by John | Aug 1, 2017 | Cryptocurrency, Learning from Mistakes, Preservation of Purchasing Power

As expected the Bitcoin Hard Fork occurred around 12:20 UTC today. A new cryptocurrency, Bitcoin Cash (BCH or BCC depending on the exchange) was born. It shares the same history as Bitcoin up until today in what I’ve already referred to as a modern day Ship of Theseus paradox.

So which Bitcoin is the real Bitcoin? BTC continues with a similar price as before and Bitcoin Cash was a new node to begin with so certainly Bitcoin remains bitcoin.

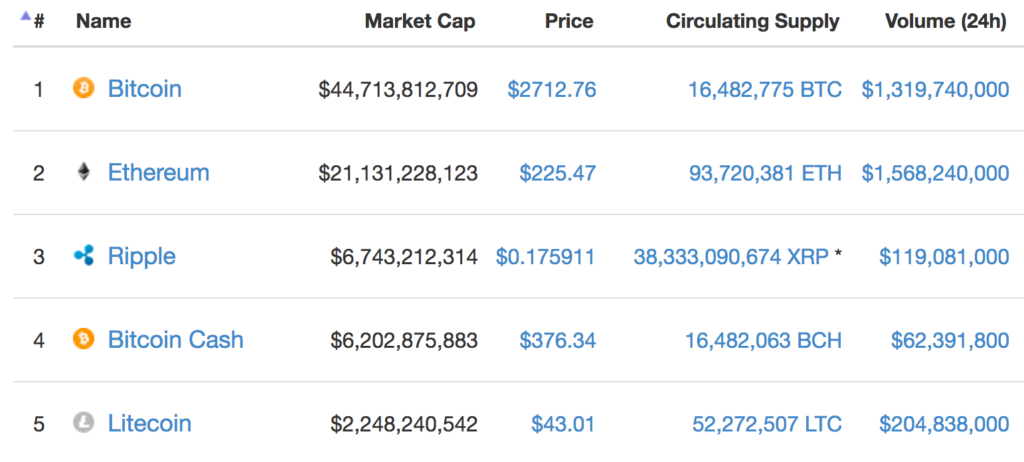

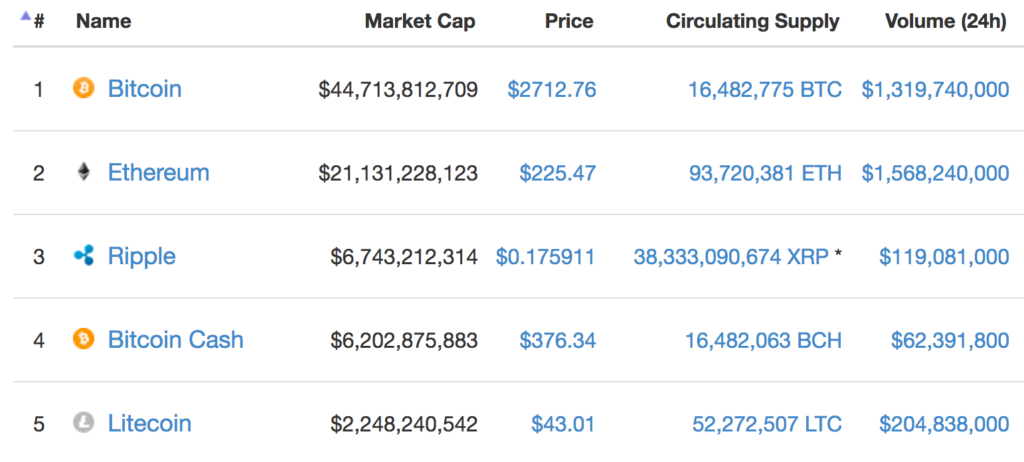

But it’s another example of how a brand new cryptocurrency, one which a current market cap of over $6 billion, can be created seemingly out of thing air.

I understand that Bitcoin Cash has the support of some miners, and work went into the technical changes (it has a larger block size, in an attempt to overcome some of Bitcoin’s scaling issues). But is it really worth $6 billion?

Source: coinmarketcap.com

The market seems to think so and that is all that matters in the present.

In the short term each BCH is trading for around $375 as of writing. My plan, which I previously shared, worked flawlessly.

