by John | Oct 30, 2016 | Insurance, Wealth Protection

I’ve started a new career in the financial services industry helping people protect their finances in the event of death, illness or disability.

I enjoy it and it goes right along with my mission on this website where I share how I grow and protect my wealth.

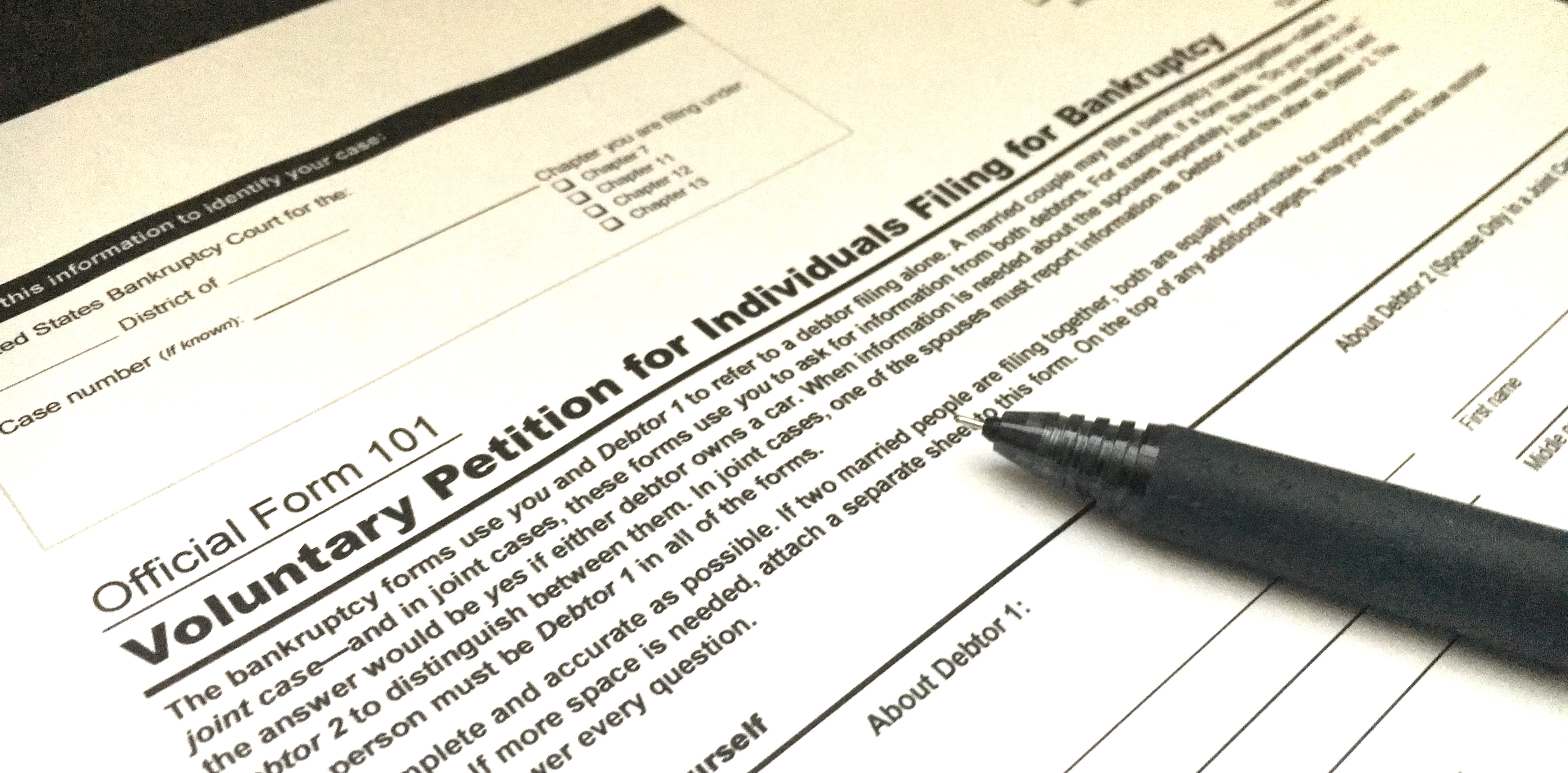

During the initial training at my new job I’ve learned a lot but one of the more surprising facts I’ve come across is the number one cause of bankruptcy in the United States.

The number one cause of personal bankruptcy in the United States is not student loans or credits cards. It isn’t gambling or home mortgages. The #1 cause of personal bankruptcy in the US is medical bills.

Source: http://www.cnbc.com/id/100840148

As a relatively young, relatively healthy person, I’m interested in making money, saving and investing it and building wealth.

But it is important to keep in mind the importance of protecting and preserving the wealth one does have. After all, what I spend 40 years building my wealth but then I get cancer and have to spend it all on medical bills?

If you own a home you probably have homeowners insurance to protect you from fires, floods and other damage. If you drive a car you have insurance for that. So why wouldn’t you insure your life and heath?

Medical bills are the #1 cause of personal bankruptcy so can you afford not to think about it?

