by John | Apr 23, 2017 | Cryptocurrency, Learning from Mistakes, Passive Income

Today I wanted to cover how to calculate cloud mining profitability. I had a recent comment on my article: Ethereum Cloud Mining is not Profitable that I’m concerned perpetuates the kind of static analysis that will cause someone to lose money on cloud mining.

I’m going to do my analysis for Ethereum Cloud Mining. However, this analysis will work for any coin that has increasing mining difficulty.

Assumptions: I’m assuming the price of ETH is static. Why? Because if it goes up, that is simply a bonus. If mining isn’t profitable unless the currency goes up, then one is better off buying the currency outright.

Step One of How to Calculate Cloud Mining Profitability

First you need to know how much the cloud mining will cost per unit of hashing power. As of 23 April 2017 Hashflare.io is selling 100 KH/s for 2.20 USD. That is 1 MH/s for 22 USD.

Use a static calculator first. This will provide the baseline static analysis. For Ethereum I like this calculator.

As of writing there is a network hashrate of 22595.62995398704 GH/s, a blocktime of 13.31 and one ETH going for 48.63 USD.

So with 1 MH/s I would earn 0.043093 ETH per month, worth 2.10 USD per month. Multiply that by 12 and the total ETH mined (0.517116) would be worth $25.2.

So if the price of ETH stays the same (which for the purpose of the static analysis we will assume it will), and the network hashing power stays the same. Then the profit will be $3.2 after a year IF THE NETWORK HASHING POWER STAYS THE SAME. The problem with a static analysis is that network hashing power does NOT stay the same.

Network Mining Difficulty Goes Up

If you stop with this static analysis you’ll surely lose money though. Why? Because the network hashing power has historically gone up and gone up A LOT.