Upon hearing about the hard fork, I moved my Bitcoins from an exchange that did not support BCH, to an exchange that did. When the fork happened I retained my original Bitcoins, but was also awarded an equal amount of Bitcoin Cash. I doubled my Bitcoins! (Sort of) The original Bitcoin is still trading around $2,700 and as stated above the new BCH I receive are only worth $375 each.

Learning from Past Mistakes

This is an example of how I was able to learn from a past mistake to benefit.

I missed out on coins resulting from when Ethereum forked. The place where I had my coins, hashflare.io, famous for unprofitable cloud mining, did not support the fork. I wasn’t about to let that happen again. If I’d been on an exchange that supported Ethereum Classic, or had my Ethereum in a wallet where I controlled the keys, I could have received 1 ETC for each ETH I held.

Cryptocurrencies are Inflationary

As I’ve written about before, one of the things that I dislike about cryptocurrencies is that there are no natural limits on the supply. Bitcoin Cash is a perfect example. Sure, the number of Bitcoins (BTC) did not increase, but a coin very similar to BTC, albeit with less network hashing power and some technological differences, was created, which in some sense doubles the amount of Bitcoins in existence.

Playing the Fork

The market doesn’t seem to care about the Bitcoin hard fork, BTC was trading up near around it’s all time high of $2,910 the day before the fork and is still at $2,700.

One could theoretically have purchased 3 BTC right before the fork for $2,900 each ($8,700 total). Then the fork happens, and the person gets to keep their 3 BTC and also gets 3 BCH, each worth $375 ($1,125 total). The price of BTC then falls to $2,700. So one would have lost $600 total on the BTC, but gained $1,125 on the BCH, for a net of $525. Not bad. That’s a 6% increase over just a few days.

Easier to talk about with the benefit of hindsight, but if someone is already holding Bitcoins, there is no financial risk to being a position to get the newly created cryptocurrency.

Long Term Problems

The market doesn’t seem to care about the Bitcoin hard fork, it was trading up near around it’s all time high of $2,910 the day before the fork and is still at $2,700. But in effect 6 billion USD worth of value was created out of thin air. Over the long term this simply isn’t sustainable. Is the price really coming from new money buying up BCH as the future cryptocurrency? It seems unlikely. The supply of cryptocurrencies continues to grow and Bitcoin Cash is only the latest example.

I’ll continue to hold various cryptocurrencies as a speculation that one or more takes off (even more) and reaches widespread adoption but as a long term investment I think it remains very risky.

by John | Jun 15, 2017 | Cryptocurrency, Learning from Mistakes, Wealth Protection

I think the vast majority of my readers get it. I think my readers are smart, critical thinkers. However, I’ve gotten a few comments from people who somehow think that because ETH is now trading upwards of $300 that somehow my article Ethereum Cloud Mining is Not Profitable is no longer valid.

I’ll make myself clear. It does not matter how high ETH goes, Ethereum cloud mining was not profitable for me.

Did I make more money as a result of Ethereum cloud mining compared to simply holding onto the $561? Yes. But the fact remains that the Ethereum cloud mining contract was a slow, expensive way to acquire ETH.

Owning ETH was profitable. I made money on the appreciation in dollar value of ETH. I would have made more money if I had bought ETH directly, versus Ethereum cloud mining.

I wrote this very clearly three months after I purchased the Ethereum Cloud Mining contract from Hashflare.io:

I would also be better off if I had just bought ETH.

If I bought $561 of ETH for $9 (where it was trading when I started mining). I would have 62 ETH…

Through Ethereum cloud mining I mined 41.27 ETH.

I would rather have 62 ETH immediately than wait a year to get 41.27 ETH. The cloud mining contract increased my cost basis.

Now, if I could buy hashing power at a low enough cost Ethereum cloud mining could have been profitable. If mining difficulty went down over time, Ethereum cloud mining would be more likely to be profitable. However, mining difficulty has consistently gone up and the cost of cloud mining contracts is too high.

Ethereum cloud mining was not a good investment for me. I would have been better off simply buying ETH directly. This is true regardless of how high the price of ETH goes.

by John | Apr 23, 2017 | Cryptocurrency, Learning from Mistakes, Passive Income

Today I wanted to cover how to calculate cloud mining profitability. I had a recent comment on my article: Ethereum Cloud Mining is not Profitable that I’m concerned perpetuates the kind of static analysis that will cause someone to lose money on cloud mining.

