by John | Apr 30, 2017 | Investor Mindset, Investor Psychology, Personal Journey

Taking the right steps to be successful is important. The right activities, actions, and attitudes are vital to success in all areas of life. Doing the right things is important. But it is almost just as important to avoid doing the wrong things.

And in order to avoid doing the wrong things that often means saying ‘no’.

Saying ‘no’ to thoughts, investments, invitations and anything else that isn’t going to bring people closer to their goals.

Saying ‘no’ is an important skill.

Saying ‘no’ to Some Demands on your Time

There are only 24 hours in a day and there are a myriad of competing obligations and demands on one’s time and attention. It’s important to reject those things that will prevent someone from being successful.

For example saying ‘no’ to staying up late because you need some extra sleep for an upcoming week that you know will be challenging. Maybe it’s saying ‘no’ to watching TV so you can read a book or learn a new skill. It could be saying ‘no’ to going out with friends if you should be spending that time doing other things. Or perhaps it is saying ‘no’ to spending money on something new that you don’t really need.

By saying ‘no’ to things that take you further away from your goals you can say ‘yes’ to those things that will help you achieve your goals.

Saying ‘no’ to Some Investment Opportunities

It’s important to say ‘no’ to mediocre or bad investing opportunities. When I was previously trading options I wasn’t always patient in waiting for the right setups, with the right combination of high implied volatility and option pricing. I needed to say ‘no’ to more of the bad option trades so I could make more profitable option trades.

It’s worth saying ‘no’ to investment opportunities that aren’t right so that one can pounce on the right investments.

Saying ‘no’ to Negativity

Attitude isn’t everything but attitude is still vitally important.

It is amazing what a change in attitude can do to even in the most horrific situations.

Being positive is something in it’s own right, but it’s also important to say ‘no’ to negative thoughts.

I find identifying negative thoughts I’m having, and working to replace them with positive thoughts is extremely helpful. It’s not suppressing negative thoughts, it’s realizing they are there and trying to find ways to reframe or re-evaluate a situation so that the negative thoughts are replaced by more healthy, realistic and positive thoughts.

Saying ‘no’ to negative thoughts can help foster a positive attitude.

I rarely enjoy saying ‘no’, wether it’s declining an invitation from a friend because it would interfere with something more important or not watching another episode on Netflix on Saturday because it’s time for me to go exercise. But it’s important to be able to say ‘no’ sometimes so that one is free to say ‘yes’ at the right time.

by John | Apr 23, 2017 | Cryptocurrency, Learning from Mistakes, Passive Income

Today I wanted to cover how to calculate cloud mining profitability. I had a recent comment on my article: Ethereum Cloud Mining is not Profitable that I’m concerned perpetuates the kind of static analysis that will cause someone to lose money on cloud mining.

I’m going to do my analysis for Ethereum Cloud Mining. However, this analysis will work for any coin that has increasing mining difficulty.

Assumptions: I’m assuming the price of ETH is static. Why? Because if it goes up, that is simply a bonus. If mining isn’t profitable unless the currency goes up, then one is better off buying the currency outright.

Step One of How to Calculate Cloud Mining Profitability

First you need to know how much the cloud mining will cost per unit of hashing power. As of 23 April 2017 Hashflare.io is selling 100 KH/s for 2.20 USD. That is 1 MH/s for 22 USD.

Use a static calculator first. This will provide the baseline static analysis. For Ethereum I like this calculator.

As of writing there is a network hashrate of 22595.62995398704 GH/s, a blocktime of 13.31 and one ETH going for 48.63 USD.

So with 1 MH/s I would earn 0.043093 ETH per month, worth 2.10 USD per month. Multiply that by 12 and the total ETH mined (0.517116) would be worth $25.2.

So if the price of ETH stays the same (which for the purpose of the static analysis we will assume it will), and the network hashing power stays the same. Then the profit will be $3.2 after a year IF THE NETWORK HASHING POWER STAYS THE SAME. The problem with a static analysis is that network hashing power does NOT stay the same.

Network Mining Difficulty Goes Up

If you stop with this static analysis you’ll surely lose money though. Why? Because the network hashing power has historically gone up and gone up A LOT.