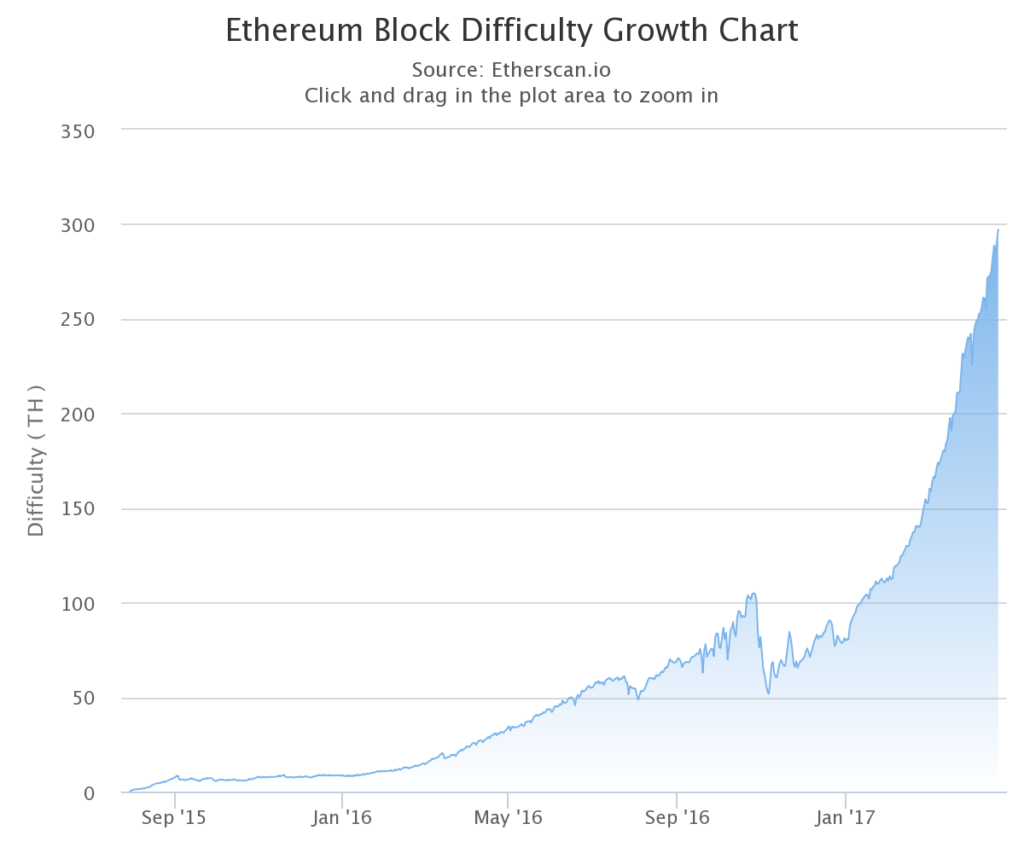

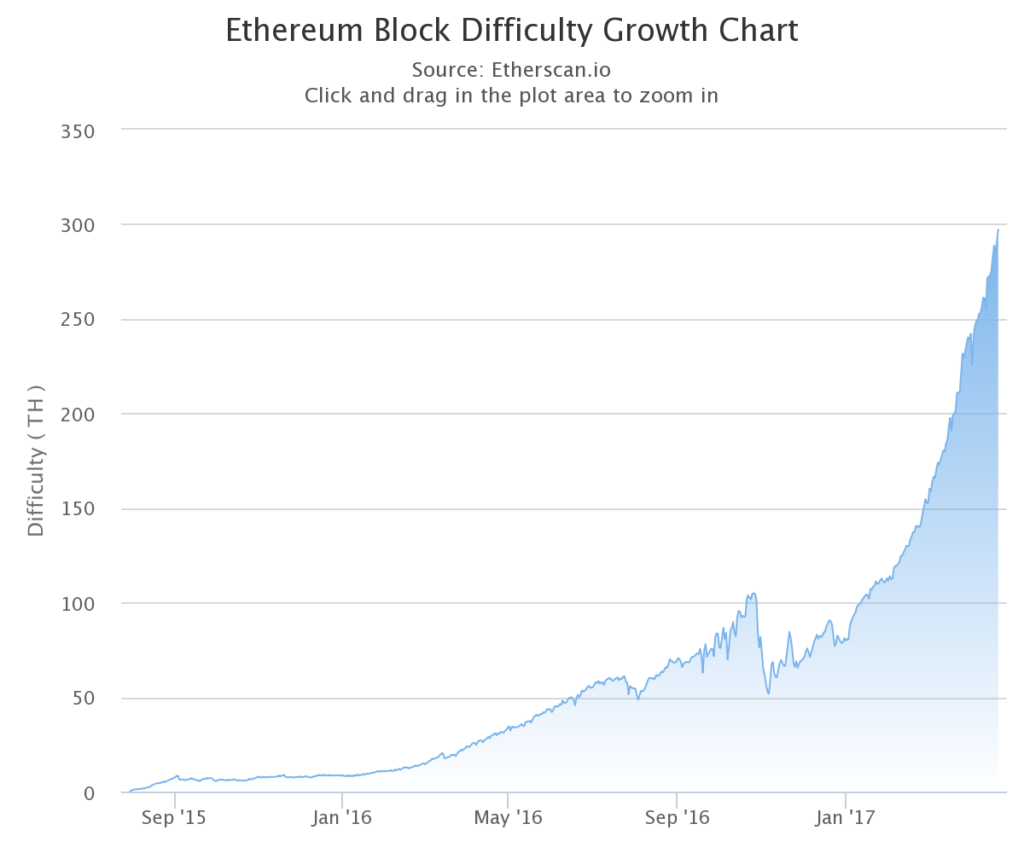

Ethereum Block Difficulty Growth Since 30 July 2015

In the first four months of 2017 alone, mining difficulty for Ethereum has gone up over 200% from under 100 TH/s up to nearly 300 TH/s. Which means the amount of ETH mined for anyone with fixed hashing power will have been reduced by over 66%.

Factoring in the growth rate of block difficulty is the most important factor when determining cloud mining profitability.

Step Two of How to Calculate Cloud Mining Profitability

Projecting how much the network hashrate will increase over the life of the cloud mining contract is vitally important. You need to make a realistic estimate of how the network hashrate will increase because it will reduce the amount you get from mining each day.

