by John | Jun 4, 2017 | Geopolitical Risk Protection, Investor Mindset, Investor Psychology, Personal Journey, Wealth Protection

There is a story in the Old Testament (or Torah) in which a man named Noah was instructed by God to build a large boat (called an Ark) in order to save himself, his family, and a lot of animals from a flood that would cover the entire earth.

Although it’s not clear exactly where Noah resided before the flood, and he must have had access to large quantities of lumber, there is reason to believe that he lived in a rather arid environment. We’ll call it the desert.

Put simply Noah was building a giant boat, on land, in the desert. He must have looked rather foolish. But Noah had good reason to believe building the Ark was a good idea and he built it in spite of what I can imagine would have been a lot of derision and mockery from his contemporaries.

Now, I’m not saying for a minute that the next financial crisis is going to be a biblical, extinction level event equivalent to the great flood in the bible. There are a lot of enterprising folks around the world and if the economy crashes and the government stays out of the way, entrepreneurs will be able to provide solutions to whatever problems ensue. Life will go on, even if it is painful for some or even many people.

But the point is, it sometimes takes courage to go against the common wisdom of the day and make some prudent preparations. If other people knew what Noah knew, I’m sure they would have been building boats as well.

As I’ve said before it’s important to have some moderation. After all, the excessive debt, spending, and general recklessness has gone on for some time, and could continue for some time to come. There is no reason to panic or go live in a bunker.

But some day, there will be a point in which governments will no longer be able to borrow and spend money beyond what the economy is producing. The United States in particular cannot continue to borrow money at low interest rates forever. When the marketplace equalizes and goes back to a normal level, a lot of the wealth people thought they had will no longer exist.

That’s why it makes sense to take some steps to consider building your own financial ark. I’ve written about various ways to do this, such as gold, value stocks, holding some cash and maybe even taking a chance on some cryptocurrencies, even though right now they are at the high side of their historic ranges. Silver, which I don’t write about that often, is also significantly undervalued in my opinion.

Some people will say owning gold is crazy. They’ll say cryptocurrencies are a large bubble or ponzi scheme (they could be right about that). They’ll say that buying stocks at all time highs is the only way to go. They’ll say that bonds are safe. They’ll say it’s impossible to beat the market and that if a stock is undervalued there is a good reason for it. They’ll say the dollar will always be relatively strong and that the US debt is manageable.

But that is head in the sand thinking. It’s dangerously naive. Being aware of the risks is important and it’s also important to take some practical steps to protect yourself.

Some people may think you’re silly for building an ark in the middle of the desert, but when the waters start rushing in, you’ll be glad you did.

by John | May 28, 2017 | Economic Outlook, Geopolitical Risk Protection, Investor Mindset, Investor Psychology, Personal Journey, Preservation of Purchasing Power, Wealth Protection

I’ve written about problems with the United States dollar and the US economy.

I’ve been influenced by folks like Peter Schiff and Simon Black. To say the least these guys are not bullish on the US economy. I think they’re right and I think it’s wise to listen to what they say, be aware of the risks, and determine what course of action makes sense for your unique situation.

But while things aren’t great, particularly for those on fixed incomes without assets or investments, there hasn’t been a significant stock market correction and the US dollar is still relatively strong. Does that mean that people like Peter Schiff or Simon Black are wrong? Does that mean I’m wrong?

Things aren’t getting better. The underlying problems remain and only get worse. Governments have tremendous debt, interest rates are distorted, governments continue to spend recklessly, central banks are out of control and asset prices are inflated.

In the face of these problems I think there are two mains risks when it comes to behavior that fall on opposite ends of a spectrum. To willfully embrace either of these mindsets and their resultant behavior is, I think, crazy.

The First Kind of Insanity: Doing Nothing

Proud as a Peacock

On the one hand there is a person who does not take the risks seriously because they don’t think there are any significant risks.

People with this mindset believe that the United States can manage it’s debt. They laugh at anyone who suggests the recovery isn’t real or that the stock market growth isn’t based on sound fundamentals.

Subscribers to this attitude think the United States is the richest and freest and greatest country in the world and that $20 trillion in debt and trillions in unfunded liabilities is not a problem. They think the US government can just print money or increase taxes or grow the economy and everything will be fine.

Folks with this type of attitude hold their savings entirely in dollars and US-centered assets. They are comfortable being heavily invested in US stocks. They believe that government promised programs will be there for them when they most need them.

They can’t envision a world in which the United States isn’t the dominant world superpower. They can’t imagine the US dollar not being the world reserve currency.

