by John | Oct 6, 2016 | Learning from Mistakes, Monthly Income, Options

Below is a summary of the option trades I closed in the month of September.

If you’re not familiar with stock options you might first read my introductory article Get Started Trading Options.

Monthly Trade Summary

September was a tough month. In total I lost $602.03. My win rate was 69% (9 out of 13). I had a total of 19 positions throughout the month: 9 of my trades were profitable, 4 were not, and 6 were “wash” trades. If I gain or lose less than $20 I count it as a wash and don’t use it to calculate my win rate.

My account is about $10,000. Some of my margin usage includes other options trades not listed here because they are made based on the trades placed by Kirk DuPlesis over at OptionAlpha.com and I am not going to post those out of respect for his paid service. I’m also NOT including any profits or losses from the OptionAlpha trades I make.

Again, the trades listed below are MY trades closed out in the month of September.

What I learned from losing $600

You can often learn more from mistakes than successes. It’s easy to Monday morning quarterback with the benefit of hindsight. I like to evaluate my trades based on what I knew at the time and what I reasonably could have foreseen.

I learned/reinforced several valuable lessons. In fact if I had followed the rules I know I need to follow to be successful and I had been more careful that $600 in losses would have been ~$70 in gains.

I want to talk about my three mistakes and the three lessons I learned from each.

Lesson One: Small Position Size

“Bears make money and bulls make money. Pigs get slaughtered.” – Old Wall Street Adage

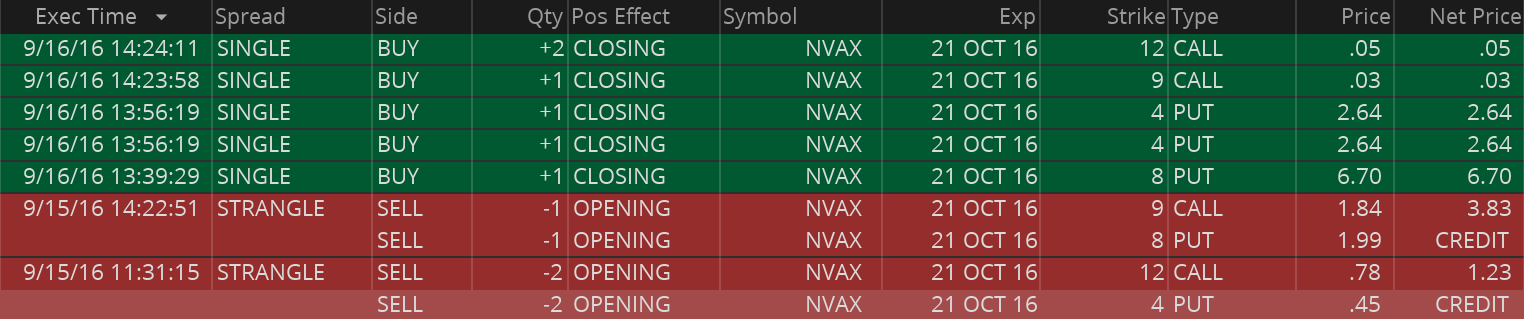

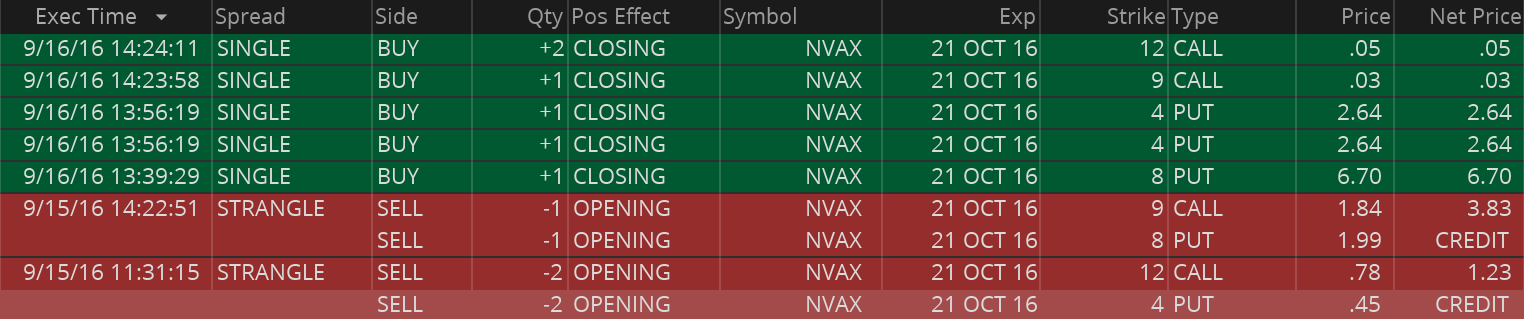

Novavax (NVAX) Strangles

Notes: My biggest mistake was with NVAX. I made $104 earlier in September but I counted this as a separate position because I completely closed out the previous position and opened this new one.

The reason volatility for NVAX was so high was because the company was awaiting “phase three trial judgment” for a vaccine they were making. The results of the trials were unfavorable and the stock tanked down to around $1.25 from $8.25. In other words the stock lost 80% of it’s value in one day.

I would have been fine if I hadn’t opened the additional 9 8 strangle because it would have been just a ~$300 loss. I got greedy like a pig and paid the price. My account is around 10k, so I should not open a position with a margin requirement over $500 (5%). The initial margin requirement started at $420, but when I opened the 9 8 strangle the margin requirement roughly doubled.

I will cheat up around $100-$150 to open positions in the $600-$650 range because otherwise I wouldn’t be able to open some positions, but when possible, I must keep the position size at or under 5% of the total account value in order to be successful long term, which in my case is $500.

Margin Requirement/Cost: $420 up to $840

Margin Requirement/Cost: $420 up to $840

Income: -$595.78 (-$582 less commissions and fees)

Lesson Two: Careful Order Entry

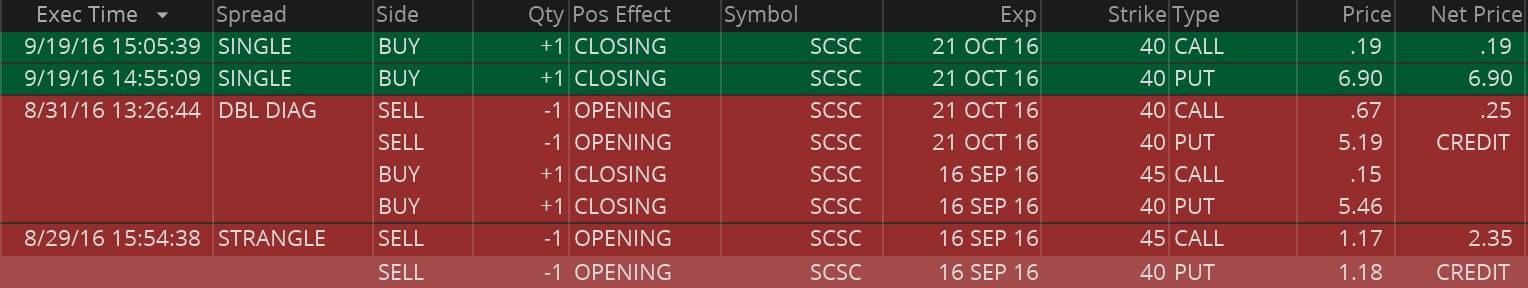

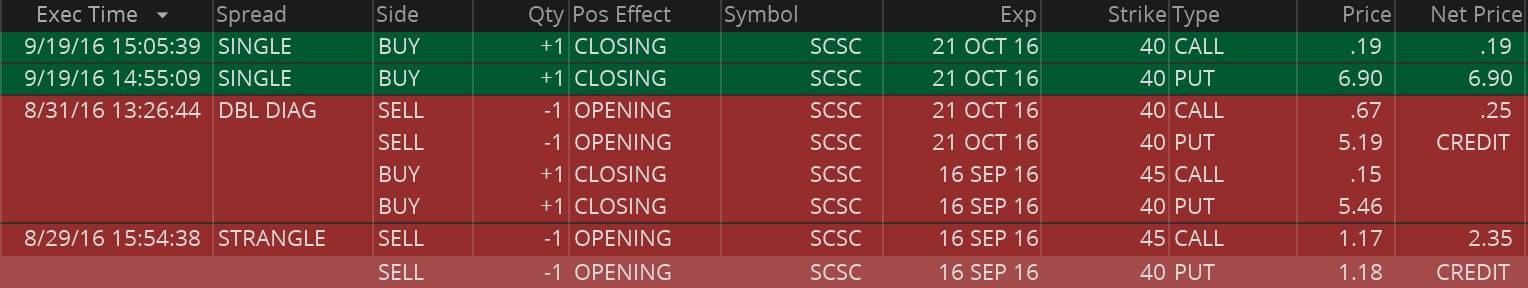

ScanSource (SCSC) Earnings Strangle

Notes: This was initially an earnings trade back on August 29. ScanSource missed earnings by a lot and the stock tanked. In after hours post earnings the stock traded down to 37.79, my break even was 37.65. I made an adjustment and held onto the position in hopes of a rebound. The stock did rebound and cut my $330 loss down to around $230.