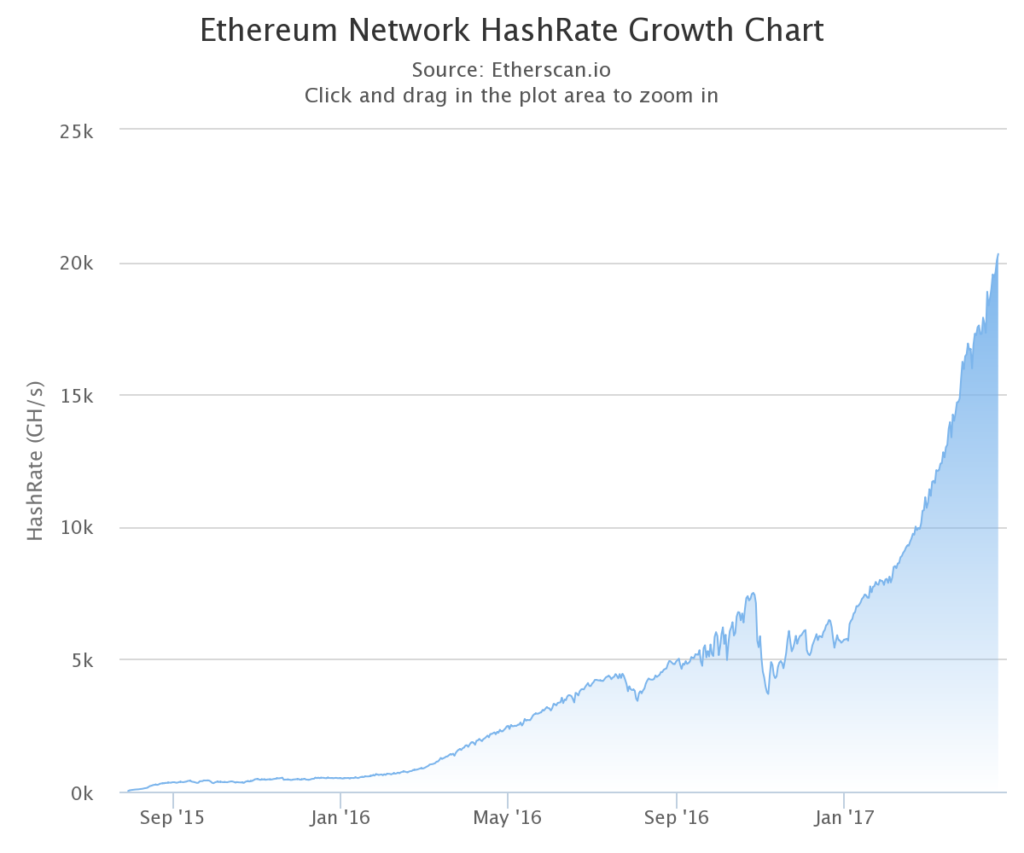

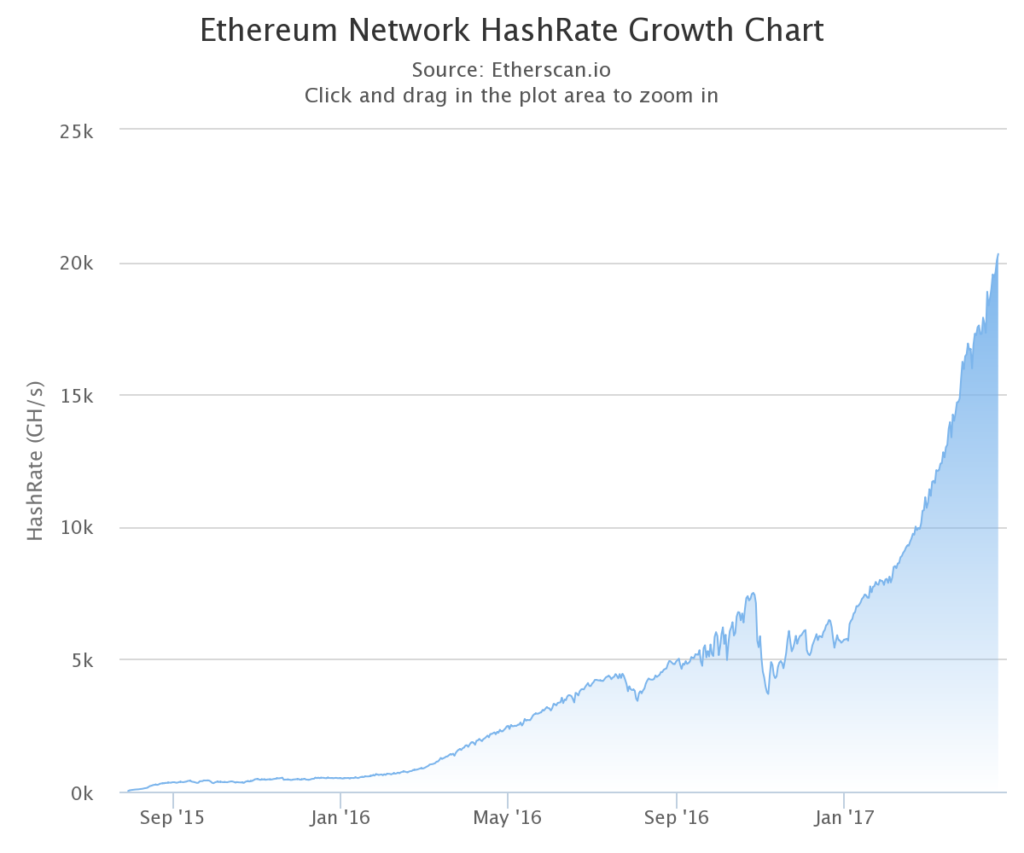

The chart above shows the Ethereum network hashrate growth. In this example, Hashflare.io contracts run in 12 month increments. So we need a realistic estimate of how much the hashing power (and thus mining difficulty) will go up over a 12 month period.

This takes some guesswork but the best indicator is the past.

The August 2015 hashrate of 55 GH/s to the August 2016 hashrate of 3,811 GH/s represents a 6,800% increase. This was the first 12 months of the Ethereum network coming online so I think this number is too high.

In 2016 the Ethereum network hashrate went from 511 GH/s to 5,700 GH/s. A 1,015% increase.

From April 2016 at 1752 GH/s to April 2017 of 20,300 GH/s was a 1,058% increase.

So I based on 2016 I think a 1,000% increase in hashing power is a good conservative guesstimate. That means the hashing power would be around 230,000 GH/s by April of 2018.

So then we follow step 1 again using the static calculator. Using the 1 MH/s and a network hashrate of 230,000 GH/s. The monthly ETH mined would be 0.004233 worth $.21.

Step Three of How to Calculate Cloud Mining Profitability

So at this point we have a projection of how much we’ll get from mining in the first month. And how much we’ll get in the last month. These are just a projections based on a static analysis and a guesstimate of where mining difficulty will be in the future.

But the amount mined doesn’t jump down from the first month to the last month. The amount mined is slowly and steadily decreasing.

I think a exponential decay model fits the data better but for the sake of ease I think a linear model will suffice.

I also think a simplified method works because the cloud mining rates I’ve seen are not close to what they would need to be for mining to be profitable.

Take the amount we think we’ll mine in the first month. In this case .043093. Then take the amount we’ll think we’ll mine in the last month, .004233. Subtract the first from the last. Then divide that by 11.