This mentality is common in those who are blissfully unaware of the lessons of history and the facts of math.

This is the peacock mentality. People with this mentality strut around and deny there are any problems and so do nothing to protect themselves.

An Ostrich Hiding

Similar to the peacocks of the world there are people who realize there are problems with the economy but still choose not to do anything about it. Maybe they think there isn’t anything they can do about it. They think if the dollar falls and the stock market crashes then they have no choice but to go down as well. They’re either unwilling to learn about alternatives or simply don’t think alternatives exist.

They also might willfully ignore anything suggesting there are problems. If pressed they would concede that another 2008 or 2000 crisis are possible and that government debts won’t be repaid, but they really don’t want to think about it.

People with this type of attitude don’t have the misplaced confidence of the peacocks but they make the same choice not to take any decisive action to protect themselves.

They stick their head in the sand. This is the ostrich mentality.

A Second Kind of Insanity: Living Life around Anticipation of Crisis

But at the same time I think there is a risk of having a bunker mentality. This attitude that crisis is imminent and the sky will fall any day now. Individuals who think this way might go 100% into cash. Or go 100% into gold. Or go 100% into guns and food. Or they take huge risks trying to short the stock market.

A Turtle in it’s Shell

But I think this attitude of going into one’s shell is not particularly helpful. It’s hard to accomplish anything or live a fruitful life when you’re hunkered down and metaphorically looking over your shoulder all the time. This is the turtle mentality.

The Golden Mean

Aristotle and the ancient Greek philosophers spoke of a golden mean. The idea that the correct course of action or virtue is the middle path between two extremes. For example, courage is the golden mean between recklessness and cowardly inaction.

The key to sanity in an insane financial world is decisive, measured and purposeful action when it comes to preparation. Two extremes when it comes to investing would be on the one end of the spectrum shorting the S&P 500 with one’s life savings. On the other end would be buying a 3x bull S&P 500 ETF.

But just because I believe US stocks are in a bubble doesn’t mean I’m going to go with the extreme of shorting the market. It does mean that I’m going to limit my exposure to US stocks and be very selective about which stocks I own.

When it comes to dollars the two extremes would be 100% in dollars or 0% in dollars. But just because I think dollars are overvalued and will continue to lose value doesn’t mean I have to go to the extreme of 0%. It doesn’t mean I go 100% into gold or I only own precious metals and cryptocurrencies. I actually advocate holding some cash. Emphasis on some. I also earn money in dollars and invest in value stocks.

This applies to attitude as well. Being negative and pessimistic isn’t going to do anyone any good. Thinking everything is awesome and always will be isn’t a very good approach either. But there are still many great businesses in the US and there is lots of opportunity in the United States and in the world.

The United States has problems. Lots of economies around the world have problems too. There are going to be winners and losers. Many promises that have been made will be broken. But in the midst of all this there is tremendous opportunity. The important thing is to remain calm, take some practical steps to protect yourself and live your life.

by John | Apr 30, 2017 | Investor Mindset, Investor Psychology, Personal Journey

Taking the right steps to be successful is important. The right activities, actions, and attitudes are vital to success in all areas of life. Doing the right things is important. But it is almost just as important to avoid doing the wrong things.

And in order to avoid doing the wrong things that often means saying ‘no’.

Saying ‘no’ to thoughts, investments, invitations and anything else that isn’t going to bring people closer to their goals.

Saying ‘no’ is an important skill.

Saying ‘no’ to Some Demands on your Time

There are only 24 hours in a day and there are a myriad of competing obligations and demands on one’s time and attention. It’s important to reject those things that will prevent someone from being successful.

For example saying ‘no’ to staying up late because you need some extra sleep for an upcoming week that you know will be challenging. Maybe it’s saying ‘no’ to watching TV so you can read a book or learn a new skill. It could be saying ‘no’ to going out with friends if you should be spending that time doing other things. Or perhaps it is saying ‘no’ to spending money on something new that you don’t really need.

By saying ‘no’ to things that take you further away from your goals you can say ‘yes’ to those things that will help you achieve your goals.

Saying ‘no’ to Some Investment Opportunities

It’s important to say ‘no’ to mediocre or bad investing opportunities. When I was previously trading options I wasn’t always patient in waiting for the right setups, with the right combination of high implied volatility and option pricing. I needed to say ‘no’ to more of the bad option trades so I could make more profitable option trades.

It’s worth saying ‘no’ to investment opportunities that aren’t right so that one can pounce on the right investments.

Saying ‘no’ to Negativity

Attitude isn’t everything but attitude is still vitally important.

It is amazing what a change in attitude can do to even in the most horrific situations.