But then I made a mistake buying the put back for more than I sold it for by entering my limit order incorrectly at the ask price instead of the midpoint. Tough $250 lesson to be more careful particularly in a less liquid market.

Margin Requirement/Cost: $875

Margin Requirement/Cost: $875

Income: -$461.17 (-$449 less commissions and fees)

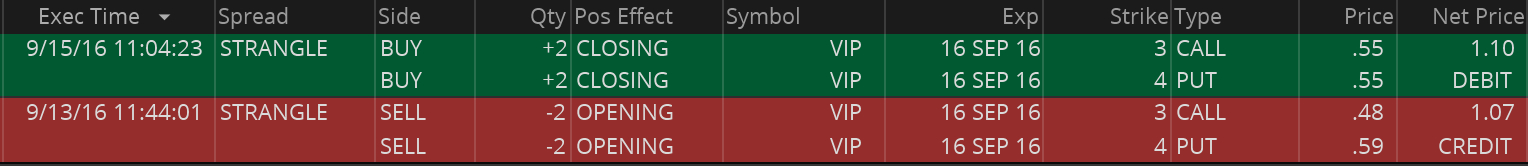

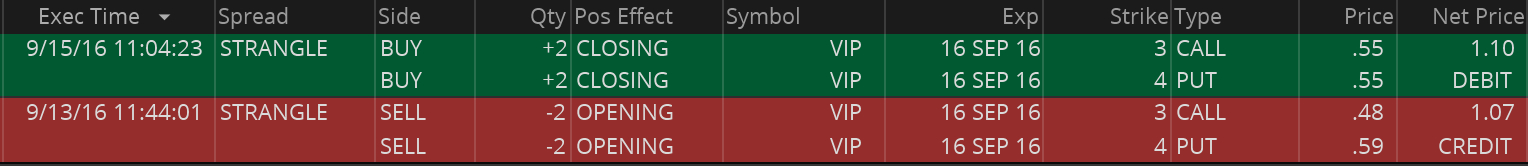

(VIP) Earnings Strangle

Notes: I opened this up incorrectly! I reversed the call and the put to create an inverted strangle. Closed it out when I could for a small wash loss.

Margin Requirement/Cost: $615

Margin Requirement/Cost: $615

Income: -$18.20 (-$6 less commissions and fees)

Lesson Three: Be on the Correct Side of Volatility

When volatility is low (less than 60%) you want to be a net buyer of options. When volatility is high (over 60%) you want to be a net seller of options.

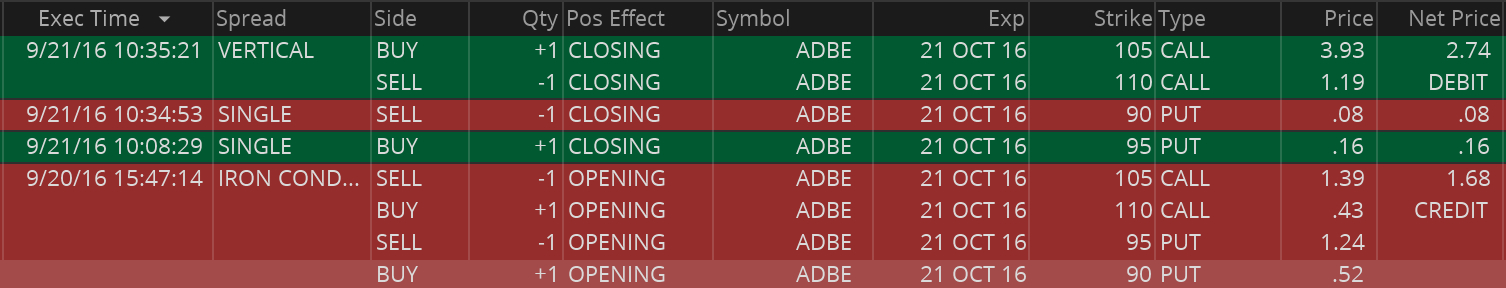

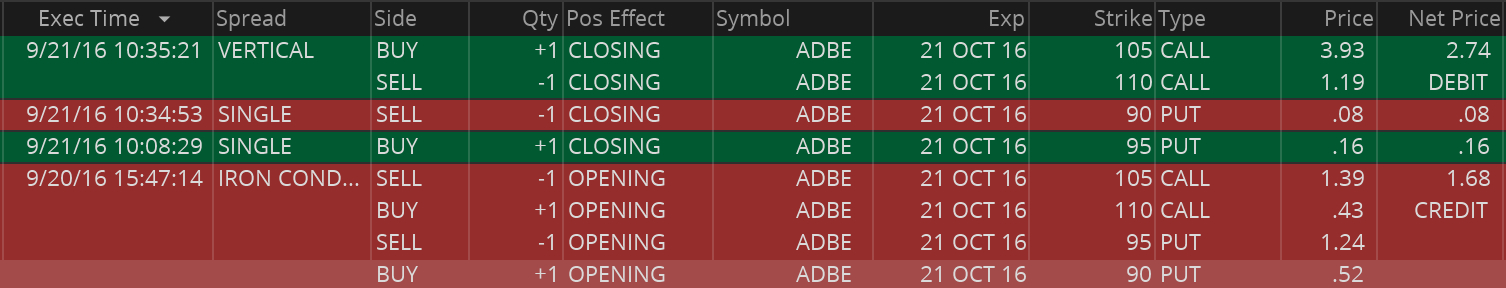

Adobe (ADBE) Earnings Iron Condor

Notes: This was an earnings trade and I was on the wrong side of volatility. The implied volatility percentile of ADBE was 58%. When selling options you want the implied volatility to be over 60% and the higher the better.

Margin Requirement/Cost: $500

Margin Requirement/Cost: $500

Income: -$126.16 (-$114 less commissions and fees)

Combined these three mistakes cost me $674.36. I expect to lose on some trades and that is okay. For example, I lost on the Verifone earnings trade. But because I was on the correct side of volatility, had the correct position size, and chose a stock with a consistent post earnings volatility drop, I was in a good position to win most of the time. However, these trades listed above are examples in which I could have known not to make and were preventable.