I’m going to do my analysis for Ethereum Cloud Mining. However, this analysis will work for any coin that has increasing mining difficulty.

Assumptions: I’m assuming the price of ETH is static. Why? Because if it goes up, that is simply a bonus. If mining isn’t profitable unless the currency goes up, then one is better off buying the currency outright.

Step One of How to Calculate Cloud Mining Profitability

First you need to know how much the cloud mining will cost per unit of hashing power. As of 23 April 2017 Hashflare.io is selling 100 KH/s for 2.20 USD. That is 1 MH/s for 22 USD.

Use a static calculator first. This will provide the baseline static analysis. For Ethereum I like this calculator.

As of writing there is a network hashrate of 22595.62995398704 GH/s, a blocktime of 13.31 and one ETH going for 48.63 USD.

So with 1 MH/s I would earn 0.043093 ETH per month, worth 2.10 USD per month. Multiply that by 12 and the total ETH mined (0.517116) would be worth $25.2.

So if the price of ETH stays the same (which for the purpose of the static analysis we will assume it will), and the network hashing power stays the same. Then the profit will be $3.2 after a year IF THE NETWORK HASHING POWER STAYS THE SAME. The problem with a static analysis is that network hashing power does NOT stay the same.

Network Mining Difficulty Goes Up

If you stop with this static analysis you’ll surely lose money though. Why? Because the network hashing power has historically gone up and gone up A LOT.

