by John | Aug 19, 2017 | Business, Cryptocurrency, Geopolitical Risk Protection

The United States is steadily becoming a worse place for individuals to do business.

The financial services industry in particular faces onerous regulations imposed by the US government–under the auspices of security and combating terrorism.

While the efficacy of the US regulators’ draconian standards in preventing money laundering and terrorism is debatable–the impact on law abiding consumers is certain.

US consumers and investors alike are the victims of the US government’s attempt to control.

A recent example is that US citizens will no longer be allowed to have accounts on Bitfinex. Bitfinex announced earlier this month they would be dropping U.S. accounts and list the following reasons:

While we have been able to normalize banking for some corporate customers and individuals in certain jurisdictions, compliant banking solutions for U.S. individuals remain elusive. We have been slowly and selectively inviting users in particular jurisdictions who meet set criteria to start using banking channels that have come online. This process is ongoing.

A surprisingly small percentage of our revenues come from verified U.S. individual accounts while a dramatically outsized portion of our resources goes into servicing the needs of U.S. individuals, including support, legal and regulatory.

We anticipate the regulatory landscape to become even more challenging in the future.

Bitfinex is not based in the United States. Exchanges based in the U.S. are better positioned to properly service retail U.S. customers.

In short:

1) It’s difficult to comply with US banking regulations

2) It’s expensive to comply with US banking regulations

3) Bitfinex expects regulations to become more challenging (probably meaning more expensive and more difficult) in the future

If the United States wants to remain competitive in the future and the new economy regulators need to back off.

Margin funding on Bitfinex is one of the methods I use to grow and protect my wealth. Very soon this will no longer be an option.

by John | Aug 1, 2017 | Cryptocurrency, Learning from Mistakes, Preservation of Purchasing Power

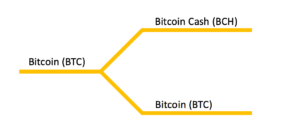

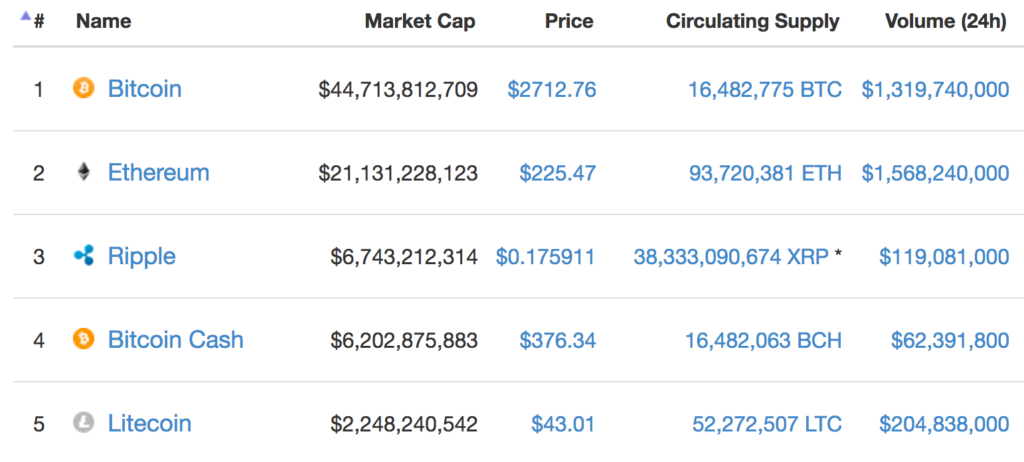

As expected the Bitcoin Hard Fork occurred around 12:20 UTC today. A new cryptocurrency, Bitcoin Cash (BCH or BCC depending on the exchange) was born. It shares the same history as Bitcoin up until today in what I’ve already referred to as a modern day Ship of Theseus paradox.

So which Bitcoin is the real Bitcoin? BTC continues with a similar price as before and Bitcoin Cash was a new node to begin with so certainly Bitcoin remains bitcoin.