The Rest of My September Trades

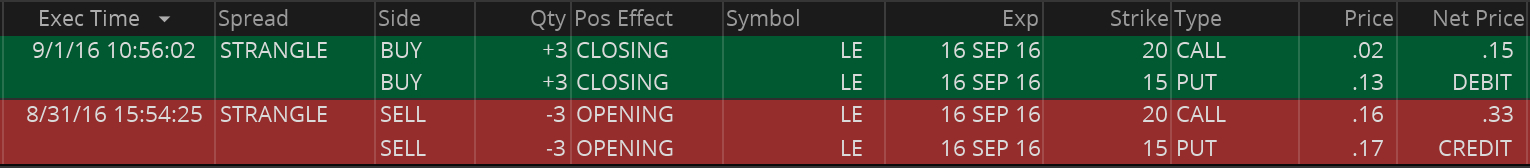

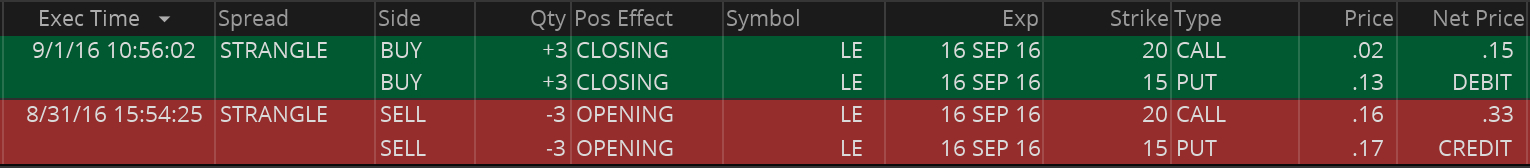

Lands’ End (LE) Earnings Strangle

Notes: This was an earnings trade that went according to plan. Closed it out at the at the 50% profit target.

Margin Requirement/Cost: ~$600

Margin Requirement/Cost: ~$600

Income: $35.72 ($54 less commissions and fees)

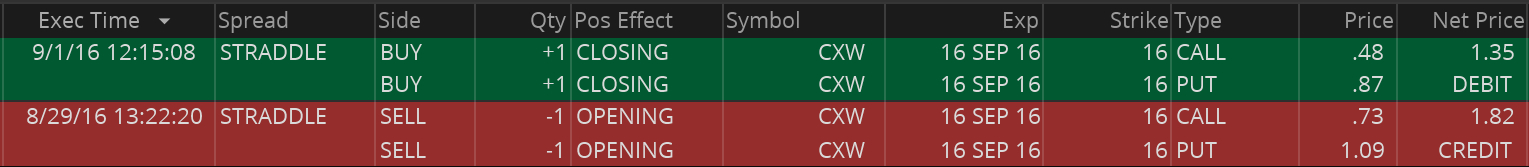

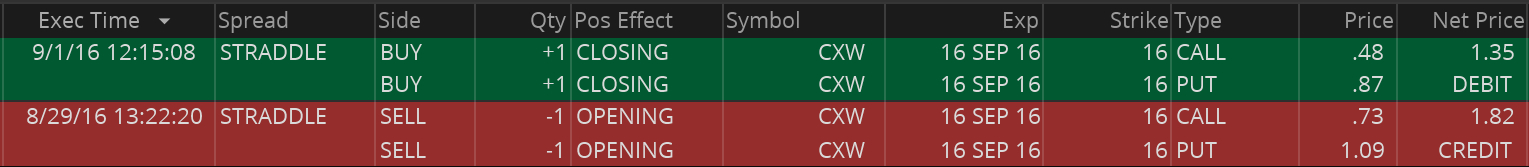

Corrections Corp of America (CXW) Straddle

Notes: There was a lot of volatility for this stock when there was an announcement that the department of homeland security was reevaluating using private prisons. A lot of these contracts are at the state level, so I thought the move would be overstated. Closed at 25% profit target once volatility died down.

Margin Requirement/Cost: ~$500

Margin Requirement/Cost: ~$500

Income: $40.92 ($47 less commissions and fees)

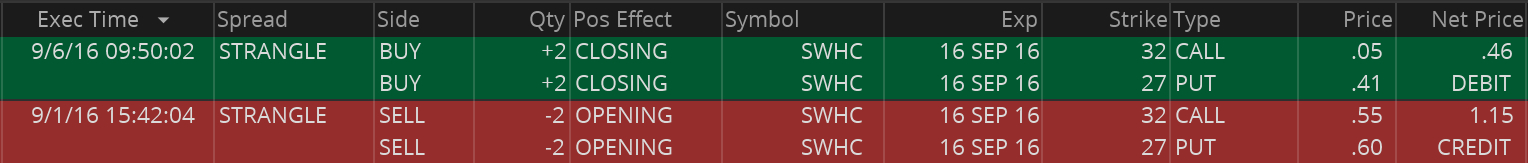

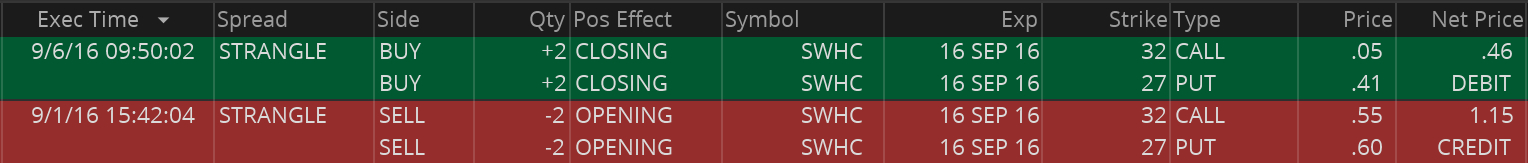

Smith and Wesson Holding Company (SWHC) Earnings Strangle

Notes: Another successful earnings trade. My position size was too big but I was fortunate in that it worked out in this case. Was able to close it out at the 50% profit target

Margin Requirement/Cost: ~$940

Margin Requirement/Cost: ~$940

Income: $125.80 ($138 less commissions and fees)

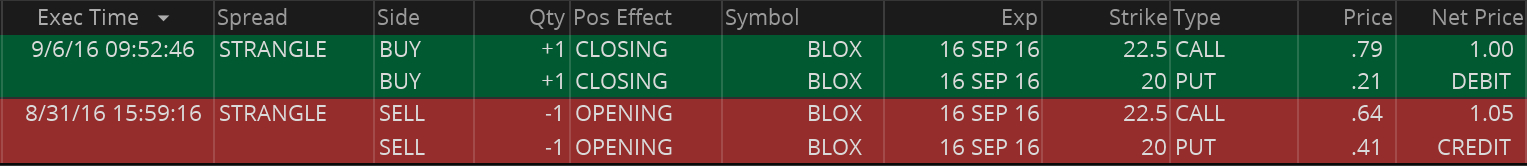

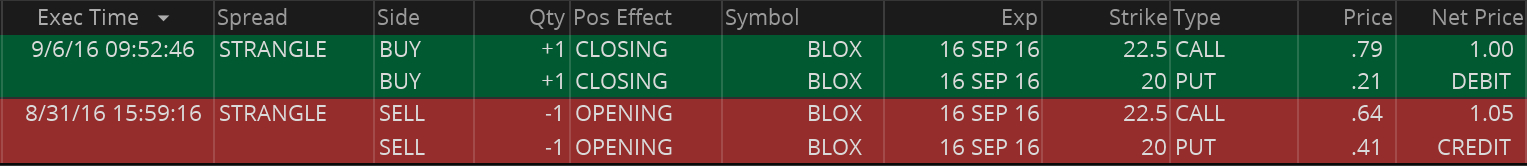

Infoblox (BLOX) Earnings Strangle

Notes: Another earnings trade. They announced earnings on August 31. Implied volatility on 2 September had dropped from the 86 percentile down to the 2nd for this stock, but the option pricing didn’t reflect that, IV dropped but was approaching my break even so I just closed for a wash/small loss.

