by John | May 28, 2017 | Economic Outlook, Geopolitical Risk Protection, Wealth Protection

Some people think the United States economy is doing well. The unemployment rate is low. Major US stock indices continue to rise.. There has not been hyperinflation of consumer prices.

So one might be tempted to think the economy is doing pretty well and everything is good and normal. I don’t think this is accurate but I think it is important to look at some of the measures that do seem to support the view that the US economy is on strong ground.

The following are some facts that people will point to when they say that everything is fine.

The “Good”

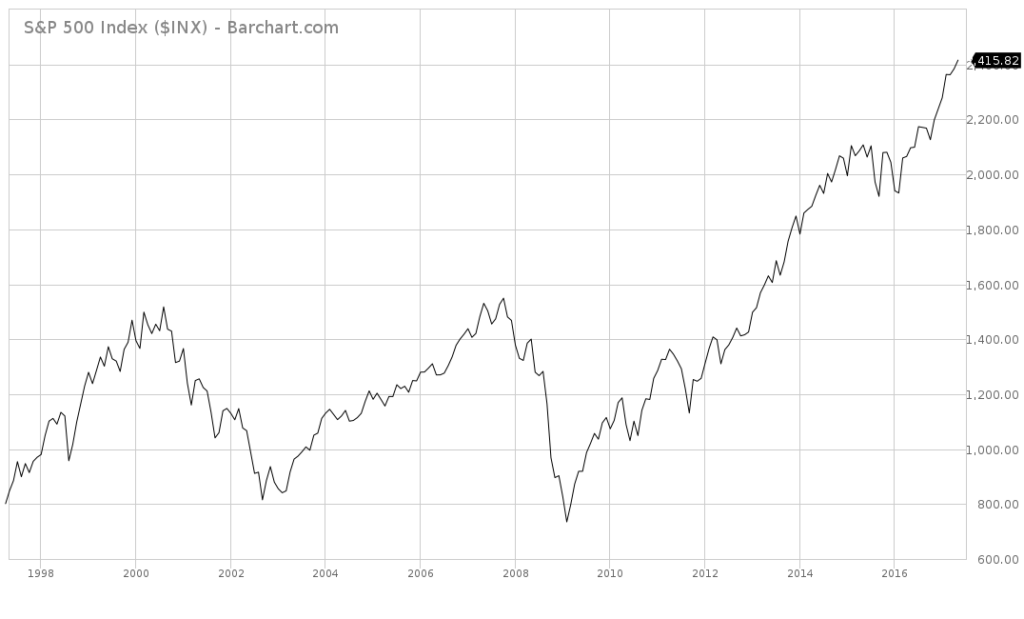

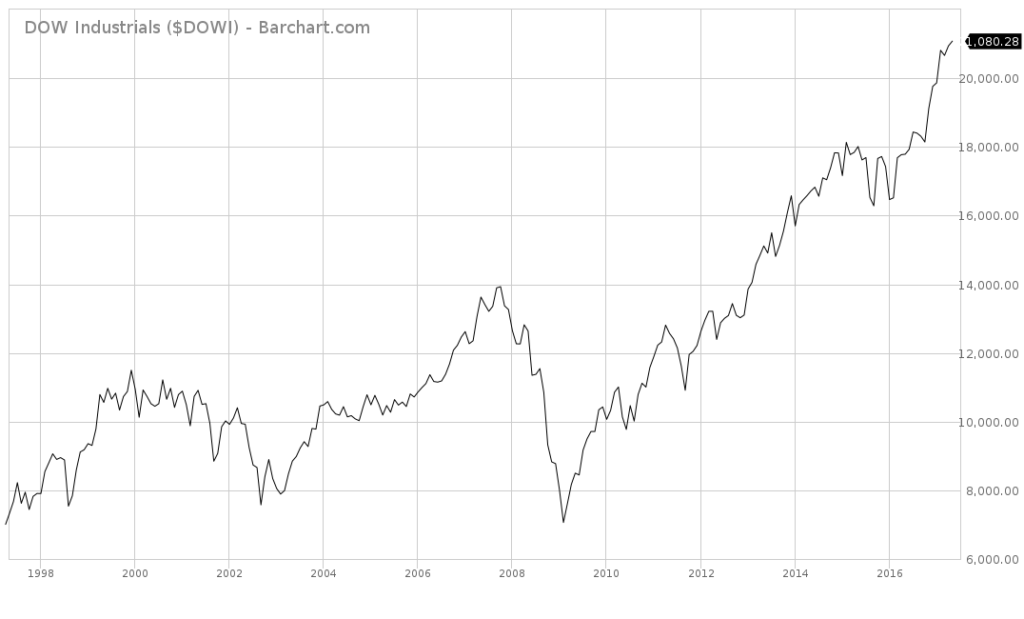

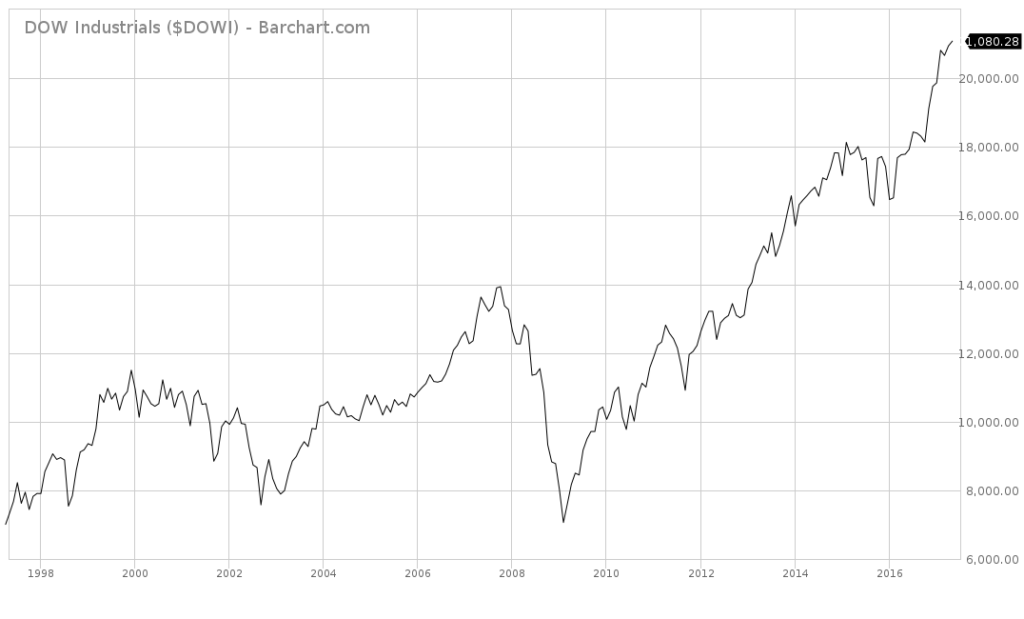

Stocks are Up

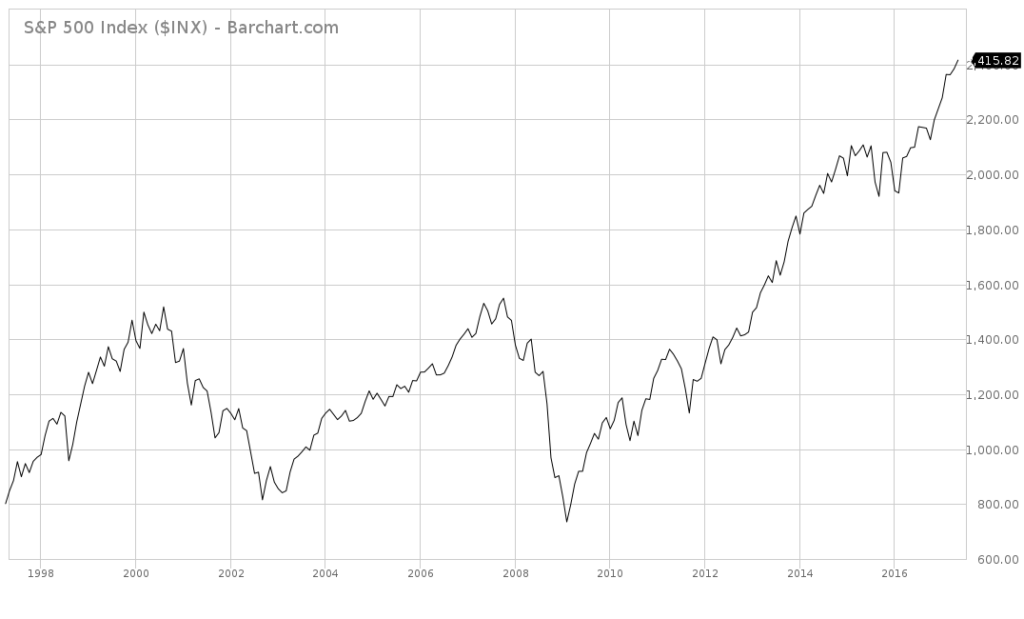

US Stock investors have been handsomely rewarded since the lows of the 2008 financial crisis.

Led by darlings such as Apple, Alphabet (Google), and Amazon, the NASDAQ composite has reached new all-time highs.

The S&P 500 has been on a tear, also making new highs without any significant corrections.

The Dow Jones Industrial average is also making new highs.

