by John | Sep 30, 2017 | Economic Outlook, Geopolitical Risk Protection, Investor Mindset

A few weeks ago on the 20th of September the United States Federal Reserve announced it would begin unwinding it’s $4.5 trillion balance sheet starting in October. The Federal Reserve undertook unprecedented action in the wake of the 2008-2009 financial crisis when it expanded it’s balance sheet from $900 billion to as high as $4.5 trillion in order to buy worthless mortgage backed securities and other assets that no one else would–as well as government bonds.

As the Fed unwinds it’s balance sheet by selling assets and not rolling over existing assets, the money supply in circulation will shrink.

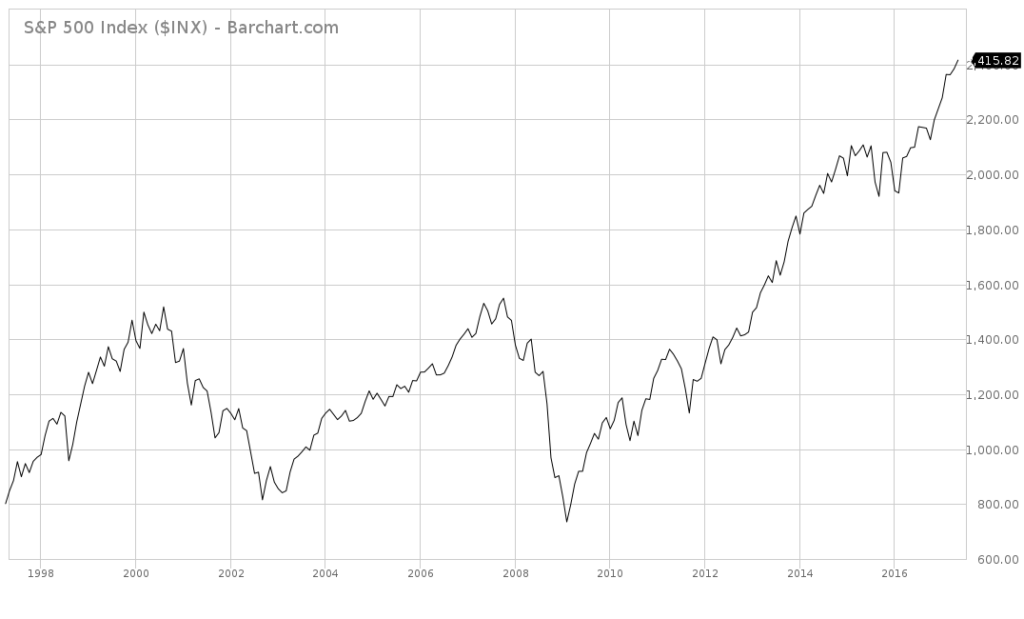

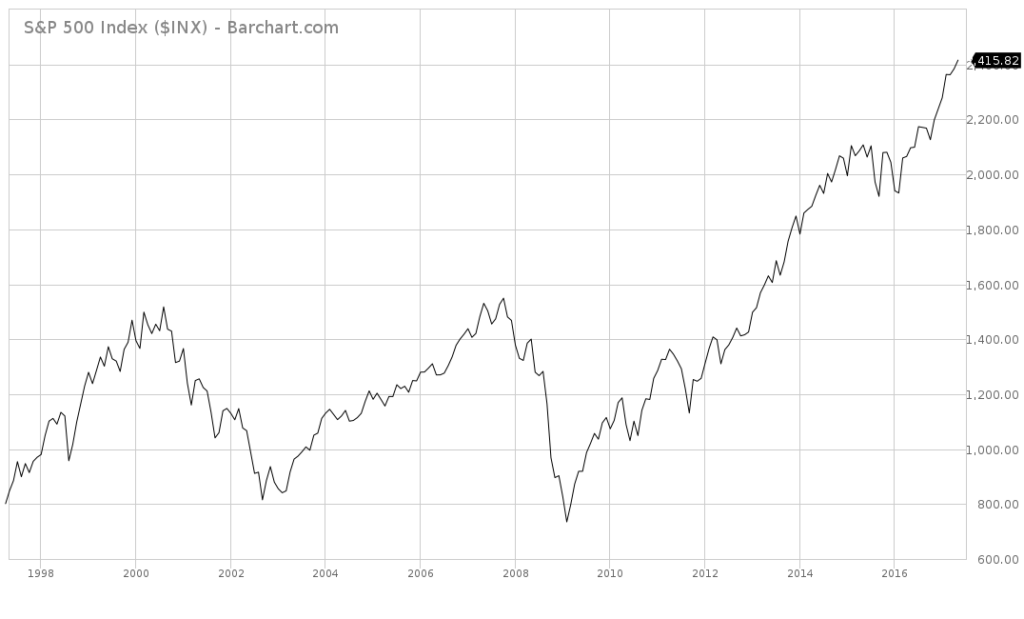

If the money supply shrinks will the value of the S&P 500 as well?