Margin Requirement/Cost: ~$600

Margin Requirement/Cost: ~$600

Income: -$1.08 ($5 less commissions and fees)

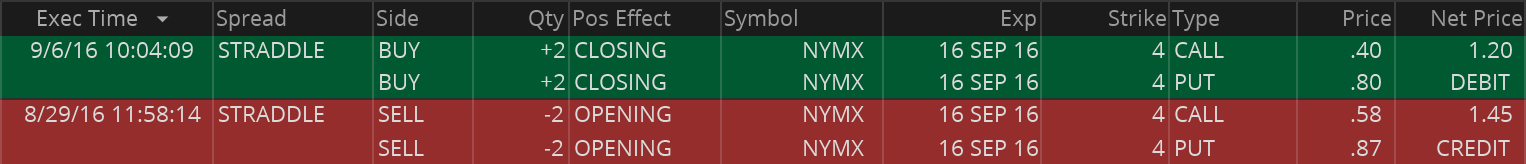

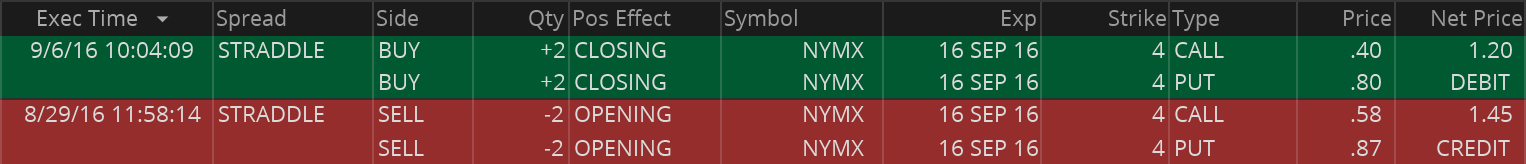

NYMOX (NYMX) Strangle

Notes: There was a lot of volatility for pharmaceutical stocks. Probably related to the EpiPen outrage. Not enough liquidity but was still able to close for a profit.

Margin Requirement/Cost: ~$635

Margin Requirement/Cost: ~$635

Income: $37.80 ($50 less commissions and fees)

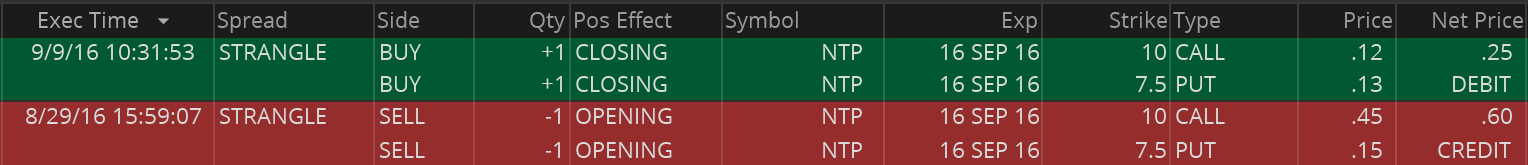

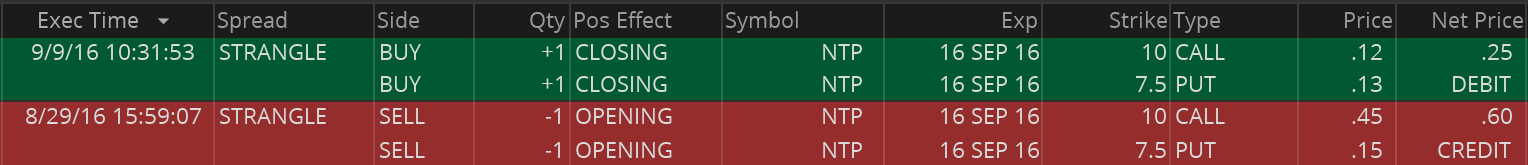

Namtai (NTP) Strangle

Notes: This was another stock trading with high volatility due to an announcement. Not sure how much volatility dropped but time decay certainly helped. Closed at 50% profit target.

Margin Requirement/Cost: Not recorded

Margin Requirement/Cost: Not recorded

Income: $28.92 ($35 less commissions and fees)

Energous Corp (WATT) Earnings Strangle

Notes: Bad Q2 earnings, net short position, high 88th percentile IV, was able to close at a 50% profit target after waiting a little while.

Margin Requirement/Cost: $535

Margin Requirement/Cost: $535

Income: $83.92 ($90 less commissions and fees)

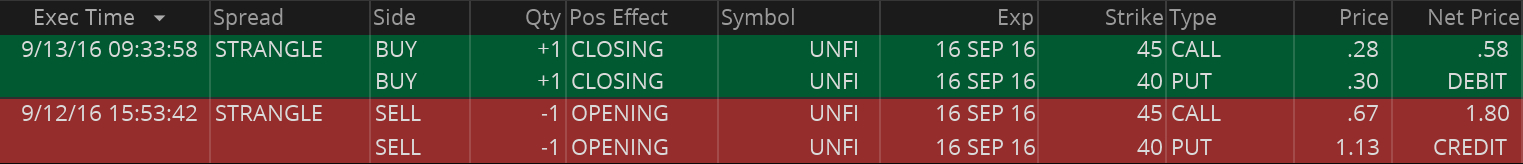

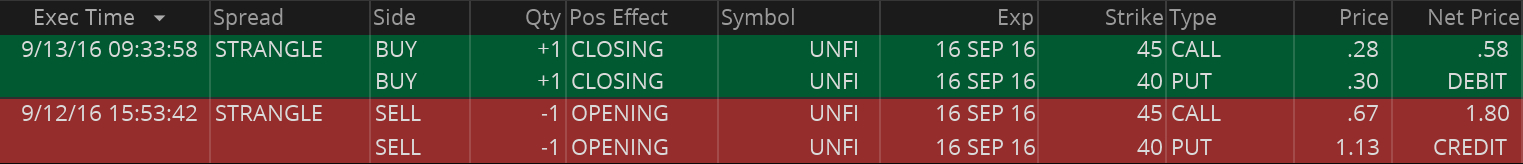

United Natural Foods (UNFI) Earnings Strangle

Notes: I calculated an expected move of +/- 2.77 from 41.80. Didn’t move hardly at all and was able to close the next day for a nice profit. Margin requirement was too high but I didn’t get burned on this one.

Margin Requirement/Cost: $837

Margin Requirement/Cost: $837

Income: $115.92 ($122 less commissions and fees)

Novavax (NVAX) Strangle

Notes: I counted this as a separate from the other NVAX position because these were September options and I closed them completely out before opening a new NVAX position. NVAX was trading with high volatility. Closed this in phases. Added a smaller strangle, which turned out to be ill advised. My initial position had a smaller margin requirement.

Margin Requirement/Cost: ~$650

Margin Requirement/Cost: ~$650

Income: $104.32 ($147 less commissions and fees)

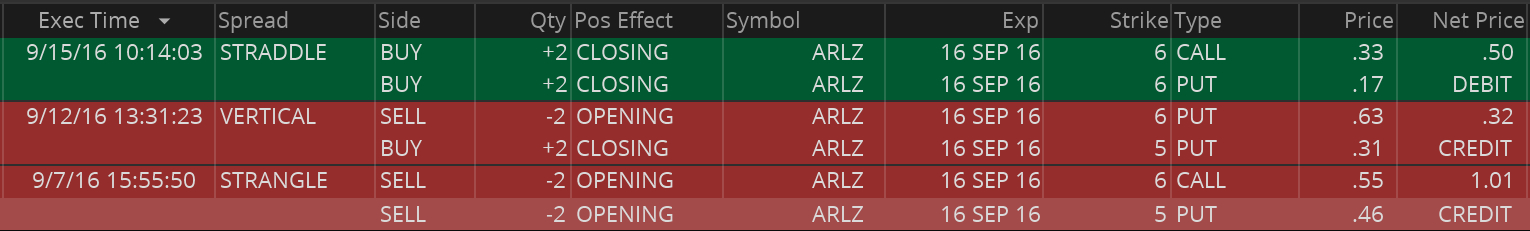

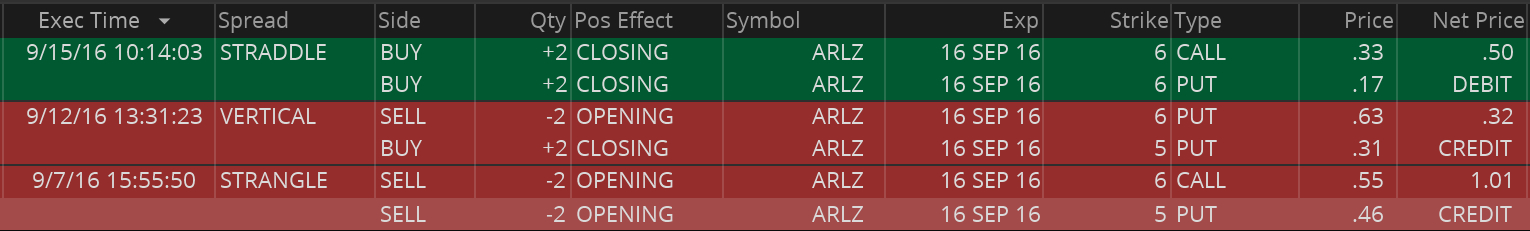

Aralez Pharmaceuticals (ARLZ) Strangle

Notes: Another pharmaceutical stock trading with high volatility, resumed trading on Thursday 9-15 and was able to close at well over a 25% profit target.

