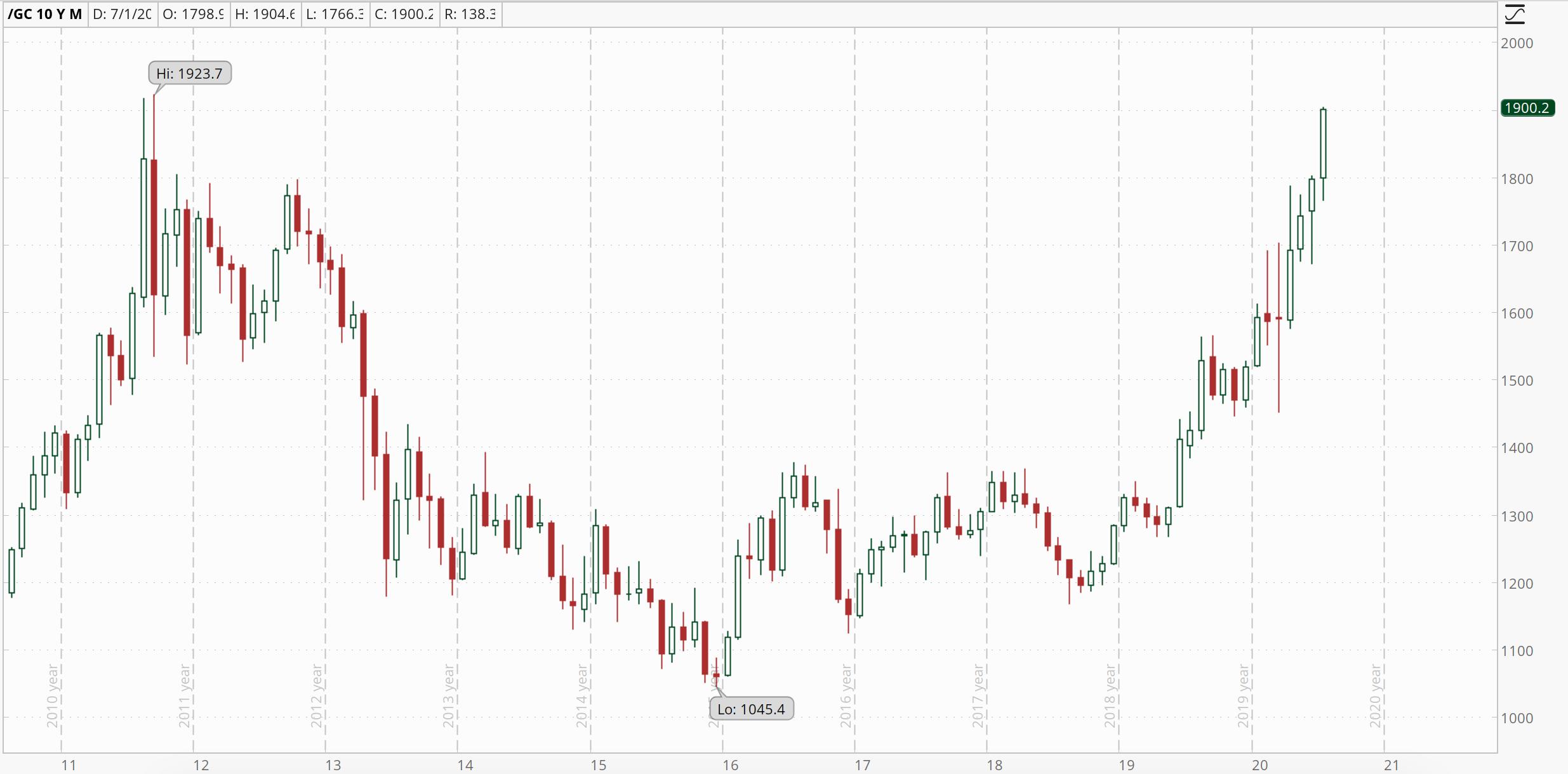

I wrote my first article on this website advocating for holding some precious metals like gold and silver over four years and four months ago on 19 March 2016. At that time gold was trading around $1,250 per ounce.

Now for the first time since September of 2011 gold is trading northwards of $1,900 per ounce. This is a 52% increase in price.

So with gold trading near the September 2011 high of $1,924 I’d like to look back at some of the previous statements I made about gold.

In November of 2019 Gold was trading in the $1,520 to $1,445 range. It had suffered a large interday drop and I predicted gold would reach $1,600 in 2020, which it did just a couple monthly later in January.

While the recent price action looks rather bearish over the next 3-6 months I think gold will reach $1600 in 2020.

Back in 2017, a few days after President Trump was sworn in, I predicted gold would reach $1,920 during his first (and probably only) four years.

I also think the dollar will lose a great deal of value and the price of gold will outperform and reclaim the 2011 high of $1,920.

