP (food stamps) and Veteran’s Benefits. So total “Mandatory” spending was $2.4 trillion. These are the kinds of programs that will never be voluntarily cut by any congress and in the case of Social Security and Medicare, will only go up in cost as more people retire.

Not only that, once you factor in interest on the $241 billion in net interest paid on the national debt (another item that congress won’t cut because it would tank the credit rating of the United States) total spending rises over $2.6 trillion. Considering congress keeps borrowing and that interest rates are rising these borrowing costs will only continue to rise.

This leaves $630 billion left to spend.

But $584 billion goes to the military. Which leaves $36 billion left. However in 2016 the US Federal Government spent an additional $600 billion in discretionary money.

Source: https://www.cbo.gov/sites/default/files/115th-congress-2017-2018/graphic/52408-budgetoverall.pdf

The red team politicians will never cut defense spending (the blues realistically won’t either).

Neither side is interested in cutting social safety net programs either like Medicaid or SNAP.

Neither side will cut Social Security or Medicare.

There a Fiscal Crisis on the Horizon

The $20.49 trillion in “Total Public Debt Outstanding” does not include unfunded Social Security and Medicare obligations.

The 2017 Social Security and Medicare Boards of Trustees report has again stated that these programs are underfunded. “The Trustees project that the combined trust funds will be depleted in 2034, the same year projected in last year’s report.”

https://www.ssa.gov/OACT/TRSUM/index.html

The Trustees cite an increase in baby boomer retirees drawing Social Security and Medicare and fewer workers paying into the system.

How will the United States Federal government make up the difference between the benefits promised to be paid out and a depleted “fund”? In reality there is no “fund” and the money from payroll taxes goes into the general budget. Lawmakers only have a few options to “save” Social Security and Medicare: some combination of raising taxes and lowering benefits (either by raising the retirement age or reducing the monetary value of benefits paid out). That is of course unless people start having a lot more kids who in turn have jobs and pay into the system.

The last option, which is really a way of lowering benefits in a dishonest way, is simply borrowing and or “printing” the money to pay the benefits.

But these expenses incurred in 2016 don’t include a multi-billion dollar bailout of some kind, funding a new war or some other large, unforeseen expense. So what would happen to the Federal debt if one of these events occurred?

Debt at the federal level will continue to climb.

Debt at the State Level is Unrepayable

I grew up and lived in Illinois for most of my life. It is just about the most indebted state in the United States, surpassed only by New Jersey.

Illinois only had enough revenue to cover 96% of expenses in 2015. The Illinois government is more than capable of overspending in any circumstance, but the revenue shortfall continues to be exacerbated by the state population decline. A total of 114,144 residents moved out of the state in 2016 and new residents plus births could not offset this exodus. The result was the count of Illinois residents dropping by 37,508 people in 2016.

Source: http://www.chicagotribune.com/news/local/breaking/ct-illinois-population-decline-met-20161220-story.html

Despite this Illinois remains the 5th most populous state in the US and the fact that the fifth most populous state is in such a bad financial position does not bode well.

Source: https://www.mercatus.org/statefiscalrankings

While Illinois can issue debt and for some reason their debt continues to be purchased, their financial risk means the cost of borrowing is high and without a central bank they aren’t able to drive down the cost of borrowing or print currency. Not that those strategies work in the long term, but they don’t have those tools to delay the pain.

I choose to single out Illinois since they spent years of my hard earned tax dollars so recklessly but many other states are in bad shape as well.

Overall state pensions are underfunded by a total of between $1 trillion to $4.3 trillion depending on how well you think the pensions will perform.

Source: https://www.mercatus.org/publication/underfunded-pensions-expanding-and-escalating-challenge

Despite years of economic “recovery” since the 2008-2009 financial crisis these problems have only gotten worse. With this “recovery” getting long in the tooth, what will happen when the economy officially slips back into a recession?

Debt at the Personal Level is Unrepayable

Student Loan Debt

Some of the most indebted people in the United States are also some of the least capable of repaying it. I’m talking about former college students. According to Lendedu.com there are over 45 million individuals in the US with student loan debt. The default rate is 11.5%.

A study by Nerdwallet.com indicated the average person with student loan debt owes $46,597 with a total owed of $1.36 trillion.

Source: https://www.nerdwallet.com/blog/average-credit-card-debt-household/

So there are 45 million people in the US that have a considerable amount of student loan debt.

These are these are the same people who will presumably have to shoulder the burden of the $20 trillion debt and accept delaying retirement or paying more in taxes to pay for baby boomer’s retirement and medical cost.

Auto Loan Debt

US consumers owed $1.21 trillion in auto loans in 2017. Unlike student loans (in which theoretically you borrow money to increase your purchasing power for the rest of your life) or mortgages used to buy a house (which can theoretically go up in value), auto loan debts are taken out on an asset that rapidly depreciates.

On average a person in the US with this kind of debt owes $27,669.

Source: https://www.nerdwallet.com/blog/average-credit-card-debt-household/

Credit Card Debt

While I am sympathetic to people who have to use a credit card to pay for the basics of life such as food or utilities–credit card debt is a horrible form of debt.

Credit cards are primary used to consume and they carry high interest rates. If you need to use a credit card to pay for something it is likely that you will not be able to pay for it later when it effectively costs more due to the credit card interest.

In 2017 individuals in the US owed $905 billion in credit card debt. Households with credit card debt owed $15,654.

Source: https://www.nerdwallet.com/blog/average-credit-card-debt-household/

Mortgage Debt

The total amount of Mortgage debt in the US is $8.74 trillion. The average person who has a mortgage owes $173,995.