Being positive is something in it’s own right, but it’s also important to say ‘no’ to negative thoughts.

I find identifying negative thoughts I’m having, and working to replace them with positive thoughts is extremely helpful. It’s not suppressing negative thoughts, it’s realizing they are there and trying to find ways to reframe or re-evaluate a situation so that the negative thoughts are replaced by more healthy, realistic and positive thoughts.

Saying ‘no’ to negative thoughts can help foster a positive attitude.

I rarely enjoy saying ‘no’, wether it’s declining an invitation from a friend because it would interfere with something more important or not watching another episode on Netflix on Saturday because it’s time for me to go exercise. But it’s important to be able to say ‘no’ sometimes so that one is free to say ‘yes’ at the right time.

by John | Apr 23, 2017 | Interview, Investor Mindset, Investor Psychology, Value Investing

I’m very excited to be sharing this interview with Jason Rivera, a man who in his first five years achieved better returns than Warren Buffet did in his first five years. Who is Jason Rivera? Let’s get into the interview and you’ll find out!

John: Can you provide some background on yourself and Rivera Holdings for those who aren’t familiar with you or your company?

Jason Rivera, Chairman, CEO, and Founder of Rivera Holdings Investment Holding Company

Jason: Yes. I’m a self taught value investor who focuses on small and obscure public companies to buy for my investors. And I’m now also looking for private businesses and cash flow producing real estate to buy as well.

I’m the author of the acclaimed value investing education book How To Value Invest. Have run the blog Value Investing Journey for more than five years now. Wrote a 60-page booklet detailing the immense power of investment float that I released for free to readers of my blog and followers – on Twitter and Facebook – titled All About Float. Have written for several publications and investment newsletters including: Seeking Alpha, Guru Focus, Insider Monkey, and Palm Beach Research Group among others.

I mentor others on how to become great value investors, consult on projects requiring business analysis and valuation skills, and run my investment holding company Rivera Holdings LLC. out of the Tampa Florida area.

John: When you were a kid did you know you wanted to grow up to be a value investor?

Jason: Ha 🙂 no. I don’t have any stories like Warren Buffett where he was buying things at wholesale prices – gum if I remember right – and then selling them at a higher price to his classmates as a kid.

Unfortunately, I was far more interested in playing sports, chasing girls, and playing video games than investing when I was a kid.

I always knew I wanted to make money, start businesses, and help people but the value investing part and putting effort into making those things happen only began happening in my late teens and early twenties.

John: Why do you favor value investing as opposed to momentum investing, a passive asset allocation approach or another strategy?

Jason: I don’t remember what first drew me to value investing but once I read about it I knew it was the strategy for me because it made total sense immediately.

I agree with value investing greats like Seth Klarman and Warren Buffett that to some degree having an affinity for value investing has to be genetic.

I never wanted to get into momentum trading because I have a long term mindset – decades not days, weeks, or even years – so that or any other kind of trading never made sense to me.

I’m terrible at predicting things into the future so macro investing was out. And I like the challenge of finding great companies so I would have gotten bored with passive investing and never done it for a long time.

John: I’ve written about the value investing metrics I use. Some of metrics I look at are the result of what I’ve learned from you. I’d be interested in getting your feedback on my approach.

Jason: First of all thanks so much for letting me know some of the content I’ve written helped.

Sitting alone in front of my computer all day reading filings and asset information, or talking with people through phone or internet makes it challenging to know if what I’m doing helps. So thanks a lot.

Everything looks great when it comes to some of the metrics you look at but I do have one quibble…And this is a personal preference so do whatever works best for you.

I prefer owner’s earnings to owner’s cash profits because OE includes working capital while OCP doesn’t. And since I focus more on the balance sheet side of things – at least to start – I find this more useful.

John: It’s clear form your book and website you spend hours and hours analyzing companies before you invest in them. Do you have a process to screen out certain stocks at a higher level so you can deep dive into a specific company?

Jason: I go into great detail on this question with an answer I wrote on Quora to the question: Is there a faster, simpler, more conclusive way to research stocks?

For those who don’t want to read that I’ll give a quick summary below:

First off, I don’t use any screeners when looking for companies to research now and instead rely on my processes and lists to find companies.

I find any lists I’m interested in – ADR list, country list like Brazil or Indonesia for example, or a list of all the OTC companies – and then do preliminary analysis based on my requirements and preliminary checklist. This can be downloaded for free by signing up to mailing list on my blog.

After this, with any companies remaining I do quick “back of the envelope” valuations.

The ones that are overvalued go on a watchlist for later research. And those that are undervalued or fairly valued I do further research on.

