by John | Mar 30, 2017 | Value Investing

I’ve been reading How to Value Invest by Jason Rivera and I’m applying what I learn to the value investing metrics I’m use.

The overall principle of value investing remains the same: purchase shares of companies for less than their intrinsic value. I’m simply trying to find the best way to do that.

Some of the additional metrics I’ve been considering at are the EBIT plus cash and cash equivalents / outstanding shares multiples. I’m also looking at the quick ratio and current ratio as ways to measure company solvency as well as net cash per share and insider ownership.

That might sound like a foreign language but I’ll be creating an updated value investing metrics article in the coming weeks that dives into each in more detail.

March Value Stock Picks

FutureFuel (FF on NYSE)

From Google Finance: “FutureFuel Corp. is engaged in the chemical and biofuels business. The FutureFuel Chemical Company, a subsidiary of Company, manufactures chemical products and bio-based products comprising biofuels and bio-based specialty chemical products. The Company operates in two segments: chemicals and biofuels. The chemicals segment manufactures chemical products that are sold to third-party customers. The biofuels segment primarily produces and sells biodiesel to its customers.”

Enterprise Value to Market Capitalization is at .5, EV/FCF is 3.541, and the EV/EBIT ratio is 7.472 (the ratios measure the value of the enterprise relative to free cashflow and earnings before interest and taxes). FF has a yield of 1.72% with a sustainable 18.62% payout ratio. Net Cash per Share is $3.68. The five year average return on equity has been over 5%. A current ratio of 2.814 ensures FutureFuel can service it’s debts. It is a little pricey at around 11 times EBIT plus cash and cash equivalents per share. It is owned over 18% by insiders, which is a good thing.

Enzon Pharmaceuticals Inc. (ENZN on OTC Markets Group)

From Google Finance: “Enzon Pharmaceuticals, Inc. receives royalty revenues from existing licensing arrangements with other companies primarily related to sales of four marketed drug products: PegIntron, Sylatron, Macugen and CIMZIA. The Company has no clinical operations and limited corporate operations. PegIntron is used both as a monotherapy and in combination with REBETOL (ribavirin) capsules for the treatment of chronic hepatitis C. Macugen is used for the treatment of neovascular (wet) age-related macular degeneration. Sylatron is used for the treatment of melanoma. CIMZIA is used for the treatment of moderate to severe rheumatoid arthritis and Crohn’s disease. CIMZIA is a biologic medicine that counteracts tumor necrosis factor (or TNF), which promotes inflammation of the joints in rheumatoid arthritis.”

Enterprise Value to Market Capitalization is at .3, EV/FCF is 1.3 and EV/EBIT ratio is just .52. Net Cash per Share is $.15. The five year average return on equity has been over 5%. Although the trailing twelve month ROE has been negative 6%. A current ratio of 8.4 ensures Enzon can service it’s debts. Even at 5 times EBIT plus cash and cash equivalents it has a a large margin of safety at over 70%.

AmTrust Financial Services (AFSI on NASDAQ)

From Google Finance: “Amtrust Financial Services, Inc. (AmTrust) is an insurance holding company. The Company, through its subsidiaries, provides specialty property and casualty insurance focusing on workers’ compensation and commercial package coverage for small business, specialty risk and extended warranty coverage, and property and casualty coverage for middle market business. Its segments include Small Commercial Business, Specialty Risk and Extended Warranty, and Specialty Program. The Small Commercial Business segment is engaged in providing workers’ compensation, commercial package and other commercial insurance lines produced by wholesale agents, retail agents and brokers in the United States. The Specialty Risk and Extended Warranty segment is engaged in providing coverage for consumer and commercial goods and custom designed coverages. The Specialty Program segment is engaged in writing commercial insurance for defined classes of insureds through general and other wholesale agents.”

Enterprise Value to Market Capitalization is at 1.37, EV/FCF is 3.6 and EV/EBIT ratio is 6.218. AFSI has a yield of 3.44% with a sustainable 22.76% payout ratio. Net Cash per Share is a whopping $45.40. The five year average return on equity has been over 5%. A current ratio of 2.98 ensures AmTrust can service it’s debts. Even at 5 times EBIT plus cash and cash equivalents it has a a large margin of safety at over 75%. It is 16.68% owned by insiders.

