I subscribe to various financial newsletters. I still have a lot to learn. One such newsletter I subscribe to is written by person who has a lot more money and an exponentially bigger following than I do. So obviously he is doing some things right.

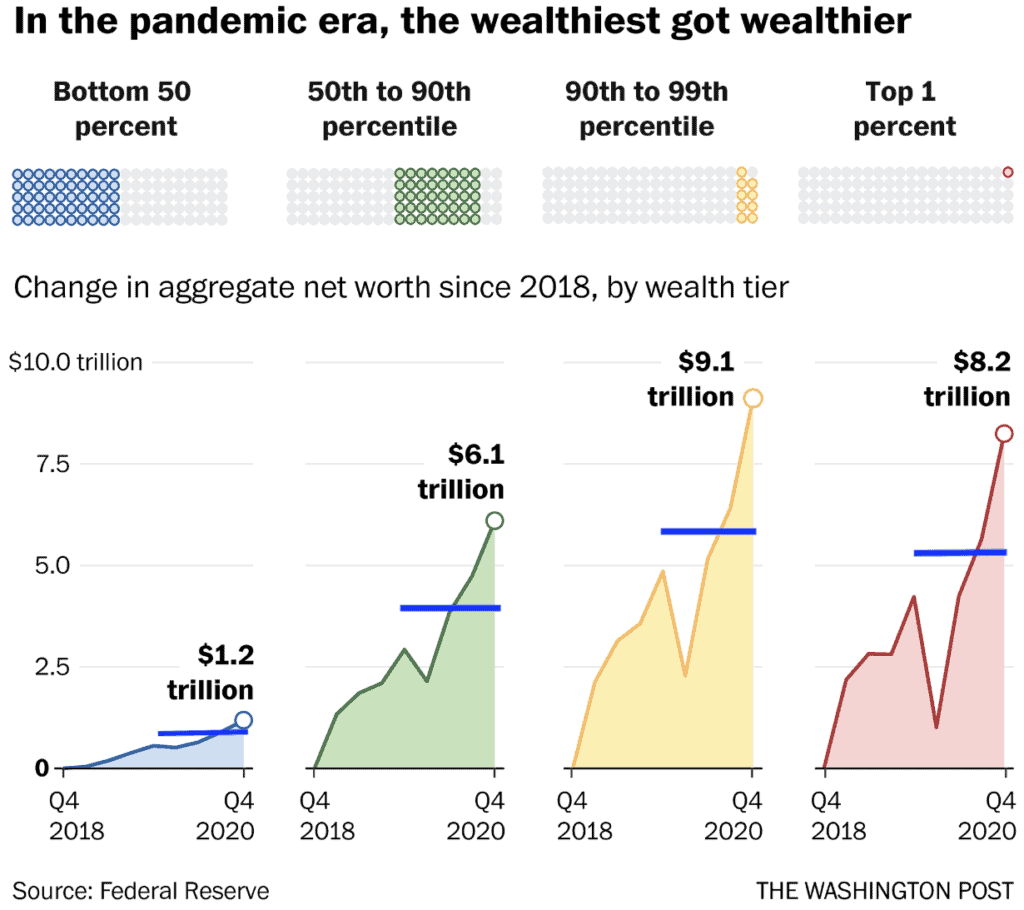

But I’m amazed by what I read recently. He posted the following image and wrote: “In other words, if there had been no pandemic, aggregate net worth for each wealth percentile would likely be around where the blue lines are today. But due to the pandemic, we’ve unexpectedly made a whole lot more.”

That is very “unexpected” for someone like me that believes hard work, innovation, capital investment and fiscal discipline are what produce wealth.

What has happened since March of 2020? Many businesses have closed, some permanently, the government has “printed” money and spent it, people have been paid to stay home and not work, and countless people have passed away. I would never have expected shutting down large portions of the economy, printing and spending money would result in wealth creation.

Now I don’t doubt that the upper income brackets have increased their wealth in real terms. However, I can’t believe that in real terms wealth in the United States has increased. Why? Because the dollar buys much less than it did pre-pandemic. Commodity prices have gone up, housing prices have gone up, and food prices have gone up. The wealthy, even accounting for multi-million dollar mansions, private jets, and the finest organic vegan food cooked by a private chef, still don’t pay as much on food, housing as transportation as the poor when viewed as a percentage of their whole net worth.

At best this wealth effect is pulling forward future returns. But I suspect, that given the rising prices, most people are worse off as a result of the pandemic. But it is amazing the attitude it shows. At no point in that newsletter did the author question why closing large portions of the economy, printing and spending money was a recipe for wealth building.

After all, staying home and collecting a check is a lot easier than going to work to produce goods and services. So why bother encouraging businesses or workers.

The tax and spend philosophy, the universal basic income philosophy, the rejection of the basic principle of economic scarcity are consistent with the belief that a government can pay people not to work, run deficients and print in order to create prosperity. It’s all part and parcel with the United States rapidly shifting away from free market enterprise and towards collectivism and state control. This hasn’t worked in the past but maybe this time is different?