For those that are undervalued or fairly valued I then go to both Morningstar and the company’s website to download its most recent annual report, quarterly report, proxy form, and any recent investor presentations.

I read all these, take notes, and if I find too many red flags discard the company.

On the other hand, if the company still looks promising I then revalue it using all the new information.

This is especially important at this stage because now you have a great idea of what the company does, if it has any competitive advantages, if there are any hidden assets, etc.

For any companies that remain promising I then research any competitors for the company. Get all their most recent financials. Take notes on them. And build a spreadsheet of profitability metrics and relative valuations so I can compare them against each other.

If the company still looks good from here I’ll then look for any recent news and developments to consider in my analysis.

At this point I’ll also read and take notes on the company’s financials going back five to 10 years. I’m also looking for things here that could blow up my investment thesis as well.

At this stage if one of the original company’s competitors looks better I’ll begin full research on that company instead of the original one.

After gathering everything, I then begin to write my investment thesis down. These usually end up being between 20 – 50 pages.

This helps me spot any errors in my investment thesis or thought processes. And it’s also valuable so you can go back to see where you made any mistakes or to see what your analysis and reasons for buying the company was months or years from now.

By the time I’ve finished doing all this research, writing, and editing I’ve put well more than 100 hours into researching one idea and its competitors.

The more I learn the more I add as well so this time is a lot closer to 200 hours total now for one idea potential idea.

The beginning of the process helps me weed out the crap companies fast. And the middle and end of the process helps make sure my investment thesis is still sound, while also helping me identify any potential risks or missing thoughts in the thesis.

I analyzed my data a few years back and found I invested in less than 1 out of every 500 companies I researched.

With more experience, knowledge, and refinement of my processes this number is now likely between 1 out of every 750 – 1,000 I end up buying.

But all this work is paying off.

By implementing this strict process I make far fewer mistakes than I used to.

Through the first five full years of my investment career I’ve produced returns of 29.2% for investors – on average not compounded – every year. This is better than the 25.4% Buffett produced in the first five years of his career on average.

John: What Inspired you to write “How to Value Invest”?

Jason: I wanted to help people not have to go through the often times painful, long, and frustrating experience I did in the first several years of learning about value investing.

I wasn’t able to go to a university because of severe health issues at the time. I didn’t have a mentor to guide me in the right direction. And for the most part other than asking questions here and there from other value investors online, had to figure everything out myself.

While this was a great learning experience, and even if I could go back I wouldn’t change anything. I wrote the book to help others avoid the years of wasted time and frustration I dealt with while beginning to learn.

John: This is probably an unfair question, but I’m going to ask it anyway, how do you go from dedicating yourself to being an excellent value investor in February of 2012, to going after an $8 million acquisition as CEO and Founder of Rivera Holdings roughly four years later?

Jason: It’s not an unfair question at all. And I actually think it’s a good one.

Several friends asked me the same thing – or said people they told about the potential deal asked them the same thing after they told them about my age and experience.

For reference, as I queried investors to raise the money for the acquisition I was still 29. I turned 30 in December of 2016 after the acquisition failed. And at that point still had yet to finish my fifth full year of being a serious investor.

I’ve studied and practiced investing for almost 10 years now but the bulk of the first five years were wasted to some degree through the process trial and error learning and frustration I mentioned above.

So what the hell at age 29, with less than five full years of serious experience under my belt as an investor without a degree from somewhere like Wharton or Columbia Business School made me think I can do an $8 million acquisition?

It’s a good question… But I think an even better one is; why not go for it?

I believe anyone can become and do great things if they’re willing to work and put in the time and effort to learn a valuable skill.

At the end of my career I want to be known as the best investor, businessman, and capital allocator ever. Yes, even better than Warren Buffett.

Is this likely, I know the answer to this is no.

But I’ve always shot for the stars… No one ever says they want to be the tenth best investor ever, or the fifth best quarterback ever, or the second best golfer ever, etc.

To do great things I believe you have to have huge goals you can work towards and then do everything in your power to work towards those goals.

So why not start by going after an $8 million acquisition?

Could I have started going after a $100,000 company? Yes. Would it have been far easier? Definitely. But would $100,000 change my life drastically and allow me to help other people change their lives for the better? No. At least not to the degree I want to help.

Why put limits on your potential, the money you make, and the amount of people you can help?

The saying: “If I could just help one person that’d be enough” has never made sense to me. If you can help one person you can help hundreds, thousands, millions, or even billions. Why stop at one?