I’m planning on opening positions in each of these three securities.

Data is from ycharts.com.

None of this information is a recommendation to buy any security. I’m just sharing some of the value stocks I like.

by John | Mar 26, 2017 | Currencies, Saving Money, Wealth Protection

There is a lot I like about cryptocurrencies. Many cryptocurrencies seek to make money decentralised and wrest control from the central banks that have a history of devaluation and abuse.

But there are several things I dislike about cryptocurrencies. I see several problems with them as a long-term store of value.

“What is a Cryptocurrency Anyway?”

Bitcoin is the largest cryptocurrency but there are hundreds of others as well. If you’re not familiar with Bitcoin I provide some background here: “What is Bitcoin?”

What I Dislike About Cryptocurrencies

Cryptocurrencies are better than government controlled fiat. But I don’t accept that being better than the disaster that is government fiat currency is good enough and I’m not going to pretend like cryptocurrencies solve all the problems of government controlled fiat money.

I’ve presented what I think are superior alternatives such as Goldmoney.

I touched on what I don’t like about cryptocurrencies in my gold versus bitcoin article but I wanted to dedicate an article solely to the elucidation of what I don’t like about cryptocurrencies.

My dislikes fall into three main categories.

1) They are centrally controlled

2) There are no natural limits on the quantity of cryptocurrencies

3) Cryptocurrencies have very low (or no) non-monetary use

Cryptocurrencies are Centrally Controlled

I am skeptical of the claim that cryptocurrencies like bitcoin are decentralised

The holdings of the cryptocurrencies are concentrated in the hands of the early adopters.

It is estimated that the mysterious creator(s) of Bitcoin, Satoshi Nakamoto, holds between 4-6% of all Bitcoin.

Source: http://www.businessinsider.com/satoshi-nakamoto-owns-one-million-bitcoin-700-price-2016-6

Vitalik Buterin owns a large number of Ether. Evan Duffield owns a large quantity of DASH.

Ripple intends to hold onto 50% of all Ripple cryptocurrency. There are similar situations for altcoins as well.

I think it is fine and good that early adopters and founders reap more reward for investing in a technology–my point is that cryptocurrencies are not actually as decentralised as cryptocurrency advocates would like you to believe.

This control isn’t limited to who holds the cryptocurrencies.

The control also extends to how the cryptocurrency technologies will function moving forward.

The Bitcoin Foundation, Bitcoin core developers and the largest miners control Bitcoin. The Ethereum Foundation and Vitalik Buterin control Ethereum.

People try to make arguments that cryptocurrencies aren’t centrally controlled and I’m not swayed by any of them.

At the end of the day cryptocurrencies are controlled by a small group of computer programmers.

What happens when cryptocurrencies actually behave in a decentralised manner? You get forks, like Ethereum Classic. Which brings me to my next point.

There are no natural limits on the quantity of cryptocurrencies

Like water in the desert, things that are both limited in supply and desirable tend to be valuable

I don’t have the knowledge or time to delve into the code of the Bitcoin algorithm but I accept on faith that because of how the bitcoin algorithm is written only 21 million Bitcoins will ever exist.

So in that way the quantity of Bitcoins are limited.

However, there is no limit to the number of “altcoins” or other cryptocurrencies that can be and are created.

There is Dash, Ethereum, Litecoin, Ripple, Monero and dozens of other altcoins you’ve never heard of. There are currently nearly 100 altcoins with a market cap over $20 million.

I’m all for competition and choice but when I’m investing in something as a long term store of value I want it to be limited in supply.

Furthermore, if the cryptocurrencies actually behave in a decentralised manner, you sometimes get hard forks.

Hard Forks

There is a cap on the maximum number of Ethereum that will ever be in circulation–but after a hack related to the “DAO” Ethereum forked and a new cryptocurrency was created called Ethereum Classic. This fork effectively doubled the number of Ethereum in existence.

Hard forks effectively result in double the number of units of that particular cryptocurrency

As a brief background, someone the “DAO” which was one of programs on the Ethereum network and stole a lot of Ether.