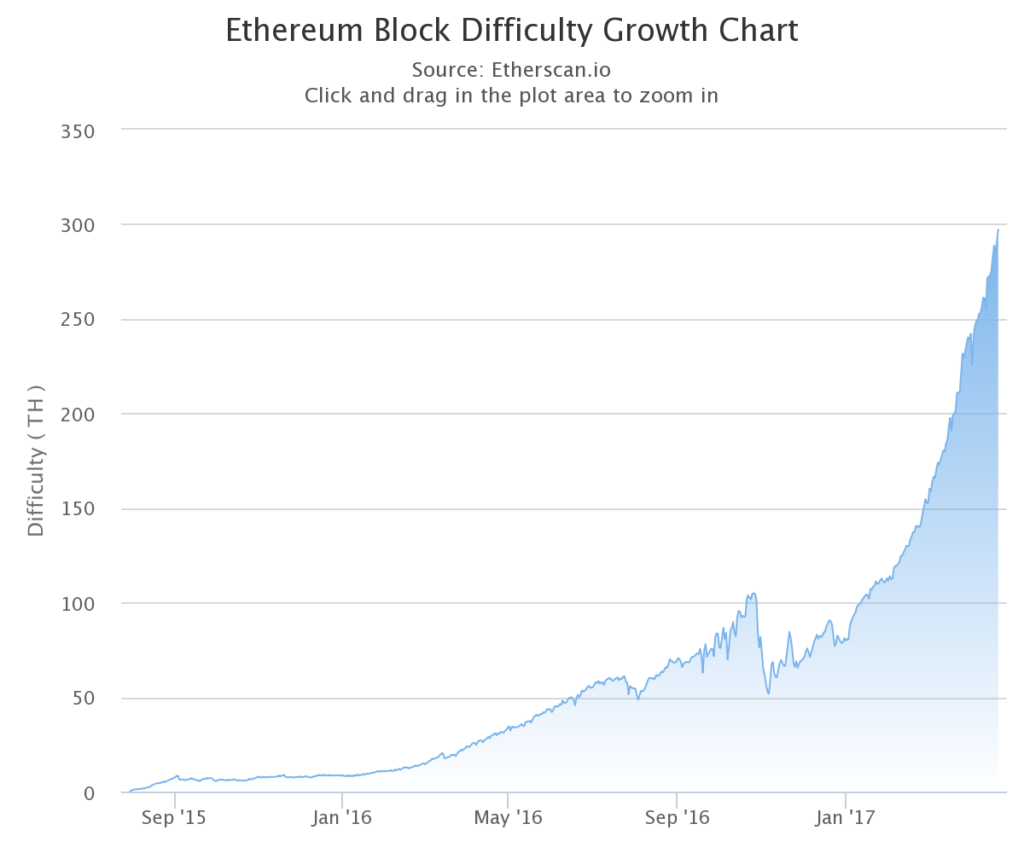

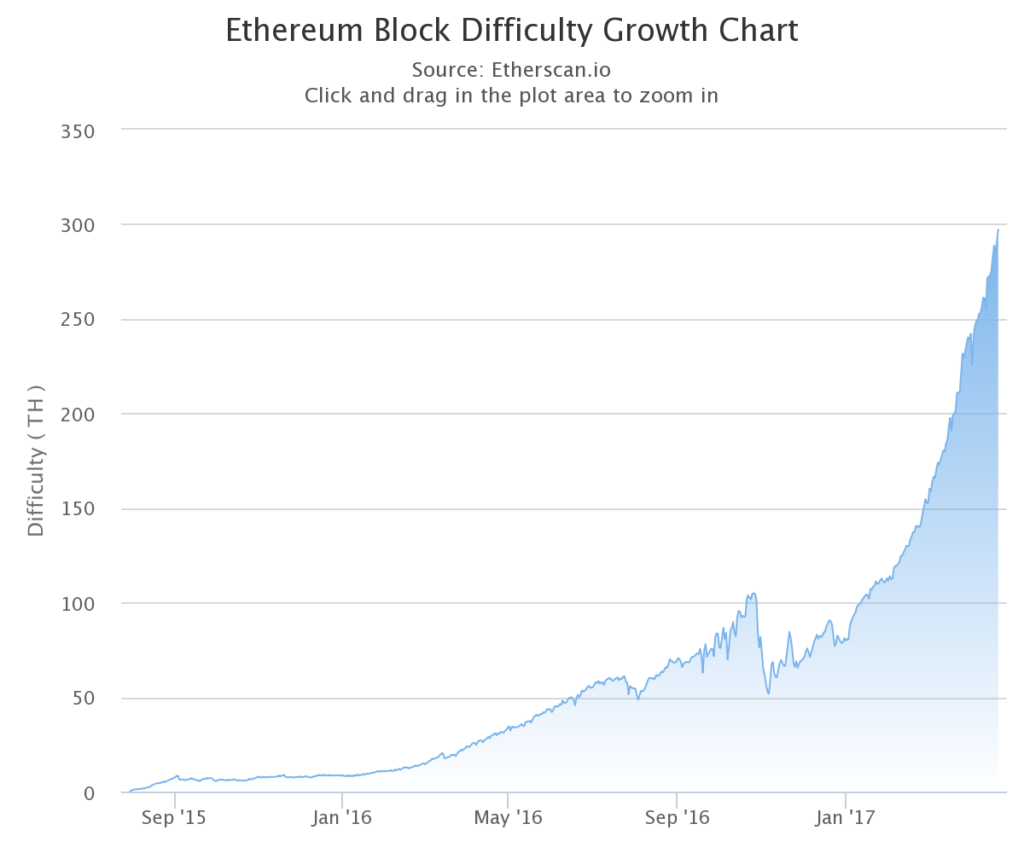

Ethereum Block Difficulty Growth Since 30 July 2015

In the first four months of 2017 alone, mining difficulty for Ethereum has gone up over 200% from under 100 TH/s up to nearly 300 TH/s. Which means the amount of ETH mined for anyone with fixed hashing power will have been reduced by over 66%.

Factoring in the growth rate of block difficulty is the most important factor when determining cloud mining profitability.

