by John | Sep 18, 2016 | Capital Appreciation, Investor Mindset, Investor Psychology, Tax Strategies, Value Investing

Warren Buffett is considered to be one of the most successful investors. He’s one of the wealthiest people in the world and he’s also fond of publicity and public appearances.

If you have some humility and don’t get caught up in jealousy you can learn a lot from wealthy and successful people like Warren Buffett.

My own Father is fond of saying that poor people should take rich people out to lunch. The idea being that the wisdom that can be gained from the wealthy is worth more than paying for lunch.

So what lessons can we learn from Warren Buffett?

Do As Warren Buffett Does, Not As He Says

There is an old expression “Do as I say, not as I do.” With Warren Buffett it is “Do as I do, not as I say.”

There is an old expression “Do as I say, not as I do.” With Warren Buffett it is “Do as I do, not as I say.”

Warren Buffett talks A LOT and shares a lot of opinions. But you shouldn’t follow what he says as advice because he might actually be doing the opposite of what he is saying.

In order to learn lessons from Buffett one must first filter out a lot of what he says.

There is a quote from Daniel Loeb that summarizes Buffett’s contradictions quite succinctly.

“He criticises hedge funds yet he really had the first hedge fund,” Loeb said. “He criticises activists. He was the first activist. He criticises financial service companies, yet he likes to invest in them. He thinks that we should all pay more taxes but he loves avoiding them himself.”

Source: http://www.smh.com.au/business/warren-buffett-is-full-of-contradictions-hedge-funds-say-20150507-ggwv2o.html

Without further ado here are three lessons we can learn from Warren Buffett.

Lesson 1: Reduce Your Taxes

While publicly discussing how he wants to pay more taxes Warren Buffett has taken extraordinary steps to reduce his taxes.

Source: http://www.nytimes.com/2011/08/15/opinion/stop-coddling-the-super-rich.html

From how he structures his businesses to how he is paid to how he has bequeathed his inheritance Warren Buffett does all he can to reduce his taxes. He gets paid through dividends and long term capital gains rather than ordinary income. He’s also left 99% of his fortune to a private charity to avoid paying inheritance taxes.

Lesson number one from Warren Buffett is Reduce Your Taxes.

There are a variety of ways you can legally reduce your taxes: IRAs, 401ks, FSA, HSAs, charitable contributions, capital gains. I discuss some of them in Five Tax Strategies to Keep More Income.

Real estate is also an excellent way to increase your wealth in a tax advantaged way. BiggerPockets.com is an excellent Real Estate resource.

Lesson 2: Invest in High Quality Companies that are Undervalued

Warren Buffett loves great value. Much of his investing philosophy can be traced back to Benjamin Graham, the father of value investing.

According to Investopedia Buffett looks at six criteria for stock investments:

1. Has the company consistently performed well?

2. Has the company avoided excess debt?

3. Are profit margins high? Are they increasing?

4. How long has the company been public?

5. Do the company’s products rely on a commodity?

6. Is the stock selling at a 25% discount to its real value?

Source: http://www.investopedia.com/articles/01/071801.asp

Warren Bueffett is a value investor and I think value investing is an excellent way for the enterprising investor to achieve outsized returns. I’ll be writing more about value investing in future posts.

If you’re interested in reading one of Graham’s seminal works “The Intelligent Investor” use this link to buy it on Amazon and help support this site: The Intelligent Investor by Benjamin Graham. Buffet calls it “the best investing book ever written.”

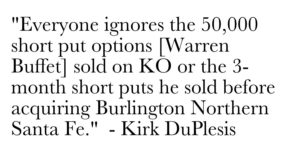

Lesson 3: Use Derivatives Wisely

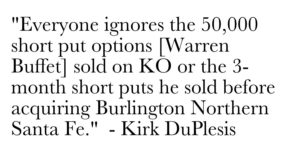

Warren Buffett has written “derivatives are financial weapons of mass destruction.”

Source: http://www.fintools.com/docs/Warren%20Buffet%20on%20Derivatives.pdf

But Buffett has billions in derivatives as pointed out by Kirk DuPlesis of OptionAlpha.com.

Source: https://optionalpha.com/warren-buffett-options-trading-strategy-19655.html

In the article above Kirk talks about two ways Buffett uses derivatives:

1) Uses naked, short puts to lower the cost basis for purchasing stock or target companies that he wants to acquire.

2) Sells short index put options when volatility is at it’s highest, knowing that volatility is the one factor that is overpriced all the time.

I’ve written about trading options and think that done correctly it can be an excellent way to bring in monthly income. I’m interested in utilizing strategy one above more often as I open new stock positions.

Lessons from Warren Buffett

Those are three lessons I’ve learned from looking at what Buffett does, not what he says. Buffett probably gives some advice that is worth following directly but you have listen through a filter and weigh heavily what he actually does over his words.

by John | Jun 30, 2016 | Capital Appreciation, Geopolitical Risk Protection, Preservation of Purchasing Power, Value Investing

Trading Australian Stocks is fairly easy. You just need to have the right broker. Making profitable trades is a little harder. But before we get too far into brokers and trading you might be asking…

What is Special about Trading Australian Stocks?