From that point you take the starting value of .043093 subtract the decay amount .003943 to get the second months value of .039149. You do this again until you get to month 12. By summing up each month’s value we get 0.283956. Multiply that by the price of ETH of 48.63 USD and we get $13.80.

The contract in this example cost 22 USD so this would not be profitable if the network hashing power goes up by 1000% (as it did in 2016) and the price of ETH stays the same.

You’d end up losing $8.2.

Okay, what if the network hashing power only goes up 500% so it goes up to 135,600 GH/s after one year? You’d mine about .3 ETH worth $14.66. You still lose.

What if the network hashing power only goes up 100% to about 45200 GH/s? You’d mine about .387 ETH worth less than $19. Loser.

What if the network hashing power only goes up 35% to 30,500 GH/s. You’d mine about .45 ETH worth $22.88. Small winner.

If Network Hashing Power Goes Up You Start to Lose

So what I hope this shows is that if the hashing power goes up, which in the case of Ethereum (and I suspect most coins as well) the amount of coins mined will drop and the profits will be eroded.

Easy Method

If you believe network hashing power will continue to go up then use this method to determine if mining is even worth a closer evaluation: use the static mining profitability calculator. Use the amount of ETH mined and the cost of the mining contract to see how much you’re effectively paying per ETH.

For example Hashflare.io is selling 1 MH/s for 22 USD for a year. That would yield 0.043093 ETH per month x 12 would be 0.517116 ETH for the year mined if the network hashrate stays the same. So the cost per ETH would be 42.54 USD. With ETH trading at 48.63 USD that is only a 14% discount over a year.

Unless you’re going to get ETH (or whichever other coin) at a significant discount using the static calculation (say 40-50% below spot price). It’s not worth it.

But the Price of ETH is going to double!

Great! Then buy ETH directly. Lets say the price of ETH does double in a year. It goes from 48.63 USD today up to $97.26. You could have bought $22 worth of ETH (.45 ETH) and the $22 worth of ETH would now be worth $43.76.