This caused an outcry, some people wanted to reverse that transaction so the thief wouldn’t get away with it. Some people didn’t want to reverse the transaction because it would mean Ethereum transactions weren’t irrevocable.

Ultimately a hard fork ensued and people who didn’t want to reverse the transaction got Ethereum Classic and those that followed the Ethereum Foundation and Vitalik Buterin remained on what is called Ethereum.

There is also talk of a fork in Bitcoin which would have a similar result: two different flavors of Bitcoin when before these was only one. In effect a doubling of the number of Bitcoins.

Cryptocurrencies have Very Low (or no) Non-Monetary use

I’m not going to flat out say that cryptocurrencies like Bitcoin have zero non-monetary use.

Although if you wanted to round down zero would be accurate.

Some people probably purchased Bitcoin as a political statement or way of saying that they didn’t want to be a part of a government controlled currency system. That is a non-monetary use.

But I think that use value is fairly low. Physical US dollars have non-monetary uses, like kindling or tacky wallpaper, but again that use value is very low and there are much better alternatives that accomplish the same thing.

Some people don’t think it matters that cryptocurrencies have little to no non-monetary use. For a time it probably doesn’t matter. People can subjectively value whatever they want. Otherwise you can’t explain why some works of modern “art” are sold for such high prices. But the question is will that subjective valuation be likely to hold?

Fiat currencies have little to no non-monetary use and how have they fared?

The value of Fiat currencies throughout history have eventually gone to zero. The fiat currencies that exist today did not exist 300 years ago.

The British pound Sterling, founded in 1694, is the oldest fiat currency in existence at 317 years. Most fiat currencies don’t last long.

Source: http://georgewashington2.blogspot.com/2011/08/average-life-expectancy-for-fiat.html

Gold has been valued for the past 3,000 years. What is the difference between gold and government issued fiat currencies? Gold has non-monetary use and non-monetary properties that have, for the past 3,000 years and up to this day, caused people to value it.

But I had better stop myself there rather than jump back into a gold versus bitcoin debate.

I don’t see how cryptocurrencies, that have very little non-monetary use, will fare better than government issued fiat over the long term.

Summing it Up

Some of the other shortcoming of cryptocurrencies are related to security and ease of use but I think those issues are sufficiently manageable.

I just don’t think the coins themselves are a good long-term store of value.

I choose to own both gold and cryptocurrency–I just choose to own more gold.

Just because there are things I don’t like about cryptocurrencies doesn’t mean I won’t use them and profit by them.

I own several flavors of cryptocurrency because I believe that they will be worth more in the future than what I paid for them. I also like to take advantage of the price differences on different exchanges.

I will be writing a future article entitled “Why I Like Cryptocurrencies” where I go into more detail about what I do like about cryptocurrencies.

What do you think of cryptocurrencies? Do you currently own any?

(29 July 2017: In a previous version of this article I claimed that cryptocurrencies are not scarce. I’ve updated the article with more precise language. At the time I first published this article there were over 100 cryptocurrencies with a market capitalization over $1 million, I’ve updated this number to nearly 100 cryptocurrencies with a market capitalization over $20 million.)

by John | Mar 21, 2017 | Cryptocurrency, Currencies, Learning from Mistakes, Personal Journey

I wrote back in June of 2016 in an article Ethereum Cloud Mining is Not Profitable. Today is exactly 1 year since I purchased an Ethereum cloud mining contract at Hashflare.io. As I recapped in that article:

In order to simply break even ETH would need to trade up to around 18.7 USD.

I would also be better off if I had just bought ETH.

That article was written about 3 months after I had made the investment in Ethereum Cloud Mining.

I wish I had done the in depth analysis in that article before I made the investment in Ethereum Cloud Mining so that I would have known not to make the investment.

And that is the lesson I learned:

Perform your due diligence before making an investment!

An artist’s representation of how I envisioned Ethereum Cloud Mining would go

I attempted due diligence but I did not consider all the relevant facts. These relevant facts were available to me at the time if I had known to look for them.

Since my mining contract is up I want to recap what actually happened with the benefit of all the facts.

The main beneficiary of my bad experience is anyone who is newly considering Ethereum Cloud Mining: caveat emptor.