What Is Insurance?

You can’t talk about insurance without talking about risk. A risk is the possibility of gaining or losing something of value. Insurance deals with pure risk. Pure risk is the possibility of a loss with no possibility of gain. For example, there is a risk of death, the risk of getting sick, the risk of your house burning down. Insurance provides financial compensation if one were to realize the risk the insurance policy covers.

True insurance is risk transfer. You trade a risk with a high cost (in the case of homeowners insurance let’s say your house burning down), in exchange for a lower cost loss (insurance premiums) and a high payout if you need it.

So if your $250k house burns to the the ground your insurance company will help you buy a new one. You hope nothing happens to your home but if it does you’re covered. You sleep better with the peace of mind knowing that if your house does catch fire you will be able to rebuild or buy a new place to stay.

So you’ve transferred the risk to your insurer.

Four Possible Outcomes

When discussing risks some people just don’t want to accept the possibility of a bad thing happening. They don’t want to think about getting sick, or their house burning down. So they deny the possibility of the risk or hope it doesn’t happen. “I’m not going to get sick!” they might say, or “That will never happen!” This is certainly one option. But is it a good option?

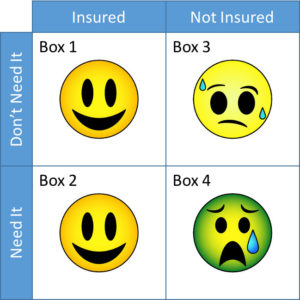

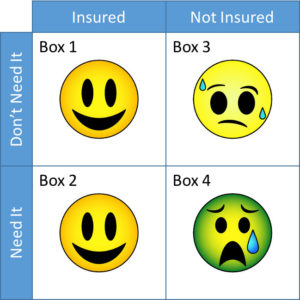

When it comes to insuring against a risk there are really only four outcomes. The first two are: either the bad thing doesn’t happen and you don’t need the insurance or the bad thing happens and you do need insurance.

Since you have a choice wether or not to purchase insurance you are either 1) insured or 2) you’re not insured.

An Example

There is a risk of getting cancer. I don’t know for sure that I will or I won’t get cancer but my family history is against me. I have a choice of wether or not to buy a critical illness plan that will pay in cash in the unfortunate event I get do get cancer.

So, I could choose to buy insurance, and it may turn out I don’t need it. I would be in Box 1. Personally I would be very glad and grateful if I never got cancer.

Would you?

Sure, I will have spent money on insurance premiums but I slept better knowing that if I did get cancer I would get a lump sum payment to help offset medical bills.

Which Box Represents the Situation You’d Rather Be In?

Well let’s say I do buy insurance and sadly I follow in the footsteps of my grandparents and parents and I do get cancer. I’ll get a lump sum payout that will help offset medicals bills or once I survive cancer (as I plan to do) I could use the money the plan pays me to go on a cruise to celebrate being alive. I’d be in Box 2.

Another option would be to not buy insurance and hope that I don’t need it. After all, maybe I won’t!

That would be nice, I’d save the money that I would have spent on the insurance premiums but I’d probably spend some time worrying about what I would do if I did get cancer. This is Box 3.

The final option would be that I choose not to purchase insurance and I do end up needing it. Medical expenses are costly! I could wind up being like one of the 2 million Americans who in 2013 went bankrupt because they couldn’t pay their medical bills. I don’t want that to happen to me. This is Box 4 and I don’t wind to end up there.

I’m certainly not saying to rush out and buy insurance today. You need to figure out what you’re at risk for, see if you’re financially vulnerable, and then find out if there are plans that meet both your needs and your budget.

But insurance is an important part of my own financial plan and it’s something I think more people should take time to think about.

Disclaimer: John is licensed with the State of Ohio for Life, Accident and Health Insurance, License # 1126312, NPN # 18149670

by John | Oct 23, 2016 | Preservation of Purchasing Power

I would not buy US treasuries and I don’t understand why there is even a market for them.

I know the Federal Reserve is a big part of the “market”, officially and otherwise, but surely they aren’t 100% of the “market” (yet).

If the Fed isn’t 100% of the market that means someone besides the Fed is still buying treasuries.

I would like to talk to someone who is buying US treasuries and understand WHY they are doing so.