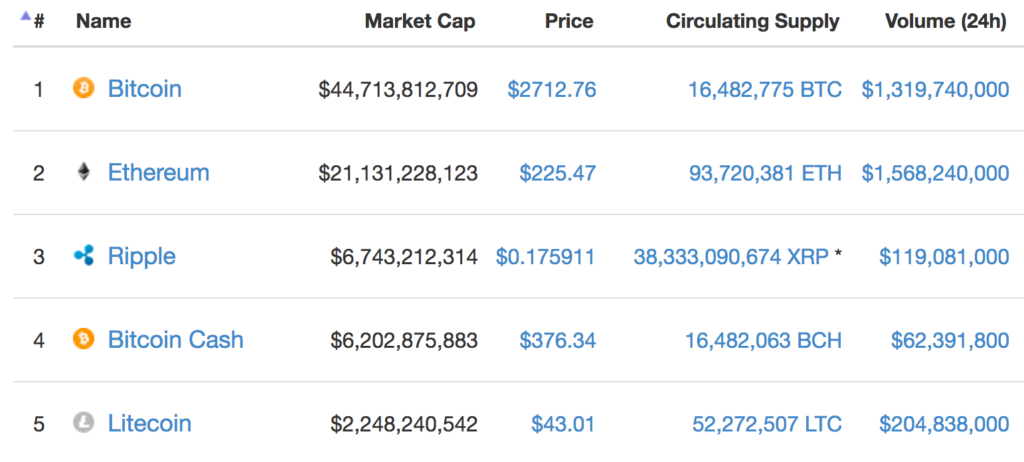

But it’s another example of how a brand new cryptocurrency, one which a current market cap of over $6 billion, can be created seemingly out of thing air.

I understand that Bitcoin Cash has the support of some miners, and work went into the technical changes (it has a larger block size, in an attempt to overcome some of Bitcoin’s scaling issues). But is it really worth $6 billion?

Source: coinmarketcap.com

The market seems to think so and that is all that matters in the present.

In the short term each BCH is trading for around $375 as of writing. My plan, which I previously shared, worked flawlessly.

Upon hearing about the hard fork, I moved my Bitcoins from an exchange that did not support BCH, to an exchange that did. When the fork happened I retained my original Bitcoins, but was also awarded an equal amount of Bitcoin Cash. I doubled my Bitcoins! (Sort of) The original Bitcoin is still trading around $2,700 and as stated above the new BCH I receive are only worth $375 each.

Learning from Past Mistakes

This is an example of how I was able to learn from a past mistake to benefit.

I missed out on coins resulting from when Ethereum forked. The place where I had my coins, hashflare.io, famous for unprofitable cloud mining, did not support the fork. I wasn’t about to let that happen again. If I’d been on an exchange that supported Ethereum Classic, or had my Ethereum in a wallet where I controlled the keys, I could have received 1 ETC for each ETH I held.

Cryptocurrencies are Inflationary

As I’ve written about before, one of the things that I dislike about cryptocurrencies is that there are no natural limits on the supply. Bitcoin Cash is a perfect example. Sure, the number of Bitcoins (BTC) did not increase, but a coin very similar to BTC, albeit with less network hashing power and some technological differences, was created, which in some sense doubles the amount of Bitcoins in existence.

Playing the Fork

The market doesn’t seem to care about the Bitcoin hard fork, BTC was trading up near around it’s all time high of $2,910 the day before the fork and is still at $2,700.

One could theoretically have purchased 3 BTC right before the fork for $2,900 each ($8,700 total). Then the fork happens, and the person gets to keep their 3 BTC and also gets 3 BCH, each worth $375 ($1,125 total). The price of BTC then falls to $2,700. So one would have lost $600 total on the BTC, but gained $1,125 on the BCH, for a net of $525. Not bad. That’s a 6% increase over just a few days.