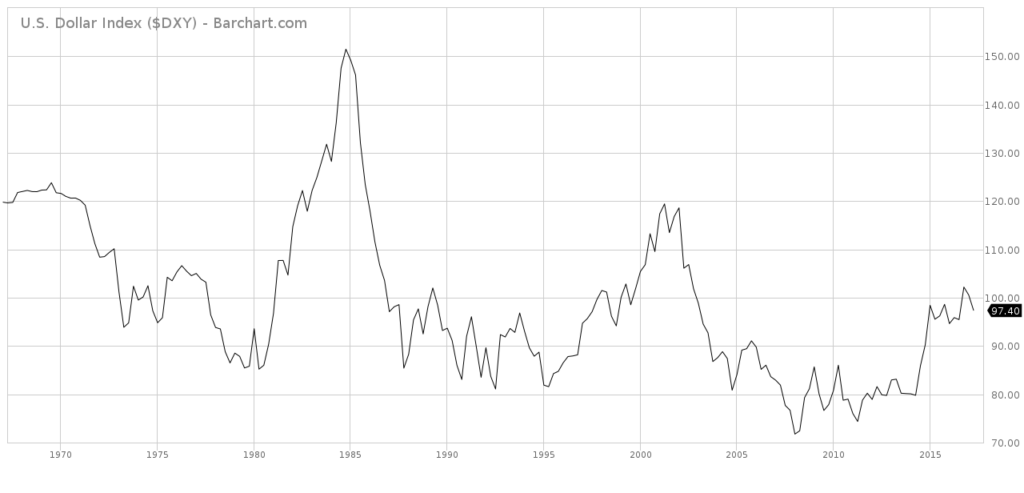

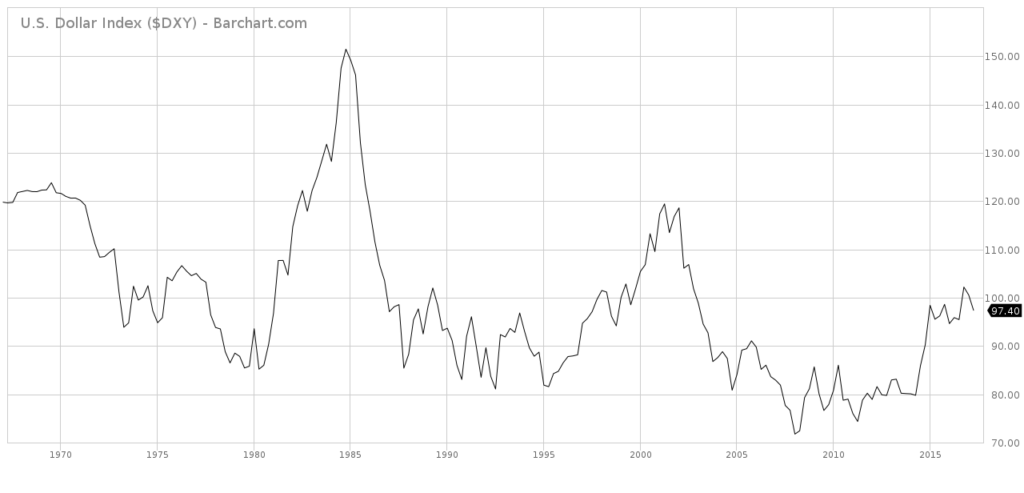

The Dollar is Relatively Strong

Despite unprecedented central bank intervention and record US debt the US Dollar Index is holding.

US GDP Continues to Rise

United States Gross Domestic Product continues to climb.

source: tradingeconomics.com

Low Unemployment

The unemployment rate is below 5%.

Source: https://data.bls.gov/timeseries/LNS14000000

The Bad

But if you look a little deeper than the headlines there are systemic problems in the United States economy.

A lot of People Aren’t Working

Labor Force Participation is at levels not seen since the 70s. And no, it’s not because of baby boomer’s retiring. Labor force participation from those age 25-54 has dropped from 82.8% in 2004 down to 80.9% in 2014. Participation from those age 65 and older has increased from 14.4% in 2004 up to 18.6% in 2014. Source: https://www.bls.gov/emp/ep_table_303.htm

Just because the unemployment rate is low doesn’t mean people aren’t unemployed. If someone is unemployed for long enough, they simply drop off. If someone is fired from a good paying salaried position, and they get two new part time jobs, that is considered a net job gain.

United States GDP Growth is Slowing

The growth rate of US GDP has been trending down.

source: tradingeconomics.com

US Debt is Growing

US National debt is up to nearly $20 trillion, not counting the unfunded liabilities of Social Security and Medicare. Source:

