Yesterday gold went up as high as $1,742 before selling off and is now currently trading around $1,688.

Interest rates have been slashed down to 0%-.25% and QE has been rebooted in earnest.

Source: https://www.bankrate.com/rates/interest-rates/federal-funds-rate.aspx

Government spending continues unabated. The US Federal Deficit is approaching $4 trillion and the US National Debt is over $24 trillion.

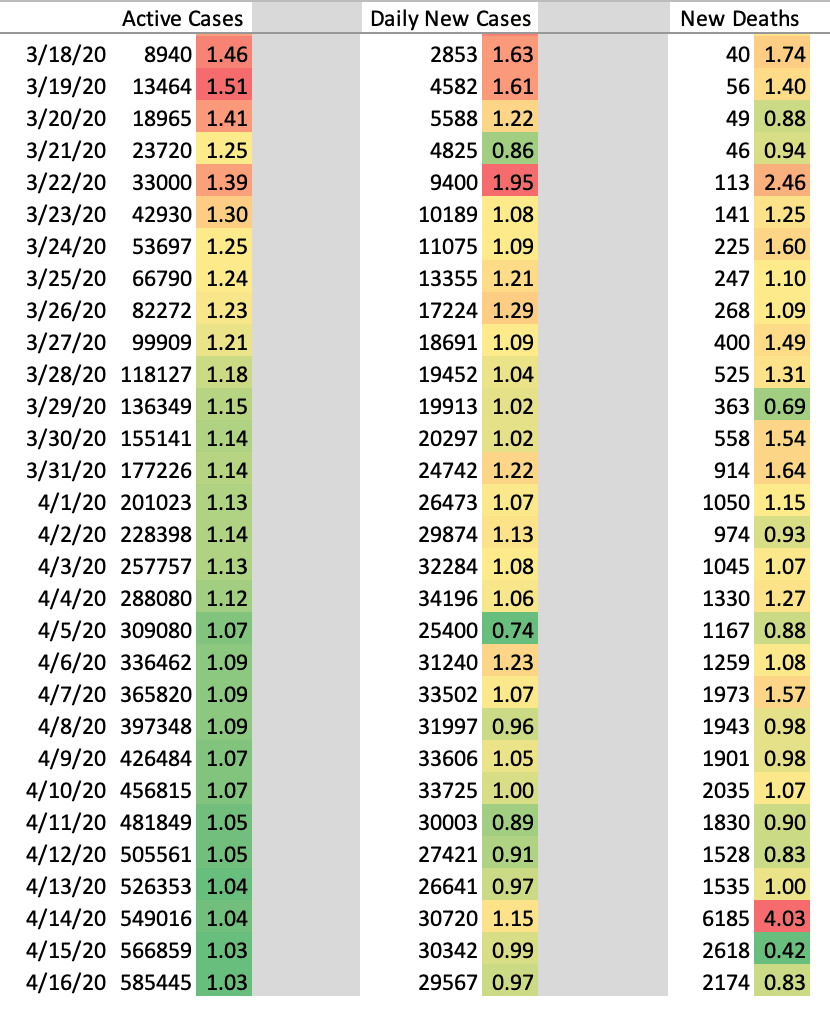

The rate of active COVID-19 case growth in the US continues to slow after peaking on 19 March.

Source: https://www.worldometers.info/coronavirus/country/us/

With several states considering reopening in May, at least in some capacity this trend will certainly be disrupted and the rate of active case growth will probably rise again.

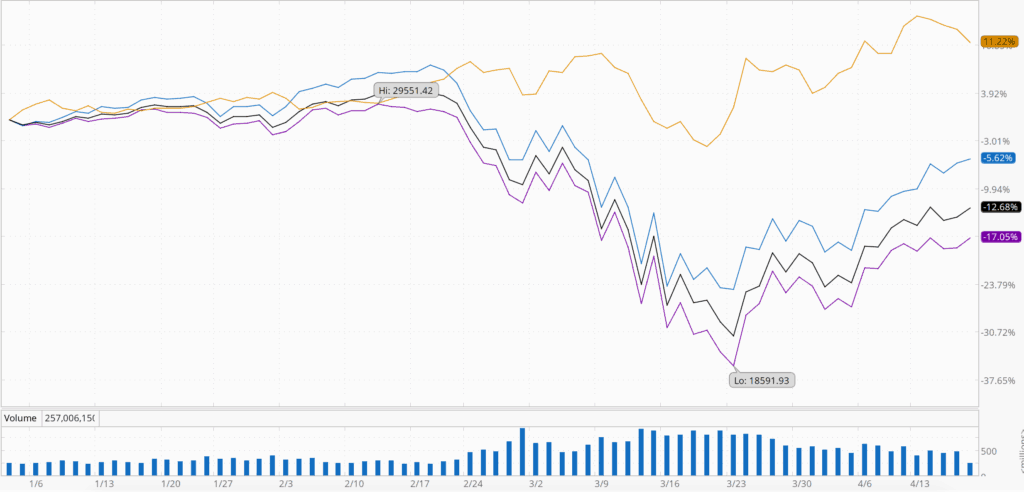

Not surprisingly, the major US indices bottomed a few days later on 23 March.

A popular theory is that this rapid selloff and equally rapid rebound is a V-shaped recovery.

While this certainly is the case right now, I believe that the fallout from COVID-19 will continue for many months and US stocks will make new lows. We’ll see which organizations and governments have been swimming naked as the tide is going out and the results will probably be ugly.