Since no one from BitBays.com or MixCoins.com support is returning my emails and their address in London is a real estate company, I have no choice but to conclude that MixCoins is a scam and BitBays was a scam. If anyone from MixCoins/BitBays can come forward and explain why it isn’t a scam and provide me with access to the Bitcoins I have (or had) on there site, I am willing to make other considerations. As of now I have to conclude that the fraction of a BTC I had on BitBays is lost.

Unfortunately I wrote about BitBays and later Mixcoins.com previously and put some Bitcoin on their site to take advantage of their arbitrage fund. I first personally deposited Bitcoins there in July of 2015 and was able to successfully deposit and withdraw. My last successful withdraw was in April of 2017.

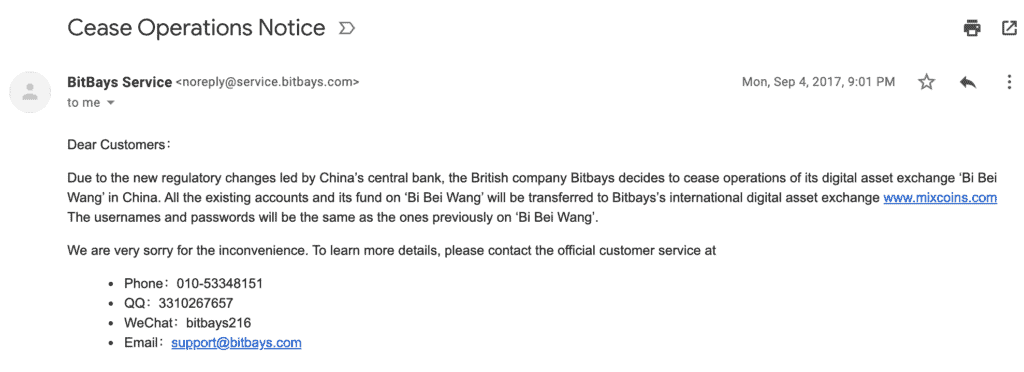

On September 4 of 2017 I received the following e-mail:

In hindsight this was a big warning sign. Around this time MixCoins also implemented a Know Your Customer or “KYC” requirement. However, since I was still able to login using my existing username and password to MixCoins.com I didn’t think too much of it.

With the more recent rise in Bitcoin this year, I decided to look into this more. I contacted MixCoins.com about doing KYC and received no response after several weeks of trying. At this point the alarm bells were ringing.

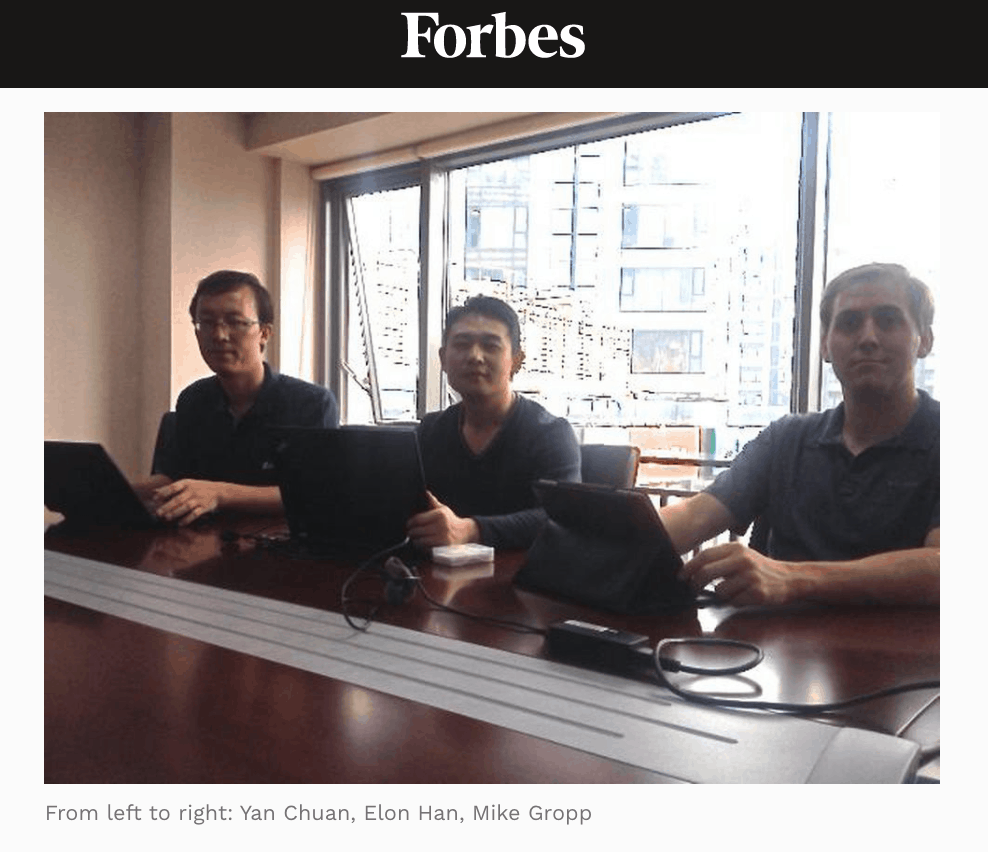

I have contacted Mike Gropp on LinkedIn. On his profile he is the “Co-Found & Chief Compliance Officer” of Bitbays from July of 2014 – July of 2016. I contacted him in June of 2020 and he advised he hasn’t “been involved in BitBays/MixCoins for years” and that he isn’t “sure what they are up to these days.”

He provided me with an email address, which I contacted, but received no response as of writing this.

So having been burned by BitBays, what lessons can I learn?

1. If It seems to Good to be true, do your Due Diligence

I think the old adage “if it seems too good to be true then it is” is helpful, but it could cause you miss out on opportunities. I was skeptical of the arbitrage fund on BitBays that claimed to pay out 10.96-12.96%. However, it made sense to me and in my testing it worked. I also messaged back and forth with one of the purported co-founders, Mike Gropp. BitBays was also featured on Forbes’ website.

But despite my reasons for believing that BitBays.com were legitimate, I didn’t do enough due diligence to prevent me from getting scammed and losing the Bitcoins I left on their site.

2. Stay diversified

One thing I did reasonably well is I didn’t keep all my BitCoins at BitBays. I kept my position there small. While it still stings to lose some BTC, especially with it making new highs, it could have been much worse.

3. A trusted custodian is worth a lot

There are other more established Bitcoin exchanges like Coinbase that don’t offer an arbitrage fund. If you’re going to entrust an organization with money you need to ensure they are worthy of trust.