There might be other cloud mining services out there that are profitable but in my experience Hashflare.io was not one of them.

Ethereum Cloud Mining Recap

On 21 march 2016 I spent $561 for a cloud mining contract at Hashflare.io. Ethereum was trading at $10.81 at the time. In the one year of mining I mined 41.27 Ethereum. As of writing Ethereum is currently trading at $42.6.

Source: http://coinmarketcap.com/currencies/ethereum/

So that 41.27 Ethereum would be worth $1,758 if I had held onto all of them and then sold today.

This is a $1,197 gain which sounds nice but it really isn’t and I’ll explain why.

Why a $1,197 Gain Wasn’t Very Good

But what if the price of Ethereum had not gone up 294%?

An artist’s representation of how Ethereum Cloud Mining actually went

What if it had stayed the same price of $10.81. Those 41.27 Ether I mined would be worth just $446.

What does that mean?

It means: The gain was entirely due to the increase in the price of ETH–the mining itself was not profitable.

In fact, if I had taken $561 and just purchased Ethereum directly, I could have acquired 51.89 Ethereum, which at current prices of $42.6 would now be worth $2,210 or a gain of $1,649.

So other than sounding cool Ethereum Cloud Mining through HashFlare.io provided no value.

The Problem with my Analysis

The downfall of my analysis when initially evaluating the investment in Ethereum Cloud Mining was assuming linear growth in hashing power of the Ethereum network.

I explain this in more detail in my original article and I also provide a process for making more accurate predictions wether a cloud mining contract will be profitable or not. Using that process I predicted I would mine about 30 ETH.

This prediction was much closer to what I actually mined compared to the 120 ETH predicted using static models.

It was a tough lesson to learn but thankfully the amount at risk was relatively small at $561.

by John | Mar 19, 2017 | Geopolitical Risk Protection, Preservation of Purchasing Power, Wealth Protection

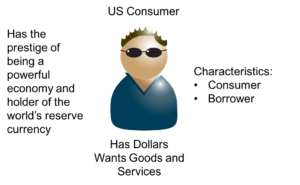

I wanted to flesh out the idea that my Caribbean Cruise was a microcosm of the global economy.