Step Two of How to Calculate Cloud Mining Profitability

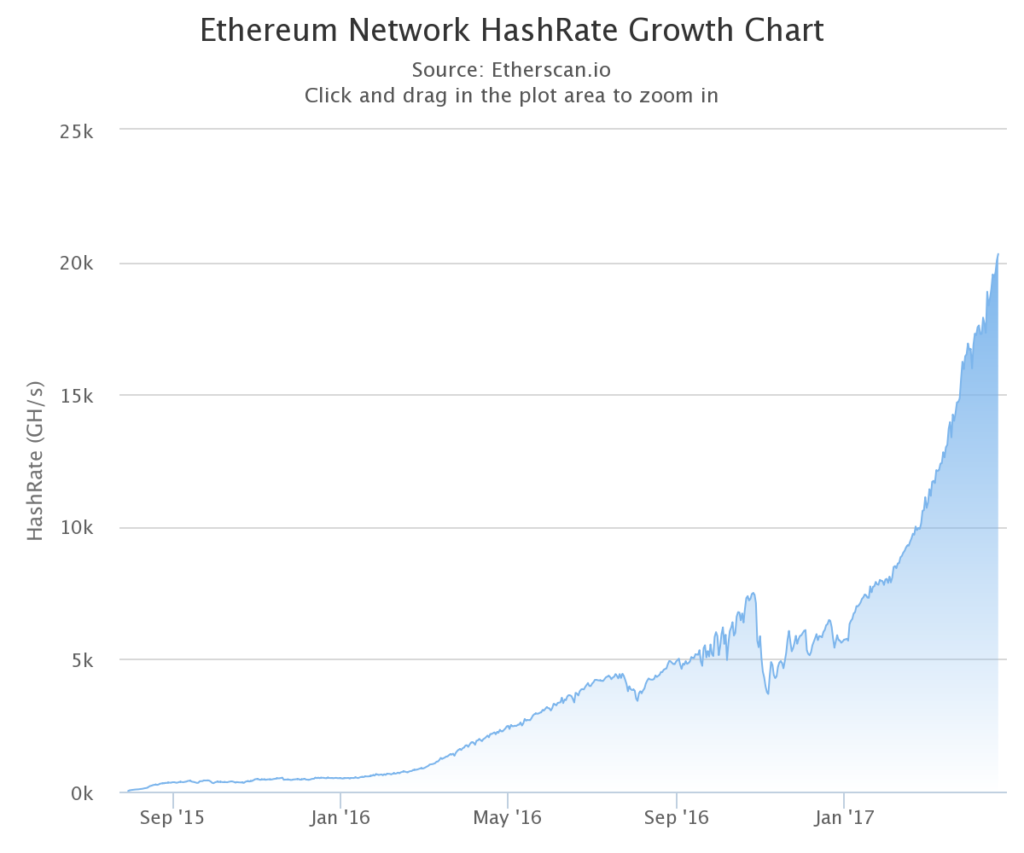

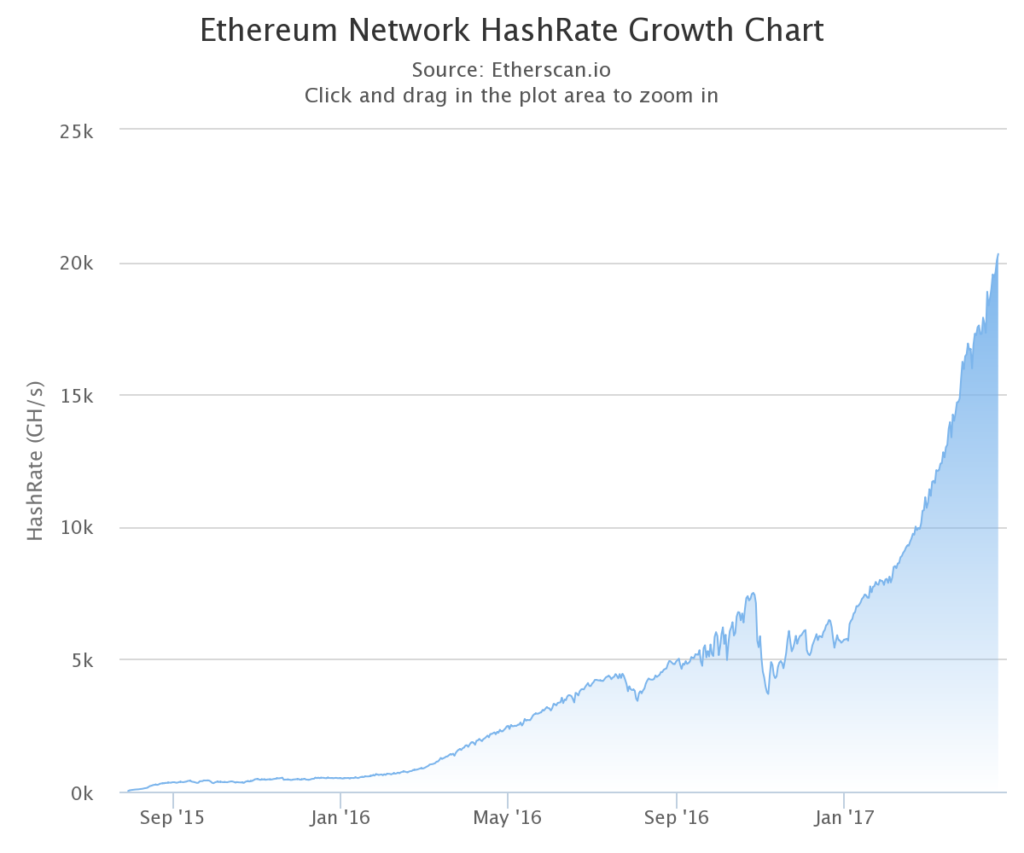

Projecting how much the network hashrate will increase over the life of the cloud mining contract is vitally important. You need to make a realistic estimate of how the network hashrate will increase because it will reduce the amount you get from mining each day.