Easier to talk about with the benefit of hindsight, but if someone is already holding Bitcoins, there is no financial risk to being a position to get the newly created cryptocurrency.

Long Term Problems

The market doesn’t seem to care about the Bitcoin hard fork, it was trading up near around it’s all time high of $2,910 the day before the fork and is still at $2,700. But in effect 6 billion USD worth of value was created out of thin air. Over the long term this simply isn’t sustainable. Is the price really coming from new money buying up BCH as the future cryptocurrency? It seems unlikely. The supply of cryptocurrencies continues to grow and Bitcoin Cash is only the latest example.

I’ll continue to hold various cryptocurrencies as a speculation that one or more takes off (even more) and reaches widespread adoption but as a long term investment I think it remains very risky.

by John | Jul 28, 2017 | Cryptocurrency, Currencies, Wealth Protection

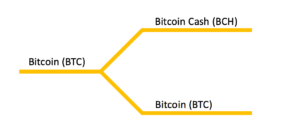

Bitcoin is going to undergo a hard fork.

What is a Hard Fork Anyway?

A hard fork in cryptocurrencies is when one cryptocurrency effectively becomes two and the number of units of currency is effectively doubled, albeit existing in two separate, incompatible blockchains. This has already happened to the second largest cryptocurrency by market capitalization: Ethereum.

Ethereum underwent a hard fork back in 2016, so there are now two blockchains, Ethereum and Ethereum classic, which both trace their origins back to the 30 July 2015 launch of Ethereum in a modern day Ship of Theseus paradox.

More information about hard forks.

Hard Forks are Logically Bad for the Price of a Cryptocurrency

As I’ve written about in the past in What I Dislike About Cryptocurrencies cryptocurrencies, like Bitcoin, aren’t scarce.

More correctly, cryptocurrencies are not very limited in supply.

There are currently 16,475,250 BTC in circulation and that number will continue to grow by design until 21 million are mined, at which point the supply of BTC will cease to grow.

So while only 21 million Bitcoins will ever exist on a given Bitcoin blockchain because of how the cryptocurrency is programmed, if Bitcoin forks, there will eventually be 21 million units of Bitcoin A and 21 million units of Bitcoin B.

In one sense the number of Bitcoins that will exist is 42 million. Now certain places might only accept Bitcoin A and not accept Bitcoin B and the price of Bitcoin B could drop to a low value and no one uses it. So in that sense there are still only 21 million Bitcoins. But when a cryptocurrency hard forks, some people favor one fork over the other and the price is lower than it otherwise would be if there was only one blockchain.

If Ethereum had not forked there would only be around 93 million ETH in existence right now. But because Ethereum did hard fork there are now 93 million ETH and 93 million ETC. The market capitalization of ETH is currently around $18.3 billion and the Market cap of ETC is around $1.3 billion. It’s beyond the scope of this article to posit how much the hard fork impacted the price of ETH, but I think it is logical to believe that the price of ETH would be higher if not for the hard fork.

Bitcoin Hard Forks

On August 1st Bitcoin is also going to fork, forming two separate and incompatible blockchains: Bitcoin (BTC) and Bitcoin Cash (BCH).

On August 1st Bitcoin is also going to fork, forming two separate and incompatible blockchains: Bitcoin (BTC) and Bitcoin Cash (BCH).

The market does not seem to care and Bitcoin is trading near all time highs around $2,800.

Time will tell what kind of impact this will have on the network and the price of the cryptocurrencies. If the hard fork does not go well and the network is adversely impacted I could see short term price drops. It’s possible (although I would guess unlikely) that Bitcoin Cash becomes more popular than Bitcoin and overtakes it in price. It’s also possible (and in my opinion much more likely) that it becomes a somewhat niche cryptocurrency like Ethereum Classic.

Bitcoin currently has a market capitalization of $46,622,650,965. It’s certain that after the fork both Bitcoin Cash and Bitcoin will not both have a $46.6 billion market capitalization.

