George Orwell’s dystopian book “1984” introduced the world to the concept of Newspeak. Newspeak is the process of redefining words for political purposes. Examples in the book include, “War is peace. Freedom is slavery. Ignorance is strength.” There are plenty of examples of Newspeak today in the United States and doubtless throughout the world. The United States Federal Reserve is a terrible offender when it comes to the use of Newspeak. Below are several examples.

Federal Reserve Newspeak: Price Stability

Part two of the Federal Reserve’s “Dual Mandate” is “Price Stability.” However, the Federal Reserve actively undermines price stability. Here is a quote from the St. Louis Federal Reserve website:

Price stability: If prices for goods and services are stable, that preserves the purchasing power of money. The Federal Open Market Committee, or FOMC, has equated price stability with a low, measured rate of inflation. (Inflation is a general, sustained upward movement of prices for goods and services in an economy.) To achieve this part of the mandate, the FOMC targets an inflation rate of 2 percent over the longer run.

Source: https://www.stlouisfed.org/open-vault/2018/august/federal-reserve-dual-mandate

Why is this newspeak? Two percent inflation is not stable. If a ship is losing 2% of its buoyancy every year it will eventually sink. Take a worker who makes $15 an hour. After 20 years, at a 2% inflation rate, that money is now worth $10.09. That “stable” price stability cut a workers wage by a third.

Price stability actually means prices neither rising nor falling.

Of course the real rate of price increases is well above 2%–more on that later.

So when the Federal Reserve use the term “Price Stability” what they really mean is rising prices and a steady erosion of the purchasing power of the dollar.

Federal Reserve Newspeak: Balance Sheet Normalization

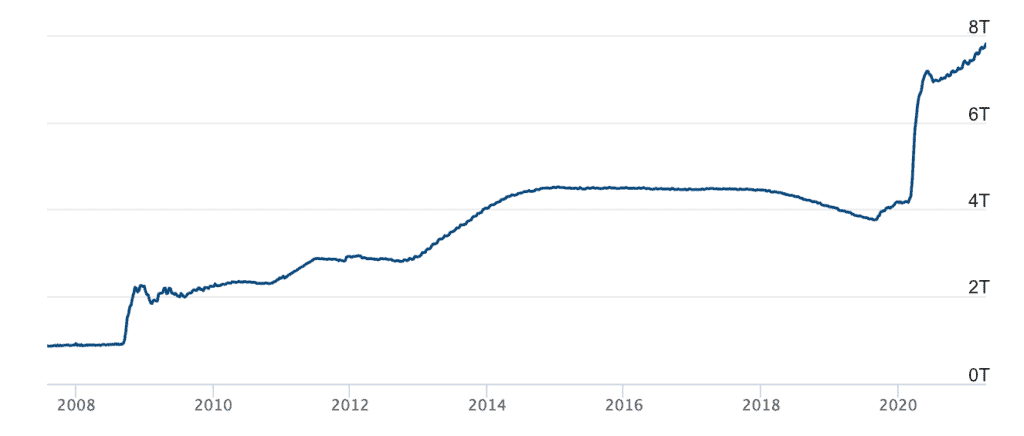

The US Federal Reserve makes available their “recent balance sheet trends.” The Federal Reserve narrative of their balance sheet trends is as follows:

The Federal Reserve’s balance sheet has expanded and contracted over time. During the 2007-08 financial crisis and subsequent recession, total assets increased significantly from $870 billion in August 2007 to $4.5 trillion in early 2015. Then, reflecting the FOMC’s balance sheet normalization program that took place between October 2017 and August 2019, total assets declined to under $3.8 trillion. Beginning in September 2019, total assets started to increase.

Source: https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm

There is lots of Newspeak in that paragraph. I will give the Federal Reserve some credit, as one sentence doesn’t need too much translation “During the 2007-08 financial crisis and subsequent recession, total assets increased significantly from $870 billion in August 2007 to $4.5 trillion in early 2015.” Here is the translation:

The Federal Reserve’s balance sheet has significantly expanded over time. During the 2007-08 financial crisis and subsequent recession, total assets more than quadrupled from $870 billion in August 2007 to $4.5 trillion in early 2015. Then, the FOMC’s balance sheet normalization program that took place between October 2017 and August 2019 failed and the balance sheet was only able to be reduced back to about $3.8 trillion which is still 3.3 times higher than it was prior to the 2007-2008 financial crisis. Starting in September of 2019 the balance sheet started to grow again. In the year long period between March 2020 to March 2021 the balance sheet increase by over 80% and is currently almost 8x higher than it was back in July of 2007

Balance Sheet normalization in actual english would mean reducing the balance sheet from $4.5 trillion back to under $1 trillion. But in Federal Reserve Newspeak it means reducing the balance sheet 17% from the highest it had been up to that point, going from $4.5 trillion down to $3.8 trillion and then proceeding to more than double it up to $7.7 trillion.

Federal Reserve Newspeak: Tools to Fight Inflation

Fed Chair Jerome Powell has talked about how he has the tools to fight inflation. This is arguably just a lie and not Newspeak, but since Newspeak is a way of lying this distinction doesn’t matter. The translation of this statement is that the tools the Federal Reserve will use to fight inflation will be to ignore and downplay that inflation exists and claim it is transitory.

The Federal Reserve first ignores and downplays inflation by using the CPI. The CPI is already designed to not measure the real rate of price increases. Official CPI released 15 April 2021 is 2.6%. According to shadowstats.com, if inflation was measured the same way it was in 1990, it would be over 6% or over twice as high. This works well for the Fed in conjunction with the Newspeak of “price stability”. If prices rising by 2% each year is price stability then 2% is the new 0% and 3% is the new 1%.

The Federal Reserve was previously targeting a 2% reduction in the value of the dollar per year. Now that the CPI is officially over 2%, the Federal Reserve is saying this is transitory and that because there were periods of time in which inflation was under 2%, it is okay to be above 2% now.

So the Federal Reserve starts by using a number that is already too low (2.6% instead of 6%) then redefines price stability to mean 2%. So we’re really only seeing a 0.6% increase in prices and that is transitory.

Meanwhile, the only real tools the Federal Reserve has to fight inflation would be to shrink its balance sheet and raise rates. But this would tank the stock market and make it too expensive for the US government to borrow money.

In US Federal Reserve Newspeak, “Price Stability” is rising prices. “Balance Sheet Normalization” is doubling. “Fighting inflation” is ignoring it.