The chart above shows the Ethereum network hashrate growth. In this example, Hashflare.io contracts run in 12 month increments. So we need a realistic estimate of how much the hashing power (and thus mining difficulty) will go up over a 12 month period.

This takes some guesswork but the best indicator is the past.

The August 2015 hashrate of 55 GH/s to the August 2016 hashrate of 3,811 GH/s represents a 6,800% increase. This was the first 12 months of the Ethereum network coming online so I think this number is too high.

In 2016 the Ethereum network hashrate went from 511 GH/s to 5,700 GH/s. A 1,015% increase.

From April 2016 at 1752 GH/s to April 2017 of 20,300 GH/s was a 1,058% increase.

So I based on 2016 I think a 1,000% increase in hashing power is a good conservative guesstimate. That means the hashing power would be around 230,000 GH/s by April of 2018.

So then we follow step 1 again using the static calculator. Using the 1 MH/s and a network hashrate of 230,000 GH/s. The monthly ETH mined would be 0.004233 worth $.21.

Step Three of How to Calculate Cloud Mining Profitability

So at this point we have a projection of how much we’ll get from mining in the first month. And how much we’ll get in the last month. These are just a projections based on a static analysis and a guesstimate of where mining difficulty will be in the future.

But the amount mined doesn’t jump down from the first month to the last month. The amount mined is slowly and steadily decreasing.

I think a exponential decay model fits the data better but for the sake of ease I think a linear model will suffice.

I also think a simplified method works because the cloud mining rates I’ve seen are not close to what they would need to be for mining to be profitable.

Take the amount we think we’ll mine in the first month. In this case .043093. Then take the amount we’ll think we’ll mine in the last month, .004233. Subtract the first from the last. Then divide that by 11.

From that point you take the starting value of .043093 subtract the decay amount .003943 to get the second months value of .039149. You do this again until you get to month 12. By summing up each month’s value we get 0.283956. Multiply that by the price of ETH of 48.63 USD and we get $13.80.

The contract in this example cost 22 USD so this would not be profitable if the network hashing power goes up by 1000% (as it did in 2016) and the price of ETH stays the same.

You’d end up losing $8.2.

Okay, what if the network hashing power only goes up 500% so it goes up to 135,600 GH/s after one year? You’d mine about .3 ETH worth $14.66. You still lose.

What if the network hashing power only goes up 100% to about 45200 GH/s? You’d mine about .387 ETH worth less than $19. Loser.

What if the network hashing power only goes up 35% to 30,500 GH/s. You’d mine about .45 ETH worth $22.88. Small winner.

If Network Hashing Power Goes Up You Start to Lose

So what I hope this shows is that if the hashing power goes up, which in the case of Ethereum (and I suspect most coins as well) the amount of coins mined will drop and the profits will be eroded.

Easy Method

If you believe network hashing power will continue to go up then use this method to determine if mining is even worth a closer evaluation: use the static mining profitability calculator. Use the amount of ETH mined and the cost of the mining contract to see how much you’re effectively paying per ETH.

For example Hashflare.io is selling 1 MH/s for 22 USD for a year. That would yield 0.043093 ETH per month x 12 would be 0.517116 ETH for the year mined if the network hashrate stays the same. So the cost per ETH would be 42.54 USD. With ETH trading at 48.63 USD that is only a 14% discount over a year.

Unless you’re going to get ETH (or whichever other coin) at a significant discount using the static calculation (say 40-50% below spot price). It’s not worth it.

But the Price of ETH is going to double!

Great! Then buy ETH directly. Lets say the price of ETH does double in a year. It goes from 48.63 USD today up to $97.26. You could have bought $22 worth of ETH (.45 ETH) and the $22 worth of ETH would now be worth $43.76.