While we wait and see what unfolds I’ve taken one important step. I had my modest BTC holdings at Coinbase. Coinbase is NOT supporting the hard fork.

So I’ve moved my BTC to Kraken. Kraken IS supporting the hard fork. By moving my BTC to an exchange that does support the fork I will get Bitcoin Cash in addition to Bitcoin.

The reason for this is because if one were to hold one BTC (Kraken uses the abbreviation XBT) at Kraken during the hard fork, Kraken will award the holder of that BTC one BTC as well as one BCH. Whereas if BTC is held at Coinbase no BCH will be credited.

I like Coinbase and I plan to move my BTC back to Coinbase after the hard fork takes place.

If you don’t currently own any Bitcoins and are interested in purchasing some, check out my easy to use walkthrough guide How to buy Bitcoins on Coinbase. Using my affiliate link when buying Bitcoins on Coinbase to get $10 worth of bitcoins free when you buy at least $100 worth of Bitcoin.

by John | Jun 15, 2017 | Cryptocurrency, Learning from Mistakes, Wealth Protection

I think the vast majority of my readers get it. I think my readers are smart, critical thinkers. However, I’ve gotten a few comments from people who somehow think that because ETH is now trading upwards of $300 that somehow my article Ethereum Cloud Mining is Not Profitable is no longer valid.

I’ll make myself clear. It does not matter how high ETH goes, Ethereum cloud mining was not profitable for me.

Did I make more money as a result of Ethereum cloud mining compared to simply holding onto the $561? Yes. But the fact remains that the Ethereum cloud mining contract was a slow, expensive way to acquire ETH.

Owning ETH was profitable. I made money on the appreciation in dollar value of ETH. I would have made more money if I had bought ETH directly, versus Ethereum cloud mining.

I wrote this very clearly three months after I purchased the Ethereum Cloud Mining contract from Hashflare.io:

I would also be better off if I had just bought ETH.

If I bought $561 of ETH for $9 (where it was trading when I started mining). I would have 62 ETH…

Through Ethereum cloud mining I mined 41.27 ETH.

I would rather have 62 ETH immediately than wait a year to get 41.27 ETH. The cloud mining contract increased my cost basis.

Now, if I could buy hashing power at a low enough cost Ethereum cloud mining could have been profitable. If mining difficulty went down over time, Ethereum cloud mining would be more likely to be profitable. However, mining difficulty has consistently gone up and the cost of cloud mining contracts is too high.

Ethereum cloud mining was not a good investment for me. I would have been better off simply buying ETH directly. This is true regardless of how high the price of ETH goes.

by John | May 28, 2017 | Cryptocurrency

The largest cryptocurrency by market capitalization, Bitcoin, is supposed to be the payment technology of the future. Gold 2.0. The decentralized currency of tomorrow.

On May 22nd sent about $1,000 worth of Bitcoin from an exchange to another address and it was not confirmed until 27 May. The BTC fee paid to process the transaction was $25 worth of Bitcoin (at the time of the transaction).

This is worse than decades old wire transfer technology.