Source: https://www.nerdwallet.com/blog/average-credit-card-debt-household/

While housing can go up in price, it is not guaranteed to do so, as many people learned in 2008.

With many Americans burdened with debt and without savings the only way they can purchase a house is to borrow the money. As interest rates rise the cost of a mortgage will increase and therefore people will not be able to borrow as much, the result is that housing prices must fall.

Why Does this Debt Matter?

Debt, specifically debt to consume, does not grow the economy. It is a drag on the economy. The amount of debt in the United States will eventually crush the US economy.

Lets assume for a moment that consumption grows the economy even though it does not. If a debtor pays back the loan that means that is money that goes towards the person who loaned the money and not towards buying goods and service. Thus a person is not able to buy as much in the future when they are servicing a debt, all else equal. So even if consumption did grow the economy consumer debt can only pull consumption into the present at the expense of future consumption.

What does grow the economy is capital investment in machinery, tools, training and other technology that make the economy more efficient and allow the production of more goods and services. If there are more goods and services prices will fall and this allows people to buy more goods and services. If it takes less materiel and labor to make something those people and materials can go to work in other or new areas of the economy that they would not otherwise be free to do so.

With wages stagnant and labor force participation rates at decade lows that does not bode well for Americans to be able to repay these debts.

Another problem is that the person borrowing the money might not be able to repay it, in which case the person who loaned the money will have to take a loss. This does not benefit the economy either.

The massive amount of Federal, State and Personal debt in the United States is a huge drag on the economy and is one of the biggest problems or “faulty wirings” that is coursing through the US economy.

My next article will be about one of the last main areas of faulty wiring in the US economic house: an overvalued stock market.

I’m not all doom and gloom. Far from it. I think there are tremendous opportunities to grow and protect your wealth through alternative investments.

by John | Jan 22, 2018 | Geopolitical Risk Protection, Preservation of Purchasing Power, Wealth Protection

The S&P 500 is currently in the longest period EVER without a 3% correction. The unemployment rate in the US is just 4%.

Source: http://money.cnn.com/2017/11/26/investing/stocks-week-ahead-sp-500/index.html

The S&P 500 is at all time highs–far surpassing the dot-com bubble and the housing bubble.

Is this the new normal? Is Federal Reserve Chair Janet Yellen right that we won’t see another crisis in her lifetime? Is there even a need for alternative investments when the stock market continues to soar?

Yes, now more than ever.

Faulty Wiring in the Economic House

Let’s say you live in an apartment building you’ve discovered has faulty wiring. You know there is a very good chance it will catch fire and burn to the ground.

Let’s say you live in an apartment building you’ve discovered has faulty wiring. You know there is a very good chance it will catch fire and burn to the ground.

Would you continue to go about your business and just hope the apartment building doesn’t burn down?

Or would you do something about it?

Unfortunately most people, if they even know about the risks, ignore them or simply choose not to do anything about them. When the fire starts they will get cooked.

But you don’t have to be one of those people

You can choose to do something about it

We can’t know exactly when but there are plenty of good reasons to believe the US economy is going to undergo an economic firestorm in the future.

Throughout US economy there is the financial equivalent to faulty wiring that will eventually cause an economic conflagration.

You can certainly point to more but here are three of the faulty wirings in the economy:

- The real economy is weak

- Debt at the Federal, State, and Personal levels are un-repayable

- Reckless Central Bank Actions have created a massive bubble in stock and bond markets

Despite all the doom and gloom there are plenty of things you can do to ensure you’re financially safe.

Do Something About It

The wiring in the building needs to be torn out, but landlords aren’t willing to go through the pain, cost and inconvenience of rewiring. All the while the problems get worse.

They’d much rather put on a new coat of paint and pretend like everything is fine.

But you can choose to position yourself so that when the building does burn down, you and your possessions won’t be incinerated.

Similarly, the powers that be in government are too entrenched and committed to maintaining the status quo as long as possible. They have continually demonstrated they are not going to take proactive steps to solve any of these economic problems (and after all they in large part the cause of the problems).

The government will only act when it has no other choice. In other words the government will only act once the crisis has hit and it is too late.

In the coming days I’ll be discussing these three categories of faulty economic wiring: a weak real economy, unrepayable debt and the stock and bond bubble.

Not only that I’ll be sharing actionable strategies through alternative investments to grow and protect your wealth.

It’s not about doom and gloom or prepping for the magnetic poles of the earth to reverse and cause gravity to invert.

It’s just about taking some practical steps in light of the very real and system risks present in the financial system.

by John | Jan 14, 2018 | Asset Allocation, Geopolitical Risk Protection, Preservation of Purchasing Power, Saving Money, Wealth Protection

A 2.6% rise in the price of gold doesn’t seem like a lot given the tremendous volatility of cryptocurrencies like Bitcoin which can go up or down 30% in a day. Twenty eighteen has started off strong for the yellow metal. While gold has lost some if it’s shine in the eyes of many since the drop from it’s highs in 2011 it remains the standard in wealth preservation as far as I’m concerned. I am as bullish on gold today as I ever have been. Perhaps not in the medium term, but in the short and long term I think gold will be rising in USD price.

