A Time to Buy Crypto

I’ve punched a lot of keys on the ‘ole qwerty debating the merits of cryptocurrency versus gold and precious metals. But when all is said and done, gold has gone up very little while cryptocurrencies have gone to the moon. I was reminiscing on some old articles and I came across “No, Even with ETH at $2 Gazzillion, Ethereum Cloud Mining Isn’t Profitable” and I’m reminded that at one point I could have bought 62 Ether (ETH) for $561. ETH was trading at $9 per coin back then. As of writing ETH is trading at $2,455.48, so those 62 ETH would be up 27,183.1% to over $152,000 in about 4 years or so. Not bad.

I remember reading about the Ethereum network before it even launched. Based on my philosophical musings of money I thought it would important for a cryptocurrency to have non-monetary use in order to be valued over the long term and not just be a speculative fad. The ability for Ethereum to support DApps in addition to “just” being a currency checked boxes and so I chose to buy some ETH. At one point I probably owned 50-60 ETH.

EOS Is Superior to Ethereum based on Several Metrics

Of course the Ethereum network was at that time, like it is now, relatively slow as highlighted by “Cryptokitties” one of the distributed apps built on Ethereum that caused the network to grind to a proverbial halt. To date the most transactions per second processed by the Ethereum network is 19. I decided to sell ETH and instead placed my cap at EOS. EOS was labeled an Ethereum killer at one point and some people said that EOS stands for “Ethereum on Steroids.” Of course this was all before Ethereum went to “the moon.”

EOS uses proof of stake (instead of Ethereum and Bitcoin’s energy intensive and slow proof of work) and has handled up 9,565 transactions per second. In my view, assessing the EOS network and Ethereum network, EOS is superior.

However the market disagrees.

The market capitalization of EOS is $5.9 billion, the market cap of ETH is $285 billion. So clearly the market favors Ethereum.

For a long time I didn’t think this market cap was in any way justified. However, because of Ethereum 2.0 and with Ethereum down 36% from the highs, I’ve decided to buy some ETH.

The “Best” Technology Doesn’t Always Win

It is hard for me not to think that the better technology won’t win out in the medium term. However, this often isn’t the case. Good technology is important, but there is name recognition, brand, leadership and the network effect, which I’ve realized I tend to discount too much.

Apple in the 90s is a great example. Macs at that time were considered to be higher quality, more innovative and easy to use. However, a lot of people used Windows based PCs at work and wanted to use what they were familiar with at home, PCs were less expensive, and more people used Windows in general. So people chose Windows and Microsoft had a larger market share as a result. There were certainly rational reasons for choosing Microsoft Windows/PCs over Apple/Macs even though a strong case could be made for superior Apple technology.

Apple was able to overcome this in the early 2000s and onward but that is a topic for another article.

EOS Has a Likability Problem

A lot of developers are interested in and devote time to Ethereum, a lot of the cryptocurrency community was and is pro Bitcoin and pro Ethereum. Ethereum was sometimes thought of as “Silver to Bitcoin being Gold.” Ethereum entered the scene in a much more diplomatic way.

The technological founder of EOS, Dan Larimer, referred to proof of work as a technological dead end, was more abrasive and alienated more people. There were also issues, perceived and otherwise, that EOS is not in fact very decentralized. EOS had a market cap in excess of $16 billion in April of 2018 but has never recovered these highs.

That is was makes the excitement about Ethereum 2.0 so interesting. EOS can already do a lot of what Ethereum 2.0 is promising to be able to do in the future. But Ethereum has people like Mark Cuban talking about it, it has more name recognition and more development interest. The cryptocurrency community, and people outside the space know about and accept Ethereum in a way other cryptocurrencies can’t match.

Ethereum Has More DAapps

According to State of the DApps, there are 2,782 DApps on Ethereum and only 328 on EOS. However, EOS has handled 353.18k in the last 24 hours (as of writing this article) compared to 201.92k for Ethereum. So despite the technological limitations in transaction count and less energy efficient consensus model, developers choose Ethereum on which to build their DApps.

Ethereum Has More Name Recognition

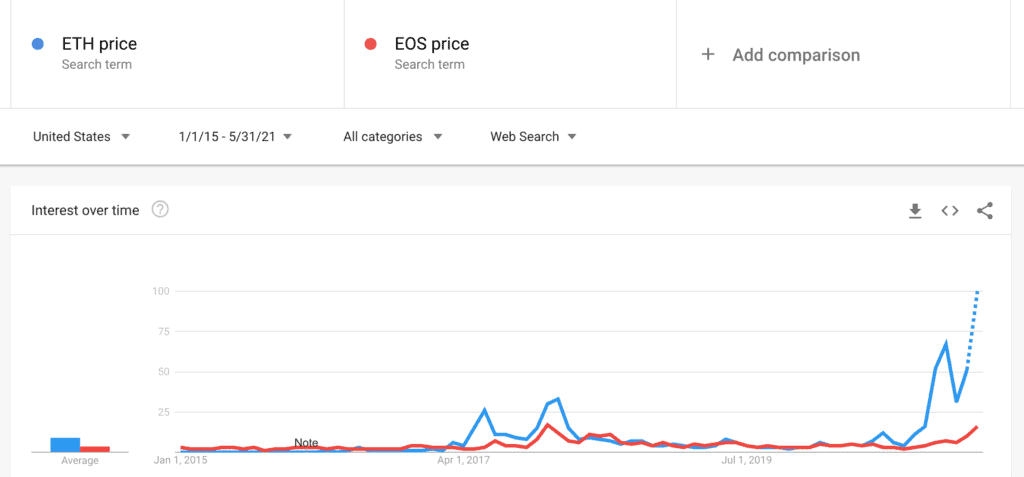

Most people have heard of Bitcoin by now. I doubt many people on the street will have heard of EOS or associate it with the cryptocurrency. Ethereum is much closer to Bitcoin in terms of name recognition. I decided to test my theory using google search trends as a proxy and found that searches for “ETH price” far outstrip searches for “EOS price”. This is an admittedly flawed approach as EOS could also refer to the Canon Cameras, the “Entrepreneurial Operating System” and there is even an EOS fitness. I don’t think Ethereum shares it’s name the way EOS does. But if anything this inflates the number of searches for EOS price beyond those searching for the cryptocurrency.

Ethereum 2.0 Should Address Many of the Performance Issues

Ethereum 2.0 should address many of the performance issues that caused me to favor EOS over ETH in the first place. Add that to the tailwinds it already has and it could be a great speculation. I’ve decided to buy some ETH and plan to continue to average in on pullbacks. You probably shouldn’t listen to me, this isn’t investment advice and I’ve had a bad trading track record when it comes to crypto, particularly on the sell side.