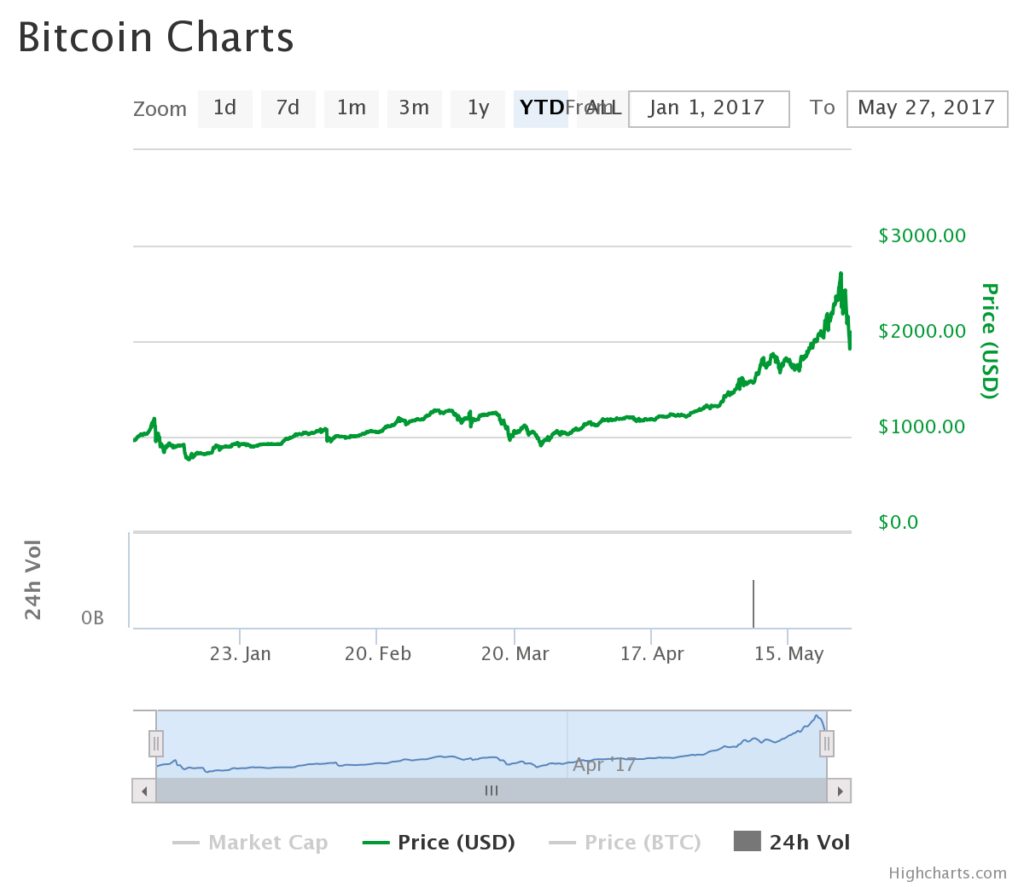

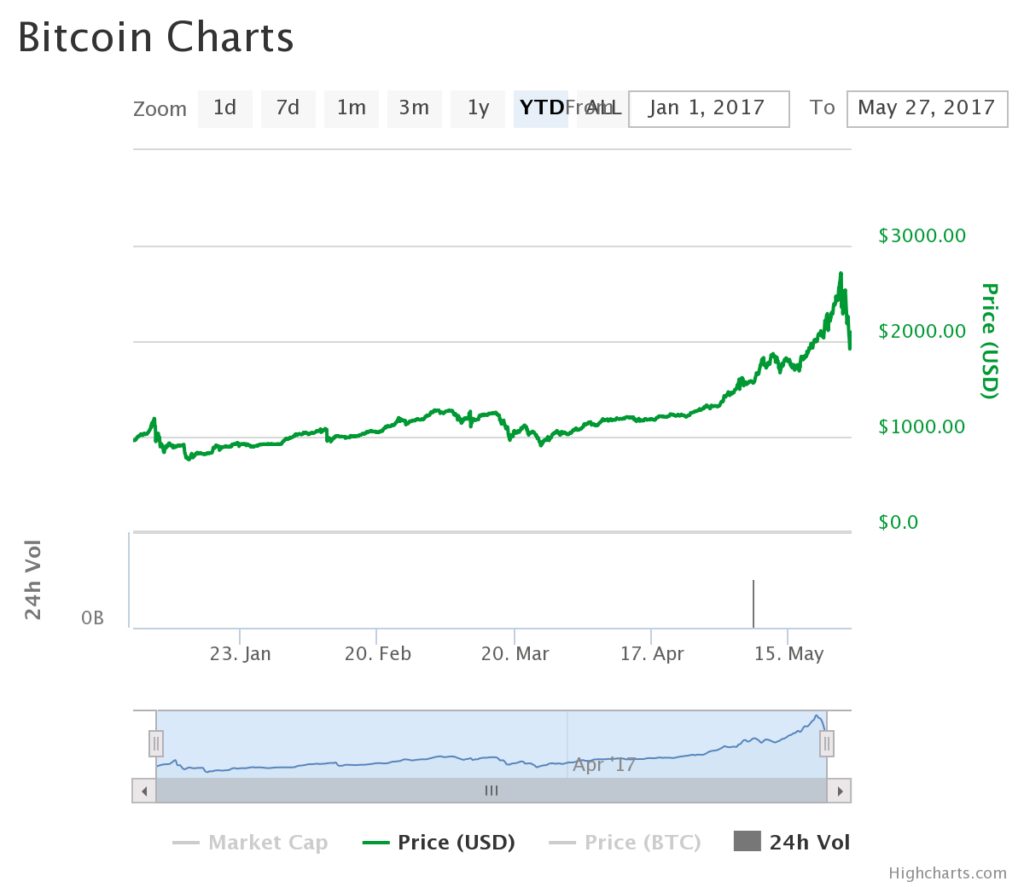

Bitcoin has risen substantially this year. It started off around $1,000 per coin, recently ran up as high as $2,700 and is now back to around $2,100.

I don’t pretend to know the exact catalyst for the upward volatility but it could have a lot to do with Asian demand particularly in Japan.

Although unconfirmed transactions and long delays in transaction confirmations are not new to the Bitcoin network, with the recent surge in price the network has been overwhelmed and the backlog of unprocessed transactions has grown.

I found a study that asserts 43% of Bitcoin transactions are not included within 1 hour.

There is a technical proposal that I understand would help with some of the Bitcoin performance issues but it has not yet been implemented.

I do think Blockchain technology pioneered by Bitcoin is here to stay. I just don’t think Bitcoin will be at the forefront forever.

by John | May 21, 2017 | Cryptocurrency

There has been tremendous upward volatility in cryptocurrencies over the past month.

The largest blockchain based cryptocurrency, Bitcoin, is trading over $2,100 with a market cap over $35 billion.

Ripple, a cryptocurrency seeking to lower the cost and increase the speed of international fund transfers is up to a market capitalization of nearly $13 billion with a price of $.33.