It is politically impossible to cut spending. As Simon Black recently pointed out:

In 2016, for example, the government spent $2.87 trillion on Defense, Social Security, and Medicare, plus an additional $433 billion paying interest on the debt.

That totals over $3.3 trillion, which is more than they collected in tax revenue.

Source: https://www.sovereignman.com/trends/and-now-for-the-bad-news-21884/

In other words all spending on the department of energy, education, homeland security, everything else besides defense, social security and medicare could be cut completely and there would still be a budget shortfall.

I believe it is politically impossible to cut social security, medicare or defense spending in the United States.

The Debt to GDP is Rising

The debt to GDP ratio is at levels not seen since the United States was fighting a World War in the 40s. Source: https://en.wikipedia.org/wiki/File:Public_debt_percent_of_GDP.pdf

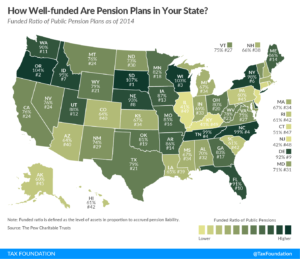

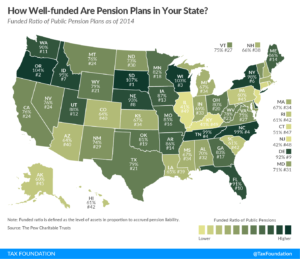

State Pension Funds are Underfunded

The majority of State Pension funds are underfunded.

Source: https://taxfoundation.org/state-pensions-funding-2017/

Social Security and Medicare are Underfunded

This isn’t some alarmist drivel. The people in charge of the Social Security and Medicare Trust Funds are issuing statements like following:

“Both Social Security and Medicare face long-term financing shortfalls under currently scheduled benefits and financing.”

