by John | Jan 29, 2017 | Capital Appreciation, Stocks I Like, Value Investing, Wealth Protection

I don’t know how to time the market.

I wish I did.

If I could do marketing timing I would have bought US stocks in in the early 90s (I was pretty young but still!). Sold in early 2000, bought in October 2002, sold in October 2007, bought in March 2009.

That would be fantastic.

S&P 500 Market Timing Guide (Only Available in Hindsight)

Unfortunately I’m only good at timing the market in hindsight.

This of course isn’t useful, since my broker doesn’t let me backdate trades.

John: “[Phone rings] Hello, TD Ameritrade?”

TD Ameritrade: “Yes, this is TD Ameritrade.”

John: “I would like to buy 100 shares of the Vanguard S&P 500 Fund at the 1992 price.”

TD Ameritrade: “….[click]”

In all seriousness though, the above chart does say something about the long-term benefits of buy and hold (but you have to buy and hold for very long periods of time and suffer through large drawdowns).

But I’ve always wanted to do better than a long term buy and hold strategy. I think the best way to do that is through value investing.

US Stocks and Bonds are Overvalued

Today I was reading a MarketWatch.com article by Thomas H. Kee Jr. in which he states, “Ultimately, liquidity matters more than valuation to professional investors, and it is far more important to the market than any of the noise we are hearing.”

I think he is right insofar as what professional investors care about. The performance of US stocks since 2009 bears this out.

This is also supports my belief that US stocks and US bonds are in a bubble, the rise in price of these asset classes is based on liquidity (central bank money printing) and NOT valuations.

But if markets have anything to do with the real economy security valuations will eventually return to a market-based and realistic level of valuation regardless of central bank injections of liquidity.

Let me summarize what I’ve said so far.

1) Stocks and bonds are in a bubble due to central bank manipulation called “liquidity”

2) I don’t know how to time the market

In other words I know that stocks are overvalued but I don’t know when they will revert to a valuation based on company performance and realistic valuation.

So I don’t want to buy stocks that I know are overvalued when I don’t know when they will crash.

Buy Stocks at a Discount

I don’t know how to time markets and I believe US markets overvalued so I take the approach of value investing.

By investing in stocks that are trading for less than their book value I have a built in margin of safety.

That way I have good reason to believe I’m not buying a security that will drop radically in price since a value stock is by definition already undervalued.

I think it’s a great way to grow wealth in good times and bad.

Later this week I’ll be unveiling some additional refinements to my value investing metrics.

[mc4wp_form id=”4538″]

by John | Jan 22, 2017 | Geopolitical Risk Protection, Value Investing, Wealth Protection

For better or worse the President of the United States gets credit (or blamed) for how the economy has performed during his tenure.

How much control does the President have over the economy? In my opinion more than he should have but less than people give him credit for.

Donald Trump was sworn in a couple days ago and there is alternating fear and hope from either side of the aisle about what he will or won’t do.

But as I’ve written before, when it comes to some of the largest systemic issues facing the United States: it doesn’t matter who won.

How has the US Economy Fared under the last three Presidents?

Pals

As part of trying to anticipate how the markets will fare under Trump I was inspired to take a brief look back at how “the economy” performed during the past three presidents’ terms.

Past performance does not guarantee future results but the past is all we have.