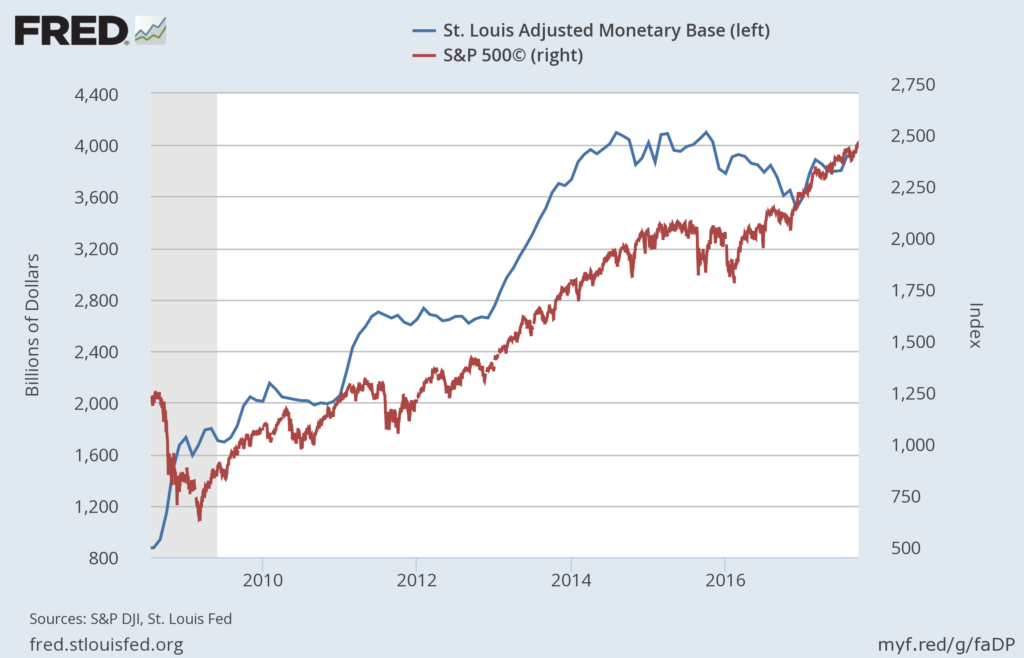

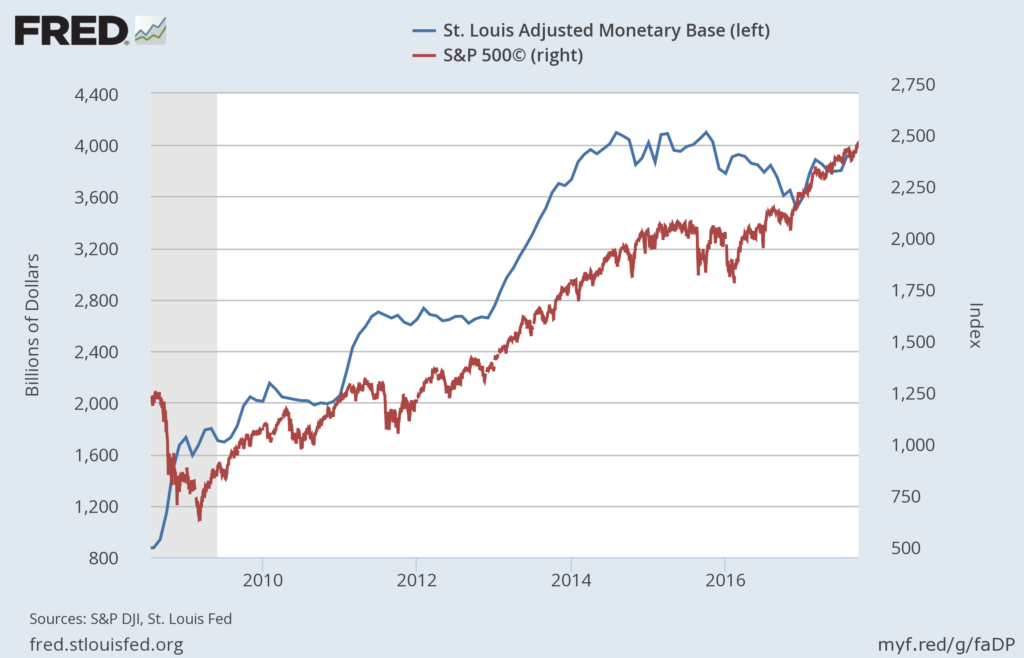

So why does this matter? Well, as pointed out at the beginning of the year over at Benzinga.com, the S&P 500 is 97% correlated with the Adjusted Monetary Base. As the Adjusted Monetary Base goes up, so does the S&P 500, as the Adjusted Monetary Base goes down, the S&P 500 goes down.

The Adjusted Monetary Base is the sum of currency (including coin) in circulation outside Federal Reserve Banks and the U.S. Treasury, plus deposits held by depository institutions at Federal Reserve Banks.

Source: https://fred.stlouisfed.org/series/BASE

So the by reducing it’s balance sheet, the Fed will lower the Adjusted Monetary Base and thus the S&P 500 would experience downward pressure.

But that isn’t the only headwind.

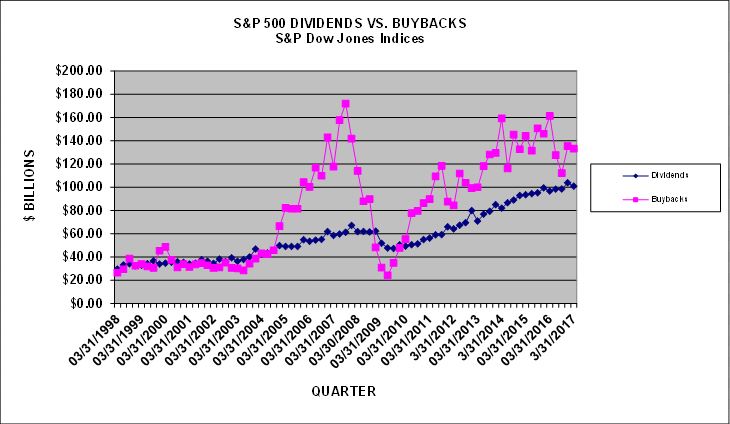

Reduction in Share Buybacks

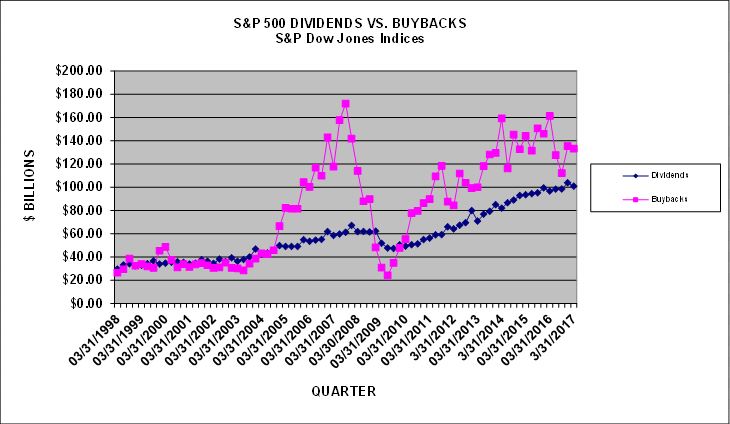

The Federal Reserve lowered interest rates to near zero for almost seven years. Low interest rates means it’s less expensive to borrow money. A lot of companies have taken advantage of these low interest rates to issue bonds (a way of borrowing money) at low interest rates and then used the proceeds not to invest in people, factories, or equipment, research and development or other business growing endeavors, but instead to use the borrowed money to buy back their own shares.

Source: http://www.marketwatch.com/story/sp-500-companies-slash-share-buybacks-despite-record-cash-levels-2017-06-21

Bond issues increases the debt companies have on their balance sheets, but also boosts their share prices, even when the companies aren’t performing any better. An example Simon Black of Sovereign Man uses is Exxon Mobil. Exxon is #4 on the Fortune 500.

In 2006, the last full year before the Federal Reserve started any monetary shenanigans, Exxon reported $365 billion in revenue, profit (net income) of nearly $40 billion and free cash flow (i.e. the money that’s available to pay out to shareholders) of $33.8 billion.

At the time, the company had $6.6 billion in debt.

Ten years later, Exxon’s full-year 2016 revenue was $226 billion, net income was $7.8 billion, free cash flow was $5.9 billion and the company had an unbelievable debt level of $28.9 billion.

In other words, compared to its performance in 2006, Exxon’s 2016 revenue dropped nearly 40%, due to the decline in oil prices.

Plus its profits and free cash flow collapsed by more than 80%. And debt skyrocketed by over 4x.

Source: sovereignman.com

Exxon Mobil is just one example. There are a variety of other blue chip stocks with shares prices that are higher despite lower profits and higher debt.

Share buybacks have declined in 2017. While the trend looks to continue upwards, rising interest rates will make it more expensive for companies to issue bonds and use the proceeds to buy back stock.