Source: https://www.ssa.gov/OACT/TRSUM/

As well as statements like:

Under the intermediate assumptions, DI Trust Fund asset reserves are projected to become depleted in the third quarter of 2023, at which time continuing income to the DI Trust Fund would be sufficient to pay 89 percent of DI

scheduled benefits. Therefore, legislative action is needed soon to address

the DI program’s financial imbalance. The OASI Trust Fund reserves are

projected to become depleted in 2035, at which time OASI income would be

sufficient to pay 77 percent of OASI scheduled benefits.

Source: https://www.ssa.gov/OACT/TR/2016/tr2016.pdf

I haven’t even touched on consumer debt, state debt, low home ownership, and low savings per capita.

The US Economy isn’t Fine

So despite headlines like the low unemployment rate and stock markets making new highs that seem to indicate a recovery from the 2008 financial crisis there are systemic issues in the US economic system. I don’t think that the United States will be able to continue to borrow and spend without consequences. The fact as the United States has a printing press and the world reserve currency doesn’t mean it can borrow and spend forever.

There are ways to protect yourself but you have to be aware of the problems.

by John | May 28, 2017 | Economic Outlook, Geopolitical Risk Protection, Investor Mindset, Investor Psychology, Personal Journey, Preservation of Purchasing Power, Wealth Protection

I’ve written about problems with the United States dollar and the US economy.

I’ve been influenced by folks like Peter Schiff and Simon Black. To say the least these guys are not bullish on the US economy. I think they’re right and I think it’s wise to listen to what they say, be aware of the risks, and determine what course of action makes sense for your unique situation.

But while things aren’t great, particularly for those on fixed incomes without assets or investments, there hasn’t been a significant stock market correction and the US dollar is still relatively strong. Does that mean that people like Peter Schiff or Simon Black are wrong? Does that mean I’m wrong?

Things aren’t getting better. The underlying problems remain and only get worse. Governments have tremendous debt, interest rates are distorted, governments continue to spend recklessly, central banks are out of control and asset prices are inflated.

In the face of these problems I think there are two mains risks when it comes to behavior that fall on opposite ends of a spectrum. To willfully embrace either of these mindsets and their resultant behavior is, I think, crazy.

The First Kind of Insanity: Doing Nothing

Proud as a Peacock

On the one hand there is a person who does not take the risks seriously because they don’t think there are any significant risks.

People with this mindset believe that the United States can manage it’s debt. They laugh at anyone who suggests the recovery isn’t real or that the stock market growth isn’t based on sound fundamentals.

Subscribers to this attitude think the United States is the richest and freest and greatest country in the world and that $20 trillion in debt and trillions in unfunded liabilities is not a problem. They think the US government can just print money or increase taxes or grow the economy and everything will be fine.

Folks with this type of attitude hold their savings entirely in dollars and US-centered assets. They are comfortable being heavily invested in US stocks. They believe that government promised programs will be there for them when they most need them.

They can’t envision a world in which the United States isn’t the dominant world superpower. They can’t imagine the US dollar not being the world reserve currency.

This mentality is common in those who are blissfully unaware of the lessons of history and the facts of math.

This is the peacock mentality. People with this mentality strut around and deny there are any problems and so do nothing to protect themselves.

An Ostrich Hiding

Similar to the peacocks of the world there are people who realize there are problems with the economy but still choose not to do anything about it. Maybe they think there isn’t anything they can do about it. They think if the dollar falls and the stock market crashes then they have no choice but to go down as well. They’re either unwilling to learn about alternatives or simply don’t think alternatives exist.

They also might willfully ignore anything suggesting there are problems. If pressed they would concede that another 2008 or 2000 crisis are possible and that government debts won’t be repaid, but they really don’t want to think about it.

People with this type of attitude don’t have the misplaced confidence of the peacocks but they make the same choice not to take any decisive action to protect themselves.

They stick their head in the sand. This is the ostrich mentality.

A Second Kind of Insanity: Living Life around Anticipation of Crisis

But at the same time I think there is a risk of having a bunker mentality. This attitude that crisis is imminent and the sky will fall any day now. Individuals who think this way might go 100% into cash. Or go 100% into gold. Or go 100% into guns and food. Or they take huge risks trying to short the stock market.

