by John | May 21, 2017 | Cryptocurrency

There has been tremendous upward volatility in cryptocurrencies over the past month.

The largest blockchain based cryptocurrency, Bitcoin, is trading over $2,100 with a market cap over $35 billion.

Ripple, a cryptocurrency seeking to lower the cost and increase the speed of international fund transfers is up to a market capitalization of nearly $13 billion with a price of $.33.

Ripple has been trading places with Ethereum as the second largest cryptocurrency. As of writing, Ethereum is up to a market capitalization over $15 billion making it the second largest cryptocurrency by market capitalization. The price is over $165 per coin.

A variety of other coins like DASH and Litecoin have also risen considerably over the past month.

Purists will despise Ripple for its adoption by large banks but it has a clear use case and the archaic international money transfer technology that is currently used by banks is ripe for replacement.

I own some Bitcoin, DASH, Ripple and Ethereum. I’m considering reducing my exposure to Bitcoin and taking some profits.

I remain skeptical of Bitcoin and I’m long term bearish on the currently largest cryptocurrency.

I consider Bitcoin an almost a purely speculative play because of the non-trivial technological issues with Bitcoin: including slow transaction speed, lack of privacy and scalability problems.

I also think the fact that Bitcoin has no non-monetary use is a problem for reasons I’ve previously described.

I think now is closer to being a good time to sell cryptocurrencies rather than buy them. The various cryptocurrencies could of course go even higher. For someone interested in purchasing crypto, waiting for a pullback or at least dollar cost averaging could be a good approach.

by John | Apr 2, 2017 | Cryptocurrency, Currencies, Wealth Protection

I have a love/hate like/dislike relationship with cryptocurrencies. But one thing I feel confidently about is that Bitcoin is not the future of cryptocurrencies.

By market capitalization Bitcoin is currently sitting in the #1 position as the largest cryptocurrency.

Source: https://coinmarketcap.com/

But it isn’t there because it’s the best. It’s there because it was first.

There is something to be said for the network effect but Bitcoin has several fatal flaws that leave it vulnerable to being overtaken by newer and better technology.

Bitcoin Transactions take “forever”

A screen capture from bitcoin.org. I don’t consider 10-30 minutes fast unless we’re talking about glaciers or the the average US bureau of motor vehicles

If I buy something digital online I want to be able to download it instantly.

Imagine buying a song on iTunes but having to wait 10-30 minutes to start downloading it. If Apple used bitcoin instead of credit cards that’s probably how long you’d have to wait.

Or what if you want to buy a latte on the way into work? Would you want to wait 10-30 minutes in the coffee shop before you can leave with your drink?

Obviously not.

But why is Bitcoin so slow?

Bitcoin takes 10 minutes per block. A block is a set of transactions. So at best Bitcoin takes 10 minutes to confirm a transaction. Most vendors however, require 2-3 confirmations before they consider the bitcoin transferred, which means 20-30 minutes of waiting.

Bitfinex requires 3 confirmations before it considers Bitcoin transferred

You need a Trusted Third Party to make Fast Payments

Websites like Overstock.com accept Bitcoin as payment. However, they do so by utilizing a trusted third party, like Coinbase, to serve as a middleman.

No doubt they do this to avoid the issue of double-spending, refunds and transactions taking thirty minutes.

But the fact that overstock.com uses a trusted third party pours cold water on the idea Bitcoin has “Fast peer-to-peer transactions”.

Bitcoin has Scalability Problems

In addition to confirmations being slow, Bitcoin has issues with scalability of the network, or the number of transactions the network can process. There are competing camps about how to resolve this issue but there has been much more debate than action.

This could lead to hard forks of the cryptocurrency. More on that later.

Bitcoin Transactions aren’t Anonymous

One of the previously oft touted benefits of Bitcoin was anonymity in transactions. While Bitcoin transactions are pseudonymous, unless you buy bitcoins in cash from someone on the street, there are links back to the exchanges and thus bank accounts.

I’m sure there are ways to purchase Bitcoins anonymously but it’s not easy or safe. If you know how to do this I’d value your input in the comments section below.

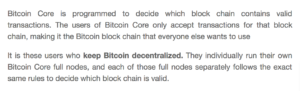

Bitcoin is Centralised and the Centralised Powers don’t have Their Act Together

A screen capture from the Bitcoin Foundation (bitcoinfoundation.org) website

Despite propaganda that Bitcoin is decentralised–it is in fact controlled by the Bitcoin Foundation in conjunction with the Bitcoin Core developers and the larger miners who can afford the expensive application specific integrated circuit hardware required to successfully mine Bitcoin.