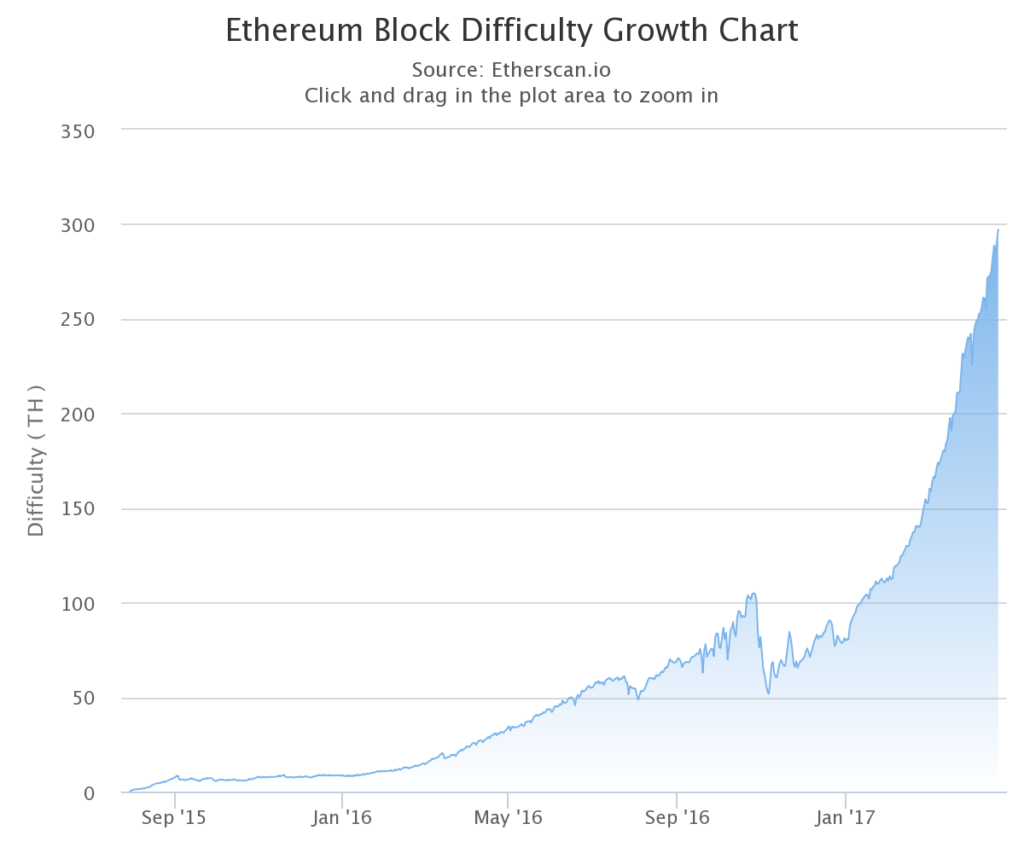

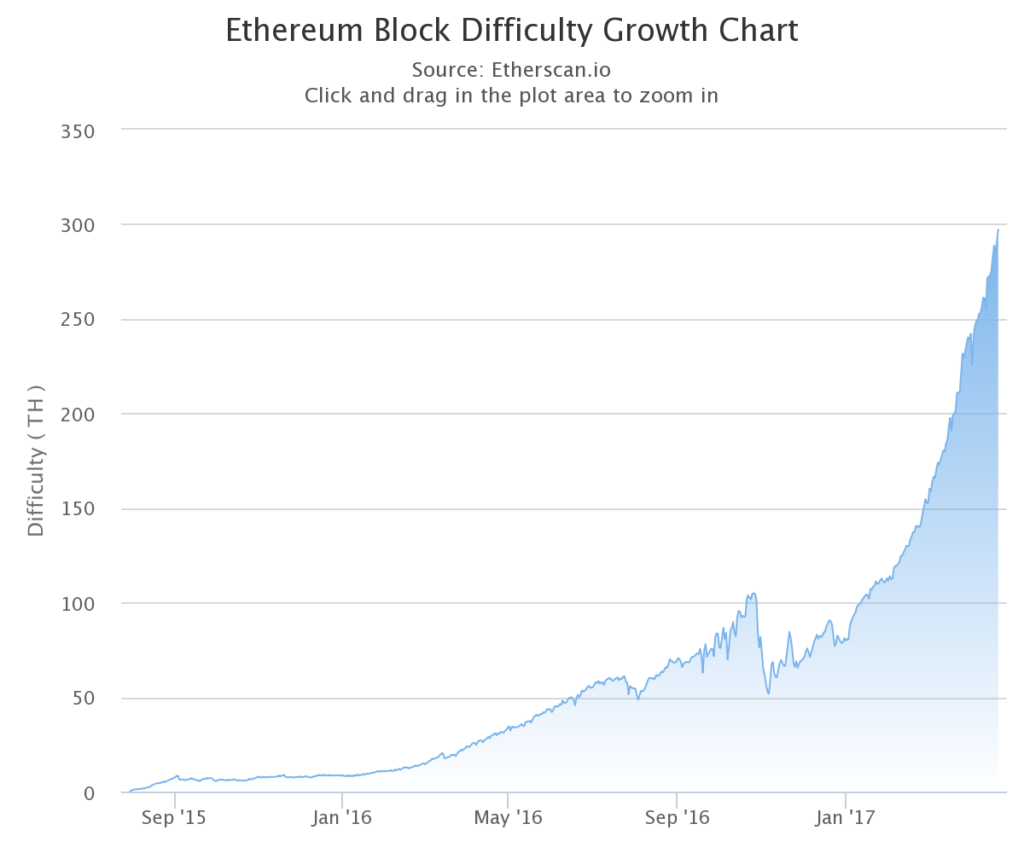

Ethereum Block Difficulty Growth Since 30 July 2015

In the first four months of 2017 alone, mining difficulty for Ethereum has gone up over 200% from under 100 TH/s up to nearly 300 TH/s. Which means the amount of ETH mined for anyone with fixed hashing power will have been reduced by over 66%.

Factoring in the growth rate of block difficulty is the most important factor when determining cloud mining profitability.

Step Two of How to Calculate Cloud Mining Profitability

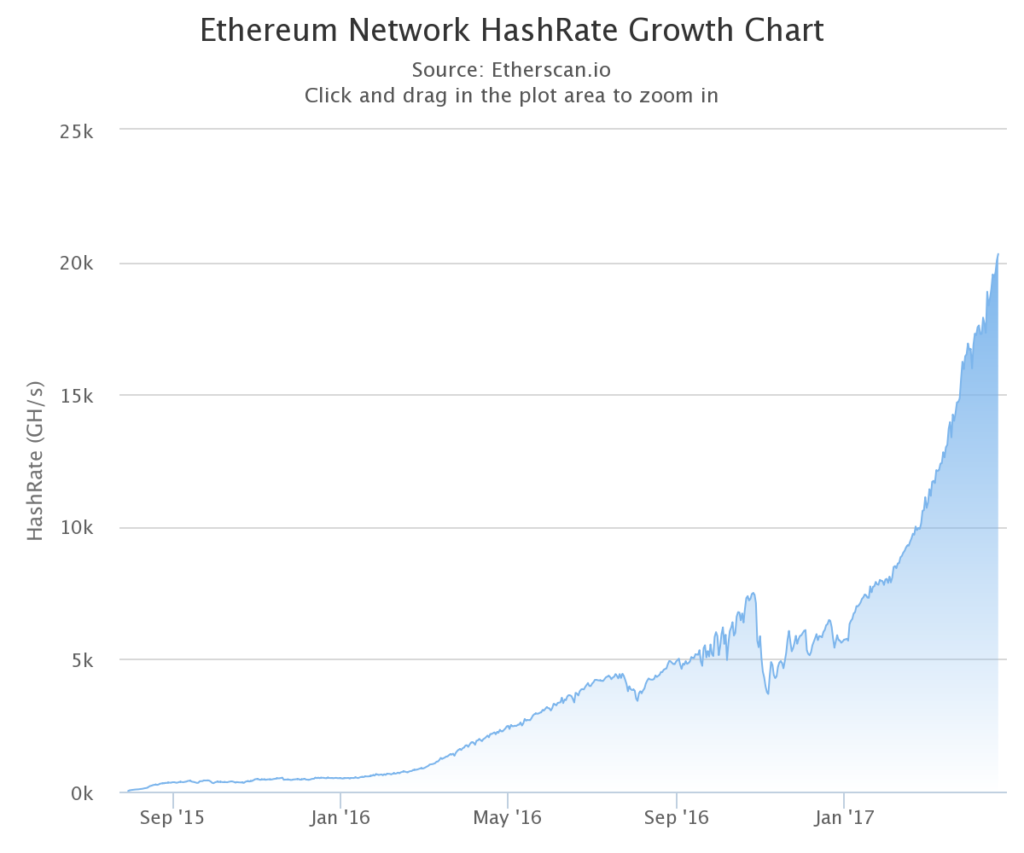

Projecting how much the network hashrate will increase over the life of the cloud mining contract is vitally important. You need to make a realistic estimate of how the network hashrate will increase because it will reduce the amount you get from mining each day.

