As expected the Bitcoin Hard Fork occurred around 12:20 UTC today. A new cryptocurrency, Bitcoin Cash (BCH or BCC depending on the exchange) was born. It shares the same history as Bitcoin up until today in what I’ve already referred to as a modern day Ship of Theseus paradox.

So which Bitcoin is the real Bitcoin? BTC continues with a similar price as before and Bitcoin Cash was a new node to begin with so certainly Bitcoin remains bitcoin.

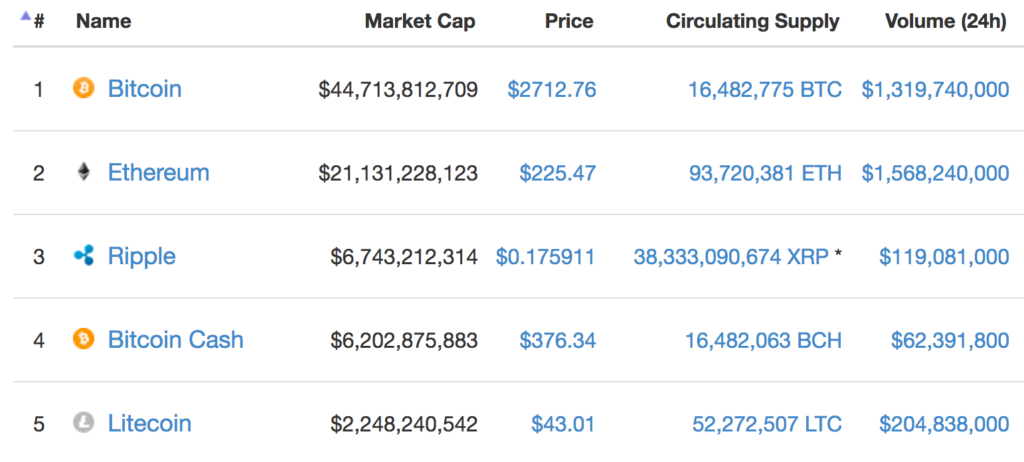

But it’s another example of how a brand new cryptocurrency, one which a current market cap of over $6 billion, can be created seemingly out of thing air.

I understand that Bitcoin Cash has the support of some miners, and work went into the technical changes (it has a larger block size, in an attempt to overcome some of Bitcoin’s scaling issues). But is it really worth $6 billion?

Source: coinmarketcap.com

The market seems to think so and that is all that matters in the present.

In the short term each BCH is trading for around $375 as of writing. My plan, which I previously shared, worked flawlessly.

Upon hearing about the hard fork, I moved my Bitcoins from an exchange that did not support BCH, to an exchange that did. When the fork happened I retained my original Bitcoins, but was also awarded an equal amount of Bitcoin Cash. I doubled my Bitcoins! (Sort of) The original Bitcoin is still trading around $2,700 and as stated above the new BCH I receive are only worth $375 each.

Learning from Past Mistakes

This is an example of how I was able to learn from a past mistake to benefit.

I missed out on coins resulting from when Ethereum forked. The place where I had my coins, hashflare.io, famous for unprofitable cloud mining, did not support the fork. I wasn’t about to let that happen again. If I’d been on an exchange that supported Ethereum Classic, or had my Ethereum in a wallet where I controlled the keys, I could have received 1 ETC for each ETH I held.

Cryptocurrencies are Inflationary

As I’ve written about before, one of the things that I dislike about cryptocurrencies is that there are no natural limits on the supply. Bitcoin Cash is a perfect example. Sure, the number of Bitcoins (BTC) did not increase, but a coin very similar to BTC, albeit with less network hashing power and some technological differences, was created, which in some sense doubles the amount of Bitcoins in existence.

Playing the Fork

The market doesn’t seem to care about the Bitcoin hard fork, BTC was trading up near around it’s all time high of $2,910 the day before the fork and is still at $2,700.

One could theoretically have purchased 3 BTC right before the fork for $2,900 each ($8,700 total). Then the fork happens, and the person gets to keep their 3 BTC and also gets 3 BCH, each worth $375 ($1,125 total). The price of BTC then falls to $2,700. So one would have lost $600 total on the BTC, but gained $1,125 on the BCH, for a net of $525. Not bad. That’s a 6% increase over just a few days.

Easier to talk about with the benefit of hindsight, but if someone is already holding Bitcoins, there is no financial risk to being a position to get the newly created cryptocurrency.

Long Term Problems

The market doesn’t seem to care about the Bitcoin hard fork, it was trading up near around it’s all time high of $2,910 the day before the fork and is still at $2,700. But in effect 6 billion USD worth of value was created out of thin air. Over the long term this simply isn’t sustainable. Is the price really coming from new money buying up BCH as the future cryptocurrency? It seems unlikely. The supply of cryptocurrencies continues to grow and Bitcoin Cash is only the latest example.

I’ll continue to hold various cryptocurrencies as a speculation that one or more takes off (even more) and reaches widespread adoption but as a long term investment I think it remains very risky.

Hi

Great articles, thanks for sharing them, though they were really useful.

Keep up the good work.

Tim Titchmarsh

DeckchairTrader

http://www.deckchairtrader.com