In sort of an Orwellian double-speak both the Bitcoin Core developers and Bitcoin Foundation talk about how they keep Bitcoin decentralised.

The Bitcoin Core development team is not very big.

I don’t see how a group of 3 “maintainers” and a dozen or so contributing developers is “decentralised”.

If I wanted to be really mean I would compare the Bitcoin Foundation to the Federal Reserve and the miners to the big wall street banks.

But I won’t do that.

The main advantage Bitcoin has over the Federal Reserve is that the number of Bitcoins that will be created is fixed at 21 million whereas there is no limit to how many dollars the Federal Reserve can conjure from within the shady halls of the Eccles Building.

A screen capture of a written statement from bitcoin.org/en/bitcoin-core/

However, if Bitcoin forks, like Ethereum did, then the number of Bitcoins will effectively double.

I don’t necessarily have a problem with a cryptocurrency being centrally controlled.

While I have a general bias towards decentralisation and subsidiarity (when possible)–I think that a benevolent dictatorship can be good–provided it is easy to jump ship if the centralised power becomes corrupt.

Bitcoin is Squandering it’s First Mover Advantage

But despite large issues with Bitcoin the Bitcoin Foundation and the Bitcoin Core developers haven’t gotten it together to make progress in fixing the aforementioned systemic issues with Bitcoin.

Could these problems be fixed? Sure. Smart, motivated individuals working together towards a common goal can accomplish amazing things. But I don’t see the Bitcoin community taking these problems seriously.

For these reasons I believe that Bitcoin is not the future of cryptocurrencies.

If you are interested in purchasing Bitcoins, I show you how to buy Bitcoins on Coinbase.

by John | Mar 26, 2017 | Currencies, Saving Money, Wealth Protection

There is a lot I like about cryptocurrencies. Many cryptocurrencies seek to make money decentralised and wrest control from the central banks that have a history of devaluation and abuse.

But there are several things I dislike about cryptocurrencies. I see several problems with them as a long-term store of value.

“What is a Cryptocurrency Anyway?”

Bitcoin is the largest cryptocurrency but there are hundreds of others as well. If you’re not familiar with Bitcoin I provide some background here: “What is Bitcoin?”

What I Dislike About Cryptocurrencies

Cryptocurrencies are better than government controlled fiat. But I don’t accept that being better than the disaster that is government fiat currency is good enough and I’m not going to pretend like cryptocurrencies solve all the problems of government controlled fiat money.

I’ve presented what I think are superior alternatives such as Goldmoney.

I touched on what I don’t like about cryptocurrencies in my gold versus bitcoin article but I wanted to dedicate an article solely to the elucidation of what I don’t like about cryptocurrencies.

My dislikes fall into three main categories.

1) They are centrally controlled

2) There are no natural limits on the quantity of cryptocurrencies

3) Cryptocurrencies have very low (or no) non-monetary use

Cryptocurrencies are Centrally Controlled

I am skeptical of the claim that cryptocurrencies like bitcoin are decentralised

The holdings of the cryptocurrencies are concentrated in the hands of the early adopters.

It is estimated that the mysterious creator(s) of Bitcoin, Satoshi Nakamoto, holds between 4-6% of all Bitcoin.

Source: http://www.businessinsider.com/satoshi-nakamoto-owns-one-million-bitcoin-700-price-2016-6

Vitalik Buterin owns a large number of Ether. Evan Duffield owns a large quantity of DASH.

Ripple intends to hold onto 50% of all Ripple cryptocurrency. There are similar situations for altcoins as well.

I think it is fine and good that early adopters and founders reap more reward for investing in a technology–my point is that cryptocurrencies are not actually as decentralised as cryptocurrency advocates would like you to believe.

This control isn’t limited to who holds the cryptocurrencies.

The control also extends to how the cryptocurrency technologies will function moving forward.

The Bitcoin Foundation, Bitcoin core developers and the largest miners control Bitcoin. The Ethereum Foundation and Vitalik Buterin control Ethereum.

People try to make arguments that cryptocurrencies aren’t centrally controlled and I’m not swayed by any of them.

At the end of the day cryptocurrencies are controlled by a small group of computer programmers.

What happens when cryptocurrencies actually behave in a decentralised manner? You get forks, like Ethereum Classic. Which brings me to my next point.