Ripple has been trading places with Ethereum as the second largest cryptocurrency. As of writing, Ethereum is up to a market capitalization over $15 billion making it the second largest cryptocurrency by market capitalization. The price is over $165 per coin.

A variety of other coins like DASH and Litecoin have also risen considerably over the past month.

Purists will despise Ripple for its adoption by large banks but it has a clear use case and the archaic international money transfer technology that is currently used by banks is ripe for replacement.

I own some Bitcoin, DASH, Ripple and Ethereum. I’m considering reducing my exposure to Bitcoin and taking some profits.

I remain skeptical of Bitcoin and I’m long term bearish on the currently largest cryptocurrency.

I consider Bitcoin an almost a purely speculative play because of the non-trivial technological issues with Bitcoin: including slow transaction speed, lack of privacy and scalability problems.

I also think the fact that Bitcoin has no non-monetary use is a problem for reasons I’ve previously described.

I think now is closer to being a good time to sell cryptocurrencies rather than buy them. The various cryptocurrencies could of course go even higher. For someone interested in purchasing crypto, waiting for a pullback or at least dollar cost averaging could be a good approach.

On August 1st Bitcoin is also going to fork, forming two separate and incompatible blockchains: Bitcoin (BTC) and Bitcoin Cash (BCH).

On August 1st Bitcoin is also going to fork, forming two separate and incompatible blockchains: Bitcoin (BTC) and Bitcoin Cash (BCH).