Margin Requirement/Cost: $582

Margin Requirement/Cost: $582

Income: $147.70 ($166 less commissions and fees)

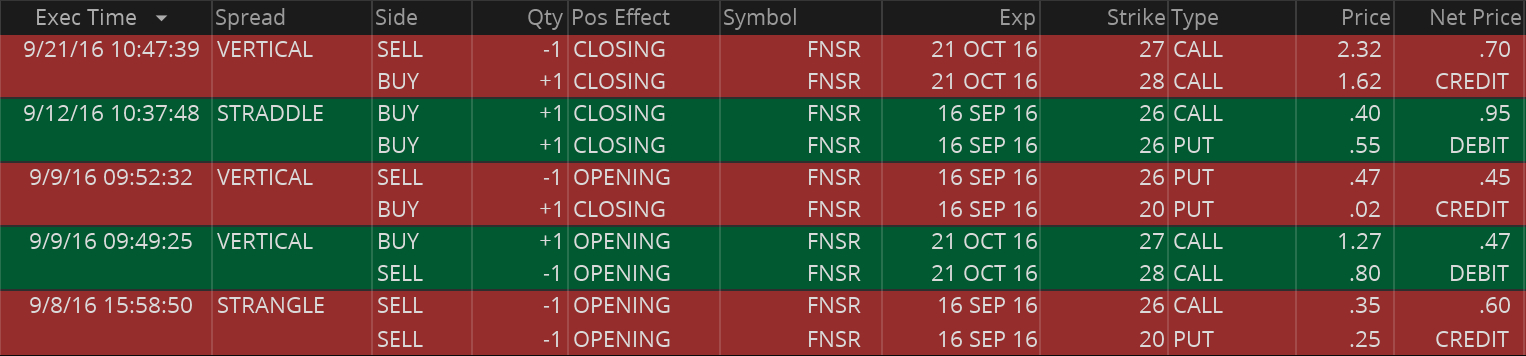

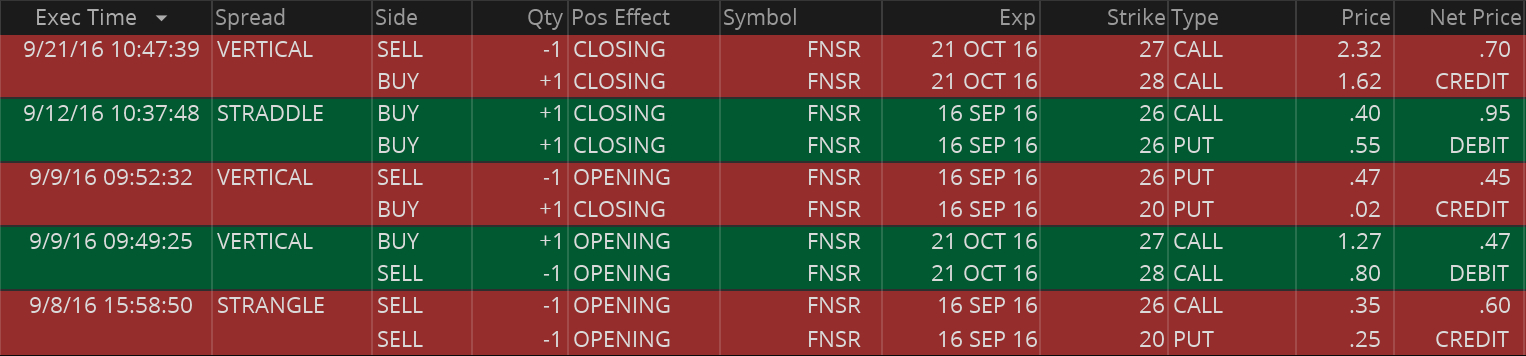

Finisar Corp (FNSR) Earnings Strangle

Notes: Had a big earnings beat, stock went up as high as 26.5 after hours. My break even on the upside was 26.61. Had a very nice drop in implied volatility. But didn’t matter as much since it moved beyond my range. Made some adjustments. Dropped down allowing me to close my original strangle, had a long position on FNSR to make up some of the losses. Closed on the 21st for a wash.

Margin Requirement/Cost: $490

Margin Requirement/Cost: $490

Income: $17.79 ($33 less commissions and fees)

iShares Mexico ETF (EWW) Iron Condor

Notes: Somewhat high volatility, took a neutral position because I think when the fed does not tighten it will help the emerging markets. Perhaps should have gone a little bullish. ETF approached by upper call, so closed out the short call on the 21st. Maybe could of held onto it, but didn’t want the risk.

Margin Requirement/Cost: ~$328

Margin Requirement/Cost: ~$328

Income: -$1.25 ($14 less commissions and fees)

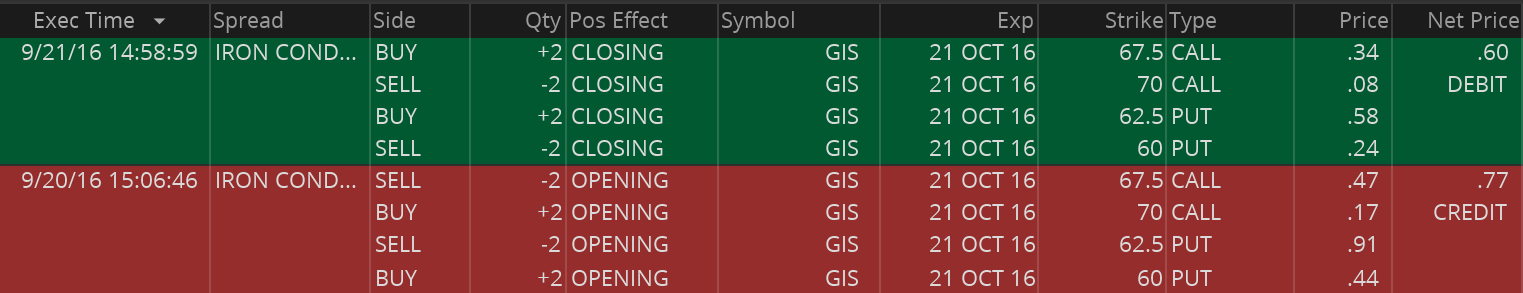

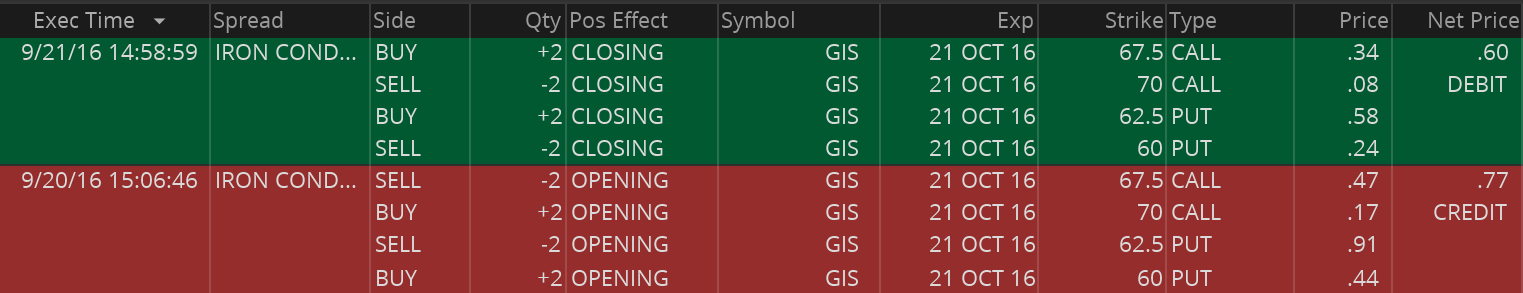

General Mills (GIS) Earnings Iron Condor

Notes: I prefer the strangle, but did this risk defined iron condor because of the margin requirements and position sizing. Standard earnings trade. Got some implied volatility drop but not as much as the last two earnings sessions. Closed for a wash.