There are no natural limits on the quantity of cryptocurrencies

Like water in the desert, things that are both limited in supply and desirable tend to be valuable

I don’t have the knowledge or time to delve into the code of the Bitcoin algorithm but I accept on faith that because of how the bitcoin algorithm is written only 21 million Bitcoins will ever exist.

So in that way the quantity of Bitcoins are limited.

However, there is no limit to the number of “altcoins” or other cryptocurrencies that can be and are created.

There is Dash, Ethereum, Litecoin, Ripple, Monero and dozens of other altcoins you’ve never heard of. There are currently nearly 100 altcoins with a market cap over $20 million.

I’m all for competition and choice but when I’m investing in something as a long term store of value I want it to be limited in supply.

Furthermore, if the cryptocurrencies actually behave in a decentralised manner, you sometimes get hard forks.

Hard Forks

There is a cap on the maximum number of Ethereum that will ever be in circulation–but after a hack related to the “DAO” Ethereum forked and a new cryptocurrency was created called Ethereum Classic. This fork effectively doubled the number of Ethereum in existence.

Hard forks effectively result in double the number of units of that particular cryptocurrency

As a brief background, someone the “DAO” which was one of programs on the Ethereum network and stole a lot of Ether.

This caused an outcry, some people wanted to reverse that transaction so the thief wouldn’t get away with it. Some people didn’t want to reverse the transaction because it would mean Ethereum transactions weren’t irrevocable.

Ultimately a hard fork ensued and people who didn’t want to reverse the transaction got Ethereum Classic and those that followed the Ethereum Foundation and Vitalik Buterin remained on what is called Ethereum.

There is also talk of a fork in Bitcoin which would have a similar result: two different flavors of Bitcoin when before these was only one. In effect a doubling of the number of Bitcoins.

Cryptocurrencies have Very Low (or no) Non-Monetary use

I’m not going to flat out say that cryptocurrencies like Bitcoin have zero non-monetary use.

Although if you wanted to round down zero would be accurate.

Some people probably purchased Bitcoin as a political statement or way of saying that they didn’t want to be a part of a government controlled currency system. That is a non-monetary use.

But I think that use value is fairly low. Physical US dollars have non-monetary uses, like kindling or tacky wallpaper, but again that use value is very low and there are much better alternatives that accomplish the same thing.

Some people don’t think it matters that cryptocurrencies have little to no non-monetary use. For a time it probably doesn’t matter. People can subjectively value whatever they want. Otherwise you can’t explain why some works of modern “art” are sold for such high prices. But the question is will that subjective valuation be likely to hold?

Fiat currencies have little to no non-monetary use and how have they fared?

The value of Fiat currencies throughout history have eventually gone to zero. The fiat currencies that exist today did not exist 300 years ago.

The British pound Sterling, founded in 1694, is the oldest fiat currency in existence at 317 years. Most fiat currencies don’t last long.

Source: http://georgewashington2.blogspot.com/2011/08/average-life-expectancy-for-fiat.html

Gold has been valued for the past 3,000 years. What is the difference between gold and government issued fiat currencies? Gold has non-monetary use and non-monetary properties that have, for the past 3,000 years and up to this day, caused people to value it.

But I had better stop myself there rather than jump back into a gold versus bitcoin debate.

I don’t see how cryptocurrencies, that have very little non-monetary use, will fare better than government issued fiat over the long term.

Summing it Up

Some of the other shortcoming of cryptocurrencies are related to security and ease of use but I think those issues are sufficiently manageable.

I just don’t think the coins themselves are a good long-term store of value.

I choose to own both gold and cryptocurrency–I just choose to own more gold.

Just because there are things I don’t like about cryptocurrencies doesn’t mean I won’t use them and profit by them.

I own several flavors of cryptocurrency because I believe that they will be worth more in the future than what I paid for them. I also like to take advantage of the price differences on different exchanges.

I will be writing a future article entitled “Why I Like Cryptocurrencies” where I go into more detail about what I do like about cryptocurrencies.

What do you think of cryptocurrencies? Do you currently own any?

(29 July 2017: In a previous version of this article I claimed that cryptocurrencies are not scarce. I’ve updated the article with more precise language. At the time I first published this article there were over 100 cryptocurrencies with a market capitalization over $1 million, I’ve updated this number to nearly 100 cryptocurrencies with a market capitalization over $20 million.)

by John | Jan 15, 2017 | Learning from Mistakes, Monthly Income, Passive Income

Bitfinex was hacked back on 2 August 2016. About 36% of Bitfinex holdings were stolen. All Bitfinex account holders took a 36% loss and were issued one BFX token for each dollar-equivalent in value that was lost.

