I recently wrote about how costs are rising–specifically about how my healthcare costs went up by $1,000 if I were to have a very bad year. But I have a solution for rising healthcare costs, the Health Savings Account (HSA).

I recently wrote about how costs are rising–specifically about how my healthcare costs went up by $1,000 if I were to have a very bad year. But I have a solution for rising healthcare costs, the Health Savings Account (HSA).

I expect the trend of healthcare cost increases to continue, especially as the U.S. population ages. Another factor that contributes to healthcare costs rising is that the Affordable Care Act was not repealed in full–however the individual mandate was repealed.

This means that people with pre-existing conditions will still be able to get healthcare, while healthy individuals will be able to choose not to buy health insurance. This sounds good, and I’m all for helping people who need medical care get it, however, it means that insurance companies will have more sick people and fewer healthy people, which means more people consuming medical care relative the number of people paying for it, which will put upward pressure on healthcare costs.

I think a great way to save for health expenses in the United States is a health savings account. I’m not an accountant, lawyer or financial advisors but I’ve decided that putting money away in an HSA makes a lot of sense for me. Money contributed towards an HSA reduces gross income.

In order to open and contribute to an HSA you do need to have a a qualifying High Deductible Health Plan (HDHP), which in 2018 was a plan with a minimum deductible of $1,350 and a maximum deductible of $6,650 for an individual. So it makes sense for folks who are relatively healthy. And you need to be able to contribute enough money to the HSA to be able to cover your deductible.

In order to open and contribute to an HSA you do need to have a a qualifying High Deductible Health Plan (HDHP), which in 2018 was a plan with a minimum deductible of $1,350 and a maximum deductible of $6,650 for an individual. So it makes sense for folks who are relatively healthy. And you need to be able to contribute enough money to the HSA to be able to cover your deductible.

The nice thing about an HSA is that once you have it you can draw from it to pay for eligible healthcare expenses even if you are no longer eligible to contribute to it. Like an IRA an HSA does not expire and it travels with you. However, unlike an IRA you don’t have to wait until you’re 59.5 to make withdrawals penalty free. You can spend HSA dollars on qualified medical expenses immediately.

Health Savings Account Benefits

- Reduces gross income (taxable income) even if you don’t itemize your deductions

- Contributions remain in your account until you use them

- Interest or other earnings on the assets in the account are tax free

- Distributions are tax free if used to pay for qualified medical expenses

- HSA stays with you even if you change employers or leave the workforce

Source: https://www.irs.gov/publications/p969#en_US_2017_publink1000204023

I have a health savings account through Further (formerly SelectAccount). When your account is up to $10,000 you have the option to activate a self-directed brokerage investment account, which you can then use to invest in mutual funds, bonds and stocks.

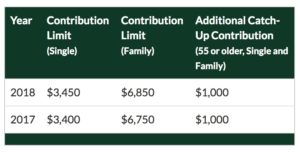

There are contribution limits so it might take 2-3 years to get to $10,000 even if you could write a $10,000 check.

Source: https://newdirectionira.com/ira-info/contributions/hsa

So by having $10,000 in an HSA you can have a tax advantaged investment account where you own stocks that would do well in an inflationary environment.

I think the best way to account for healthcare expenses is to not have them. Eating healthy and exercising (something I use more of myself!). However, the human condition is such that, especially as we age, healthcare costs become a significant financial burden. A health savings account is a great way to alleviate that burden.