With a 1000% network hashrate increase you’d have only mined 0.283956 which would be worth $27.61. Unless the mining is profitable with the price of ETH fixed, you’re better off owning the currently directly even if the price of the currency goes up.

At what price would cloud mining be worth it?

As of today 23 April 2017, based on a 1000% increase in hashing power over the next year I would not pay more than around $7 for 1 GH/s of hashing power.

Based on my projections that would yield about 40%. Given the risk and volatility in cryptocurrencies I would need to see that kind of return for it to be worth the risk to me.

With 1 GH/s costing 22 USD, if the network hashing power stays the same I would still only make about 15%. Given the history of network hashrate increases that isn’t worth it.

Hashflare.io is nowhere close to $7 per GH/s. Genesis Mining offers 1 GH/s for 2 years for 29.99. Who knows where the network hash rate will be in 2 years.

Some People Claim Cloud Mining is Profitable

I have read testimonials from people who think cloud mining is profitable. My main question would be is it profitable because the underlying cryptocurrency went up, or because the mining itself was profitable? In other words would you have been better off just owning the cryptocurrency directly?

by John | Apr 2, 2017 | Cryptocurrency, Currencies, Wealth Protection

I have a love/hate like/dislike relationship with cryptocurrencies. But one thing I feel confidently about is that Bitcoin is not the future of cryptocurrencies.

By market capitalization Bitcoin is currently sitting in the #1 position as the largest cryptocurrency.

Source: https://coinmarketcap.com/

But it isn’t there because it’s the best. It’s there because it was first.

There is something to be said for the network effect but Bitcoin has several fatal flaws that leave it vulnerable to being overtaken by newer and better technology.

Bitcoin Transactions take “forever”

A screen capture from bitcoin.org. I don’t consider 10-30 minutes fast unless we’re talking about glaciers or the the average US bureau of motor vehicles

If I buy something digital online I want to be able to download it instantly.

Imagine buying a song on iTunes but having to wait 10-30 minutes to start downloading it. If Apple used bitcoin instead of credit cards that’s probably how long you’d have to wait.

Or what if you want to buy a latte on the way into work? Would you want to wait 10-30 minutes in the coffee shop before you can leave with your drink?

Obviously not.

But why is Bitcoin so slow?

Bitcoin takes 10 minutes per block. A block is a set of transactions. So at best Bitcoin takes 10 minutes to confirm a transaction. Most vendors however, require 2-3 confirmations before they consider the bitcoin transferred, which means 20-30 minutes of waiting.

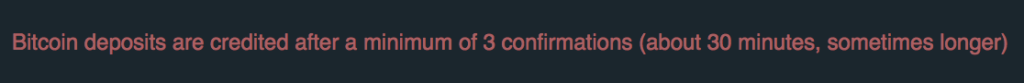

Bitfinex requires 3 confirmations before it considers Bitcoin transferred

You need a Trusted Third Party to make Fast Payments

Websites like Overstock.com accept Bitcoin as payment. However, they do so by utilizing a trusted third party, like Coinbase, to serve as a middleman.

No doubt they do this to avoid the issue of double-spending, refunds and transactions taking thirty minutes.

But the fact that overstock.com uses a trusted third party pours cold water on the idea Bitcoin has “Fast peer-to-peer transactions”.

Bitcoin has Scalability Problems

In addition to confirmations being slow, Bitcoin has issues with scalability of the network, or the number of transactions the network can process. There are competing camps about how to resolve this issue but there has been much more debate than action.

This could lead to hard forks of the cryptocurrency. More on that later.

Bitcoin Transactions aren’t Anonymous

One of the previously oft touted benefits of Bitcoin was anonymity in transactions. While Bitcoin transactions are pseudonymous, unless you buy bitcoins in cash from someone on the street, there are links back to the exchanges and thus bank accounts.

I’m sure there are ways to purchase Bitcoins anonymously but it’s not easy or safe. If you know how to do this I’d value your input in the comments section below.

Bitcoin is Centralised and the Centralised Powers don’t have Their Act Together

A screen capture from the Bitcoin Foundation (bitcoinfoundation.org) website

Despite propaganda that Bitcoin is decentralised–it is in fact controlled by the Bitcoin Foundation in conjunction with the Bitcoin Core developers and the larger miners who can afford the expensive application specific integrated circuit hardware required to successfully mine Bitcoin.