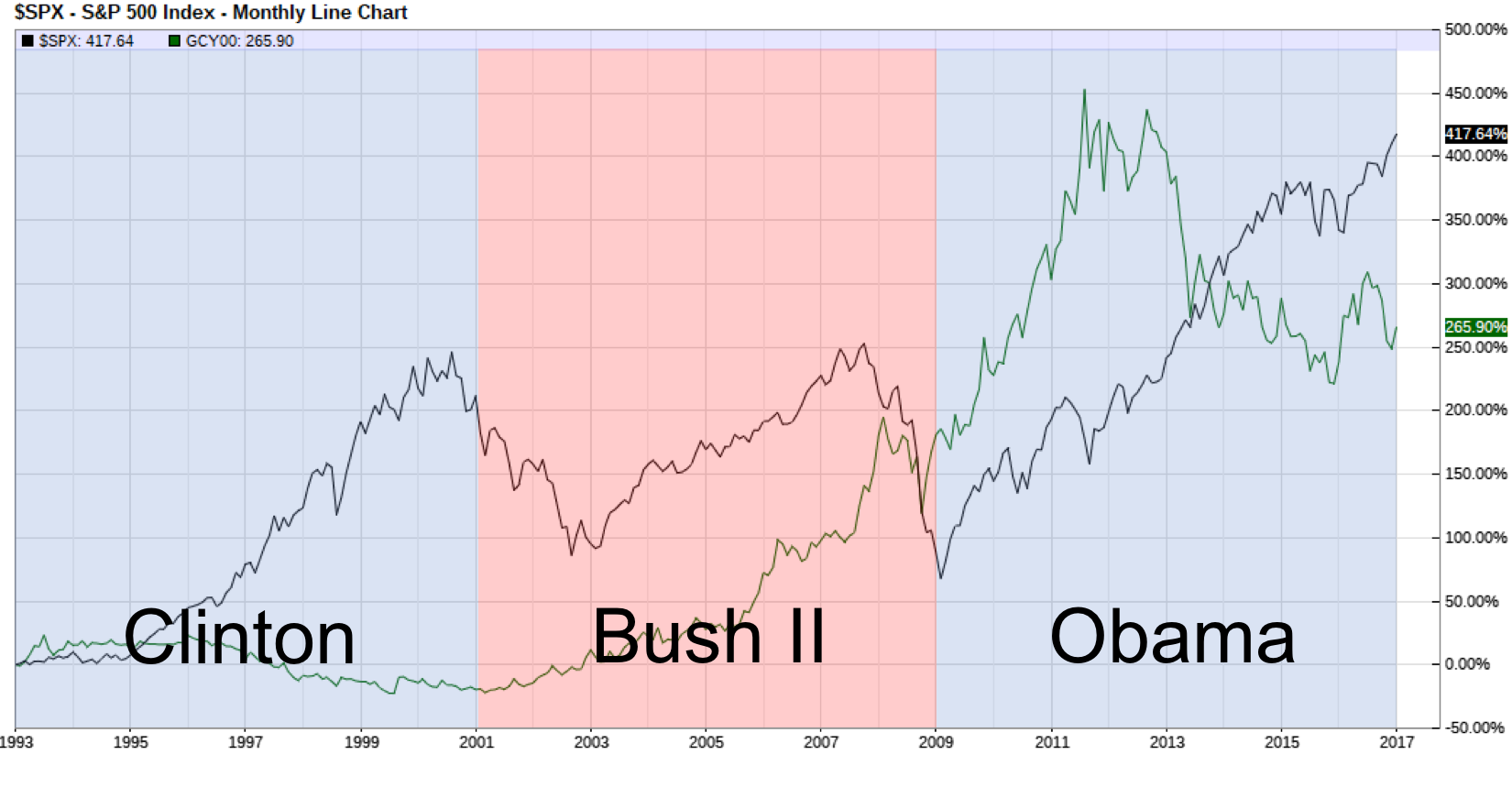

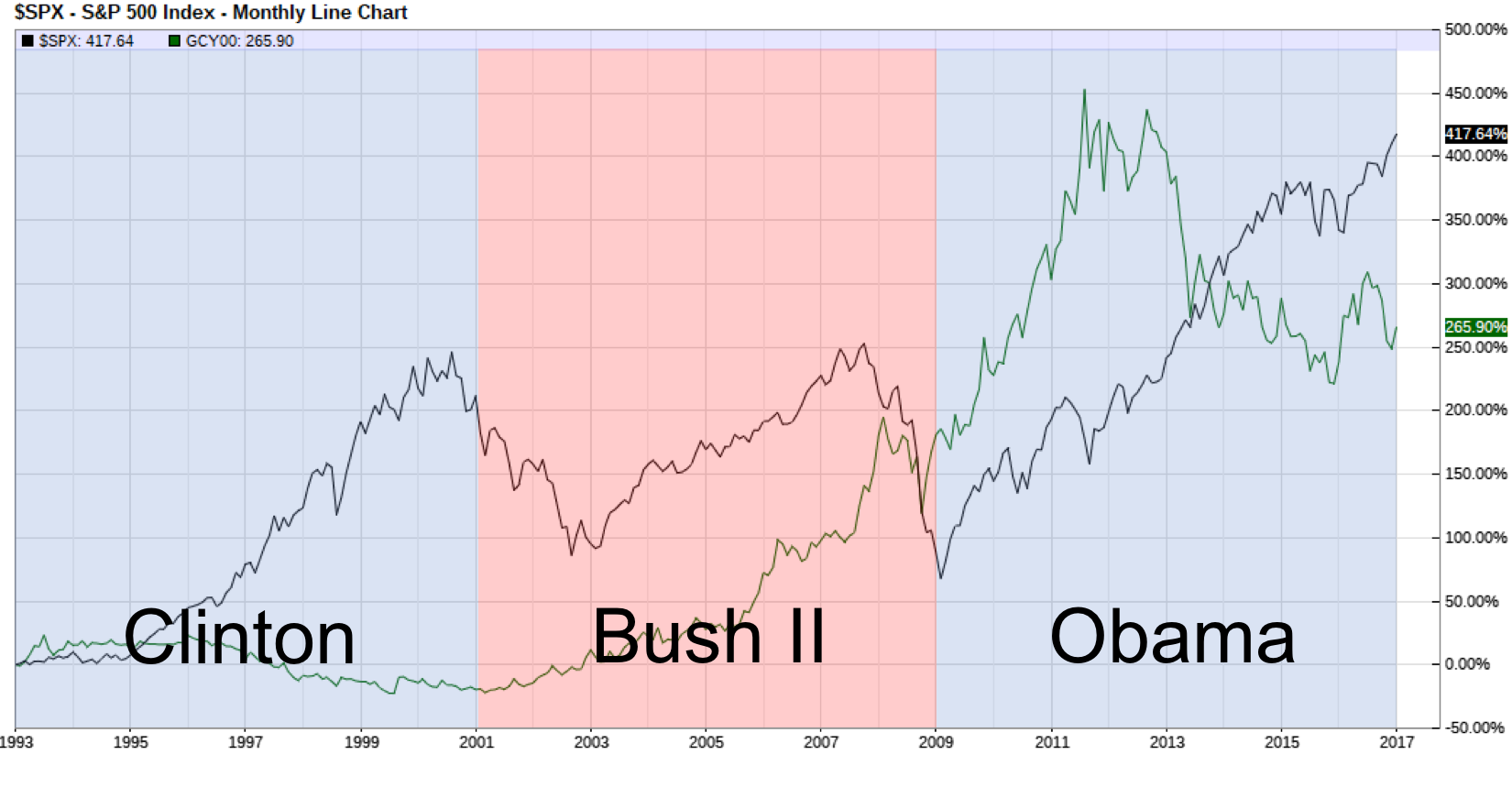

For my high-level assessment I looked at US national debt, the price of gold and the S&P 500.

These three areas are just scratching the surface of the United States economy.

Other metrics one could look at are GDP (which I don’t think is useful), unemployment rate (deceptive), the Consumer Price Index (CPI, which has been resigned so that it doesn’t measure consumer prices), labor force participation, dollar strength relative to other currencies, home ownership, household debt, etc.

However as an investor I’m mainly interested in getting any clues as to how stocks and precious metals are going to perform.

Keep in mind these trends have more to do with Federal Reserve actions, regulations, laws, and government spending and less to do with who is taking up space in the oval office.

Slick Willy

Former President Bill Clinton and Former First Lady of the United States Hillary Clinton

Under President William J. Clinton, the US national debt went from $4.2 trillion to $5.73 trillion, the price of gold fell 30% and the S&P 500 went up 182%. The housing bubble also started to form under Clinton.

Bonus: During the Clinton reign the NASDAQ tech bubble popped and the index went from it’s high of 4,696 down to 2,500.

To be fair, if you bought the NASDAQ in 1993 you would been up almost 300% by the end of Clinton’s term. But that doesn’t help anyone who bought in during the peak.

W

Former President George W. Bush attempting to wear a poncho.

Under US President George W. Bush the housing bubble continued to form and peaked. This bubble popped resulting in the 2008 financial crisis, the national debt nearly doubled and went from $5.73 trillion to $10.63 trillion, gold went up 222% and the S&P 500 dropped 41%.

In an attempt to paper over the 2008 financial crisis a stock and bond bubble also started to form in Bush’s last year.