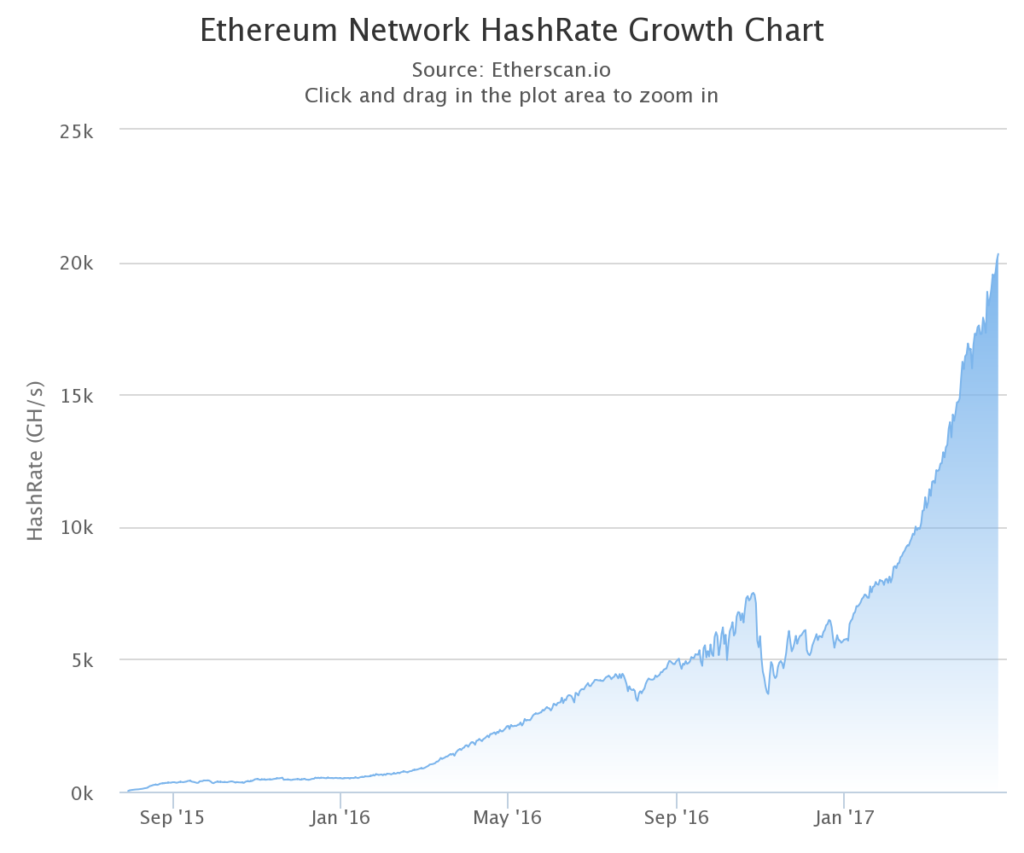

The chart above shows the Ethereum network hashrate growth. In this example, Hashflare.io contracts run in 12 month increments. So we need a realistic estimate of how much the hashing power (and thus mining difficulty) will go up over a 12 month period.

This takes some guesswork but the best indicator is the past.

The August 2015 hashrate of 55 GH/s to the August 2016 hashrate of 3,811 GH/s represents a 6,800% increase. This was the first 12 months of the Ethereum network coming online so I think this number is too high.

In 2016 the Ethereum network hashrate went from 511 GH/s to 5,700 GH/s. A 1,015% increase.

From April 2016 at 1752 GH/s to April 2017 of 20,300 GH/s was a 1,058% increase.

So I based on 2016 I think a 1,000% increase in hashing power is a good conservative guesstimate. That means the hashing power would be around 230,000 GH/s by April of 2018.

So then we follow step 1 again using the static calculator. Using the 1 MH/s and a network hashrate of 230,000 GH/s. The monthly ETH mined would be 0.004233 worth $.21.

Step Three of How to Calculate Cloud Mining Profitability

So at this point we have a projection of how much we’ll get from mining in the first month. And how much we’ll get in the last month. These are just a projections based on a static analysis and a guesstimate of where mining difficulty will be in the future.

But the amount mined doesn’t jump down from the first month to the last month. The amount mined is slowly and steadily decreasing.

I think a exponential decay model fits the data better but for the sake of ease I think a linear model will suffice.

I also think a simplified method works because the cloud mining rates I’ve seen are not close to what they would need to be for mining to be profitable.

Take the amount we think we’ll mine in the first month. In this case .043093. Then take the amount we’ll think we’ll mine in the last month, .004233. Subtract the first from the last. Then divide that by 11.

From that point you take the starting value of .043093 subtract the decay amount .003943 to get the second months value of .039149. You do this again until you get to month 12. By summing up each month’s value we get 0.283956. Multiply that by the price of ETH of 48.63 USD and we get $13.80.

The contract in this example cost 22 USD so this would not be profitable if the network hashing power goes up by 1000% (as it did in 2016) and the price of ETH stays the same.

You’d end up losing $8.2.

Okay, what if the network hashing power only goes up 500% so it goes up to 135,600 GH/s after one year? You’d mine about .3 ETH worth $14.66. You still lose.

What if the network hashing power only goes up 100% to about 45200 GH/s? You’d mine about .387 ETH worth less than $19. Loser.

What if the network hashing power only goes up 35% to 30,500 GH/s. You’d mine about .45 ETH worth $22.88. Small winner.

If Network Hashing Power Goes Up You Start to Lose

So what I hope this shows is that if the hashing power goes up, which in the case of Ethereum (and I suspect most coins as well) the amount of coins mined will drop and the profits will be eroded.