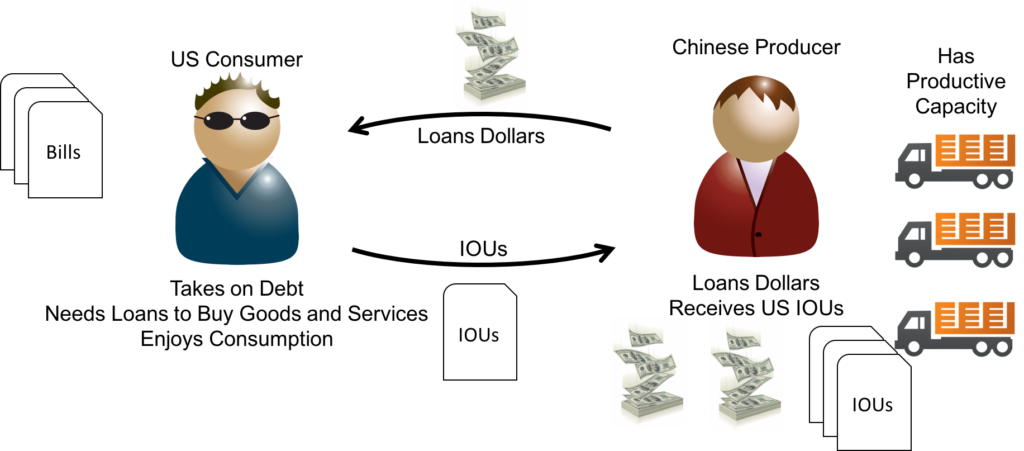

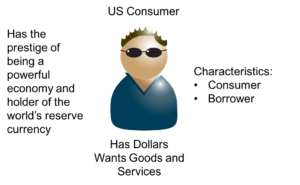

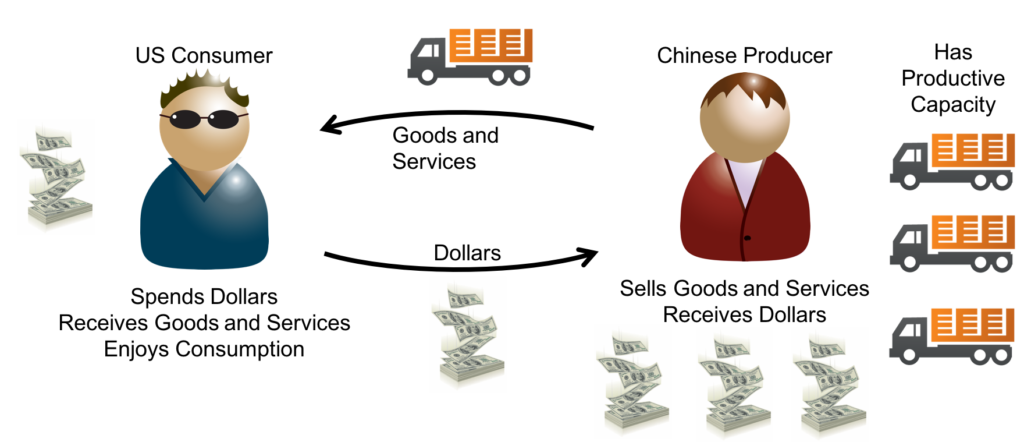

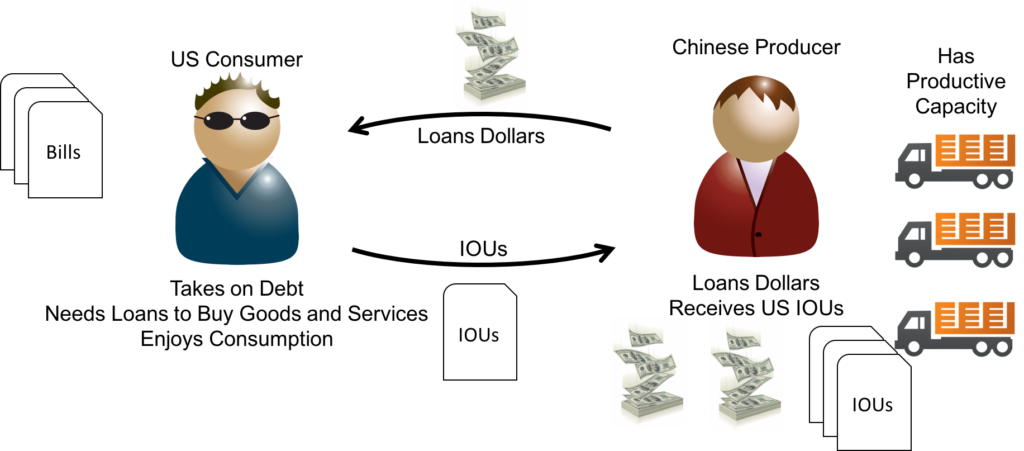

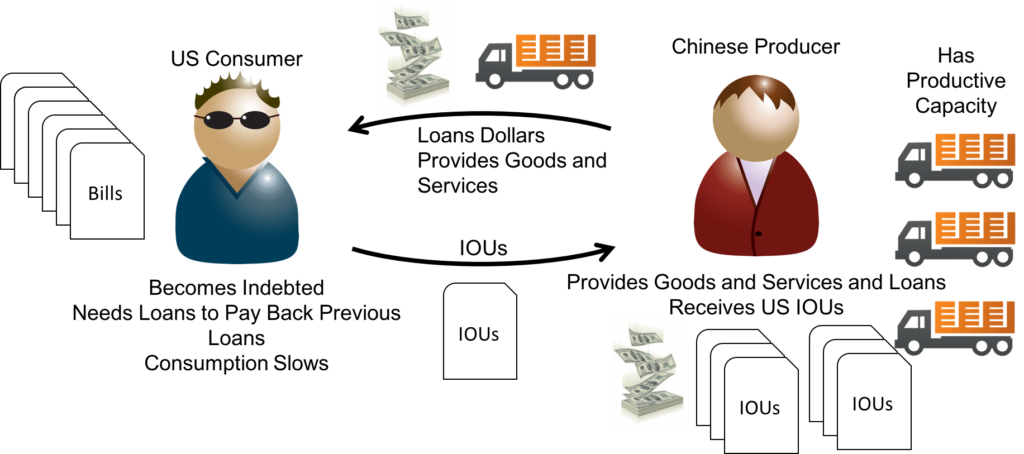

Basically Americans spend US dollars to consume goods and services while the rest of the world works to provide those goods and services in exchange for dollars.