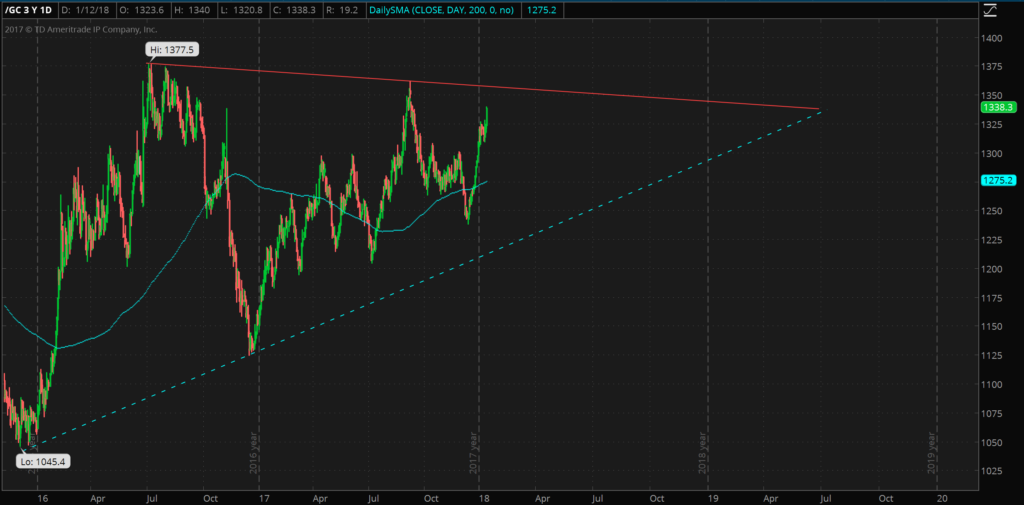

I posited back in April 2017 that 2016 was the start of a new bull market in gold and that trend has continued.

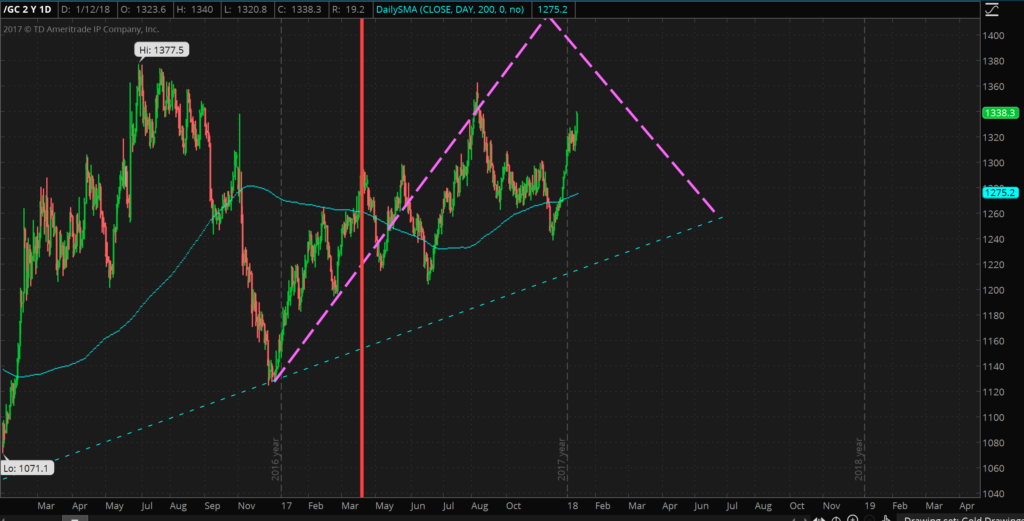

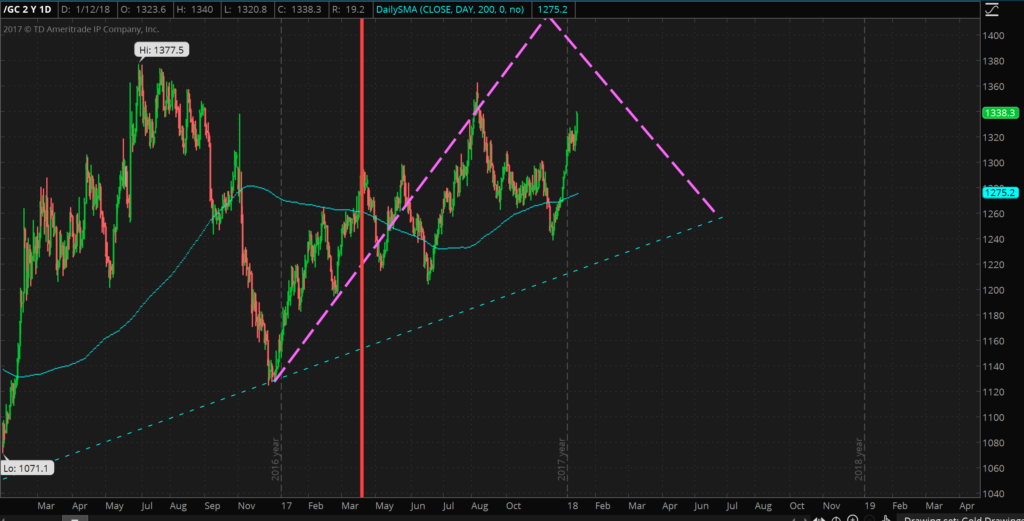

The dashed purple line indicates my prediction/guess as to the price movement of gold. This prediction was made back in the middle of April, 2017 (indicated by the vertical red line).

While this prediction looked fairly close up through August 2017, gold has since diverged quite a bit. Because gold hasn’t been able to take out the previous high of $1377.5 made back in July 2016, this bull market is looking fairly weak from a technical perspective, especially compared to the 2008-2011 bull market. This is why I think gold looks weak in the medium term (say 6 months to a year). In the short term gold is looking good, as previously mentioned gold is up over 2.5% this year.