This mindset makes even less sense to me after listening to the audiobooks of The 10X Rule and Be Obsessed or Be Average – both by Grant Cardone.

Like I said above I want to help as many people as I possibly can. But to do that requires great sums of money. And to have great sums of money I need to go after big targets.

I’m working towards that. And it just happened that when I began looking I found an $8 million company to go after that was a great business.

Did I plan this when I started looking, no. But again, why not go after it if it’s there?

If I went after a $100,000 target and completed the acquisition I would have a $100,000 company but not learned as much in the process, gained as much experience, or grew my connections like I did and continue doing.

I’d rather fail huge but still make massive progress towards my goals then set small goals, reach them, and still be disappointed by not doing what I truly want to do.

But by doing and going after big things negativity creeps in so if you go this route you need to be prepared.

Below are some of the negative things I’ve heard since going after that acquisition.

- He’s crazy.

- Who the hell is he to think he can go after an $8 million acquisition?

- Why the hell are you going after an $8 million acquisition? This was one of my own thoughts at the beginning of the process by the way so this isn’t limited to others thoughts.

- Why are you going after such a big target to start? Again, one of my own thoughts.

- Can you pull this off?

- What if you fail?

- What if you succeed? This question came after someone questioned my experience running this size of a business.

- You’re so young still, why not take your time and start slow?

- You’re so young still why do you think you can do this?

Something else I learned from Be Obsessed or Be Average is: “If you can, you must.”

I have the skills and mindset necessary to help a lot of people so I feel an obligation to work towards helping as many people as I possibly can.

Something else that will illustrate why I went after such a big target to start and how my goals are intertwined with that is from a post I wrote on Facebook about a month ago which I repost below.

“I know that I have the ability to ACHIEVE the object of my DEFINITE PURPOSE in life; therefore I DEMAND of myself persistent, continuous action toward its attainment, and I here and now promise to render such action.

I realize the DOMINATING THOUGHTS of my mind will eventually reproduce themselves in outward, physical action, and gradually transform themselves into physical reality; therefore I will CONCENTRATE my thoughts for 30 min. daily upon the task of thinking of the person I intend to become, thereby creating in my mind a clear MENTAL PICTURE.

I know through the principle of autosuggestion, any desire that I PERSISTENTLY hold will eventually seek expression through some practical means of attaining the object back of it; therefore, I will devote 10 min. daily to DEMANDING of myself the development of SELF-CONFIDENCE.

I have clearly written down a description of my DEFINITE CHIEF AIM in life, and I will never stop trying until I shall have developed sufficient self-confidence for its attainment.”

– Bruce Lee

This is a perfect reflection of where I’m at and what I work on every day as well.

Something I’ll add to these thoughts is from Grant Cardone’s book Be Obsessed or Be Average – “If you can, you must”

What this combination of thoughts means to me is that because I have the ability to help people throughout the US and world through my knowledge and businesses, I must – at a moral and ethical level – help as many people in my lifetime as I possibly can.

If I don’t do everything in my power every day to excel, work towards achieving my goals, and build great businesses and wealth to help as many people as I can, I’m betraying my deepest moral convictions and ethics. Failing myself, failing my family and kids, and failing those I could help.

Sorry about this long answer but it’s such a great question you asked which leads to a bunch of other questions and answers.

I hope this question and answer resonate with your readers on some level.

John: Is Rivera Holdings open to non-accredited investors?

Jason: Yes it is. If they’re based in the United States and are either US citizens, green card holders, or naturalized citizens.

Unfortunately, I can only accept outside the US investors at this point if they’re accredited.

John: Where can folks go for more information about investing with Rivera Holdings?

Jason: They can visit my website and go to my blog Value Investing Journey for more information on Rivera Holdings. At the following link they can also view The Rivera Holdings Acquisition criteria. And here they can sign up for the Rivera Holdings mailing list where I send out potential deals I’m working on that investors can invest in.

This mailing list is also where I share some of my exclusive past recommendation issues/investment thesis with subscribers.

Thanks a lot for having me on to do this John.

John: Thank you very much Jason.

by John | Sep 18, 2016 | Capital Appreciation, Investor Mindset, Investor Psychology, Tax Strategies, Value Investing

Warren Buffett is considered to be one of the most successful investors. He’s one of the wealthiest people in the world and he’s also fond of publicity and public appearances.

If you have some humility and don’t get caught up in jealousy you can learn a lot from wealthy and successful people like Warren Buffett.

My own Father is fond of saying that poor people should take rich people out to lunch. The idea being that the wisdom that can be gained from the wealthy is worth more than paying for lunch.

So what lessons can we learn from Warren Buffett?