Source: http://www.marketwatch.com/story/sp-500-companies-slash-share-buybacks-despite-record-cash-levels-2017-06-21

Headwinds

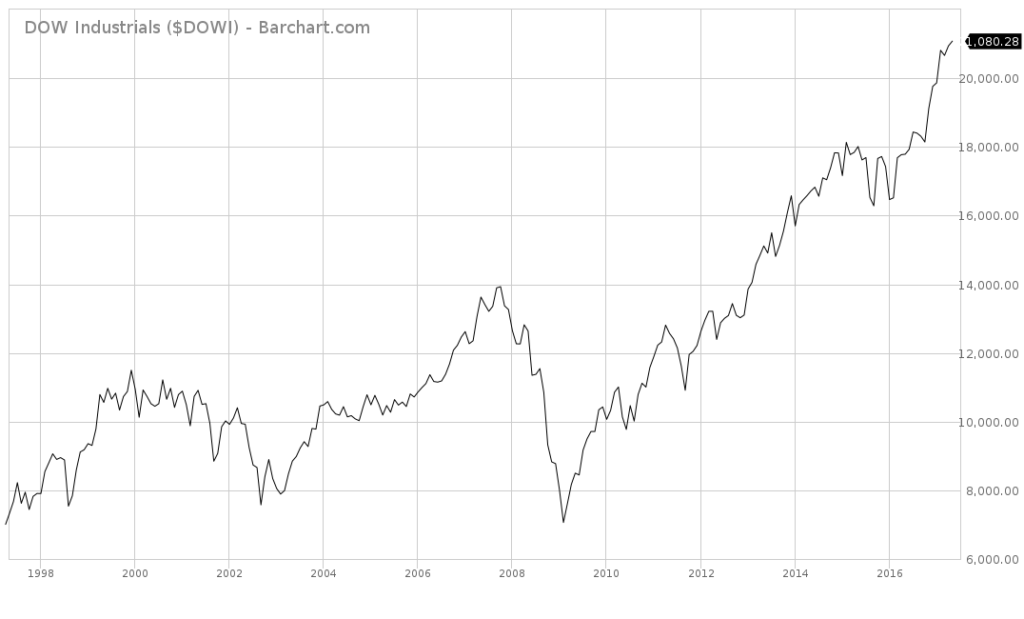

Despite the article image and title I certainly don’t know that October will see the stock market dip into the red. It would make sense if it did, but the S&P 500 continues to make new highs in spite of the Federal Reserve tightening, lackluster GDP growth and saber rattling from both North Korea and the United States.

But it is another headwind.

At some point there will be a stock market correction. That is simply how markets work since the advent of central banking and hence the business cycle. It has take much longer than I expected for there to be a correction. I didn’t believe that President Barrack Obama would leave office without seeing a stock market crash, but he did.

But markets have been on a steady climb since early 2009 and the bull market is looking long in the tooth. The S&P 500 could continue to rise for the foreseeable future, but with this new headwind of balance sheet reduction in addition to interest rate hikes, it might be time to take some dollars off the table and pivot some assets into alternative opportunities.

by John | Aug 27, 2017 | Economic Outlook, Geopolitical Risk Protection, Wealth Protection

Article image above is by Chloe Cushman

Humpty Dumpty sat on a wall,

Humpty Dumpty had a great fall.

All the king’s horses and all the king’s men

Couldn’t put Humpty together again.

Denslow’s Humpty Dumpty

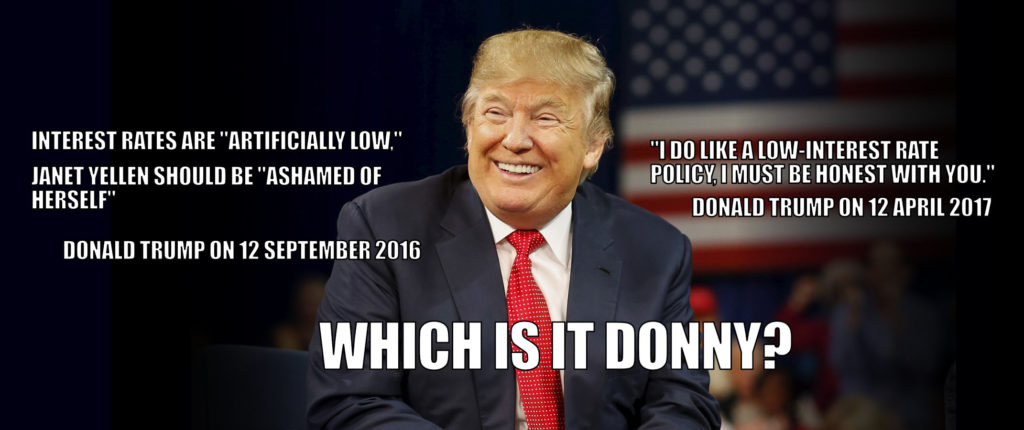

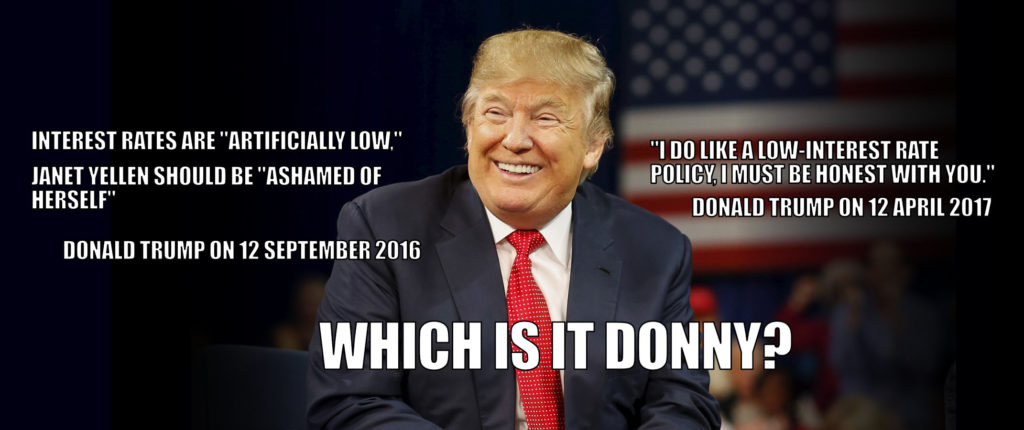

Back in February of 2016 Candidate Donald J. Trump stated, “I hope I’m wrong, but I think we’re in a big, fat, juicy bubble.”

Source: https://www.cnbc.com/2016/02/08/trump-markets-in-a-big-fat-juicy-bubble.html

In the first presidential debate in September of 2016 Trump stated the US economy is, “in a big, fat, ugly bubble.”

He also presciently said that when Obama returns to the golf course (did Obama ever leave the golf course?) that the U.S. Federal Reserve would raise interest rates.

Source: http://www.businessinsider.com/we-are-in-a-bubble-trump-debate-attacks-federal-reserve-chair-yellen-2016-9

Candidate Trump seemed to have some understanding that U.S. Stocks and Bonds are in a Bubble.

So President Trump should be concerned that the bubble is going to pop on his watch. But he seems to have pivoted to taking credit for the stock market just a few weeks after his election.

“We’re doing really well. The fake news media doesn’t like talking about the economy. I never see anything about the stock market” setting new records every day, he said.