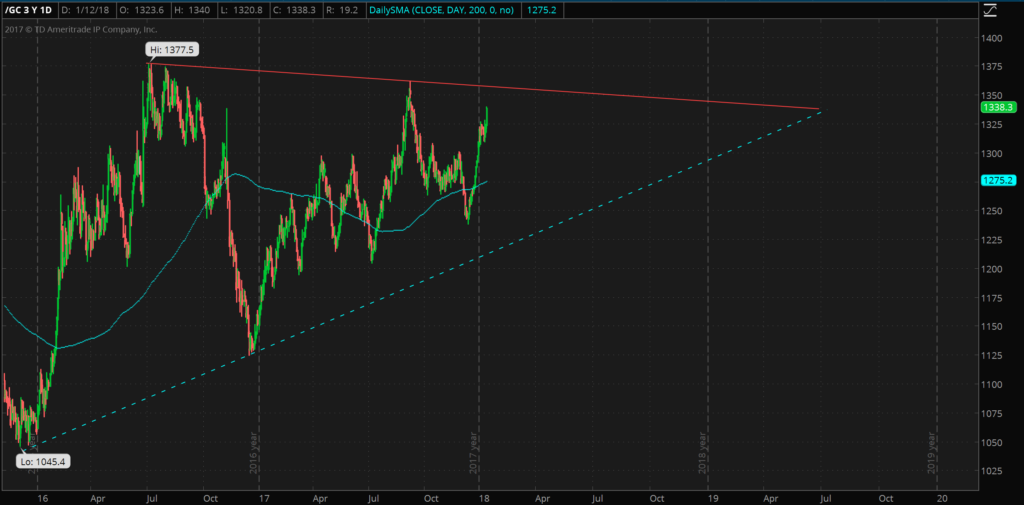

But even if the technicals of gold look weak the fundamentals of gold are still extremely strong. I think there is little chance that we will see gold available at a price of 1045 USD ever again and I think gold will eventually make new highs in excess of $2,000. I do think gold is in a bull market, albeit a weak one. A US War with North Korea, a Trump impeachment, another large scale terrorist attack, or any number of other catalysts could easily send gold upwards.

While we might have to wait until 2019, it will be interesting to see if gold breaks through the resistance (solid red line) and if so if it makes a new high above 1377.5, or if it goes back to test the longer term support levels drawn in a dashed blue line. Of course it could even do both if we see a lot of volatility.

I feel confident that gold will be above $1300. Regardless I think holding between 10%-25% of one’s assets in physical precious metals is a wise move. Go closer to 10% if you have faith in the US.gov and legacy financial system and closer towards 25% if you are a little more bearish on the US governments ability to handle the national debt, pension, social security and medicare funding crises. Of course all of these precious metal allocation percentages are just opinions and don’t take into account your age, goals and risk tolerance. If I had a lot of money in cashflow positive real estate or a successful and recession resistant business then I probably wouldn’t put as much into gold.

But if my income came from stocks and my job I would want to have 10-25% of my assets in precious metals and I would want to have some money in foreign stocks. I don’t think betting on the dollar is wise, it hasn’t been since 1913 and I think the dollar will only continue to weaken and at an accelerated pace.

While there is no substitute for physical precious metals like gold and silver held in a secure location one controls I think Goldmoney is a fast, easy and secure way to own physical precious metals. When you sign up for a Goldmoney holding account be sure to use my referral code: howigrowmywealth. A Goldmoney holding account allows you to store physical gold throughout the world in secure jurisdictions like Singapore and Switzerland. I personally own over $1,000 worth of gold through Goldmoney.

by John | Nov 13, 2017 | Security, Wealth Protection

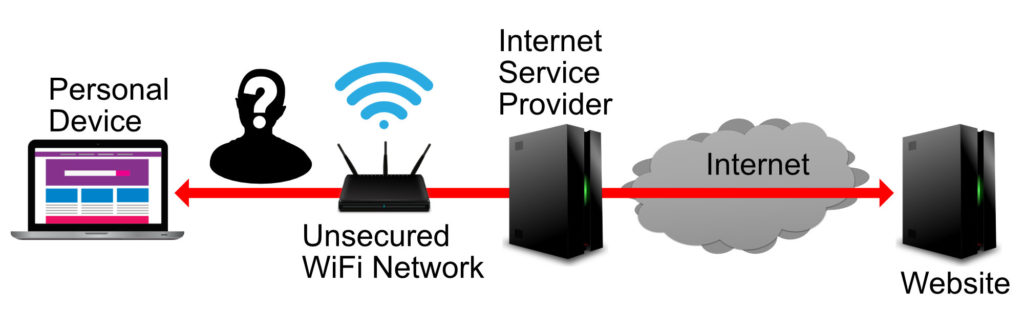

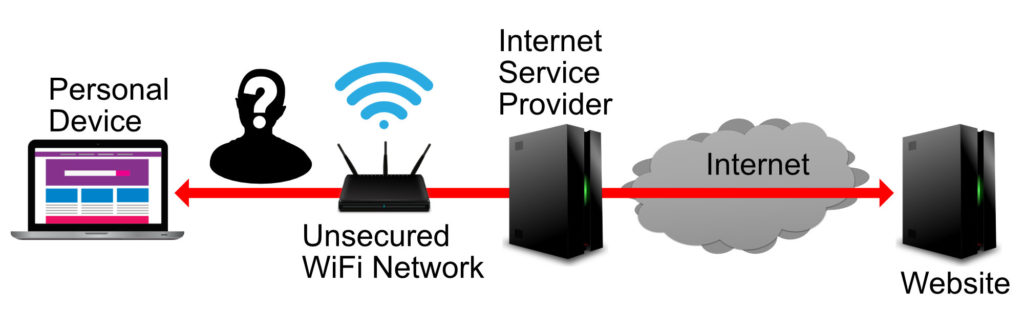

You’re at a coffee shop drinking a latte, taking advantage of the free Wi-Fi and reading the latest article on HowIGrowMyWealth.com. But then you realize you forgot to pay a bill that is due today. So you login to your online banking website and pay your bill. You continue to sip your latte go back to reading the article.

