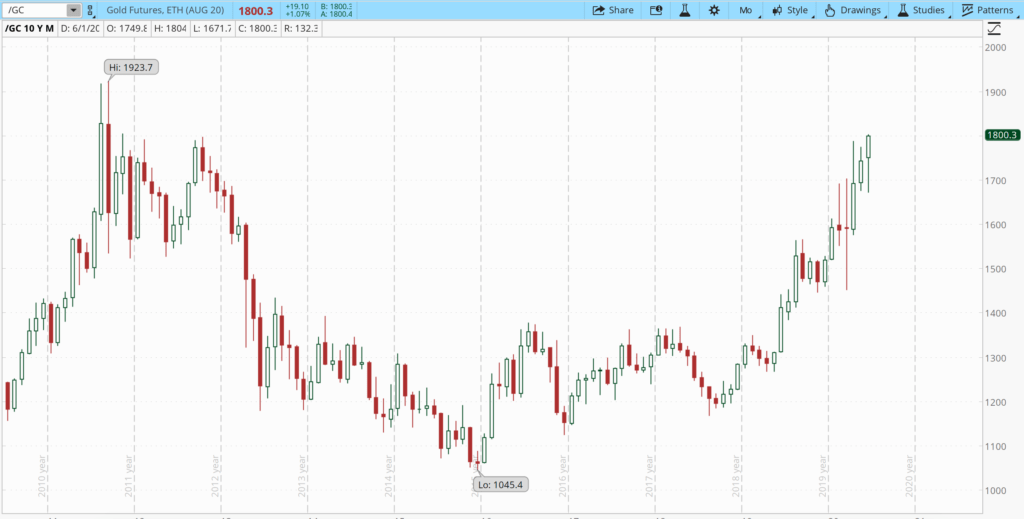

As of writing this article spot gold is trading at $1,783. August gold futures are trading at $1,800. Gold hasn’t been at the $1,800 level since November of 2011, although it came close in October 2012.

Silver is up to $18.19.

I’ve been bullish on gold since 2013. I think gold has more legs to go higher. There is a lot of uncertainly right now in the short term. The November election, Covid-19, social unrest, and of course the national debt. Gold is often used as a safe haven to park money amidst uncertainty.

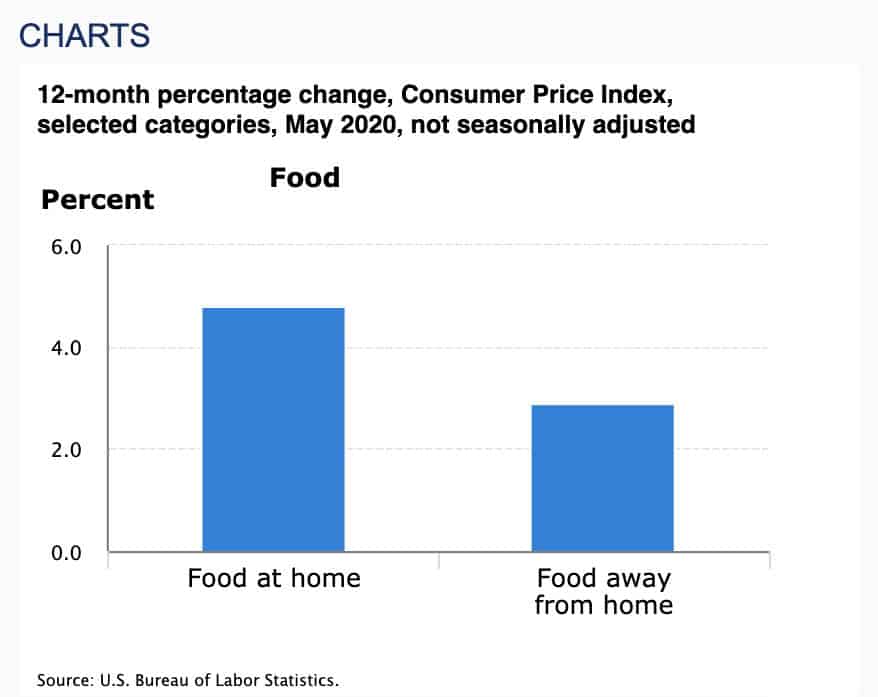

Inflation Pressures

With many people unemployed, that will put downward pressure on consumer spending. However, between credits cards, stimulus checks and unemployment benefits, people will still be able to spend. So in categories like food and other essentials, I think there will be price inflation. And even the CPI, which historically under-represents actual price increases, shows food prices increasing by 4.8%.

While the COVID-19 recession is undoubtably be deflationary, the government’s response will surely be to print and inflate. Gold should continue to do well in this environment.