Source: https://www.cnbc.com/2017/02/16/donald-trump-tweets-that-hes-the-reason-the-stock-market-is-rallying.html

I don’t know that Trump listens to any of his advisors, but if he did and I was one of his advisors, I’d encourage him to distance himself from the stock market.

Why?

President Obama got the advantage of the stock market high induced by low interest rate monetary heroin, and Trump is likely going to have to cope with the inevitable stock market crash and withdrawal.

President Trump is a Humpty Dumpty, perched upon the top of a stock market bubble, which is about to collapse.

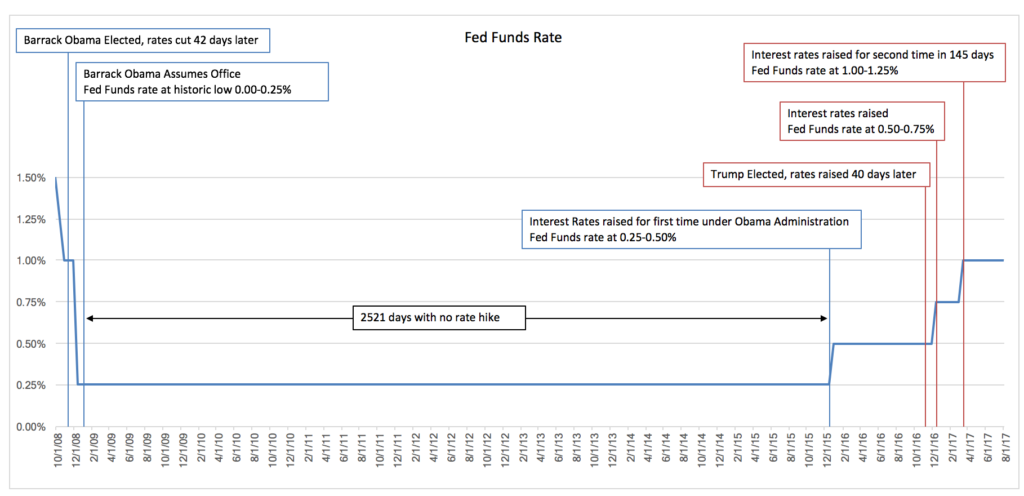

President Obama had just 2 rate hikes over 8 years

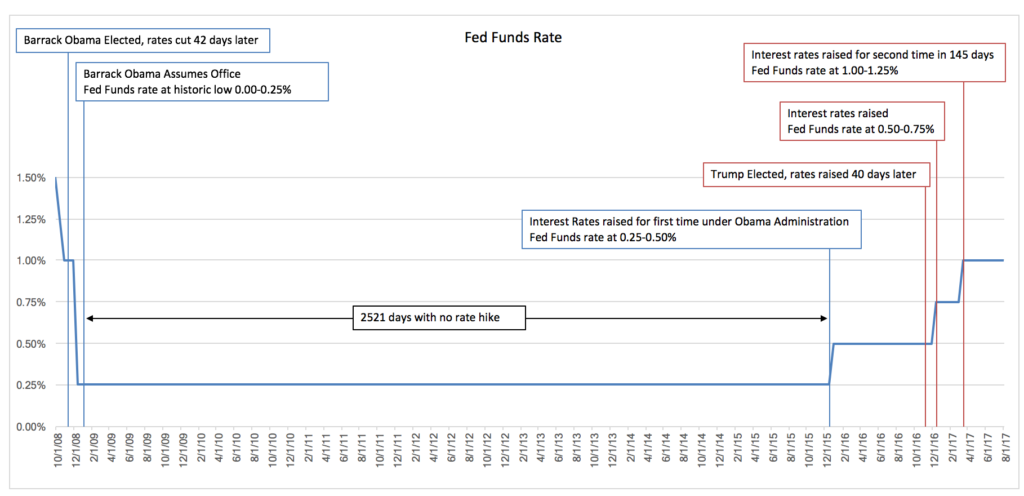

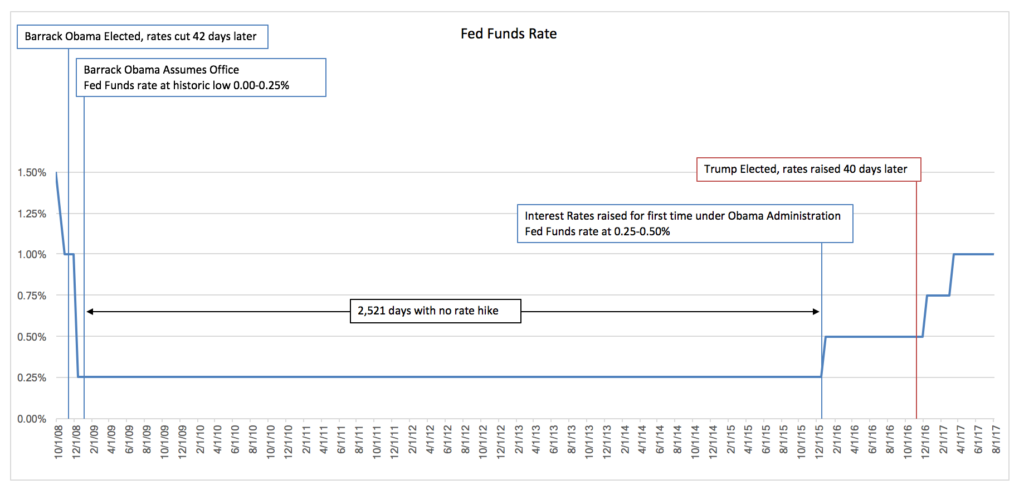

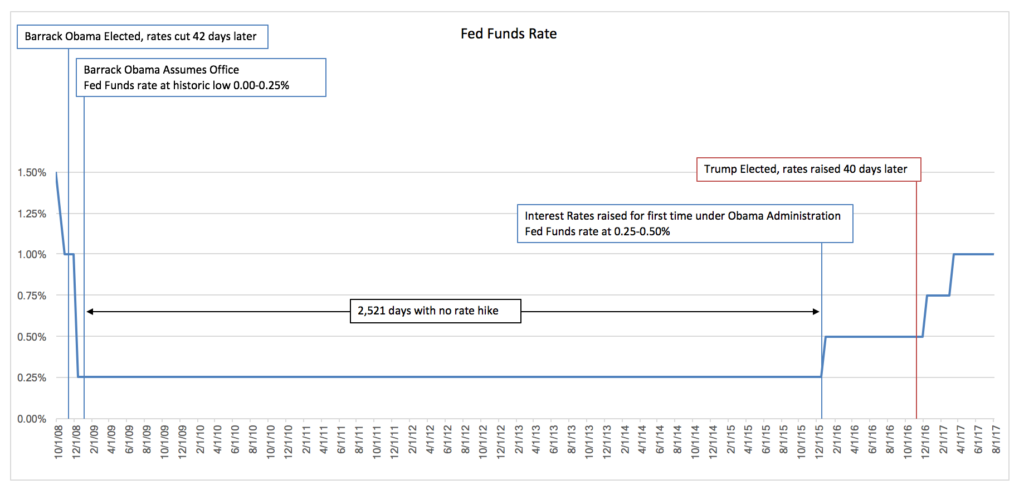

President Obama began his presidency going into a time when the US Federal Reserve was providing extremely accommodative monetary policy. He then had near zero interest rates for the first 2,521 days of his presidency (just one month shy of 7 years out of 8) then the Fed Funds rate was hiked once for his last year.

