Just about four years ago I wrote the first article on HowIGrowMyWealth.com “Inflation Destroys Dollars“. I wrote about how what I do to protect against price inflation and dollar devaluation. Specifically value investing and precious metals. So in retrospect, how did those investments do?

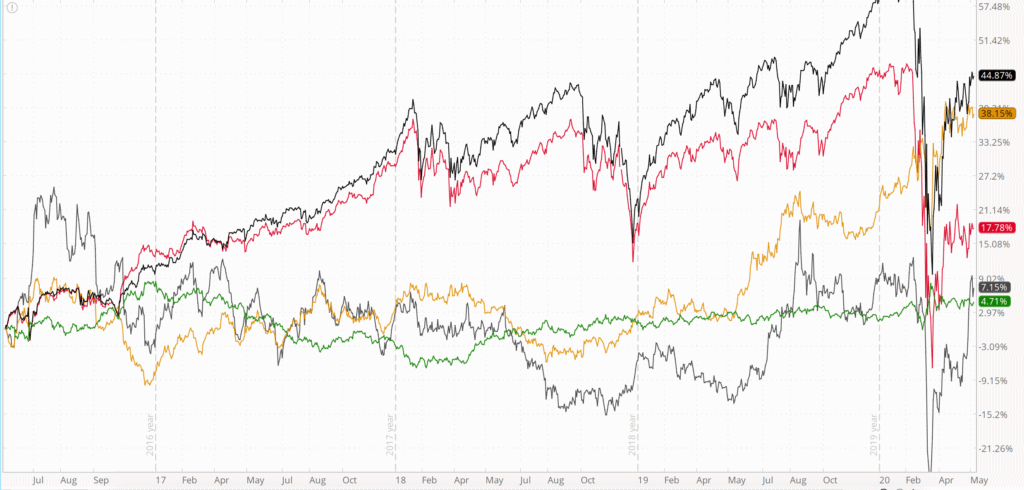

As a control we’ll add the U.S. Dollar Index ($DXY, shown in green), which compares the dollar’s strength against a basket of other currencies. To represents “stocks” I’d added the S&P 500 Index (SPX) (shown in black).

I’m using the Vanguard Large Cap Value ETF (VTV) as a proxy for value stocks (shown in red). You can see how my current and past individual value stock picks have done here. Gold futures are in yellow and silver futures in gray.

As you can see the S&P 500 has been the place to be. To be fair gold isn’t too far behind. Gold was in fact keeping pace with and surpassing S&P 500 this past April. So while gold has been a good hedge and having exposure to stocks has continue to be important.

Value stocks have lagged the S&P 500, particularly in the aftermath of the December 2018 selloff.

Silver is only slightly outpacing the dollar index, up just 7.15%. Silver has had a few failed breakout attempts, but continues to underperform. The gold/silver ratio that some precious metal bugs talk about would suggest that silver is a better value right now.

Costs continue to rise each year as the dollar loses value. But as measured by the DXY the dollar has kept its value against other currencies.

As I wrote back in November of 2016 in “I Own Too Much Gold“, you don’t want to own too much gold as a percentage of your net worth. The performance of the S&P 500 is a good reason why. If gold ever were to take off a 10-25% allocation would be more than sufficient.

We certainly haven’t see broad hyperinflation yet in the US, but my rent, food and medical costs continue to rise each year in excess of the government measured CPI. As I have for the past four years, gold and precious metals remains an important (albeit minority) portion of one’s portfolio.

If you are just starting to buy precious metals emphasizing silver over gold (while still buying both) could be a good approach.