BFX tokens are basically “IOUs” specific to Bitfinex. I was issued the 313 BFX tokens since I had lost 313 dollars.

BFX tokens were then made tradable and the price plummeted from a 1 to 1 parity with the dollar down to a fraction of a dollar.

This enabled folks to close their BFX tokens and get some of their money back immediately. Or they could choose to hold onto the BFX and wait for Bitfinex to raise capital to make good on these IOUs.

I was fairly upset for a while about this hack and my loss. I withdrew the remaining 64% of my holdings from Bitfinex and I didn’t login to Bitfinex for a while.

But one of my readers informed me that he was going to be investing some more money in margin funding at Bitfinex and that got me interested again.

Plus I still had 313 BFX tokens sitting in my account.

BFX Redemptions are Slow

About a month after the hack, in September 2016, Bitfinex started redeeming BFX tokens for dollars at a 1 to 1 parity. They essentially began making good on the IOUs they’d given out.

I received $17 in BFX token redemptions between 1 September 2016 and 7 January 2017. Bitfinex most recently redeemed 2% of all outstanding BFX tokens on 10 January.

I calculate that if it took four months to get $17 back it will take over six years to get the rest back.

Because the rate of redemption is so slow I sold my BFX tokens for dollars at a rate of .55 USD per token.

I’ve started margin lending using these dollars.

Why go back to Bitfinex after their security breach cost me 36%?

My thought process is that Bitfinex was hurt so much by the last hack that they are hyper-vigilant now. They’ve implemented additional security features such as two-factor authentication and offline, cold wallets.

Bitfinex is the only game in town I’m aware of that allows users to do margin funding.

And I want to recoup my losses. As of writing the “Flash Rate of Return” for margin funding is .07% per day. So based on my calculations I should be able to get back to $313 in about 3.5 years.

That is assuming the FRR stays at or above .07% per day. Hopefully it goes up.

Bitcoin is Volatile

Bitcoin Price Projection Diagram

I think margin funding is a great way to take advantage of the popularity of Bitcoin without the exposure to BTC price fluctuations.

BTC is volatile which is something that traders like.

In January Bitcoin started around $950 went up over $1,100, then back down to roughly $800.

Do These Price Fluctuations Matter?

If I believed Bitcoin was a great long term holding I don’t think I would care about these price fluctuations. A big run-up would be a time to take some money off the table and a big drop might be a time to increase my holdings.

Some people like holding BTC and believe it will go “to the moon” but I am somewhat skeptical of Bitcoin as a currency and I don’t know that BTC will be valued higher 10 or 20 years from now than it is today.

I prefer gold over Bitcoin because it has a 3,000 year history of being valued; but as I’ve said before, you can own both (I do). I just choose to own much more gold than Bitcoin.

I still like Margin Funding

By being a margin lender (in my case with USD) I’m not exposed to Bitcoin price changes and there is a set rate of return each time funds are lent out. From a market perspective there is no BTC price risk.

There is USD debasement risk. But the main risk, as I learned, is hacks.

There is also counter-party risk but I believe Bitfinex to be a reputable company.

Of course I wish they had better security so they never got hacked in the first place but I think they handled the situation fairly well and have taken a lot of steps to increase security.

It is too bad for that folks in US are not eligible to buy BFX tokens (if I recall correctly they were selling for .33 USD at one point and are now at .59, that would have been a good trade).

Citizens of the land of the free were also not eligible to partake in the BFX token-for-equity-programs–onerous US regulations are to blame for these restrictions.

I discuss the benefits of margin funding in more detail in my article Margin Funding to Generate Passive Income. I do think that it is a market-safe way to grow wealth, but the risk of future hacks is not something to be taken lightly.

If you do decide that signing up for a Bitfinex account is right for you, use this link: Bitfinex.

by John | Nov 27, 2016 | Preservation of Purchasing Power, Saving Money, Wealth Protection

I favor gold over Bitcoin as a long-term store of value. I do think that blockchain technology is here to stay for a long time. However, I question the long-term viability of Bitcoin.

But before I get into that I want to say that if someone loves Bitcoin and hates gold they are free to own Bitcoin and no one will force them to own a single gram of gold! The opposite is also true. You can also own some combination of both!