Margin Requirement/Cost: $500

Margin Requirement/Cost: $500

Income: $9.60 ($34 less commissions and fees)

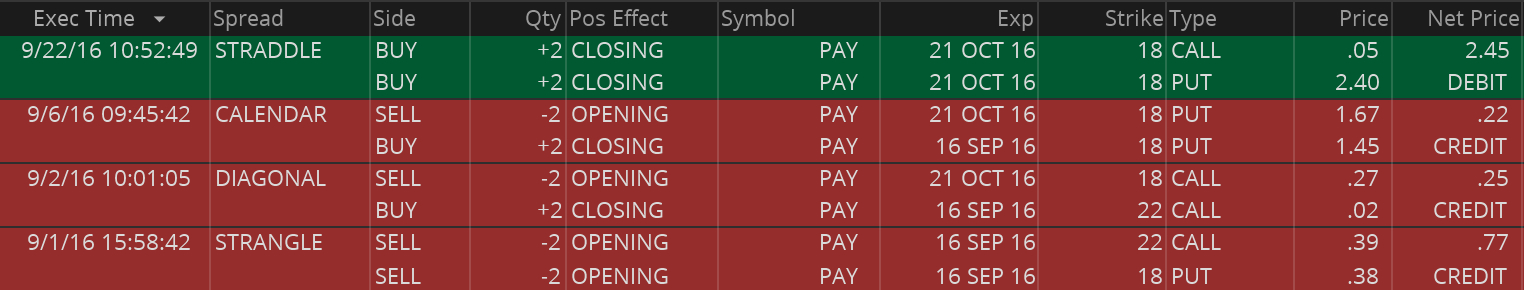

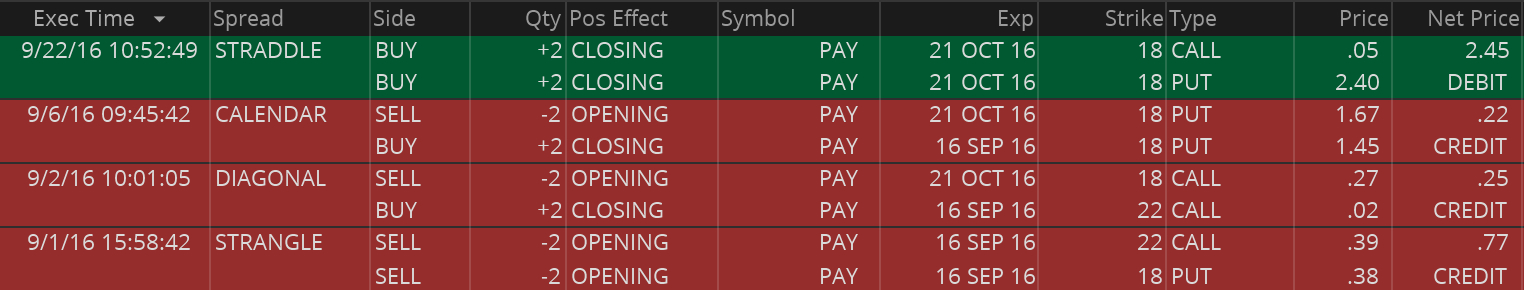

VeriFone Systems (PAY) Earnings Strangle

Notes: Beat earnings but stock tanked beyond my break even. Adjusted the call side down for some additional credit, and hopes that the stock rebounds some. Adjustment ended up costing me more $.

Margin Requirement/Cost: ~$640

Margin Requirement/Cost: ~$640

Income: -$266.64 (-$242 less commissions and fees)

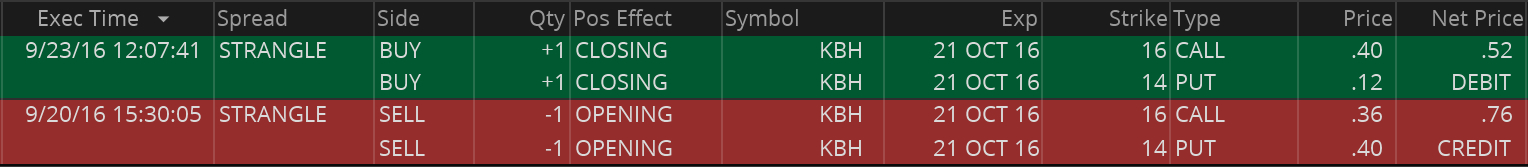

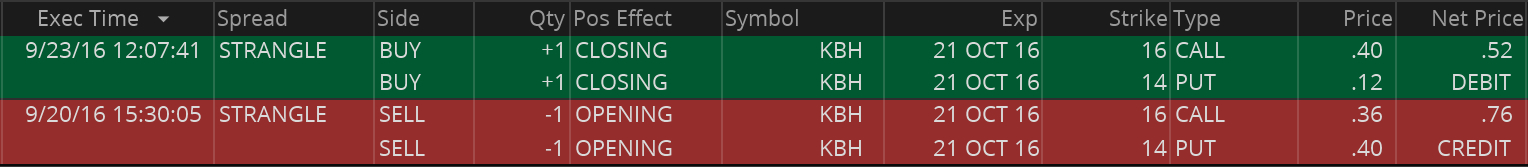

KB Home (KBH) Earnings Strangle

Notes: Earnings trade. Got a nice drop in volatility but stock was approaching my break even on the high side and decided to close out for other opportunities.

Margin Requirement/Cost: $280

Margin Requirement/Cost: $280

Income: $17.96 ($24 less commissions and fees)