Reward-Free Risk

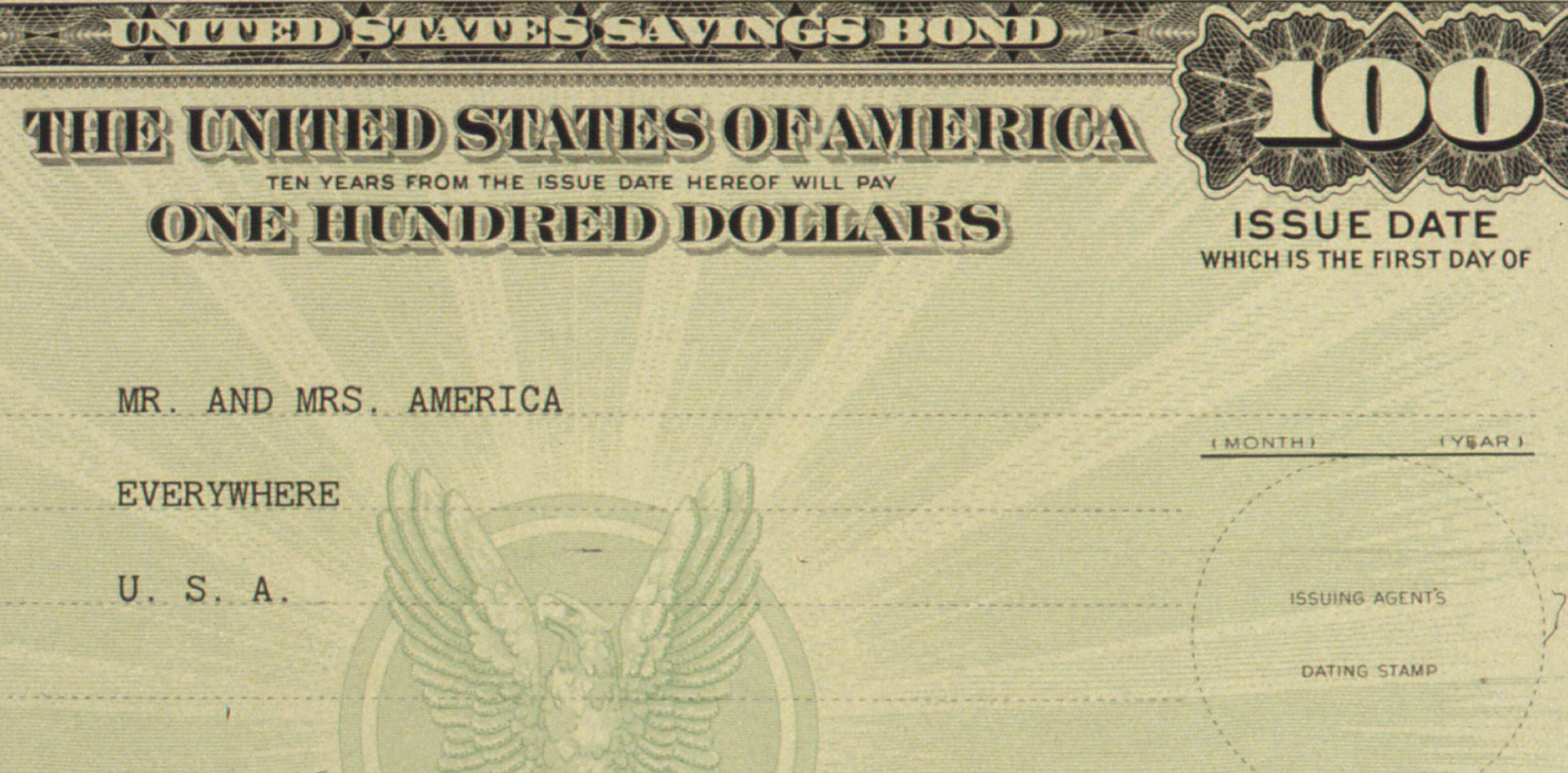

US debt yields are paltry. As of today the 10 year treasury has a 1.5% coupon. That means if I buy a $100, 10 year treasury, I’ll get $1.5 per year, in two $.75 payments and after ten years I’ll have gotten $15, plus the $100 face amount of the treasury.

Ten year treasuries are trading at a discount rate of $97.89 so if I hold the treasury to maturity, I could gain $17.11 ($1.5 per year times 10, plus $2.11 (difference between the bond price and face value)).

Price from Bloomberg: http://www.bloomberg.com/markets/rates-bonds/government-bonds/us

In other words if I were to purchase a 10 year treasury I’ve loaned the government $97.89 and ten years later the government pays me back $115. While $17.11 isn’t fantastic it looks positive.

The problem is price inflation.

The 2015 consumer price index (CPI) was 1.7%. So using a handy inflation calculator (link below), I know that $115 ten years from now has the same purchasing power as $97.16 in today’s dollars.

Source: http://www.calculator.net/inflation-calculator.html

Basically, I would have loaned the government $97.89 and in ten years they pay me back with the purchasing power of $97.16.

I’ll have lost purchasing power!

When I loan someone money (unless I really like them) I should be compensated for not having access to those funds. I certainly don’t accept being paid back with less valuable money when I make an investment.

Personally, I don’t think the CPI is accurate. I think that price inflation is at least 2%, perhaps even as high as 10% per year. So let’s say prices are rising on average 5% per year.

With a 5% annual price inflation rate, that $97.89 is worth just $70.60 ten years from now, so the ten year treasury lost over $27 in present day purchasing power.

Compound Interest

If you reinvest the bond coupon payments (the $.75 you get every six months) you would start taking advantage of compound interest and the math works out a little better.