Easy Method

If you believe network hashing power will continue to go up then use this method to determine if mining is even worth a closer evaluation: use the static mining profitability calculator. Use the amount of ETH mined and the cost of the mining contract to see how much you’re effectively paying per ETH.

For example Hashflare.io is selling 1 MH/s for 22 USD for a year. That would yield 0.043093 ETH per month x 12 would be 0.517116 ETH for the year mined if the network hashrate stays the same. So the cost per ETH would be 42.54 USD. With ETH trading at 48.63 USD that is only a 14% discount over a year.

Unless you’re going to get ETH (or whichever other coin) at a significant discount using the static calculation (say 40-50% below spot price). It’s not worth it.

But the Price of ETH is going to double!

Great! Then buy ETH directly. Lets say the price of ETH does double in a year. It goes from 48.63 USD today up to $97.26. You could have bought $22 worth of ETH (.45 ETH) and the $22 worth of ETH would now be worth $43.76.

With a 1000% network hashrate increase you’d have only mined 0.283956 which would be worth $27.61. Unless the mining is profitable with the price of ETH fixed, you’re better off owning the currently directly even if the price of the currency goes up.

At what price would cloud mining be worth it?

As of today 23 April 2017, based on a 1000% increase in hashing power over the next year I would not pay more than around $7 for 1 GH/s of hashing power.

Based on my projections that would yield about 40%. Given the risk and volatility in cryptocurrencies I would need to see that kind of return for it to be worth the risk to me.

With 1 GH/s costing 22 USD, if the network hashing power stays the same I would still only make about 15%. Given the history of network hashrate increases that isn’t worth it.

Hashflare.io is nowhere close to $7 per GH/s. Genesis Mining offers 1 GH/s for 2 years for 29.99. Who knows where the network hash rate will be in 2 years.

Some People Claim Cloud Mining is Profitable

I have read testimonials from people who think cloud mining is profitable. My main question would be is it profitable because the underlying cryptocurrency went up, or because the mining itself was profitable? In other words would you have been better off just owning the cryptocurrency directly?

by John | Apr 23, 2017 | Interview, Investor Mindset, Investor Psychology, Value Investing

I’m very excited to be sharing this interview with Jason Rivera, a man who in his first five years achieved better returns than Warren Buffet did in his first five years. Who is Jason Rivera? Let’s get into the interview and you’ll find out!

John: Can you provide some background on yourself and Rivera Holdings for those who aren’t familiar with you or your company?

Jason Rivera, Chairman, CEO, and Founder of Rivera Holdings Investment Holding Company

Jason: Yes. I’m a self taught value investor who focuses on small and obscure public companies to buy for my investors. And I’m now also looking for private businesses and cash flow producing real estate to buy as well.

I’m the author of the acclaimed value investing education book How To Value Invest. Have run the blog Value Investing Journey for more than five years now. Wrote a 60-page booklet detailing the immense power of investment float that I released for free to readers of my blog and followers – on Twitter and Facebook – titled All About Float. Have written for several publications and investment newsletters including: Seeking Alpha, Guru Focus, Insider Monkey, and Palm Beach Research Group among others.

I mentor others on how to become great value investors, consult on projects requiring business analysis and valuation skills, and run my investment holding company Rivera Holdings LLC. out of the Tampa Florida area.

John: When you were a kid did you know you wanted to grow up to be a value investor?

Jason: Ha 🙂 no. I don’t have any stories like Warren Buffett where he was buying things at wholesale prices – gum if I remember right – and then selling them at a higher price to his classmates as a kid.

Unfortunately, I was far more interested in playing sports, chasing girls, and playing video games than investing when I was a kid.

I always knew I wanted to make money, start businesses, and help people but the value investing part and putting effort into making those things happen only began happening in my late teens and early twenties.

John: Why do you favor value investing as opposed to momentum investing, a passive asset allocation approach or another strategy?

Jason: I don’t remember what first drew me to value investing but once I read about it I knew it was the strategy for me because it made total sense immediately.

I agree with value investing greats like Seth Klarman and Warren Buffett that to some degree having an affinity for value investing has to be genetic.

I never wanted to get into momentum trading because I have a long term mindset – decades not days, weeks, or even years – so that or any other kind of trading never made sense to me.

I’m terrible at predicting things into the future so macro investing was out. And I like the challenge of finding great companies so I would have gotten bored with passive investing and never done it for a long time.

John: I’ve written about the value investing metrics I use. Some of metrics I look at are the result of what I’ve learned from you. I’d be interested in getting your feedback on my approach.

Jason: First of all thanks so much for letting me know some of the content I’ve written helped.

Sitting alone in front of my computer all day reading filings and asset information, or talking with people through phone or internet makes it challenging to know if what I’m doing helps. So thanks a lot.

Everything looks great when it comes to some of the metrics you look at but I do have one quibble…And this is a personal preference so do whatever works best for you.

I prefer owner’s earnings to owner’s cash profits because OE includes working capital while OCP doesn’t. And since I focus more on the balance sheet side of things – at least to start – I find this more useful.

John: It’s clear form your book and website you spend hours and hours analyzing companies before you invest in them. Do you have a process to screen out certain stocks at a higher level so you can deep dive into a specific company?

Jason: I go into great detail on this question with an answer I wrote on Quora to the question: Is there a faster, simpler, more conclusive way to research stocks?

For those who don’t want to read that I’ll give a quick summary below:

First off, I don’t use any screeners when looking for companies to research now and instead rely on my processes and lists to find companies.

I find any lists I’m interested in – ADR list, country list like Brazil or Indonesia for example, or a list of all the OTC companies – and then do preliminary analysis based on my requirements and preliminary checklist. This can be downloaded for free by signing up to mailing list on my blog.

After this, with any companies remaining I do quick “back of the envelope” valuations.

The ones that are overvalued go on a watchlist for later research. And those that are undervalued or fairly valued I do further research on.

For those that are undervalued or fairly valued I then go to both Morningstar and the company’s website to download its most recent annual report, quarterly report, proxy form, and any recent investor presentations.

I read all these, take notes, and if I find too many red flags discard the company.

On the other hand, if the company still looks promising I then revalue it using all the new information.

This is especially important at this stage because now you have a great idea of what the company does, if it has any competitive advantages, if there are any hidden assets, etc.

For any companies that remain promising I then research any competitors for the company. Get all their most recent financials. Take notes on them. And build a spreadsheet of profitability metrics and relative valuations so I can compare them against each other.