Technically it was hiked a second time, but only for the last month he was in office and after Trump had won the election.

Effectively, rates were only hiked once in 8 years.

Rates have been hiked 3 times since Trump was elected

If you count the last rate hike during the Obama presidency, Obama had two rate hikes. If you consider the second hike during Obama’s Presidency was just 37 days before he would vacate the White House, he really only saw one rate hike.

Within 54 days of Trump’s inauguration the Fed raised rates from 0.50–0.75% range to the 0.75-1.00% range. Within 145 days of Trump’s inauguration, rates increased again to the 1.00-1.25% range. So Trump has began his presidency going into less accommodative monetary policy and has already seen 2 hikes during his presidency and 3 since he was elected.

Setting Trump up for a Fall

Virtually no one who lives inside the Washington, D.C. beltway likes Trump. The established powers in Washington hate Trump. The leaders in Trump’s own party hate him.

Trump’s whole presidency was based on spitting in the face of the established powers in the Imperial City of Washington, D.C.

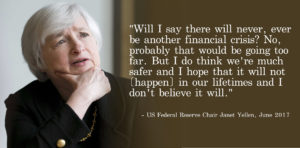

Fed Chair Janet Yellen is a Democrat appointed by Obama and she was criticized by Candidate Trump during the campaign–if she is like virtually everyone else in the Imperial City then she can’t stand Trump.

Artificially low interest rates that are manipulated down by the US Federal Reserve and other central banks cause asset values to become artificially inflated in a bubble. President Obama received the “benefit” of these artificially low interest rates: the economy was able to limp along and the stock market continued to rise as valuations were artificially inflated by the cheap money.

In order for the US Federal Reserve to normalizes interest rates they need to pop the asset bubble they’ve created. I don’t know if the Fed realizes they’ve created a bubble, but if they do, then popping it on Trump’s watch would be ideal from their perspective.

What better way to get Trump out of office than to raise interest rates, pop the stock market bubble which would result in a recession and then ensure that President Trump is not reelected?

In the Machiavellian world of short term political expediency, Trump would do well to distance himself from the markets and put pressure on the fed to retain a more accommodative policy. It will make the problems worse but it will delay the pain. It’s certainly not the right thing to do but it’s what Presidents have been doing for decades.

by John | Aug 6, 2017 | Economic Outlook, Geopolitical Risk Protection

Former President Barrack Obama had many advantages in his presidency. He had the vast majority of the media firmly behind him, a sense of inevitability, support from the establishment, strong support from higher education institutions and he ran against weak candidates.

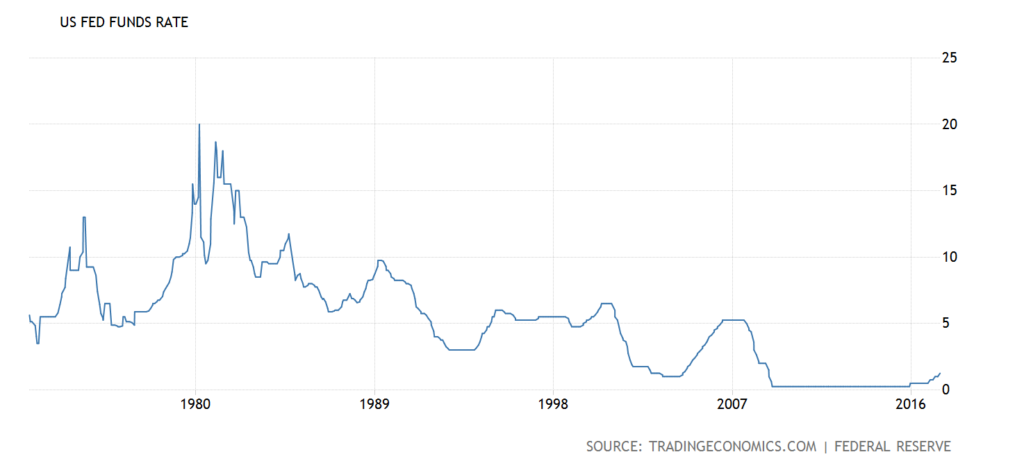

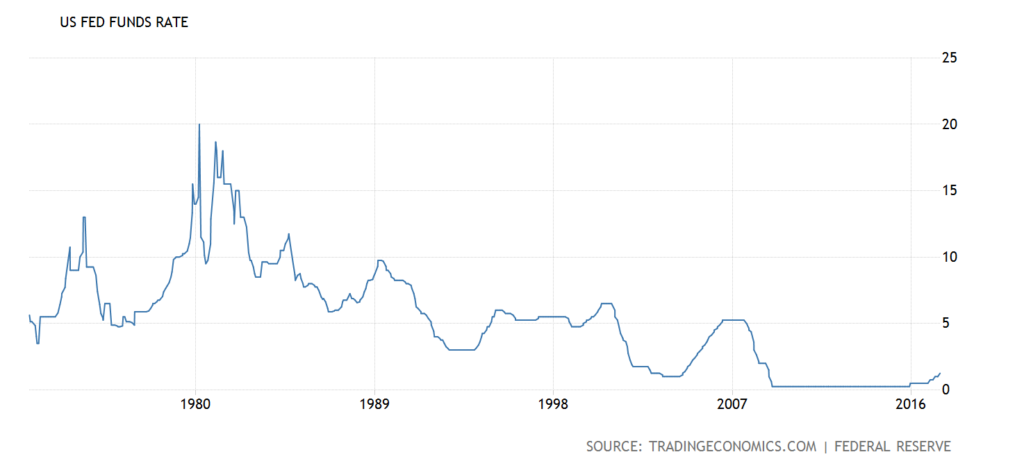

One of his greatest advantages was the unprecedentedly low interest rates throughout his eight years in office.

In fact no President has ever had lower rates for longer.

As President Obama was fond of reminding folks: America was recovering from the worst economic crisis since the great depression. His defenders can point to the fact that rates were that low because they needed to be.

Before we go Any Further

Now before I go any further, I want to make two points. One, the United States President does very little to impact how the US economy fairs.

In my opinion the President has more power than he should have but less than people realize. The President gets blamed when the economy is doing poor and gets credit when it is doing well. But it’s all unwarranted.

The second point is that artificially low interest rates are destructive. They cause bubbles and the ensuing financial crises. The 2000 dot com bust, the 2008-2009 financial crises were caused by a number of factors, but one large and consistent factor was artificially low interest rates set by the U.S Federal Reserve. Interest rates should be determined via a market based price discovery system not by the soviet style central planners occupying the Eccles Building.

The Obama Presidency was marked by the Lowest Interest Rates Ever

It’s almost comical how tightly low interest rates corresponded with the Obama Presidency. After he was elected, but before he took office the US Federal Reserve lowered interest rates to 0.25%. The lowest they have ever been.