One problem with this arrangement, at least for the people of the world who aren’t US citizens, is that the US dollar is no longer backed by a solvent and productive economy.

Another problem is that a lot of the loans American use to acquire dollars are provided by the very countries who also provide the goods and services.

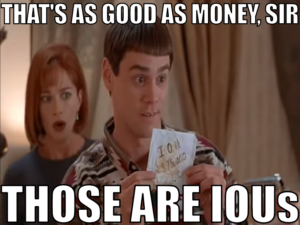

In other words what are these countries getting in exchange for providing goods and services? IOUs.

These IOUs are promises to pay from a group of people and a country that has more debt that any country or people in the history of finance.

In the movie Dumb and Dumber, main characters Harry and Lloyd spend hundreds of thousands of other people’s money. But hey, they kept IOUs so they could pay them back! (both were unemployed)

So what will happen?

The US dollar will continue to lose a significant portion of it’s remaining value and American’s standard of living will continue to fall while the standard of living for the rest of the world will eventually rise once they stop selling their goods and services in exchange for overvalued US dollars.

This has been happening for a while, but people still have faith in the dollar and the other fiat currencies around the world are being devalued by their respective government even faster than the dollar.

So dollars are the cleanest dirty shirt.

But will this continue forever? Will Americans be able to continue to borrow at low rates and live beyond their means while the rest of the world foots the bill?

I doubt it.

The World Reserve Currency

The US dollar is the world reserve currency which means that many things that are traded on the global market are priced and bought and sold with US dollars.

It also means I was able to buy a Hawaiian shirt in Honduras, go snorkeling in Belize and buy drinks in Mexico at a low cost using US dollars.

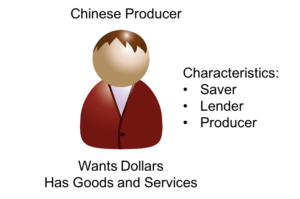

Using China as an Example

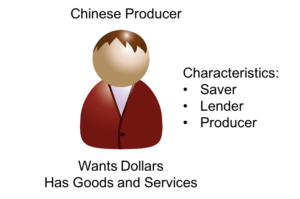

Why do countries put up with this lopsided arrangement?

It has everything to do with history and perception. I touch on this some in another article downfall of the US dollar. But the short version is that the US was the most powerful and dominant country after World War II and the currency reflected this strength.

The result was that critical goods like oil were priced in dollars.

Countries like China therefore need dollars in order to buy oil.

Meanwhile the American consumer wants goods and services.

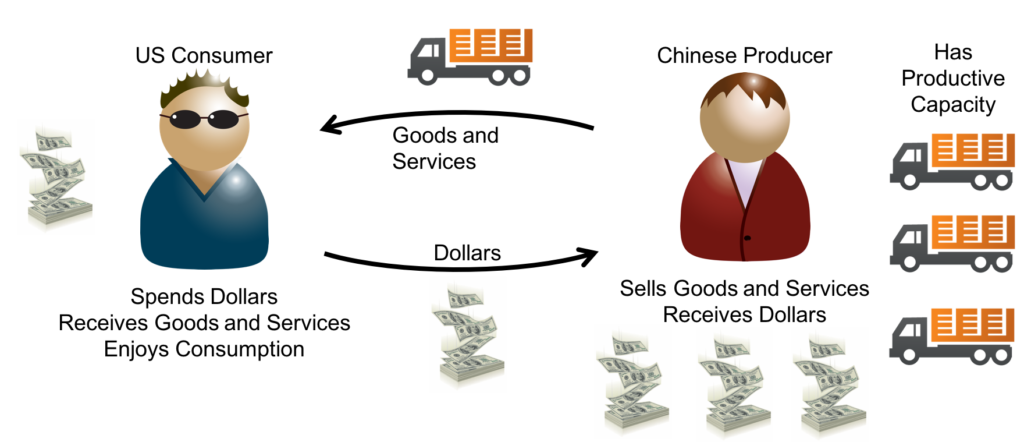

So in order to get dollars China produces goods and services that are then sold to Americans for dollars.