What you just did is risky. Not reading the article of course, but using public Wi-Fi to send confidential information.

Unfortunately there are unscrupulous characters out there who will try to steal your personal information

Unsecured Wi-Fi in a public place is dangerous to your wealth and privacy. Someone else could have been on that Wi-Fi network and used a “sniffer” to monitor the information being sent and received between your device to your bank’s website. Thanks to HTTPS the most sensitive information from your bank should be secure–but with the right tools bad people would still be able to see the sites you go to and see any emails or instant messages you send.

It’s fairly alarming how much people can see with readily available tools. Eric Geier of PC World was able to view emails, instant messages, logins and websites of people on an unsecured Wi-Fi network.

Source: https://www.pcworld.com/article/2043095/heres-what-an-eavesdropper-sees-when-you-use-an-unsecured-wi-fi-hotspot.html

The Importance of Security

I’ve worked in Information Technology for over a decade. I’ve worked for small businesses, startups, three fortune 500 companies, a non-profit and online-only virtual companies. I understand the importance of security. I also value my privacy.

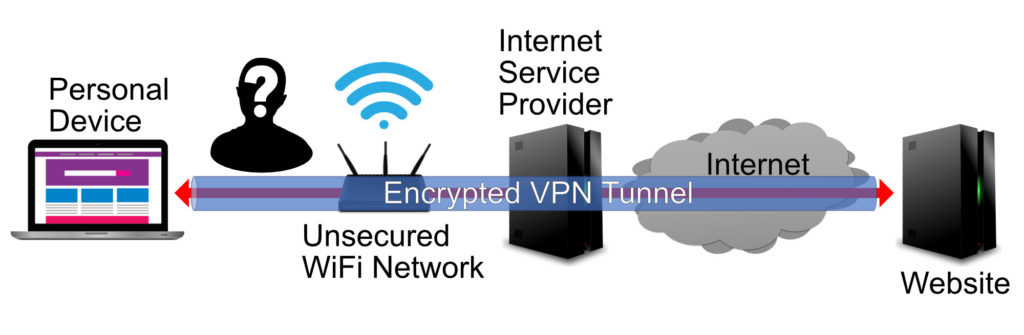

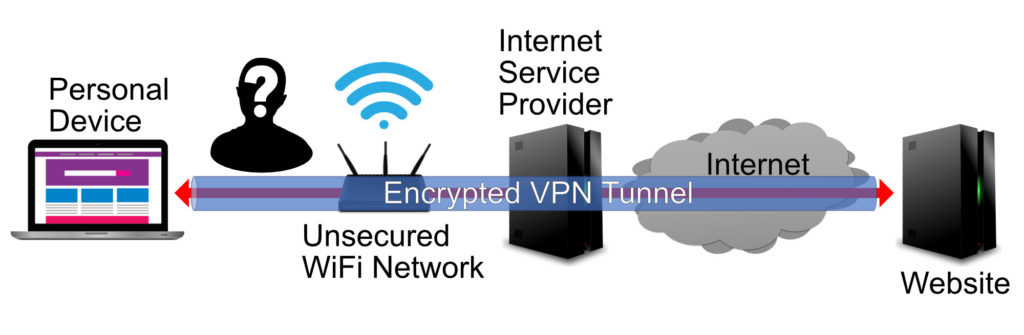

While websites that use HTTPS to safeguard vital information is helpful–one of the best ways to protect your privacy when browsing the internet on an unsecured network is virtual private networking (VPN). It essentially creates a secure tunnel between you and the website you’re accessing and prevents malicious hackers from intercepting the data you’re sending and receiving.

As more and more of what we do is conducted online it becomes more and more important to take steps to protect your digital life.

LifeHacker.com has this to say about VPN:

The most important thing you need to know about a VPN: It secures your computer’s internet connection to guarantee that all of the data you’re sending and receiving is encrypted and secured from prying eyes.

Source: https://lifehacker.com/5940565/why-you-should-start-using-a-vpn-and-how-to-choose-the-best-one-for-your-needs

TechHive does not mince words about the importance of VPN:

One of the most important skills any computer user should have is the ability to use a virtual private network (VPN) to protect their privacy. A VPN is typically a paid service that keeps your web browsing secure and private over public Wi-Fi hotspots. VPNs can also get past regional restrictions for video- and music-streaming sites and help you evade government censorship restrictions—though that last one is especially tricky.

Source: https://www.techhive.com/article/3158192/privacy/howand-whyyou-should-use-a-vpn-any-time-you-hop-on-the-internet.html

To that last point, if your government is censoring information it is probably illegal and thus not advisable to use VPN to circumvent any laws.

VPN means Serious Security

The best security comes in layers. Any online banking webpage worth anything will have an HTTPS that secures your most sensitive information. But that won’t stop hackers from spoofing fake site and exploiting vulnerabilities in the HTTPS protocol. Even if you’re accessing an HTTPS site, your ISP and hackers can still tell what sites you’re going to, even if they can’t see all the data being sent back and forth.

A VPN provides an extra layer of security on top of HTTPS sites because not only does it encrypt the information you’re sending and receiving, but it also prevents anyone, whether it be your internet service provider or a malicious hacker, from viewing the sites you’re going to.

