The major US indices were down today, each about 3%, likely triggered by the inversion of treasury yields as well as cynicism regarding a US-China trade deal.

The yield on the 10-year treasury note fell below the yield of the 2 year treasury note for the first time since May 2007.

Source: https://www.marketwatch.com/story/dow-ends-around-800-points-lower-after-bond-market-flashes-recession-signal-2019-08-14

“Consider that 2s-10s yield curve inversions have preceded the last seven recessions and nine out of the last 12 recessions.“

ZeroHedge.com

Source: https://www.zerohedge.com/news/2019-08-14/2s10s-just-inverted-heres-what-happens-next

Yield Inversions

Source: barchart.com

Normally if you are loaning money for 10 years, you demand a rate of return greater than if you’re loaning money for 2 years. In other words, longer term debt should pay more interest than shorter term debt. When this isn’t true, it’s called inversion.

The fact that the yield on the 10-year was less than the 2 year (ie inverted) is a bad sign that historically indicates an incoming recession.

What do negative yields mean?

The way the government responds during a recession is to lower interest rates and spend money. This is the conventional, Keynesian approach, often referred to as monetary stimulus.

Unfortunately, this only makes the problem worse, but the government doesn’t realize that and it will be what they do in the next downturn.

Interest rates are already low, and so there isn’t a lot of room to cut before hitting 0%.

Rational people have positive time preference, meaning that they would rather have $1 now than $1 ten years from now. If you’re going to loan a stranger $1, you’re going to want interest, partly because there is a risk they won’t pay you back and partly because rational, normal people have a positive time preference.

What would negative time preference look like? A person with a negative time preference would rather have $.90 ten years from now rather than $1 now.

You can’t find real people who have negative time preference.

However, former Fed Chair Alan Greenspan, famous for inflating the 2000 stock market bubble and thus causing the subsequent crash doesn’t think negative yields are a problem.

“There is no barrier for U.S. Treasury yields going below zero. Zero has no meaning, beside being a certain level.”

Former US Fed Chair Alan Greenspan

Source: https://www.marketwatch.com/story/ex-fed-boss-greenspan-says-there-is-no-barrier-to-treasury-yields-falling-below-zero-2019-08-13?mod=MW_story_top_stories

He and many other supposed technocrats don’t have a problem with negative yields on debt. That combined with the lack of room to maneuver means that if there is a stock market correction or crash, once the Fed cuts rates to zero and restarting quantitative easing and asset purchases, negative rates are not far behind.

Gold should do well in this environment.

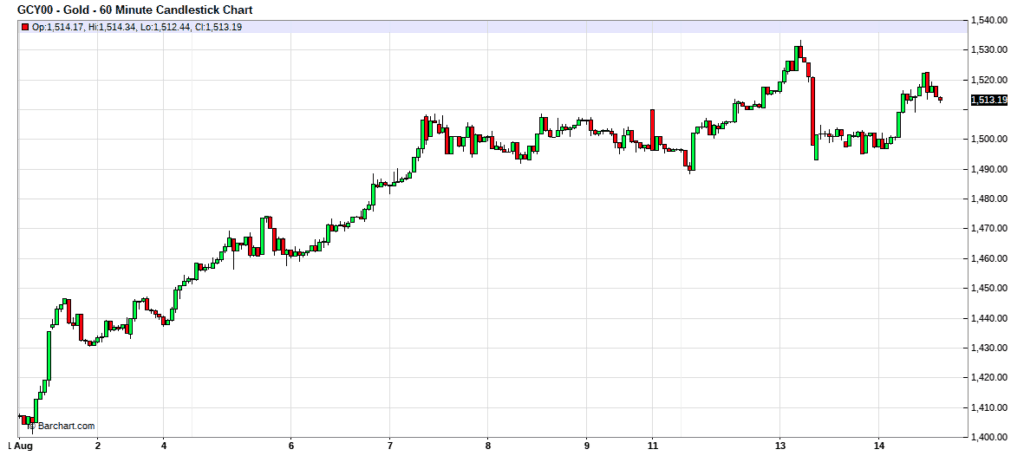

Gold has been bouncing around between $1,490s and $1,510, with a brief breakout attempt on the 13th in which the spot price of gold went as high as $1,530 before retesting supporting at the $1,490s. The yellow metal is up over 17% on the year.

I think we’ll see $1,600 per ounce gold this year, and it could go even higher before 2020 arrives.

Time will tell.