Artificially low interest rates do in the short term provide an economic high similar to the short term euphoric feeling narcotics are reported to produce. But in the long term they are incredibly destructive to an economy.

But politicians either don’t understand this or simply don’t care and want to goose the economy so they can get re-elected. More likely both.

The US Fed Funds rate during Obama’s Presidency were the lowest ever for the longest ever

Now the Fed (probably by design to at least have the superficial appearance of impartiality) can point to the fact that they began raising interest rates in November of 2015. They also raised rates a second time in the 8 years of Obama’s reign on Dec 14, 2016, after Donald J. Trump won the presidential election.

In other words, leading up to and for nearly the first 7 years (2,521 days) of Obama’s presidency, the Fed Funds rate was set at 0.00-0.25%. For roughly the next year they were set at 0.25-0.50%. Then about a month after Trump’s election, for the last month of Obama’s presidency, interest rates were raised to 0.50–0.75%.

This is the most accommodative monetary policy the United States has ever had. This low interest rate policy began to be withdrawn as Obama prepared to vacate his residency at the White House.

Practically speaking rates were only hiked once in 8 years.

(Source: https://en.wikipedia.org/wiki/History_of_Federal_Open_Market_Committee_actions#cite_note-FOMC-15)

The Political Nature of the U.S. Federal Reserve

Democratic President Barrack Obama nominated Democratic party member Janet Yellen as US Federal Reserve Chairwoman

Despite the ridiculous and hollow rhetoric that the US Federal Reserve is impartial, it is a political institution that is integrated within the Federal Government.

Like all Federal Reserve Chairmen (or in this case Chairwoman) Janet Yellen was nominated by the President and confirmed by the Senate. Janet Yellen is a member of the Democratic party and was nominated by the de facto leader of the Democratic party.

Is a rational person really supposed to believe that Janet Yellen (or any other Fed Chair) who is a member of a political party, who is nominated by the leader of a political party, suddenly becomes a completely impartial overseer of the economy?

Of course not.

Obama got the High

The key takeaway is that the Obama administration was supported by an ultra-loose monetary policy that provided a strong tailwind for stock prices albeit at the expense of the real economy. A stock and bond bubble was also re-inflated.

The Fed has reversed gears and has begun a tightening cycle.

Obama was very fortunate to have gotten out of office before the next Federal Reserve fueled economic crisis hits. The economy is even weaker than it was before the great recession of 2008-2009.

Obama was the Fed’s sweetheart but he’s no longer in the office. So the Fed might not be as motivated to keep the bubble inflated and the charade going.

This is doubly true because Obama’s successor is universally despised. The powers that be would love to remove Trump from office and prevent him finishing out his first term, but at a minimum they will work to ensure he never sees a second term.

One way to do that is to crash the economy while Trump is president and hang the blame around his neck.

More on that in another article.

by John | Jul 16, 2017 | Economic Outlook, Geopolitical Risk Protection

A group of people go camping. Two of them are central bankers. The group decides to divvy up jobs. A couple people are in charge of setting up the tents, another group goes and gets some water, a third group is in charge of preparing food for cooking and the central bankers are put in charge of building a nice fire for cooking.

The central bankers have never had jobs in the real economy built a fire, but they went to Harvard and Yale so they’re smart and they are certain they can figure it out.

“Lets think about fires first.” says the Harvard trained economist.

“Great idea!” says the Yale grad, “Whenever I see a fire, there is smoke. I saw a video of a building burning down once and I could see the smoke long before I saw any flames.”

“I’ve seen that as well. Smoke obviously causes fire, so if we get enough smoke I’m sure we’ll have a nice fire going in no time.”

So the central bankers asked someone else to stack up some firewood while they figure out a way to get smoke onto the firewood. They have a few hours before dusk, more than enough time to smoke up a nice fire.

They rig a hose up to the exhaust of one of their vehicles and feed the exhaust smoke over to the firewood.

No fire starts.

They try revving up the engine to get more exhaust smoke onto the firewood. They try a diesel engine from one of the other cars.

They continued to feed smoke into the firewood, confident that if they just got enough smoke a fire would ignite.

The people setting up the tents and preparing the food looked over and see all the smoke. “They must have a large fire going!” said one person preparing some beautiful steaks. “I can’t wait to cook these up and eat!”

But despite creating an unprecedented amount of smoke the central bankers are not able to start a fire.

The sun set and darkness falls on the campsite. They aren’t able to cook the steaks so the food is wasted, the cars are out of gas and everyone goes to bed hungry and frustrated.

As they drift off to sleep the central bankers sigh, “If only we’d been able to get enough smoke onto the firewood…”

Central Bankers in the Real World

The logic of central bankers is completely backwards.

Fires often have smoke. However, smoke does not cause a fire to burn. Smoke is a side effect of fire.

Similarly, when an economy is humming along rising consumer prices can sometimes be observed. But rising prices are a side effect and not the cause of a healthy productive economy.

There is nothing particularly helpful to an economy as a whole about rising consumer prices (some of America’s most prosperous years were during periods of falling prices). Most recently the computer industry and cell phone industries have grown and expanded despite the price of computers and cell phones falling.

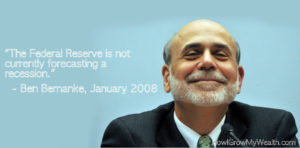

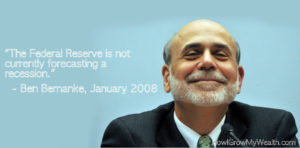

Central bankers like Ben Bernanke (Federal Reserve Chair before and after the 2008 financial crisis) often can’t forecast the present

However, central bankers mistake a side effect for the cause, and they believe price inflation is what causes economic growth.

It’s an idea so absurd that only someone with a Ph.D in economics could come up with it.

If a non-Ph.D went around saying that the key to economic growth is to make things unaffordable people would rightly think that person was crazy just like people would think it’s crazy to try to start a fire with smoke.

Economic Distortions

There has been unprecedented central bank intervention in the economy. Interest rates were at nigh zero for roughly 8 years following the 2008 financial crisis (which was also caused by central banks). This is the economic equivalent of blowing smoke onto firewood to create a fire. It wastes resources and time and it causes damage with no benefit.

Often people will point to the historic highs of the stock market and low unemployment as evidence of a recovery. However, people dropping out of the labor force causes the unemployment rate to go down and if one person loses a full time job and gets 2 part time jobs that counts as a net job gain.

While the US stock market is at all time highs, this provides little benefit to people who don’t own stocks. It is also of little benefit to people who own stocks, if they don’t sell the stocks before there is an inevitable stock market crash. Printing money (and it’s digital equivalent) out of thin air to buy US government debt, which lowers yields and incentivizes investors into stocks rather than bonds (which in many cases pay a negative real yield) does not make for a safer and healthier economy. Companies issuing bonds and borrowing money to buy their own stock back (thus raising the price) does not grow the economy. It does create a lot of paper wealth as well as a stock market bubble.

Because the high stock market value isn’t due to economic fundamentals, eventually the stock market will crash.