Bonus: Under the Bush regime, during the 2008 financial crisis the S&P 500 went from it’s peak of 1550 down to 805.

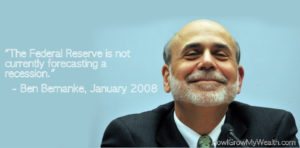

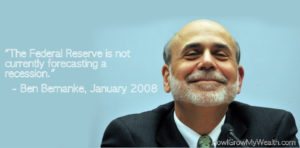

One of the worst things Bush did from an economic perspective was to appoint Federal Reserve Chair Ben Bernanke in 2006.

Based on all his public comments Bernanke was completely blindsided by the 2008 financial crash and is perhaps most responsible for the current stock and bond bubbles.

Obama

Former United States President and Golfer in Chief, Barack Obama

Under US President Barack H. Obama, the stock and bond bubbles grew to a capacious size, national debt went from $10.63 trillion to nearly $20 trillion, the price of gold went up 30% and the S&P 500 went up 175%.

Bonus: Under Obama’s rule, the labor force participation rate dropped down to a level not seen since the late 1970s. And no, it’s not because of baby boomers retiring.

Double Bonus: During Obama’s entire tenure as President the Fed Funds rate was never over .75%. Except for Obama’s last year in office the Fed Funds rate was below .25% for his entire presidency.

There has never been a period in US history that interest rates were that low for that long.

This means Obama presided over the US economy while the largest economic bubble to date was blown.

Interestingly, Obama retained the Bush appointed Fed Chair Ben Bernanke for the majority of his presidency. It was over five years into Obama’s presidency that Bernanke was replaced by current Fed Chair Janet Yellen.

Blow a Bubble, Let it Pop, Repeat

Bernanke could not correctly forecast the present

As you can see from the chart below, the S&P 500 grows in a bubble, then the bubble pops.

Obama truly lucked out.

During Obama’s tenure there was no significant correction, there was also no significant attempt to normalize interest rates and the bubble has grown even larger than past bubbles.

This means that when the stock and bond bubbles do pop the fallout will be much worse.

Most people don’t understand how the Federal Reserve fuels asset bubbles.

Unfortunately for Trump, the bubble will probably pop during his first (and thus only) term and he (and free-markets) will be blamed for it.

Free markets and deregulation are not the cause of these bubbles: it’s government spending, moral hazard created by the government, harmful government incentives and the Federal Reserve.

Green Shows the % increase in the price gold, Black shows the % increase in the S&P 500

What Can the Past Tell Us about the Future

History might not repeat itself but it does rhyme.

In many ways the Trump presidency, from an economic and market perspective, is starting off similarly to George W. Bush’s presidency.

Both Bush II and Trump inherited a bubble economy that formed under his predecessors. Bush continued to grow the housing, stock and bond bubbles and made them worse. Trump will probably do the same to the existing stock and bond bubbles.

Buddies

But the stock and bond bubbles will burst eventually.

It’s nigh-impossible to predict exactly when, but at some point valuations of US debt and US stocks will revert to their historical averages and more realistic valuations.

I thought theses bubbles would pop while Obama was in office but I was wrong. I think the bubbles will pop during Trump’s first term and I don’t anticipate being wrong again.

When the bubble does pop, the government will react the way it always does. Lower interest rates, print money, lower taxes (maybe), and spend, spend, spend.

This doesn’t work but it’s the only playbook the government knows.

I believe real assets and foreign stocks will perform well in this environment.

Trump’s Plans

Trump has talked about lowering taxes and reducing regulations.

Trump has talked about lowering taxes and reducing regulations.

These actions would benefit the US economy.

But Trump would also need to significantly reduce government spending. The US government is already insolvent and reducing taxes without also reducing government spending would only increase US national debt.

However, because most government spending is on the military, social security and medicare there is practically no chance Trump will actually reduce government spending.

Thus the US national debt will continue to grow and I believe will double to $40 trillion.

I hope I’m wrong.

Trump has also talked about tariffs, infrastructure spending, and how the dollar is too strong (implying he will try to weaken it).

These things are all bad for the US economy.

Over the next four years I believe the stock and bond bubbles will collapse. I also think the dollar will lose a great deal of value and the price of gold will outperform and reclaim the 2011 high of $1,920.