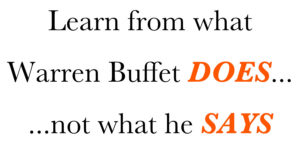

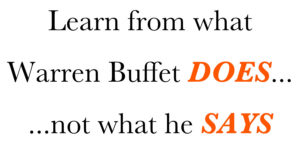

Do As Warren Buffett Does, Not As He Says

There is an old expression “Do as I say, not as I do.” With Warren Buffett it is “Do as I do, not as I say.”

There is an old expression “Do as I say, not as I do.” With Warren Buffett it is “Do as I do, not as I say.”

Warren Buffett talks A LOT and shares a lot of opinions. But you shouldn’t follow what he says as advice because he might actually be doing the opposite of what he is saying.

In order to learn lessons from Buffett one must first filter out a lot of what he says.

There is a quote from Daniel Loeb that summarizes Buffett’s contradictions quite succinctly.

“He criticises hedge funds yet he really had the first hedge fund,” Loeb said. “He criticises activists. He was the first activist. He criticises financial service companies, yet he likes to invest in them. He thinks that we should all pay more taxes but he loves avoiding them himself.”

Source: http://www.smh.com.au/business/warren-buffett-is-full-of-contradictions-hedge-funds-say-20150507-ggwv2o.html

Without further ado here are three lessons we can learn from Warren Buffett.

Lesson 1: Reduce Your Taxes

While publicly discussing how he wants to pay more taxes Warren Buffett has taken extraordinary steps to reduce his taxes.

Source: http://www.nytimes.com/2011/08/15/opinion/stop-coddling-the-super-rich.html

From how he structures his businesses to how he is paid to how he has bequeathed his inheritance Warren Buffett does all he can to reduce his taxes. He gets paid through dividends and long term capital gains rather than ordinary income. He’s also left 99% of his fortune to a private charity to avoid paying inheritance taxes.

Lesson number one from Warren Buffett is Reduce Your Taxes.

There are a variety of ways you can legally reduce your taxes: IRAs, 401ks, FSA, HSAs, charitable contributions, capital gains. I discuss some of them in Five Tax Strategies to Keep More Income.

Real estate is also an excellent way to increase your wealth in a tax advantaged way. BiggerPockets.com is an excellent Real Estate resource.

Lesson 2: Invest in High Quality Companies that are Undervalued

Warren Buffett loves great value. Much of his investing philosophy can be traced back to Benjamin Graham, the father of value investing.

According to Investopedia Buffett looks at six criteria for stock investments:

1. Has the company consistently performed well?

2. Has the company avoided excess debt?

3. Are profit margins high? Are they increasing?

4. How long has the company been public?

5. Do the company’s products rely on a commodity?

6. Is the stock selling at a 25% discount to its real value?

Source: http://www.investopedia.com/articles/01/071801.asp

Warren Bueffett is a value investor and I think value investing is an excellent way for the enterprising investor to achieve outsized returns. I’ll be writing more about value investing in future posts.

If you’re interested in reading one of Graham’s seminal works “The Intelligent Investor” use this link to buy it on Amazon and help support this site: The Intelligent Investor by Benjamin Graham. Buffet calls it “the best investing book ever written.”

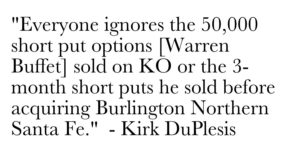

Lesson 3: Use Derivatives Wisely

Warren Buffett has written “derivatives are financial weapons of mass destruction.”

Source: http://www.fintools.com/docs/Warren%20Buffet%20on%20Derivatives.pdf

But Buffett has billions in derivatives as pointed out by Kirk DuPlesis of OptionAlpha.com.

Source: https://optionalpha.com/warren-buffett-options-trading-strategy-19655.html

In the article above Kirk talks about two ways Buffett uses derivatives:

1) Uses naked, short puts to lower the cost basis for purchasing stock or target companies that he wants to acquire.

2) Sells short index put options when volatility is at it’s highest, knowing that volatility is the one factor that is overpriced all the time.

I’ve written about trading options and think that done correctly it can be an excellent way to bring in monthly income. I’m interested in utilizing strategy one above more often as I open new stock positions.

Lessons from Warren Buffett

Those are three lessons I’ve learned from looking at what Buffett does, not what he says. Buffett probably gives some advice that is worth following directly but you have listen through a filter and weigh heavily what he actually does over his words.

by John | Aug 28, 2016 | Getting Started, Investor Mindset, Investor Psychology

I was having coffee with some new acquittances a few weeks back and mentioned I run a blog website about personal finance. I was asked a very good question which I don’t think I answered very well!