With a 1000% network hashrate increase you’d have only mined 0.283956 which would be worth $27.61. Unless the mining is profitable with the price of ETH fixed, you’re better off owning the currently directly even if the price of the currency goes up.

At what price would cloud mining be worth it?

As of today 23 April 2017, based on a 1000% increase in hashing power over the next year I would not pay more than around $7 for 1 GH/s of hashing power.

Based on my projections that would yield about 40%. Given the risk and volatility in cryptocurrencies I would need to see that kind of return for it to be worth the risk to me.

With 1 GH/s costing 22 USD, if the network hashing power stays the same I would still only make about 15%. Given the history of network hashrate increases that isn’t worth it.

Hashflare.io is nowhere close to $7 per GH/s. Genesis Mining offers 1 GH/s for 2 years for 29.99. Who knows where the network hash rate will be in 2 years.

Some People Claim Cloud Mining is Profitable

I have read testimonials from people who think cloud mining is profitable. My main question would be is it profitable because the underlying cryptocurrency went up, or because the mining itself was profitable? In other words would you have been better off just owning the cryptocurrency directly?

by admin | Apr 4, 2017 | Investment Failures, Learning from Mistakes, Postlet

I want to give credit to Bitfinex. They paid back all their IOUs by redeeming 100% of all BFX tokens.

These BFX tokens were issued as a placeholder for Bitfinex account holders who received a haircut of 36% when 119,756 BTC was stolen from Bitfinex on 2 August 2016.

Back in January I sold my remaining BFX tokens for .55 USD per token. If I had held onto them today I would have gotten 1 USD per token.

With the benefit of hindsight that was not the best call.

However, it’s pointless to evaluate a decision based on information that wasn’t available at the time. I don’t think I could have known that Bitfinex was going to aggressively redeem the IOUs at such an accelerated pace.

With that in mind I made the best decision I could with the information available to me at the time.

by John | Mar 21, 2017 | Cryptocurrency, Currencies, Learning from Mistakes, Personal Journey

I wrote back in June of 2016 in an article Ethereum Cloud Mining is Not Profitable. Today is exactly 1 year since I purchased an Ethereum cloud mining contract at Hashflare.io. As I recapped in that article:

In order to simply break even ETH would need to trade up to around 18.7 USD.

I would also be better off if I had just bought ETH.

That article was written about 3 months after I had made the investment in Ethereum Cloud Mining.

I wish I had done the in depth analysis in that article before I made the investment in Ethereum Cloud Mining so that I would have known not to make the investment.

And that is the lesson I learned:

Perform your due diligence before making an investment!

An artist’s representation of how I envisioned Ethereum Cloud Mining would go

I attempted due diligence but I did not consider all the relevant facts. These relevant facts were available to me at the time if I had known to look for them.

Since my mining contract is up I want to recap what actually happened with the benefit of all the facts.

The main beneficiary of my bad experience is anyone who is newly considering Ethereum Cloud Mining: caveat emptor.

There might be other cloud mining services out there that are profitable but in my experience Hashflare.io was not one of them.

Ethereum Cloud Mining Recap

On 21 march 2016 I spent $561 for a cloud mining contract at Hashflare.io. Ethereum was trading at $10.81 at the time. In the one year of mining I mined 41.27 Ethereum. As of writing Ethereum is currently trading at $42.6.

Source: http://coinmarketcap.com/currencies/ethereum/

So that 41.27 Ethereum would be worth $1,758 if I had held onto all of them and then sold today.

This is a $1,197 gain which sounds nice but it really isn’t and I’ll explain why.

Why a $1,197 Gain Wasn’t Very Good

But what if the price of Ethereum had not gone up 294%?

An artist’s representation of how Ethereum Cloud Mining actually went

What if it had stayed the same price of $10.81. Those 41.27 Ether I mined would be worth just $446.

What does that mean?

It means: The gain was entirely due to the increase in the price of ETH–the mining itself was not profitable.

In fact, if I had taken $561 and just purchased Ethereum directly, I could have acquired 51.89 Ethereum, which at current prices of $42.6 would now be worth $2,210 or a gain of $1,649.

So other than sounding cool Ethereum Cloud Mining through HashFlare.io provided no value.

The Problem with my Analysis

The downfall of my analysis when initially evaluating the investment in Ethereum Cloud Mining was assuming linear growth in hashing power of the Ethereum network.