What John is Doing

So what is one to do in the age of Trump?

I know what I’ll be doing to grow and protect my wealth.

It’s the same things I’ve been doing:

Investing in Foreign Value Stocks

Purchasing Gold

Investing in alternatives like peer to peer loans

Holding some Cash

I’ve got those setup to both grow and protect my wealth. I also work in my day-career in financial services earning US dollars to spend on the necessities of life and to convert any excess funds to the assets I’ve mentioned above.

I’m excited about the Trump presidency.

Not because I expect him to do the right thing or because I think he can or will fix the foundational systemic issues with the US economy; but because this is a time of great opportunity for individuals who take the appropriate steps to protect themselves.

by John | Jan 15, 2017 | Learning from Mistakes, Monthly Income, Passive Income

Bitfinex was hacked back on 2 August 2016. About 36% of Bitfinex holdings were stolen. All Bitfinex account holders took a 36% loss and were issued one BFX token for each dollar-equivalent in value that was lost.

BFX tokens are basically “IOUs” specific to Bitfinex. I was issued the 313 BFX tokens since I had lost 313 dollars.

BFX tokens were then made tradable and the price plummeted from a 1 to 1 parity with the dollar down to a fraction of a dollar.

This enabled folks to close their BFX tokens and get some of their money back immediately. Or they could choose to hold onto the BFX and wait for Bitfinex to raise capital to make good on these IOUs.

I was fairly upset for a while about this hack and my loss. I withdrew the remaining 64% of my holdings from Bitfinex and I didn’t login to Bitfinex for a while.

But one of my readers informed me that he was going to be investing some more money in margin funding at Bitfinex and that got me interested again.

Plus I still had 313 BFX tokens sitting in my account.

BFX Redemptions are Slow

About a month after the hack, in September 2016, Bitfinex started redeeming BFX tokens for dollars at a 1 to 1 parity. They essentially began making good on the IOUs they’d given out.

I received $17 in BFX token redemptions between 1 September 2016 and 7 January 2017. Bitfinex most recently redeemed 2% of all outstanding BFX tokens on 10 January.

I calculate that if it took four months to get $17 back it will take over six years to get the rest back.

Because the rate of redemption is so slow I sold my BFX tokens for dollars at a rate of .55 USD per token.

I’ve started margin lending using these dollars.

Why go back to Bitfinex after their security breach cost me 36%?

My thought process is that Bitfinex was hurt so much by the last hack that they are hyper-vigilant now. They’ve implemented additional security features such as two-factor authentication and offline, cold wallets.

Bitfinex is the only game in town I’m aware of that allows users to do margin funding.

And I want to recoup my losses. As of writing the “Flash Rate of Return” for margin funding is .07% per day. So based on my calculations I should be able to get back to $313 in about 3.5 years.

That is assuming the FRR stays at or above .07% per day. Hopefully it goes up.

Bitcoin is Volatile

Bitcoin Price Projection Diagram

I think margin funding is a great way to take advantage of the popularity of Bitcoin without the exposure to BTC price fluctuations.

BTC is volatile which is something that traders like.

In January Bitcoin started around $950 went up over $1,100, then back down to roughly $800.

Do These Price Fluctuations Matter?

If I believed Bitcoin was a great long term holding I don’t think I would care about these price fluctuations. A big run-up would be a time to take some money off the table and a big drop might be a time to increase my holdings.

Some people like holding BTC and believe it will go “to the moon” but I am somewhat skeptical of Bitcoin as a currency and I don’t know that BTC will be valued higher 10 or 20 years from now than it is today.

I prefer gold over Bitcoin because it has a 3,000 year history of being valued; but as I’ve said before, you can own both (I do). I just choose to own much more gold than Bitcoin.

I still like Margin Funding

By being a margin lender (in my case with USD) I’m not exposed to Bitcoin price changes and there is a set rate of return each time funds are lent out. From a market perspective there is no BTC price risk.

There is USD debasement risk. But the main risk, as I learned, is hacks.

There is also counter-party risk but I believe Bitfinex to be a reputable company.

Of course I wish they had better security so they never got hacked in the first place but I think they handled the situation fairly well and have taken a lot of steps to increase security.