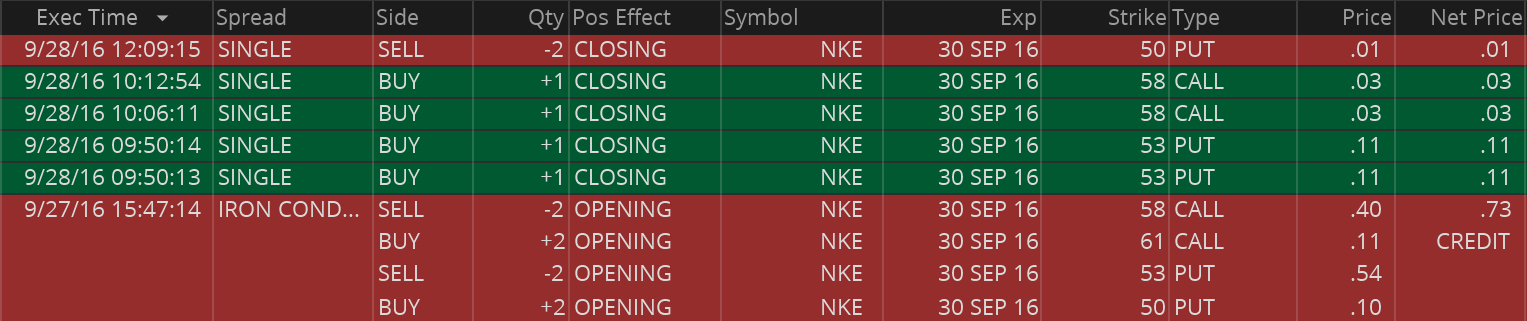

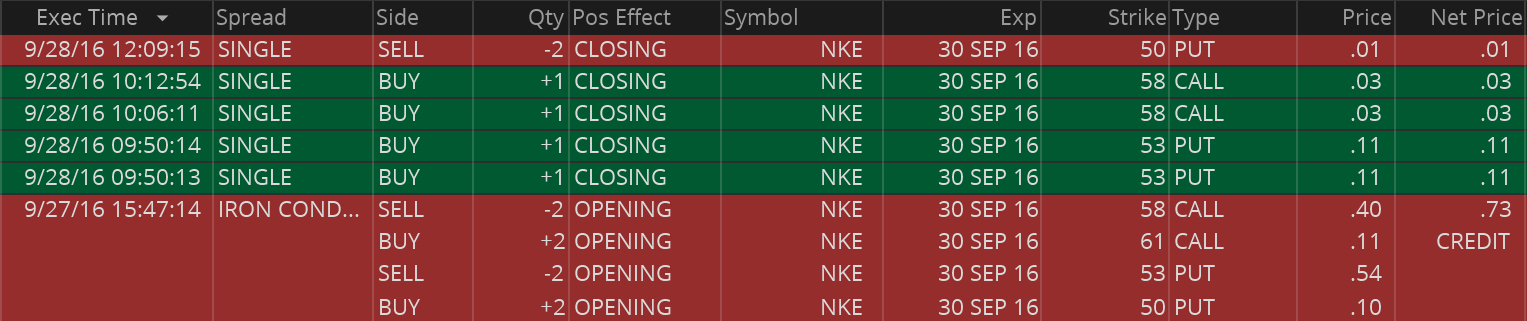

Nike (NKE) Earnings Iron Condor

Notes: Another earnings trade. This one had a nice setup. NKE has a nice volatility drop after earnings, there are month contracts (which have the most volatility “juice”), and IV percentile was at 72%. I’d prefer volatility was higher, but 72% is certainly high enough for an earnings trade. I did a defined risk Iron Condor since the margin requirements are high. Nike announced earnings after hours, they beat, but the stock sold off. As of 10PM in after hours NKE was at 54.09, just hope it holds tomorrow and volatility drops! IV dropped to 28%, and with it the value of the options I sold plummeted. This was a textbook trade, if I could do this 2-3 times a week I’d be thrilled, but unfortunately these types of trades don’t come along every week.

Margin Requirement/Cost: $600

Margin Requirement/Cost: $600

Income: $101.65 ($120 less commissions and fees)

by John | Sep 20, 2016 | Learning from Mistakes, Saving Money

I have several credit cards. All of which I pay off each month.

I have one that I use for most of my expenses: groceries, petrol, utilities, etc. I have it set to be paid automatically each month.

I have a few others that I rarely use unless I’m making a purchase at a specific store. With those cards, I try to pay them off as soon as I make the purchase.

Well this month I made a mistake. I forgot to pay one of my rarely used cards off. I was alerted to my omission the other night via text that I was hit with a $25 late fee.

Ugh. I hate that.

I immediately paid off all my balance. Then I called up the bank and asked if there was anything they could do about the late fee. They said my account was in good standing and they would waive the fee.

Now I don’t think my bank had to do this. After all, they might say “I’m sorry, your payment was late and we can’t help you,” in which case I will have lost $25.

But you don’t know unless you ask.

The Phone I used didn’t look like this.

I caught it within a couple days, called up the bank and got the fees reversed.

I then went in and setup my auto-pay. In this second case I don’t feel as responsible, since I had auto-pay setup, but it is another example that you just have to ask.

Plus if your bank says no, that might be a good reason to take your business elsewhere.

by John | Aug 13, 2016 | Investment Failures, Learning from Mistakes

On August 2 Coindesk reported a hacker stole some $60 million worth of Bitcoin from the Bitfinex exchange. Altcoins such as ETH, ETC, LTC on Bitfinex were not stolen by the hacker.

Source: http://www.coindesk.com/bitfinex-bitcoin-hack-know-dont-know/

Bitfinex decided to “socialize” the losses in what they claim would be similar to a bankruptcy liquidation.

All account holders on Bitfinex at the time of the hack received the newly created BFX tokens equal to roughly 36% of their pre-hack balance in place of the losses.

The tokens were issued at a one token to dollar parity. For crypto currency balances the value was based on prices announced by Bitfinex.

Source: http://blog.bitfinex.com/uncategorized/bitfinex-update/

Interestingly before trading was live the ticker already priced BFX at .80 per token–a 20% discount.

As of writing tokens are trading down around $.36.

But this low price creates an opportunity for the exchange Bitfinex. They could buy their own tokens back at a huge discount and then forgive their own debt.

Debt Buyback: An Example

Let’s say you borrow $100 from your friend Robert. You give Robert a piece of paper promising to pay him back (an “IOU”).

You fall on hard times and Robert is convinced you won’t make good on your promise to pay him back so he decides to cut his losses.

He sells the IOU to Susan for $25. Robert figures $25 is better than $0.

Susan holds the IOU for a little while but then decides she wants the money. She offers to sell the IOU for $30.

You could buy your own IOU back for just $30 and then forgive the debt to yourself.

In other words you’ve just gotten $100 for $30.

See where I’m going with this?

While no one voluntarily loaned money to Bitfinex in exchange for the BFX tokens my hypothetical example above is very similar to the position Bitfinex finds itself.

Bitfinex public relations man Zane Tackett claims they do not buy their own debt on the exchange.

Source: https://www.reddit.com/r/BitcoinMarkets/comments/4xcrup/bfxcoin_discussion/d6ei72p?context=3

I have no evidence that Bitfinex is buying their own tokens. But there is a strong incentive for them to do so.

BFX Token Losers

From my perspective the tokens are a huge disappointment.

The tokens pay no interest, no dividend, and there is no timeline on when the tokens will be repaid or even if they will ever be repaid.

“However, no property held back will be used to pay dividends to current shareholders unless and until our customers are repaid.” Emphasis Added.

Source: http://blog.bitfinex.com/uncategorized/interim-announcement/

The best people like me who were assigned the token can hope for is Bitfinex will pay the face value back in full as soon as possible.

I don’t see how the BFX tokens will ever be worth $1 or more via trade. If Bitfinex releases a legally binding repayment plan I could see the token value approach $1. For example, if Bitfinex announced BFX tokens would be repaid on 8/14/2016, they might trade up to $.99 per token leading up to the payout for people to make .01 per token in one day.

Why is that the case? Because a rational investor will not voluntarily buy an instrument today for the promise of the same (or less) amount in the future. A rational investor wants to be compensated for the time value of money.

Plus there is a lot of risk that the amount will never be repaid. The BFX tokens are reward-free risk for anyone assigned the token.

It beats just taking the full 36% loss, but falls far short of my hopes for interest, equity, tradability (for US clients) and a set maturity.

Presumably the tokens could be held to “maturity” at which point Bitfinex would buy them back at face value but if maturity is 1 or 100 years from now, tomorrow or never, no one knows.

That could be a long time with no interest which is a big fat loss both in terms of lost opportunities to invest the money elsewhere and purchasing power lost due to price inflation.

BFX Token Winners

As mentioned earlier in this article, if Bitfinex were to buy back their own debt at current token prices they would be saving 64% on their outstanding debt.

Other winners could be risk loving speculators. With the token trading at just $.36 speculators who believe that Bitfinex will buy the tokens at face value could buy BFX tokens at a huge discount.

For example if I could buy BFX tokens for $.36 each and I knew I’d get a dollar for them in a year it’d be a no brainer investment.

Roulette or BFX Token: Which is riskier?

What is a Bitfinex Client to do?

If you were assigned BFX tokens at face value and you’re a US resident you’ve only got two options. The first is sell the BFX tokens to cut your losses. The second is to hold onto them and hope they go up in value or are repaid.

If you’re not in the US you could double down and buy BFX tokens to decrease your BFX token cost basis, but I think this is super high risk.

I’m still sitting on my BFX tokens to see what happens. At some point I may cut my losses and sell them but I haven’t made a decision yet.

If you feel like gambling and you’re not a US resident you could buy BFX tokens and hope Bitfinex pays them off. But with no set maturity, no guarantee of repayment and no interest it’s certainly not investing.

by John | Aug 6, 2016 | Learning from Mistakes

Update 11 September 2016 1:23 AM EST

The following was announced on the 9th:

We are pleased to provide an update on our partnership with BnkToTheFuture. As we announced on August 22nd, we are coordinating with BnkToTheFuture to launch a Special Purpose Vehicle (SPV) that will allow the conversion of BFX tokens to equity stakes in iFinex, the corporate entity behind Bitfinex. We expect to release final details and terms on or before Sept. 15, 2016.