If the company still looks good from here I’ll then look for any recent news and developments to consider in my analysis.

At this point I’ll also read and take notes on the company’s financials going back five to 10 years. I’m also looking for things here that could blow up my investment thesis as well.

At this stage if one of the original company’s competitors looks better I’ll begin full research on that company instead of the original one.

After gathering everything, I then begin to write my investment thesis down. These usually end up being between 20 – 50 pages.

This helps me spot any errors in my investment thesis or thought processes. And it’s also valuable so you can go back to see where you made any mistakes or to see what your analysis and reasons for buying the company was months or years from now.

By the time I’ve finished doing all this research, writing, and editing I’ve put well more than 100 hours into researching one idea and its competitors.

The more I learn the more I add as well so this time is a lot closer to 200 hours total now for one idea potential idea.

The beginning of the process helps me weed out the crap companies fast. And the middle and end of the process helps make sure my investment thesis is still sound, while also helping me identify any potential risks or missing thoughts in the thesis.

I analyzed my data a few years back and found I invested in less than 1 out of every 500 companies I researched.

With more experience, knowledge, and refinement of my processes this number is now likely between 1 out of every 750 – 1,000 I end up buying.

But all this work is paying off.

By implementing this strict process I make far fewer mistakes than I used to.

Through the first five full years of my investment career I’ve produced returns of 29.2% for investors – on average not compounded – every year. This is better than the 25.4% Buffett produced in the first five years of his career on average.

John: What Inspired you to write “How to Value Invest”?

Jason: I wanted to help people not have to go through the often times painful, long, and frustrating experience I did in the first several years of learning about value investing.

I wasn’t able to go to a university because of severe health issues at the time. I didn’t have a mentor to guide me in the right direction. And for the most part other than asking questions here and there from other value investors online, had to figure everything out myself.

While this was a great learning experience, and even if I could go back I wouldn’t change anything. I wrote the book to help others avoid the years of wasted time and frustration I dealt with while beginning to learn.

John: This is probably an unfair question, but I’m going to ask it anyway, how do you go from dedicating yourself to being an excellent value investor in February of 2012, to going after an $8 million acquisition as CEO and Founder of Rivera Holdings roughly four years later?

Jason: It’s not an unfair question at all. And I actually think it’s a good one.

Several friends asked me the same thing – or said people they told about the potential deal asked them the same thing after they told them about my age and experience.

For reference, as I queried investors to raise the money for the acquisition I was still 29. I turned 30 in December of 2016 after the acquisition failed. And at that point still had yet to finish my fifth full year of being a serious investor.

I’ve studied and practiced investing for almost 10 years now but the bulk of the first five years were wasted to some degree through the process trial and error learning and frustration I mentioned above.

So what the hell at age 29, with less than five full years of serious experience under my belt as an investor without a degree from somewhere like Wharton or Columbia Business School made me think I can do an $8 million acquisition?

It’s a good question… But I think an even better one is; why not go for it?

I believe anyone can become and do great things if they’re willing to work and put in the time and effort to learn a valuable skill.

At the end of my career I want to be known as the best investor, businessman, and capital allocator ever. Yes, even better than Warren Buffett.

Is this likely, I know the answer to this is no.

But I’ve always shot for the stars… No one ever says they want to be the tenth best investor ever, or the fifth best quarterback ever, or the second best golfer ever, etc.

To do great things I believe you have to have huge goals you can work towards and then do everything in your power to work towards those goals.

So why not start by going after an $8 million acquisition?

Could I have started going after a $100,000 company? Yes. Would it have been far easier? Definitely. But would $100,000 change my life drastically and allow me to help other people change their lives for the better? No. At least not to the degree I want to help.

Why put limits on your potential, the money you make, and the amount of people you can help?

The saying: “If I could just help one person that’d be enough” has never made sense to me. If you can help one person you can help hundreds, thousands, millions, or even billions. Why stop at one?

This mindset makes even less sense to me after listening to the audiobooks of The 10X Rule and Be Obsessed or Be Average – both by Grant Cardone.

Like I said above I want to help as many people as I possibly can. But to do that requires great sums of money. And to have great sums of money I need to go after big targets.

I’m working towards that. And it just happened that when I began looking I found an $8 million company to go after that was a great business.

Did I plan this when I started looking, no. But again, why not go after it if it’s there?

If I went after a $100,000 target and completed the acquisition I would have a $100,000 company but not learned as much in the process, gained as much experience, or grew my connections like I did and continue doing.

I’d rather fail huge but still make massive progress towards my goals then set small goals, reach them, and still be disappointed by not doing what I truly want to do.

But by doing and going after big things negativity creeps in so if you go this route you need to be prepared.

Below are some of the negative things I’ve heard since going after that acquisition.

- He’s crazy.

- Who the hell is he to think he can go after an $8 million acquisition?

- Why the hell are you going after an $8 million acquisition? This was one of my own thoughts at the beginning of the process by the way so this isn’t limited to others thoughts.

- Why are you going after such a big target to start? Again, one of my own thoughts.

- Can you pull this off?

- What if you fail?

- What if you succeed? This question came after someone questioned my experience running this size of a business.

- You’re so young still, why not take your time and start slow?

- You’re so young still why do you think you can do this?

Something else I learned from Be Obsessed or Be Average is: “If you can, you must.”

I have the skills and mindset necessary to help a lot of people so I feel an obligation to work towards helping as many people as I possibly can.

Something else that will illustrate why I went after such a big target to start and how my goals are intertwined with that is from a post I wrote on Facebook about a month ago which I repost below.

“I know that I have the ability to ACHIEVE the object of my DEFINITE PURPOSE in life; therefore I DEMAND of myself persistent, continuous action toward its attainment, and I here and now promise to render such action.

I realize the DOMINATING THOUGHTS of my mind will eventually reproduce themselves in outward, physical action, and gradually transform themselves into physical reality; therefore I will CONCENTRATE my thoughts for 30 min. daily upon the task of thinking of the person I intend to become, thereby creating in my mind a clear MENTAL PICTURE.

I know through the principle of autosuggestion, any desire that I PERSISTENTLY hold will eventually seek expression through some practical means of attaining the object back of it; therefore, I will devote 10 min. daily to DEMANDING of myself the development of SELF-CONFIDENCE.