If a camper believes that smoke causes fire they won’t be able to successfully start a fire no mater how much smoke they pour onto their firewood. If a central banker believes that price inflation causes economic growth they won’t be able to “stimulate” the economy regardless of how much inflationary monetary policy they adopt.

As long as central bankers continue to misunderstand what makes an economy grow, they will continue to pursue failed policies that waste resources, create financial crises and make recessions worse.

by John | Jul 4, 2017 | Economic Outlook, Geopolitical Risk Protection, Wealth Protection

In order to grow wealth one does need to live in a society that values personal responsibility, property rights and equal protection under the law. Of course if one is fortunate enough to be born into an elite ruling class or a wealthy family that isn’t necessarily the case.

The United States of America was a country that made more wealthy people than any other up to that point was because the majority of people in the United States, among other things, valued personal responsibility, property rights and equal protection under the law.

It wasn’t because the United States had any special divine right, or “manifest destiny.” There wasn’t anything exceptional about the skin color of it’s residents or that the average person there was exceptionally smart.

There are certain values and principles that enable wealth creation and the United States adopted many of them.

Unfortunately many in the United States no longer hold those values. There is the attitude that the United States is inherently rich. “It’s the richest country in the world!” And that whatever financial decisions the US makes is good because it’s the US.

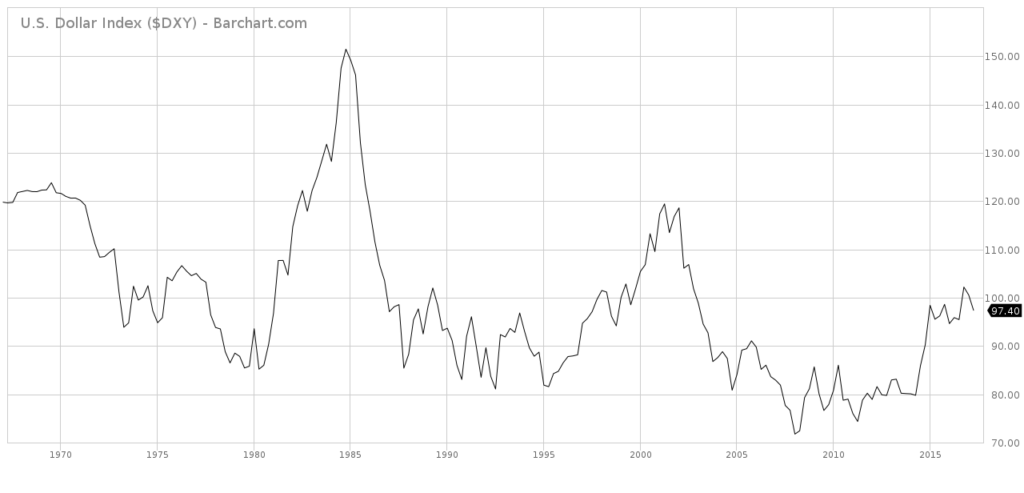

This nationalistic hubris has resulted in poor decision after poor decision by political leaders and the decline of the wealth of the US. Sure, there are wealthy people in the United States and the average person in the US is much better off than the average (or above average) person in the Somalia. But the debts, the decline in life expectancy (albeit small), the failed and pointless wars in Iraq and Afghanistan, the insolvency of states like Illinois and the collapse of the value of the dollar are all indicative of the decline of the United States.

Spending Like a Drunken Sailor

Both of my parents were in the Navy and exemplars of sobriety, so please forgive the analogy, but the United States has a huge spending problem.

The biggest and most entrenched are: Defense, Social Security, and Medicare.

I quote from Simon Black of Sovereign Man:

…just between those three programs, plus paying interest on the debt, the US government already spends MORE than it collects in tax revenue.

In 2016, for example, the government spent $2.87 trillion on Defense, Social Security, and Medicare, plus an additional $433 billion paying interest on the debt.

That totals over $3.3 trillion, which is more than they collected in tax revenue.

In other words, they could cut EVERYTHING ELSE in government: Homeland Security, national parks, funding for the arts, the Department of Energy. Everything.

And there would still be a budget deficit.

Source: sovereignman.com/

There is no mainstream US politician that discusses cutting defense spending. There is no mainstream US politician that discusses cutting Social Security spending. There is no mainstream US politician that discusses cutting Medicare. Politicians on the American “left” don’t cut defense spending. Politicians on the American “right” don’t cut defense spending.

Independence Day

Many in the United States celebrate Independence Day today. Ostensibly celebrating fireworks, food and America. Originally the celebrating was to commemorate the Declaration of Independence of 13 British colonies.

Dependence on Debt

However, the colonies that would become states that would become the United States have become enslaved to debt. This debt is a problem. A large problem.

The debts owed by the United States certainly won’t be repaid honestly. The United States could default on it’s debt, which would be the honest thing to do, or it could monetize the debt by printing the money the repay the debts. This has and will continue to destroy the dollar.

High taxes and regulations are also a crushing burden on the productive capacity of the United States. Honest productive business that bring valued goods and services to consumers are most hurt by this, while politically connected businesses with powerful friends benefit from unequal enforcement and cronyism.

The United States became an economic superpower because people who created value were rewarded. People who took calculated risks to bring value to others were able to reap the benefits. Capital was allocated not by government ministers or overlords but by private individuals closest to the decisions being made. People worked hard and smart and those that didn’t work hard and smart had to suffer more negative consequences than they do today.

The United States has strayed far from those principles that made it successful but the 4th of July celebration of this country goes on.

by John | May 28, 2017 | Economic Outlook, Geopolitical Risk Protection, Wealth Protection

Some people think the United States economy is doing well. The unemployment rate is low. Major US stock indices continue to rise.. There has not been hyperinflation of consumer prices.

So one might be tempted to think the economy is doing pretty well and everything is good and normal. I don’t think this is accurate but I think it is important to look at some of the measures that do seem to support the view that the US economy is on strong ground.

The following are some facts that people will point to when they say that everything is fine.

The “Good”