A Turtle in it’s Shell

But I think this attitude of going into one’s shell is not particularly helpful. It’s hard to accomplish anything or live a fruitful life when you’re hunkered down and metaphorically looking over your shoulder all the time. This is the turtle mentality.

The Golden Mean

Aristotle and the ancient Greek philosophers spoke of a golden mean. The idea that the correct course of action or virtue is the middle path between two extremes. For example, courage is the golden mean between recklessness and cowardly inaction.

The key to sanity in an insane financial world is decisive, measured and purposeful action when it comes to preparation. Two extremes when it comes to investing would be on the one end of the spectrum shorting the S&P 500 with one’s life savings. On the other end would be buying a 3x bull S&P 500 ETF.

But just because I believe US stocks are in a bubble doesn’t mean I’m going to go with the extreme of shorting the market. It does mean that I’m going to limit my exposure to US stocks and be very selective about which stocks I own.

When it comes to dollars the two extremes would be 100% in dollars or 0% in dollars. But just because I think dollars are overvalued and will continue to lose value doesn’t mean I have to go to the extreme of 0%. It doesn’t mean I go 100% into gold or I only own precious metals and cryptocurrencies. I actually advocate holding some cash. Emphasis on some. I also earn money in dollars and invest in value stocks.

This applies to attitude as well. Being negative and pessimistic isn’t going to do anyone any good. Thinking everything is awesome and always will be isn’t a very good approach either. But there are still many great businesses in the US and there is lots of opportunity in the United States and in the world.

The United States has problems. Lots of economies around the world have problems too. There are going to be winners and losers. Many promises that have been made will be broken. But in the midst of all this there is tremendous opportunity. The important thing is to remain calm, take some practical steps to protect yourself and live your life.

by John | May 28, 2017 | Cryptocurrency

The largest cryptocurrency by market capitalization, Bitcoin, is supposed to be the payment technology of the future. Gold 2.0. The decentralized currency of tomorrow.

On May 22nd sent about $1,000 worth of Bitcoin from an exchange to another address and it was not confirmed until 27 May. The BTC fee paid to process the transaction was $25 worth of Bitcoin (at the time of the transaction).

This is worse than decades old wire transfer technology.