I have clearly written down a description of my DEFINITE CHIEF AIM in life, and I will never stop trying until I shall have developed sufficient self-confidence for its attainment.”

– Bruce Lee

This is a perfect reflection of where I’m at and what I work on every day as well.

Something I’ll add to these thoughts is from Grant Cardone’s book Be Obsessed or Be Average – “If you can, you must”

What this combination of thoughts means to me is that because I have the ability to help people throughout the US and world through my knowledge and businesses, I must – at a moral and ethical level – help as many people in my lifetime as I possibly can.

If I don’t do everything in my power every day to excel, work towards achieving my goals, and build great businesses and wealth to help as many people as I can, I’m betraying my deepest moral convictions and ethics. Failing myself, failing my family and kids, and failing those I could help.

Sorry about this long answer but it’s such a great question you asked which leads to a bunch of other questions and answers.

I hope this question and answer resonate with your readers on some level.

John: Is Rivera Holdings open to non-accredited investors?

Jason: Yes it is. If they’re based in the United States and are either US citizens, green card holders, or naturalized citizens.

Unfortunately, I can only accept outside the US investors at this point if they’re accredited.

John: Where can folks go for more information about investing with Rivera Holdings?

Jason: They can visit my website and go to my blog Value Investing Journey for more information on Rivera Holdings. At the following link they can also view The Rivera Holdings Acquisition criteria. And here they can sign up for the Rivera Holdings mailing list where I send out potential deals I’m working on that investors can invest in.

This mailing list is also where I share some of my exclusive past recommendation issues/investment thesis with subscribers.

Thanks a lot for having me on to do this John.

John: Thank you very much Jason.

by John | Apr 16, 2017 | Geopolitical Risk Protection, Preservation of Purchasing Power, Wealth Protection

Starting in October of 2008 gold made a run from 680 US dollars per ounce up to and over $1920 in September of 2011 for a gain of 182% in less than 3 years. Gold traded sideways and down for the next year and a half until April of 2013 when it crashed down to the low $1300s. For the next few years gold trended down in a falling wedge pattern. Gold was negative for years 2013, 2014, and 2015.

The recent multi-year low of $1045 was logged in December 2015 and I believe this price is the new bottom for the gold market.

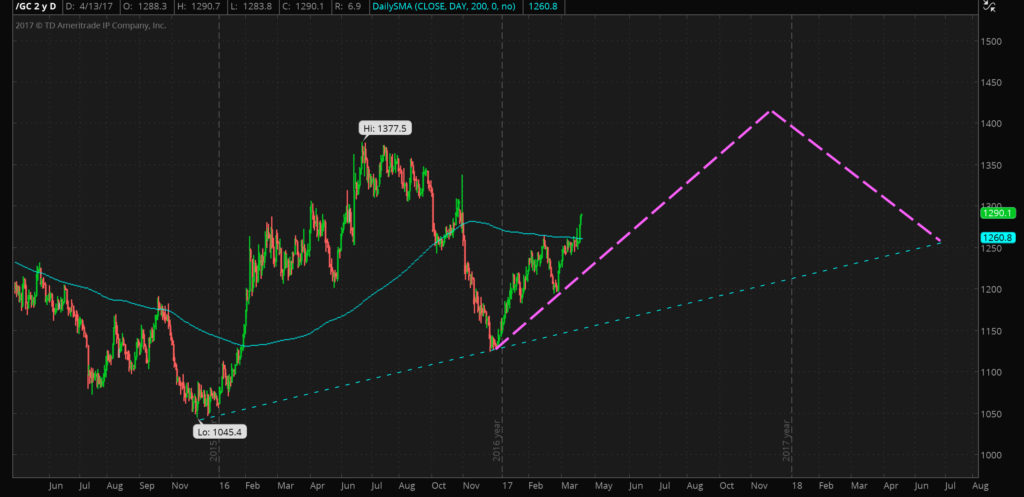

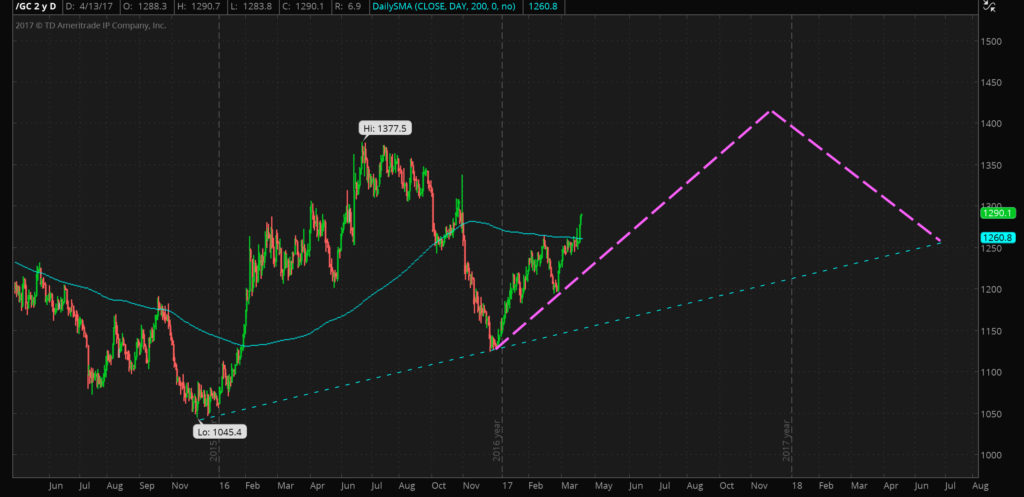

Below is a chart of the gold market with my comments. Click the link if you’re not familiar with reading candlestick charts.

2016 was a positive year for gold even though a lot of the gains were surrendered in November. On the whole for 2016 the yellow metal was up over 9%. It’s my opinion 2017 will continue this trend of gains in extension of a new multi-year bull market.

Gold is up over 11% in 2017. It started the year around $1,155 per ounce and is currently trading over $1,290.

Gold still Undervalued and US Dollars are Overvalued

Despite these positive moves I still believe gold is significantly undervalued at this price.

Why?

Paltry efforts at “tightening” at the United States Federal Reserve notwithstanding interest rates are at historic lows. There is also record debt and unfunded liabilities paired with an unbalanced budget. The United States Federal Reserve balance sheet remains over $4 trillion. Globally interest rates are also historically low and debt is high. There are even negative interest rates in Europe and Japan. Geopolitical risk of war in North Korea and Syria may have caused the most recent bump in precious metals price.