Using VPN helps ensure that hackers and other can’t view your online activity.

I’ve been using a VPN to secure sensitive data while on public networks for years. There are many VPN providers but I use TorGuard. They are fast, affordable and they don’t keep any logs. You can sign up for TorGuard here: https://torguard.net/aff.php?aff=3596

I’ve been using a VPN to secure sensitive data while on public networks for years. There are many VPN providers but I use TorGuard. They are fast, affordable and they don’t keep any logs. You can sign up for TorGuard here: https://torguard.net/aff.php?aff=3596

And for a limited time you can sign up for 2 years of secure browsing for just $49.99 by using the above referral link and then using the following coupon code: TGLifetime50.

Protect your Online Wealth with VPN

Banking sites, brokerage accounts, email accounts: these are all at risk if you access them on an unsecured connection like an airport, library, hotel or coffee shop. Using a VPN in these high risk places ensures your valuable personal information is safe.

You owe it to yourself and your loved ones to educate yourself on Virtual Private Networking (VPN) and reduce the risks you face when accessing confidential information in via public Wi-Fi.

TorGuard is one such VPN provider that I use and recommend. Take a look at their services and if you decide to sign up be sure to use the coupon code TGLifetime50 to get 2 years of secure browsing for under $50.

by John | Oct 28, 2017 | Preservation of Purchasing Power, Wealth Protection

The other day I was watching an excellent and classic Japanese film: The Hidden Fortress. This picture stars the inimitable Toshiro Mifune and is directed by Akira Kurosawa. It is about a defeated Samurai clan attempting to smuggle gold across enemy territory to restore the clan’s domain.

I also recently read a Clive Cussler novel: Inca Gold, a mildly diverting story which mixes historical events with legend and fiction. Inca Gold is about a race to discover a hidden cache of gold in South America. While both works are obviously fiction they serve as a reminder of the historical fact that gold has been valued across cultures and across time. One might even say gold is timeless.

Here are a few examples of gold in cultures throughout the world.

A 6,000 year old Gold Pendant

A gold pendant crafted over 6,000 years ago. Photo: via The Daily Mail

The oldest known gold treasure trove is in a Necropolis (burial site, literally “city of the dead”) near the city of Varna in what is now Bulgaria where thousands of gold pieces have been discovered.

One item in the hoard includes a 2 gram 24 karat gold pendant was found thought to date back to 4,300 BC. It is the oldest known gold jewelry.

Other Varna Necropolis gold includes necklaces, bracelets, earrings, a tiara and a gold hammer-scepter.

Source: http://archaeologyinbulgaria.com/2015/10/15/bulgaria-showcases-worlds-oldest-gold-varna-chalcolithic-necropolis-treasure-in-european-parliament-in-brussels/

Each of these bracelets weights upwards of 110 grams. These timeless bracelets look like they could have been forged yesterday. (Varna Regional Museum of History)

Source: https://www.smithsonianmag.com/travel/varna-bulgaria-gold-graves-social-hierarchy-prehistoric-archaelogy-smithsonian-journeys-travel-quarterly-180958733/

The Varna Necropolis was rediscovered in 1972. Only about 30% of the site has been excavated. Although I wonder that it might be better to leave the graves, the remains, and the artifacts undisturbed.

Source: http://archaeologyinbulgaria.com/2015/11/20/bulgarias-varna-to-make-site-of-worlds-oldest-gold-varna-chalcolithic-necropolis-accessible-for-tourists/

The 3,300 year Old Gold Death Mask of Tutankhamun

Golden Mask of Tutankhamun in the Egyptian Museum

Tutankhamun was an Egyptian Pharoh (colloquially referred to as “King Tut”). He is famous because his tomb, located in the Valley of the Kings, was found largely intact in 1922. It had been robbed twice in antiquity and resealed. But despite this his tomb is still one of the greatest archaeological finds. The tomb of Tutankhamun contained a veritable trove of artifacts including the iconic solid gold funerary mask pictured to the left.

Source: https://en.wikipedia.org/wiki/KV62

Some of the Egyptian pyramidia were said to have been coated in gold leaf or electrum.

Source: https://en.wikipedia.org/wiki/Pyramidion

Earliest known Gold Coins over 2,500 years old

Early 6th century BC Lydian electrum coin weighing about 4.7 grams

According to greek historian Herodotus the Lydians (a people located in modern day Turkey) were the first to use gold and silver coins somewhere between 700 BC and 550 BC.

At least some of these coins were made from a naturally occurring alloy of gold and silver called electrum and stamped with a lion’s head.

Source: https://en.wikipedia.org/wiki/Lydia#First_coinage

Roman Gold Coins dating back 2,050 years

Aureus of Octavian, c. 30 BC.

The roman aureus dates back to the first century BC. Although minted prior to Julius Caesar, Caesar standardized the aureus at a weight of approximately 8 grams of 99% pure gold.

But the history of the aureus, like virtually all government issued money, is one of devaluation.

By the reign of Constantine Solidus, the aureus contained just 4.55 grams of gold.

The latin word for gold is aurum and is the genesis of the periodic table symbol of gold: Au. A derivative of the aurum can also be found in the first name of gold-loving James Bond villain Auric Goldfinger.

Source: https://en.wikipedia.org/wiki/Aureus

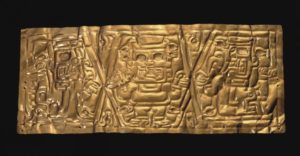

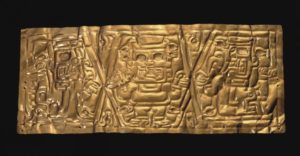

Inca and Pre-Columbian Gold

The Inca Empire had considerable gold and silver. However, between 1532-1572 Spanish conquistadors systematically plundered, stole and extorted this wealth as they destroyed the Inca Empire. The cups, necklaces and other gold items crafted by the Incas was melted down, cast into bars and shipped back to Spain.