In sort of an Orwellian double-speak both the Bitcoin Core developers and Bitcoin Foundation talk about how they keep Bitcoin decentralised.

The Bitcoin Core development team is not very big.

I don’t see how a group of 3 “maintainers” and a dozen or so contributing developers is “decentralised”.

If I wanted to be really mean I would compare the Bitcoin Foundation to the Federal Reserve and the miners to the big wall street banks.

But I won’t do that.

The main advantage Bitcoin has over the Federal Reserve is that the number of Bitcoins that will be created is fixed at 21 million whereas there is no limit to how many dollars the Federal Reserve can conjure from within the shady halls of the Eccles Building.

A screen capture of a written statement from bitcoin.org/en/bitcoin-core/

However, if Bitcoin forks, like Ethereum did, then the number of Bitcoins will effectively double.

I don’t necessarily have a problem with a cryptocurrency being centrally controlled.

While I have a general bias towards decentralisation and subsidiarity (when possible)–I think that a benevolent dictatorship can be good–provided it is easy to jump ship if the centralised power becomes corrupt.

Bitcoin is Squandering it’s First Mover Advantage

But despite large issues with Bitcoin the Bitcoin Foundation and the Bitcoin Core developers haven’t gotten it together to make progress in fixing the aforementioned systemic issues with Bitcoin.

Could these problems be fixed? Sure. Smart, motivated individuals working together towards a common goal can accomplish amazing things. But I don’t see the Bitcoin community taking these problems seriously.

For these reasons I believe that Bitcoin is not the future of cryptocurrencies.

If you are interested in purchasing Bitcoins, I show you how to buy Bitcoins on Coinbase.

by John | Mar 21, 2017 | Cryptocurrency, Currencies, Learning from Mistakes, Personal Journey

I wrote back in June of 2016 in an article Ethereum Cloud Mining is Not Profitable. Today is exactly 1 year since I purchased an Ethereum cloud mining contract at Hashflare.io. As I recapped in that article:

In order to simply break even ETH would need to trade up to around 18.7 USD.

I would also be better off if I had just bought ETH.

That article was written about 3 months after I had made the investment in Ethereum Cloud Mining.

I wish I had done the in depth analysis in that article before I made the investment in Ethereum Cloud Mining so that I would have known not to make the investment.

And that is the lesson I learned:

Perform your due diligence before making an investment!

An artist’s representation of how I envisioned Ethereum Cloud Mining would go

I attempted due diligence but I did not consider all the relevant facts. These relevant facts were available to me at the time if I had known to look for them.

Since my mining contract is up I want to recap what actually happened with the benefit of all the facts.

The main beneficiary of my bad experience is anyone who is newly considering Ethereum Cloud Mining: caveat emptor.

There might be other cloud mining services out there that are profitable but in my experience Hashflare.io was not one of them.

Ethereum Cloud Mining Recap

On 21 march 2016 I spent $561 for a cloud mining contract at Hashflare.io. Ethereum was trading at $10.81 at the time. In the one year of mining I mined 41.27 Ethereum. As of writing Ethereum is currently trading at $42.6.

Source: http://coinmarketcap.com/currencies/ethereum/

So that 41.27 Ethereum would be worth $1,758 if I had held onto all of them and then sold today.

This is a $1,197 gain which sounds nice but it really isn’t and I’ll explain why.

Why a $1,197 Gain Wasn’t Very Good

But what if the price of Ethereum had not gone up 294%?

An artist’s representation of how Ethereum Cloud Mining actually went

What if it had stayed the same price of $10.81. Those 41.27 Ether I mined would be worth just $446.

What does that mean?

It means: The gain was entirely due to the increase in the price of ETH–the mining itself was not profitable.

In fact, if I had taken $561 and just purchased Ethereum directly, I could have acquired 51.89 Ethereum, which at current prices of $42.6 would now be worth $2,210 or a gain of $1,649.

So other than sounding cool Ethereum Cloud Mining through HashFlare.io provided no value.

The Problem with my Analysis

The downfall of my analysis when initially evaluating the investment in Ethereum Cloud Mining was assuming linear growth in hashing power of the Ethereum network.

I explain this in more detail in my original article and I also provide a process for making more accurate predictions wether a cloud mining contract will be profitable or not. Using that process I predicted I would mine about 30 ETH.

This prediction was much closer to what I actually mined compared to the 120 ETH predicted using static models.

It was a tough lesson to learn but thankfully the amount at risk was relatively small at $561.