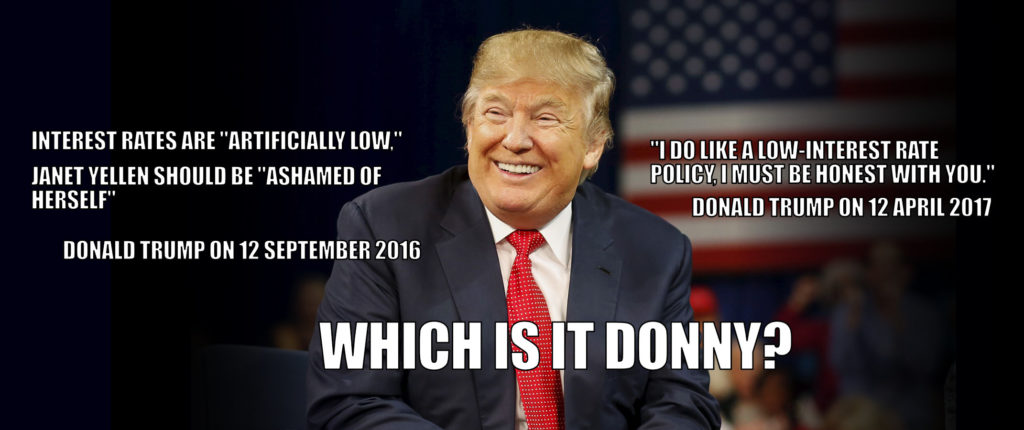

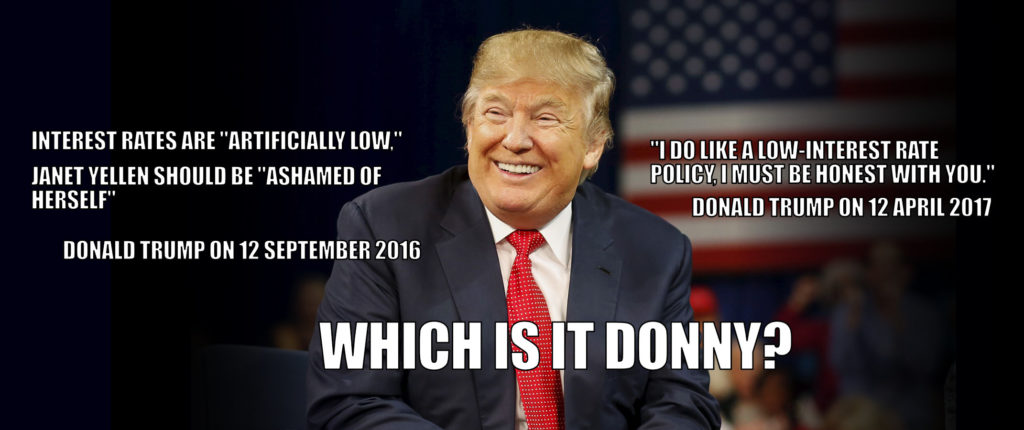

President Trump has recently done a 180 on several issues. He told the Wall Street Journal the dollar “is getting too strong.” He has also warmed to Janet Yellen and has stated: “I do like a low-interest rate policy, I must be honest with you.”

Source: https://seekingalpha.com/news/3256891-trump-talks-dollar-yields-gold-jumps?ifp=0

Source: https://www.wsj.com/articles/trump-says-dollar-getting-too-strong-wont-label-china-currency-manipulator-1492024312

The Recent Past of Gold

Last week gold made a strong move up through the 200 day moving average (the solid light blue line above is the 200 day simple moving average.

My Predictive Guesses as to the Price of Gold

The following are my guesses/predictions as to where the price of gold will move over the next year. I’m not recommending anyone buy or sell gold based on these predictions.

Gold has been trending upward since the December 2015 bottom. I think gold will make a new intermediate high between 1400 and 1425 in the fourth quarter of 2017. From that peak it should drop back down to 1260 sometime in mid-2018 perhaps around June.

Of course if there is another 2008-style crash or a hot war in the middle east then all bets are off.

The dashed purple line is my predictive guess as to the price of gold

Longer term I expect gold to make a new high above $1920 within the next four to eight years.

Although there is no substitute for physical possession of a percentage of one’s precious metals I also think it is vital to have some gold stored offshore.

The most cost effective way to own physical gold offshore, particularly for investors will less capital, is through Goldmoney.

I personally own several grams worth of gold via Goldmoney and I’ve been extremely pleased with the service.

Gold has been valued across cultures for thousands of years. It has no counter party risk and I believe it is an excellent defensive holding.

by John | Apr 13, 2017 | Options, Value Investing

On Tuesday 11 April 2017 one of my Value Stock Picks: AmTrust Financial Services (AFSI) dropped from $18.87 down to as low as $13.65 then closed at $15.30. The catalyst was a Wall Street Journal Article titled “Secret Recordings Play Role in SEC Probe of Insurer AmTrust”.

Source: https://seekingalpha.com/news/3256590-amtrust-knocked-12-percent-secret-tapes

AmTrust Financial Services has been on the rocks anyway after advising that financial statements dating back to 2014 were not to be trusted.

Source: https://www.wsj.com/articles/amtrust-shares-drop-after-admission-of-errors-1489766314

About half of the selloff occurred pre-market

The initial panic selling in these instances is often overdone.