Back when the majority of Americans had a lot of savings and the dollar had more value this worked fine.

But the US began producing less while simultaneously consuming more resulting in trade deficits.

In 2015 the US imported $497.8 billion in goods and services from China and exported $161.6 billion to China. Thus the U.S. goods and services trade deficit with China was $336.2 billion.

Source: https://ustr.gov/countries-regions/china-mongolia-taiwan/peoples-republic-china#

You can’t consume more than you produce (which is what a trade deficit is) without losing money and as time passed the US consumer found his savings depleted.

About half of Americans have zero net worth.

Source: https://www.marketplace.org/2014/04/21/wealth-poverty/about-half-america-has-zero-net-wealth

But China has an large portion of it’s economy built around American consumption and the world associated dollars with strength and prosperity.

So China loans money to the American consumer to pay for the American to buy the things China produces.

This works for the time being because the US is the most powerful economy in the world and the dollar is the world reserve currency.

So of course the American will pay back the Chinese producer! Or so the thought goes.

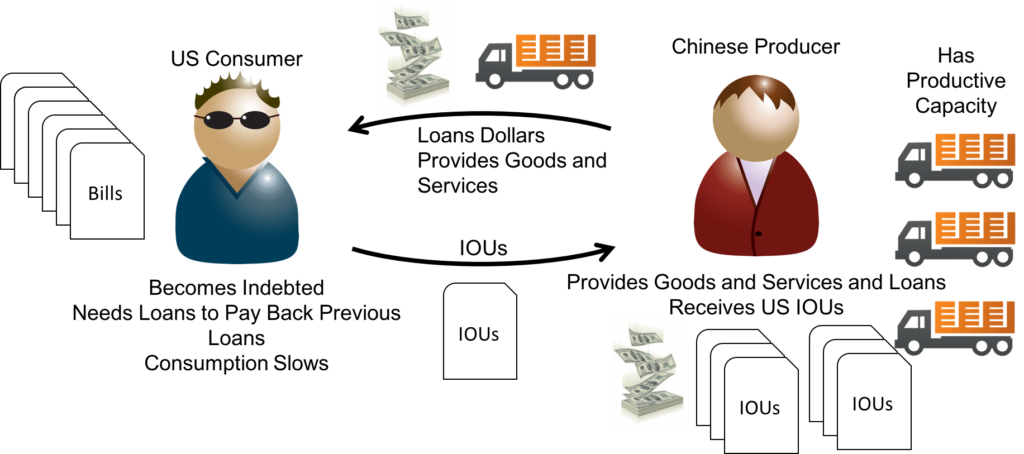

It’s the ultimate vendor financing: China provides the goods and services as well as the loans to pay for the goods and services.

Meanwhile the US government has also taken on monstrous amounts of debt and has devalued the dollar.

So the IOUs the Chinese producer already has are worth less and less each year.

How long before the Chinese producer begins to seriously doubt if the US consumer will ever pay back the IOUs?

Once this doubt takes how long before the Chinese producer stops providing the loans to buy the goods and services?

When this happens prices will have to rise and it will be harder for Americans to buy goods and services.

This process is explained in more detail in an excellent book that I recommend. The book is written by Peter Schiff and is called “How an Economy Grows and Why It Crashes “.

“.

Two beers, four mixed drinks and chips and salsa for under 20 USD. Compliments of El Cial La Ceiba in Cozumel, Mexico. It wasn’t just the two of us imbibing though!

This is basically what I was witnessing on my Caribbean Cruise.

I was able to spend my higher valued US dollars for goods and services provided by peoples outside the US who wanted dollars.

It is a great benefit that Americans have had for some time but will it continue forever?

I don’t think it will.

I think there are lots of opportunities to position oneself to avoid getting destroyed as the dollar continues to lose value.