The calculations become much more complex but if I were to reinvest the coupon payments, best I can tell is the $97.89 would grow to around $135 after ten years. With a 5% inflation rate the $135 would be less than $83 in today’s dollars so it is still a loser investment. That assumes the 10 year continues to trade at the current price and the coupon stays the same for the treasuries purchased with the reinvested coupons.

If I were to reinvest the coupons and if inflation really was 1.7%, the $135 ten years from now would be around $114 in today’s dollars, so I will have gained purchasing power.

But as I said before I don’t think inflation is that low.

Short Term Treasuries are No Good Either

The 12 month treasury pays no coupon but sells at a discount such that it yields .64% upon maturity. With inflation at 1.7% it is another situation in which a buyer is guaranteed to lose purchasing power if the treasury is held to maturity.

The only way to gain real value with a treasury would be to sell the treasury for more than the purchase price by a wide enough margin to beat the rate of price inflation or to hope that there is significant price deflation.

The Federal Reserve will fight any price deflation that might occur so I don’t think that will work. I also think that bonds are in a bubble, so while right now there might be an ample source of greater fools willing to pay more for a bond than the last person, eventually the only greater fool will be the Fed.

Again, I don’t understand why any rational investor would loan money to the US government in exchange for being paid back with dollars that are less valuable later. It’s the opposite of how the time value of money is supposed to work and it isn’t sustainable.

It’s one of the reasons I think bonds are in a bubble. I’m not the only one who thinks that. Folks much smarter and experienced than I have been saying the same thing.

The takeaway for me is don’t buy US treasuries. They are reward-free risk and there is no place for them in my portfolio.

Disclaimer: The information on this site is provided for discussion and educational purposes only and should not be misconstrued as investment advice. Under no circumstances does this information represent a recommendation to buy or sell securities.

by John | Oct 16, 2016 | Active Monthly Income, Geopolitical Risk Protection, Monthly Income, Passive Income, Saving Money

In my culture there is an old adage: “Don’t put all your eggs in one basket.” It’s a quaint agrarian saying that captures a great deal of wisdom.

This principle applies most directly to savings and asset allocation. Savings are key but today I’m writing about income.

When it comes to income the expression is don’t have all your eggs come from one chicken.

When it comes to income the expression is don’t have all your eggs come from one chicken.

In truth many people have almost no income diversity.

To stretch the analogy way to far: most workers have access to one chicken and in exchange for their work they get a small portion of the eggs the chicken lays. If the chicken stops laying eggs or the person who owns the chicken doesn’t want want or need a worker anymore, then the workers go hungry until they can find access to another chicken.

They have their job (and little to no savings or maybe a little to a lot of debt) and that’s it.