The Australian Stock Exchange (ASX)

If you believe that US and European stocks are overvalued, as I do, and that gold mining stocks are undervalued, as I do, Australia presents, pardon the pun, a golden opportunity.

Australia is a stable jurisdiction that is gold mining friendly. It’s also relatively close to the biggest emerging markets in the world: India and China.

India and China are also some of the world’s largest purchasers of gold.

Why not just trade ADRs?

An ADR is defined by investopedia as follows:

An American depositary receipt (ADR) is a negotiable certificate issued by a U.S. bank representing a specified number of shares (or one share) in a foreign stock that is traded on a U.S. exchange. ADRs are denominated in U.S. dollars, with the underlying security held by a U.S. financial institution overseas.

Source: http://www.investopedia.com/terms/a/adr.asp

If the Australian stock you want to buy IS available as an ADR through your existing broker you can save yourself the trouble of opening a new brokerage account.

But there ARE advantages to owning a stock directly on the exchange (instead of buying the ADR).

1) It costs banks money to create ADRs and they sometimes keep part of the dividend to cover these costs (Peter Schiff, Crash Proof 2.0)

2) Trading stocks on the local exchange can be more liquid (Tim Price, Price Value International)

3) The only way you can acquire many excellent value stocks is to purchase them directly on their “native” exchange. So if you limit yourself to ADRs you’ll miss out on opportunities.

While I do make some of my own stocks picks I also rely on competent professionals that I trust.

Which brings me to…

Price Value International

One such expert I look to is Tim Price.

One such expert I look to is Tim Price.

Among many other accolades Tim boasts 25 years in the capital markets; 15 years as a discretionary multi-asset portfolio manager and was Chief Investment Officer at three successive firms. Tim is currently one of two principals at Price Value Partners and a columnist for MoneyWeek magazine.

Tim also has a monthly paid newsletter called Price Value International (PVI) in which he provides value stock picks of international companies. Tim hails from the UK which I believe helps adds to his unique perspective that is hard to find from asset managers closer to Wall Street.

I receive no financial benefit from Time Price or Price Value International by writing about his newsletter.

But I have been a Price Value International subscriber for over 10 months now and for me it has been worth every penny. As a result I want to share it with my readers.

You can sign up for the PVI newsletter at the following link: Price Value International.

Make Money Like Warren Buffet

Tim Price follows a methodology heavily influenced by “the father of value investing” Benjamin Graham. Graham developed investment strategies that Warren Buffet adopted to grow his fortune.

Using these methods Tim looks for high quality companies around the globe that trade close to or even less than their book value. It’s kind of like buying a house for $190,000, when building the same house would cost $200,000. Value investing provides built in downside protection and is a proven investing method.

Through the Price Value International newsletter Tim shares a new value stock recommendation each month. When you sign up you also get access to back issues so you can see recommendations from prior months.

The stocks range from firms throughout the world and two of them are traded on the Australian Stock Exchange.

I’d love to share the names of these stocks (both of which I own) but it would not be right to do so since I learned about them from Tim through his Price Value International newsletter.

But if you do sign up for PVI and/or decide you want to trade stocks on the Aussie stock exchange, I can provide you with the name of…

A Broker that allows you to trade directly on the Australian Stock Exchange

Most foreign brokers don’t accept US clients largely because of the onerous US laws foreign brokers would have to comply with if they did allow US citizens.

However, I’ve found a US based broker that allows you to trade directly on the Australian Stock Exchange.

This allows me to purchase an Australian stock recommended by Tim Price that I know for a fact is not available as an ADR.

This broker has no minimum account balance which is great if you don’t have a lot of capital to invest.

I DON’T get anything if you sign up for an account with this broker. It’s a firm that I personally have an account with and find valuable.

What is the name of the Broker?

I AM trying to gain more subscribers to my own FREE email newsletter where I talk about what I’m doing to grow my wealth. So while I’m more than happy to provide the name of the broker at no cost, in return I just ask that you sign up for the How I Grow My Wealth email Newsletter using the form below.

Again, out of respect for Tim I’m not going to share the name of any of his stock recommendations. Plus he might cancel my subscription and then I’ll miss out!

But I am happy to share the name of broker that I use.

I was able to start trading Australian stocks quickly. It took me less than a week to get my account setup and make my first trade.

To get instant access to the name of this broker simply sign up for my free email newsletter using the form below.

There is an old expression “Do as I say, not as I do.” With Warren Buffett it is “Do as I do, not as I say.”

There is an old expression “Do as I say, not as I do.” With Warren Buffett it is “Do as I do, not as I say.”

One such expert I look to is Tim Price.

One such expert I look to is Tim Price.