Tesla (TSLA) stock has been tanking

Electric car company Tesla has a market capitalization over $40 billion. Over the past few months the stock (TSLA) has lost nearly a third of it’s value dropping from $360 per share down as low as $244.

Bonds issued by this electric car company are yielding higher than that of Ukraine (indicating higher risk) and recently the autopilot on one of their cars resulted in a death.

Tesla as a company is not exactly in great shape. The stock was already trading down to the year lows.

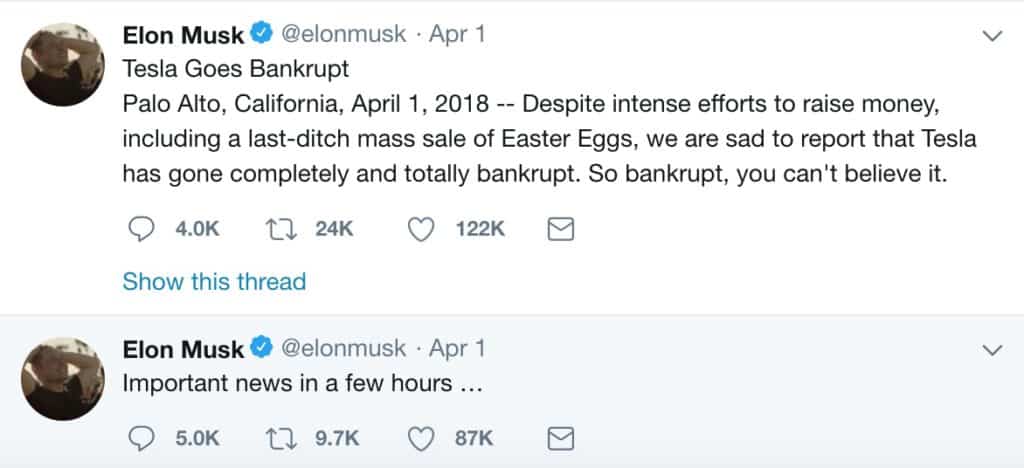

Now it’s 1 April–what does CEO Elon Musk decide to do?

Elon decided it would be hilarious to tweet about his company going bankrupt.

CEO Elon Musk tweeted out some “jokes” about his company filing for bankruptcy

Now if Tesla was humming along nicely this would be little more than a sophomoric prank by an eccentric billionaire.

However Elon’s company is performing extremely poorly.

In terms of free cash flow Tesla has consistently “generated” negative free cash flow in the billions since 2014. It’s free cash flow has been negative as far back as I can find data (2008).

Many other metrics are similarly dismal.

Negative margins, $.51 worth of liquid assets for every dollar of current liabilities, negative return on assets and a negative return on equity.

If you just looked at the balance sheet and didn’t know what company it was for you’d have a hard time finding anything positive to say.