I explain this in more detail in my original article and I also provide a process for making more accurate predictions wether a cloud mining contract will be profitable or not. Using that process I predicted I would mine about 30 ETH.

This prediction was much closer to what I actually mined compared to the 120 ETH predicted using static models.

It was a tough lesson to learn but thankfully the amount at risk was relatively small at $561.

by John | Jan 15, 2017 | Learning from Mistakes, Monthly Income, Passive Income

Bitfinex was hacked back on 2 August 2016. About 36% of Bitfinex holdings were stolen. All Bitfinex account holders took a 36% loss and were issued one BFX token for each dollar-equivalent in value that was lost.

BFX tokens are basically “IOUs” specific to Bitfinex. I was issued the 313 BFX tokens since I had lost 313 dollars.

BFX tokens were then made tradable and the price plummeted from a 1 to 1 parity with the dollar down to a fraction of a dollar.

This enabled folks to close their BFX tokens and get some of their money back immediately. Or they could choose to hold onto the BFX and wait for Bitfinex to raise capital to make good on these IOUs.

I was fairly upset for a while about this hack and my loss. I withdrew the remaining 64% of my holdings from Bitfinex and I didn’t login to Bitfinex for a while.

But one of my readers informed me that he was going to be investing some more money in margin funding at Bitfinex and that got me interested again.

Plus I still had 313 BFX tokens sitting in my account.

BFX Redemptions are Slow

About a month after the hack, in September 2016, Bitfinex started redeeming BFX tokens for dollars at a 1 to 1 parity. They essentially began making good on the IOUs they’d given out.

I received $17 in BFX token redemptions between 1 September 2016 and 7 January 2017. Bitfinex most recently redeemed 2% of all outstanding BFX tokens on 10 January.

I calculate that if it took four months to get $17 back it will take over six years to get the rest back.

Because the rate of redemption is so slow I sold my BFX tokens for dollars at a rate of .55 USD per token.

I’ve started margin lending using these dollars.

Why go back to Bitfinex after their security breach cost me 36%?

My thought process is that Bitfinex was hurt so much by the last hack that they are hyper-vigilant now. They’ve implemented additional security features such as two-factor authentication and offline, cold wallets.

Bitfinex is the only game in town I’m aware of that allows users to do margin funding.

And I want to recoup my losses. As of writing the “Flash Rate of Return” for margin funding is .07% per day. So based on my calculations I should be able to get back to $313 in about 3.5 years.

That is assuming the FRR stays at or above .07% per day. Hopefully it goes up.

Bitcoin is Volatile

Bitcoin Price Projection Diagram

I think margin funding is a great way to take advantage of the popularity of Bitcoin without the exposure to BTC price fluctuations.

BTC is volatile which is something that traders like.

In January Bitcoin started around $950 went up over $1,100, then back down to roughly $800.

Do These Price Fluctuations Matter?

If I believed Bitcoin was a great long term holding I don’t think I would care about these price fluctuations. A big run-up would be a time to take some money off the table and a big drop might be a time to increase my holdings.

Some people like holding BTC and believe it will go “to the moon” but I am somewhat skeptical of Bitcoin as a currency and I don’t know that BTC will be valued higher 10 or 20 years from now than it is today.

I prefer gold over Bitcoin because it has a 3,000 year history of being valued; but as I’ve said before, you can own both (I do). I just choose to own much more gold than Bitcoin.

I still like Margin Funding

By being a margin lender (in my case with USD) I’m not exposed to Bitcoin price changes and there is a set rate of return each time funds are lent out. From a market perspective there is no BTC price risk.

There is USD debasement risk. But the main risk, as I learned, is hacks.

There is also counter-party risk but I believe Bitfinex to be a reputable company.

Of course I wish they had better security so they never got hacked in the first place but I think they handled the situation fairly well and have taken a lot of steps to increase security.

It is too bad for that folks in US are not eligible to buy BFX tokens (if I recall correctly they were selling for .33 USD at one point and are now at .59, that would have been a good trade).

Citizens of the land of the free were also not eligible to partake in the BFX token-for-equity-programs–onerous US regulations are to blame for these restrictions.

I discuss the benefits of margin funding in more detail in my article Margin Funding to Generate Passive Income. I do think that it is a market-safe way to grow wealth, but the risk of future hacks is not something to be taken lightly.

If you do decide that signing up for a Bitfinex account is right for you, use this link: Bitfinex.