Gold recently traded above $1,300 per troy ounce for the first time time in 2017. It immediately fell back down to the mid $1,280s. This is the third time the price of gold has been beaten back down when attempting to breakout above $1,300.

Price Resistance at $1,295 continues to hold.

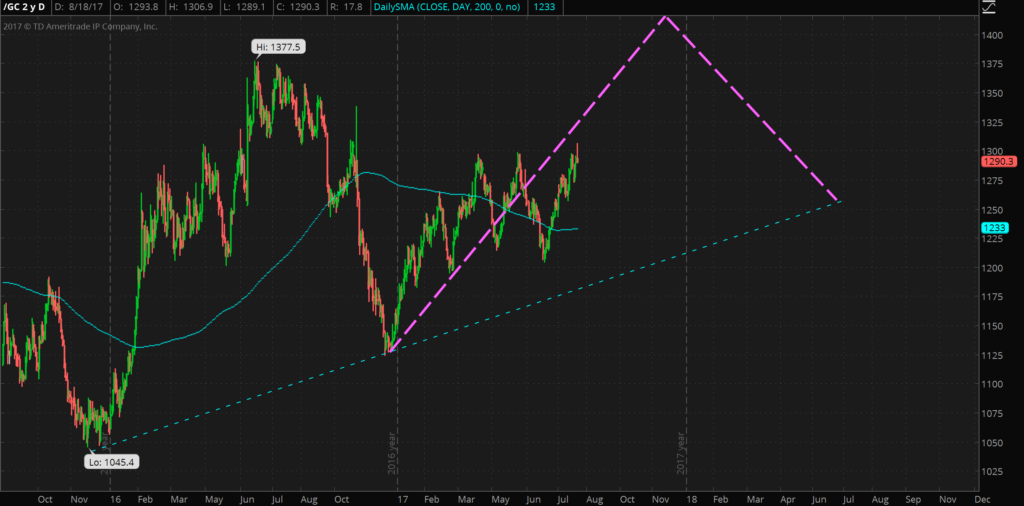

In April of this year I made some “predictive guesses” as to the price of gold. Thus far gold has traded around the purple dotted line that I anticipate will be the general price of the yellow metal.

The purple line is my predictive guess as to the price of gold, made in April of 2017.

My predictive guess calls for gold to trade up to $1,400 in November before tailing off again. I expect gold to continue to trend slowly upward in the long term, until there is some large external catalyst such as a stock market crash, physical supply shortage, war or currency crisis, that propels the price upward.

I think holding some gold in one’s physical possession is wise, it’s also important to hold some offshore out of one’s home jurisdiction. While I only hold a portion of my assets in physical gold and silver I think it’s an important component of a diversified portfolio.

Click here to learn about one of my favorite ways to own physical gold.