by John | May 28, 2017 | Cryptocurrency

The largest cryptocurrency by market capitalization, Bitcoin, is supposed to be the payment technology of the future. Gold 2.0. The decentralized currency of tomorrow.

On May 22nd sent about $1,000 worth of Bitcoin from an exchange to another address and it was not confirmed until 27 May. The BTC fee paid to process the transaction was $25 worth of Bitcoin (at the time of the transaction).

This is worse than decades old wire transfer technology.

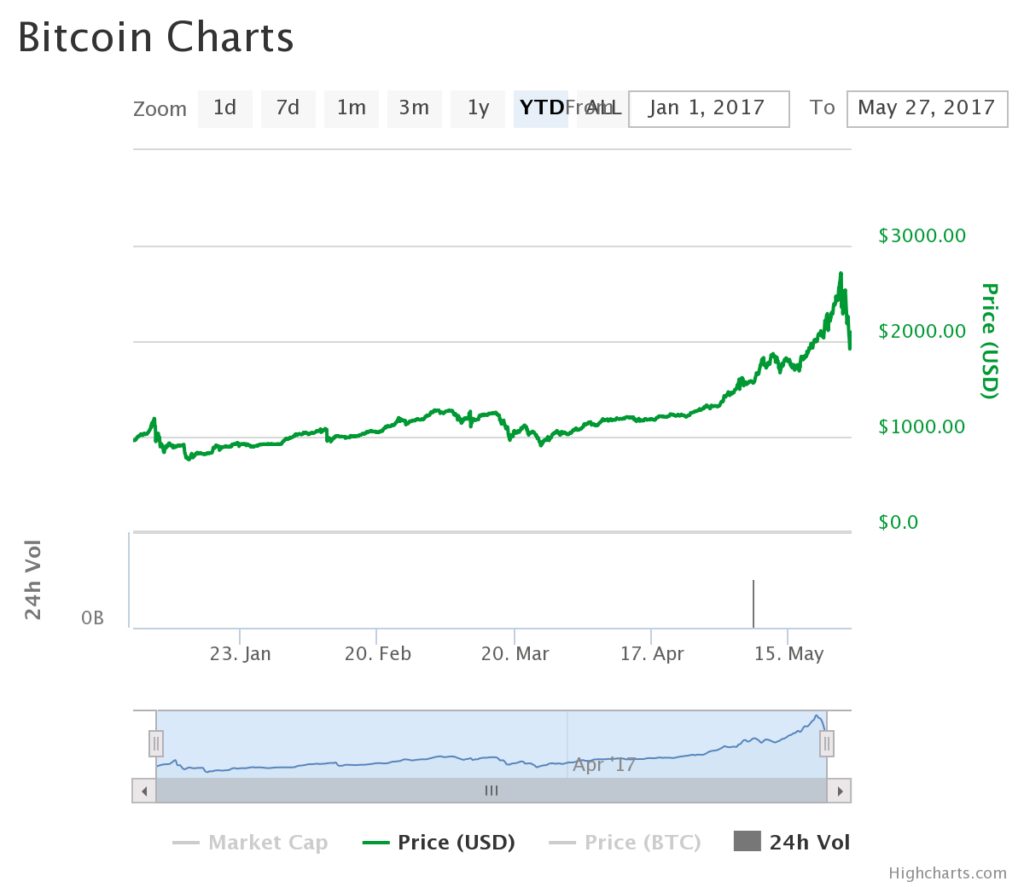

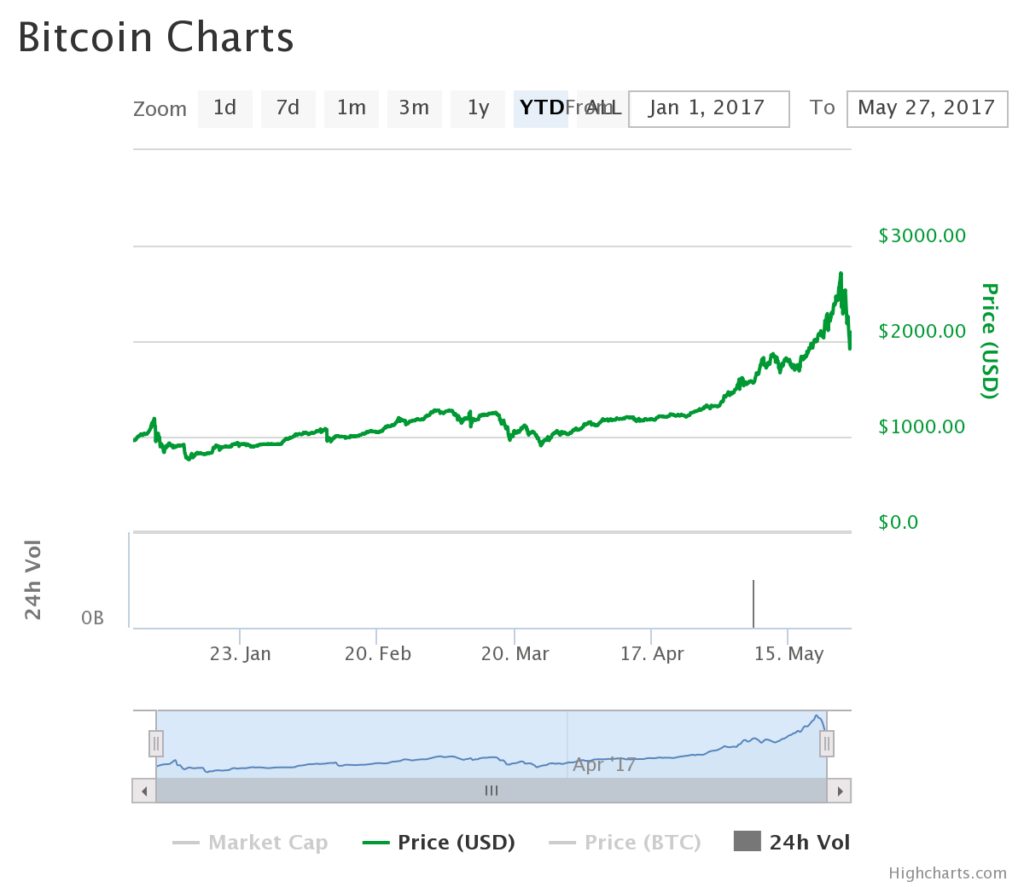

Bitcoin has risen substantially this year. It started off around $1,000 per coin, recently ran up as high as $2,700 and is now back to around $2,100.

I don’t pretend to know the exact catalyst for the upward volatility but it could have a lot to do with Asian demand particularly in Japan.

Although unconfirmed transactions and long delays in transaction confirmations are not new to the Bitcoin network, with the recent surge in price the network has been overwhelmed and the backlog of unprocessed transactions has grown.

I found a study that asserts 43% of Bitcoin transactions are not included within 1 hour.

There is a technical proposal that I understand would help with some of the Bitcoin performance issues but it has not yet been implemented.

I do think Blockchain technology pioneered by Bitcoin is here to stay. I just don’t think Bitcoin will be at the forefront forever.

by John | May 21, 2017 | Cryptocurrency

There has been tremendous upward volatility in cryptocurrencies over the past month.

The largest blockchain based cryptocurrency, Bitcoin, is trading over $2,100 with a market cap over $35 billion.

Ripple, a cryptocurrency seeking to lower the cost and increase the speed of international fund transfers is up to a market capitalization of nearly $13 billion with a price of $.33.