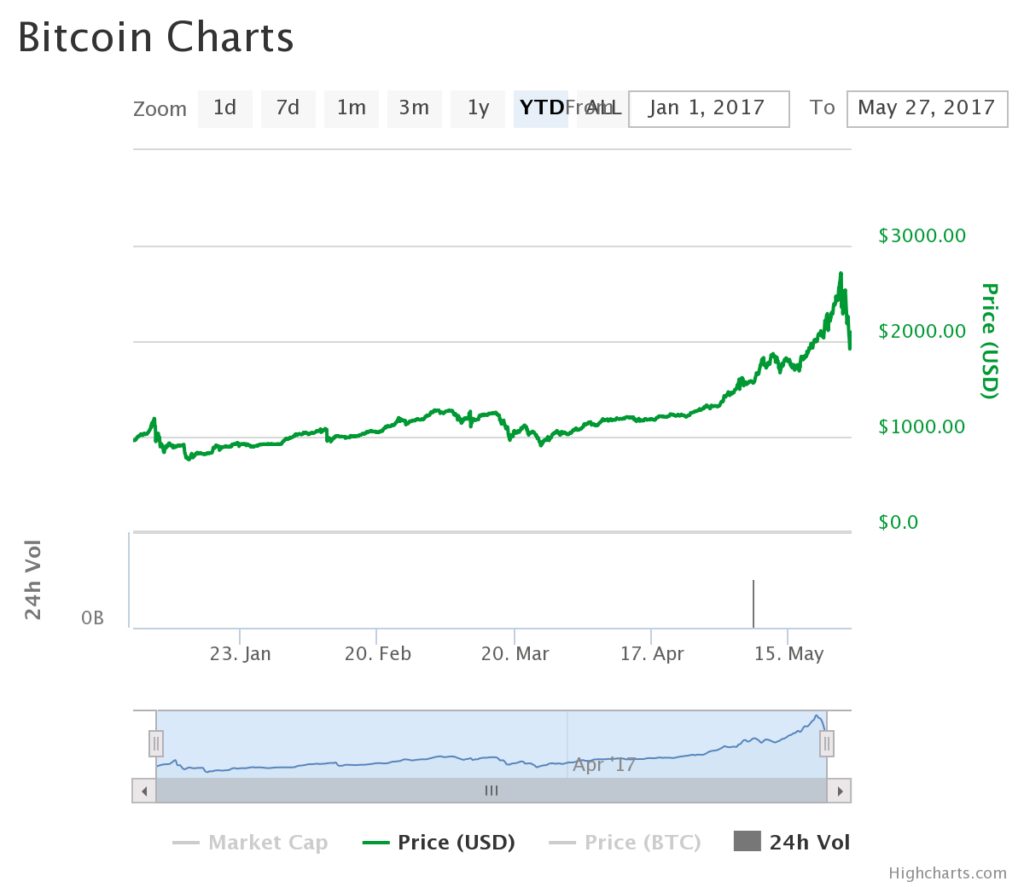

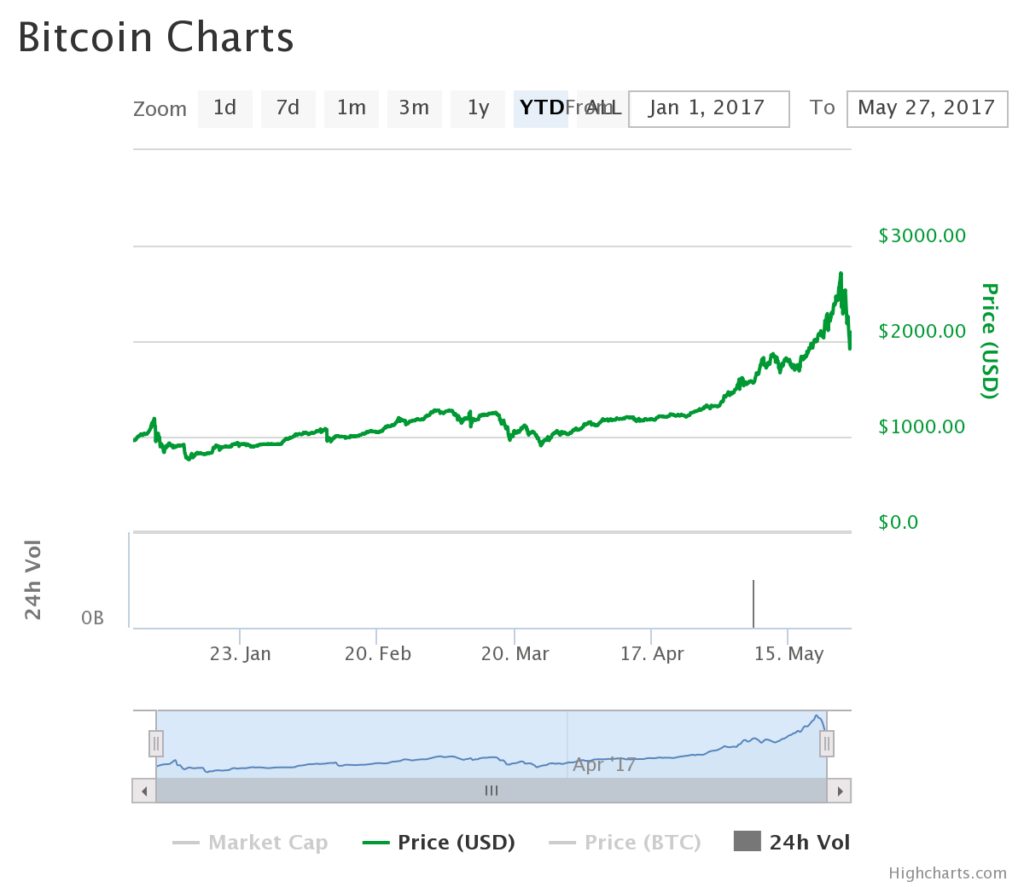

Bitcoin has risen substantially this year. It started off around $1,000 per coin, recently ran up as high as $2,700 and is now back to around $2,100.