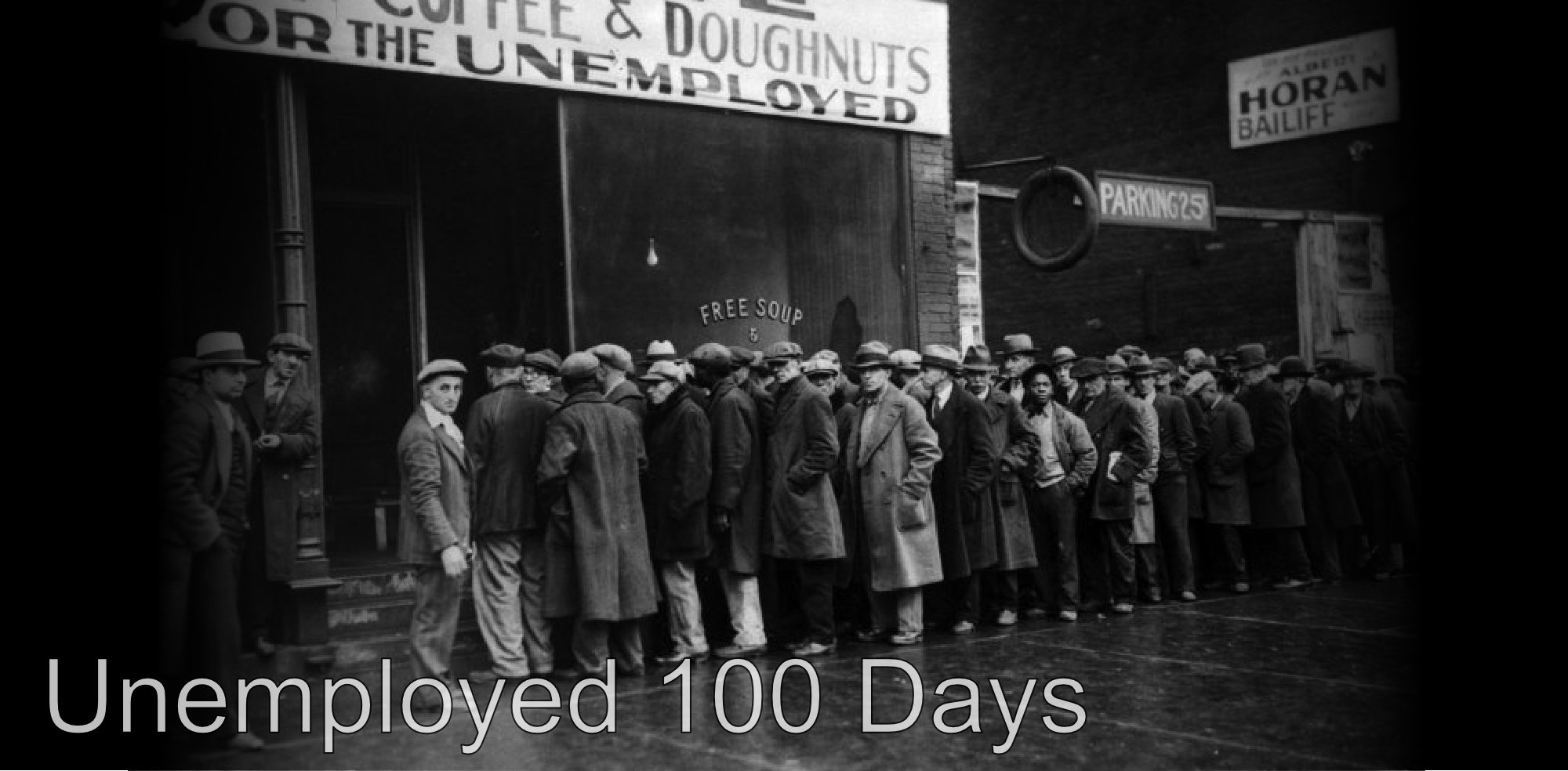

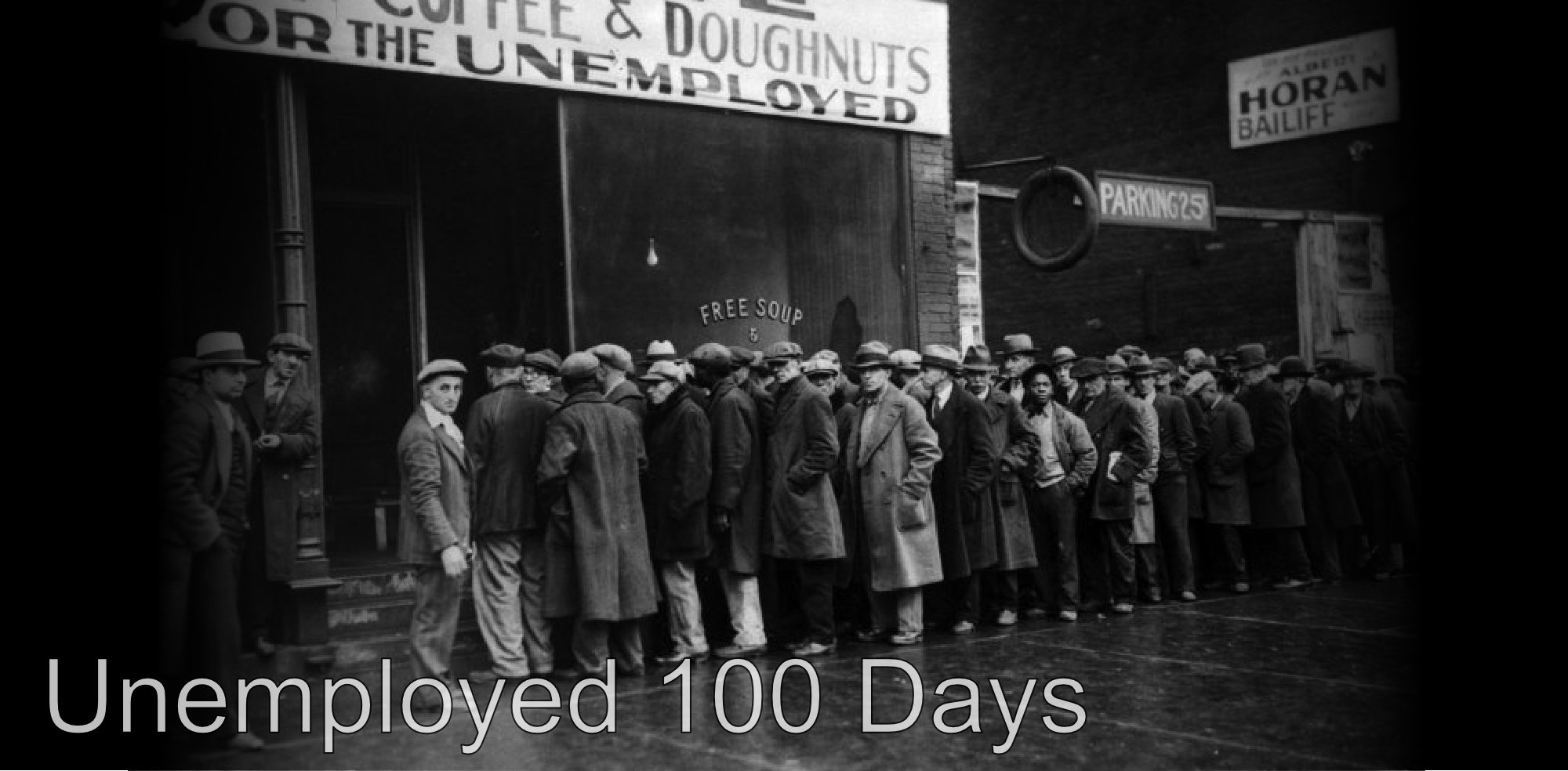

If they lose their job and can’t find another one they are in a very bad place. Without a job many people can’t service the debts they have, they can’t pay for their basic needs, it’s a hot mess. An emergency fund and savings are helpful but I was unemployed for 100 days and it was stressful even though I do have savings!