Inca Gold Cup, Picture from National Geographic

A large trove of Inca gold does remain, at least in a legend. Like many others the legend of the lost Inca gold begins in historical fact.

In 1533 the war of succession between two Inca princes had ended. The younger prince Atahualpa defeated his half-brother Huáscar to become Sapa Inca (emperor). Emperor Atahualpa met with Spanish conquistador Francisco Pizarro. Despite being vastly outnumbered Pizarro and his 150 some troops were able to capture the Inca ruler.

Commander Pizarro agreed to release Atahualpa in return for a roomful of gold. This gold was indeed delivered, but Pizarro reneged on the deal and after a show trial had Atahualpa garroted. At this point the line between history and legend blurs.

Legend purports Pizarro had the Inca leader put to death before the last and largest part of the ransom had been delivered. Upon learning their Emperor was killed, the Incas buried the remaining gold in a secret mountain cave. This cave has never been discovered.

Source: https://en.wikipedia.org/wiki/Spanish_conquest_of_the_Inca_Empire

Source: https://www.nationalgeographic.com/archaeology-and-history/archaeology/lost-inca-gold/

Chavín Gold Crown 1200-300 BC

There were of course many other pre-Columbian civilizations apart from the Incas. One is the Chavín culture–an extinct civilization that was located in what is now the northern Andean highlands of Peru. Their achievements included advances in metallurgy, as evidenced by the gold crown shown to the right which could be over 3,000 years old.

Source: https://en.wikipedia.org/wiki/Chav%C3%ADn_culture

Gold Coins of Feudal Japan

The koban (小判) was a Japanese oval gold coin in Edo period (1603–1868) feudal Japan. Shown here is the Keichō-period koban containing 16.5 grams of gold.

Shogun Tokugawa Ieyasu established a metallic monetary system in 1601 which would last until 1867.

Source: https://en.wikipedia.org/wiki/Tokugawa_coinage

One of the units in the Tokugawa monetary system was the koban (小判) which means oval. When first introduced it contained 1 ryō of gold or about 16.5 grams and was considered to be a rough equivalent to four koku (石) of rice.

Source: https://en.wikipedia.org/wiki/Ry%C5%8D

One koku of rice was originally defined as the amount of rice needed to feed one person for one year. This original definition of a koku of rice would weigh about 150 kilograms (330 pounds). Thus one koban would be worth around 4 years of sustenance.

Source: https://en.wikipedia.org/wiki/Koku

Although in reality the amount of rice that could be obtained, even with a Keichō-period koban certainly would have fluctuated based on the size of the rice harvest, demand and various other factors, it still serves as an insight into the value of the koban when first introduced.

Like all nearly all governmental systems of money, it was steadily devalued as shown visually with the decreasing size of the koban over the years.

Koban debasement

Gold is Timeless

Gold has been valued across the ages and across cultures. In the spirit of modern hubris commentators have declared gold a barbarous relic and a pet rock. Some folks might concede that gold was once useful, but now that we have computers and electricity and bitcoin we don’t need gold. It takes a unique pride or perhaps outright ignorance to make such a pronouncement about an element that has been valued for millennia.

by John | Oct 16, 2017 | Learning from Mistakes, Saving Money, Wealth Protection

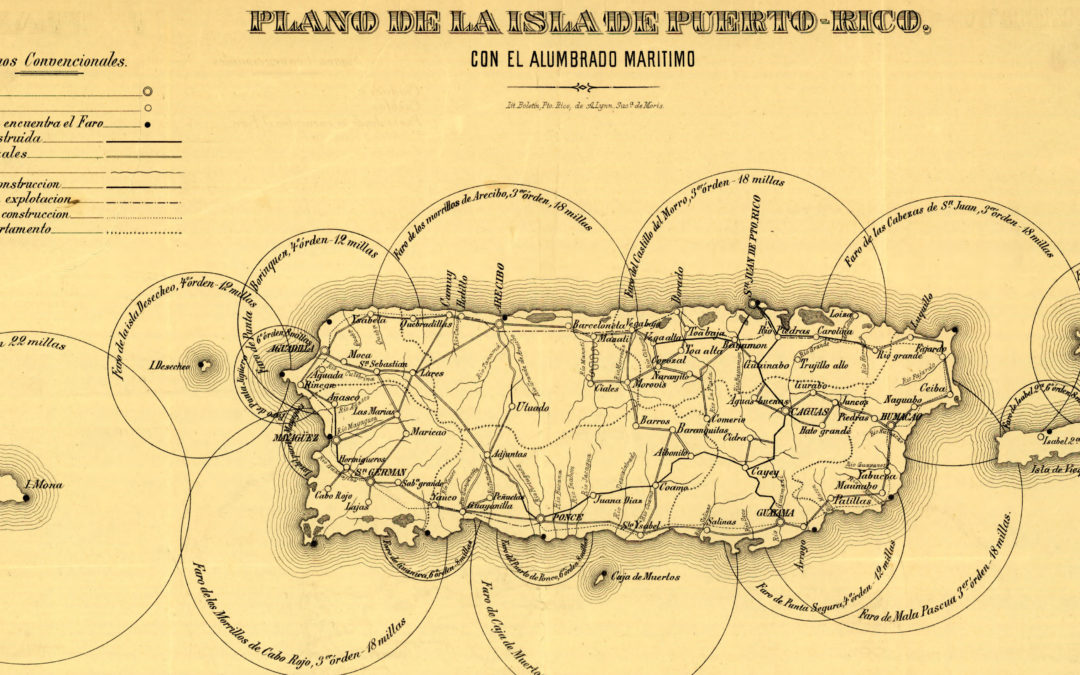

“With Widespread Power Failures, Puerto Rico is Cash Only” reads the title of a recent New York Times article in the wake of Hurricane Maria. This tragedy in the “Rich Port” is a sad reminder of the importance of keeping some emergency funds in physical cash.

