Value Stock Picks – January 2017

I’m a value investor which means I buy stock in profitable companies trading at a discount.

I’ll be tracking the stocks I like over at my Value Stock Picks page.

The information presented here, like all the content on this website, is not investment advice. These are stocks I own (or intend to own) but they might not be suitable for you. The information presented is accurate to the best of my knowledge, but no guarantee of accuracy is made.

Prices are as of 11 January 2017 on market close, unless otherwise noted. Market data is from morningstar.com.

Korea Electric Power Corp (KEP on NYSE)

| Price | Market Cap | Shareholder’s Equity | Price to Book | Earnings per Share | Yield | Return on Equity (TTM) | Price to Earnings (TTM) |

| $18.27 | $23.5 bil | $56.3 bil (converted from KRW) | 0.4 | $8.74 (converted from KRW) | 7.63% | 12.2% | 3.3 |

Korea Electric Power Corp “KEPCO” is a large cap electric company that transmits and distributes nearly all the electricity in South Korea.

Korea Electric Power Corp “KEPCO” is a large cap electric company that transmits and distributes nearly all the electricity in South Korea.

I like this stock because the company pays a very nice yield. They have net income growth the past three years. I also think that people aren’t going to stop using electricity anytime soon, so it is in a good industry. With a price to book of just 0.4 it’s a steal.

It is an ADR, which isn’t my preference. But is is optionable.

I own 100 shares of KEP and have sold a covered call.

Brookfield Property Partners (BPY on NYSE)

| Price | Market Cap | Shareholder’s Equity | Price to Book | Earnings per Share | Yield | Return on Equity (TTM) | Price to Earnings (TTM) |

| $22.17 | $5.8 bil | $7.4 bil | 0.8 | $3.6 | 5.05% | 6.9% | 6.6 |

I would rather own real-estate directly because doing so provides crazy tax benefits. Despite looking into real estate previously I’m not in a position to join the class of landed gentry.

An alternative way to be a part of the real estate market is through a real-state investment trust (REIT).

A REIT is a company that owns, and often operates, income-producing real estate.

Like many other companies Brookfield Property (BPY) has issued stock that can be purchased.

BPY is a REIT that pays a nice 5% dividend and is currently trading at a 20% discount to it’s book value. It’s had modest revenue growth over the past three years and is profitable.

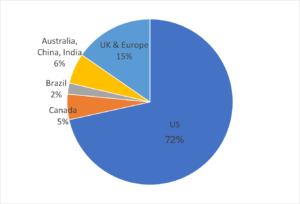

The properties BPY owns operates and invests in are located in North America, Europe, Australia and Brazil.

Unfortunately most of the assets under management are in the US (72%). I would prefer seeing more exposure in Brazil, Australia, and Asia.

BPY is optionable. I currently have an option position on this stock and intend to acquire shares of this stock directly in the near future.