For me, I’ve chosen to own much more Gold than Bitcoin but I still own both.

I’ve written about how I buy bitcoin and also about bitcoin arbitrage. I’ve also written about owning physical gold outright and physical gold through Goldmoney.

I do think having a very small percentage of my assets in crypto currency is appropriate for me but I’m leery of having too much of my net worth in cryptocurrency.

So with that in mind I present gold versus Bitcoin. This is a comparison between the two as I think of it. What you value or find important will likely be different.

That is the great thing about free markets: there doesn’t have to be one answer that is forced on everyone.

What I like about Bitcoin

International Value Transfer

I think BTC beats everything else out there for international value transfer. I’ve done international wire transfers and domestic wire transfers in traditional government fiat currency and Bitcoin is faster, easier and cheaper than anything else I’ve used.

Bitcoin has Advantages over Fiat Money

Dollars (and other fiat money) are constantly being devalued and destroyed via fractional reserve banking and central bank debt monetization and money “printing”. The total number of Bitcoins that will ever exist is set by how the bitcoin algorithm is coded.

What I don’t like about Bitcoin

It is Centrally Controlled

A disillusioned insider I came in contact with has swayed me to the opinion that Bitcoin is not decentralised. The decisions about Bitcoin are made by the Bitcoin Foundation and a few of the larger miners.

Bitcoin evangelists will tout Bitcoin as being decentralised. I’m open to new arguments and evidence supporting that Bitcoin is in fact decentralised but as of now I see Bitcoin as being centrally controlled.

It’s Direct-Use Value is Very Low

Some people argue that there is direct-use value in Bitcoin. It can be used as an experiment, political statement, etc. Others argue that Bitcoin has no direct-use value.

Even if Bitcoin is valued for direct use I think that value is very low. Dollars have some direct use value as well, for example kindling, tacky wallpaper, etc, but it is a fraction of the value dollars currently command in trade.

Even if Bitcoin is valued for direct use I think that value is very low. Dollars have some direct use value as well, for example kindling, tacky wallpaper, etc, but it is a fraction of the value dollars currently command in trade.

The reason I think this is a problem is because the direct-use value (aka non-monetary use value which is also sometimes called “intrinsic value”) provides a floor.

Government fiat currencies and Bitcoin have little (or zero) direct-use. So when these mediums of exchange fall out of favor, they can go to zero or near zero.

Bitcoin Could be Replaced by a Better Cryptocurrency

Bitcoin has some issues in my opinion. Bitcoin could be improved to overcome those issues, but it is also possible one of the myriad of alternative coins (called “altcoins”) could become more popular than Bitcoin and eventually replace what is currently the most established and largest cryptocurrency.

Delay in Confirmations

Virtually all vendors require a certain number of confirmations after Bitcoin is sent before it is confirmed and is considered successfully sent. This is to avoid the problem of double-spending.

Bitcoin takes about 10 minutes per confirmation. In the world of the internet, 10 minutes is a long time. Some vendors require 2 or 3 confirmations, which would take between 20-30 minutes. That is a really long time.

Scalability

There are also concerns about the scalability of Bitcoin.

There are probably other reasons that haven’t even been invented yet that could make some new Bettercoin™ a superior choice to Bitcoin.

So while the number of Bitcoins is fixed the number of competing altcoins is not fixed.

Competing altcoins can serve to devalue Bitcoin. I like it when companies compete for my business to lower price but if I owned $1,000 worth of Bitcoin and then BetterCoin™ comes out and everyone switches to it, my $1,000 worth of Bitcoin could drop to a small fraction of a dollar in value.

The United States Commodities Futures Trading Commission (CFTC) declared Bitcoin is a commodity

Which means it’s taxable as a commodity.

Just because the government decrees that something is the case doesn’t mean that it is true.

Various elements of the US government can say that dollars are a store of value but that doesn’t mean they are.

I can disagree with the CFTC intellectually. But I obviously can’t ignore what the government says if I don’t want to get fined or go to jail.

Like most Americans I’m afraid of the Internal Revenue Service (IRS) so compliance with all appropriate tax laws is very important to me.

That means that every time I transact in Bitcoin I have to keep track of my cost basis and pay any appropriate capital gains.

Security

Mt. Gox, Bitfinex, and countless other exchanges have been hacked. You have to be kinda savvy to secure your Bitcoins. Plus, if you go the cold storage route you lose may of the benefits of Bitcoin as a medium of exchange.