As previously reported, we have signed a letter of intent with BnkToTheFuture, an online investment platform, to provide an SPV through which BFX token holders can exchange their BFX for a beneficial interest in iFinex. Since then we have worked on adding functionality to facilitate these exchanges within the Bitfinex platform. Redemption of BFX for the beneficial interest in iFinex will be done at BFX’s face value of $1 US Dollar.

Participation in the SPV will be limited to holders of a minimum of 1,000 BFX tokens. It is principally designed to compensate Bitfinex customers who suffered losses resulting from a security breach that occurred against the company on August 2, 2016.

We are continuing to press forward with our plan to retire as many BFX tokens as possible through the equity conversion.

Going forward, our principal objectives are to raise new capital to help redeem outstanding BFX tokens and fund investment in future growth.

Source: https://www.bitfinex.com/posts/141

The following was announced earlier:

We are pleased to announce the redemption of 1.1812% of outstanding BFX tokens. This redemption was applied pro rata to all wallet balances on September 1, 2016

Update 22 August 2016 11:16 AM EST

From Bitfinex:

We have formally signed a letter of intent with BnkToTheFuture, the online investment platform for financial innovation and technology investment opportunities, to provide solutions towards compensating customers with equity in Bitfinex.

BnkToTheFuture will be providing a Special Purpose Vehicle (SPV) through which qualifying BFX token holders can contribute their tokens in exchange for an equity interest in compliance with their individual jurisdictions. Further details will be released in future announcements.

Source: https://www.bitfinex.com/posts/137

Will “qualifying BFX token holders” include US residents I wonder?

Update 17 August 2016 3:25 PM EST

In addition to providing some general information regarding the hack and assuring everyone of additional security measures, Bitfinex addressed the efforts to compensate affected customers.

From Bitfinex:

We are actively engaged with efforts to convert certain qualifying token-holders to shareholders of Bitfinex and to redeeming the remaining BFX tokens through a combination of new capital and earnings. We have re-enabled most of the features on the platform and are deeply grateful to our customers, who continue to trade with and help us rebuild our brand.

Source: https://www.bitfinex.com/posts/135

Update 10 August 2016 10:15 AM EST

From Bitfinex:

Today, August 10th, 2016, at 16:00:00 UTC we will be enabling additional platform features as we continue to restore service after the incident on August 2nd. Exchange trading will be enabled for all currencies and pairs, while deposits and withdrawals will be enabled for BTC, ETC, ETH, and USD – with LTC and Tether to follow shortly thereafter.

16:00 UTC is 12:00 Eastern.

Source: https://bitfinex.statuspage.io/incidents/7vjycmzlwr85

Update 8 August 2016 2:16 PM EST

Bitfinex PR man Zane Tackett is relaying that US accounts will not be able to trade the BFX token.

Source: https://www.reddit.com/r/Bitcoin/comments/4wng2j/site_relaunch_bitfinex_blog/d69ag74?context=3

Update 7 August 2016 11:06 PM EST

The BFX token will not be tradable for US clients. This is a huge disadvantage.

Source: https://www.reddit.com/r/BitcoinMarkets/comments/4wng7l/site_relaunch_bitfinex_blog/d68gv7y?context=3

Or they “may” be tradable? Unclear.

“The trading of BFX tokens may be restricted for US customers.”

Source: https://bitfinex.statuspage.io/incidents/pckmx0trfq3n

—

Update 7 August 2016 8PM EST

Bitfinex.com is now live and read-only to check account balances.

Source: http://blog.bitfinex.com/uncategorized/site-relaunch/

—

The situation at Bitfinex is very fluid. I’m relaying the facts as I understand them as of writing. I’m not affiliated with Bitfinex and I do not speak for them.

The source for this information (as listed below) is from the Bitfinex status page and Zane Tackett’s reddit posts. Mr. Tackett is the Director of Community & Product Development at Bitfinex.

Facts as of 6 August 2016 at 4:50 PM EST

•119,756 BTC was stolen from Bitfinex on 2 August 2016.

•The value of the BTC stolen at that time was around $60 million.

Source: http://www.coindesk.com/bitfinex-bitcoin-hack-know-dont-know/

•Losses will be socialized across all account values.

•Accounts will be worth 36.067% less than their pre-hack levels.

Source: https://bitfinex.statuspage.io/incidents/8qd35qxs01mm

•For example, even though no Ethereum (ETH) has been reported stolen, ETH balances will suffer 36.067% losses.

•Put differently, if someone had 1 BTC pre-hack, that account balance will now be .63933.

•If someone had 100 ETH pre-hack, that account balance will now be 63.933 ETH.

Source: https://www.reddit.com/r/Bitcoin/comments/4wge37/bitfinex_interim_update_plans_to_compensate_users/d66sy6w?context=3

•BFX Tokens will be issued.

•BFX Tokens *could* be exchanged for equity in iFinex Inc. (Bitfinex)

We are actively discussing various strategic options with numerous potential investors as part of our strategy to fully compensate our customers. Such discussions, however, are in early stages and will likely take time to play out. In the meantime, In place of the loss in each wallet, we are crediting a token labeled BFX to record each customer’s discrete losses. Tokens will be distributed without release or waiver. The BFX tokens will remain outstanding until redeemed in full by Bitfinex or possibly exchanged—upon the creditor’s request and Bitfinex’s acceptance—for shares of iFinex Inc. We are still sorting out many details on this; we will post further updates in the coming days.

Source: https://bitfinex.statuspage.io/incidents/8qd35qxs01mm

•The exchange will come back on within 24-48 hours. (This announcement was made at 11:02 AM Eastern on 6 August 2016. So 24 hours would be 11:02 AM on Sunday 7 August and 48 hours would be 11:02 AM on Monday 8 August.)

•My understanding is that when users can login to Bitfinex, it will only be to check account balances. Initially no trades or withdrawals will be available.

Source: https://bitfinex.statuspage.io/incidents/8qd35qxs01mm

by John | Jun 2, 2016 | Learning from Mistakes, Passive Income

Ethereum Cloud Mining on Hashflare.io is a losing investment. It is more profitable to simply buy Ether on an exchange.

(more…)

Margin Requirement/Cost: $420 up to $840

Margin Requirement/Cost: $420 up to $840 Margin Requirement/Cost: $875

Margin Requirement/Cost: $875 Margin Requirement/Cost: $615

Margin Requirement/Cost: $615 Margin Requirement/Cost: $500

Margin Requirement/Cost: $500 Margin Requirement/Cost: ~$600

Margin Requirement/Cost: ~$600 Margin Requirement/Cost: ~$500

Margin Requirement/Cost: ~$500 Margin Requirement/Cost: ~$940

Margin Requirement/Cost: ~$940 Margin Requirement/Cost: ~$600

Margin Requirement/Cost: ~$600 Margin Requirement/Cost: ~$635

Margin Requirement/Cost: ~$635 Margin Requirement/Cost: Not recorded

Margin Requirement/Cost: Not recorded Margin Requirement/Cost: $535

Margin Requirement/Cost: $535 Margin Requirement/Cost: $837

Margin Requirement/Cost: $837 Margin Requirement/Cost: ~$650

Margin Requirement/Cost: ~$650 Margin Requirement/Cost: $582

Margin Requirement/Cost: $582 Margin Requirement/Cost: $490

Margin Requirement/Cost: $490 Margin Requirement/Cost: ~$328

Margin Requirement/Cost: ~$328 Margin Requirement/Cost: $500

Margin Requirement/Cost: $500 Margin Requirement/Cost: ~$640

Margin Requirement/Cost: ~$640 Margin Requirement/Cost: $280

Margin Requirement/Cost: $280 Margin Requirement/Cost: $600

Margin Requirement/Cost: $600