Using Stock Options to Manage Risk

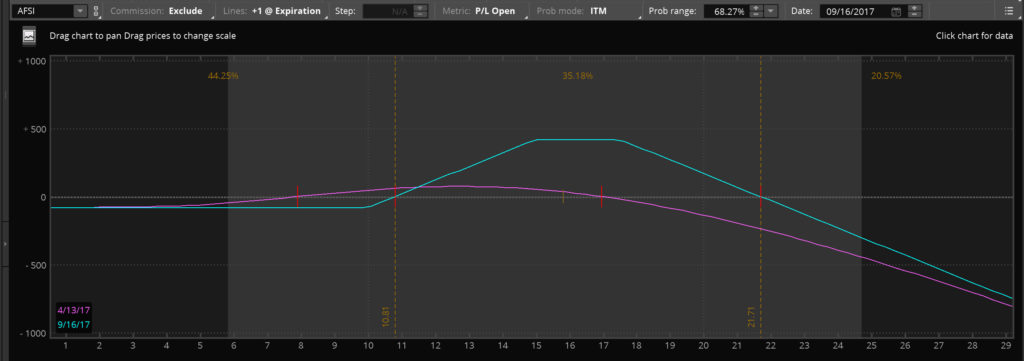

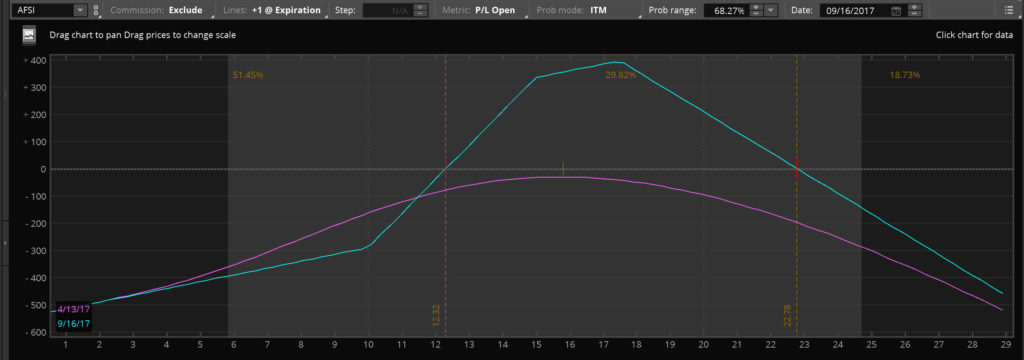

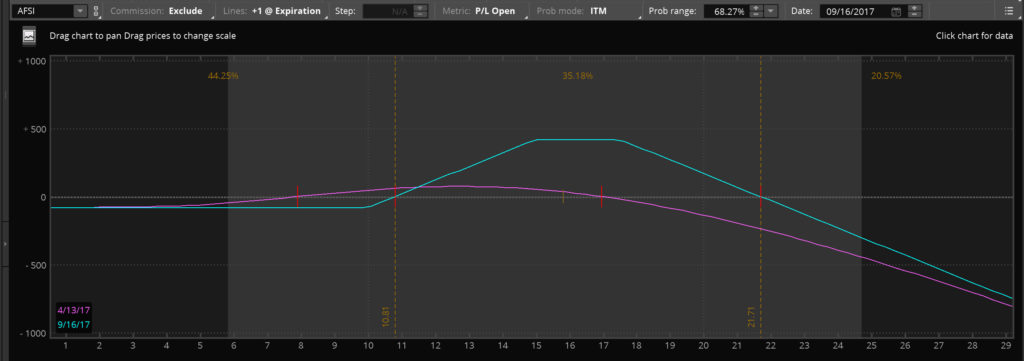

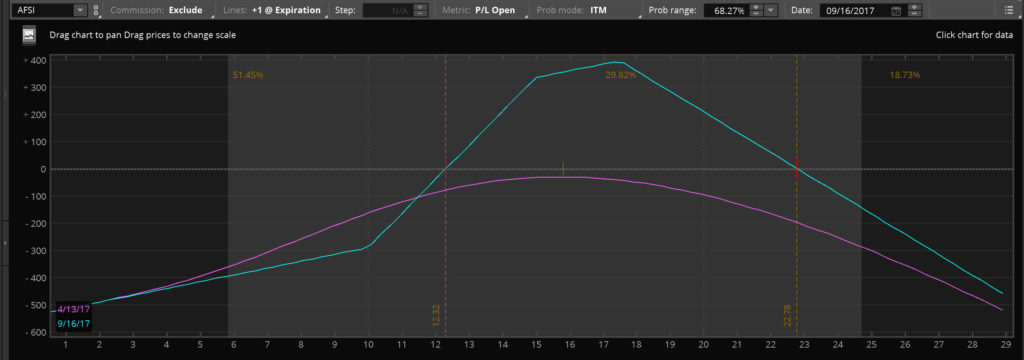

With the implied volatility of the stock so high I decided to sell a vertical bull put spread around noon eastern time. The vertical bull put spread is an option position that makes money if the stock is above a certain price (in my case $12.80) when the options expire.

I sold a 15 put and bought the 10 put with a September expiration. Total credit was $220.

By mid-morning on the 12th AFSI had rallied back to around $16.

On paper I had already made some money on the vertical put spread. I decided to sell the 17.5 September call for $200 in credit. I did this for downside protection. This created a half strangle/half iron condor.

Just looking at the options, my break even point on the downside is $10.81 and on the upside it is $21.74. The option market seems to think there is a greater chance of AFSI going back down as opposed to rising. Currently my position is fairly centered. If AFSI does sell off and start to approach my downside break even I will roll down the call I sold.

My maximum gain is $420 if the stock is trading between $15.06 and $17.40 at expiration in September. I will look to close out this position if I get to 50% of that profit.

I’m currently long 25 shares of AFSI. If I didn’t have the option position and the stock dropped down to say $10, I would be at a paper loss of about $211. With the options the loss at a stock price of $10 would be $160. So by adding options to my stock position I’m limiting my losses and also increasing my potential gains if the stock settles down between $10.81 and $21.74 and volatility drops.

The main risk I have, is if the stock were to really take off above $21.74 before September, I would start realizing losses on the option position, whereas if I was simply long the stock I would be sitting on gains.

Given the large drop and the negative press I think this is unlikely. The September 17.5 call also indicates this is unlikely, with a 25% chance of AFIS being above $19.51 in September. Furthermore, if AFSI would to start to go up significantly, I would anticipate implied volatility dropping and I would probably be able to close out the short call at a small loss or perhaps even a gain.

My overall gain/loss looks as follows.

Obviously using options like this isn’t for the feint of heart. Options used emotionally and incorrectly are a great way to loose lots of money fast.

But in this case I’m actually limiting my risk and increasing safety. If AFSI sells off I reduce my downside risk, if volatility drops and AFSI stays rangebound I make money. The main risk is if AFSI takes off again before September and trades above $22.79. In this case I start to lose money. Based on the option probabilities and recent history I judge this to be an unlikely scenario.

AmTrust Financial has issued a statement essentially denying the Wall Street Journal article’s claims and while I am waiting to hear more this selloff could represent a buying opportunity.

As always this is not investment advice. I’m not advising or recommending anyone buy or sell any security, stock or option. I’m simply sharing what I am doing.