The question was: “Where do I start?”

I’ve been saving and investing for a long time and thus far this website has often focused on alternative and more aggressive investment strategies.

I can appreciate it’s hard (and likely unwise) to jump right into advanced investing so I want to write what I think are some things to consider when just getting started in the world of personal finance.

I originally wrote this as one big article. But realized it was too much! So I broke it down into three digestible parts. Today is Part I: Stabilization

Disclaimer: I don’t give financial advice. One of the reasons I don’t give investment advice here on my website is because there are exceptions to many rules and your personal situation could merit additional considerations. What is suitable for me might not be suitable for you.

Basic Principles about Personal Finance

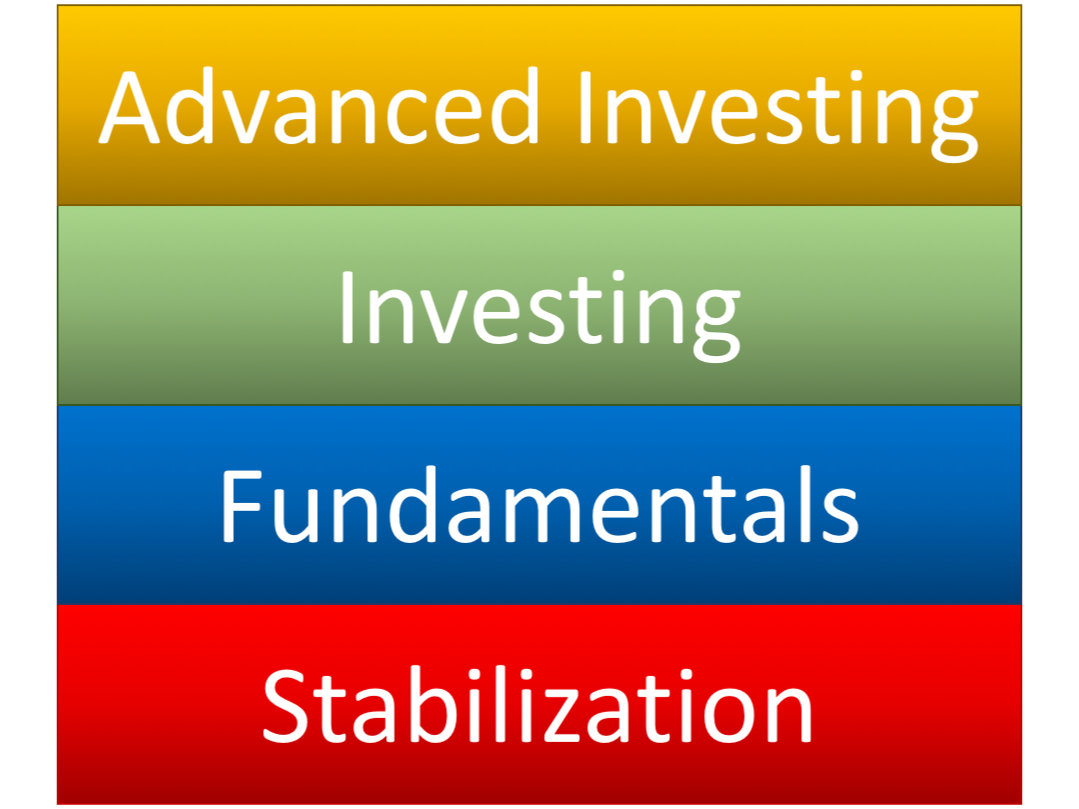

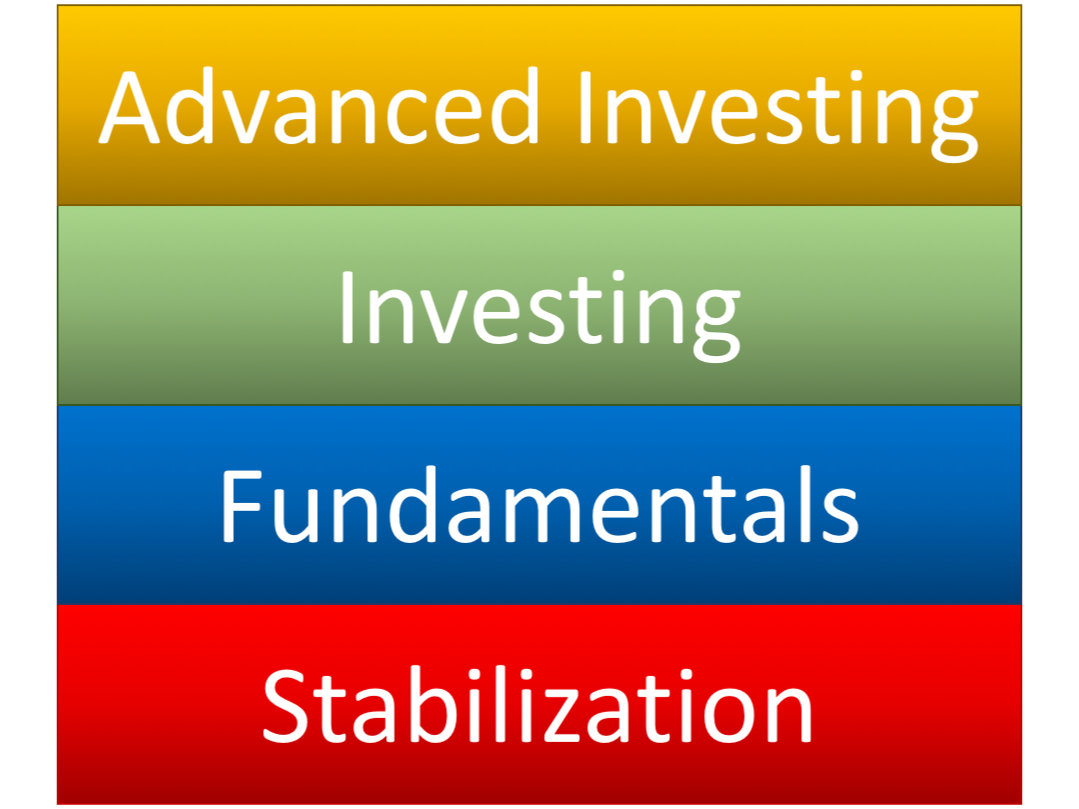

The Building Blocks of Personal Finance

I visualize these principles like building blocks. You have to have the lower levels in place before you can move to the upper levels.

Here are the basic principles:

– Debt for consumption is bad (Stabilization)

– You must produce and save more than you consume (Fundamentals)

– Have your money work for you (Investing and Advanced Investing)

The first level: Stabilization

In the health and medical field it is wise to make sure that a patient is stable and healthy before they try to fix some less pressing long term issue.

If an out of shape person is hemorrhaging blood due to an injury it would be absurd to focus on ways to improve their cardiovascular fitness until they are stable and healed from their injury.

If an out of shape person is hemorrhaging blood due to an injury it would be absurd to focus on ways to improve their cardiovascular fitness until they are stable and healed from their injury.

The first step on the path to growing your wealth is to stabilize your financial situation.

These things don’t make you rich but they stop you from getting poorer.