Ripple has been trading places with Ethereum as the second largest cryptocurrency. As of writing, Ethereum is up to a market capitalization over $15 billion making it the second largest cryptocurrency by market capitalization. The price is over $165 per coin.

A variety of other coins like DASH and Litecoin have also risen considerably over the past month.

Purists will despise Ripple for its adoption by large banks but it has a clear use case and the archaic international money transfer technology that is currently used by banks is ripe for replacement.

I own some Bitcoin, DASH, Ripple and Ethereum. I’m considering reducing my exposure to Bitcoin and taking some profits.

I remain skeptical of Bitcoin and I’m long term bearish on the currently largest cryptocurrency.

I consider Bitcoin an almost a purely speculative play because of the non-trivial technological issues with Bitcoin: including slow transaction speed, lack of privacy and scalability problems.

I also think the fact that Bitcoin has no non-monetary use is a problem for reasons I’ve previously described.

I think now is closer to being a good time to sell cryptocurrencies rather than buy them. The various cryptocurrencies could of course go even higher. For someone interested in purchasing crypto, waiting for a pullback or at least dollar cost averaging could be a good approach.

by John | Apr 2, 2017 | Cryptocurrency, Currencies, Wealth Protection

I have a love/hate like/dislike relationship with cryptocurrencies. But one thing I feel confidently about is that Bitcoin is not the future of cryptocurrencies.

By market capitalization Bitcoin is currently sitting in the #1 position as the largest cryptocurrency.

Source: https://coinmarketcap.com/

But it isn’t there because it’s the best. It’s there because it was first.

There is something to be said for the network effect but Bitcoin has several fatal flaws that leave it vulnerable to being overtaken by newer and better technology.