Unless you’re self employed you don’t own your job and can be let go even if you work hard and do a great job!

Losing a job happens all the time. A company gets bought and people get laid off. “My boss is a jerk and I can no longer stand to work for her.” The industry you’re in collapses. Dollars don’t buy as much and a raise doesn’t cover the difference.

Even if you are gainfully self-employed the market you’re in could contract and squeeze your earnings.

Multiple Income Streams

Multiple income streams, income diversification, it means not keeping all of your income “eggs” coming from just one chicken.

Multiple income streams provides strength and security. If one has multiple streams of income and lives below their means it isn’t a big deal if one of the income streams stops.

Multiple income streams provides strength and security. If one has multiple streams of income and lives below their means it isn’t a big deal if one of the income streams stops.

If all of your income comes from your job, and you lose your job for any reason, you have to rely on any savings you have until you find another job.

But if you have income from 4 sources and one of them stops yielding; you’re still getting a large percentage of your income.

Going out and getting four full time jobs is probably not possible. I know I’m only one person and can’t be two places at once and there are only so many hours in the week.

Right now my day job is the main engine that drives my economic wagon. But I’m saving money so that won’t always be the case.

I continue to develop additional income streams including ones that make money even while I sleep. Some of the areas I’m capitalizing on are: dividend paying value stocks, bitcoin arbitrage, and trading options. While option trading is somewhat active during regular business hours (unless you place good till cancelled limit orders in the morning or evening), the others can be done with little time outside normal working hours.

I do still want to get into real estate (rental property) that has been on hold until I’m more established in my new career.

It’s popular to talk about diversity and diversification, but when it comes to income the norm seems to be getting one job and working there for a long time. That isn’t always possible, practical or prudent in “today’s economy.” Branching out into multiple sources of income provides most financial resilience and security.

by John | Oct 13, 2016 | Geopolitical Risk Protection, Preservation of Purchasing Power, Wealth Protection

I share how I grow and protect my wealth and one way I do that is by owning gold and silver. Gold and silver have served as money and a store of value for thousands of years and are a key component of my portfolio.