One of the great financial traumas to an individual’s finances is bad debt. This bad debt must be controlled before any other steps can be taken.

Stop Adding Bad Debt!

Bad debt is when you borrow money (usually at higher interest rates) to buy something that goes down in value and produces no income.

Examples of bad debt:

– Credit card debt (if you don’t pay it off every month)

– Auto loans

– Payday and title loans

Stop racking up bad debt!

$5 per day on coffee is $150 a month and $1800 per year

Stop buying things you don’t need via debt! Downgrade or cancel your cable plan. Stop buying $10 lattes. Stop eating out as much (I’m really bad at this one!).

If you live in a swanky single apartment maybe you could bring on roommates, downsize, or some combination of both.

Don’t buy a a new car every 2 years. Buy a used car you can afford.

If it doesn’t involve clothing your naked body, providing shelter, eating, or isn’t required for your job, consider cutting it out.

Yeah, this is no fun, but it pays off in the longer term.

If you don’t address your bad debt, its like having an uncontrollable bleed and wanting to start training for a marathon. You must stop the bleeding and get stabilized before you can start training for a race.

Next up Part II: Fundamentals

In Part II I discuss the importance of a budget and setting goals. Not only will this help you get and stay out of the stabilization level, but will help you save more than you spend and prepare you for level III: Investing.

There is an old expression “Do as I say, not as I do.” With Warren Buffett it is “Do as I do, not as I say.”

There is an old expression “Do as I say, not as I do.” With Warren Buffett it is “Do as I do, not as I say.”

If an out of shape person is hemorrhaging blood due to an injury it would be absurd to focus on ways to improve their cardiovascular fitness until they are stable and healed from their injury.

If an out of shape person is hemorrhaging blood due to an injury it would be absurd to focus on ways to improve their cardiovascular fitness until they are stable and healed from their injury.