“It’s tough to make predictions, especially about the future.” – Yogi Berra

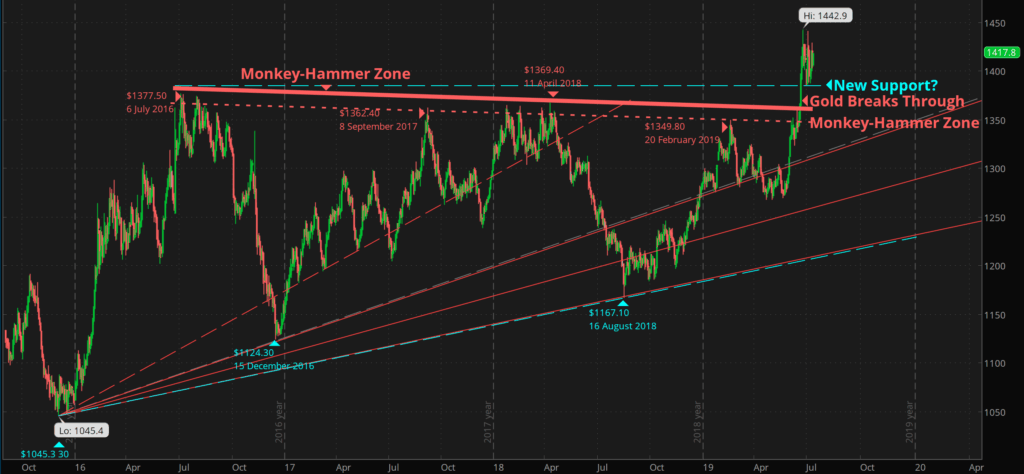

I must say I’m pleasantly surprised. Over a month ago I wrote how gold was entering the monkey-hammer zone. This zone was the price level of $1,350-$1,360, where over the past five years, whenever gold gets to around that range, it gets beaten back down.

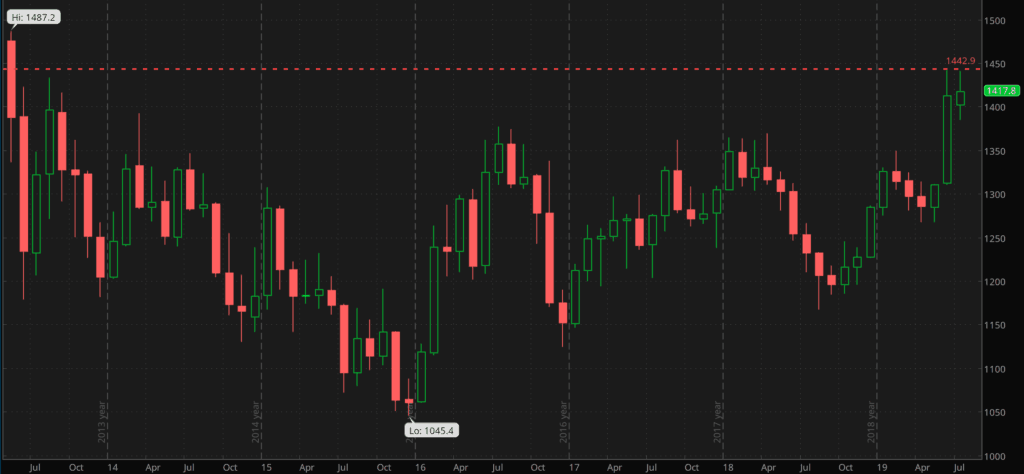

Not so in June of 2019. Gold has punched through the monkey-hammer zone and made a new multi-year high of over $1,440. In fact gold hasn’t traded that high since May of 2013.

I had written the following: “I would be pleasantly surprised if gold could breech $1,360 and remain there or higher but if not I think it’s likely to drop down to the $1,230-$1,240 range.”

Turns out the external catalysts gold needed to punch through the monkey-hammer zone was potential war with Iran, trade war with China and the end of the US Federal Reserve’s tightening cycle and the European Central Bank cutting interest rates.

The US Federal Reserve

The US Fed has strongly suggested they will cut rates in July.

Source: https://www.washingtonpost.com/business/2019/07/10/embattled-federal-reserve-chair-jerome-powell-hints-interest-rate-cut-likely-july/?noredirect=on&utm_term=.71da3190baf6

Markets are pricing in a 100% chance of a rate cut in July.

Source: https://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html

The fact that the US Federal Reserve is cutting rates with low unemployment and all time highs in stocks is an indicator that gold could go much, much higher.

There isn’t much room to cut rates before hitting 0, and effective interest rates are already near zero if you simply look at the government statistics. The fed-funds rate is 2.25-2.50% and the official CPI as of July being 1.6% means the effective interest rate is just 0.65%-0.9%.

This is simply using the government numbers.

I think the actual rate of inflation is higher than 1.6%. The largest expense I have is rent. I renewed my lease this month and it was 3.5% higher.

Let’s say the rate of price inflation is actually 2.5%. Rates are already effectively zero or even slightly negative.

If the Fed is cutting rates now, when things are good, what are they going to do if things go bad?

The narrative since 2009, with record low interest rates, has been buy stocks. However, price inflation, at least as the government measures it, has been contained. If inflation were to really take off, gold should do well.

I also think stocks could continue to do well in this environment. I think it is possible that stocks keep going up as the more people lose confidence in the dollar. However, if there is a scenario in which gold will really shine, it is in an stagflationary environment the Fed has been creating for the past decade.

Gold in 2019

I didn’t know when gold was going to break out, I just knew it would eventually because of the weak fundamentals of the fiat and debt based global economy.

I actually thought gold would get monkey-hammered back down this go-around, just like is has the past half dozen or so times before over the last five years.

As I’ve stated before, I believe the gold market bottomed in December of 2015 at a price of $1,045. It has been consolidating over the past four years and now, with this breakout above $1,400, could be starting a new and stronger leg of the bull market that began in late 2015.

Of course external catalysts such as a full on war with Iran could cause gold to move higher quickly.

You have to go back pretty far to find any level of price resistance. Around where gold is trading $1,420-$1,430 is one level of potential resistance, the other being around the mid-$1,500s.