What I don’t like about Gold

Gold isn’t used as Money or a Medium of Exchange

Few if any retailers will accept gold as payment for goods and services. One must first convert the gold into money and then spend the money.

Gold is not considered a currency and like Bitcoin does not get favorable tax treatment.

It could be Confiscated

The United States government has made gold bullion ownership illegal in the past and could do so again. Therefore any gold held in the US is susceptible to confiscation. I think it is unlikely this will happen again because not very many people own gold bullion, as compared to years past, but this is a possibility.

You Can’t use it to Buy Stuff Online

I can’t get onto Overstock.com and use physical gold in my possession to buy goods or services. What that would look like would be to mail in a shipment of gold, Overstock would wait until the gold arrives, and then ship out what I ordered.

I think the Paper Gold Markets are Manipulated

I think governments have a vested interest in keeping the price of gold down. I think the gold futures markets are manipulated down. While I think that this manipulation is not sustainable and eventually the price of gold will reflect supply and demand fundamentals, it is annoying in the short term. On the flip side, gold manipulation does provide a lot of great buying opportunities.

What I like about Gold

It’s Been Valued for 3,000 years

Despite all the changes since 1,000 B.C. gold is still valued by billions of people.

It has Significant Direct-Use Value

Gold is used in electronics, jewelry, dentistry, satellites, and decoration. Even though gold is not used as money or a medium of exchange today it is still valued by billions of people.

How many people would want US dollars if they weren’t used as money?

Gold is a Natural Element that Satisfies the Classical Requirements of Money

Gold is one of the least reactive chemical elements. Gold that has been lost on the ocean floor for hundreds of years is still in the same shape it was when the ship went down.

Gold is durable, portable, scare, divisible and uniform. Gold can act as a unit of account, a medium of exchange and a store of value.

Gold is Scarce

A new element that has all the properties of gold is unlikely to be discovered or created.

New gold can only be created in a nuclear reaction and gold can only be pulled out of the ground with significant effort and time.

Mining gold-rich asteroids would also be tremendously expensive and dangerous.

Gold can be used with Payment Technologies

Much of the below thought is from or inspired by Roy Sebag. Mr. Sebag makes a distinction between money technologies and payment technologies.

Money Technologies

Dollars and Euros are debt-based, fiat money technologies or assets that can act as a store of value (albeit poor stores). Gold is an asset that can act as a store of value. Bitcoins are an asset that can act as a store of value.

Payment Technologies

Credit card networks, Paypal, Apple Pay, Bitcoin, and Ether are examples of payment technologies. These are networks and systems that allow ownership of assets to be transferred.

Buying things online with a credit or debit card, Goldmoney, Paypal, or Bitcoin is simply ownership transfer of an asset via a payment technology.

In the case of credit cards, the credit card network is the payment technology and dollars are the money “technology” or asset being transferred.

In the case of Bitcoin, the Bitcoin blockchain is the payment technology which also has an integrated and inseparable unit of account, also called Bitcoins.

Gold can be used separately from a payment system (physically exchanged), or it could be used in conjunction with another payment system.

Goldmoney is one such service that combines physical gold ownership storage and transfer with the payment technology potential of internet based transactions.

Gold remains a fantastic store of value. I think the best of both worlds in money would be a gold-backed currency or electronic ownership transfer of Gold held at a trusted third party.

In Conclusion

Bitcoin has a very low (if any) direct-use value. That fact combined with the potential for Bitcoin to be supplanted by a superior payment technology makes me skeptical of Bitcoin as a long-term store of value.

I like gold because it has a 3,000 year history of being valued across cultures. It’s scarce and I think it’s extremely unlikely that another element will come along that will be able to replace the desired and historically valued properties of gold.

Not only that, but you can still make payments and spend gold in a way that takes advantage of the electronic payment systems that are so useful today.

Ultimately investors and consumers will make their own decisions. Gold and Bitcoin are competitors but they could also continue to exist side by side for some time.

That is just how gold and Bitcoin compare in my view. Which one do you prefer? Let me know in the comments section below!

Even if Bitcoin is valued for direct use I think that value is very low. Dollars have some direct use value as well, for example kindling, tacky wallpaper, etc, but it is a fraction of the value dollars currently command in trade.

Even if Bitcoin is valued for direct use I think that value is very low. Dollars have some direct use value as well, for example kindling, tacky wallpaper, etc, but it is a fraction of the value dollars currently command in trade.