Thats why I created this website.

by John | Mar 12, 2017 | Currencies, Geopolitical Risk Protection, The Inflation Bandit, Travel, Wealth Protection

I recently got back from a Caribbean cruise I took with my family. It was a wonderful time of relaxation, adventure and reconnecting.

But since I’m often thinking about economics and finance it was also a proxy for the global economy.

The first stop of the cruise was Roatan, an Island in Honduras. We drove from the port (pictured below) to the other side of the Island to go snorkeling.

Roatán Island, Honduras

Driving around the Island I saw mostly what I would have described as lower income areas if I’d been back in the United States.

I’ve certainly seen worse neighborhoods in the US.

I still got LTE mobile phone coverage with data (made a few stock trades), we drove by pharmacies, gas stations, supermarkets, a bank with rifle toting guards outside and a modern looking power plant.

One of the houses we drove by had some chickens in the front yard which at first seemed quite rustic until I remember I’ve seen that same thing an hour south of Columbus, Ohio.

The people I encountered were very friendly. I didn’t know what to expect but it was fascinating to spend time in another country.

Spending US Dollars outside the United States

My sister and I at Roatan. The Hawaiian shirt shows my commitment to leisure.

I bought a Hawaiian shirt for 22 US dollars (USD) as well as a small hand carved mahogany box that cost 45 USD.

The next day the ship stopped off the coast Belize and we took a tender into the City of Belize.

From there we went on a semi-guided snorkeling tour in which we got to swim with stingrays and nurse sharks.

It was incredible.

Afterwards we stopped at an Island called Caye Caulker for lunch. I could get a burger and fries for about 10 USD (Hey! Lobster wasn’t in season!).

It was on the Island of Caye Caulker that I first saw a Belize dollar. We paid for lunch in cash and the waitress gave us change in a mix of Belize dollars and USD. All the other transactions both on Roatan in Honduras and Belize up to that point were solely in USD.

This restaurant on Caye Caulker, Belize accepted dollars

It was the same in Cozumel, Mexico. The vendors priced items in dollars. One hotel we stopped at had drinks priced in pesos, but they accepted dollars without question.

US Dollars as the World Reserve Currency

Even on the relatively remote Isle of Caye Caulker the vendors on the street took US dollars as if I was in the US. And goods were priced in USD.

Welcome to the Caribbean love. – Captain Jack Sparrow

It struck me as odd that I was transacting in dollars in other countries. If someone came to the US and wanted to pay me in Belize dollars I probably wouldn’t accept them.

Part of the reason why the people of Honduras, Belize and Cozumel accepted dollars is likely because dollars still are the reserve currency of the world.

I doubt they think about world reserve currencies (I wouldn’t if I didn’t really enjoy this stuff) but the people I encountered who accepted dollars know that dollars are valued and can be used to buy useful things.

A Microcosm of the Global Economy

On the ship itself the vast majority of crew members are not from the United States. Amongst the crew there are around fifty home countries, such as Mauritius, Hungary, Ukraine, India, Romania, France, United Kingdom, Canada, Nicaragua, Philippines and dozens more.

I did find a couple US crew members as well as one from Canada, and the UK. But the majority of the home countries in my informal assessment of the crew were Philippines, India and Mauritius.

The passengers, while not wearing name tags with their nationality listed on it, seem to be mostly from the United States.

I think this trip represents a microcosm of the global economy.

The US dollar is strong, it’s accepted by other countries, and people from the US participate in a lot of consumption and spending of US dollars. People from other countries work to provide goods and services for the Americans and accept these dollars.

My brother and I outside of El Cid La Ceiba in Cozumel, Mexico.

This is a great deal for the Americans.

But the fundamentals of the US dollar are not strong.

Even when it isn’t bullying foreign banks the US government has made no serious effort to balance the budget, reign in entitlement spending or reduce the debt. A few quarter point hikes notwithstanding the Federal Reserve has not seriously attempted to reduce it’s balance sheet or normalize interest rates.

These factors are not positive for the US dollar as evidenced by it losing over 90% of it’s value.

It made a lot of sense why everyone wanted dollars 50-60 years ago. It makes less and less sense as time goes on.

As Simon Black likes to say this isn’t a consequence free environment. More to follow on this topic in the next article.