It is too bad for that folks in US are not eligible to buy BFX tokens (if I recall correctly they were selling for .33 USD at one point and are now at .59, that would have been a good trade).

Citizens of the land of the free were also not eligible to partake in the BFX token-for-equity-programs–onerous US regulations are to blame for these restrictions.

I discuss the benefits of margin funding in more detail in my article Margin Funding to Generate Passive Income. I do think that it is a market-safe way to grow wealth, but the risk of future hacks is not something to be taken lightly.

If you do decide that signing up for a Bitfinex account is right for you, use this link: Bitfinex.

by John | Jan 9, 2017 | Options, Stocks I Like, Value Investing

Value Stock Picks – January 2017

I’m a value investor which means I buy stock in profitable companies trading at a discount.

I’ll be tracking the stocks I like over at my Value Stock Picks page.

The information presented here, like all the content on this website, is not investment advice. These are stocks I own (or intend to own) but they might not be suitable for you. The information presented is accurate to the best of my knowledge, but no guarantee of accuracy is made.

Prices are as of 11 January 2017 on market close, unless otherwise noted. Market data is from morningstar.com.

Korea Electric Power Corp (KEP on NYSE)

| Price |

Market Cap |

Shareholder’s Equity |

Price to Book |

Earnings per Share |

Yield |

Return on Equity (TTM) |

Price to Earnings (TTM) |

| $18.27 |

$23.5 bil |

$56.3 bil (converted from KRW) |

0.4 |

$8.74 (converted from KRW) |

7.63% |

12.2% |

3.3 |

Korea Electric Power Corp “KEPCO” is a large cap electric company that transmits and distributes nearly all the electricity in South Korea.

Korea Electric Power Corp “KEPCO” is a large cap electric company that transmits and distributes nearly all the electricity in South Korea.

I like this stock because the company pays a very nice yield. They have net income growth the past three years. I also think that people aren’t going to stop using electricity anytime soon, so it is in a good industry. With a price to book of just 0.4 it’s a steal.

It is an ADR, which isn’t my preference. But is is optionable.

I own 100 shares of KEP and have sold a covered call.

Brookfield Property Partners (BPY on NYSE)

| Price |

Market Cap |

Shareholder’s Equity |

Price to Book |

Earnings per Share |

Yield |

Return on Equity (TTM) |

Price to Earnings (TTM) |

| $22.17 |

$5.8 bil |

$7.4 bil |

0.8 |

$3.6 |

5.05% |

6.9% |

6.6 |

I would rather own real-estate directly because doing so provides crazy tax benefits. Despite looking into real estate previously I’m not in a position to join the class of landed gentry.

An alternative way to be a part of the real estate market is through a real-state investment trust (REIT).

A REIT is a company that owns, and often operates, income-producing real estate.

Like many other companies Brookfield Property (BPY) has issued stock that can be purchased.

BPY is a REIT that pays a nice 5% dividend and is currently trading at a 20% discount to it’s book value. It’s had modest revenue growth over the past three years and is profitable.

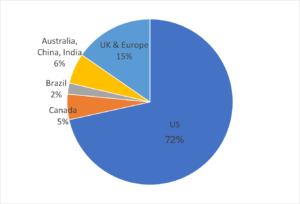

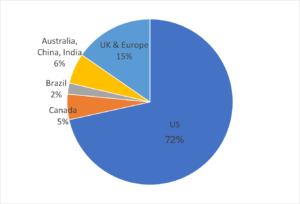

The properties BPY owns operates and invests in are located in North America, Europe, Australia and Brazil.

Unfortunately most of the assets under management are in the US (72%). I would prefer seeing more exposure in Brazil, Australia, and Asia.

Source: http://bpy.brookfield.com/~/media/Files/B/Brookfield-BPY-IR/events/BPY%20Corporate%20Profile%20November%202016%20FINAL.pdf

BPY is optionable. I currently have an option position on this stock and intend to acquire shares of this stock directly in the near future.

by John | Jan 9, 2017 | Insurance, Tax Strategies, Wealth Protection

With the dawn of the Affordable Care Act (ACA, more often called ObamaCare) individuals are now taxed for NOT buying something.

I encountered this for the first time the 2016 calendar year during my 100 days of unemployment. For for the first six months of 2016 I had what the Affordable Care Act calls “minimum essential coverage” (MEC) through my employer.

