Whatever vestigial link between US dollars and gold ended after Bretton Woods was terminated on 15 August 1971. The classic gold standard was abolished long before in 1933 when the despotic executive order of United States President Franklin D. Roosevelt that made it illegal for citizens in the land of the free to own gold.

There are periodic calls to return to a gold standard as a way to reign in government spending. The return to a pre-1933 gold standard would be a huge step in the right direction.

A true gold standard uses gold as money. A true gold standard in the US would redefine dollars as a quantity of gold. A true gold standard is NOT saying that gold is worth $35 per ounce as was the case in Bretton Woods.

This is explained in fantastic detail by Mises Institute Senior Fellow Joseph T. Salerno in his lecture Gold Standards: True and False.

A Return to the Gold Standard in the US?

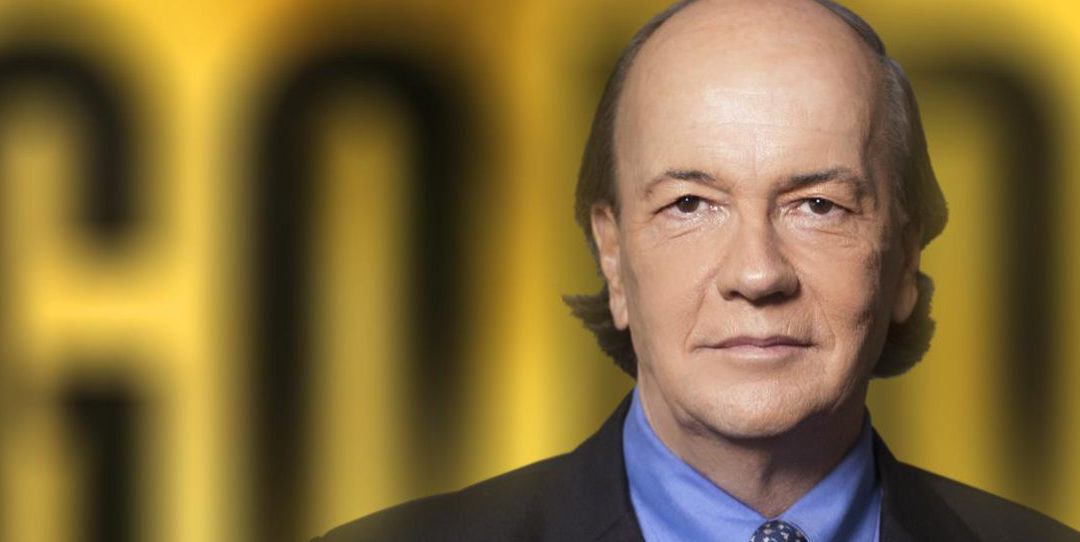

It sounds click-baity to me too, but Jim Rickards is predicting $10,000 gold as the result of a currency reboot. The link above is to a sales page (which I get zero benefit from and considered not linking to) that explains in his own words why Rickards thinks Trump will return the US to a “gold standard”.

James G. Rickards is a New York Times bestselling author who appears on networks like RT, CNBC and Bloomberg. He’s testified in front of congress, he’s done some consulting on currency for the CIA and Pentagon. So there are some reasons to listen to what he says and at least evaluate his rationale and his arguments.

If I can quickly summarize his argument it’s that the US is deeply in debt, debt has crushed the middle class, a gold standard is one of the keys to “Making America Great Again” and so President Trump going to move the US back onto a gold standard. Rickards also claims he has some inside information that gives him additional reason to believe a return to such a gold standard is likely.

I agree the US is deeply in debt. I also agree the economy is broken and stacked against the middle class in favor of the super-wealthy. I also agree that a return to a classic gold standard similar to what existed pre-1933 would help America.

There is also some evidence that Trump is receptive to the gold standard.

Would Trump Support a Gold Standard?

Trump has stated to GQ: “Bringing back the gold standard would be very hard to do, but boy would it be wonderful. We’d have a standard on which to base our money.” In the same montage of questions he also stated that Justin Bieber shouldn’t be deported and that he’s not a fan of Man Buns.

Trump has also tweeted this:

Remember the golden rule of negotiating: He who has the gold makes the rules.

— Donald J. Trump (@realDonaldTrump) March 21, 2013

Although “gold” here could simply mean wealth.

As far as I can tell Donald Trump is not a systematic thinker. He doesn’t have a set of principles with which he evaluates problems and situations. I think Trump’s “philosophy” is basically “I’m a smart guy with good business sense. So I’m going to use my gut and my experience to make ad hoc judgments about what to do.”

Although he probably wouldn’t use the term ad hoc.

So could Trump be in favor of a gold standard? Who knows? Even if he was in some way at some point in the past who knows what he would decide today. Just look at his 180 turn on the war in Afghanistan as one example of his fickleness.

Where does Rickards get $10,000?

Rickards uses a fairly basic calculation based on what he thinks the world money supply will be, how much gold there is and a 40% backing to get $10,000 gold.

Rickards writes that the US government would keep the price at this level by simply conducting some “open market operations” in gold:

The Federal Reserve will be a gold buyer if the price hits $9,950 per ounce or less and a gold seller if the price hits $10,050 per ounce or higher

And this is really the rub. Such a price peg is not a return to a true gold standard. It would not change the US government’s fiat monetary system in any meaningful way.

Dollar to Gold Price Pegs are not a True Gold Standard

The plan Rickards describes is essentially the same as a bill that was proposed in 2013. Mises Institute fellow Joseph T. Salerno explains how such a fake gold standard would not help at all. A true gold standard defines dollars (or other currency) as a certain weight of gold. For example, the definition of a dollar used to be 1/20th of an ounce of gold (roughly). A $20 bill was not the money per se but a claim to one ounce of gold.

The “gold standard” Rickards speaks of is simply fixing the price of gold in dollars.

I Would Like Gold at $10,000

All else equal I would like gold at $10,000. Sure, if I wanted to add to my holdings it would be cost prohibitive, but since I already own some gold a price increase to $10,000 via Federal Reserve open market operations would be of benefit to me.

However, if the dollar collapsed and a loaf of bread costs $10,000 I’m probably not better off. After all no sane person would want to be a millionaire in Zimbabwean dollars in 2008.

This fake gold standard Rickards is predicting certainly wouldn’t help the US economy at large. As I mentioned above, it would not be any significant change to the fiat monetary system. A price peg of gold in terms of dollars is NOT a gold standard. If anything I think it would be horrible optics for the US government and shake the world’s confidence in the dollar. It would effectively be a revaluation down of the dollar, at least relative to gold, and the Fed’s balance would very likely have to massively expand in order to bid gold up to $10,000.

A Return to the Gold Standard Seems Unlikely

A return of the United States to a true gold standard seems very unlikely. A fake gold standard as described by Rickards is more likely than a return to a true gold standard–but still a long shot. I do believe gold is a fantastic long term investment but I also believe it will take the market waking up to the problems of the global financial system and not an act of government.