Most people aren’t willing to go back to a pre-industrial standard of living and so energy is very important. Nuclear energy is deemed too dangerous by many and solar and wind are niche players. This leaves fossil fuels.

[poll id=”5″]

Until we get Mr. Fusion to run cars and power electronics big energy companies will continue to be indispensable.

Big oil companies are also great for dividend investors as they tend to pay a good yield. Places like the US and Europe are highly dependent on energy imports. In 2016, Europe turns to import for 54% of its energy needs. The biggest provider of these imports is Russia when it comes to crude oil, natural gas and solid fuels.

Source: https://ec.europa.eu/eurostat/cache/infographs/energy/bloc-2c.html

It tends to be cold in most of Europe during the winter. The EU gets a lot of natural gas from Russia for heating purposes. The largest producer of Natural Gas in Russia is Gazprom (OTC: OGZPY).

As early as September, Gazprom could be ready to start providing 38 billion cubic meters of Natural Gas to China over the next thirty years.

Source: https://www.energy-reporters.com/production/gazprom-china-pipeline-to-be-ready-three-months-early/

Gazprom has a de facto monopoly of Natural Gas production in Russia and while this isn’t good for consumers it ensures that Gazprom will have less competition.

How does Gazprom Stack up to the Competition?

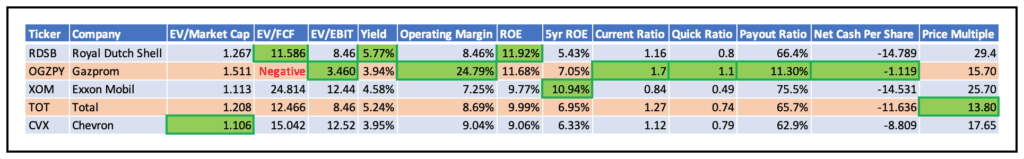

Using my value investing metrics I show below how Gazprom stacks up against some of the other energy giants.

The main thing that Gazprom has going against it is the negative free cash flow. The enterprise value to market cap is also the highest amongst the five stocks I’ve looked at. The trailing twelve month (TTM) operating cashflow is $24.969 billion and capital spending is $25 billion. This results in a negative $0.34 billion in free cash flow.

Gazprom’s five year average free cash flow has been $3.62 billion and they could increase free cashflow by trimming their capital spending if needed.

If I add their FCF history to the firm’s stellar operating margin, high return on equity (ROE), and financially healthy current ratio, quick ratio, and dividend payout ratio I’m willing to overlook the lack of free cashflow in the last 2 years.

Recent Price Action

On 14 May 2019 Gazprom jumped up from around $5 to over $6 on the news management recommended increasing the dividend. This was the most price action the stock has seen in nearly a decade.

Source: https://seekingalpha.com/news/3463497-dividend-proposal-boost-sends-gazprom-soaring

If the dividend increase falls through the stock will likely give up these gains. I don’t know how likely that is to happen or if that is even a realistic possibility.

Gazprom is the kind of boring, cashflow machine that doesn’t get a lot of attention from the mainstream but can help grow wealth.

There are geopolitical risks, however, I think being a large supplier for Europe as well as increasing the capability to supply energy to China could offset these risks.

Of course individuals need to make their own investment decisions based on what is suitable for their unique situation.