Gold has not hit $1,920 yet but it is within an Andrew Jackson (or Harriet Tubman?) of that price.

Back in 2016 I predicted gold would reach $2,000 or higher.

I would have preferred to have bought gold at the lows of $1,040, but as yet I don’t have a crystal ball that allows me to perfectly time the bottom of markets and I firmly believe that based on the fundamentals gold will make new highs in excess of $2,000.

Gold isn’t at $2,000 yet but it seems increasingly likely. I of course can’t predict the future, just make educated guesses on price and time. But so far gold has been a solid investment. The technical damage after the 2011 high has been filled in and the chart is looking strong.

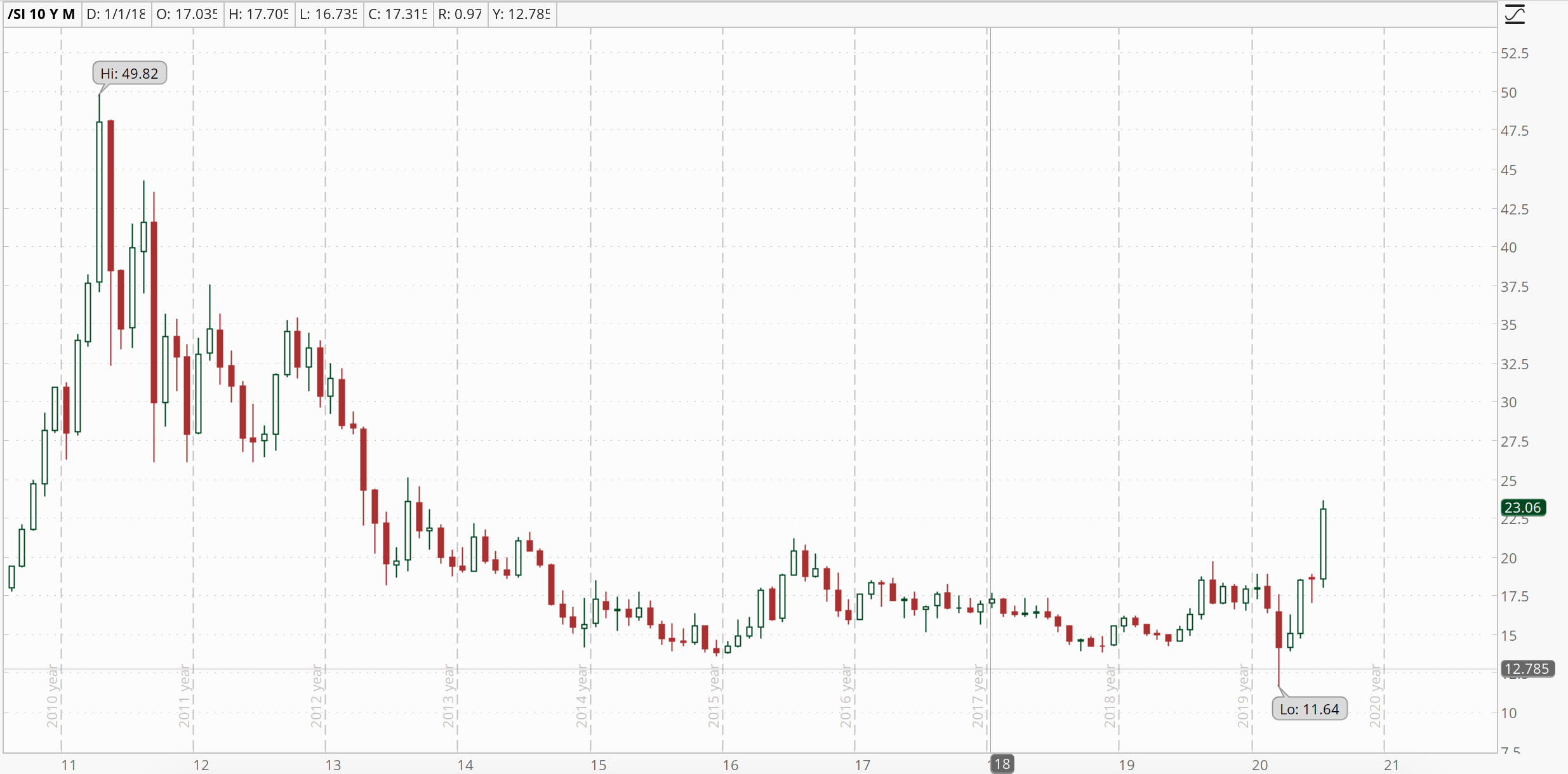

Silver has done well in the very short term. It’s previous high was almost $50 in April of 2011. It’s been steadily trending downward since then, making a low of $11.64 in March of 2020. Since then it has rocketed back up to $22.82 in a 96% increase in just a handful of months. It is still well shy of the $50 high but silver could provide a better value and more upside potential than gold. However, it tends to be more volatile.