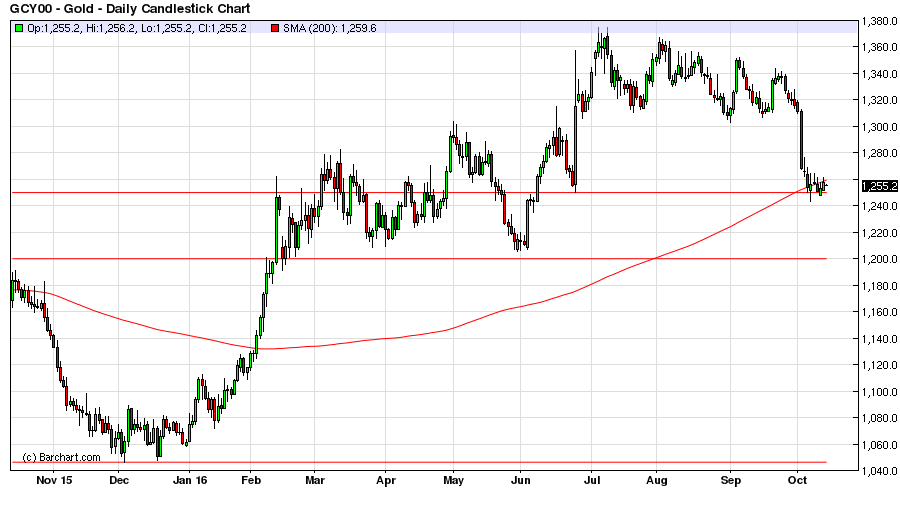

Gold

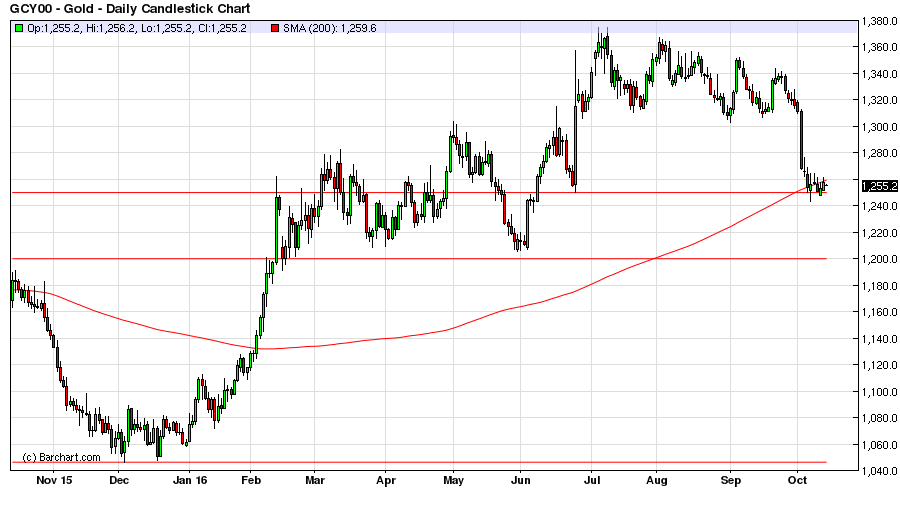

This year the yellow metal was as high as 1,370 dollars per ounce. But over the past few days the yellow metal has been pummeled and is now flitting about the mid $1,200s. It’s still up 17% on the year, having started down at $1,060.

The horizontal red lines are what I think are support levels. There was support at $1,310 but gold blew through that.

Could gold go lower? Sure could.

It’s certainly possible it goes back down to $1,200. But once the Fed does NOT raise rates in November, or even if they do and it’s only by a paltry .25%, I think gold has a lot more upside potential.

I personally think this is a golden buying opportunity. If I wasn’t already over-allocated to gold I would figure out how much free cash I have to allocate to gold. Then I would probably buy half now and then if gold does drop down to $1,200 buy the other half. If I had $3,000 to invest in gold I would buy physical bullion. With less than $3,000 I’d go with Goldmoney.

Goldmoney is a fantastic and low cost way to buy and store physical gold.

Silver

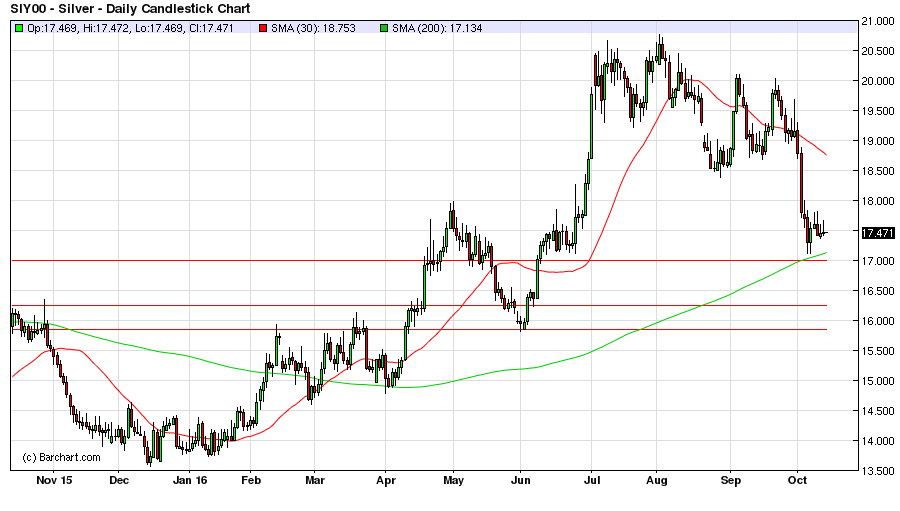

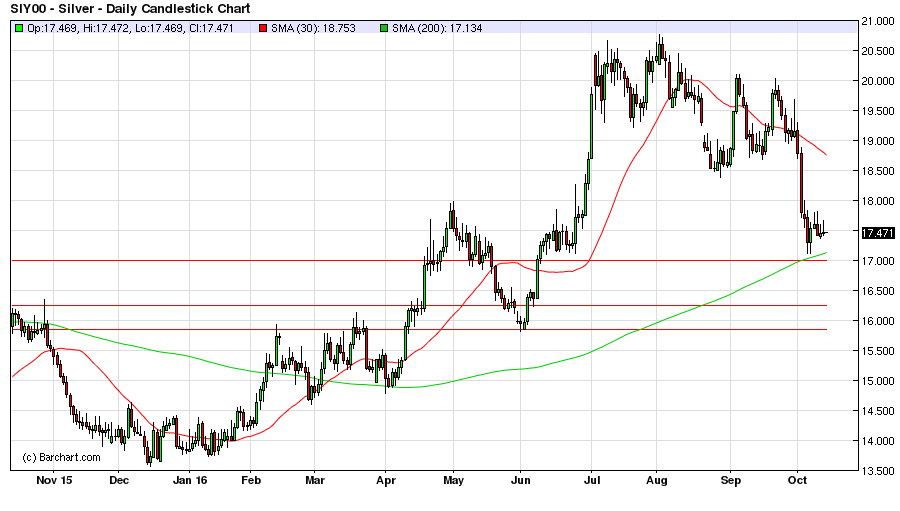

Silver is no slouch either. This metals used for electronics, industrial applications, jewelry and medicine is up over 23% year to date and the drop from the year highs of $20.75 down to $17 also presents a great buying opportunity in my opinion.