Bitcoin Transactions take “forever”

A screen capture from bitcoin.org. I don’t consider 10-30 minutes fast unless we’re talking about glaciers or the the average US bureau of motor vehicles

If I buy something digital online I want to be able to download it instantly.

Imagine buying a song on iTunes but having to wait 10-30 minutes to start downloading it. If Apple used bitcoin instead of credit cards that’s probably how long you’d have to wait.

Or what if you want to buy a latte on the way into work? Would you want to wait 10-30 minutes in the coffee shop before you can leave with your drink?

Obviously not.

But why is Bitcoin so slow?

Bitcoin takes 10 minutes per block. A block is a set of transactions. So at best Bitcoin takes 10 minutes to confirm a transaction. Most vendors however, require 2-3 confirmations before they consider the bitcoin transferred, which means 20-30 minutes of waiting.

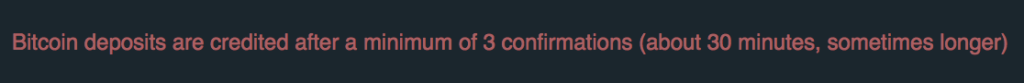

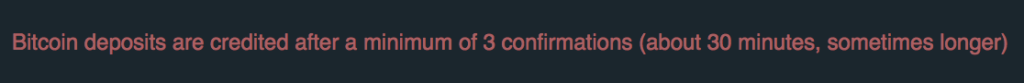

Bitfinex requires 3 confirmations before it considers Bitcoin transferred

You need a Trusted Third Party to make Fast Payments

Websites like Overstock.com accept Bitcoin as payment. However, they do so by utilizing a trusted third party, like Coinbase, to serve as a middleman.

No doubt they do this to avoid the issue of double-spending, refunds and transactions taking thirty minutes.

But the fact that overstock.com uses a trusted third party pours cold water on the idea Bitcoin has “Fast peer-to-peer transactions”.

Bitcoin has Scalability Problems

In addition to confirmations being slow, Bitcoin has issues with scalability of the network, or the number of transactions the network can process. There are competing camps about how to resolve this issue but there has been much more debate than action.

This could lead to hard forks of the cryptocurrency. More on that later.

Bitcoin Transactions aren’t Anonymous

One of the previously oft touted benefits of Bitcoin was anonymity in transactions. While Bitcoin transactions are pseudonymous, unless you buy bitcoins in cash from someone on the street, there are links back to the exchanges and thus bank accounts.

I’m sure there are ways to purchase Bitcoins anonymously but it’s not easy or safe. If you know how to do this I’d value your input in the comments section below.

Bitcoin is Centralised and the Centralised Powers don’t have Their Act Together

A screen capture from the Bitcoin Foundation (bitcoinfoundation.org) website

Despite propaganda that Bitcoin is decentralised–it is in fact controlled by the Bitcoin Foundation in conjunction with the Bitcoin Core developers and the larger miners who can afford the expensive application specific integrated circuit hardware required to successfully mine Bitcoin.

In sort of an Orwellian double-speak both the Bitcoin Core developers and Bitcoin Foundation talk about how they keep Bitcoin decentralised.

The Bitcoin Core development team is not very big.

I don’t see how a group of 3 “maintainers” and a dozen or so contributing developers is “decentralised”.

If I wanted to be really mean I would compare the Bitcoin Foundation to the Federal Reserve and the miners to the big wall street banks.

But I won’t do that.

The main advantage Bitcoin has over the Federal Reserve is that the number of Bitcoins that will be created is fixed at 21 million whereas there is no limit to how many dollars the Federal Reserve can conjure from within the shady halls of the Eccles Building.

A screen capture of a written statement from bitcoin.org/en/bitcoin-core/

However, if Bitcoin forks, like Ethereum did, then the number of Bitcoins will effectively double.

I don’t necessarily have a problem with a cryptocurrency being centrally controlled.

While I have a general bias towards decentralisation and subsidiarity (when possible)–I think that a benevolent dictatorship can be good–provided it is easy to jump ship if the centralised power becomes corrupt.

Bitcoin is Squandering it’s First Mover Advantage

But despite large issues with Bitcoin the Bitcoin Foundation and the Bitcoin Core developers haven’t gotten it together to make progress in fixing the aforementioned systemic issues with Bitcoin.

Could these problems be fixed? Sure. Smart, motivated individuals working together towards a common goal can accomplish amazing things. But I don’t see the Bitcoin community taking these problems seriously.

For these reasons I believe that Bitcoin is not the future of cryptocurrencies.

If you are interested in purchasing Bitcoins, I show you how to buy Bitcoins on Coinbase.