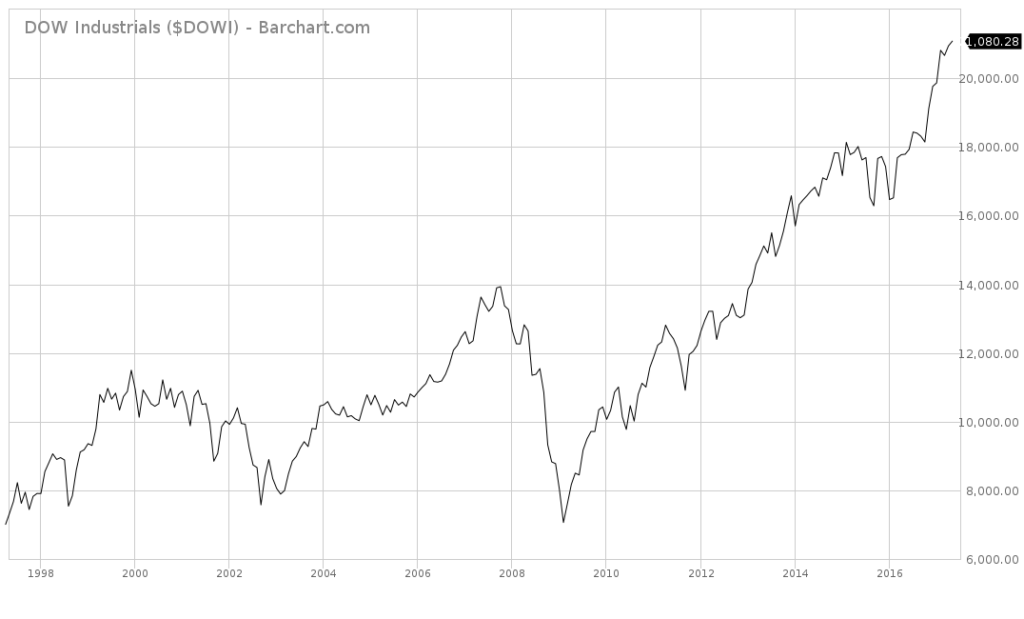

Stocks are Up

US Stock investors have been handsomely rewarded since the lows of the 2008 financial crisis.

Led by darlings such as Apple, Alphabet (Google), and Amazon, the NASDAQ composite has reached new all-time highs.

The S&P 500 has been on a tear, also making new highs without any significant corrections.

The Dow Jones Industrial average is also making new highs.

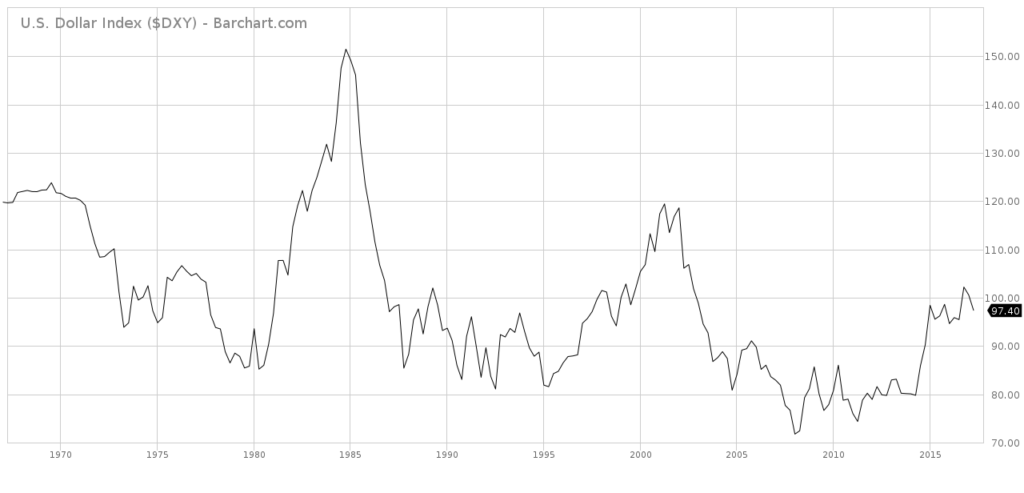

The Dollar is Relatively Strong

Despite unprecedented central bank intervention and record US debt the US Dollar Index is holding.

US GDP Continues to Rise

United States Gross Domestic Product continues to climb.

source: tradingeconomics.com

Low Unemployment

The unemployment rate is below 5%.

Source: https://data.bls.gov/timeseries/LNS14000000

The Bad

But if you look a little deeper than the headlines there are systemic problems in the United States economy.

A lot of People Aren’t Working

Labor Force Participation is at levels not seen since the 70s. And no, it’s not because of baby boomer’s retiring. Labor force participation from those age 25-54 has dropped from 82.8% in 2004 down to 80.9% in 2014. Participation from those age 65 and older has increased from 14.4% in 2004 up to 18.6% in 2014. Source: https://www.bls.gov/emp/ep_table_303.htm

Just because the unemployment rate is low doesn’t mean people aren’t unemployed. If someone is unemployed for long enough, they simply drop off. If someone is fired from a good paying salaried position, and they get two new part time jobs, that is considered a net job gain.

United States GDP Growth is Slowing

The growth rate of US GDP has been trending down.

source: tradingeconomics.com

US Debt is Growing

US National debt is up to nearly $20 trillion, not counting the unfunded liabilities of Social Security and Medicare. Source:

It is politically impossible to cut spending. As Simon Black recently pointed out:

In 2016, for example, the government spent $2.87 trillion on Defense, Social Security, and Medicare, plus an additional $433 billion paying interest on the debt.

That totals over $3.3 trillion, which is more than they collected in tax revenue.

Source: https://www.sovereignman.com/trends/and-now-for-the-bad-news-21884/

In other words all spending on the department of energy, education, homeland security, everything else besides defense, social security and medicare could be cut completely and there would still be a budget shortfall.

I believe it is politically impossible to cut social security, medicare or defense spending in the United States.

The Debt to GDP is Rising

The debt to GDP ratio is at levels not seen since the United States was fighting a World War in the 40s. Source: https://en.wikipedia.org/wiki/File:Public_debt_percent_of_GDP.pdf

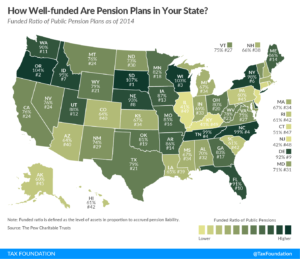

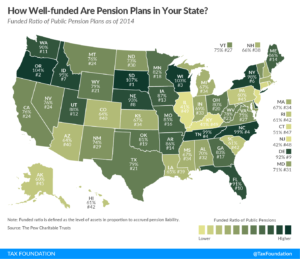

State Pension Funds are Underfunded

The majority of State Pension funds are underfunded.

Source: https://taxfoundation.org/state-pensions-funding-2017/

Social Security and Medicare are Underfunded

This isn’t some alarmist drivel. The people in charge of the Social Security and Medicare Trust Funds are issuing statements like following:

“Both Social Security and Medicare face long-term financing shortfalls under currently scheduled benefits and financing.”

Source: https://www.ssa.gov/OACT/TRSUM/

As well as statements like:

Under the intermediate assumptions, DI Trust Fund asset reserves are projected to become depleted in the third quarter of 2023, at which time continuing income to the DI Trust Fund would be sufficient to pay 89 percent of DI

scheduled benefits. Therefore, legislative action is needed soon to address

the DI program’s financial imbalance. The OASI Trust Fund reserves are

projected to become depleted in 2035, at which time OASI income would be

sufficient to pay 77 percent of OASI scheduled benefits.

Source: https://www.ssa.gov/OACT/TR/2016/tr2016.pdf

I haven’t even touched on consumer debt, state debt, low home ownership, and low savings per capita.

The US Economy isn’t Fine

So despite headlines like the low unemployment rate and stock markets making new highs that seem to indicate a recovery from the 2008 financial crisis there are systemic issues in the US economic system. I don’t think that the United States will be able to continue to borrow and spend without consequences. The fact as the United States has a printing press and the world reserve currency doesn’t mean it can borrow and spend forever.

There are ways to protect yourself but you have to be aware of the problems.