From a technical perspective $17 silver looks like a strong support level because it is the 30 day moving average and was a support (or resistance) level in April, May and June.

Waiting a few days to see if silver does break through the $17 support level or goes higher is a good idea. If silver does go down through $17 there could be support at the $16.25 level, but even stronger looking technical support appears at the $15.85 level.

The horizontal red lines are where I think the price of silver could find support. I think $17 could hold, but if not would likely retest $16.25 and/or $15.85.

Gold and silver are long term hedges against central bank recklessness and currency devaluation. I own these precious metals with a 5-10 year (or longer) outlook. I think a 10-20% allocation makes sense for my portfolio.

I’ve been wrong about gold and silver’s price moves plenty of times. I’m not encouraging anyone to go out and buy bullion without doing their own research and consulting their investment advisor.

by John | Oct 9, 2016 | Personal Journey

I’ve been unemployed for the past 100 days.

Since July 1, for the first time since graduating from college, I’ve found myself without a job.

June 30th was my last day of employment at a good paying job with health insurance and three weeks of paid vacation.

I could have stayed with my then current employer but wanted to live closer to my wonderful girlfriend!

I moved to a Columbus, Ohio where I only knew a handful of people and had no job.

Not having a job has been scary, frustrating, educational, enjoyable, and inspiring.

So what have I been up to?

The Enjoyable

I went backpacking with my brother in Colorado, visited my parents, watched all four seasons of Prison Break and have gotten to spend a lot of time promoting and writing for this website.

I was also able to do a lot of work at my girlfriend’s condo like painting and repairs.

I’ve gotten to trade options and watch the markets throughout the day, which despite my unsuccessful September, I still enjoy!

Most importantly I get to see my girlfriend several times per week!

The Scary

I’ve had to live off my savings and whatever money I could earn with side jobs and hustles. I have not applied for and am not receiving any unemployment benefits.

It’s difficult to go from having a decent amount of cash flow from a monthly paycheck to almost none. Thoughts like “Will I ever find a job?” and “How am I going to pay for rent?” and others go through my head and it is easy to get negative or discouraged if I’m not careful!

I’ve bought health insurance and have been covered the entire time I’ve been unemployed but I worry about what would happen if something did happen to me since I have a higher deductible. The answer is I would pay the deductible out of my health savings account and other savings, but for some reason it is something I think about.

The Frustrating

I’ve applied to dozens of jobs; I talk to recruiters and most of the time I don’t hear back. I have a strong resume in the IT industry and haven’t had trouble finding jobs in the past. It’s tough when you limit your job search to one city and hiring is slow.

Little cash flow means I don’t have additional money to invest and soon I will need to start selling some of my investments to pay for basic needs, which I find frustrating since I want to be GROWING my wealth.

I’m not able to contribute as much money to the charities I support and I’ve cut back on virtually all my discretionary spending.

It’s also tough not being able to treat my girlfriend as much.

The Educational

I definitely have much more appreciation for those times when I did have steady income. I’ve had a good paying full time job for about six years and have had some type of job for most of the time before that when I was in college and high school. So while I’ve worked hard and provided a lot of value to my employers, I realize now that I’ve taken that income for granted.

I’ve gotten better at cooking. When I was working I would eat out a lot. Most of the time in fact. To save money I do a lot more grocery shopping and cooking.

I’ve also learned that I can get by with about $1,500 per month. Most of that goes towards rent and food. If I moved in with a roommate I could get by on even less. I’m still enjoying my single apartment for now!

The Inspiring

I’ve been able to spend a lot of time working on this website and I believe it is possible that with enough readership this website could provide some monthly income.

It’s great when someone signs up for one of my affiliate opportunities. A reader recently signed up for the bitcoin arbitrage fund that pays over 10% and I’ll get a nice bonus from that this month.

I’ve had a lot more time for meaningful introspection and reflection whilst unemployed. I’ve thought about what it is I want to do for a career and what my long term goals in life are.

The difficulty in finding work in my field inspired me to expanded my job search and as a result I’ve been extended an OFFER to work in the financial services industry contingent on getting the appropriate licenses in this state.

As evidenced by this website, financial services is an area that I’ve been passionate about for a long time but something was always holding me back from making the switch in my day job.

It reminds of a quote from one of my favorite movies The Hunt for Red October.

“When he reached the New World, Cortès burned his ships. As a result his men were well motivated.”

Moving to Columbus and not having a job has made me well motivated!

I’m very blessed in that I have the savings to weather this period without much hardship. Being unemployed has it’s perks but on the whole it’s tough. As I work on the licensing needed to take the job I was offered I realize that being unemployed for a time may turn out to be one of the greatest gifts in my career.

When it comes to income the expression is don’t have all your eggs come from one chicken.

When it comes to income the expression is don’t have all your eggs come from one chicken. Multiple income streams provides strength and security. If one has multiple streams of income and lives below their means it isn’t a big deal if one of the income streams stops.

Multiple income streams provides strength and security. If one has multiple streams of income and lives below their means it isn’t a big deal if one of the income streams stops.