The horrible devastation in this Caribbean territory of the Unites States is another reminder why keeping a few months worth of expenses in cash is a great idea.

It’s also a reminder to the anti-cash types that even in parts of the United States, power restoration can take weeks or months and a society without some cash is economically more vulnerable. This isn’t some abstract problem. It has a face, the face of people waiting in line, not being sure if they’ll be able to buy food or gas because they can’t access their bank account or use their debit card.

If there is a power outage I’m not going to want to spend my gold (the average cashier at the quick mart would probably stare at me dumbly even if I tried), I’m not going to be able to use a credit card, Goldmoney or bitcoin—I need cash.

If you think you’re going to be able to wait for a disaster and then go to an ATM at the same time as everyone else then at best you’re going to be faced with a long line. At worst the ATM won’t work or will be out of cash. Banks will have long lines and they could start imposing withdrawal limits to ration the cash they have available.

This isn’t my theory or some doomsday scenario, this is what happened (and is still happening as I write this) in Puerto Rico.

If people held a few months of expenses in cash then they would be in a better position to buy food, fuel, and start repairing their homes and businesses.

Of Course There are Downsides to Cash

I’m as bearish on US dollars and fiat money as anyone. So of course holding cash has downsides: Here are the main ones:

1) It loses value

The dollar has lost most of it’s value since 1913. So the wealth you have in cash will be inflated away as central banks inflate the money supply.

2) Theft

Carrying around a lot of cash is generally considered risky and not without reason. Looting and a general increase in crime is an unfortunate reality in the wake of disasters. There is also the problem of civil asset forfeiture. In the United States, the “freest country in the world,” if members of the law enforcement community suspect you of a crime, they have the means to simply take your money and/or other property and it will be up to you to sue the government and prove you’re not guilty and get your property back.

Civil asset forfeiture in the US is a black and white violation of the 4th amendment, but it happens all across the US and in 2014 more property was taken from US citizens by members of the law enforcement community than was taken by burglars. But I digress.

These Risks can be Mitigated

Think of cash as a form of insurance against: 1) Loss of electrical power 2) Capital controls 3) Negative interest rates

And like all insurance it comes at a cost. The cost of holding cash is inflation and the opportunity to put the cash to work in other investments.

I already own various hedges against inflation, such as gold, silver, stocks, and even cryptocurrency, albeit I remain very cautious of this last one. So the fact that a few months worth of expenses in cash losing value is of little concern.

The risk of theft can be mitigated as well:

1) Keep most of your cash in a safe or hidden place

2) Keep it in various locations around your home and perhaps at other locations as well

3) Don’t carry all of your cash at any one time

4) Dress nicely and be respectful to members of the law enforcement community

If two months worth of expenses is $2,000 I’m not saying carry around two grand. Maybe you keep $900 in a safe, $500 hidden someplace else in your home, and $500 with a trusted family member or close friend and a $100 in your purse or wallet. When you go to the store or gas station only take the cash with you that you need. That way if someone uses force to take your money, they won’t get all of it.

The Upsides Makes Holding Some Cash the Smart Move

1) I can be my own ATM. I’m not reliant on a bank or ATM allowing me to withdraw my money. I hold my money. This is vital when everyone is trying to withdraw cash at the same time.

2) If there is a power outage or communication disruption I can still buy food and fuel. Whether it is an EMP, ice storm, hurricane, brownout or cyber-attack, I can still buy the basics of life until things settle down. While fiat money is weak over the long term, in a disaster cash is still king.

Holding a few months of expenses in cash is a great idea. It can also double as an emergency fund in case you have an emergency repair to your car or home, medical expenses, etc.

Smaller denomination bills make more sense. Acquire $10s and $20s not $50s and $100s. Stores are generally more suspicious of larger denomination bills.

Not only that but it allows you to provide for yourself and help others. If I don’t have to go to the ATM or bank to withdraw cash that means there is one less person in line and anyone who would have been behind me in line can get cash faster. If 20-30% of people or more are prepared for a disaster it means there are much fewer people that need to be helped and there will be more resources to help a smaller number of people who need help. Maybe you’ll be able to share some of your cash with a neighbor and help them out.

Cash isn’t an investment and yes it loses value thanks to central banks, but holding a month or two’s worth of expenses in cash is a smart idea as part of a larger wealth and financial protection strategy. My thoughts and prayers are certainly with the people of Puerto Rico and it is a sad reminder of the importance of cash.

Let’s say you live in an apartment building you’ve discovered has faulty wiring. You know there is a very good chance it will catch fire and burn to the ground.

Let’s say you live in an apartment building you’ve discovered has faulty wiring. You know there is a very good chance it will catch fire and burn to the ground.

I’ve been using a VPN to secure sensitive data while on public networks for years. There are many VPN providers but I use TorGuard. They are fast, affordable and they don’t keep any logs. You can sign up for TorGuard here:

I’ve been using a VPN to secure sensitive data while on public networks for years. There are many VPN providers but I use TorGuard. They are fast, affordable and they don’t keep any logs. You can sign up for TorGuard here: