Trumped Up Economy

For better or worse the President of the United States gets credit (or blamed) for how the economy has performed during his tenure.

How much control does the President have over the economy? In my opinion more than he should have but less than people give him credit for.

Donald Trump was sworn in a couple days ago and there is alternating fear and hope from either side of the aisle about what he will or won’t do.

But as I’ve written before, when it comes to some of the largest systemic issues facing the United States: it doesn’t matter who won.

How has the US Economy Fared under the last three Presidents?

Pals

As part of trying to anticipate how the markets will fare under Trump I was inspired to take a brief look back at how “the economy” performed during the past three presidents’ terms.

Past performance does not guarantee future results but the past is all we have.

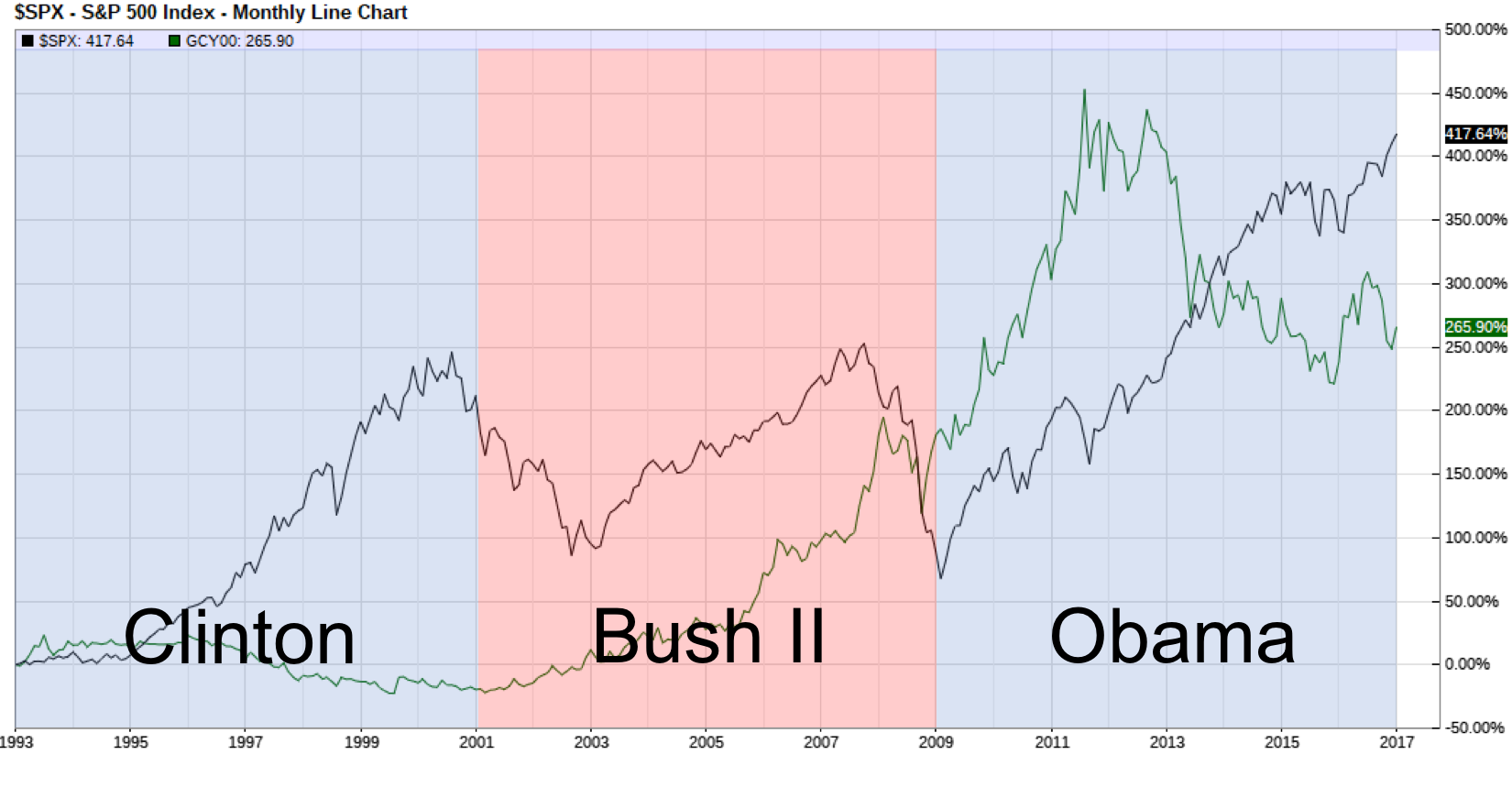

For my high-level assessment I looked at US national debt, the price of gold and the S&P 500.

These three areas are just scratching the surface of the United States economy.

Other metrics one could look at are GDP (which I don’t think is useful), unemployment rate (deceptive), the Consumer Price Index (CPI, which has been resigned so that it doesn’t measure consumer prices), labor force participation, dollar strength relative to other currencies, home ownership, household debt, etc.

However as an investor I’m mainly interested in getting any clues as to how stocks and precious metals are going to perform.

Keep in mind these trends have more to do with Federal Reserve actions, regulations, laws, and government spending and less to do with who is taking up space in the oval office.

Slick Willy

Former President Bill Clinton and Former First Lady of the United States Hillary Clinton

Under President William J. Clinton, the US national debt went from $4.2 trillion to $5.73 trillion, the price of gold fell 30% and the S&P 500 went up 182%. The housing bubble also started to form under Clinton.

Bonus: During the Clinton reign the NASDAQ tech bubble popped and the index went from it’s high of 4,696 down to 2,500.

To be fair, if you bought the NASDAQ in 1993 you would been up almost 300% by the end of Clinton’s term. But that doesn’t help anyone who bought in during the peak.

W

Former President George W. Bush attempting to wear a poncho.

Under US President George W. Bush the housing bubble continued to form and peaked. This bubble popped resulting in the 2008 financial crisis, the national debt nearly doubled and went from $5.73 trillion to $10.63 trillion, gold went up 222% and the S&P 500 dropped 41%.

In an attempt to paper over the 2008 financial crisis a stock and bond bubble also started to form in Bush’s last year.

Bonus: Under the Bush regime, during the 2008 financial crisis the S&P 500 went from it’s peak of 1550 down to 805.

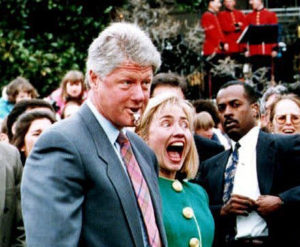

One of the worst things Bush did from an economic perspective was to appoint Federal Reserve Chair Ben Bernanke in 2006.

Based on all his public comments Bernanke was completely blindsided by the 2008 financial crash and is perhaps most responsible for the current stock and bond bubbles.

Obama

Former United States President and Golfer in Chief, Barack Obama

Under US President Barack H. Obama, the stock and bond bubbles grew to a capacious size, national debt went from $10.63 trillion to nearly $20 trillion, the price of gold went up 30% and the S&P 500 went up 175%.

Bonus: Under Obama’s rule, the labor force participation rate dropped down to a level not seen since the late 1970s. And no, it’s not because of baby boomers retiring.

Double Bonus: During Obama’s entire tenure as President the Fed Funds rate was never over .75%. Except for Obama’s last year in office the Fed Funds rate was below .25% for his entire presidency.

There has never been a period in US history that interest rates were that low for that long.

This means Obama presided over the US economy while the largest economic bubble to date was blown.

Interestingly, Obama retained the Bush appointed Fed Chair Ben Bernanke for the majority of his presidency. It was over five years into Obama’s presidency that Bernanke was replaced by current Fed Chair Janet Yellen.

Blow a Bubble, Let it Pop, Repeat

Bernanke could not correctly forecast the present

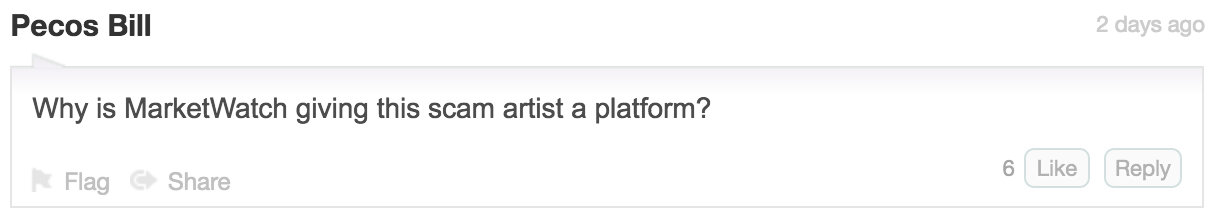

As you can see from the chart below, the S&P 500 grows in a bubble, then the bubble pops.

Obama truly lucked out.

During Obama’s tenure there was no significant correction, there was also no significant attempt to normalize interest rates and the bubble has grown even larger than past bubbles.

This means that when the stock and bond bubbles do pop the fallout will be much worse.

Most people don’t understand how the Federal Reserve fuels asset bubbles.

Unfortunately for Trump, the bubble will probably pop during his first (and thus only) term and he (and free-markets) will be blamed for it.

Free markets and deregulation are not the cause of these bubbles: it’s government spending, moral hazard created by the government, harmful government incentives and the Federal Reserve.

Green Shows the % increase in the price gold, Black shows the % increase in the S&P 500

What Can the Past Tell Us about the Future

History might not repeat itself but it does rhyme.

In many ways the Trump presidency, from an economic and market perspective, is starting off similarly to George W. Bush’s presidency.

Both Bush II and Trump inherited a bubble economy that formed under his predecessors. Bush continued to grow the housing, stock and bond bubbles and made them worse. Trump will probably do the same to the existing stock and bond bubbles.

Buddies

But the stock and bond bubbles will burst eventually.

It’s nigh-impossible to predict exactly when, but at some point valuations of US debt and US stocks will revert to their historical averages and more realistic valuations.

I thought theses bubbles would pop while Obama was in office but I was wrong. I think the bubbles will pop during Trump’s first term and I don’t anticipate being wrong again.

When the bubble does pop, the government will react the way it always does. Lower interest rates, print money, lower taxes (maybe), and spend, spend, spend.

This doesn’t work but it’s the only playbook the government knows.

I believe real assets and foreign stocks will perform well in this environment.

Trump’s Plans

Trump has talked about lowering taxes and reducing regulations.

Trump has talked about lowering taxes and reducing regulations.

These actions would benefit the US economy.

But Trump would also need to significantly reduce government spending. The US government is already insolvent and reducing taxes without also reducing government spending would only increase US national debt.

However, because most government spending is on the military, social security and medicare there is practically no chance Trump will actually reduce government spending.

Thus the US national debt will continue to grow and I believe will double to $40 trillion.

I hope I’m wrong.

Trump has also talked about tariffs, infrastructure spending, and how the dollar is too strong (implying he will try to weaken it).

These things are all bad for the US economy.

Over the next four years I believe the stock and bond bubbles will collapse. I also think the dollar will lose a great deal of value and the price of gold will outperform and reclaim the 2011 high of $1,920.

What John is Doing

So what is one to do in the age of Trump?

I know what I’ll be doing to grow and protect my wealth.

It’s the same things I’ve been doing:

Investing in Foreign Value Stocks

Purchasing Gold

Investing in alternatives like peer to peer loans

Holding some Cash

I’ve got those setup to both grow and protect my wealth. I also work in my day-career in financial services earning US dollars to spend on the necessities of life and to convert any excess funds to the assets I’ve mentioned above.

I’m excited about the Trump presidency.

Not because I expect him to do the right thing or because I think he can or will fix the foundational systemic issues with the US economy; but because this is a time of great opportunity for individuals who take the appropriate steps to protect themselves.