Starting in July I no longer had employer provided health insurance.

I hardly considered continuing my employer coverage via COBRA because it’s so expensive.

Even though I’m relatively young and healthy, accidents do happen. The number one cause of bankruptcy in the US is medical bills and I don’t want to be part of that statistic.

I could have signed up for a 2016 ACA plan within 60 days of losing my employer provided coverage but I didn’t think that was a good option.

The Affordable Care Act Made Healthcare Less Affordable For Me

The least expensive plan for me on healthcare.gov was $203.55 per month and had a $6,650 deductible, $40-$80 co-pays and/or 40/60 co-insurance and $6,850 maximum out of pocket.

This ACA health plan would have cost $2,442.60 per year or $1,221.30 for six months.

But even when you pay the premiums one still has to meet the $6,650 deductible.

For those not familiar with insurance jargon, a deductible is an amount that must be paid out of pocket by the insured (in this case me) before the insurance plan will cover anything.

So, in the course of a year you’d have to spend over $9,000 before this plan would kick in and start covering medical bills.

No thank you I’ll find a better plan.

What I Decided to Do for the Second Half of 2016

I purchased a non-MEC health insurance plan for $52 per month. It had a $5,000 deductible 30/70 co-insurance and a maximum out of pocket of $16,666.

I also got an accidental medical expense plan for $57.36 per month with a $250 deductible. I would be paid out up to $10,000 in the event of a disability or cancer/stroke.

So for a little over half the cost I was able to buy what I think is better coverage from both a cost and benefit perspective. My total cost was $656.16 for six months of coverage.

Minimum Essential Coverage

The only problem with the plan I purchased is that it does not fit into the government’s definition of “minimum essential coverage” (MEC).

Not having MEC results in one having to pay the Orwellian “Shared Responsibility Payment” which is $695 in 2016 or 2.5% of Adjusted Gross Income, whichever is higher, prorated for any months in which there was no coverage.

Since I had MEC for 6 months through work, but non-MEC for the 6 month I was unemployed, I would be “responsible” for paying half of the “Shared Responsibility Payment”. This “tax penalty” in 2016 is $695 or $347.5 or 2.5% of my AGI, whichever is higher.

So my total cost for health insurance in the last six months of the year was $1,003.66. Which is still $200 less expensive than if I had gone with the least expensive healthcare.gov plan.

Would I Have Done Anything Differently?

In hindsight I think I would have done the following.

After losing my employer coverage I would have gone without insurance for about 50 days or so (if I had gotten catastrophically ill in that time I would have bought an ACA plan since I would still be within that 60 day window). Then after 50 days of going without insurance I’d sign up for the least expensive ACA plan.

The ACA plan would have cost me $203.55 per month for four months or about $815.

You can go up to 3 months without MEC provided you have MEC for the rest of the time. So I wouldn’t have had to pay the newspeak “Shared Responsibility Payment.”

Lessons

My mistake was not factoring in the “tax penalty”. The health insurance I did buy was less expensive than buying the cheapest ACA plan for four months, but NOT once I factor in having to pay the penalty.

In 2016 I was right in the heart of the people who DON’T benefit from the ACA.

Young healthy single people who don’t need most of the extras health insurance HAS TO HAVE to be considered MEC and thus avoid the “tax penalty”.

At my stage in life I don’t need or want maternity and newborn care or pediatric services. I don’t need or want coverage for rehabilitative services and devices or nursing home care. All things that increase the cost of an insurance plan that MUST be included in an ACA approved plan.

I also was making enough money that I didn’t qualify for any tax subsidy.

Other people my age might opt to go without any health insurance and just pay the fine/tax. That would have been the least expensive option for me in 2016 but not one I was willing to take.

I didn’t want to go without insurance.

I know some people benefit from the Affordable Care Act. However, I was not one of them. The ACA made healthcare more expensive for me and limited my choices.

Trump has talked about lowering taxes and reducing regulations.

Trump has talked about lowering taxes and reducing regulations.

Korea Electric Power Corp “KEPCO” is a large cap electric company that transmits and distributes nearly all the electricity in South Korea.

Korea Electric Power Corp “KEPCO” is a large cap electric company that transmits and distributes nearly all the electricity in South Korea.