I don’t pretend to know the exact catalyst for the upward volatility but it could have a lot to do with Asian demand particularly in Japan.

Although unconfirmed transactions and long delays in transaction confirmations are not new to the Bitcoin network, with the recent surge in price the network has been overwhelmed and the backlog of unprocessed transactions has grown.

I found a study that asserts 43% of Bitcoin transactions are not included within 1 hour.

There is a technical proposal that I understand would help with some of the Bitcoin performance issues but it has not yet been implemented.

I do think Blockchain technology pioneered by Bitcoin is here to stay. I just don’t think Bitcoin will be at the forefront forever.

by John | May 21, 2017 | Cryptocurrency

There has been tremendous upward volatility in cryptocurrencies over the past month.

The largest blockchain based cryptocurrency, Bitcoin, is trading over $2,100 with a market cap over $35 billion.

Ripple, a cryptocurrency seeking to lower the cost and increase the speed of international fund transfers is up to a market capitalization of nearly $13 billion with a price of $.33.

Ripple has been trading places with Ethereum as the second largest cryptocurrency. As of writing, Ethereum is up to a market capitalization over $15 billion making it the second largest cryptocurrency by market capitalization. The price is over $165 per coin.

A variety of other coins like DASH and Litecoin have also risen considerably over the past month.

Purists will despise Ripple for its adoption by large banks but it has a clear use case and the archaic international money transfer technology that is currently used by banks is ripe for replacement.

I own some Bitcoin, DASH, Ripple and Ethereum. I’m considering reducing my exposure to Bitcoin and taking some profits.

I remain skeptical of Bitcoin and I’m long term bearish on the currently largest cryptocurrency.

I consider Bitcoin an almost a purely speculative play because of the non-trivial technological issues with Bitcoin: including slow transaction speed, lack of privacy and scalability problems.

I also think the fact that Bitcoin has no non-monetary use is a problem for reasons I’ve previously described.

I think now is closer to being a good time to sell cryptocurrencies rather than buy them. The various cryptocurrencies could of course go even higher. For someone interested in purchasing crypto, waiting for a pullback or at least dollar cost averaging could be a good approach.

by John | May 14, 2017 | Business, Earning Income, Personal Journey, Saving Money

The vast majority of money I’ve made has been working for someone else. Why were they willing to pay me? Because I created value for them. The work I did for my employer allowed the employer to make more money than would have otherwise been possible–even after paying for my labor.

That is really the key to wealth: creating value for others.

The vast majority of wealthy people have helped lots and lots of people. Sure there are exceptions, but most people who have wealth have created value in proportion to the money they’ve made.

So if you want to grow wealth, ask “How can I help people?” If you provide a product or service that helps people and it is available to them at an attractive price people will gladly pay you money for it.

I appreciate that can be hard to do.

But there are people and organizations (businesses) that have already figured out a product or service that people want and are willing to pay money for and they often hire others to help them run their business. That is of course the way that most people make money–by working for someone else. That is how I’ve made the majority of my money, by working as an employee.

But the value creation mindset is still there. I think that mindset helps me to be a valued employee. It prompts me to ask: What knowledge, skills and abilities to I need in order to help this company? How can I help make this business more successful? How can I help this business be more efficient and more profitable?

By creating value at a company and helping make the business more profitable I know that I’ll be rewarded as well. Does it always work that way? No. But it has worked that way for me more often than not.

I enjoy investing. Investing is a way to passively grow one’s wealth over the long term. But I need to make money to have money to invest.

The way to make money in business is by helping people. It’s by creating value. Wether you’re starting or running your own business or working for someone else creating value is the key to growing wealth.